Bear Market Screening Method: Why do high-quality projects become clearer when the market is more confusing?

- 核心观点:BitMart上币策略转向精准与稳定。

- 关键要素:

- 11月上币45个,首发率降至36%。

- 16个新资产涨幅超200%,筛选有效。

- 策略调整以管理风险,聚焦长期价值。

- 市场影响:平台策略转变,影响资产发现逻辑。

- 时效性标注:中期影响。

If one word could describe the cryptocurrency market in November 2025, "disorder" would be the most fitting.

The unexpected absence of key US economic data left a vacuum in the macroeconomic narrative, causing the market to fluctuate downwards amid confusion and panic. BTC spot ETFs saw a net outflow of $35.8 billion in a single month, and the total market capitalization once fell from a high of $3.88 trillion to $2.98 trillion.

Against this backdrop, every move made by trading platforms becomes a window into the industry's confidence and strategic resilience. BitMart's latest November listing data provides a typical case study of how leading platforms adjust their pace and maintain their core competitiveness in a headwind environment.

Data Overview: Quantity Pullback, Quality Remains Unchanged

According to publicly available data, BitMart launched 45 new assets in November 2025. This figure represents a proactive pullback compared to the peak of over 80 launches per month in the third quarter. A more noteworthy structural change is reflected in the initial offering rate: the initial offering rate for assets launched in November was 36%. Looking back at recent months, BitMart's initial offering rate has fluctuated—34% in July, exceeding 50% in August, remaining at 44% in September, and reaching 54% again in October. The November data clearly falls at the lower end of this fluctuation range.

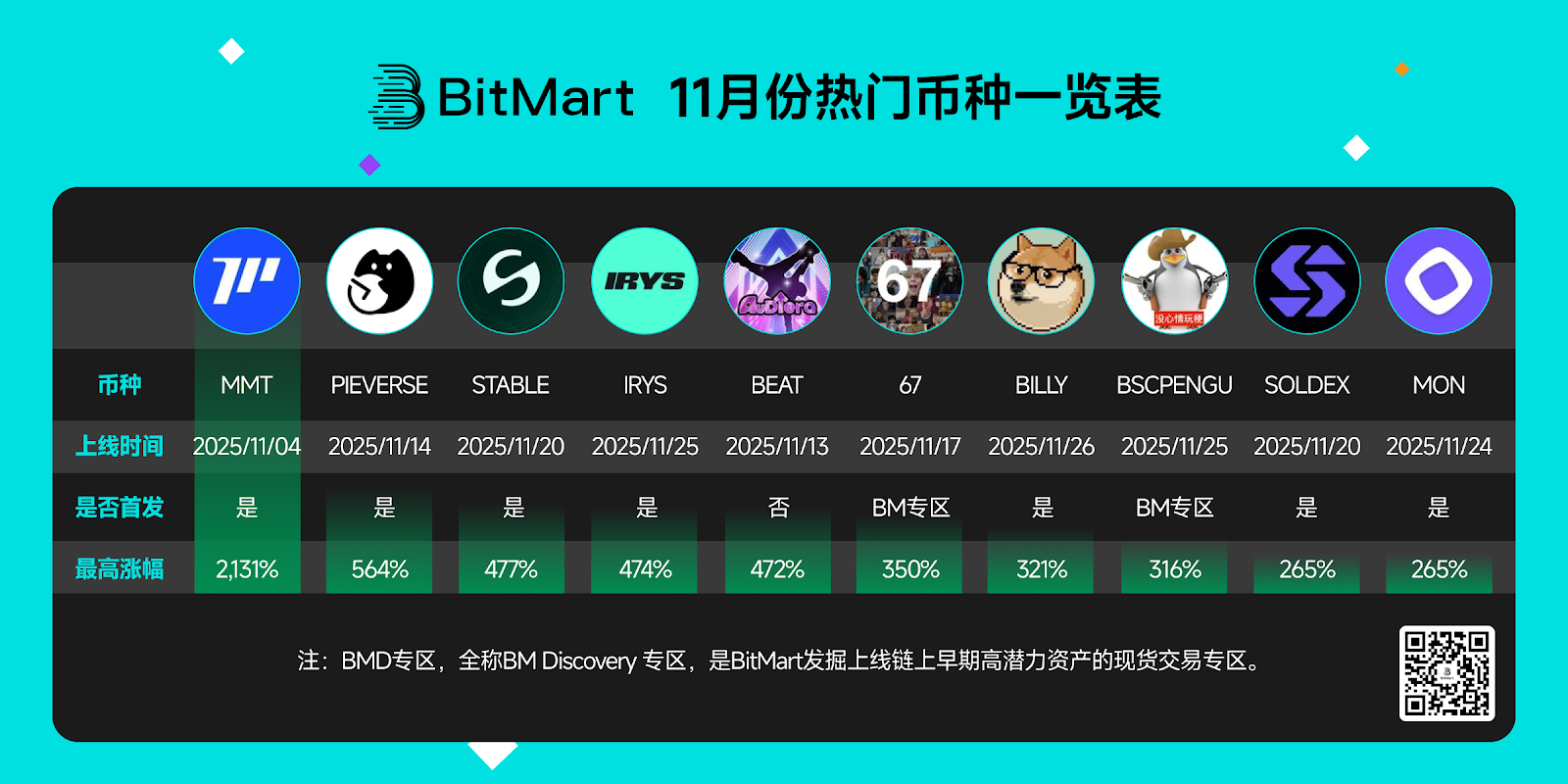

However, the simple change in quantity is not the whole story. The key indicator for measuring the success of the listing strategy—the market performance of the assets—remains remarkably resilient. Of the 45 assets listed in November, 16 achieved price increases exceeding 200%, accounting for 36%. Among them, MMT saw the highest increase at 2,131%, while the top five performing assets averaged an increase of approximately 823%. This indicates that while controlling the overall listing pace, the platform's asset selection mechanism has maintained its effectiveness.

Strategy Analysis: The Risk Control Logic Behind the Decline in Initial Public Offering Rate

The decline in the initial offering rate in November should not be interpreted solely as a weakening of the platform's discovery capabilities. During bull markets or periods of heightened market sentiment, a high initial offering rate is an effective way for platforms to capture early value and attract new users. However, when the market enters a downturn or a period of volatility, the "cold start" risk faced by initial offerings is amplified. Projects may encounter problems such as insufficient liquidity and slow community consensus building, which means greater uncertainty for both the platform and users.

Therefore, BitMart's moderate increase in the proportion of assets that were not initially launched but had already established liquidity and market recognition on other trading platforms in November was a pragmatic strategic choice. This adjustment balanced the portfolio: on the one hand, it continued to provide users with opportunities to capture early alpha through channels such as BMD ; on the other hand, it introduced some assets that had been "preliminarily tested by the market," providing relatively stable options for a wider range of risk-averse users. This reflects a shift in its strategy from pursuing a single speed metric to pursuing overall portfolio success rate and user experience.

Long-term perspective: Counter-cyclical investment and the accumulation of ecological value

Maintaining a stable rather than aggressively contracting pace of coin listings during an industry downturn is strategically significant. During this period, market noise decreases, and high-quality projects have a stronger demand for exchanges that can provide genuine liquidity and long-term support; the barriers to entry are also relatively more rational. BitMart's continued activity at this time helps it establish deeper connections with potential core assets for the next cycle at a more reasonable cost.

This choice may be related to the market stage. During market euphoria, funds may chase various hot topics; while during periods of adjustment, projects with long-term narratives and fundamental support tend to attract more attention. The platform's selection logic may be adapting to this change, favoring projects with clear business logic and a certain development foundation. For the platform, this means attempting to improve the long-term survival rate and success probability of its newly listed assets, rather than simply pursuing short-term hype.

Summary: From "Speed Race" to "Precision and Consistency"

In summary, BitMart's listing data for November 2025 reveals the strategic responses of a mature platform during market transitions. Its core characteristic is no longer simply pursuing "earliest" or "most numerous" listings, but rather shifting towards "more accurate" and "more stable" listings. This is achieved by proactively adjusting initial listing ratios to manage market risk, deepening the selection logic of the BMD zone to focus on long-term value, and cultivating ecosystem partnerships through counter-cyclical and stable operations.

This data ultimately indicates that BitMart's strategic focus has shifted from a simple race to "speed of asset discovery" to building an asset management ecosystem with "risk adaptability" and "long-term value recognition capabilities." For users, this means that even when the market generally lacks direction, the platform still attempts to provide an asset discovery framework with inherent logic and risk adjustment. In the perpetual cyclical nature of the cryptocurrency market , this ability to build certainty may be more important than creating short-term price miracles.