Digital banks no longer make money from traditional banking; the real goldmine lies in stablecoins and identity verification.

- 核心观点:数字银行竞争核心转向盈利模式与基础设施掌控。

- 关键要素:

- 稳定币成为核心盈利与价值捕获环节。

- 身份认证正演变为可移植的独立账户载体。

- 支付流驱动与利息驱动成为关键商业模式。

- 市场影响:推动行业向垂直整合与基础设施层竞争演变。

- 时效性标注:中期影响

Original title: Neobanks Are No Longer About Banking

Original author: Vaidik Mandloi, Token Dispatch

Original translation by Chopper, Foresight News

Where does the true value of digital banking go?

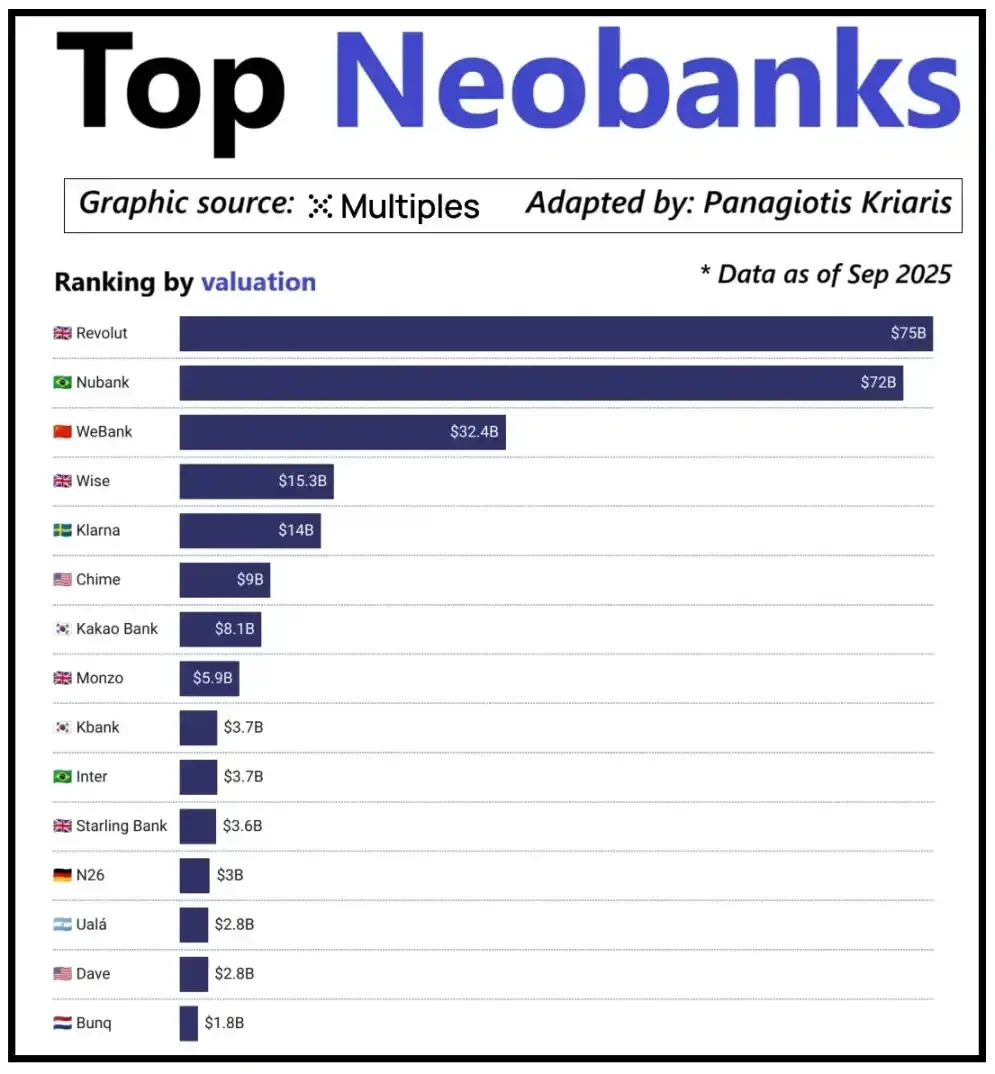

Looking at the world's leading digital banks, their valuations are not solely determined by user scale, but rather by their revenue-generating capacity per customer. Revolut is a prime example: despite having fewer users than Brazilian digital bank Nubank, its valuation surpasses the latter. This is because Revolut's revenue streams are diversified, covering multiple sectors including foreign exchange trading, securities trading, wealth management, and high-end membership services. In contrast, Nubank's business expansion relies primarily on lending and interest income, rather than bank card fees. China's WeBank has taken a different, differentiated approach, achieving growth through extreme cost control and deep integration into the Tencent ecosystem.

Valuation of leading emerging digital banks

Currently, cryptocurrency banks are reaching a similar developmental juncture. The "wallet + bank card" combination is no longer a viable business model; any institution can easily launch such services. A platform's differentiated competitive advantage lies precisely in its chosen core monetization path: some platforms earn interest from user account balances; some profit from stablecoin payment transactions; and a few pin their growth potential on the issuance and management of stablecoins, as this is the most stable and predictable source of revenue in the market.

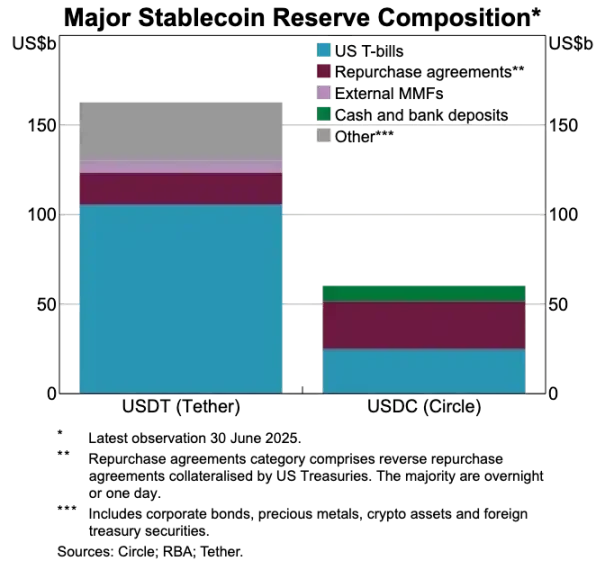

This explains the growing importance of the stablecoin sector. For reserve-backed stablecoins, the core profit comes from the investment income of reserves, specifically the interest generated from investing reserves in short-term government bonds or cash equivalents. This income belongs to the stablecoin issuer, not the digital bank that merely provides users with stablecoin holding and spending functions. This profit model is not unique to the crypto industry: in traditional finance, digital banks also cannot earn interest from user deposits; the actual recipient of this income is the partner bank that manages the funds. The emergence of stablecoins makes this "separation of income ownership" model more transparent and centralized. The entity holding short-term government bonds and cash equivalents earns interest income, while consumer-facing applications are primarily responsible for user acquisition and product experience optimization.

As stablecoin adoption continues to expand, a contradiction is emerging: application platforms responsible for user acquisition, transaction matching, and trust building often fail to profit from the underlying reserves. This value gap is forcing companies to integrate into vertical sectors, moving beyond simple front-end tools and focusing on controlling core aspects such as fund custody and management.

Driven by this consideration, companies like Stripe and Circle have significantly increased their investment in the stablecoin ecosystem. They are no longer content with simply distributing stablecoins, but are expanding into settlement and reserve management, as these are the core profit-generating aspects of the entire system. For example, Stripe launched its own blockchain, Tempo, specifically designed for low-cost, instant transfers of stablecoins. Instead of relying on existing public chains like Ethereum and Solana, Stripe built its own transaction channels to control the settlement process, fee pricing, and transaction throughput, all of which directly translate into better economic benefits.

Circle adopted a similar strategy, creating its own dedicated settlement network, Arc, for USDC. Through Arc, USDC transfers between institutions can be completed in real time without causing congestion on the public blockchain network or incurring high transaction fees. Essentially, Circle built an independent USDC backend system through Arc, freeing it from dependence on external infrastructure.

Privacy protection is another key motivation for this strategy. As Prathik explains in his article "Reinventing the Blockchain," public blockchains record every stablecoin transaction on a transparent ledger. This feature is suitable for open financial systems, but it has drawbacks in business scenarios such as payroll, supplier payments, and treasury management. In these scenarios, transaction amounts, counterparties, and payment methods are all sensitive information.

In practice, the high transparency of public blockchains allows third parties to easily reconstruct a company's internal financial situation using blockchain explorers and on-chain analytics tools. Meanwhile, the Arc Network allows USDC transfers between institutions to be settled outside the public blockchain, retaining the advantages of high-speed settlement for stablecoins while ensuring the confidentiality of transaction information.

Comparison of asset reserves between USDT and USDC

Stablecoins are disrupting the old payment system.

If stablecoins are the core of value, then traditional payment systems appear increasingly outdated. Current payment processes require multiple intermediaries: payment gateways collect funds, payment processors route transactions, card organizations authorize transactions, and the banks of both parties ultimately handle clearing. Each step incurs costs and causes transaction delays.

Stablecoins bypass this lengthy chain entirely. Stablecoin transfers don't rely on card organizations or acquiring institutions, nor do they require waiting for bulk settlement windows; instead, they achieve direct peer-to-peer transfers based on the underlying network. This characteristic has a profound impact on digital banks because it fundamentally changes user expectations—if users can transfer funds instantly on other platforms, they will never tolerate the cumbersome and expensive transfer processes within digital banks. Digital banks must either deeply integrate stablecoin transaction channels or become the least efficient link in the entire payment chain.

This shift has also reshaped the business model of digital banks. In the traditional system, digital banks could earn stable fee income through bank card transactions because the payment network firmly controlled the core links of transaction flow. However, under the new system dominated by stablecoins, this profit margin has been significantly compressed: stablecoin peer-to-peer transfers have no fees, and digital banks that rely solely on bank card spending for profit are facing a completely fee-free competitive arena.

Therefore, the role of digital banks is shifting from card issuers to payment routing layers. As payment methods move from bank cards to direct stablecoin transfers, digital banks must become the core nodes in stablecoin transactions. Digital banks capable of efficiently processing stablecoin transaction flows will dominate the market because once users adopt them as their default channel for fund transfers, it will be difficult for them to switch to other platforms.

Identity authentication is becoming the next generation of account carriers

As stablecoins make payments faster and cheaper, another equally important bottleneck is becoming increasingly apparent: identity verification. In the traditional financial system, identity verification is a separate process: banks collect user documents, store information, and complete the verification in the background. However, in scenarios involving instant transfers of funds in wallets, every transaction relies on a trusted identity verification system; without this system, compliance review, anti-fraud control, and even basic access management become impossible.

This is why identity authentication and payment functions are rapidly merging. The market is gradually abandoning the fragmented KYC processes of various platforms and moving towards a portable authentication and identity system that can be used across services, countries, and platforms .

This transformation is unfolding in Europe, with the EU's digital identity wallet now in its implementation phase. Instead of requiring each bank and application to conduct independent identity verification, the EU has created a unified identity wallet backed by the government, usable by all residents and businesses. This wallet not only stores identity information but also holds various certified credentials (age, proof of residence, licenses, tax information, etc.), supports users in signing electronic documents, and includes built-in payment functionality. Users can complete identity verification, share information on demand, and make payments in a single process, achieving seamless integration throughout the entire process.

If the EU's digital identity wallet is successfully implemented, the entire European banking system will be restructured: identity verification will replace bank accounts as the core entry point for financial services. This will make identity verification a public good, blurring the lines between traditional banks and digital banks, unless they can develop value-added services based on this trusted identity system.

The crypto industry is moving in the same direction. Experiments with on-chain identity authentication have been underway for years, and while there is no perfect solution yet, all explorations point to the same goal: to provide users with a way to verify their identity or related facts without limiting information to a single platform.

Here are a few typical cases:

- Worldcoin: To build a global identity verification system that verifies a user's true human identity without compromising user privacy.

- Gitcoin Passport: Integrates multiple reputation and verification credentials to reduce the risk of Sybil attacks during governance voting and reward distribution.

- Polygon ID, zkPass, and ZK-proof frameworks enable users to prove specific facts without revealing underlying data.

- Ethereum Name Service (ENS) + Off-Chain Credentials: Enabling crypto wallets to not only display asset balances but also link users' social identities and authentication attributes.

Most cryptographic identity verification projects share a common goal: to enable users to independently prove their identity or related facts, and to prevent identity information from being locked by a single platform. This aligns with the EU's push for digital identity wallets: a single identity credential can accompany a user freely across different applications without requiring repeated verification.

This trend will also change the operating model of digital banks. Currently, digital banks consider identity authentication a core control point: user registration, platform verification, and ultimately, an account belonging to the platform. However, when identity authentication becomes a credential that users can carry themselves, the role of digital banks transforms into that of a service provider connecting to this trusted identity system. This will simplify the user account opening process, reduce compliance costs, decrease redundant verifications, and allow encrypted wallets to replace bank accounts as the core carrier of user assets and identity.

Future Development Trends

In conclusion, the core elements of the digital banking system are gradually losing their competitiveness: user scale is no longer a moat, bank cards are no longer a moat, and even a simple user interface is no longer a moat . The real competitive advantage lies in three dimensions: the profitable products chosen by digital banks, the fund transfer channels they rely on, and the identity authentication system they integrate with. Beyond these, other functions will gradually converge, becoming increasingly substitutable.

Successful digital banks of the future will not be lightweight versions of traditional banks, but rather wallet-first financial systems. They will be anchored to a core profit engine, which directly determines the platform's profit margin and competitive advantages. Generally speaking, core profit engines can be divided into three categories:

Interest-driven digital banks

The core competitiveness of these platforms lies in becoming the preferred channel for users to store stablecoins. As long as they can attract a large number of user balances, the platform can earn income through reserve-backed stablecoin interest, on-chain rewards, staking, and re-staking, without relying on a large user base. Their advantage lies in the fact that the profitability of asset holding is far higher than that of asset circulation. These digital banks, seemingly consumer-facing applications, are in reality modern savings platforms disguised as wallets, with their core competitiveness being providing users with a seamless experience of depositing and earning interest.

Payment flow driven digital bank

The value of these platforms stems from their transaction volume. They become the primary channel for users to receive and spend stablecoins, deeply integrating payment processing, merchants, fiat-to-cryptocurrency exchange, and cross-border payment channels. Their profit model is similar to that of global payment giants: the profit per transaction is small, but once they become the preferred channel for users' fund transfers, they can accumulate considerable revenue through their massive transaction volume. Their competitive advantage lies in user habits and service reliability, making them the default choice for users when they need to transfer funds.

Stablecoin infrastructure digital banks

This is the deepest and potentially most lucrative sector. These digital banks are not merely channels for stablecoin circulation; they aim to control the issuance of stablecoins, or at least their underlying infrastructure. Their business scope covers core aspects such as stablecoin issuance, redemption, reserve management, and settlement. This area offers the highest profit margins because control of the reserves directly determines the distribution of profits. These digital banks integrate consumer-facing functionality with infrastructure ambitions, moving beyond simple applications towards a full-fledged financial network.

In short, interest-driven digital banks make money by users depositing currency, payment flow-driven digital banks make money by users transferring currency, while infrastructure-based digital banks can generate continuous profits regardless of what users do.

I predict that the market will split into two camps: the first camp consists of consumer-oriented application platforms that mainly integrate existing infrastructure, offer simple and easy-to-use products, and have extremely low user switching costs; the second camp will move towards the core area of value aggregation, focusing on businesses such as stablecoin issuance, transaction routing, settlement, and identity authentication integration.

The latter will no longer be limited to applications, but will instead be infrastructure service providers disguised as consumer-facing entities. They will have extremely high user stickiness because they will quietly become the core system for on-chain fund transfers.