From the "crime cycle" to the return to value: Four major opportunities in the 2026 crypto market.

- 核心观点:加密行业正经历净化,向创造真实价值转型。

- 关键要素:

- 高FDV、无应用项目与空投骗局损害市场。

- 稳定币、PerpDex、DAT在2025年表现突出。

- 行业需转向实际应用、真实收入与价值回流。

- 市场影响:淘汰投机项目,利好务实建设者。

- 时效性标注:中期影响

Original author: Poopman

Original article translated by: Deep Tide TechFlow

Ansem declared the market had peaked, and CT called this cycle "crime."

High FDV (Fully Diluted Valuation) projects with no real-world applications have squeezed every last penny out of the crypto space. The bundled sale of Memecoin has tarnished the crypto industry's reputation in the public eye.

Worse still, almost no funds are being reinvested in the ecosystem.

On the other hand, almost all airdrops have turned into scams designed to pump and dump. The sole purpose of Token Generation Events (TGEs) appears to be to provide exit liquidity for early participants and teams.

Firm holders and long-term investors are suffering heavy losses, and most altcoins have never recovered.

The bubble is bursting, token prices are plummeting, and people are furious.

Does this mean it's all over?

Difficult times forge the strong.

To be fair, 2025 wasn't a bad year.

We have witnessed the birth of many excellent projects. Projects such as Hyperliquid, MetaDAO, Pump.fun, Pendle, and FomoApp have proven that there are still true builders in this field striving to drive development in the right way.

This is a necessary "purification" to eliminate bad actors.

We are reflecting on this and will continue to improve.

Now, to attract more funding and users, we need to showcase more practical applications, genuine business models, and revenue that generates real value for the token. I believe this is precisely the direction the industry should be heading in by 2026.

2025: The Year of Stablecoins, PerpDex, and DAT

Stablecoins are becoming more mature

In July 2025, the Genius Act was officially signed, marking the birth of the first regulatory framework for payments of stablecoins, requiring stablecoins to be backed by 100% cash or short-term Treasury bonds.

Since then, traditional finance (TradFi) has shown increasing interest in stablecoins, with net inflows into stablecoins exceeding $100 billion this year alone, making it the strongest year in the history of stablecoins.

RWA.xyz

Institutions favor stablecoins, believing they have great potential to replace traditional payment systems, for reasons including:

- Lower cost and more efficient cross-border transactions

- Instant settlement

- Low transaction fees

- Available 24/7

- Hedging the risk of local currency fluctuations

- On-chain transparency

We have witnessed major mergers and acquisitions by tech giants (such as Stripe's acquisition of Bridge and Privy), Circle's IPO being oversubscribed, and several top banks expressing interest in launching their own stablecoins.

All of this indicates that stablecoins have indeed been maturing over the past year.

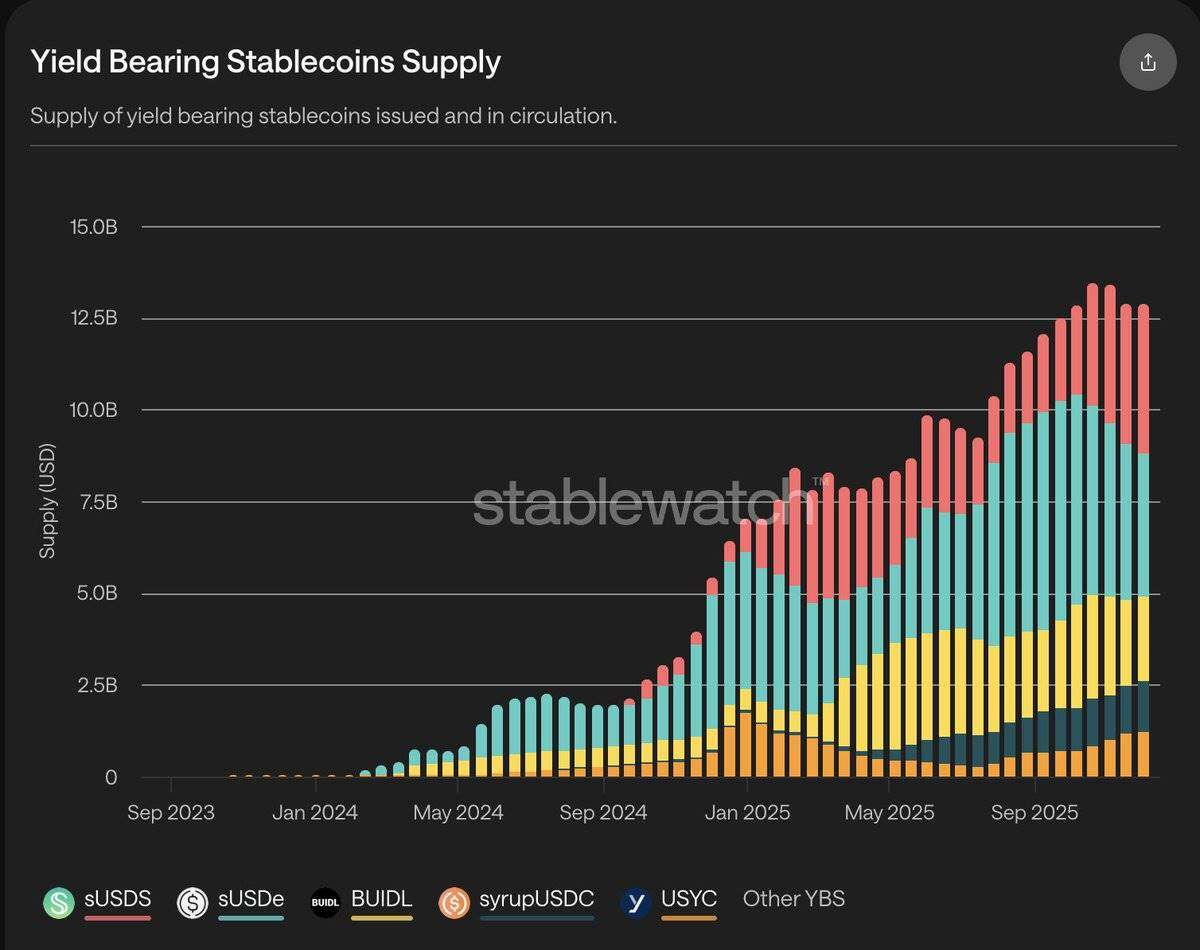

Stablewatch

Besides payments, another major use case for stablecoins is earning permissionless yields, which we call yield-bearing stablecoins (YBS).

This year, the total supply of YBS actually doubled to $12.5 billion, a growth primarily driven by yield providers such as BlackRock BUIDL, Ethena, and sUSDs.

Despite the rapid growth, the recent Stream Finance incident and the broader poor performance of the crypto market have affected market sentiment and reduced the yields of these products.

Nevertheless, stablecoins remain one of the few truly sustainable and growing businesses in the crypto space.

PerpDex (a decentralized exchange for perpetual contracts):

PerpDex is another star this year.

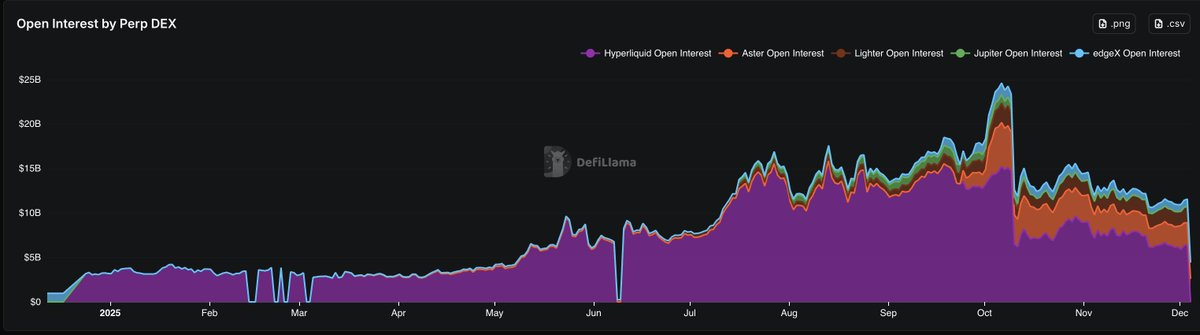

According to DeFiLlama, PerpDex's open interest grew by an average of 3-4 times, from $3 billion to $11 billion, and at one point reached a peak of $23 billion.

Trading volume in perpetual contracts has also surged dramatically, quadrupling since the beginning of the year, climbing from an astonishing $80 billion in weekly trading volume to over $300 billion (partly driven by token mining), making it one of the fastest-growing sectors in the crypto space.

However, both indicators have begun to show signs of slowing down since the sharp market correction on October 10 and the subsequent market downturn.

PerpDex Open Interest (OI), Data Source: DeFiLlama

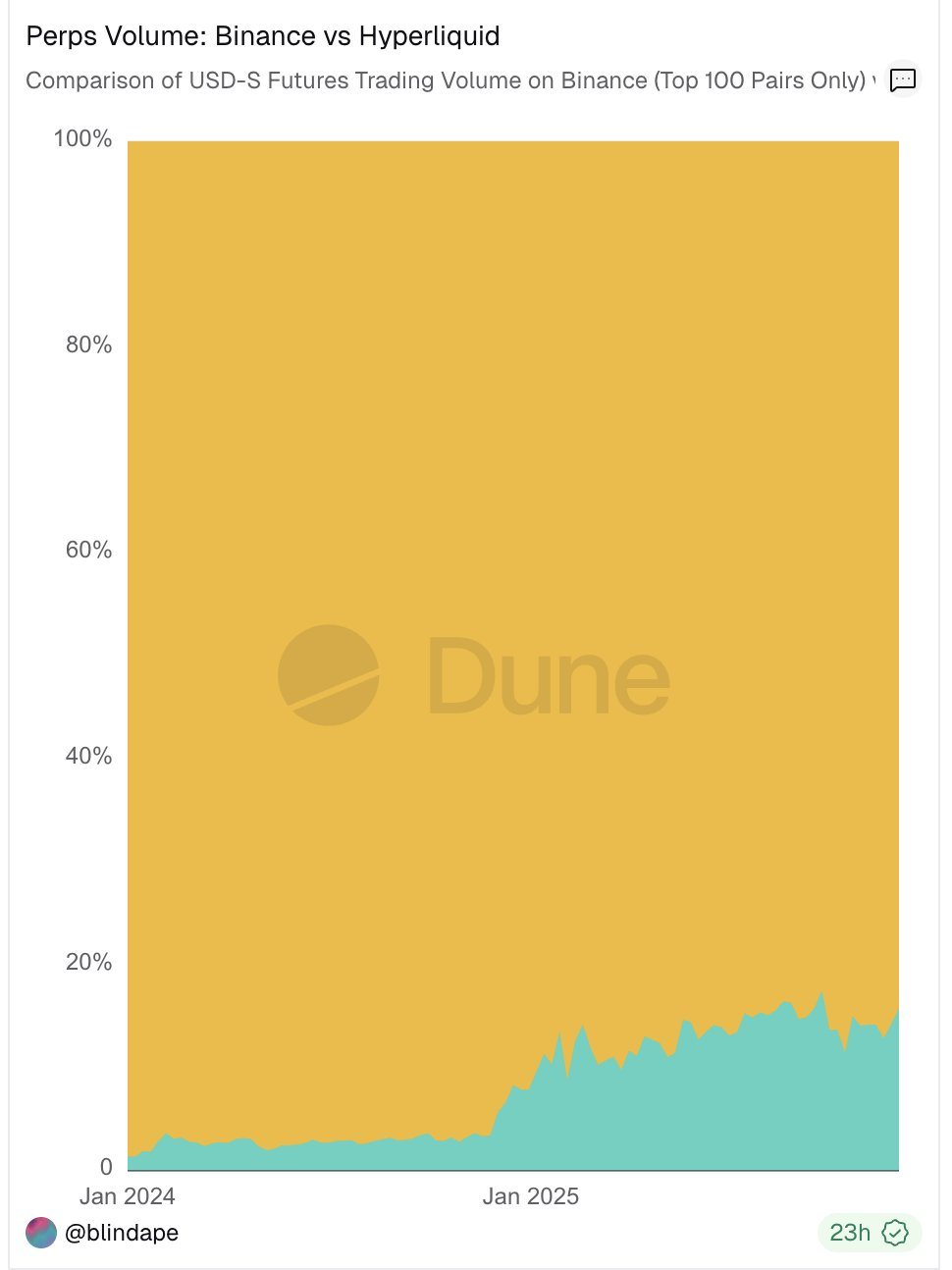

The rapid growth of perpetual contract decentralized exchanges (PerpDex) poses a real threat to the dominance of centralized exchanges (CEX).

For example, Hyperliquid's perpetual contract trading volume has reached 10% of Binance's, and this trend continues. This is not surprising, as traders can find some advantages on PerpDex that CEX perpetual contracts cannot offer.

- No KYC (identity verification) required.

- It has good liquidity, and in some cases can even rival that of CEXs.

- Airdrop Speculation Opportunities

Valuation games are another key point.

Hyperliquid demonstrated that perpetual contract decentralized exchanges (PerpDex) can reach extremely high valuation caps, attracting a new wave of competitors to the arena.

Some new entrants have received backing from large venture capital firms (VCs) or centralized exchanges (CEXs) (such as Lighter and Aster), while others are trying to differentiate themselves through native mobile apps and loss compensation mechanisms (such as Egdex and Variational).

Retail investors have high expectations for the high FDV (fully diluted valuation) at the launch of these projects, as well as for the airdrop rewards. This mentality has led to the "points war" we see today.

Although perpetual contract decentralized exchanges can achieve extremely high profitability, Hyperliquid has chosen to repurchase $HYPE through the "Assistance Fund" to reinvest the profits back into the tokens (the repurchase amount has reached 3.6% of the total supply).

This buyback mechanism, by providing a return of real value, became a major driving force behind the token's success and effectively pioneered the "buyback metaverse" trend—prompting investors to demand a stronger value anchor rather than governance tokens with high FDV but no practical use.

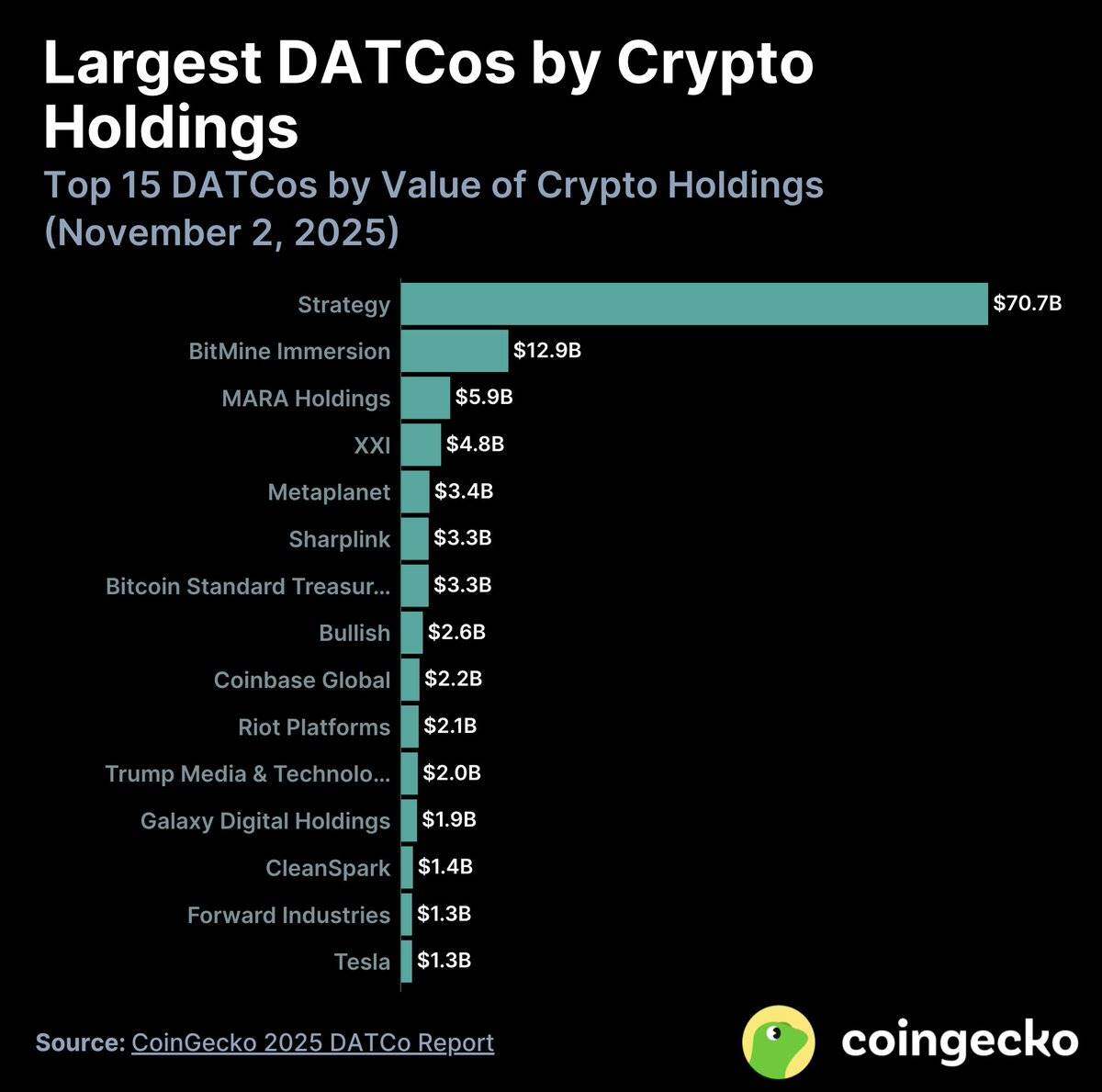

DAT (Digital Asset Reserve):

Due to Trump's pro-crypto stance, we have seen a significant influx of institutional and Wall Street funds into the crypto space.

Inspired by MicroStrategy's strategy, DAT has become one of the main ways for traditional finance (TradFi) to indirectly access crypto assets.

Approximately 76 new DAT tokens were added in the past year. Currently, DAT's treasury holds $137 billion worth of crypto assets. Of this, over 82% is Bitcoin (BTC), about 13% is Ethereum (ETH), and the remainder is distributed across various altcoins.

Please see the chart below:

Bitmine (BMNR)

Bitmine (BMNR), launched by Tom Lee, became one of the iconic highlights of this DAT craze and became the largest ETH buyer among all DAT participants.

However, despite the initial surge in attention, most DAT stocks experienced a "pump and dump" rally in the first 10 days. Since October 10, inflows into DAT have plummeted by 90% compared to July levels, and the net asset value (mNAV) of most DATs has fallen below 1, indicating that the premium has disappeared and the DAT craze has essentially come to an end.

During this period, we learned the following:

- Blockchain needs more real-world applications.

- The primary use cases in the crypto space remain transactions, revenue generation, and payments.

- Today, people are more inclined to choose protocols with the potential to generate fees rather than simply being decentralized (Source: @EbisuEthan).

- Most tokens need a stronger value anchor, linked to the protocol's fundamentals, to protect and reward long-term holders.

- A more mature regulatory and legislative environment will provide greater confidence for builders and talent to join the field.

- Information has become a tradable asset on the Internet (Source: PM, Kaito).

- New Layer 1/Layer 2 projects that lack a clear positioning or competitive advantage will gradually be phased out.

So, what will happen next?

2026: The Year of Prediction Markets – More Stablecoins, More Mobile Apps, More Realistic Income

I believe the crypto space will develop in the following four directions in 2026:

- Prediction Market

- More stablecoin payment services

- The increasing popularity of mobile DApps

- Realizing more real income

Still predicting the market

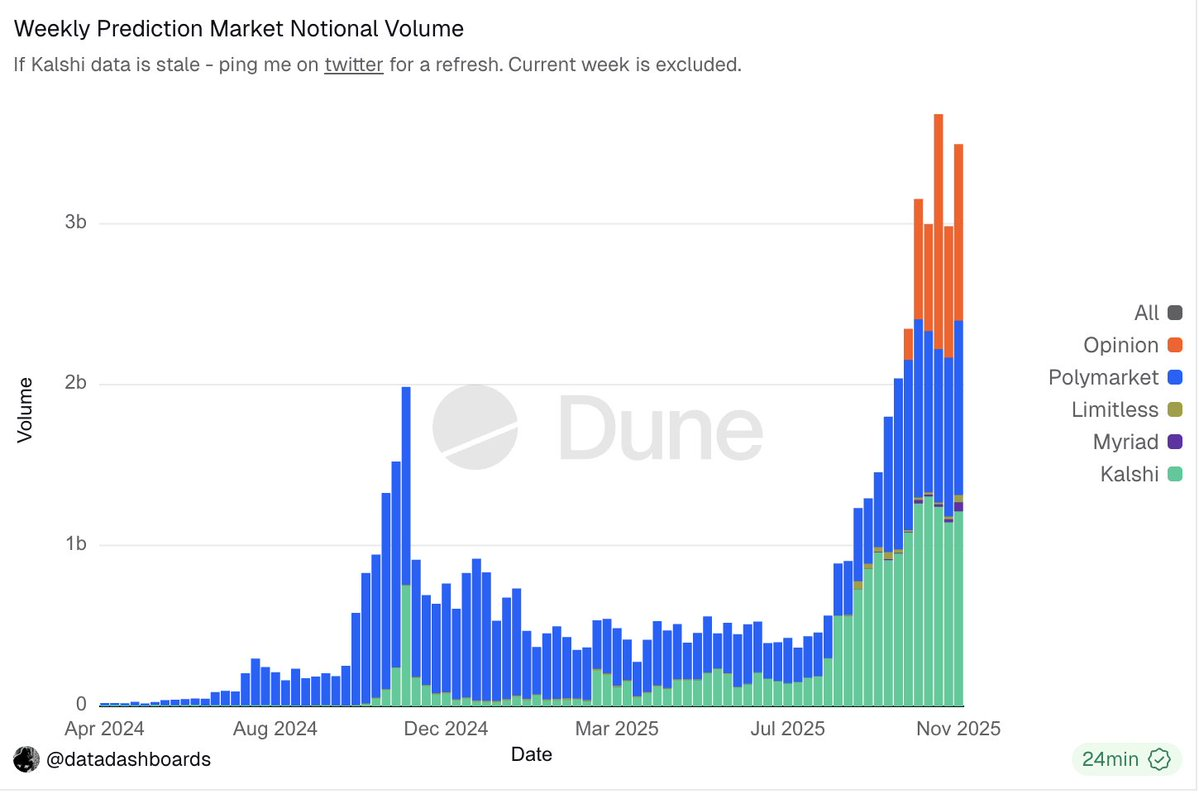

Undoubtedly, prediction markets have become one of the hottest sectors in the crypto space.

"You can bet on anything."

"90% accuracy in predicting real-world outcomes"

"Participants assume their own risks"

These headlines attracted a lot of attention, and the predictions about the market's fundamentals were equally compelling.

As of this writing, the total weekly trading volume in the prediction market has already surpassed the peak during the election period (even if that included volume manipulation at that time).

Today, giants like Polymarket and Kalshi have completely dominated distribution channels and liquidity, leaving competitors without significant differentiation with virtually no chance of gaining meaningful market share (except for Opinion Lab).

Institutional investors also began to flock in. Polymarket received investment from ICE at a valuation of $8 billion, and its secondary market valuation has reached $12-15 billion. Meanwhile, Kalshi completed its Series E funding round at a valuation of $11 billion.

This momentum is unstoppable.

Moreover, with the upcoming launch of the $POLY token, the imminent IPO, and mainstream distribution channels through platforms like Robinhood and Google Search, prediction markets are likely to become one of the main narratives of 2026.

That said, prediction markets still have much room for improvement, such as optimizing result parsing and dispute resolution mechanisms, developing methods to deal with malicious traffic, and maintaining user engagement during long feedback cycles. These aspects all require further enhancement.

In addition to the dominant players in the market, we can also expect the emergence of new, more personalized prediction markets, such as @BentoDotFun .

Stablecoin payment sector

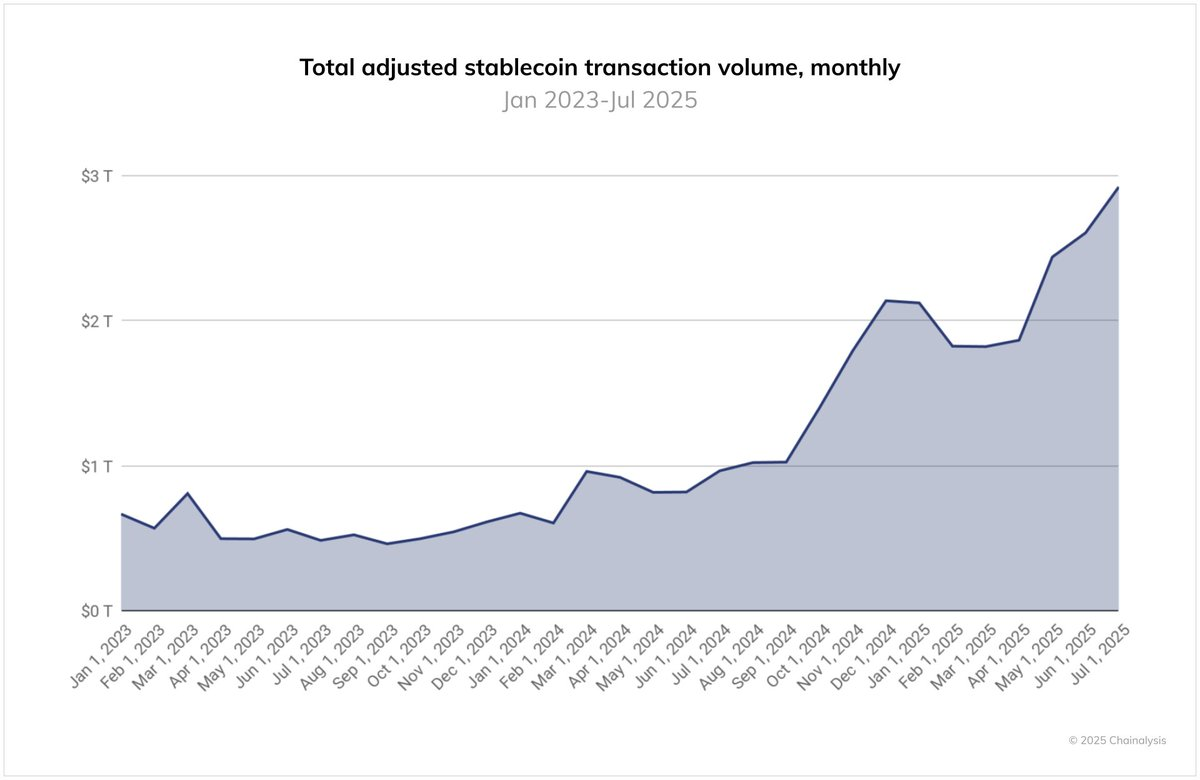

Following the enactment of the Genius Act, increased institutional interest and activity in stablecoin payments has become one of the main drivers for its widespread adoption.

Over the past year, monthly trading volume of stablecoins has climbed to nearly $3 trillion, and adoption is accelerating rapidly. While this may not be a perfect metric, it clearly demonstrates the significant growth in stablecoin usage following the Genius Act and the European MiCA framework.

On the other hand, Visa, Mastercard, and Stripe are all actively embracing stablecoin payments, whether by supporting stablecoin spending through traditional payment networks or by partnering with centralized exchanges (CEXs) (such as Mastercard's partnership with OKX Pay). Merchants can now choose to accept stablecoin payments without being restricted by their customers' payment methods, demonstrating the Web2 giants' confidence in and flexibility regarding this asset class.

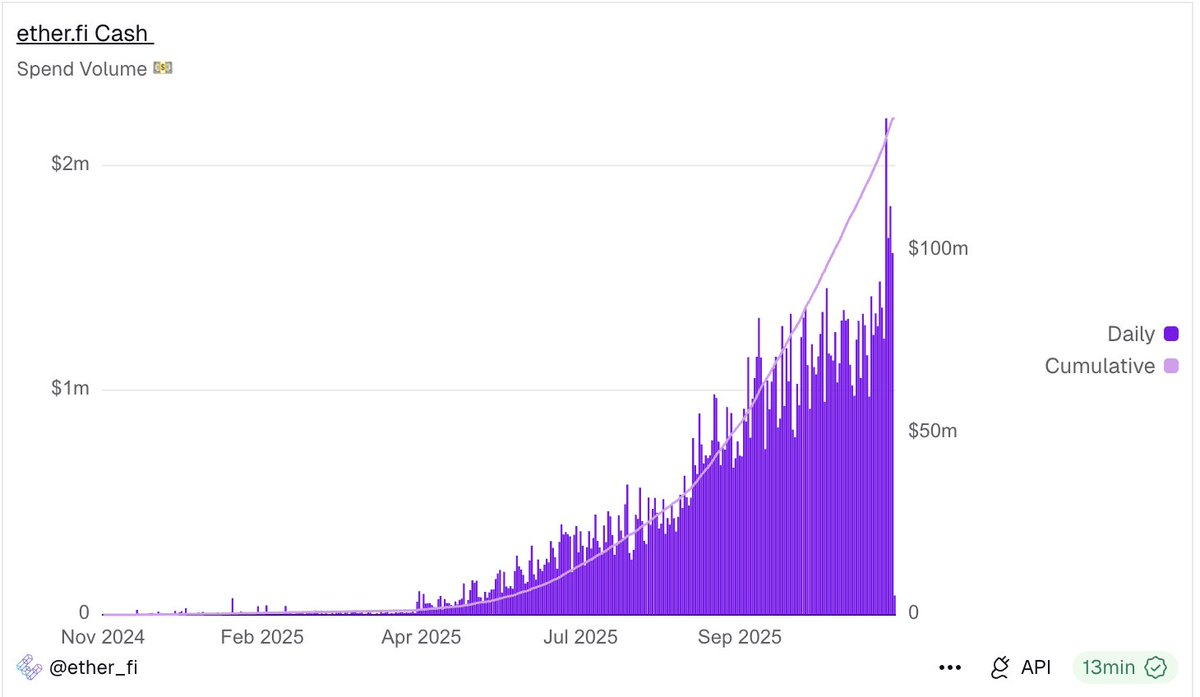

At the same time, new crypto banking services like Etherfi and Argent (now renamed Ready) have begun offering card products that allow users to spend directly with stablecoins.

For example, Etherfi's daily spending has steadily increased to over $1 million, and there is no sign of the growth slowing down.

Etherfi

Nevertheless, we cannot ignore some challenges that new crypto banks still face, such as high customer acquisition costs (CAC) and the difficulty in generating profits from deposit funds due to users self-managing their assets.

Some potential solutions include offering in-app token redemption or repackaging the revenue-generating product and selling it to users as a financial service.

With payment-focused chains like @tempo and @Plasma poised for takeoff, I anticipate significant growth in the payments sector, particularly driven by the distribution capabilities and brand influence of Stripe and Paradigm.

The popularity of mobile applications

Smartphones are becoming increasingly popular worldwide, and the younger generation is driving the shift to electronic payments.

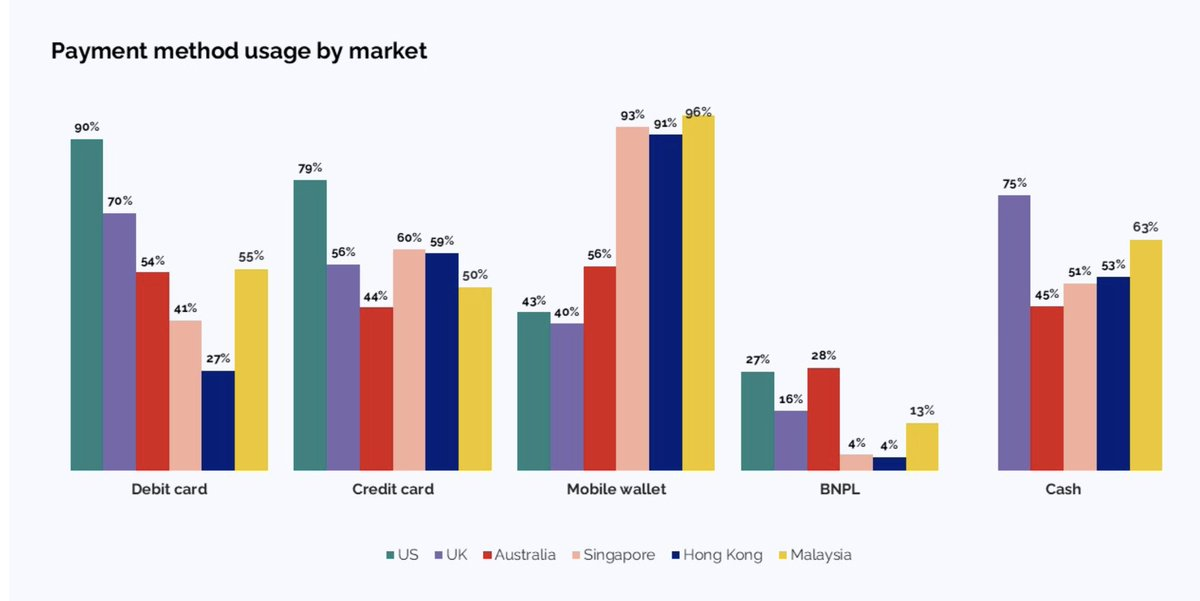

To date, nearly 10% of daily transactions worldwide are completed via mobile devices. Southeast Asia has led this trend due to its "mobile-first" culture.

Ranking of payment methods in various countries

This represents a fundamental shift in behavior within traditional payment networks, and I believe that with the significant improvements in mobile transaction infrastructure compared to a few years ago, this shift will naturally extend to the crypto space.

Remember the account abstraction, unified interface, and mobile SDK in tools like Privy?

The mobile user onboarding experience is now smoother than it was two years ago.

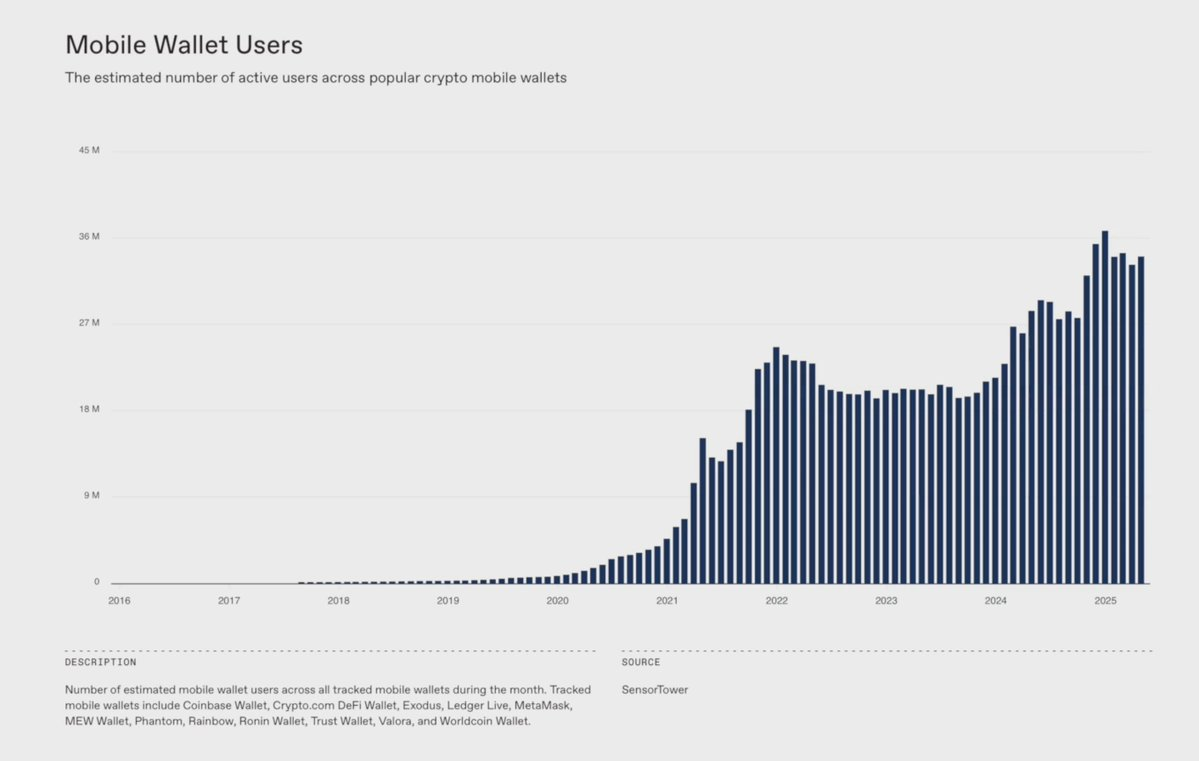

According to research by a16z Crypto, the number of crypto mobile wallet users has increased by 23% year-over-year, and this trend shows no signs of slowing down.

In addition to the evolving consumption habits of Generation Z, we also see a surge in native mobile dApps in 2025.

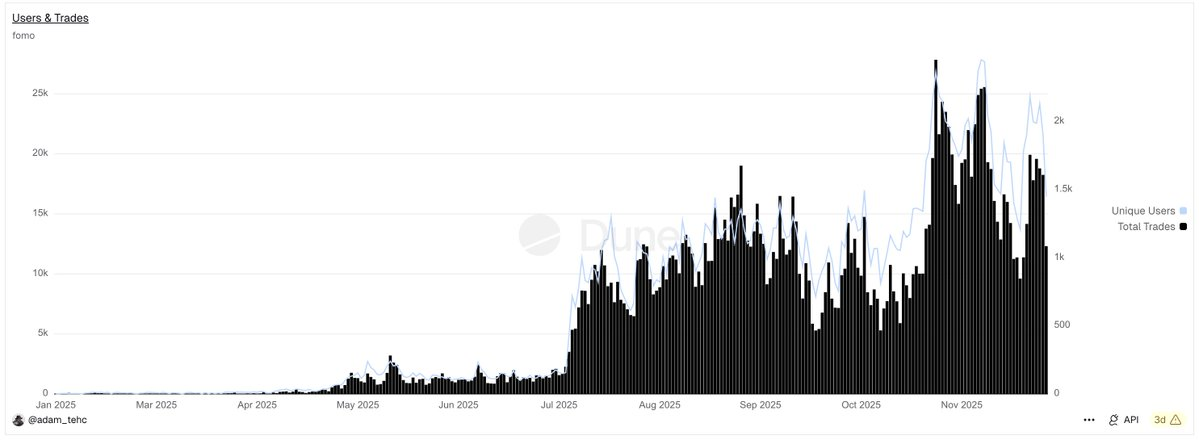

For example, Fomo App, as a social trading application, has attracted a large number of new users with its intuitive and consistent user experience, allowing anyone to easily participate in token trading even without prior knowledge.

Developed in just six months, the app achieved an average daily transaction volume of $3 million and peaked at $13 million in October.

With the rise of FOMO, major players like Aave and Polymarket have begun to prioritize offering mobile savings and gambling experiences. Meanwhile, newcomers like @sproutfi_xyz are experimenting with mobile-centric revenue models.

With the continued growth of mobile behavior, I expect mobile dApps to be one of the fastest-growing sectors in 2026.

Please give me more income.

One of the main reasons why people find this cycle hard to believe is quite simple:

Most tokens listed on major exchanges still generate almost no meaningful revenue, and even when they do, they lack a value anchor between their tokens or "shares." Once the narrative fades, these tokens fail to attract sustainable buyers, and their subsequent trajectory often only goes one direction—downward.

Clearly, the crypto industry relies too much on speculation and pays insufficient attention to real business fundamentals.

Most DeFi projects fall into the trap of designing “Ponzi schemes” to drive early adoption, but each time the result is that after the token generation event (TGE), the focus shifts to how to dump the tokens instead of building a sustainable product.

To date, only 60 protocols have generated over $1 million in revenue within 30 days. In comparison, approximately 5,000–7,000 IT companies on the Web2 have achieved this level of monthly revenue.

Fortunately, a shift began in 2025, driven by Trump's pro-crypto policies. These policies made profit-sharing possible and helped address the long-standing problem of tokens lacking a value anchor.

Projects like Hyperliquid, Pump, Uniswap, and Aave are proactively focusing on product and revenue growth. They recognize that crypto is an ecosystem centered on asset holding, which naturally requires positive value return.

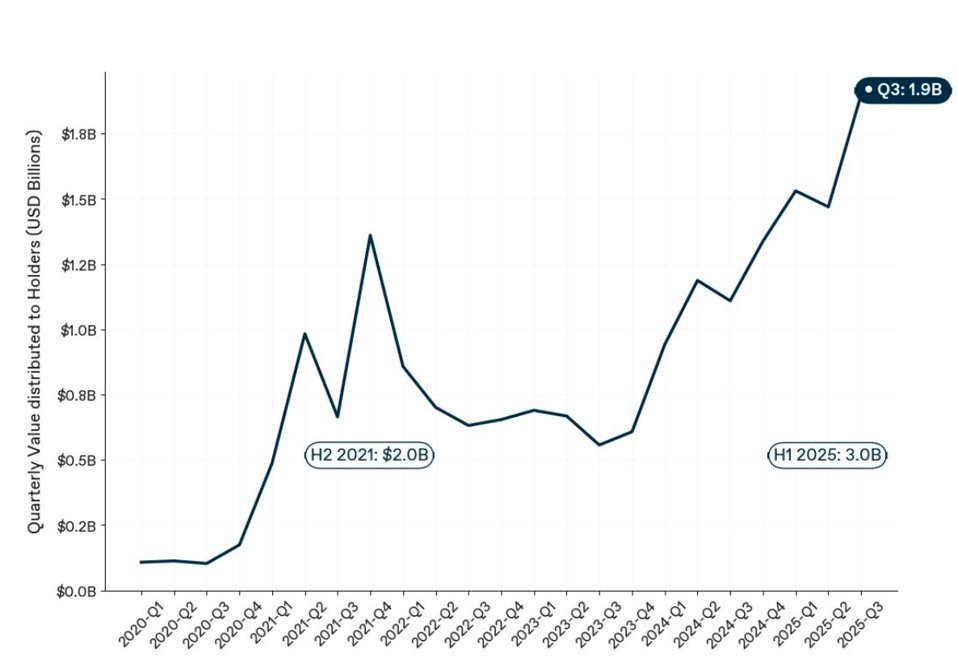

This is why buybacks will become such a powerful value anchoring tool in 2025, as it is one of the clearest signals that the interests of the team and investors are aligned.

So, which businesses generated the strongest revenue?

The primary use cases for encryption remain transactions, revenue generation, and payments.

However, due to cost compression in blockchain infrastructure, chain-level revenue is expected to decline by about 40% this year. In contrast, decentralized exchanges (DEXs), exchanges, wallets, trading terminals, and applications are the biggest winners, with growth of 113%!

Please bet more on applications and DEXs.

If you still don't believe it, according to 1kx research, we are actually experiencing the highest peak in crypto history of value flowing to token holders. See the data below:

Summarize

The crypto industry is not over; it is evolving. We are undergoing a necessary "cleansing" that will make the crypto ecosystem better than ever before, perhaps even ten times better.

Those projects that survive, achieve real-world applications, generate real income, and create tokens with practical utility or value return will ultimately be the biggest winners.

2026 will be a pivotal year.