Will Japan's interest rate hike trigger a global liquidity shock?

- 核心观点:日本鹰派加息对全球流动性冲击有限。

- 关键要素:

- 投机性日元空头已提前平仓,风险释放。

- 当前宏观环境减弱了日元升值与平仓压力。

- 美联储扩表政策为市场提供了流动性缓冲。

- 市场影响:或成市场脆弱性下的短期冲击催化剂。

- 时效性标注:短期影响。

Original author: Long Yue

Original source: Wall Street News

As the Bank of Japan's monetary policy meeting on December 19th approaches, market concerns are growing that it may adopt a hawkish interest rate hike. Will this move end the era of cheap yen and trigger a global liquidity crisis? A recent strategy report released by Western Securities on December 16th provides an in-depth analysis of this issue.

With inflation high, a hawkish interest rate hike in Japan is inevitable.

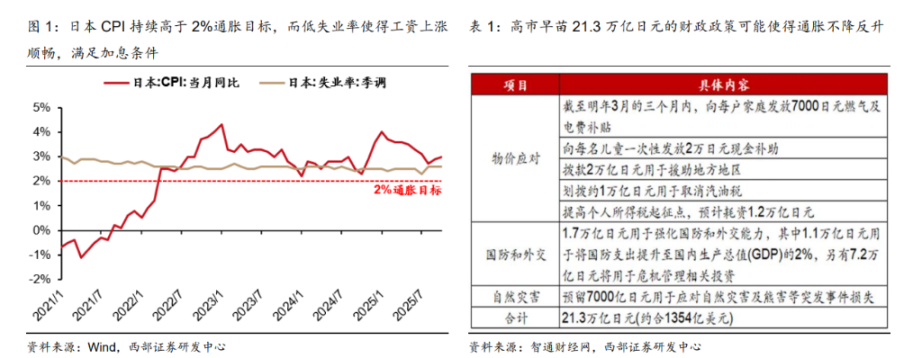

The report points out that the Bank of Japan's interest rate hike is driven by multiple factors. First, Japan's CPI has consistently exceeded the official inflation target of 2%. Second, the unemployment rate has remained below 3% for an extended period, creating favorable conditions for nominal wage growth. Market expectations for wage growth during next year's "Spring Labor-Management Negotiations" are high, which will further push up inflationary pressures. Finally, Sanae Takaichi's 21.3 trillion yen fiscal policy may also exacerbate inflation.

These factors combined have forced the Bank of Japan to adopt a more hawkish stance. Market concerns are that once the interest rate hike is implemented, it will lead to a concentrated unwinding of a large number of carry trades accumulated during Japan's YCC (yield curve control) era, thereby causing a liquidity shock to global financial markets.

Theoretical breakdown: Why may the most dangerous phase of the liquidity shock have passed?

Despite market concerns, the report argues that, theoretically, the impact of Japan's current interest rate hike on global liquidity is limited.

The report listed four reasons:

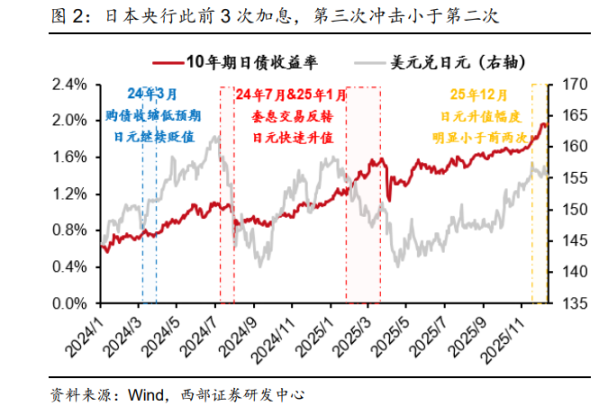

Risks have been partially mitigated: The Bank of Japan has raised interest rates three times since March of last year. The rate hike in July of last year, coupled with the exit from the YCC (Yield Control Program), did indeed cause a significant liquidity shock, but the impact of the rate hike in January of this year has clearly weakened, indicating that market resilience is increasing.

Speculative positions have already exited: Futures market data shows that most speculative short positions in the yen were closed out in July of last year. This means that the most active and potentially catastrophic "carry trades" have subsided, and the most dangerous phase of the liquidity shock has passed.

The macroeconomic environment is different: The US is not currently experiencing a "recession trade" similar to that of July last year, and the pressure on the dollar to depreciate is not significant, while the yen itself is weak due to geopolitical and debt issues. This reduces expectations of yen appreciation, thereby alleviating the urgency to unwind carry trades.

The Fed's "safety cushion": The report specifically mentions that the Fed has begun to pay attention to potential liquidity risks and has started a balance sheet expansion (QE-like) policy, which can effectively stabilize market liquidity expectations and provide a buffer for the global financial system.

Real Risk: A Catalyst in a Fragile Market

The report emphasizes that theoretical security does not equate to complete peace of mind. The current fragility of global markets is the real root cause of the potential shocks triggered by Japan's interest rate hike. The report describes this as a "catalyst."

The report analyzes that the significant impact of Japan's interest rate hike last July was due to the combined effects of two factors: the unwinding of a large number of active carry trades and the "US recession trade." Currently, the former condition has weakened. However, new risks are emerging: global stock markets, represented by US stocks, have experienced a six-year bull market, accumulating substantial profits and making them vulnerable. Simultaneously, concerns about an "AI bubble" are resurfacing in the US market, leading to a strong risk aversion among investors.

However, the global stock market, represented by the US stock market, has been in a bull market for six years and is inherently vulnerable. At the same time, concerns about the US "AI bubble" have resurfaced, leading to a strong risk aversion among investors. The yen's interest rate hike could become a "catalyst" for triggering a global liquidity shock.

Against this backdrop, the certainty of Japan raising interest rates could very well become a trigger, causing a panic flight of funds and thus inducing a global liquidity shock. However, the report also offers a relatively optimistic assessment: this liquidity shock will likely force the Federal Reserve to implement stronger easing policies (QE), so global stock markets are likely to recover quickly after a brief sharp decline.

Watch more and act less, closely monitor signals of a "triple whammy" in stocks, bonds, and currency.

Faced with this complex situation, the report advises investors to "observe more and act less".

The report argues that since the Bank of Japan's decisions are largely "open secrets," but the choice of funds is difficult to predict, the best strategy is to remain on the sidelines and observe.

Scenario 1: If there is no panic outflow of funds, the actual impact of Japan's interest rate hike will be very limited, and investors will not need to take any action.

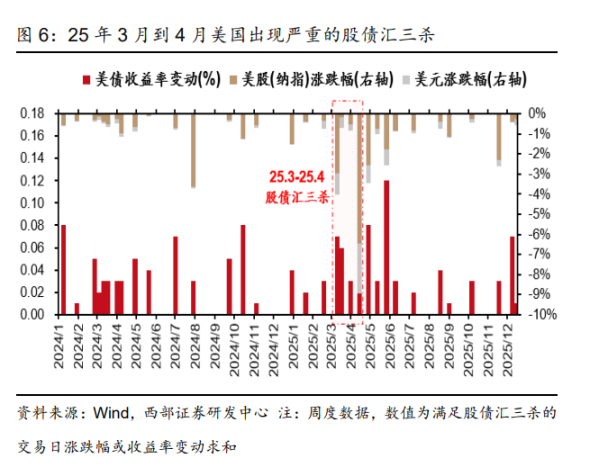

Scenario 2: If a panic selling does indeed trigger a global liquidity shock, investors need to closely monitor a key signal—whether the US market experiences two to three consecutive instances of a "triple whammy" (i.e., simultaneous declines in the stock, bond, and currency markets). The report points out that if a situation similar to that of early April this year were to repeat itself, it would indicate a significantly increased probability of a market liquidity shock.

Finally, the report argues that even if Japan's interest rate hike causes short-term turmoil, it will not change the global trend of medium- to long-term monetary easing. Against this backdrop, the report remains optimistic about the strategic allocation value of gold. Meanwhile, with the expansion of China's export surplus and the Federal Reserve's resumption of interest rate cuts, the RMB exchange rate is expected to return to a medium- to long-term appreciation trend, accelerating the repatriation of cross-border capital and benefiting Chinese assets. The report anticipates a "Davis double play" (a boost in both earnings and valuation) for A-shares and H-shares. Regarding US stocks and bonds, the report holds a volatile view.