Non-farm payrolls data gave a mixed signal, causing a market-wide sell-off and casting uncertainty over a December rate cut by the Federal Reserve.

- 核心观点:美国非农数据矛盾引发加密市场暴跌。

- 关键要素:

- 失业率4.4%超预期,为2021年新高。

- BTC跌破8.7万美元,24H跌幅6.22%。

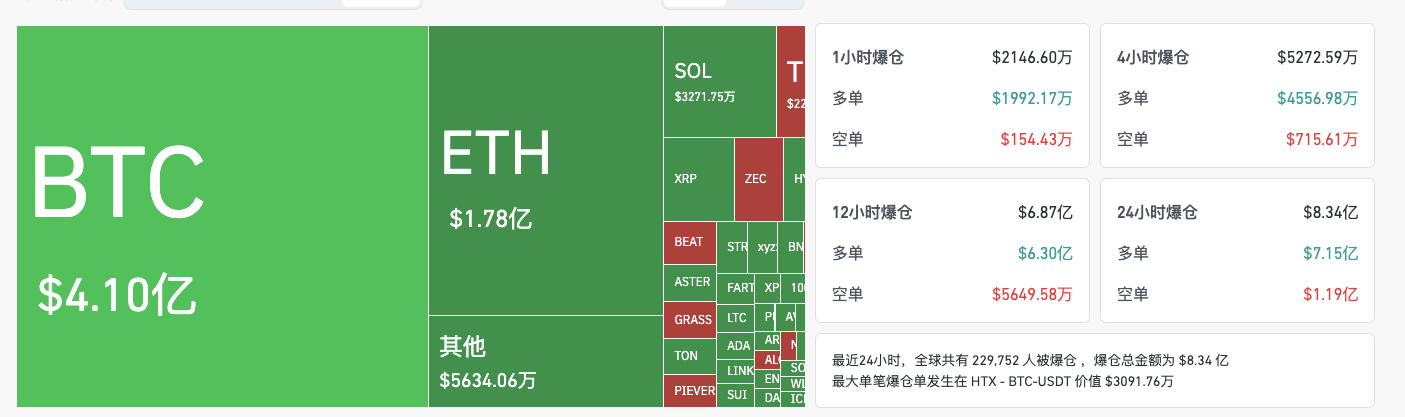

- 全网爆仓8.33亿美元,多单占7.14亿。

- 市场影响:加剧市场恐慌,投资者避险情绪升温。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author|Golem ( @web3_golem )

Yesterday, the US September non-farm payrolls report was released. Seasonally adjusted non-farm payrolls increased by 119,000 in September, compared with an expected 50,000. However, the unemployment rate in September was 4.4%, higher than the market expectation of 4.3%, the highest since October 2021.

Following the data release, the cryptocurrency market suffered another bloodbath. BTC fell below $87,000, hitting a low of $86,100, a 6.22% drop in the past 24 hours; ETH fell below $2,800, hitting a low of $2,790, a 6.1% drop in the past 24 hours; SOL fell 6.18% in the past 24 hours; and BNB fell below $900, a 4.48% drop in the past 24 hours. The altcoin market was even more disastrous; according to Quantifycrypto data, 90% of the top 200 cryptocurrencies by market capitalization were down in the past 24 hours.

In the derivatives sector, according to Coinglass data, the total liquidation amount across the network reached $833 million in the past 24 hours, of which $714 million were long positions and $410 million were BTC positions.

But the crypto market wasn't the only one that fell last night; global financial markets also fared poorly.

All three major U.S. stock indexes closed lower yesterday. The Dow Jones Industrial Average fell 0.84% to 45,752.26 points, the S&P 500 fell 1.56% to 6,538.76 points, and the Nasdaq Composite fell 2.15% to 22,078.05 points. Technology stocks also fell sharply, with Nvidia falling more than 3%. U.S. Treasury yields also fell across the board. The 2-year Treasury yield fell 5.25 basis points to 3.533%, the 3-year Treasury yield fell 5.84 basis points to 3.525%, the 5-year Treasury yield fell 5.76 basis points to 3.646%, the 10-year Treasury yield fell 4.83 basis points to 4.085%, and the 30-year Treasury yield fell 2.98 basis points to 4.723%.

"Mixed signals" complicate the Fed's decision-making.

This September non-farm payroll report was the first economic indicator released by the U.S. Bureau of Labor Statistics since the end of the U.S. federal government shutdown. Investors originally thought it would bring clear risks to the Federal Reserve's decision to cut interest rates, but it unexpectedly made things more complicated.

The September non-farm payroll report presented a mixed picture. On the one hand, non-farm payrolls increased by 119,000, far exceeding the expected 50,000. Looking at the breakdown, healthcare added 43,000 jobs, outpatient medical services added 23,000, and hospitals added 16,000. Hiring in the food service and alcohol sectors was also very active, adding 37,000 jobs. This suggests that US employment is growing steadily, and the Federal Reserve may shift its focus to inflation.

On the other hand, the US unemployment rate in September was 4.4%, the highest since October 2021. This indicator shows that the US job market remains weak. Despite an increase in jobs in the labor market, the number of unemployed remains extremely high, and the Federal Reserve should pay more attention to employment.

The reason for these seemingly contradictory data is that the statistical methods used for non-farm payrolls and the unemployment rate are different. Non-farm payrolls mainly survey the number of jobs in companies, and short-term part-time jobs are also counted as new jobs. Therefore, an individual can hold multiple jobs, which is one of the reasons why non-farm payrolls and the unemployment rate may deviate.

At the same time, the unemployment rate primarily measures individuals, and a person is not considered unemployed if they don't have a job, but is considered unemployed when they start looking for work. Therefore, when the job market improves, it attracts more people to look for work, which can actually increase the unemployment rate.

However, such "mixed signals" increase the uncertainty surrounding a Fed rate cut in December. According to CME's FedWatch Tool, the probability of a 25 basis point rate cut by the Fed in December is currently 35.6%, while the probability of keeping rates unchanged is 64.4%. Polymarket also bets that the Fed will keep rates unchanged in December at a 65% probability.

Among analysts' expectations for the Federal Reserve's decision, the "no rate cut" camp currently holds the upper hand.

Morgan Stanley analyst Michael Gapen said that strong employment has reduced the risk of rising unemployment and he no longer expects the Federal Reserve to cut rates in December. He now expects three rate cuts in January, April and June next year, thus keeping the final interest rate expectation at 3-3.25%.

Art Hogan, an analyst at B. Riley Wealth, stated that the September US non-farm payroll report was significantly delayed, and the next report won't be released until after the Fed's December interest rate decision. This puts the Fed in a decision-making dilemma and hasn't significantly increased the probability of any rate cuts. The market rally was mainly driven by solid earnings reports from Nvidia and Walmart, so the market reaction was more driven by corporate profits than economic data.

Ali Jaffery, an analyst at CIBC Capital Markets, said the Federal Reserve's pause in rate hikes in December was largely due to insufficient data, thus postponing the policy decision until next year to act when complete data is available. This may have been a wiser choice, especially given the legal challenges facing tariffs.

However, some institutions still hope for an interest rate cut in December.

"Given the continued weakness in the labor market reflected in the unemployment rate, the possibility of a Fed rate cut in December remains," said Heinrich Hay, head of fixed income at Goldman Sachs Asset Management.

Wells Fargo analyst Sarah House said the Federal Reserve should cut interest rates by 25 basis points in December, citing easing inflation and a weakening labor market. She noted that hawks might oppose the cut because inflation is above target and job growth is robust, but the Fed is sticking to its position while acknowledging it's a 50/50 decision.

Before the release of the September non-farm payroll report, the market was very confident that the Federal Reserve would cut interest rates in December. Although the data did not clearly favor "no rate cut", with the market heavily betting on a rate cut, any ambiguous news would trigger a rapid market adjustment.

Although the September non-farm payroll report was ambiguous, it was the only macroeconomic information we could rely on before the December rate cut. The next non-farm payroll report will not be available until after December.

The cryptocurrency market is currently gripped by extreme panic, with the Fear & Greed Index at 11, a new low since 2023. Therefore, this market downturn may simply be a short-term emotional slump triggered by macroeconomic factors. However, as investors, it is crucial to avoid blindly buying the dip; preserving your capital is far better than rushing in blindly.