More Than Just Transactions: How Sun Wukong Used Real Money to Forge a Value Loop for SUN

- 核心观点:去中心化合约交易所竞争转向价值回馈用户。

- 关键要素:

- 孙悟空平台推出交易挖矿与手续费回购销毁SUN机制。

- 其11月合约交易量环比激增271%,达90.78亿美元。

- 通过通缩模型将用户、平台与代币利益深度绑定。

- 市场影响:推动行业竞争从空投叙事转向可持续价值创造。

- 时效性标注:长期影响。

The competition among decentralized futures exchanges (Decentralized Futures Exchanges) has reached a fever pitch. Initially, Hyperliquid's "airdrop wealth effect" sparked a surge of interest in Decentralized Futures Exchanges; subsequently, various exchanges launched their own platform tokens and implemented TGE (Trading on Tokens), and the pursuit of this new narrative initially drove a broad-based price increase in the sector. However, as the market cooled, these wealth effects gradually faded, and the focus of competition shifted to underlying capabilities such as liquidity, market depth, and capital efficiency. However, optimizing these underlying capabilities enhances the user trading experience but cannot directly provide users with value or wealth effects in the short term.

With the disappearance of early-stage advantages, even industry leaders cannot escape user churn. Therefore, to maintain a foothold in the market, they must genuinely implement concrete measures to reward users.

Sun Wukong creates real value for SUN through buyback and destruction.

As a latecomer to the decentralized contract (DPC) market, SunWuKong platform has demonstrated remarkable growth momentum in just two months thanks to a precise and differentiated strategy. By offering zero gas fees and the lowest transaction rates across the network, it directly addresses the biggest pain point for high-frequency traders. Simultaneously, leveraging the robust ecosystem of TRON, it provides a wide range of high-yield investment options, building a strong foundation for user retention.

The recently launched "Transaction Mining" limited-time event signifies a shift in its strategy from simple product optimization to proactive value creation. The event features: full refund of transaction fees + additional SUN token rewards (110% reward for makers, 107% reward for takers). This not only incentivizes trading activity with real money but also deeply links the platform's transaction fee revenue to the value growth of its ecosystem token, SUN. By publicly committing to using revenue to buy back and burn SUN, Sun Wukong is transforming a short-term market activity into a powerful engine driving the long-term, virtuous cycle of its ecosystem value, fundamentally injecting sustainable value expectations into SUN.

You can imagine a clear chain like this:

You make a transaction on the Sun Wukong platform and pay a very low transaction fee.

The platform pools these transaction fees and uses them to buy SUN tokens on the open market.

The purchased SUN tokens were immediately sent to the burn address.

As transactions continue, the buyback and burn mechanism keeps the total supply of SUN constantly decreasing, and this scarcity directly catalyzes the increase in SUN's value. This greatly enhances the sense of belonging and confidence of token holders, and more deeply binds the interests of users, the platform, and the token.

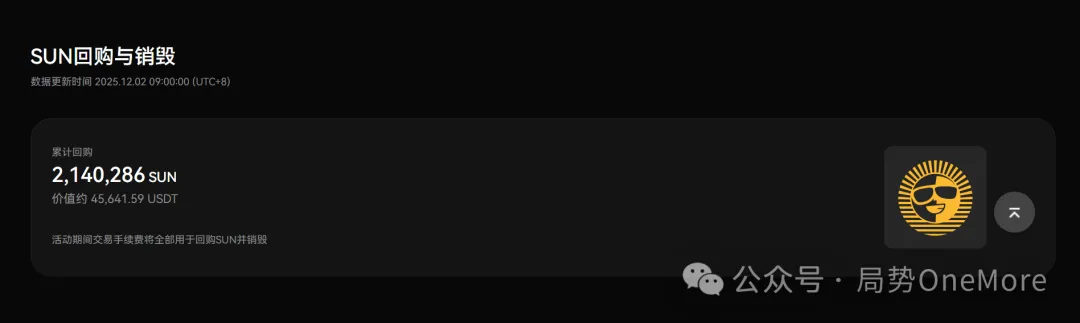

As of now, according to its official data, the number of SUN shares repurchased is 2,140,286.

Dual empowerment: From user retention to ecosystem trust

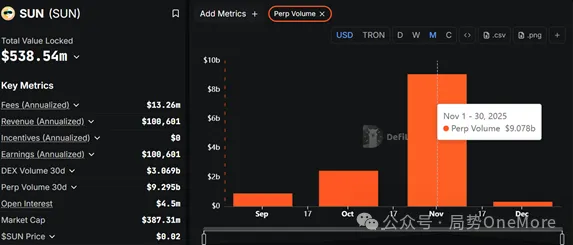

In the short term, Sun Wukong's high incentives attracted a massive influx of traders, which not only solidified the liquidity depth of the designated trading pairs but also directly boosted the platform's contract trading volume. According to data from DeFiLlama, in November, Sun Wukong's contract trading volume reached $9.078 billion, a 271% increase compared to October.

In the medium term, users transform from "freebie hunters" to "habitual users" through high-frequency trading, which also helps the platform accumulate real liquidity and trading depth.

In the long run, when users realize that every transaction contributes to the deflation of the SUN token, their role will evolve from "platform user" to "ecosystem co-builder." This deep alignment of interests and sense of belonging is the best strategy to prevent user churn.

Therefore, paying attention to SUN is not just about the price fluctuations of a single token; it represents a trend: after the noise of traffic and narratives, only those projects that can clearly and fairly return the growth dividends to users can weather the cycles and build a truly solid moat.