Using data to vote: Insights into the hottest trading products of 2025 | OKX Yearbook

- 核心观点:账户操作策略比市场行情更能决定收益。

- 关键要素:

- 稳定币理财是账户最稳定的收益底层。

- 高收益用户依赖动态风控与策略纪律。

- 策略组合与风险可控成为主流选择。

- 市场影响:推动交易策略向体系化、自动化发展。

- 时效性标注:中期影响。

Looking only at market data makes it difficult to explain the differences in returns among exchange users in 2025. What truly determines returns is the way accounts are managed, not just market fluctuations themselves.

OKX's annual report shows that mainstream cryptocurrencies remain the core of cash flow and returns, supporting trading and strategy execution. Emerging cryptocurrencies are more used to amplify volatility and provide short-term opportunities, but are not stable, long-term sources of returns. The real contributors to sustained returns are product portfolios with long-term use and controllable risk. For example, in 2025, stablecoin investments consistently ranked high in both usage frequency and return contribution, becoming the most stable underlying asset for exchange accounts, effectively boosting overall returns during periods of volatility and pullbacks.

This report will analyze the real choices made by exchange users in 2025 based on data from OKX exchange's strategy products, earning products, trading pairs, and actual returns. It will reveal which strategies are effective in the long run and which are merely "seemingly profitable." Once the narrative noise is stripped away, the annual trends of centralized exchanges (CEXs) become clearer and more concrete than imagined. Given the high transparency and individual differences in trading data and market information, details will not be elaborated upon here; please refer to relevant resources for further information. This article does not focus on specific trading results but rather on the breakdown of strategic thinking, providing simple, feasible, and referable strategy models for readers to understand and apply in their own circumstances.

DOGE, Trump, and XRP are among the most popular cryptocurrencies traded by users this year.

OKX's annual report shows that BTC, ETH, Trump, SOL, DOGE, and XRP were among the most popular cryptocurrencies traded this year. BTC and ETH, as core value assets, dominated, not only due to their market capitalization and liquidity, which solidified consensus among retail and institutional investors, but also because their resilience and price discovery capabilities across multiple bull and bear market cycles provided a stable anchor for users in highly volatile markets. Volatile blue-chip coins like SOL and XRP demonstrated users' sensitivity to short- to medium-term volatility opportunities, often resulting in concentrated trading activity driven by market trends, technological updates, or community narratives. The MEME craze continued to spread this year, attracting a large number of new users to this area while established users actively sought new opportunities. Trump and DOGE, among other MEME coins, thus became highly popular, further demonstrating that user trading behavior is not solely determined by project fundamentals, but is also significantly influenced by community sentiment, platform incentives, and event catalysts.

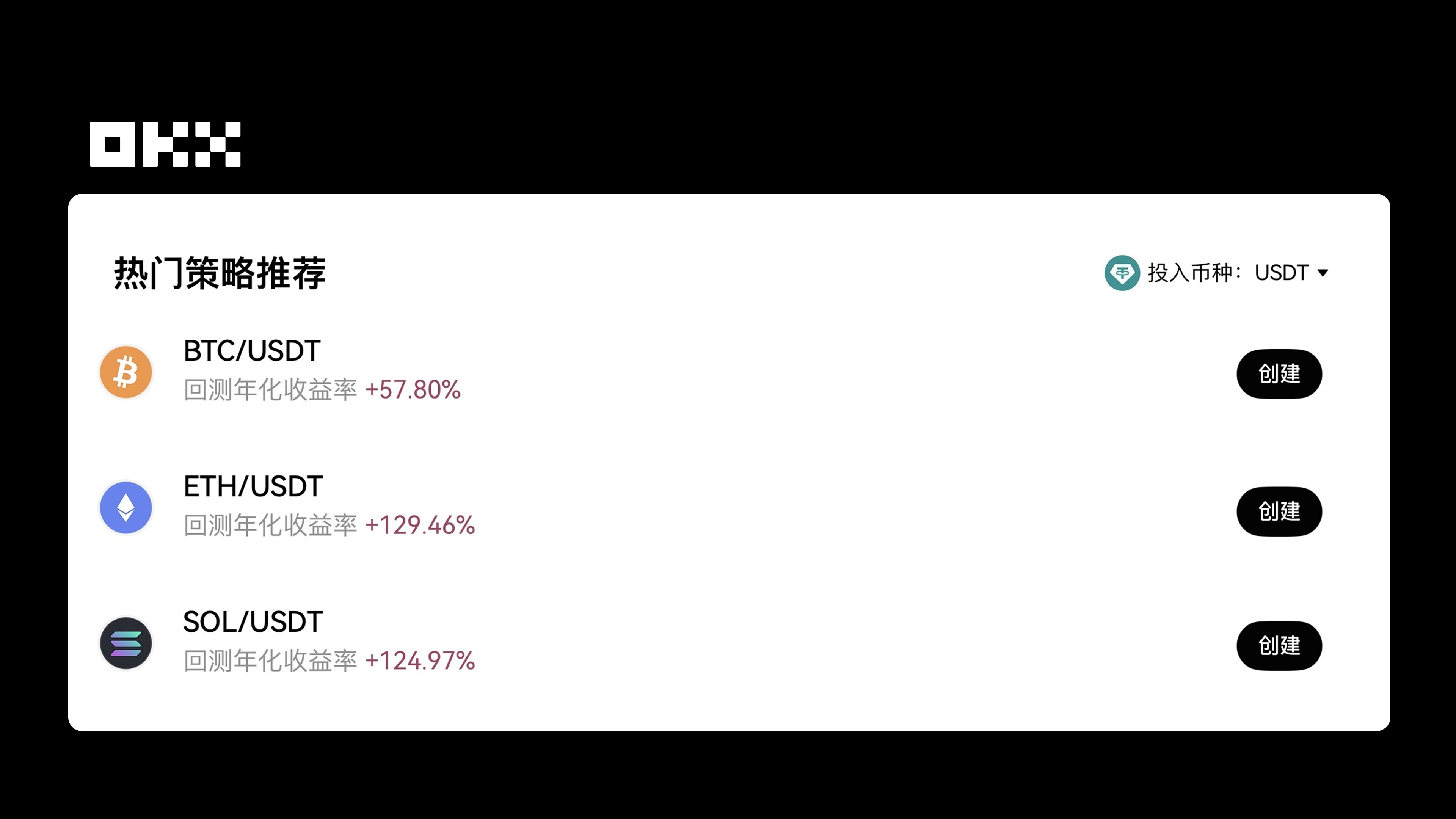

Corroborating this, the most popular cryptocurrencies among OKX's strategy products this year still include mainstream and highly liquid assets such as BTC, ETH, SOL, DOGE, and XRP, consistent with the aforementioned trends. In particular, OKX's BTC dollar-cost averaging (DCA) strategy has become the top choice for most users this year, its effectiveness stemming from deep market logic. By buying at fixed intervals and diversifying costs, DCA smooths market volatility, reduces timing risks, and remains stable even during short-term sharp fluctuations. By entering at the bottom of a large trading range and adhering to disciplined buying, users can maintain psychological stability in a highly volatile market, avoiding erroneous operations caused by emotions or market noise, achieving long-term asset accumulation and risk-controlled return growth.

It's worth noting that DOGE and XRP have become "dark horse" cryptocurrencies favored by OKX strategy product users this year. Driven by active market sentiment or compelling narratives, these assets have offered significant price arbitrage opportunities, attracting short-term and swing trading funds, resulting in increased trading volume. Furthermore, with the inclusion of these assets in ETFs and other financial products, they have been incorporated into standard trading strategies, further accelerating liquidity and activity.

Earning USDT yields an average annualized return of approximately 4.32%.

Top exchanges typically maintain stablecoin liquidity pools in the billions or even tens of billions of dollars annually. As technology service providers, they convert these funds into stable interest spreads for users through lending matching, staking, and DeFi protocols. Even within a conservative annualized range, this generates substantial returns for users.

Especially when viewed within this year's market structure, stablecoins have consistently held a central position in OKX's "Earn" products. This isn't due to exorbitant interest rates, but rather the high frequency of participation, deep capital accumulation, and long compounding periods. For example, holding USDG automatically earns up to 4.10% annualized return, while holding USDT yields an average annualized return of approximately 4.32% (adjusted in real-time based on market conditions and lending demand). During periods of significant market volatility, USDT's "Earn" feature once surged to 53%, supporting 24/7 deposits and withdrawals with hourly interest accrual. To improve capital efficiency, both OKX's strategy trading and trading accounts now support the "Automatic Earn" function. Furthermore, in addition to stablecoins, the platform also offers approximately 5% annualized returns on mainstream assets like BTC and ETH within limited limits, allowing users to obtain stable returns even amidst the volatility of mainstream cryptocurrencies.

The market in 2025 was not a "comprehensive bull market": funds were highly concentrated in a few mainstream assets such as BTC and related ETFs. In the long run, many small and medium-sized altcoins underperformed BTC, and even with a rebound at the index level, their price center still showed a downward trend. For most investors, "choosing the wrong coin" meant that all their efforts for the year could be wasted or even result in losses. The margin for error in directional trading was significantly reduced, and account returns showed obvious divergence. In this structural market, stablecoin investment became one of the few account bases that could continuously contribute returns without needing to time the market or bet on direction . When the BTC rise could not spread to the entire market and altcoins as a whole entered a slow consumption phase, the value of stablecoins lay not in outperforming the bull market, but in ensuring that funds were not "idle" while waiting for opportunities.

The average annual return for 10% of strategy users is close to 60%.

In the volatile market environment of 2025, an increasing number of users flocked to OKX strategy products, with the daily number of users nearly doubling. However, returns showed a clear stratification. 25% of strategy users achieved an average annual return of over 15%, while 10% achieved an average annual return of nearly 60%. These high-return users shared common characteristics: their strategies not only had a clear risk control framework but also dynamically adjusted positions and parameters, making judgments based on price, volatility, trading volume, and macroeconomic information, while strictly adhering to discipline and avoiding emotional trading. This explains why, even with multiple market pullbacks and significant sentiment fluctuations, a few users were still able to achieve annualized returns close to 20%, while the majority of users' returns fell within the neutral range.

In other words, the ceiling for returns is not market conditions, but rather the user's depth of understanding of the strategy logic and their ability to execute it . Only users who truly master dynamic risk control, parameter iteration, and behavioral discipline can generate structural excess returns in the volatile and divergent market of 2025.

Among OKX's strategy products, some strategies have exhibited unexpected characteristics. First, while dollar-cost averaging (DCA) and coin-margined grid trading seem niche, they have proven to offer stable returns in practice, consistently accumulating profits during volatile markets or bottom-building phases, with relatively controllable risk, making them suitable for most users' long-term investment strategies. Second, the DCA and dual-currency win strategies have a smaller user base, but their average returns are significantly higher than the average. These strategies, through intelligent two-way positioning and risk hedging, can capture both upward trends and preserve profit potential during market fluctuations, thus being used by a small number of experienced users for stable arbitrage.

Furthermore, some strategies, while favored by advanced users, possess enormous potential. For instance, contract DCA strategies can amplify returns in bull markets, yet are often overlooked by ordinary retail investors. Although they carry higher risks in extreme market conditions, they can still serve as a strategy choice for advanced users to allocate assets in stages, provided the trend is relatively clear and the parameters are set reasonably. Signal strategies, on the other hand, rely on advanced quantitative signals and market judgment, and are preferred by high-net-worth individuals or experienced traders to obtain excess returns.

An average user runs 4-5 strategies per year.

On the OKX platform, the average user runs 4–5 strategies simultaneously. Most novice users only run 1–2 strategies, which satisfies their exploratory mindset and low-risk needs with small-scale trials; active traders typically run 3–10 strategies to cover different market opportunities and trading logics.

For beginners, a few strategies are mainly used to "test the waters" and understand the market; for experienced users, multiple strategies are used to simultaneously capture trend opportunities, arbitrage opportunities in ranges, and long-term dollar-cost averaging returns. This behavior also illustrates that automated trading is no longer the exclusive tool of a few advanced players, but rather an important means for more and more ordinary users to manage their assets on a daily basis.

High-net-worth individuals invest significantly more capital in each strategy than the average, but typically keep the number of strategies below 10. Their core concerns are capital efficiency and risk management —a smaller, more focused approach ensures high capital concentration and a significant compounding effect, while avoiding the complexity and liquidity fragmentation caused by too many strategies. They prefer to select high-probability, high-capital-efficiency strategies, such as wide-range grid trading or capital arbitrage, rather than pursuing a large number of strategies. This behavioral pattern explains why high-net-worth individuals often outperform ordinary users, even with similar market volatility.

For professional traders or quantitative teams, this might mean running dozens of strategies simultaneously for cross-market arbitrage, different parameter grids, and dollar-cost averaging across multiple timeframes. This distribution logic directly addresses user pain points: the difference in returns often lies not in market volatility itself, but in the differences in the number of strategies, their combination logic, and risk management capabilities.

6 Best Annual Strategies

In 2025, the most popular strategies almost all pointed to the same core demand: fewer mistakes, predictability, and low drawdowns . The reason OKX BTC large-range spot grid trading became the most popular strategy is logically consistent with BTC dollar-cost averaging and annual low-drawdown spot grid trading—they don't require users to predict direction or rely on market timing abilities. Instead, they reduce the risk of human decision-making errors through decentralized execution and automation mechanisms. The value of these strategies lies not in their high short-term returns, but in their ability to cover most market phases, making them suitable for long-term, continuous use by ordinary users.

Strategies that truly maximize returns are concentrated in scenarios involving high-volatility assets like ETH, SOL, and DOGE combined with contract grids. These high returns don't stem from "smarter judgment," but rather from the combined effect of volatility and amplification mechanisms. In bull markets or trending markets, these strategies can rapidly amplify profits, but simultaneously, the risk is also amplified. Profits are highly concentrated among a small number of users who can withstand volatility and understand the limits of range and leverage. Therefore, while they can be called "most profitable," they are not the "most widely used" strategies.

In the long run, stable excess returns are more likely to occur when the strategy portfolio and time horizon are well-matched. The BTC and ETH dollar-cost averaging combination achieved a 100% return in less than two years, essentially due to the combined effect of the stability of the core asset and the volatility of the asset within a suitable timeframe. The DCA strategy, favored by smaller, larger investors, reflects the same idea—as the capital scale increases, the goal shifts from pursuing maximum returns to improving capital efficiency and drawdown control. Ultimately, what determines the difference in returns is not the individual strategy itself, but whether its applicable boundaries are understood and respected.

The three most classic strategy types and their parameters

BTC spot price range grid (40,000–400,000, approximately 200 dense grid cells)

This is currently the most frequently verified and longest-used type of OKX grid setting. Real user preferences show that the core of BTC grids is not "predicting direction," but rather exchanging an ultra-wide price range for long-term survival. The 40,000–400,000 range essentially covers the main oscillation zones of multiple bull and bear markets. Combined with a dense grid of approximately 200 grid cells, it can continuously capture BTC's structural fluctuations without frequent shutdowns or repeated reopenings. The 200-grid number is not arbitrary: too few grid cells would waste oscillations, while too many would be eroded by transaction fees; this density achieves the optimal balance between transaction frequency and cost. For most users, this strategy addresses a very real pain point—being able to participate in BTC's fluctuations long-term without timing the market.

OKX Coin-Margined Contract Grid (Typical: SOLUSD)

In trending markets, users' demands for grid trading shift from "stability" to "amplification," which is why cryptocurrency-margined grid trading is so prevalent. Cryptocurrency-margined grid trading, exemplified by SOLUSD, essentially amplifies the bull market beta: rising prices not only generate grid spread profits, but the position itself also continuously appreciates in cryptocurrency terms. Real-world usage data shows that this strategy is more commonly used for short-term market movements than for year-round use; consistently profitable accounts typically only activate it after a clear trend emerges, keeping leverage low to avoid forced liquidation during periods of volatility. It doesn't address "stable cash flow," but rather the most pressing concern for users in a bull market: how to maximize trend profits without frequent manual intervention. However, it's important to note that cryptocurrency-margined grid trading is still a leveraged strategy, highly sensitive to market direction and volatility. When trend judgments are incorrect or the market experiences significant fluctuations, leverage and position size must be carefully managed to control risk.

AI parameter recommendation (automatic matching of three types of strategies)

The reason AI-powered parameter recommendations have become the default choice for many users is not because they are "more aggressive," but because they are less prone to making basic mistakes . The OKX strategy system automatically provides users with three grid strategies—long-term stable, medium-term range-bound, and short-term volatile—based on the current volatility, trend structure, and historical range of the currency pair. Its core value lies in helping users complete the most difficult step—the reasonable setting of the range and grid density. In reality, most grid losses are not due to market conditions, but rather because the parameters are ineffective from the start: the range is too narrow, the grid is too sparse, or it is frequently broken through. AI recommendations do not guarantee the highest returns, but they significantly reduce the probability of strategy failures such as "starting and stopping immediately, repeatedly resetting," which directly addresses the core pain point for ordinary users.

BTC spot DCA strategy backtesting yields over 50% annualized return, and ETH over 120%.

OKX's spot Martingale strategy essentially involves increasing investment during price pullbacks to lower the average cost and taking profits when the trend reverses. Compared to traditional equal-amount DCA, it's better at capturing rebound gains, but it also carries higher risk, especially in a one-sided downtrend where multi-level averaging can quickly deplete capital. Its core value lies in combining market volatility and trend structure to achieve high-frequency cyclical arbitrage, while overcoming the risk of missing out on rebound opportunities by simply holding cash.

Taking BTC as an example, typical spot Martingale parameters are: a 0.96% drop triggers adding to the position, a adding factor of 1.05, a maximum of 7 addings, and a profit target of 0.5%. Backtesting shows that the annualized return can exceed 50%. This strategy can quickly capture profits from long-term BTC trend rebounds, while using multi-layered adding to the position to reduce costs in volatile markets. However, there is still a risk of running out of funds in a continuously falling or sideways market environment.

Taking ETH as an example, due to its higher volatility, a Martingale strategy with a 1.42% drop trigger, a 1.05 averaging-up factor, and a 2.8% profit target can achieve an annualized return exceeding 120% in backtesting. The most successful example of continuous doubling shows that with an initial position of 1000 USDT, after triggering 7 consecutive averaging-up moves, a 2-3x return can be achieved during a trend rebound cycle. Compared to BTC, ETH's high-frequency volatility makes it easier for the Martingale strategy to achieve multiple rounds of averaging-up and profit-taking within a short period. However, money management and profit-taking settings remain crucial to the strategy's success.

Conclusion: Combination and risk control have become the mainstream choices.

By analyzing the trading activity throughout the year, it's clear that most accounts achieving positive returns did not rely on aggressive, single-point speculation. Instead, they accumulated returns steadily through a combination of trading strategies, product strategies, and money-making tools, all while maintaining manageable risk. While users with different capital sizes and trading styles employed different execution methods, their underlying logic remained highly consistent: proactively reducing reliance on single market predictions and instead choosing more replicable, scalable, and drawdown-controlled profit paths.

This trend not only reflects the maturation of users' trading philosophies but also demonstrates the market's genuine demand for professional and systematic tools. As a provider of trading infrastructure and products, OKX will continue to iterate its product capabilities around real-world usage scenarios, improving the overall synergy from trade execution and strategy management to profit-generating tools. This will help users manage risks and seize opportunities more efficiently in an ever-changing market environment. Looking ahead, we also look forward to exploring more robust and sustainable trading methods with more users, creating deterministic value in the long run.