JPMD and MONY push for on-chain banking funds

- 核心观点:银行存款代币化标志RWA从试点进入实际运行。

- 关键要素:

- 摩根大通存款代币JPMD在Base链上实际运行。

- 摩根大通推出链上货币市场基金MONY提供收益。

- 链上RWA总价值超4000亿美元,规模显著。

- 市场影响:为传统金融大规模上链奠定基础设施。

- 时效性标注:长期影响。

In December 2025, bank deposits will be entered into the public blockchain.

Not long ago, the application of real-world assets (RWA) on public blockchains was mainly concentrated in tokenized government bonds, money market funds, and structured investment products, while commercial bank deposits—the most systemically important and most strictly regulated form of capital in the financial system—were always confined to the closed banking system. This boundary was broken in December 2025 when JPMorgan Chase & Co. confirmed that its bank deposit-based token product, JPM Coin (JPMD), had entered the actual operation stage on Coinbase's Ethereum Layer 2 network, Base.

Unlike previous tests conducted only on internal ledgers or permissioned networks, JPMD now supports real institutional-grade settlement activities on Base, allowing whitelisted clients to complete payments, margin settlements, and collateral transfers on-chain. This means that for the first time, balance sheet deposits of large global banks are operating in a public blockchain environment, rather than remaining within a closed system.

Why deposit tokens are more important than stablecoins

For years, stablecoins have been the main form of on-chain cash, but for regulated financial institutions, stablecoins have always been outside the banking system, with structural differences in the credit of their issuers, reserve transparency, and regulatory applicability. The fundamental difference with deposit tokens is that they represent a direct claim to commercial bank deposits and are naturally embedded in the existing regulatory, accounting, and auditing framework.

In JPMorgan Chase's case, this difference is not a theoretical discussion, because according to information disclosed on November 12, 2025, JPMD has entered a production-ready state on Base, and the first batch of trial transactions were completed with the participation of Mastercard, Coinbase and B2C2. It also supports a 24/7 on-chain settlement mechanism, which shows that a financial instrument based on bank deposits can already assume real settlement functions on a public blockchain, and is no longer just a conceptual pilot.

Scale determines significance

The systemic significance of deposit tokenization becomes clearer when viewed from a balance sheet perspective.

According to data disclosed in JPMorgan Chase's 2024 Form 10-K annual report, as of December 31, 2024, the bank's total deposits amounted to US$2,406,032 million, or US$2.406032 trillion. This means that even if only a very small percentage of deposit settlement activities migrate to blockchain infrastructure, its scale will far exceed that of most current on-chain RWA products.

In contrast, although tokenized government bonds and money market funds have grown rapidly in recent years, their total on-chain size is still in the tens of billions of dollars range, while commercial bank deposits operate in a financial system worth trillions of dollars.

MONY will bring the profits onto the blockchain.

If deposit tokens solve the settlement problem, then the absence of yield assets has long been another weakness in the on-chain funding structure. This problem was addressed on December 15, 2025, when JPMorgan Asset Management announced the launch of its first tokenized money market fund, My OnChain Net Yield Fund (MONY), and clarified that the fund would be issued on the public Ethereum network.

According to the official announcement, MONY is a 506(c) private equity fund, open only to qualified investors. Its assets are allocated solely to US Treasury bonds and repurchase agreements secured by Treasury bonds. JPMorgan Chase provides $100 million of its own funds as the initial investment, enabling investors to hold assets with USD yield attributes directly on-chain within a fully compliant framework.

Data shows that RWA is moving from pilot testing to full operation.

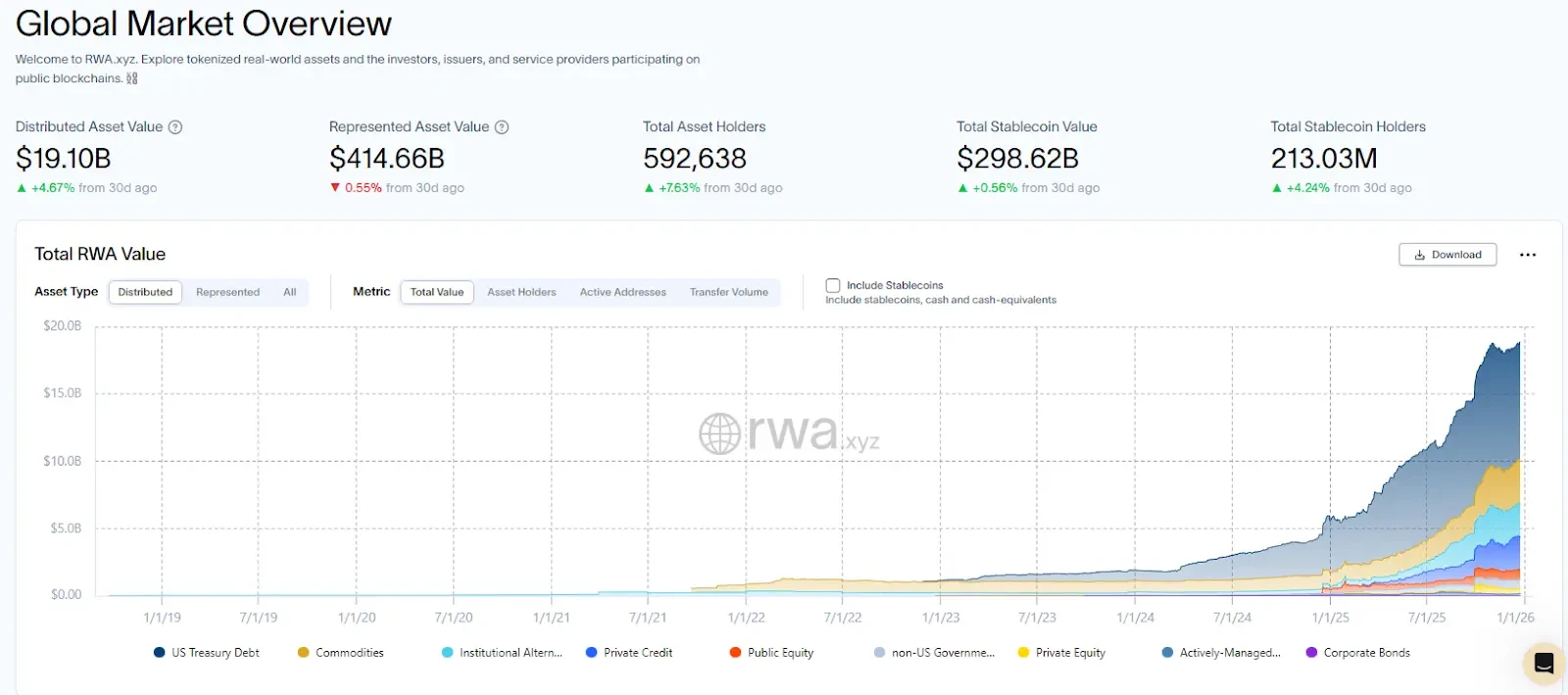

Quantitative data further confirms that RWA has moved beyond the proof-of-concept stage.

According to data from RWA.xyz, as of December 25, 2025, the distributed asset value of on-chain RWA was $19.1 billion, representing an asset value of $414.66 billion, with 592,638 asset holders, providing a publicly verifiable overall snapshot of the on-chain RWA market at that time.

In the sub-sector of government debt assets, which is closest to "on-chain cash management," the same data source shows that as of December 25, 2025, the total on-chain value of tokenized government bonds was $9 billion, covering 62 assets and 59,214 holders, and providing a current indicator of a 7-day annualized yield of 3.82%, which gradually gives it functional attributes comparable to traditional cash management tools.

The Macroeconomic Background Behind Institutional Adoption

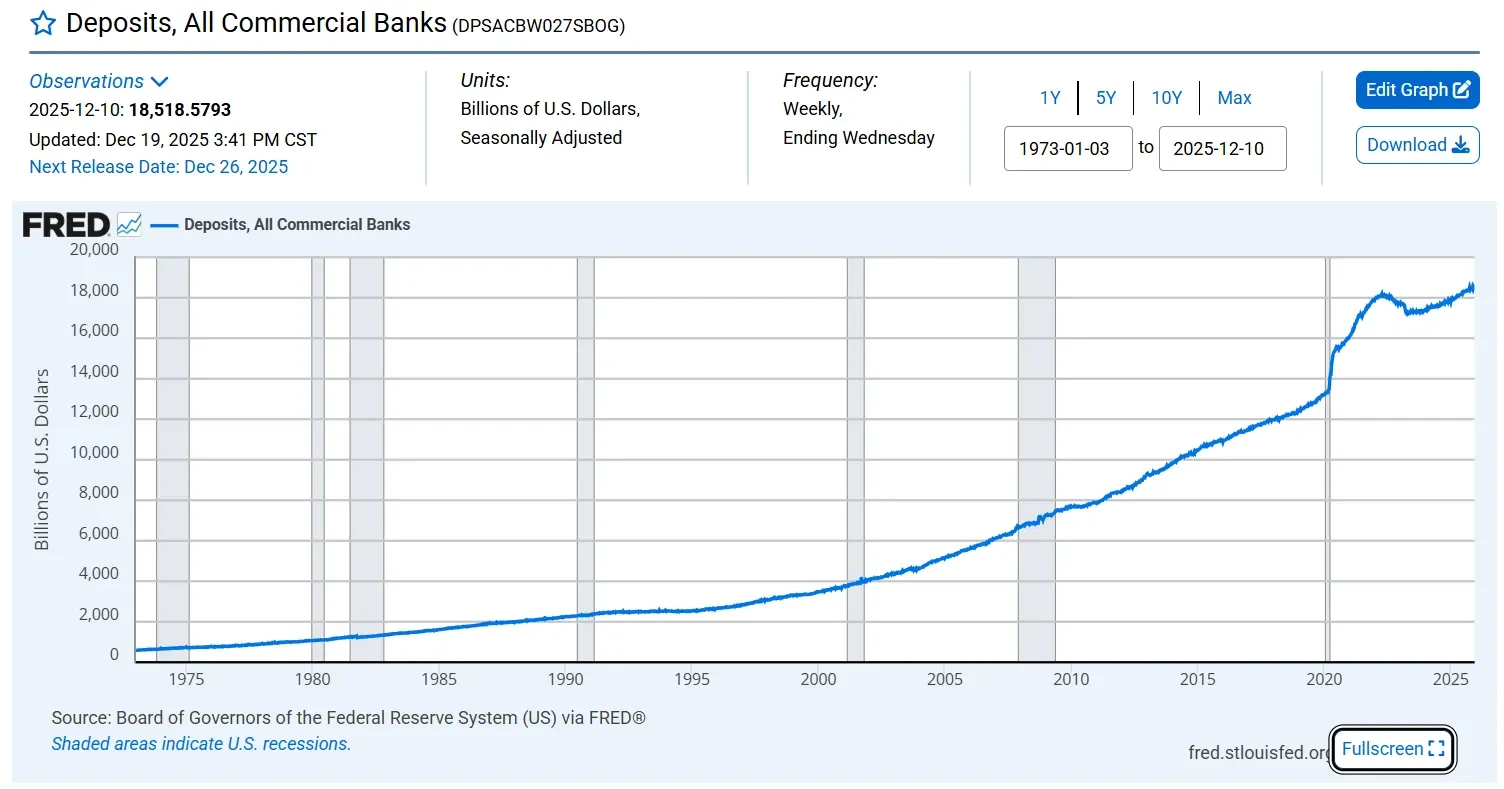

The broader banking system environment helps to understand why this change is concentrated in 2025.

According to the Federal Reserve's H.8 statistics, as of December 10, 2025, the total deposits in the U.S. commercial banking system amounted to $18,518.5793 trillion, or $18.5185793 trillion. At this scale, any technological approach that can improve settlement efficiency, support 24/7 operation, and increase collateral reuse will naturally fall within the scope of institutional evaluation.

Against this backdrop, the emergence of deposit tokens and on-chain money market funds is less a technological experiment and more a practical choice made by the traditional financial system in terms of efficiency and structure.

From Tokenization to Financial Infrastructure

By placing JPMD and MONY within the same framework, it becomes clear that they are not isolated product launches, but rather constitute a clear institutional-grade on-chain finance path: deposit tokens transform bank liabilities into an on-chain cash layer that can be settled 24/7, while tokenized money market funds provide compliant, low-risk USD-yielding assets in the same environment, backed by an ever-expanding pool of tokenized government bonds as collateral and liquidity.

Between November and December 2025, these developments collectively send a clear signal: real-world assets are transforming from “objects that can be tokenized” into “components of financial systems that can operate continuously in public blockchain environments”, and are gradually being integrated into institutional-level clearing, cash management and asset allocation logic.