RWA Weekly Report | Total On-Chain Value Rebounds Again; US SEC Issues Guidelines for Crypto Asset Custody (December 10-17)

- 核心观点:RWA板块数据回暖,监管与机构动作频繁。

- 关键要素:

- RWA链上总价值周涨1.63%,结束横盘。

- SEC批准DTCC进行资产代币化试点。

- Visa开放银行使用USDC进行结算。

- 市场影响:推动传统资产上链,利好RWA赛道发展。

- 时效性标注:中期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

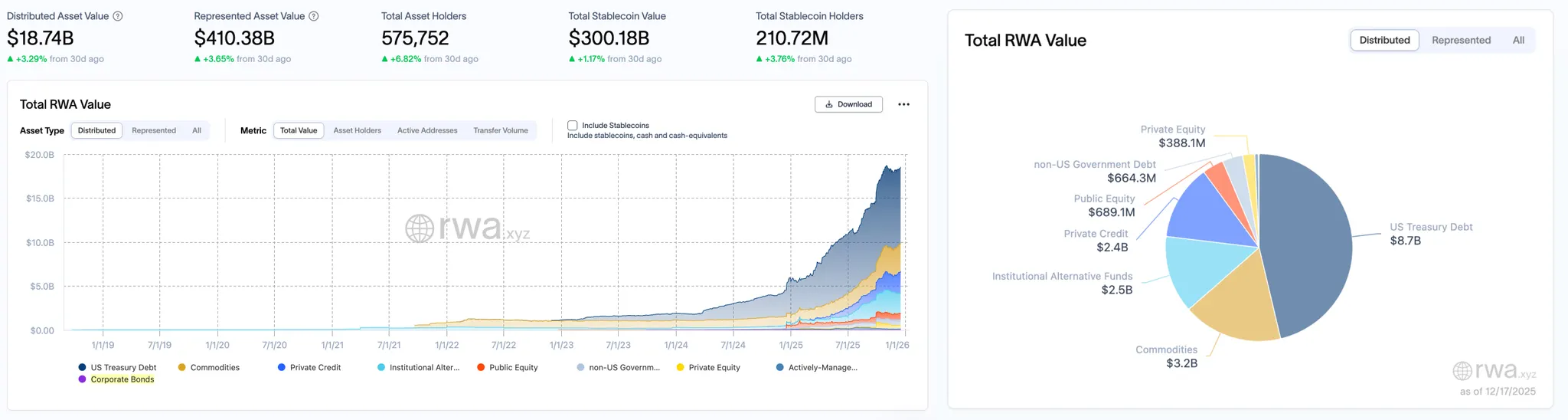

RWA sector market performance

According to the rwa.xyz data dashboard, as of December 17, 2025, the total on-chain asset value (Distributed Asset Value) of RWA was $18.74 billion , an increase of $300 million from $18.44 billion on December 9, representing a growth of approximately 1.63% . This ended a period of sideways trading and indicates that the activity of on-chain assets is gradually recovering. The represented asset value increased from $391.66 billion to $410.38 billion , a weekly increase of 4.92% , the largest weekly increase in nearly two months, which may be related to the recovery in the valuation of off-chain assets. The total number of asset holders also continued to rise, from 561,558 to 575,752 , a net increase of over 14,000 in one week, representing a growth of 2.52% . The stablecoin market was relatively stable, with the total market capitalization decreasing slightly from $301.92 billion to $300.18 billion , but still remaining at a high level. The number of users increased from 207.75 million to 210.72 million , an increase of nearly 3 million, or 1.42%.

From an asset structure perspective, US Treasury bonds remain the largest segment of on-chain assets, but this week saw a slight decline, decreasing from $8.8 billion to $8.7 billion , indicating a cooling of the US Treasury bond frenzy. Meanwhile, commodity assets remained stable, rising slightly from $3.1 billion to $3.2 billion , marking the third consecutive week of upward movement and gradually demonstrating the potential of emerging safe-haven assets. Private lending did not continue its previous rebound this week, with its size increasing only slightly from $2.2 billion to $2.4 billion , maintaining a neutral stance. Institutional alternative funds remained unchanged at $2.5 billion , indicating a more cautious allocation of funds.

Among other asset classes, publicly traded equity continued its upward trend, rising from $671.7 million last week to $689.1 million , outperforming other equity assets. Non-US government debt also saw a slight increase, rising from $637.2 million to $664.3 million , but its size remains less than one-tenth of US Treasury bonds. Private equity, however, declined slightly this week from $391.6 million to $381 million .

Trend Analysis (Compared to last week )

This week's key words for the RWA sector are " valuation repair + user growth ". The overall value of on-chain assets has rebounded, with a significant increase in the size of representative assets, indicating that the repricing of off-chain assets may be driving the overall valuation center of RWA upwards. Structurally, the pullback in US Treasury bonds may release some highly liquid funds, diverting them to commodities and public equity sectors, forming a new indicator of risk appetite. The growth of the stablecoin user base is particularly crucial, with off-exchange funds continuing to flow into the market, creating a "reservoir" for subsequent on-chain asset growth.

Market keywords: structural optimization, valuation recovery, user expansion.

Key Events Review

The U.S. Congress is urging the Securities and Exchange Commission (SEC) to approve the inclusion of Bitcoin and other cryptocurrencies in 401(k) retirement plans. Members of the House Financial Services Committee sent a letter to SEC Chairman Paul Atkins urging him to update securities rules to treat digital assets as an equivalent investment class to other alternative investments in retirement accounts. The letter argues that Americans saving for retirement deserve more investment options, and that current rules are outdated and overly restrictive, preventing millions from accessing new asset classes. Furthermore, the letter emphasizes the need to redefine the criteria for "accredited investors." Currently stringent investor eligibility requirements limit participation in parts of the private and alternative investment markets.

BNB Chain: A brand new stablecoin will be launched.

BNB Chain announced on the X platform that a brand new stablecoin will be launched on BNB Chain, aiming to integrate liquidity across various application scenarios and designed specifically for large-scale applications.

According to community speculation, the project may be United Stables, with more details expected to be released on December 18.

Negotiations in the US Senate over a crypto market structure bill may be delayed until January due to unresolved disagreements. The legislative text has been circulating privately among industry insiders, and industry executives briefly reviewed the current draft at a White House meeting on Thursday, chaired by Patrick Witt, crypto advisor to President Donald Trump. The negotiations involve Senate Democrats and Republicans, the White House, and the crypto industry, and four major points of contention remain. These include ethical considerations for government officials involved in digital assets, particularly President Donald Trump's involvement; whether stablecoins should be pegged to yield; and the Securities and Exchange Commission's (SEC) jurisdiction over tokens and decentralized finance (DeFi). Patrick Witt stated on the X platform that the White House and Senate Republicans are "aligned on the need to protect software developers and DeFi." Despite the disagreements, the intensity and pace of the negotiations remain high. Digital Chamber CEO Cody Carbone stated that all parties have a genuine desire and motivation to complete the legislation, and tangible progress is expected early next year.

The U.S. Securities and Exchange Commission (SEC) released guidance for investors on crypto wallets and asset custody on Friday, systematically outlining the advantages and risks of different crypto asset storage methods. The guidance compares self-custody and third-party custody models and reminds investors to carefully examine whether the custodian institution engages in asset rehypothecation and whether client assets are commingled when choosing a third-party custodian. The SEC also outlined the key differences between hot and cold wallets: hot wallets, being connected to the internet, face higher risks from hackers and cybersecurity; while cold wallets reduce the risk of online attacks, damage to storage devices, theft, or loss of private keys can lead to permanent asset loss. Market analysts believe this guidance indicates a significant shift in the SEC's regulatory stance towards the crypto industry. The day before, SEC Chairman Paul Atkins stated that the traditional financial system is rapidly migrating to blockchain, and the SEC has approved the DTCC to explore tokenization of assets such as stocks, ETFs, and government bonds.

South Korea's ruling party had previously called on all ministries and the Financial Services Commission (FSC) to submit a bill regulating the won stablecoin by December 10. However, the FSC failed to submit the bill on time. A spokesperson for the agency said that the FSC needed more time to coordinate its position with relevant agencies. Rather than rushing to complete the proposal before the deadline, it would be better to announce the proposal at the same time as submitting it to the National Assembly.

Nasdaq plans to extend trading hours for stocks and trading products to 23 hours.

Nasdaq has filed documents with the U.S. Securities and Exchange Commission (SEC) proposing to extend trading hours for its stocks and exchange-traded products (ETPs) from 16 hours daily to 23 hours daily, five days a week. This move aims to meet the growing demand from global investors for delayed trading in U.S. stocks and to align with the expectations of new investors in the 24/7 cryptocurrency market. According to the proposal, Nasdaq's new trading hours will include: Daytime trading session: 4:00 AM to 8:00 PM ET; One-hour break: 8:00 PM to 9:00 PM (for maintenance, testing, and trade clearing); Nighttime trading session: 9:00 PM to 4:00 AM the following day. The entire trading week will begin at 9:00 PM Sunday and end at 8:00 PM Friday. The existing regular trading session (9:30 AM to 4:00 PM) will remain unchanged. Nasdaq stated in its filing that this move aims to attract order flows from foreign investors in different time zones, such as Asia, as well as investors active in the cryptocurrency market. This will make Nasdaq-listed companies such as Coinbase (COIN), Robinhood (HOOD), and Strategy (MSTR), as well as many Bitcoin mining companies, more accessible to global traders.

The U.S. Securities and Exchange Commission (SEC) granted Depository Trust & Clearing Corporation (DTCC) a license, issued as a no-action letter, to custody and endorse tokenized stocks and other real-world assets (RWAs) on a blockchain. This move enables DTCC to offer tokenization services on a pre-approved blockchain for a three-year period. SEC Commissioner Hester Peirce stated in a press release, “While the project is still in the pilot phase and subject to various operational constraints, it marks a significant step towards the market’s migration to on-chain.” Michael Winnike, Head of Global Strategy and Market Solutions for Clearing and Securities Services at DTCC, said in an interview that following the license, DTCC will also extend its record-keeping operations to the blockchain. DTCC, as a core clearing and settlement center in the U.S. financial system, plays a crucial role in the equity and fixed-income product sectors. Many liquid assets in the U.S. market are held in custody by DTCC’s custodian, Depository Trust Co. The company expects to launch its new tokenization service in the second half of next year.

The Trump family's crypto project, WLFI, plans to deploy the USD1 stablecoin on the Canton Network.

Canton Network announced that World Liberty Financial (WLFI), the Trump family's crypto project, will deploy the USD1 stablecoin on its network. The aim is to expand the reach of USD1 in institutional on-chain finance and accelerate its adoption among regulated market participants globally, including collateral for derivatives and institutional loans, instant cross-border payments and 24/7 settlement, on-chain asset issuance, financing and redemption, and more.

Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stated in an article published on the X platform that the U.S. financial market is about to transition to on-chain and will prioritize innovation and actively adopt new technologies. The SEC has sent a letter to the American Depository Trust & Clearing Corporation (DTC) stating that no action will be taken. On-chain markets will bring investors greater predictability, transparency, and efficiency. Now, DTC participants can directly transfer tokenized securities to the registered wallets of other participants, and these transactions will be officially recorded and tracked by the DTC.

The Trump family's crypto project, WLFI, plans to deploy the USD1 stablecoin on the Canton Network.

Canton Network announced that World Liberty Financial (WLFI), the Trump family's crypto project, will deploy the USD1 stablecoin on its network. The aim is to expand the reach of USD1 in institutional on-chain finance and accelerate its adoption among regulated market participants globally, including collateral for derivatives and institutional loans, instant cross-border payments and 24/7 settlement, on-chain asset issuance, financing and redemption, and more.

Visa opens USDC settlement services to U.S. banks through Solana

Visa has begun allowing U.S. banks and payment partners to settle transactions in the United States using the dollar-backed stablecoin USDC.

Cross River Bank and Lead Bank are among the first institutions to use Visa USDC settlement services via the Solana blockchain, with Visa planning to roll out the service more widely in 2026.

Visa stated that this move aims to provide participating banks with faster fund transfers and a seven-day settlement window, without altering the consumer card user experience. As of November 2025, the company's annualized stablecoin settlement volume exceeded $3.5 billion.

Trending Projects

Ondo Finance (ONDO)

In short:

Ondo Finance is a decentralized finance protocol focused on the tokenization of structured financial products and real-world assets. Its goal is to provide users with fixed-income products, such as tokenized US Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, highly liquid assets while maintaining decentralized transparency and security. Its token, ONDO, is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest news:

On December 15, Ondo Finance announced on its X platform that its tokenized stock and ETF platform will be launched on the Solana blockchain in early 2026, aiming to bring Wall Street liquidity to the internet capital market.

Previously, it was reported that the U.S. Securities and Exchange Commission (SEC) had concluded its investigation into tokenized asset company Ondo Finance and did not recommend any charges.

The investigation, initiated in October 2023 by former SEC Chairman Gary Gensler, primarily examined whether Ondo complied with U.S. securities laws in its tokenization of U.S. Treasury products and whether ONDO tokens should be classified as securities. An Ondo spokesperson stated that the company received formal notification in late November that the two-year SEC investigation had concluded. Since the pro-cryptocurrency SEC Chairman Paul Atkins took office, the agency has concluded most cryptocurrency-related investigations. Ondo stated that the resolution of the investigation clears obstacles for its expansion in the U.S., having previously registered as an investment advisor and acquired SEC-registered broker-dealer, ATS operator, and transfer agent Oasis Pro Markets. Ondo is scheduled to hold its annual Ondo Summit in New York on February 3, where it is expected to announce new tools and products for tokenizing real-world assets.

MSX (STONKS)

In short:

MSX is a community-driven DeFi platform focused on tokenizing and trading RWA (Retail Assets and Services) such as US stocks on the blockchain. Through a partnership with Fidelity, the platform achieves 1:1 physical custody and token issuance. Users can mint stock tokens such as AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks aims to bridge the gap between TradeFi and DeFi, providing users with a highly liquid, low-barrier-to-entry on-chain investment gateway to US stocks, building a "Nasdaq for the crypto world."

Latest news:

On December 3rd, data from MSX's official website ( msx.com ) showed that the platform's trading volume reached $2 billion in the past 24 hours, setting a new single-day record. As of the time of writing, the platform's total trading volume has exceeded $20.6 billion, surging by over $7.5 billion in the past five days, representing a cumulative increase of over 57%. Furthermore, MSX concluded its Season 1 points competition on December 2nd, and the M-Credit earned by users will be directly used for future MSX token distributions.

On December 5th, Bruce, founder of MSX, posted on X that Nasdaq has submitted its application for a stock token, and MSX is ready to be exchanged for the "official" token. He stated, "Nasdaq submitted its stock token application to the SEC in September of this year, and if all goes well, it will officially launch in Q1 of next year. The launch of Nasdaq's stock token will impact all 'unofficial stock tokens,' and MSX is ready to be exchanged for the 'official' token at any time."

Related Links

We've compiled the latest insights and market data for the RWA sector.

The 5 Most Watched L1 Public Chains in 2026: The Main Evolution from DeFi to RWA

Aimed at investors, developers, and traders, it helps them identify which public blockchains are consistently accumulating real activity, users, and long-term value.