What? Lighter isn't airdropping today?

- 核心观点:Lighter空投预期骤降,社区信心受挫。

- 关键要素:

- 空投概率从87%暴跌至25%。

- 严厉反女巫筛查引发社区不满。

- 市场对其高估值和抛压存疑。

- 市场影响:削弱项目热度,影响同类项目市场情绪。

- 时效性标注:短期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

Data from the prediction platform Polymarket shows that the expected probability of "Lighter will be airdropped on December 29" has plummeted from 87% four days ago to 25%, almost halved.

While a drop in probability doesn't directly equate to the cancellation of the airdrop, market sentiment has clearly cooled. As of press time, Lighter has still not released a detailed token economic model, which doesn't resemble the atmosphere of an upcoming TGE and airdrop. Interestingly, LIT spot trading is now visible on the Lighter Staging page, but no one knows how long this testing will take. (Odaily note: Staging refers to the pre-release environment, which falls between testing and production in the product development process and is generally considered the final rehearsal before the official launch.)

It's important to note that Polymarket uses Eastern Time for settlement of Lighter airdrop information. Therefore, for investors in the UTC+8 time zone, if they want "Lighter will be airdropped on December 29th" to settle with "no", Lighter needs not be airdropped before 13:00 on December 30th. Investors in other time zones should adjust the time accordingly.

Despite Lighter's marketing head, Pilla.eth, having previously stated in an AMA that both TGE and the airdrop would take place in 2025, the probability of a Lighter airdrop before December 31, 2025, has dropped from 94% to 64% on Polymarket due to panic. The highly-rated analyses from players betting "No" lack any reasonable analysis or insider information; most are emotional betting or simply nitpicking.

- "Airdrop confirmed for 2026"

- "I still can't figure it out. Why didn't these idiots mention TGE at all, even though the probability is already 94%? This was the worst AMA of my life. I wasted 45 minutes listening to a bunch of nonsense without getting a single useful piece of information."

- "TGE is not the same as an airdrop; they are not the same thing. There are many examples of this, so please read the rules carefully first."

- "In the judgment rules, locked tokens or non-tradable tokens cannot be used as a condition for 'Yes'. Even if the project team releases an airdrop query and shows your allocation, as long as the tokens cannot be freely traded on the market, the conclusion is 'No'."

Of course, besides the unclear airdrop date, Lighter also faces concerns such as anti-Syllabic criticism and valuation traps, casting a shadow over the project. With the market cooling down at the end of the year, any move by a project attracts extra attention from the community—Lighter's actions at this moment can be described as "timely."

The toughest anti-witch measures in 2025

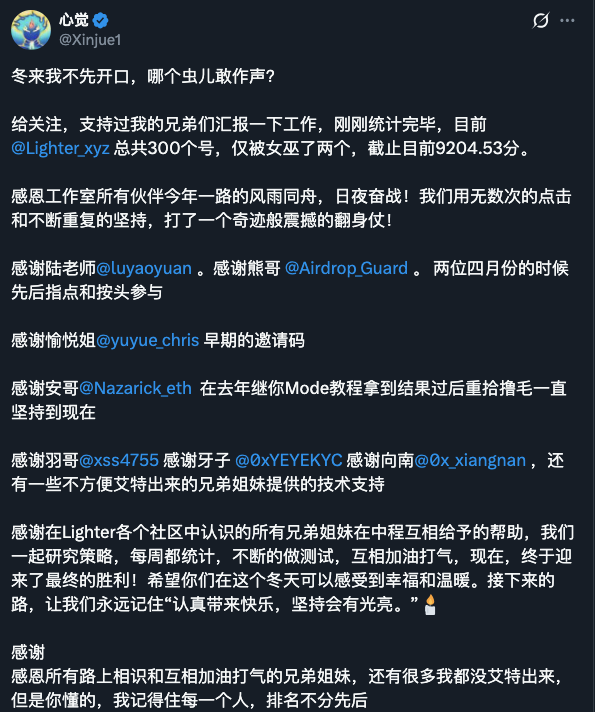

Lighter capitalized on two of the hottest narratives of 2025 (Prep DEX and RWA), leading to high investor confidence. In early December, rumors circulated that Lighter would launch TGE and airdrops within 2025, further fueling investor enthusiasm, with some high-spending players even celebrating on social media.

Lighter's top-ranked players release their acceptance speeches ahead of time.

But as the old saying goes, things are accomplished in secrecy and ruined by leaks. Many people blame these boastful users for the strict witch screening that Lighter implemented afterward (although this may not be true).

On December 23, Lighter announced on its official Discord that it was launching a massive witch screening, removing witch addresses, self-traded transactions, and points earned by exchanges that engage in wash trading. However, these reduced points (including those that have already been removed) will be redistributed to the community.

The community erupted instantly. After Lighter launched its witch check, a large number of studio accounts had their points deducted. Some bloggers said that Lighter's anti-witch campaign was extremely strict, with 70-90% of studio accounts being investigated and dealt with. Ordinary players' accounts were not spared either, and social media was filled with "wailing".

Some have even compared Lighter to LayerZero in 2025. In 2024, LayerZero investigated and shut down over 800,000 wallet addresses before its airdrop. While Lighter Witch may not have as many addresses as LayerZero, its severity may be comparable.

Such harsh anti-witness actions will undoubtedly put Lighter on the opposite side of the community.

According to some users who have been affected by the witching, Lighter's only reason for witching is "abnormal transaction," with no other explanation. The witching rules are also not public or transparent, so users don't even know how they "died."

Despite community skepticism, Lighter founder and CEO Vladimir Novakovski remains confident in the rather forceful witchcraft screening method and stated that he will not publicly disclose the anti-witchcraft algorithm. His explanation is that he "doesn't want it to be targeted and optimized," and he also stated that the witchcraft screening has an appeal mechanism, but so far, the number of appeals is much lower than expected.

However, some community members did not believe Vladimir's nonsense and thought that Lighter's harsh anti-Crystal behavior was to protect its own insider trading, and that the price of off-exchange points might even be secretly manipulated by the Lighter team.

After all, the crypto world has always held the principle of simplicity in its dealings with big money. The more complex the interaction and the stricter the anti-Syllabus measures, the more likely the outcome is to be shady. Even Hyperliquid and Aster, which are in the same sector as Lighter, did not act as slowly and stingily as Lighter when airdropping their products.

The Lighter community is currently like students checking their college entrance exam scores; every day Lighter stops witch screenings, they suffer another day.

Is FDV overvalued?

Given the already sluggish market environment and the negative sentiment in the community, the market has begun to wonder if Lighter has been overvalued.

On Polymarket, the probability of predicting "Lighter's FDV exceeding $1 billion on day one" has dropped from 90% to 72%, and the probability of predicting "Lighter's FDV exceeding $2 billion on day one" has also dropped from 87% to 68%. This indicates that market confidence in Lighter's valuation is also declining.

Referring to the market capitalization of the other two major Prep DEXs (Hyperliquid and Aster) on their first day of trading, Hyperliquid's FDV on November 29, 2024, was approximately $3.6 billion, while Aster's FDV on September 17, 2024, was approximately $10.8 billion. According to Binance's pre-market data, Lighter's current pre-market FDV is approximately $3.3 billion, with a peak of $4.3 billion.

So, from this perspective, the valuation of Lighter on Polymarket seems reasonable, so why has market confidence declined?

One reason is the significant selling pressure from the airdrop, especially given Lighter's extensive witch hunt and the already damaged community goodwill. Most experienced users will likely sell immediately upon receiving the airdrop. According to the Lighter team, the airdrop may represent 25% of the total token supply, with no lock-up restrictions. Therefore, the selling pressure from the airdrop will undoubtedly pose a significant obstacle to Lighter's market capitalization growth.

The second reason is that for a period after its launch, the Lighter token will only be traded on its own platform and will not be actively listed on exchanges. The Lighter team has also stated that Lighter has not paid any listing fees to any trading platform. This means that for a period after its launch, Lighter will not be able to fully obtain liquidity from centralized exchanges, thus limiting the potential for Lighter token price appreciation after its launch.

Despite this, some whales still maintain confidence in Lighter. On Hyperliquid, the balance of power between bulls and bears on Lighter remains relatively even. Since the pre-market contracts were launched, 10 whales with positions exceeding one million US dollars have entered the market, with five on the long side and five on the short side.

Andy, founder of The Rollup, also stated that although Lighter's open interest (OI) is likely to drop by more than 20% and trading volume by more than 30% after the initial token volatility is absorbed, he would still choose to buy if LIT's fully diluted valuation (FDV) is around $2 billion.