On the eve of a major dollar devaluation, the real turning point for Bitcoin has not yet arrived.

- 核心观点:美联储短期国债购买并非真正量化宽松。

- 关键要素:

- 购买短期国债,未吸收市场久期风险。

- 未实质压低长期收益率和期限溢价。

- 金融条件未全面宽松,影响局部。

- 市场影响:风险资产短期未获强劲动力。

- 时效性标注:短期影响。

Original title: BTC: Onchain Data Update + our views on last week's FOMC and the "big picture"

Original author: Michael Nadeau, The DeFi Report

Original article translated by Bitpush News

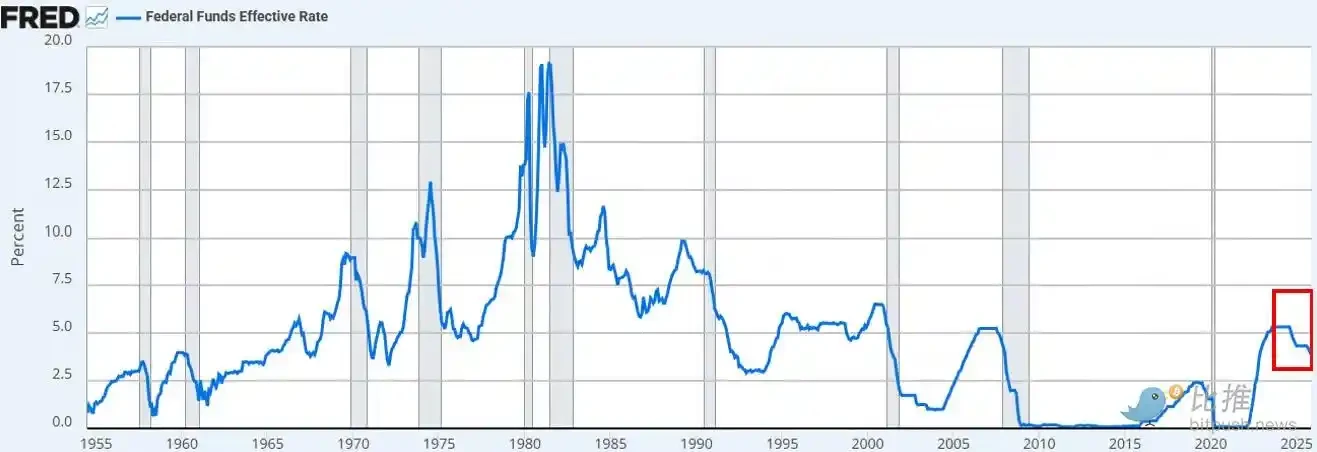

Last week, the Federal Reserve lowered interest rates to a target range of 3.50%–3.75%—a move that was fully priced in by the market and largely expected.

What truly surprised the market was the Federal Reserve's announcement that it would purchase $40 billion in short-term Treasury bills (T-bills) per month, which was quickly labeled by some as a " lightweight version of quantitative easing (QE-lite )".

In today's report, we will delve into what this policy has changed and what it hasn't. Furthermore, we will explain why this distinction is crucial for risk assets.

Let's begin.

1. Short-term strategy

The Federal Reserve cut interest rates as expected. This is the third rate cut this year and the sixth since September 2024. The total rate has been lowered by 175 basis points, pushing the federal funds rate to its lowest level in about three years.

In addition to the interest rate cut, Powell also announced that the Federal Reserve will begin "Reserve Management Purchases" of short-term Treasury bonds at a rate of $40 billion per month starting in December. Given the continued tightness in the repo market and liquidity in the banking sector, this move was entirely expected.

The current market consensus (both on the X platform and on CNBC) is that this is a "dovish" policy shift.

Discussions about whether the Federal Reserve's announcement was equivalent to "money printing," "QE," or "QE-lite" immediately dominated social media timelines.

Our observations:

As "market observers," we observe that market sentiment remains risk-on. In this state, we anticipate investors will "overfit" policy headlines, attempting to construct bullish logic while ignoring the specific mechanisms by which policies translate into actual financial conditions.

Our view is that the Fed's new policy is beneficial to the "financial market pipeline," but not to risk assets .

Where do we differ from the general market perception?

Our viewpoint is as follows:

• Purchasing short-term government bonds ≠ Absorbing market duration

The Federal Reserve is buying short-term Treasury bills (T-bills), not long-term interest-bearing bonds (coupons). This does not remove the market's interest rate sensitivity (duration).

• Did not suppress long-term yields

While short-term purchases may slightly reduce future long-term bond issuance, this does not help to compress the term premium. Currently, approximately 84% of Treasury bond issuance is in the form of short-term notes, so this policy does not substantially change the duration structure faced by investors.

Financial conditions have not eased across the board.

These reserve management purchases, designed to stabilize the repurchase market and bank liquidity, do not systematically lower real interest rates, corporate borrowing costs, mortgage rates, or equity discount rates. Their impact is localized and functional, rather than a broad-based monetary easing.

Therefore, no, this is not QE. This is not financial repression. To be clear, the abbreviation is not important; you can call it money printing as you like, but it does not intentionally suppress long-term yields by removing duration—which is precisely what forces investors to move to the high end of the risk curve.

This has not yet happened. The price movements of BTC and the Nasdaq index since last Wednesday have also confirmed this.

What can change our perspective?

We believe that BTC (and risk assets more broadly) will have its moment of glory. But that will happen after QE (or as the Fed calls the next phase of financial repression).

That moment arrives when the following occurs:

• The Federal Reserve artificially suppresses the long end of the yield curve (or signals the market).

• Real interest rates are falling (due to rising inflation expectations).

• Lower corporate borrowing costs (providing momentum for tech stocks/Nasdaq).

• Term premium narrows (long-term interest rates decline).

• The discount rate for stocks has decreased (forcing investors to move into riskier assets with longer time horizons).

• Mortgage rates fell (driven by the suppression of long-term rates).

At that time, investors will sense a "financial repression" and adjust their portfolios. We are not currently in this environment, but we believe it is coming. While timing is always difficult to predict, our baseline assumption is that volatility will increase significantly in the first quarter of next year.

This is what we consider the short-term situation.

2. A broader perspective

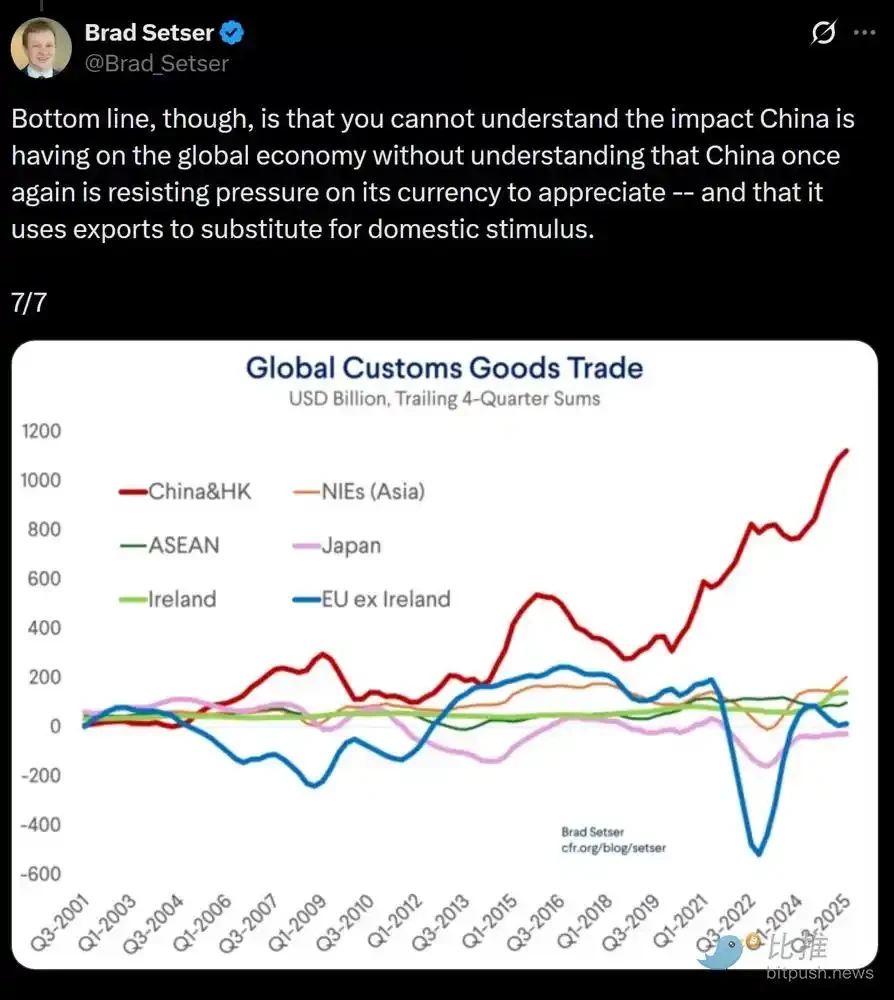

The deeper issue lies not in the Fed’s short-term policies, but in the global trade war (currency war) and the tensions it creates at the core of the dollar system.

Why?

The United States is moving towards the next strategic phase: bringing manufacturing back to the US, reshaping the global trade balance, and competing in strategically essential industries such as AI. This goal directly conflicts with the dollar's role as the world's reserve currency.

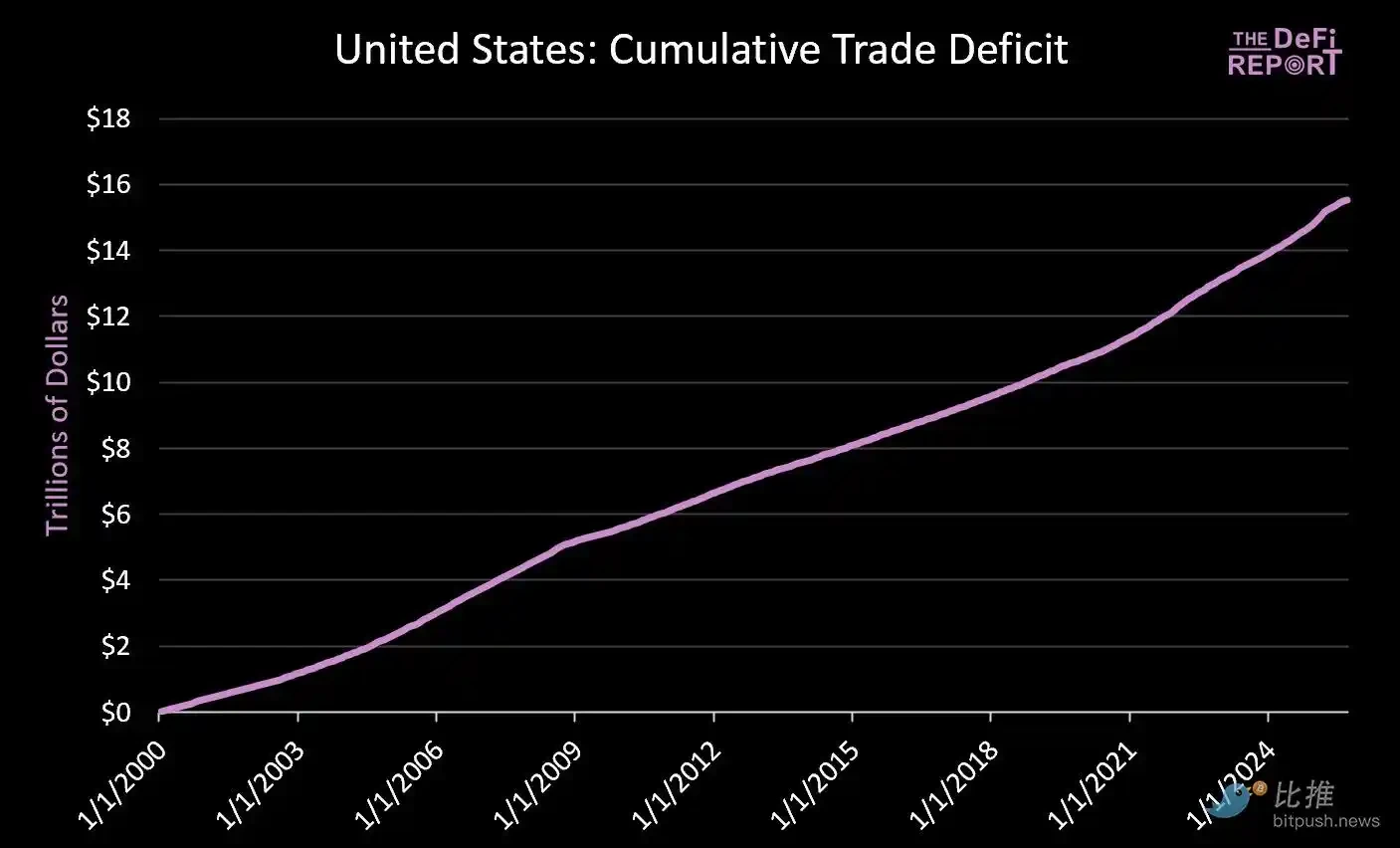

Reserve currency status can only be maintained if the United States maintains a persistent trade deficit. Under the current system, dollars are sent overseas to purchase goods, and then flow back to the US capital markets through a cycle of Treasury bonds and risky assets. This is the essence of the "Triffin's Dilemma."

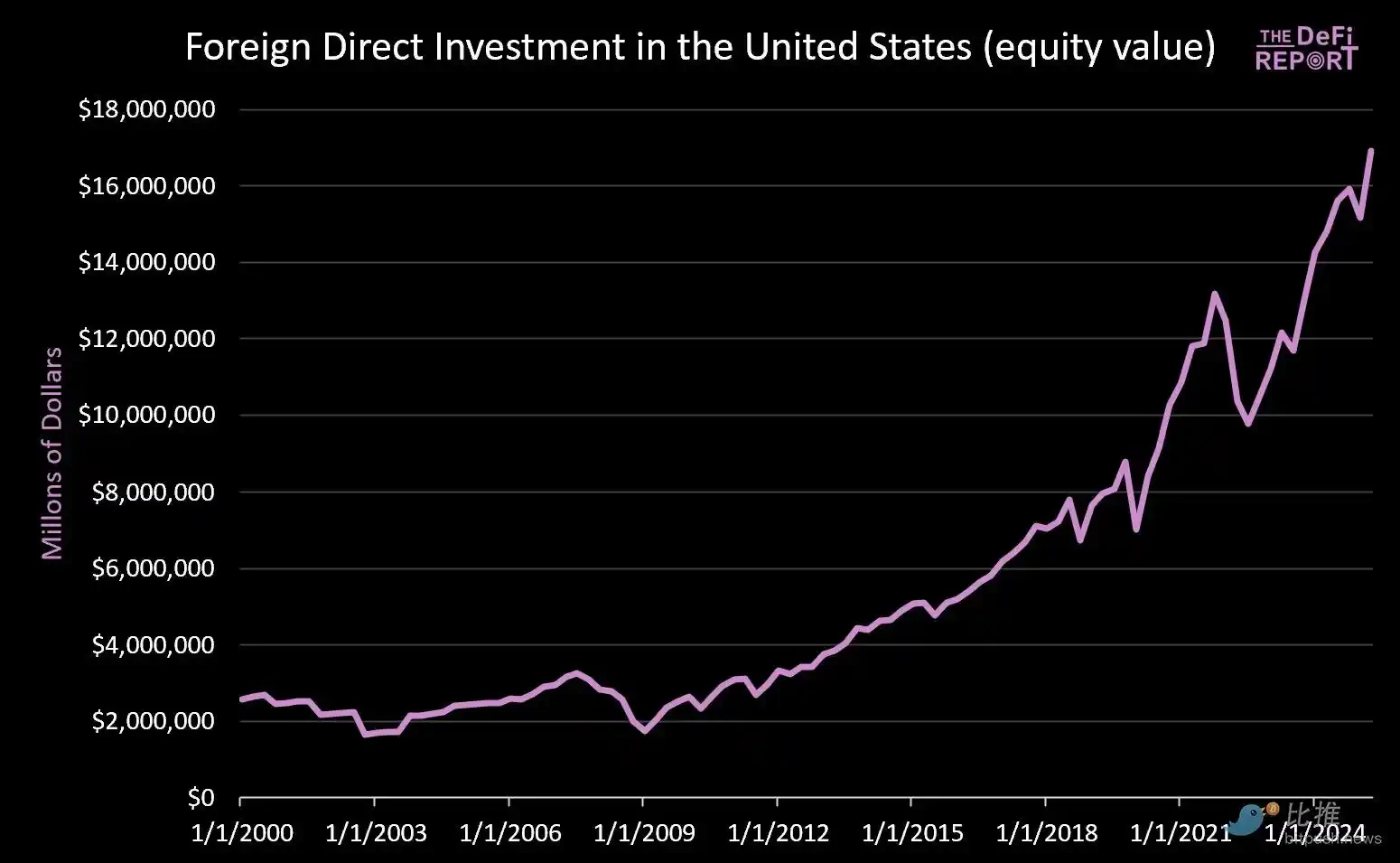

Since January 1, 2000: More than $14 trillion has flowed into the U.S. capital markets (not including the $9 trillion in bonds currently held by foreigners).

Meanwhile, approximately $16 trillion flowed overseas to pay for goods.

Efforts to reduce the trade deficit will inevitably reduce the flow of circulating capital back to the U.S. market. While Trump touted the commitment of countries like Japan to "invest $550 billion in U.S. industry," he failed to address the fact that Japanese (and other) capital cannot simultaneously exist in both manufacturing and capital markets.

We believe this tension will not be resolved smoothly. Instead, we anticipate higher volatility, asset repricing, and eventual currency adjustments (i.e., a depreciation of the dollar and a reduction in the real value of U.S. Treasury bonds).

The core argument is that China is artificially depressing the RMB exchange rate (to give its exports an artificial price advantage), while the US dollar is artificially overvalued due to foreign capital investment (leading to relatively low prices for imported products).

We believe that a forced devaluation of the US dollar may be imminent to address this structural imbalance . In our view, this is the only viable path to resolving the global trade imbalance.

In the new round of financial repression, the market will ultimately determine which assets or markets qualify as "stores of value".

The key question is whether U.S. Treasury bonds can continue to serve as global reserve assets once everything settles down.

We believe that Bitcoin, along with other global, non-sovereign stores of value (such as gold), will play a far more significant role than they do now. This is because they are scarce and do not rely on any policy credit.

This is the “macro-level” setting we are seeing.