SEC's "Two-Year On-Chain Implementation" Prediction: Tokenization Restructuring of the DTCC Clearing System

- 核心观点:美国金融市场两年内或全面迁移至区块链。

- 关键要素:

- SEC主席推动跨部门“Project Crypto”倡议。

- 贝莱德、摩根大通等巨头已展开代币化实践。

- DTCC获SEC批准,连接传统与代币化系统。

- 市场影响:将极大提升金融效率与全球可及性。

- 时效性标注:中期影响

Original author: @BlazingKevin_, the Researcher at Movemaker

SEC Chairman Paul Atkins pointed out that the entire U.S. financial market, including stocks, fixed income, Treasury bonds, and real estate, may fully migrate to the blockchain technology architecture that underpins cryptocurrencies within the next two years. This could be considered the most significant structural change to the U.S. financial system since the advent of electronic transactions in the 1970s.

1. A fully blockchain-based cross-departmental collaboration framework and its practical contributions.

Atkins' "Project Crypto" initiative is not a unilateral action by the SEC; it is built on systemic cooperation across legislation, regulation, and the private sector. Achieving full blockchain coverage of the over $50 trillion U.S. financial market (including stocks, bonds, Treasury bonds, private credit, real estate, etc.) requires clear roles and contributions from multiple institutions.

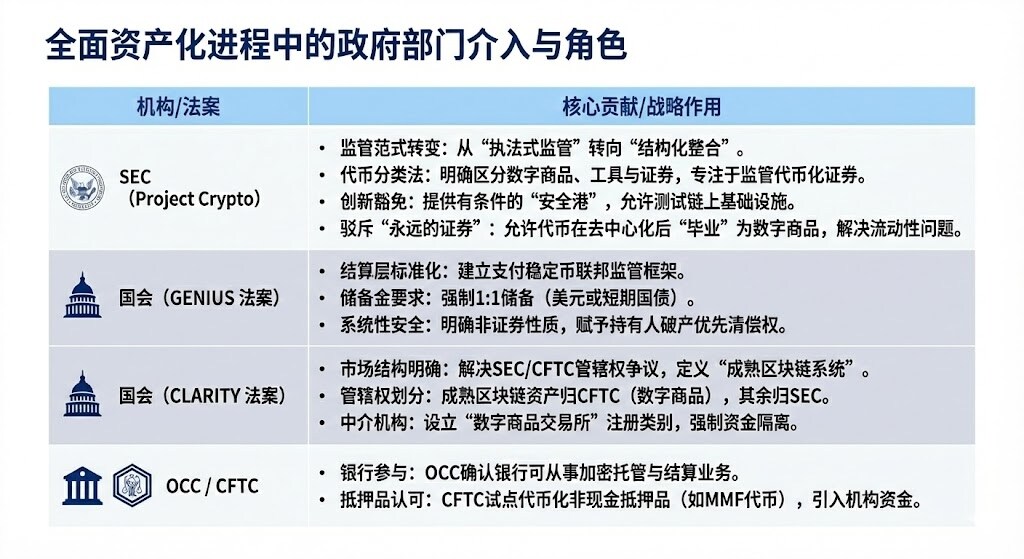

1.1 Government departments that will be involved in full assetization

It should be added that the "Project Crypto" and "Innovation Exemption" mechanisms acknowledge the incompatibility between blockchain technology and existing financial regulations, providing a controlled testing environment that allows traditional financial institutions (TradFi) to explore and implement tokenized infrastructure without violating core investor protection principles.

The GENIUS Act addresses the Cash Leg issue, which is essential for institutions to conduct on-chain transactions and collateralize stablecoins by creating compliant, fully reserve-backed stablecoins and clearly transferring regulatory authority to banking regulators.

The Clarity Act, by delineating the jurisdiction of the SEC and CFTC, clearly defines crypto-native platforms and establishes a definition of "maturity," enabling institutions to clearly know under which regulatory body their digital assets (such as Bitcoin) operate. It also provides a pathway for crypto-native platforms to register as federally regulated intermediaries ("brokers/dealers").

Established in 1973, the OCC specializes in providing clearing and settlement services for options, futures, and securities lending transactions, promoting market stability and integrity. The CFTC is the primary regulator of the futures market and futures dealers.

This cross-departmental collaboration is a prerequisite for the full on-chain implementation of the US financial market, laying a solid foundation for subsequent large-scale deployments by giants such as BlackRock and JPMorgan Chase, as well as the integration of core infrastructures such as DTCC.

2.2 Collaboration among traditional financial giants

Within the collaborative blueprint of traditional US financial giants, the deepening deployments of each institution reflect more specific strategic focuses and technical details. BlackRock's issuance of the first tokenized US Treasury bond fund on a public blockchain (Ethereum) establishes its cornerstone position as an asset manager bringing traditional financial returns into the public blockchain ecosystem.

After renaming its blockchain business to Kinexys, JPMorgan Chase has enabled banks to complete atomic swaps of tokenized collateral with cash within hours rather than days, significantly optimizing liquidity management. Meanwhile, its pilot program for JPMD on the Base chain is seen as a strategic step toward extending into the broader public blockchain ecosystem, aiming to seek stronger interoperability.

Finally, the specific breakthrough for Depository Trust and Clearing Corporation (DTCC) was accomplished by its subsidiary, Depository Trust Company (DTC). As one of the world's most important trading infrastructure providers, the SEC's "no objection letter" enabled it to connect the traditional CUSIP system with the new token infrastructure, thereby officially launching a pilot program for the tokenization of mainstream assets, including Russell 1000 constituent stocks, in a controlled environment.

2. Analysis of the Financial Environment and Impacts after Full Tokenization

The core objective of asset tokenization is to break the "island effect" and "time constraints" of traditional finance and create a global, programmable, and 24/7 financial system.

2.1 Significant Improvement in the Financial Environment: A Leap in Efficiency and Performance

Tokenization will bring efficiency and performance advantages that are difficult for traditional financial systems to match:

2.1.1 A leap in settlement speed (from T+1/T+2 to T+0/second):

Improvement: Blockchain enables near real-time (T+0) or even second-level settlement and delivery, a stark contrast to the T+1 or T+2 settlement cycles typically required by traditional financial markets. UBS's digital bonds issued on SDX demonstrated T+0 settlement capabilities, while the European Investment Bank's digital bond issuance reduced settlement time from five days to one day.

Addressing key pain points: Significantly reduces counterparty credit risk and operational risk caused by settlement delays. For time-sensitive transactions such as repurchase agreements and derivatives margin calls, faster settlement is crucial.

2.1.2 The Revolution in Capital Efficiency and the Release of Liquidity:

Enhancements: It enables "atomic settlement," meaning assets and payments occur simultaneously in a single, indivisible transaction. Simultaneously, tokenization unlocks "dormant capital" currently locked in settlement wait periods or inefficient processes. For example, programmable collateral management could release over $100 billion in trapped capital annually.

Addressing key pain points: Eliminating the principal risk inherent in traditional "delivery first, payment later" operations. Reducing the need for high margin buffers at clearinghouses. Simultaneously, tokenized money market funds (TMMFs) can be directly transferred as collateral, preserving returns and avoiding the liquidity friction and profit losses associated with redeeming cash and reinvesting in traditional systems.

2.1.3 Enhanced transparency and auditability:

Enhancements: Distributed ledgers provide a single, immutable, authoritative record of ownership, with all transaction history publicly verifiable. Smart contracts can automatically execute compliance checks and corporate actions (such as dividend payments).

Addressing key pain points: It completely resolves the inefficiencies of data silos, multiple ledgers, and manual reconciliation in traditional finance. It provides regulatory agencies with an unprecedented "God's-eye view," enabling real-time, penetrating oversight and effective monitoring of systemic risks.

2.1.4 24/7/365 Global Market Access:

Enhancement: Markets are no longer limited by traditional bank hours, time zones, or holidays. Tokenization makes cross-border transactions smoother, enabling peer-to-peer asset transfers globally.

Addressing key pain points: It overcomes the time lag and geographical limitations in traditional cross-border payments and liquidity management, and is particularly beneficial to the cash management of multinational corporations.

2.2 The participants most affected

Tokenization has brought about disruptive changes, with the greatest impact on the following types of market participants:

Key challenges and risks:

- Trade-offs between liquidity and netting: DTCC currently achieves significant capital efficiency by reducing the amount of cash and securities that actually need to be transferred by 98% through netting millions of transactions. Atomic settlement (T+0) is essentially real-time gross settlement (RTGS) , which can lead to a loss of netting efficiency, requiring the market to find a hybrid solution between speed and capital efficiency, such as intraday repurchase agreements.

- The privacy paradox: Institutional finance relies on transaction privacy, while public blockchains (such as Ethereum) offer transparency. Large institutions cannot execute large transactions on public blockchains without being "preempted." Solutions include employing privacy-preserving technologies such as zero-knowledge proofs, or operating on permissioned blockchains (such as JPMorgan Chase's Kinexys).

- Amplified Systemic Risk: 24/7 markets eliminate the traditional market "cooling-off period." Algorithmic trading and automated margin calls (via smart contracts) can trigger large-scale cascading liquidations under market stress, thus amplifying systemic risk, similar to the liquidity pressures during the UK LDI crisis in 2022.

2.3 The Core Value of the Tokenized Fund (TMMF)

The tokenization of money market funds (MMFs) is one of the most representative examples of RWA's growth. TMMFs are particularly attractive as collateral:

- Retained earnings : Unlike non-interest-bearing cash, TMMFs can continue to earn earnings as collateral until they are actually used, reducing the opportunity cost of "collateral drag".

- High liquidity and composability : TMMFs combine the regulatory familiarity and security of traditional MMFs with the instant settlement and programmability of DLT. For example, BlackRock's BUIDL fund, through Circle's USDC instant redemption channel, solves the pain point of the traditional MMF redemption T+1, achieving 24/7 instant liquidity.

3. The role of DTCC/DTC in the tokenization process

DTCC and DTC are indispensable core systemic institutions in the US financial infrastructure. DTC holds a massive amount of assets, covering the vast majority of stock registration, transfer, and custody in the US capital market. DTCC and DTC are considered the "central warehouse" and "central ledger" of the US stock market. DTCC's involvement is fundamentally crucial to ensuring the compliance, security, and legal validity of the tokenization process.

3.1 Core Roles and Responsibilities of DTC

- Identity and Scale: The DTC is responsible for central securities custody, clearing, and asset servicing. As of 2025, the DTC held $100.3 trillion in assets under custody, covering 1.44 million securities issuances, and dominated the registration, transfer, and ownership confirmation of the vast majority of stocks in the U.S. capital market.

- Tokenization Bridge and Compliance Guarantee: DTCC's involvement represents official recognition of digital assets by traditional financial infrastructure. Its core responsibility is to act as a trust bridge between the traditional CUSIP system and emerging tokenization infrastructure. DTCC promises that tokenized assets will maintain the same high levels of security, robustness, legal rights, and investor protection as their traditional counterparts.

- Liquidity Integration: DTCC’s strategic goal is to enable a single liquidity pool between the TradFi (traditional finance) and DeFi (decentralized finance) ecosystems through its ComposerX platform suite.

3.2 DTC Tokenization Process and SEC No Objection Letter

In December 2025, DTCC's subsidiary DTC obtained a landmark no-objection letter from the U.S. SEC, which provides the legal basis for its large-scale advancement of tokenization business.

3.3 The impact of DTC tokenization

The approval of DTC NAL is considered a milestone in tokenization, and its impact is mainly reflected in:

- Certainty of the Official Token: The tokenization of DTC signifies the imminent arrival of tokenized stocks backed by the US government. In the future, projects tokenizing US stocks will likely directly integrate with DTC's official asset token, rather than building their own on-chain asset infrastructure.

- Market structure integration: Tokenization will drive the US stock market toward a "CEX + DTC custody trust" model. Exchanges like Nasdaq may directly act as CEXs, while DTCs manage token contracts and allow withdrawals, achieving full liquidity integration.

- Enhanced Collateral Liquidity: DTC's tokenization services will support enhanced collateral liquidity, enabling 24/7 access and asset programmability. DTCC has been exploring the use of DLT technology to optimize collateral management for nearly a decade.

- Eliminating market fragmentation: Stock tokens are no longer digital types separated from traditional assets, but are fully integrated into the general ledger of traditional capital markets.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly launched by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking region, Movemaker is committed to building a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecosystem partners.

Disclaimer:

This article/blog is for informational purposes only and represents the author's personal views, not the position of Movemaker. This article is not intended to provide: (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries extremely high risk, with significant price volatility and the possibility of becoming worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your own financial situation. For specific questions, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general informational purposes only. Reasonable care has been taken in preparing these data and charts, but we are not responsible for any factual errors or omissions expressed herein.