Who is placing contrarian bets in prediction markets?

- Core Viewpoint: The liquidity for "contrarian" contracts in prediction markets is provided by three types of rational strategies.

- Key Elements:

- Lottery Players: Betting small for a big win, chasing high-odds black swan events.

- Bots: Automated trading, profiting through spreads and volume strategies.

- Prediction Platforms: Incentivizing liquidity through order placement and holding rewards.

- Market Impact: Reveals the deep sources of liquidity and the game theory logic within prediction markets.

- Timeliness Note: Long-term impact.

Original | Odaily (@OdailyChina)

Author|Golem (@web3_golem)

This week, I wrote an article reviewing absurd event contracts on Polymarket, pointing out that betting on some seemingly utterly ridiculous contracts at this moment could be profitable.

This led me to ponder: who exactly is betting against "common sense," providing the market with "free money"?

Bets that go against us smart people are not impossible; there are certainly some who firmly believe in their judgment (for example, some still believe the Earth is flat). However, a prediction market is not a "greater fool market." I believe when players use real money to predict whether an event will occur, they strive to think as "rational actors," meaning their decisions are the most economical and profitable. Therefore, from this perspective, users betting Yes on seemingly impossible event contracts must also have some profit-making strategy; they are not fools simply providing us with "high-certainty" investment opportunities.

After consideration and discussion, I believe those providing counterparty liquidity in these absurd event markets likely fall into the following three categories (this article aims to spark discussion; feedback and corrections are welcome on X @web3_golem):

Lottery Players

The logic of lottery players is simple: they focus solely on odds, aiming for a small stake to win big.

Sometimes, reality is far more bizarre than we imagine; even seemingly absurd events can happen. Moreover, while prediction markets settle based on real-world outcomes, settlement results can sometimes be distorted from reality due to settlement conditions, system failures, etc. Polymarket has had multiple instances where results settled differently from reality due to issues with UMA's dispute resolution mechanism. A recent example is Polymarket ruling that the US military action in Venezuela did not constitute an "invasion."

Thus, long-tail odds deviations appear. Even for events with extremely low probability, the Yes side might still have a 1%-3% price. As long as the odds are high enough, "lottery players" will buy, becoming one of the firm bottom bids.

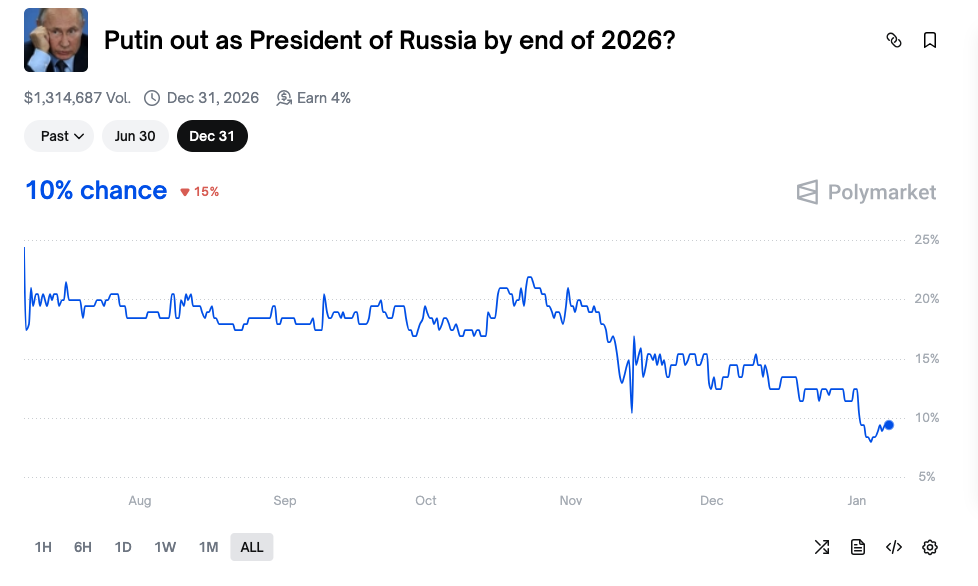

But actually, this "lottery player" psychology is rational. For example, in the event contract "Will Putin step down before the end of 2026?", driven by common sense, most people buy "No," and the probability already reflects people's attitude. However, the Yes side still has a 10% probability. This means if you bet $10 and Putin actually steps down before the end of 2026, you would get $100 back—a 10x return. So why not gamble?

Furthermore, lottery players don't necessarily place heavy bets on a single market. Since prediction markets are not short of such high-odds events, by casting a wide net and hitting the jackpot a few times, there's still a chance to recoup costs or even profit.

They anticipate black swan events more than normal people. Therefore, they are happy to provide buy-side liquidity on the Yes side of "counter-intuitive" markets (Polymarket sometimes offers maker rewards and holding rewards in certain markets, but this is not the main driver for lottery players).

Bots

If an event contract itself has high certainty, the entry of tail-end players' funds can push one side's probability to 99%-100% before settlement. The existence of "lottery players" can partly explain why there are still players taking the Yes side sell orders in these "counter-intuitive" markets (Odaily Note: Because Polymarket uses a shared order book, meaning when a $0.99 buy order appears on the No side, a corresponding $0.01 sell order appears on the Yes side). But they are always a minority and cannot explain why these markets still have large trading volumes and good depth.

So, who else injects substantial liquidity into these markets? The answer is bots.

Market-making bots on Polymarket have developed quite rapidly. Bots using the Polymarket API for automated trading actively monitor all newly created markets and are often among the first participants. These bots can profit by actively trading in these markets.

In these "counter-intuitive" markets, when the No side price is $0.99, due to the shared order book, $0.01 sell orders appear on the Yes side. Market-making bots, like "lottery players," will take these $0.01 sell orders. But immediately after, they place sell orders on the Yes side at $0.02, $0.03, or even higher, waiting for "lottery players" or other bots to fill them. Correspondingly, buy orders at $0.98, $0.97, or even lower will appear on the No side (Odaily Note: again due to the shared order book). Thus, the order book gains significant depth.

However, after communicating with the crypto VC Jsquare team (they invested in the prediction market aggregator Rocket), they believe there aren't many bots executing this specific strategy in the market. In these "counter-intuitive" markets, the speculative psychology of "lottery players" or regular players is enough to support most of the opposing bets.

The existence of some wash trading bots also provides market liquidity and trading volume for these "counter-intuitive" and relatively niche markets (compared to events like the US election). One wash trading bot places a $0.02 buy order on the Yes side, and another wash trading bot places a corresponding $0.98 buy order on the No side to match it.

This behavior is mainly to farm potential future prediction market airdrops. In high-frequency markets, orders might be matched by other players, so these "counter-intuitive" event contracts are ideal tools for wash trading.

Prediction Platforms

Besides the "lottery players" and bots mentioned above, the prediction platforms themselves also contribute significantly to the liquidity of these markets.

Polymarket's mechanism includes two liquidity incentives: maker rewards and holding rewards. Maker rewards mean that in some specific markets, players receive rewards simply for placing orders within the maximum specified spread. Holding rewards mean that in some specific markets, players holding shares (Yes or No) can receive a 4% annualized holding reward.

The highlighted area indicates the maximum spread range for maker rewards.

According to statistics, Polymarket has invested approximately $10 million in market maker incentives. At its peak, it paid over $50,000 daily to maintain order book liquidity. Now, these incentives have decreased to just $0.025 per $100 traded.

These investments have indeed been effective, driving trading in many "counter-intuitive" markets. For example, the event contract "Will Putin step down before the end of 2026?" has already seen over $1.3 million in trading volume. Holding shares in this contract yields a 4% annualized reward. For players holding Yes shares, this effectively translates to a 14% annualized return (10% tail-end profit + 4% platform reward), which is highly attractive. For players holding No shares, the maker rewards and holding rewards also hedge some of the risk.

There is also speculation that, beyond openly providing liquidity incentives, prediction markets themselves act as market makers, providing liquidity for these "counter-intuitive," niche markets to achieve advertising and marketing effects. But this is pure speculation and open for discussion.