2025 KOLs' Most Used OKX Products Overview

- Core Viewpoint: OKX products are favored by KOLs for their efficient integration, security, and convenience.

- Key Elements:

- OKX Wallet's multi-chain support significantly improves interaction efficiency.

- DEX aggregator enables one-click cross-chain swaps and best-price execution.

- Products like Flash Earn provide simple and transparent stable returns.

- Market Impact: Drives the industry's tools towards integration and high efficiency.

- Timeliness Note: Medium-term impact

In the cryptocurrency industry, the choices of professional players are always direct and pure. In 2025, KOLs cast the most authentic vote for industry tools and ecosystem development with their year-long capital investment and time commitment.

We engaged with over a dozen top KOLs covering airdrop farming, MEMEs, secondary trading, wealth management, and other tracks, focusing on four core questions: "What was your biggest achievement this year?", "Given your results, what was your most frequently used and favorite OKX product in 2025?", "Why do you like it?", and "What practical value has this product brought you?".

From their annual reviews, it's evident that with the rapid development of on-chain ecosystems, on-chain operations accelerated significantly in 2025, and KOLs' product preferences quietly shifted: they no longer settle for single functions but place greater emphasis on efficiency, combined strategies, and value capture. Among the many tools, OKX secured a spot in the TOP 3 of the year's most popular products list, thanks to its wallet, DEX aggregator, yield-generating products (Flash Earn, Dual Currency Win, PayFi, etc.), and its precise insight into and execution of user needs.

1. OKX Wallet: Don't Drain User Energy on Irrelevant Operations

The most obvious change in the 2025 on-chain environment is that opportunities have become more fragmented. It's no longer "one chain dominating for half a year." Instead, L2s, modular chains, appchains, Move-based chains, and mainstream public chains have taken turns in the spotlight, with airdrops and early opportunities sliced into smaller pieces. However, the time and energy of ordinary users, and even professional airdrop farmers, are finite. The practical problem has become not that you don't understand the chains, but that you can't simultaneously manage operations across so many chains with precision.

The shortcomings of traditional wallets are magnified infinitely in this environment—networks must be configured manually, RPCs often fail, interaction experiences across different chains are disjointed, and errors become frequent during intensive operations. Many users aren't "incapable of farming"; they are deterred by the costs of configuration, switching, and potential mistakes. The high-frequency use of the OKX Wallet during this phase essentially addresses a real need: keeping operational complexity within a manageable range for users as the number of chains proliferates. For power users, this isn't about an experience upgrade; it's a matter of whether they can continue "running long-term."

Xuegaogx(@Xuegaogx): If I had to choose just one product, it would be the OKX Wallet.

It's a bit embarrassing to say, but there wasn't really a project this year that made me rich overnight. However, if we're talking about the biggest gain, it would definitely be my own growth experience. Starting from the beginning of the year, I systematized my previously chaotic trading actions, breaking them down into four main tasks: filtering information, recording accounts, executing with tools, and tracking profits. I've consistently run this system for a year, and I clearly feel that time costs are lower, repetitive labor is reduced, and the sustainability of on-chain profits has stabilized somewhat. For example, using this method, I achieved relatively consistent returns from airdrops in sectors like Kaito, Layer2, and ZK. This is my major outcome for the year.

Given these results, if I had to choose just one product, it would truly be the OKX Wallet. Features like multi-chain expansion, abstract accounts, and batch tasks have become standard in my daily operations. Honestly, in airdrop farming scenarios, it's the entry point I opened the most this year. The combination of the wallet, multi-chain expansion, and embedded task flows has become my main battleground for airdrop farming.

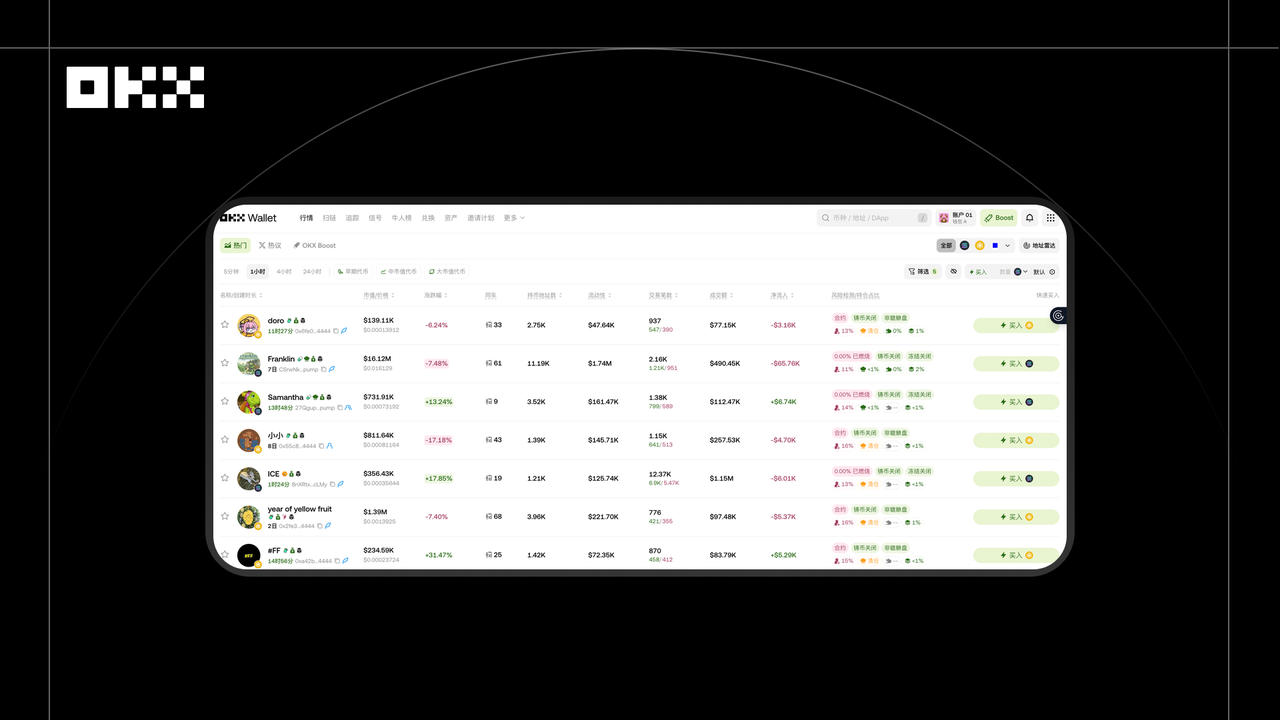

From an airdrop farmer's perspective, the OKX Wallet experience is really comfortable. First, multi-chain coverage. The chains I've used this year range from L2s, L3s, Move-based chains to Cosmos, and then to new modular chains. The OKX Wallet can basically connect to them all directly. No need to install a dozen browser extensions or constantly switch RPCs. Stability, sufficient speed, and no failures are especially crucial during intensive farming periods. Second, tasks for almost all popular projects can be completed directly within OKX. This year, many projects integrated their task entry points into the wallet. The benefits are smoother interactions, no missed task data, and a much better experience with gas estimation and signing compared to extension wallets. The task completion process is smoother, completely eliminating the need to open and switch between dozens of web pages.

The practical value this product brings is very direct. First, it reduces repetitive costs, allowing me to cover more projects. For instance, this year, there was a "full suite" task for a certain modular L2 involving 8 on-chain projects. Using a native wallet, I'd have to open 8 web pages, connect to 8 RPCs, and repeatedly switch chains, taking about half an hour per session. With the OKX Wallet, I could basically string them together on one page, actually spending only ten minutes. The extra 20 minutes allowed me to run tasks for another L3 at the time, and that L3's airdrop turned out to be more generous. This is a very direct positive feedback loop of "time → profit." Additionally, it reduces error rates, significantly decreasing incidents of wrong signatures or missteps. Certain cross-chain bridge or staking tasks are prone to errors like selecting the wrong chain, RPC freezes, or signature failures. OKX's smart chain detection and task flow guidance basically eliminate these situations. For airdrop farming, not making mistakes is profit in itself. There's also the transfer alert feature. If the address you're sending to is a contract address, the OKX Wallet gives a very prominent warning. This feature saved me from a loss of several thousand dollars on a transfer this year.

Max(@0xcrypto_max): On-chain funds have to be in the OKX Wallet to feel relatively secure.

This year has been okay. I haven't been as aggressive as last year, basically accumulating bit by bit. Since I haven't gone all-in, my capital curve has been slowly rising. But I find this state quite comfortable, less painful, and actually feel quite happy.

My favorite product has to be the OKX Wallet, the smoothest product. More importantly, it's about security. Because I have a strong risk control mindset, I'm not very comfortable leaving money anywhere. I don't dare to keep too much on exchanges, I'm hesitant about wealth management products, and most of my funds are stored in cold wallets. The OKX Wallet is like half a cold wallet to me; on-chain funds have to be in OKX to feel relatively secure.

Additionally, I think its pool data is also the best. When playing with on-chain pools, pool size is a very important reference metric. On other DEXs, pool data is often incomplete. Pool size helps me judge if whales are exiting. Sometimes when large liquidity is added at highs, I exit with them, and I'm right most of the time, though I occasionally sell too early.

On-chain Expert(@wenxue600): The main value of the OKX Wallet is improving on-chain interaction efficiency.

My major result this year was the Aster airdrop. My main account received nearly 100,000 tokens in the first phase, with a peak value exceeding $200,000, though I sold too early at launch. Fortunately, the batch-farmed small accounts held on. The sense of achievement from this project isn't just about how much I farmed, but that at every important juncture, I made key recommendations and reminders that perfectly matched the final airdrop rules. Many followers and group members who followed the advice achieved significant gains (A7 level) in one go.

My most commonly used product is the OKX Wallet. Because the OKX Wallet really understands that airdrop farmers don't want to deal with messy configurations. It's feature-complete, operates smoothly, and is essential for farming, helping everyone improve efficiency in many ways. Of course, the main value is improving on-chain interaction efficiency. The OKX Wallet responds very quickly to popular networks, eliminating the need for users to manually configure networks, and it has a dedicated faucet entry, making it very convenient to use. During interactions, other wallets might report errors, but switching to the OKX Wallet often avoids such problems. Whether it's trading, cross-chain, participating in new launches, or chasing meme coins, OKX has given me an excellent experience.

Suy(@Crypto_Suy): The OKX Wallet is the smoothest and allows for operation anytime, anywhere.

This year's market trends were intermittent. In March with $mubarak, and in September/October with $giggle and $palu, I achieved my biggest results of the year. But whenever the trend ended, I gave back a large portion. My favorite and most used product has to be OKX's wallet.

I started using OKX's wallet during the inscription era. I remember at the time, OKX's wallet was the smoothest, and on mobile, I could operate it anytime, anywhere while out. Using the OKX wallet, I made money in crypto for the first time. The OKX wallet's UI is very pleasing to the eye, and every new feature closely follows hot trends, from inscriptions to memes. The OKX wallet also seems to bring me good fortune. I remember the second morning after $baibu launched. After waking up, on my way to a lab class, I was walking and looking at the charts. Then I bought $baibu with three wallets and held until it listed on an exchange, resulting in over 30x gains.

2. OKX DEX Aggregator: For MEME Opportunities, Being Able to Execute in the First Moment is Key

In 2025, MEMEs and small-cap tokens had shorter windows, more violent volatility, and more fragmented liquidity. Prices either didn't move or skyrocketed; the real profits were often made by those who executed in the very first segment. But the reality is, many on-chain traders don't misjudge; they lose because the execution path is too long. For example, cross-chain takes time, finding pools takes time, swapping for gas takes time. By the time the operation is complete, the price is no longer the same.

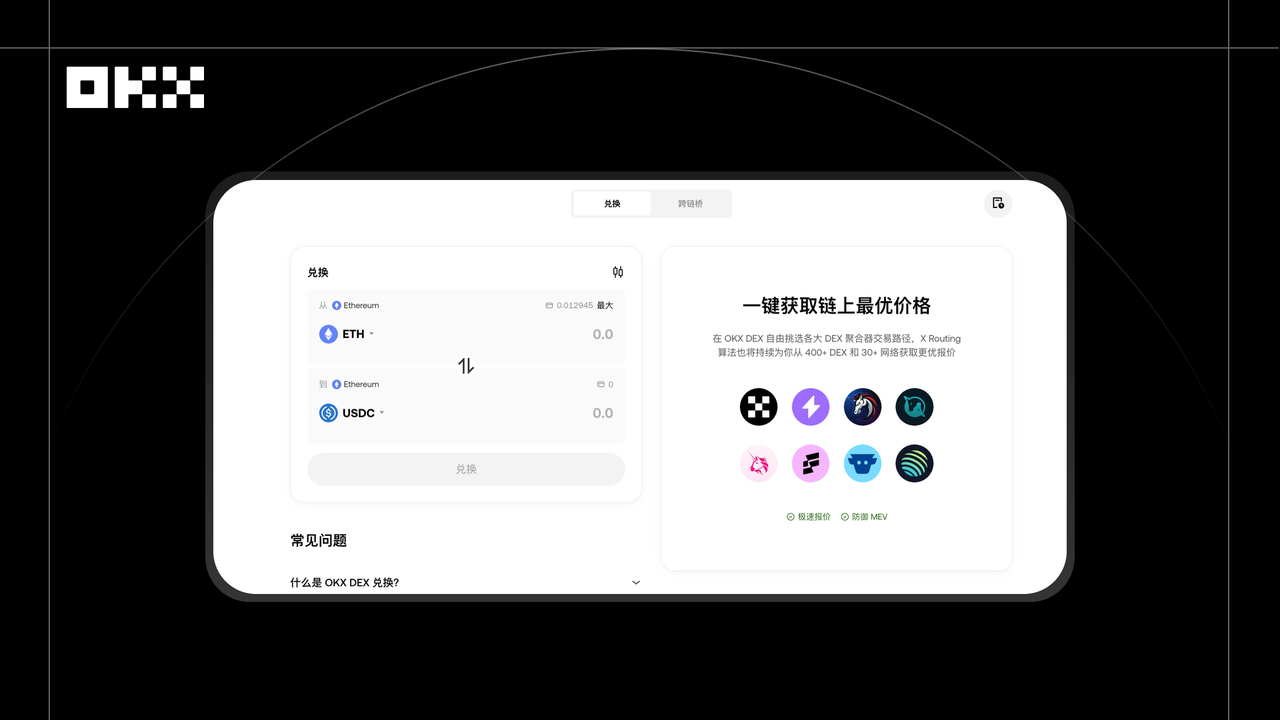

This is why more and more users' focus on "whether a DEX is good" has shifted from fees and UI to whether it can complete tasks with one click. The value of the OKX DEX Aggregator at this stage is more about shortening the path—compressing operations originally scattered across multiple platforms and steps into a single trading decision. For users, it solves not "how to trade," but whether the trade is still timely. In a market with increasingly short-lived opportunities, this is a very real pain point.

Haz59188(@Haz59188): OKX DEX trading and cross-chain are super convenient, no need to switch back and forth.

In the first half of this year, I was actually in a losing situation. It wasn't until X Layer launched that I turned $3,000 into $80,000 in a week. The biggest gains back then were from $XDOG, $OKAY, $ODOG, $XLAB, $FUN, etc., all caught by entering early. That's how I embarked on my "meme hunting" journey. To be honest, OKX literally dragged me, a secondary market blogger, into becoming an on-chain warrior.

The product I pick for this year is definitely the combination of the OKX built-in DEX + OKX Wallet. Now, 99.9% of my meme coin buying, selling, cross-chain, profit-taking, and escaping are done using just the OKX App. Even for buying spot, I'm used to buying directly with the OKX Wallet—it's especially convenient. The recently launched OKX built-in DEX has directly become a game-changer, giving me another reason to love OKX.

What I hated most before was switching wallets, paying gas, looking at fake charts (delayed K-lines), and the hassle of cross-chain. I used to find on-chain trading particularly cumbersome, and I'm someone who really dislikes hassle. Two years ago, when farming airdrops, I found other wallets chaotic with all the switching. A friend recommended the OKX Wallet then—it supports all chains, cross-chain is super convenient, and most crucially, no need to switch back and forth. At that time, I wasn't chasing meme coins; the cross-chain experience was the earliest reason I fell in love with it. Although cross-chain speed was slower before, now it's not only faster but sometimes almost instant, with zero lag. Innovations keep coming. The K-line charts in the wallet are also very detailed with no delay; many other wallets have delays, making it impossible to react in time. In terms of speed for catching new launches, it's incredible. As soon as a new token appears on DexScreener, OKX already allows direct purchase. For any new token on any chain, I directly buy it via cross-chain in the OKX Wallet. The recently launched built-in DEX even saves the cross-chain step, allowing direct token purchase. While others are still cross-chaining on other wallets to buy platform tokens for gas, I've already made money! This point alone crushes most wallets on the market. I love it! Although, the new built-in DEX does have a bit of delay; this part isn't as fast as the original wallet's K-line and data reaction speed yet. I believe it can be further improved later.

To be honest, I was previously a pure secondary market blogger, looking at K-lines all day, leading community followers in opening contracts. After making money with the OKX Wallet, I learned a lot about the core logic of ecosystems, understood the industry reality of multi-chain coexistence, grasped how cross-chain technology breaks barriers between different blockchains, etc. The OKX Wallet gave me a new blueprint for my career.

Mike(@maik2hello): Tokens from various chains can be swapped quickly and optimally on the OKX DEX Aggregator.

I haven't had a major result this year, but OKX's product features have really helped me many times.

My favorite OKX product is the OKX DEX Aggregator. Its smart aggregated trading and one-click cross-chain bridging features are what I most recommend. This is the first thing that pops into my mind. It has helped me several times to swap small-cap tokens at the best price in the shortest time. Recalling the first time I used it: I was participating in a project's private sale round and happened to be outside without access to a computer (it was a small-cap type, and the idea was to exit as fast as possible at TGE, as many understand). I quickly claimed the airdrop using the OKX Wallet. After claiming, I wanted to transfer it to an exchange to sell immediately, but the token transfer wasn't open on that exchange yet. I thought of trying if I could trade/swap it on OKX's DEX Aggregator. Unexpectedly, it worked smoothly, and the price matched the exchange, completely avoiding losses from the subsequent rapid price drop. Since then, I've frequently used it for trading and swapping. You'll find that tokens from various chains can be swapped quickly and optimally on the OKX DEX Aggregator, including one-click cross-chain bridging of tokens, allowing me to quickly meet trading needs for tokens across chains.

Later, I looked into why the OKX DEX Aggregator is so good, which further clarified why I've always liked using it. It can capture liquidity from 500+ DEXs in real-time through its proprietary algorithm, allowing me to get the best price across the entire chain ecosystem without switching between different platforms, with overall slippage stably controlled below 0.3%. At the same time, its execution efficiency is very high, with transaction speeds at the millisecond level. Combined with the one-click jump of the "floating plugin," overall operation time can be reduced by about 70%. In terms of security, the OKX DEX Aggregator proactively intercepts blacklisted addresses and provides risk warnings before transactions, making me feel more at ease when participating in small-cap or new projects, reducing the chance of accidentally touching high-risk tokens.

I remember around Q3 2024, during the BRC-20 token surge, a meme token ($SHIBZ) on the OKX DEX had a buy-sell spread of only 0.5% due to aggregated liquidity advantages, while other platforms had spreads as high as 3%. Using the OKX DEX Aggregator's smart order book function to set limit orders in advance allowed for precise profit capture during token price fluctuations, achieving a single-day return rate exceeding 150%.

3. OKX Yield-Generating Products: Rising Demand for Certainty in Stable Returns

In 2025, user patience for high returns decreased, while demand for certainty increased. After experiencing several rounds of on-chain incidents, project failures, and complex wealth management models, more and more users realized the problem isn't low returns, but "funds being locked, inaccessible, or not understanding what they're earning." Especially during airdrop and narrative lulls, idle funds are slowly eroded by inflation and opportunity costs.

Against this backdrop, simple, transparent, and readily redeemable wealth management products have regained importance. The repeated mention of OKX's Flash Earn, PayFi, and similar products isn't because they offer the highest returns, but because users know what their money is doing and when they can get it back. Their role is more like a "transitional solution"—ensuring funds don't become a drag when there's no clear offensive direction. This demand isn't aggressive, but it's very real.

Furthermore, as market volatility structures became more complex, structured products like Dual