RWA Weekly Report | Data: Approximately 50% of Euro stablecoins are deployed on the Ethereum blockchain; If Trump adjusts his policies in preparation for the November midterm elections, it could again impact digital currencies and other assets (December 18-23).

- 核心观点:RWA链上资产稳步增长,结构向多元化切换。

- 关键要素:

- RWA链上总价值单周增长1.65%至190.5亿美元。

- 商品、私募股权等中风险资产获更多资金倾斜。

- 用户持续增长,链上活跃度增强。

- 市场影响:推动资本向多元化RWA资产配置。

- 时效性标注:中期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA sector market performance

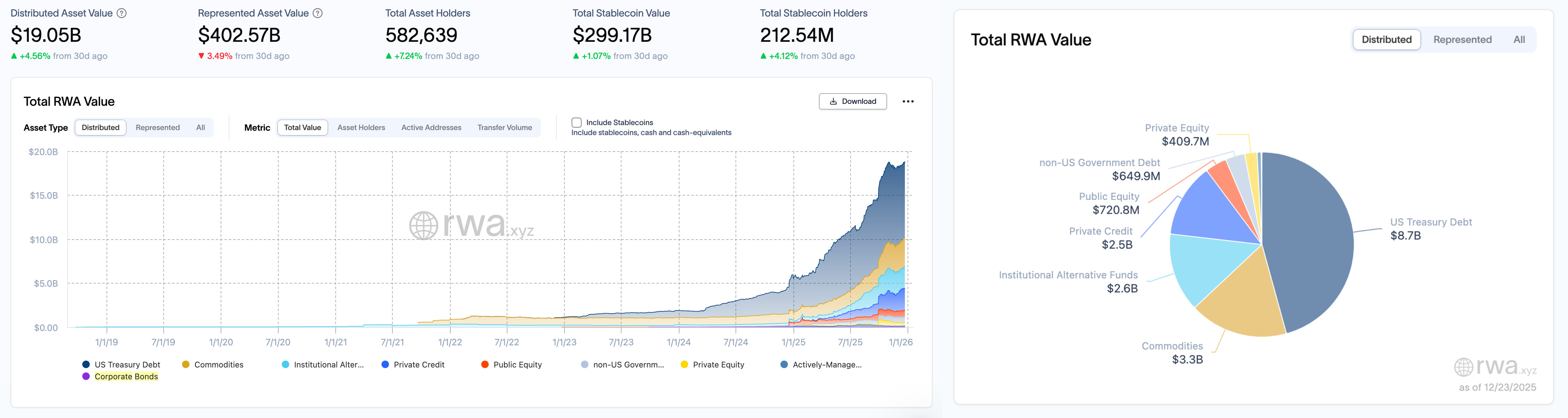

According to data from rwa.xyz, as of December 23, 2025, the total on-chain value (Distributed Asset Value) of RWA continued its moderate growth this week, increasing from $18.74 billion on December 17 to $19.05 billion, an increase of approximately $310 million, representing a weekly increase of 1.65%. The broader RWA market size, however, contracted slightly, falling from $410.38 billion to $402.57 billion, a decrease of $7.81 billion, or 1.9%. The total number of asset holders increased from 575,752 to 582,639, a weekly increase of 6,887, or 1.2%. Meanwhile, the stablecoin user base continued to grow, with the number of holders climbing from 210.72 million to 212.54 million, an increase of approximately 1.82 million, or 0.86%. The total market capitalization of stablecoins has declined slightly, from $300.18 billion to $299.17 billion. Although the decline is slight, the magnitude is very small (about $101 million), and the overall market remains relatively stable.

In terms of asset structure, US Treasury bonds remain the core anchor of the RWA sector, with its on-chain size remaining unchanged at $8.7 billion. Commodity assets rose, from $3.22 billion to $3.33 billion, an increase of $110 million, contributing the most to this week's increase. The institutional alternative fund sector also saw a slight increase, from $2.5 billion to $2.6 billion, indicating a trend of reallocation of funds into stable non-traditional assets. Private equity recorded significant growth, jumping from $381 million to $410 million, an increase of $29 million. The size of non-US government debt saw a slight pullback, decreasing slightly from $664.3 million to $649.9 million, a decrease of 2.2%. However, publicly traded equity quietly increased, from $689.1 million to $720.8 million. Private credit remained stable, increasing slightly by $10 million to $2.5 billion, continuing its previous sideways trend after stabilizing.

Trend Analysis (Compared to last week )

Overall, the total on-chain assets in the RWA market steadily increased this week, while traditional broad-based representative assets experienced slight fluctuations. User growth continued, indicating a gradual increase in the actual activity of the on-chain RWA market. Commodities, private equity, and institutional alternative funds—assets with a medium-risk appetite—began to receive more funding, suggesting that some market participants have released some liquidity from low-risk instruments such as US Treasuries and are now pursuing higher marginal returns. Furthermore, the continued rise in stablecoin holders remains a key variable driving potential future capital inflows.

Market keywords: steady growth, structural shift, and active users.

Key Events Review

Caixin released its "2026 New Year Special Review and Outlook," which pointed out that the "Trump trade" took effect in 2025, with gold prices and cryptocurrencies experiencing fluctuations. In March, an executive order was signed to include approximately 210,000 bitcoins held by the federal government in the national strategic reserve. Various transactions based on stablecoins and digital currencies were implemented extensively in 2025, and listed companies transformed into treasury companies specializing in hoarding digital currencies, triggering speculation. However, the seizure of $15 billion worth of bitcoins from Chen Zhi's telecom fraud group in the US raised concerns about transaction security, and bitcoin prices fell from their historical highs at the end of the year. Moving into 2026, as Trump begins preparing for the November midterm elections, the areas in which his policies will be adjusted based on feedback, and how this will affect the performance of various asset classes, will be a key theme to watch in 2026.

The US SEC issued guidance on broker-dealer crypto asset custody and crypto ATS operations.

The U.S. Securities and Exchange Commission (SEC) this week released a new staff statement through its Division of Trading and Markets, providing operational guidance on regulated broker-dealers holding clients' crypto assets, and simultaneously released a frequently asked question document on crypto alternative trading systems (ATS).

Regarding custody, the SEC stated that as long as broker-dealers follow the informal standards outlined in the statement, including properly safeguarding client private keys and anticipating scenarios such as blockchain failures, 51% attacks, hard forks, or airdrops, regulatory action will not be taken. This guidance applies to crypto securities, including tokenized stocks and debt securities, but the definitions still require further clarification.

In addition, the SEC raised key regulatory concerns regarding trading and settlement activities on crypto ATSs. Hester Peirce, Commissioner and head of the SEC's Crypto Task Force, stated that trading platforms and market participants need to operate under clearly defined market structure rules to promote a fair and orderly market environment without imposing unnecessary burdens.

The Hong Kong Insurance Authority has proposed new regulations aimed at guiding insurance funds into the crypto asset and infrastructure sectors. According to a presentation document dated December 4, the regulator plans to impose a 100% risk capital requirement on crypto assets, while the risk capital requirement for stablecoin investments will be determined based on the fiat currency pegged to the stablecoin under Hong Kong's regulatory framework.

The Hong Kong Insurance Authority stated that it initiated a review of the risk capital regime this year, with the primary objective of supporting the insurance industry and broader economic development. The proposal is expected to undergo public consultation from February to April next year, followed by legislation. Furthermore, the new regulations also address infrastructure investment incentives, proposing capital concessions for investments in infrastructure projects in Hong Kong, mainland China, or those linked to Hong Kong (such as new town developments in the Northern Metropolitan Area), to support the Hong Kong SAR government's local infrastructure development plans. As of 2024, the total premium income of the Hong Kong insurance industry is estimated at approximately HK$635 billion.

US lawmakers have proposed tax breaks for small stablecoin payments and staking rewards.

US lawmakers have introduced a draft bill for discussion that would alleviate the tax burden on ordinary cryptocurrency users by exempting small stablecoin transactions from capital gains tax, including a $200 tax exemption for stablecoin payments, and providing new deferral options for staking and mining rewards. According to the draft, if a stablecoin is issued by an issuer approved under the GENIUS Act, pegged to the US dollar, and trades within a narrow range of around $1, users would not need to recognize gains or losses on transactions not exceeding $200.

Data: Approximately 50% of Euro stablecoins are deployed on the Ethereum blockchain.

According to Token Terminal data, approximately 50% of the market capitalization of Tokenized Euro (a stablecoin for the Euro) is deployed on the Ethereum blockchain, with the remainder distributed across multiple blockchains such as Arbitrum, Polygon, Base, and Solana.

Grayscale stated in an article on its X platform that stablecoins are poised for explosive growth in 2025, with a supply reaching $300 billion and monthly trading volume reaching $1.1 trillion. With the passage of the GENIUS Act (Stablecoin Genius Act), increased stablecoin adoption will benefit blockchain projects such as ETH, TRX, BNB, and SOL from the growing transaction flow, as will infrastructure like Chainlink (LINK) and emerging networks like XPL.

Gemini: Urges US Congress to uphold the Genius Act as is.

Gemini stated in a post on the X platform that it has joined over 125 companies and organizations in signing a joint letter urging the U.S. Congress to uphold the Genius Act as is. Gemini argues that legitimate stablecoin rewards benefit consumers and competition and are legally permissible. Modifying the Genius Act at this time would harm certainty and innovation.

United Stables has officially launched its USD stablecoin, U, which is currently deployed on both the BNB Smart Chain (BSC) and Ethereum (ETH) chains and has completed several ecosystem integrations. Reportedly, the U stablecoin is based on 1:1 full reserve backing (USD + leading stablecoins) and features real-time on-chain Proof-of-Reserves (PoR) and monthly audits. Future support will include enterprise-level privacy protection and AI-native payments (EIP-3009/x402). U is the first "unified stablecoin" on the BNB Chain, integrating mainstream stablecoins as usable collateral assets to form a unified liquidity foundation.

In terms of ecosystem integration: U has integrated support for mainstream DeFi protocols including PancakeSwap, Aster, Four.meme, and ListaDAO, allowing users to trade, stake, lend, and provide liquidity directly on-chain. Regarding wallet support, Binance Wallet, Trust Wallet, and SafePal are all listed on U. In addition to the on-chain world, U is also listed on the centralized exchange HTX.

United Stables stated that U will focus on empowering scenarios such as trading, DeFi, institutional settlement, cross-border payments, and AI-driven autonomous economy, and plans to expand to more public chains, DeFi protocols, and trading platforms in the future.

WLFI has released a governance update stating that a new community governance proposal is now open for voting, suggesting the use of a portion of the unlocked WLFI treasury funds as an incentive to promote the adoption and growth of the stablecoin USD1.

The announcement indicates that over the past three weeks, WLFI has used USD1 to repurchase approximately $10 million worth of WLFI tokens and has successfully secured support for multiple spot trading pairs on Binance. Meanwhile, the usage of USD1 in CeFi and DeFi scenarios has increased significantly, and the WLFI token unlocking schedule is progressing steadily and nearing finalization.

The proposal aims to continue the current growth momentum by further expanding USD1's integration, use cases, and number of partners through incentive mechanisms, thereby enhancing the overall economic activity of the WLFI ecosystem. The announcement states that USD1's growth will directly drive the expansion of the WLFI ecosystem and benefit the entire community.

Ghana passes new law legalizing cryptocurrency trading and plans to explore gold-backed stablecoins.

The Ghanaian Parliament has passed a bill on virtual asset service providers, formally legalizing cryptocurrency trading and related digital asset activities. The bill stipulates that individuals and entities engaged in digital asset activities must register with the Central Bank of Ghana or the Securities and Exchange Commission, depending on the nature of their business.

In his speech, Bank of Ghana President Johnson Asiama stated that the bill lays the foundation for licensing and oversight of industry participants, ensuring that emerging activities are brought under a transparent and regulated framework. Johnson Asiama explicitly stated that after the bill's passage, no one will be arrested for trading cryptocurrencies. Furthermore, Ghana plans to conduct specific explorations in payments, trade finance, and market infrastructure in 2026, including research into asset-backed digital settlement tools such as gold-backed stablecoins. According to estimates by Web3 Africa Group, Ghana processed approximately $3 billion in cryptocurrency transactions between July 2023 and June 2024.

Bankless founder David Hoffman released his market predictions for 2026, stating that he believes 2026 will be the year of asset tokenization, with traditional financial giants like BlackRock fully embracing blockchain technology; ICOs will return to the market in a more mature form as the regulatory environment improves; the DeFi ecosystem will accelerate its expansion, and stablecoin banks are expected to develop into super financial applications; robo-related tokens may experience speculative price frenzy; and the potential threat of quantum computing to cryptocurrency security will gradually attract industry attention.

Trending Projects

Ondo Finance (ONDO)

In short:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its token, ONDO, is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest news:

On December 15, Ondo Finance announced on the X platform that its tokenized stock and ETF platform will be launched on the Solana blockchain in early 2026, aiming to bring Wall Street liquidity to the internet capital market.

Previously, it was reported that the U.S. Securities and Exchange Commission (SEC) had concluded its investigation into tokenized asset company Ondo Finance and did not recommend any charges.

The investigation, initiated in October 2023 by former SEC Chairman Gary Gensler, primarily examined whether Ondo complied with U.S. securities laws in its tokenization of U.S. Treasury products and whether ONDO tokens should be classified as securities. An Ondo spokesperson stated that the company received formal notification in late November that the two-year SEC investigation had concluded. Since the pro-cryptocurrency SEC Chairman Paul Atkins took office, the agency has concluded most cryptocurrency-related investigations. Ondo stated that the resolution of the investigation clears obstacles for its expansion in the U.S., having previously registered as an investment advisor and acquired SEC-registered broker-dealer, ATS operator, and transfer agent Oasis Pro Markets. Ondo is scheduled to host its annual Ondo Summit in New York on February 3, where it is expected to announce new tools and products for tokenizing real-world assets.

MSX (STONKS)

In short:

MSX is a community-driven DeFi platform focused on tokenizing and trading RWA (Retail Assets and Services) such as US stocks on the blockchain. Through a partnership with Fidelity, the platform achieves 1:1 physical custody and token issuance. Users can mint stock tokens such as AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradeFi and DeFi, providing users with a highly liquid, low-barrier-to-entry on-chain investment gateway to US stocks, building a "Nasdaq for the crypto world."

Latest news:

On December 22, Bruce, founder of MSX, posted an article stating that BTC selling pressure has recently encountered resistance, marginal selling pressure has dried up, and there is actual capital absorbing the chips below, rather than emotional buying. He is bullish on this.

Previously, Bruce posted on X that Nasdaq had submitted its application for a stock token, and MSX was ready to be exchanged for the "official" token. He stated, "Nasdaq submitted its stock token application to the SEC in September of this year, and if all goes well, it will officially launch in Q1 of next year. The launch of Nasdaq's stock token will impact all 'unofficial stock tokens,' and MSX is ready to be exchanged for the 'official' token at any time."

Related Links

We've compiled the latest insights and market data for the RWA sector.

The 5 Most Watched L1 Public Chains in 2026: The Main Evolution from DeFi to RWA

Aimed at investors, developers, and traders, it helps them identify which public blockchains are consistently accumulating real activity, users, and long-term value.

The article's advice is: if you want to engage in RWA (Real Money Market Fund) activities, first sever all ties with domestic RMB, ordinary retail investors, and promotional channels. When it comes to red lines, survival is more important than speed. Legal red lines are never meant to be played like a game of hopscotch.