Fusaka Upgrade: The Intersection of Ethereum's Technological Leap and Financialization Cycle

- 核心观点:Fusaka升级是以太坊迈向机构级结算层的技术起点。

- 关键要素:

- 引入PeerDAS,实现无需全节点的数据可用性。

- EIP-7918强制L2支付费用,使ETH回归通缩。

- 降低系统摩擦,为未来Verkle升级奠定基础。

- 市场影响:增强以太坊对机构资本的吸引力与价值捕获能力。

- 时效性标注:中期影响

Fusaka Upgrade: The Intersection of Ethereum's Technological Leap and Financialization Cycle

0 | Executive Summary — Fusaka is not a short-term event, but the technological starting point for the era of Ethereum's financialization.

The significance of Fusaka has been severely underestimated.

It is not "another upgrade," but rather the true starting point for Ethereum's move towards an institutional settlement layer .

Ethereum is currently at the intersection of two key curves:

(1) Technology Curve: Systemic Upgrade Path Since 2022

Merge → Dencun → Pectra → Fusaka → Verkle

This curve represents Ethereum's long-term strategy to reduce node costs, enhance consistency, and improve L2 economic efficiency .

(2) Financialization curve: Systematic influx of capital and traditional finance

ETFs → On-chain Treasury Bonds → On-chain Fund Products → Institutional-grade Liquidity Management

This curve signifies that Ethereum is transitioning from a "crypto operating system" to a "global financial settlement layer." The Fusaka upgrade sits at the intersection of these two curves, and its core value lies not in short-term TPS, but in:

- Reduce validator synchronization costs

- Strengthen Rollup security and consistency

- Optimize L2 data availability (PeerDAS)

- Clearing the way for future stateless clients (Verkle)

- To give Ethereum the stability requirements of traditional financial institutions

Fusaka is not a price catalyst, but rather the starting point of ETH's mid-cycle repricing. It will determine the pace of institutional adoption of ETH between 2025 and 2027.

1. Why does Ethereum need Fusaka? (Technological motivations + Market motivations)

1.1 The Continuation Logic of Ethereum's Upgrade Roadmap: From Scaling Narrative to Structural Consistency

Over the past two years, Ethereum's roadmap has shifted from "pursuing linear scaling" to "building a long-term consistent operating structure".

The logical evolution of the upgrade path is as follows:

Fusaka: Cost System Restructuring + Rollup-Based Standardized Infrastructure

Fusaka's core purpose is not TPS (transactions per second), but rather to make Ethereum's operation more stable, consistent, and predictable, preparing for future Verkle upgrades. Its key functions include:

- Reduce node synchronization costs

- Improve the efficiency of data availability verification

- Make Rollup's providing pipeline more consistent

- Make the validator mechanism more lightweight

- Improve system recovery capabilities

Why is this a turning point?

Because the PeerDAS (Data Availability Sampling) introduced by Fusaka is essentially the "true sharding" that Ethereum has been waiting for for 8 years.

Vitalik's assessment is crucial:

“PeerDAS is significant because it literally is sharding. Ethereum comes to consensus on blocks without any node needing to see all the data.” —— Vitalik

This means that Ethereum has achieved a system architecture that allows DA to be confirmed without relying on a single node for the first time.

However, Fusaka remains an "incomplete shard" for three reasons:

- L2 can be expanded, but L1 still requires ZK-EVM to be fully expanded.

- Block building is still concentrated on a single builder, and there is a need for future development of distributed block building.

- Mempool is still not sharded, and transaction scheduling remains centralized.

In other words, Fusaka is "sharding 1.0" —good enough, but far from its peak. In terms of value, Fusaka is a "foundational upgrade" to the Ethereum operating system. When you're building the foundation, you don't see massive TPS, but all future superstructures will depend on it.

Image source: Vitalik's Twitter

1.2 Rollups are diverse but lack consistency: Fusaka's technological mission is to "govern chaos".

The Rollup ecosystem has reached a state of "prosperous chaos," and Fusaka's mission is to make this chaos manageable. The prosperity and fragmentation of L2 have severely impacted the main chain's technological and economic sovereignty, while also making the main chain's L1 value capture extremely passive. Over the past two years, Ethereum Rollups have entered a phase of "prosperity but chaos."

The current structural problems in the Rollup ecosystem include: inconsistent Prover logic (different Rollups use different ZK stacks); huge differences in synchronization and state update speeds; inconsistent bridging logic and uneven security (multi-signature, third-party sorters); and the fact that the security structure of Data Analytics (DA) has not been unified despite the decrease in data costs.

In short:

Rollups are growing rapidly, but each one is "connecting to Ethereum in its own way".

This poses a threat to Ethereum's long-term "modular structural consistency".

Fusaka's mission: To make Rollups manageable, predictable, and verifiable. To make Ethereum a more "neutral and integrated" underlying layer.

- Unified proving pipeline baseline

- More predictable DA sampling

- More consistent settlement finality

- A more reasonable L1-L2 asynchronous verification relationship

- Laying the foundation for future L2 interoperability and cross-chain security

Fusaka is a necessary step for the Rollup ecosystem to move from a "self-operating island chain" to a "standardized internet". Fusaka aims to solve the "mismatch problem between L1 resources and L2 puzzle pieces".

1.3 Market Background: Ethereum Enters Institutional Adoption Cycle (Financialization-Driven Upgrade)

ETFs represent the first phase of Ethereum's financialization; true adoption has yet to begin. Beyond the technological drivers, the market motivations behind Ethereum's launch of Fusaka at this moment are more noteworthy . We are entering an "Institutional Adoption Cycle."

Its manifestations are as follows:

- ETH Spot ETFs are becoming a gateway for long-term funds: ETH has been incorporated into the mainstream asset allocation system in the United States; the creation and redemption mechanism of ETFs forms a structural inflow model.

- Financial institutions are viewing Ethereum as a "technological foundation" rather than a "speculative asset."

Image source: rwa.xyz

These include BlackRock, Fidelity, Franklin Templeton, and WisdomTree, which are experimenting with on-chain government bonds, on-chain money market funds, on-chain short-term debt products, and on-chain yield management. These products share common requirements: stable synchronization with the underlying public blockchain, controllable verification costs, and consistent data availability.

- Ethereum has become the "default platform" for US financial institutions to conduct on-chain experiments.

This includes: BUIDL (BlackRock On-chain Fund), Franklin OnChain US Treasury Fund (BENJI), stable yield products from Ondo / Mountain Protocol, and several RWA-dedicated L2 servers currently being deployed.

These institutional on-chain financial systems all require a more stable, rapidly synchronized, and cost-effective Ethereum underlying layer, which is why Fusaka emerged at this time.

2. In-depth analysis of the Fusaka upgrade: reducing system friction and accelerating the mid-stage of Ethereum's value capture and financialization.

Fusaka essentially reduces Ethereum's system friction cost, while simultaneously completing a true closed loop of the "value capture path" for the first time: the larger the L2 scale, the stronger ETH's value capture.

2.1 Technological Evolution: Core Protocol Improvements (Reducing System Friction Costs)

Key takeaway: Fusaka is not about explosively increasing TPS, but about "making Ethereum operate faster, more stably, cheaper, and more trustworthy."

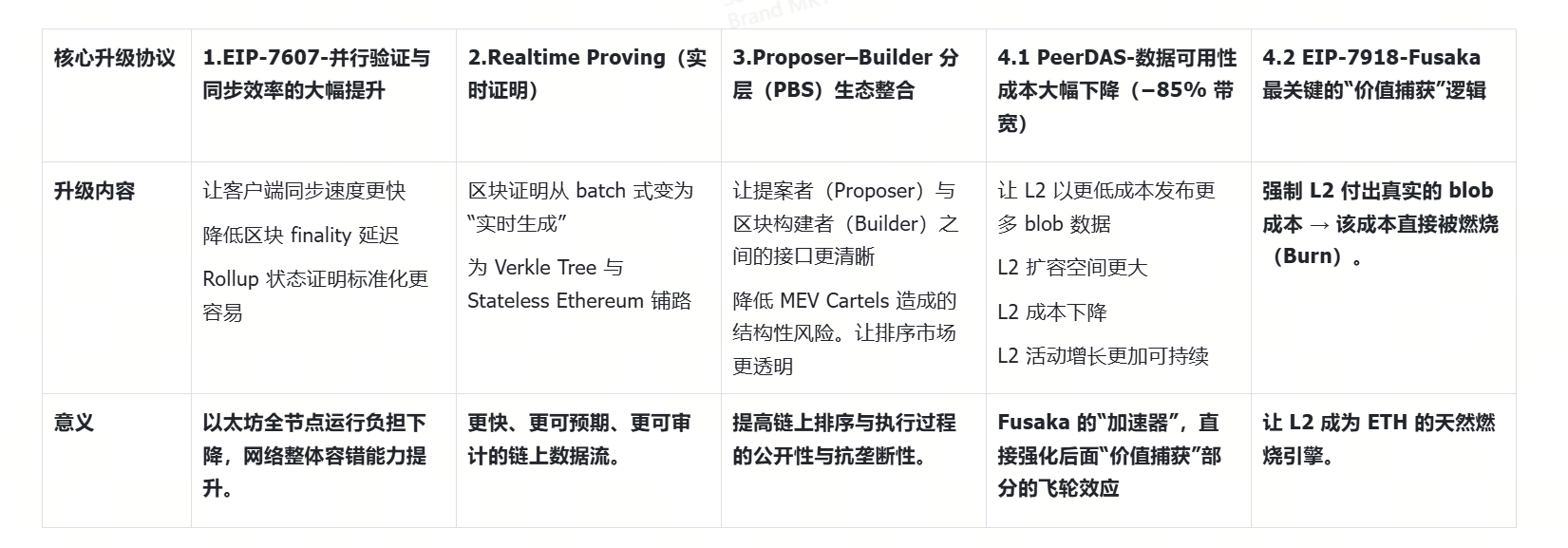

Fusaka's core technology can be broken down into four main lines:

2.2 EIP-7918: Fusaka's most crucial "value capture" logic

This is the most underrated part of Fusaka, but the one that truly changes the ETH economic model.

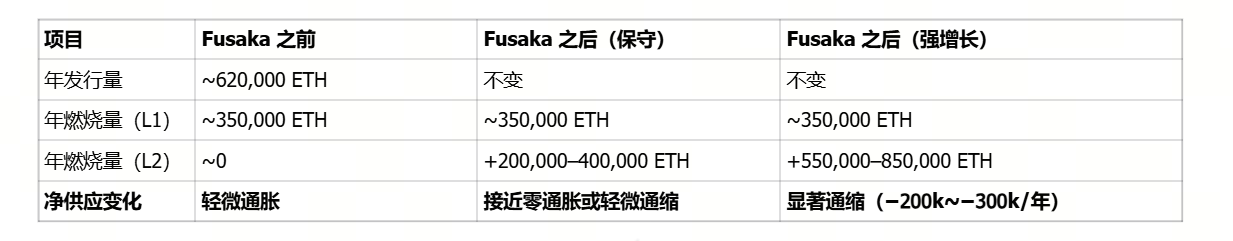

The problem before the upgrade: 85% of Ethereum transactions occurred on L2, but the fees for L2-issued blobs were almost zero. As a result , the more prosperous L2 became, the lower the ETH burning rate. ETH actually experienced slight inflation in 2024–2025.

The core function of EIP-7918:

By forcing L2 to pay real blob costs, the scope of ETH burning has been expanded from primarily L1 to include both L1 and all L2 activities; EIP-7918 mandates that Layer 2 services pay actual transaction fees to Ethereum. This means that every L2 transaction will now automatically participate in ETH burning, making L2 a natural engine for burning ETH.

Currently, most ETH burning comes from mainnet transactions. This is why Ethereum will experience slight inflation in 2024-2025: L2 tokens reduce the cost of the mainnet, thus reducing the amount of ETH burned, while the staking mechanism continues to issue new ETH.

After the Fusaka incident:

- Each L2 blob has a minimum cost.

- This cost = direct combustion

- All L2 growth corresponds to a corresponding increase in ETH burning. The higher the adoption rate of L2 tokens, the more Ethereum is burned, making Ethereum scarcer. Ethereum has effectively gained a completely new burning mechanism driven by the entire L2 ecosystem.

Ethereum may be returning to deflation for the first time in years; annual ETH economic model after Fusaka:

This is considered the most significant value capture upgrade since EIP-1559.

EIP-7918+PeerDAS will accelerate the realization of the flywheel effect:

- PeerDAS accelerates L2 growth (and consequently increases the amount of ETH burned). PeerDAS reduces bandwidth by 85%, allowing L2 nodes to publish more BLOBs at a lower cost. More BLOBs = paying more fees. Paying more fees = burning more ETH. Ethereum has essentially turned L2 growth into a flywheel of ETH scarcity.

- Gas cap increase → More transaction activity → More blocks burned. The gas cap jumps from 36 million to 60 million. - Each block can hold more transactions. More transactions = More base fees. - Base fees = Automatic burning. - Therefore, the amount of blocks burned on the mainnet also increases with the increase in L2 burning.

- Lower L2 fees = More usage = More burning. With Fusaka: cheaper transactions + cheaper bridging + cheaper on-chain games + easier social applications = lower L2 fees → more transactions → more BLOB issuance → more ETH burning. Ethereum is essentially monetizing its own scaling.

- This upgrade finally brought Ethereum in line with Rollups. Before Fusaka: L2 token growth → reduced ETH burning → ETH experienced inflationary effects. After Fusaka: L2 token growth → increased ETH burning → ETH experienced deflationary effects.

In summary, deflation brings positive energy. Previously, deflation required transactions to occur, but now L1 and L2Q are both positively contributing to deflation. Prices will become more stable as deflation occurs, and the supply will decrease. This is a huge positive for ETH, and a long-term positive.

2.3 From $3,000 to $8,000: An Empirical Analysis of the Advancement of ETH's Financialization, Resulting from the Certainty of Interest Rate Cuts, the Implementation of RWA, and Low Institutional Turnover.

RWA and the Treasury pool are not just narratives; they are evidence of Ethereum's transformation from financial infrastructure to a financial system.

- The December rate cut is a positive factor that will last until early 2026; the benefits of a rate cut are highly certain.

Mid-December 2025 - Early January 2026: Within 1-2 weeks after the interest rate cut, ETF net inflows are expected to exceed $5 billion per week, pushing ETH from the current $3,000 range to quickly break through the two major resistance levels of $4,000 (July high) and $6,000 (second highest in history in 2021);

Mid-January to February 2026: With the initial allocation of 401(k) funds and the concentrated launch of RWA projects, ETH is expected to hit $8,000, corresponding to a market capitalization of $816 billion, which is close to 80% of the current total size of gold ETFs, making its valuation reasonable.

- ETF assets under management: $17.825 billion

Unlike the short-term volatility of ETFs, institutional on-chain holdings exhibit characteristics of "low turnover rate + high stability." Coinbase's on-chain wallet, holding $440 million in ETH, has an average monthly turnover rate of only 0.3%, far lower than the 5% average in the ETF market. More importantly, the Trump administration's policy of including crypto assets in 401(k) retirement accounts has opened a channel for $12.5 trillion in long-term funds to enter the market. These funds, through compliant on-chain custody, directly allocate ETH, providing a "counter-cyclical" support for prices.

- RWA tokenization is entering a period of explosive growth.

Institutional participation is accelerating the on-chain circulation of real-world assets. BlackRock's BUIDL token, issued on Ethereum, has reached a scale of $2.385 billion, transforming traditional assets such as US Treasury bonds into programmable tokens. Yuancoin Innovation, a Hong Kong-based compliant stablecoin issuer, is further exploring the "stablecoin + RWA" combination model, planning to issue a stablecoin pegged to the offshore RMB on Ethereum for cross-border trade settlement. According to RWA.xyz data, the scale of on-chain tokenized assets grew by 113% year-on-year in 2025, with Ethereum handling 82% of the transaction volume.

- Layer 2 infrastructure is experiencing a surge in demand.

The high-frequency trading demands of institutions are driving performance upgrades in Layer 2. Arbitrum has already supported Robinhood in launching tokenized trading of over 200 US stocks, with daily on-chain trading volume exceeding $1.2 billion. R3-led TEN, an L2 network, completed a $9 million funding round, developing a compliant clearing module specifically for institutions, and is expected to integrate with HSBC's cross-border payment system in Q4. The proportion of Layer 2 trading volume is expected to rise from 21% in 2024 to 47%, becoming a "performance buffer" for institutional entry.

In summary, the above are currently positive factors with significant certainty. Short-term fluctuations will not change the long-term trend, although there may be short-term pullback risks and regulatory risks. Furthermore, institutional holdings offer high stability.

3. The Underlying Impact of Fusaka on Ethereum's Long-Term Competitive Landscape

While the Fusaka upgrade focused on internal structural optimization, its impact has transcended the technology itself, subtly altering Ethereum's competitive position across the industry. The combination of PeerDAS and 7918 has established a "structurally consistent, predictable, and auditable" underlying framework for Ethereum, elevating it from an "ecosystem leader" to a "system-level stability leader."

This is why institutions almost always choose Ethereum when conducting on-chain finance experiments: it provides a sufficiently robust liquidation layer, a unified data availability model, and a sustainable cost structure. In this scenario, Layer 2 expansion no longer diminishes the value of Ethereum but directly contributes to the scarcity of ETH.

Therefore, Fusaka is not just a technological iteration, but lays the foundation for higher-level competition such as Verkle, stateless clients, distributed block building, and institutional on-chain finance.

In this new cycle of public blockchains, Ethereum's competitive advantage is shifting from "performance" to "structured security + financial-grade availability," and this advantage will be further amplified in the next 2–3 years.