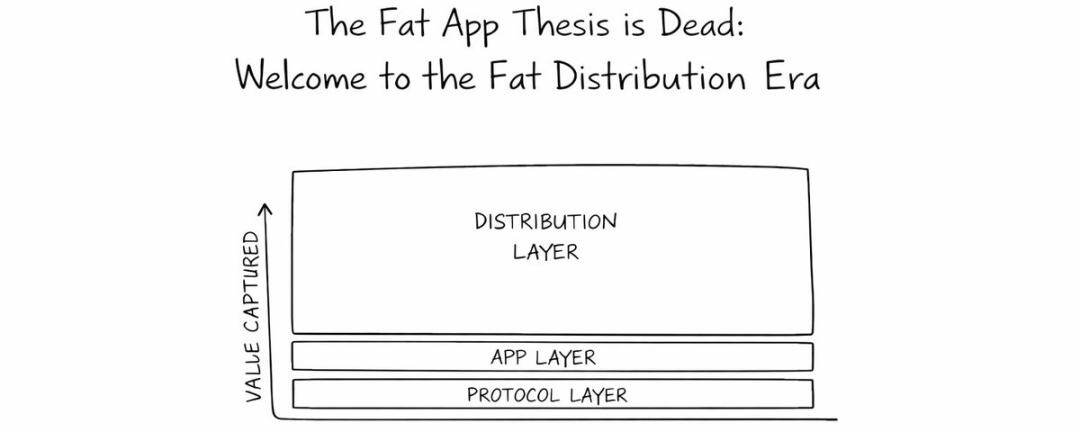

The "fat app" is dead; welcome to the era of "fat distribution."

- 核心观点:加密应用正沦为标准化后端基础设施。

- 关键要素:

- 基础设施技术投入边际效益递减,用户无感。

- 用户更看重熟悉的前端界面,而非底层技术优化。

- 应用转向B端合作,嵌入其他产品生态(如Coinbase集成Morpho)。

- 市场影响:前端平台与分发渠道将占据更大价值份额。

- 时效性标注:中期影响。

Original author: Matt

Original translation by Chopper, Foresight News

Today, even cryptocurrency applications are gradually becoming standardized infrastructure, serving Web2 and traditional financial institutions with user-familiar front-end interfaces.

Each cryptocurrency cycle gives rise to a new theory about "how value is deposited in the crypto ecosystem," and these theories are all reasonable at the time.

- In 2016, Joel Monegro proposed the " Fat Protocol Theory ": value converges to underlying public chains such as Ethereum through shared data, tokens, and network effects.

- In 2022, Westie proposed the " fat application theory ": as Layer 2 networks significantly reduce transaction costs, applications such as Uniswap, Aave, and OpenSea earn transaction fees that even exceed those of their respective public chains by building liquidity and user experience barriers.

Today, in 2025, the industry has officially entered a new phase: cryptocurrency applications themselves have become standardized products that can be easily replaced.

The reason for this shift is simple: the crypto industry has over-invested in infrastructure and technology optimization. We've focused solely on complex Automated Market Maker (AMM) algorithms, innovative liquidation mechanisms, customized consensus protocols, and cost optimization for zero-knowledge proofs, but we're now experiencing diminishing marginal returns. Technological improvements in applications are becoming imperceptible to end users.

Users don't care about a 1 basis point reduction in oracle data costs, a 10 basis point increase in lending rates, or improved pricing accuracy in decentralized exchange liquidity pools; what they really care about is using the user interface they already trust and are familiar with.

This trend is becoming increasingly apparent: applications such as Polymarket, Kalshi, Hyperliquid, Aave, Morpho, and Fluid are investing more time and resources in B2B collaborations. Instead of struggling to attract new users and adapt to cumbersome on-chain operations, they are transforming into backend services, embedding themselves into other product ecosystems.

Convincing 25 million new users to download browser plugins, safeguard their private keys, prepare gas fees, and transfer assets across chains, while also adapting to complex on-chain processes; or having platforms like Robinhood add a "yields" feature to directly channel user deposits into your lending market. Clearly, the latter is easier to achieve.

Integration and cooperation will ultimately prevail, distribution channels will ultimately prevail, and front-end interfaces will ultimately prevail; while encrypted applications will only be reduced to mere traffic conduits.

Coinbase's case perfectly illustrates this point: users can borrow USDC using their Bitcoin (cbBTC) as collateral on their platform, and this transaction flow is directed to the Morpho lending market on the Base chain. Although Aave and Fluid platforms on the Base chain offer significantly better interest rates for borrowing stablecoins using cbBTC as collateral, Morpho still dominates the market. The reason is simple: Coinbase users are willing to pay extra for "visible convenience."

However, not all applications will become invisible infrastructure. Some applications will remain committed to the B2C (business-to-consumer) model and will not rely on B2B2C (business-to-business-to-consumer) as their primary profit model. But they must undergo a complete transformation: adjusting core priorities, restructuring their profit logic, building new competitive barriers, optimizing marketing strategies and development strategies, and simultaneously re-understanding the core path users take to enter the crypto space.

This does not mean that infrastructure applications can no longer create value, but rather that front-end platforms that truly control user traffic will capture a larger share of value.

In the future, competitive barriers will no longer be built around liquidity or native crypto user experience, but will focus on distribution capabilities.