OKX Research Institute | Why will RWA become a key narrative in 2025?

- 核心观点:RWA是连接传统金融与Web3的关键桥梁。

- 关键要素:

- 链上RWA总规模达350亿美元。

- 私募信贷和美国国债占主导地位。

- 机构巨头如贝莱德推动市场合规化。

- 市场影响:加速万亿美元级资产上链进程。

- 时效性标注:长期影响

Real World Assets (RWA) are becoming a new favorite of global capital.

In simple terms, RWA takes valuable, owned assets from the real world—such as traditional financial assets like houses, bonds, and stocks, and even assets that are not usually easy to trade directly, like art, private loans, and carbon credits—and puts them on the blockchain, turning them into tradable, programmable crypto assets. This way, you can trade these things on the blockchain anytime, anywhere, at low cost.

OKX Research believes that RWA is not a fleeting crypto trend, but rather a crucial bridge connecting Web3 with the trillion-dollar traditional financial market. From asset securitization in the 1970s to today's RWA-ization, the core focus remains on improving asset liquidity, reducing transaction costs, and expanding the user base. This report aims to provide an in-depth analysis of the RWA landscape and explore its future possibilities.

I. RWA Market Overview: Development History, Scale, and Institutional Drivers

Taking the rental scenario as an example, RWA is reshaping the traditional model: no intermediaries are needed, no deposit or three months' rent is required, and renting for one month can be done automatically via mobile phone; upon check-out, the deposit is refunded instantly with one click; for temporary relocation, the remaining lease term can be transferred on the blockchain, with the entire process transparent and tamper-proof. Landlords complete on-chain property rights confirmation through RWA, and rent is automatically distributed by smart contracts, even allowing them to monetize "future lease terms" or "rental income rights" in advance. RWA transforms real estate into flexibly transferable crypto assets, improving efficiency.

RWA is the inevitable result of making traditional financial assets machine-readable on the blockchain. It is not about creating new assets, but about building a completely new and efficient operating environment for old assets.

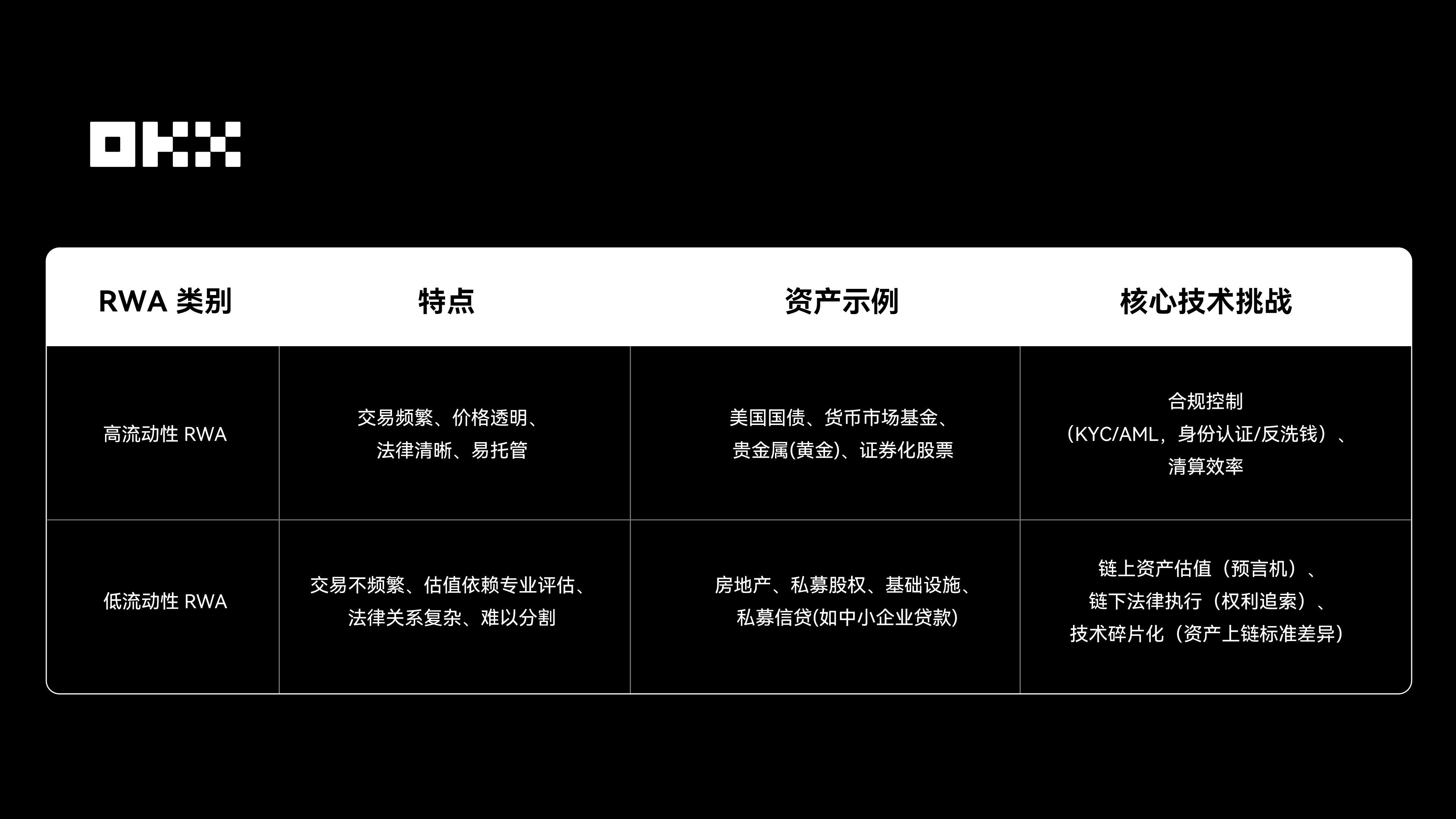

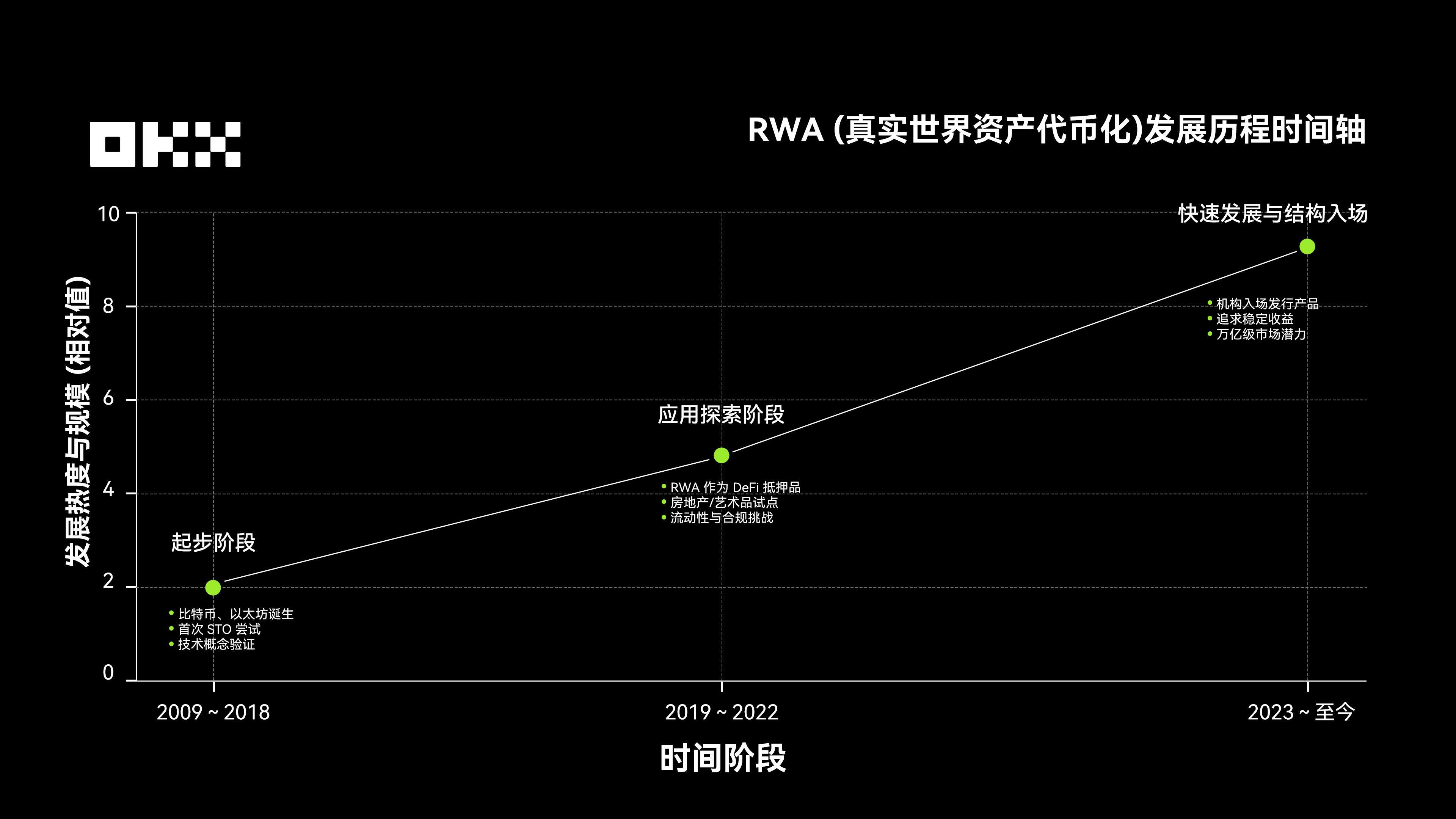

The development of RWA can be roughly divided into three stages: the initial stage from 2009 to 2018, during which Bitcoin and Ethereum were born, initiating early explorations of asset tokenization and STO; the application exploration stage from 2019 to 2022, during which RWA was introduced into DeFi as collateral, and assets such as real estate and art began to be piloted on the blockchain, but still faced liquidity and compliance challenges; since 2023, with investors pursuing stable returns and institutions actively issuing tokenized products, the RWA market has entered a period of rapid development, with its scale continuing to expand, and is moving towards a trillion-dollar new financial market.

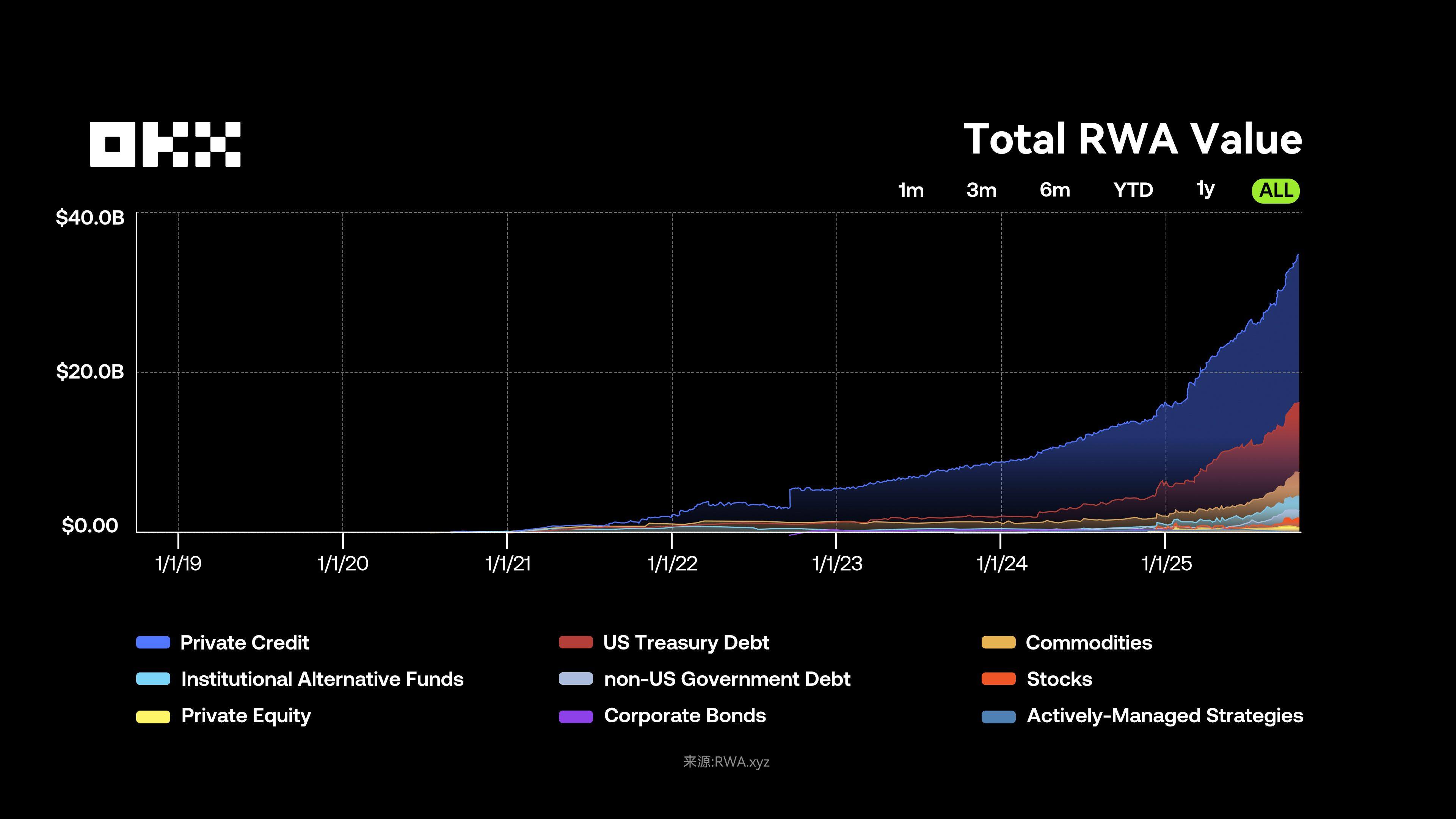

From a macro perspective, RWA is poised to first improve payment and collateral efficiency, then expand into lending, and ultimately support AI wallet transactions, potentially reshaping the capital market over the next five to ten years. The RWA market has experienced exponential growth since reaching $50 million in 2019, with particularly significant growth expected in 2024-2025. As of November 3, 2025, the total on-chain RWA (excluding stablecoins) reached $35 billion, an increase of over 150% year-over-year; the total market capitalization of stablecoins exceeded $295 billion, with over 199 million users holding tokens, reflecting the tokenization narrative's transition from concept to large-scale application.

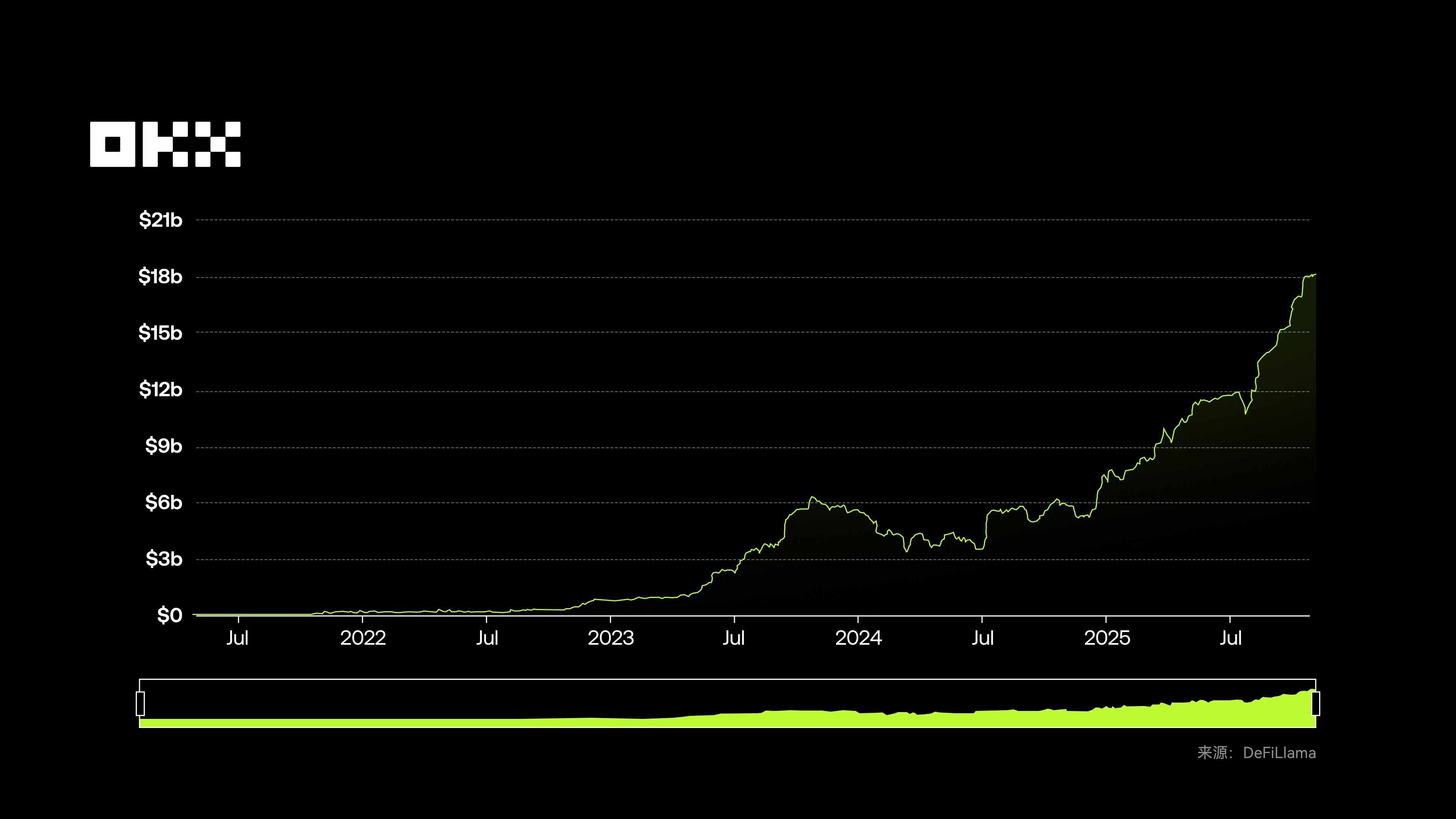

According to DeFiLlama data, the total value locked (TVL) of global RWA reached $18.117 billion, continuing its growth trend. (Note: On-chain RWA totals represent the total value of all related tokens issued on-chain; while TVL specifically refers to the value of RWA held as collateral or interest-bearing assets in DeFi protocols. A large portion of RWA (such as BlackRock's BUIDL) is held directly in users' wallets and not deposited into DeFi protocols, therefore the TVL is much smaller than the total issuance.)

This growth stems from the convergence of institutional participation, clear regulation, and technological maturity: The uncertain global interest rate environment has made tokenized US Treasury bonds (yielding around 4%) a preferred low-risk asset for DeFi users and institutions; regulatory frameworks such as the EU's MiCA provide a legal blueprint; and asset management giants like BlackRock and Franklin Templeton have validated the compliance and feasibility of RWA through product issuance. Simultaneously, DeFi protocols have introduced RWA as collateral and yield benchmarks to mitigate volatility, and MakerDAO and others have accepted RWA collateral to release stablecoin liquidity, creating a resonance between on-chain and off-chain funding.

II. RWA Market Analysis: User Profile, Structure, and Six Key Assets

According to data from RWA.xyz, as of November 3, 2025, RWA had over 520,000 asset holders. Institutional investors dominate the market (approximately 50-60%), participating through platforms such as BlackRock BUIDL and JPMorgan TCN; qualified/high-net-worth individuals account for 10-20%, primarily through platforms such as Ondo and Paxos; retail investor participation remains low, but they are gradually entering the market through new models such as fractional ownership.

The current RWA market appears prosperous, but institutional capital is primarily chasing a few safe assets, such as US Treasury bonds and top-tier private equity loans, making it a highly competitive market. Real growth lies in the ability to scale up and on-chain illiquid long-tail assets (such as SME invoices, carbon credits, and consumer loans), but the composability of DeFi fundamentally conflicts with the risk isolation of traditional finance. Without supporting disclosure and constraint tools, RWA will forever remain merely an on-chain mirror of traditional finance, rather than a more efficient capital market.

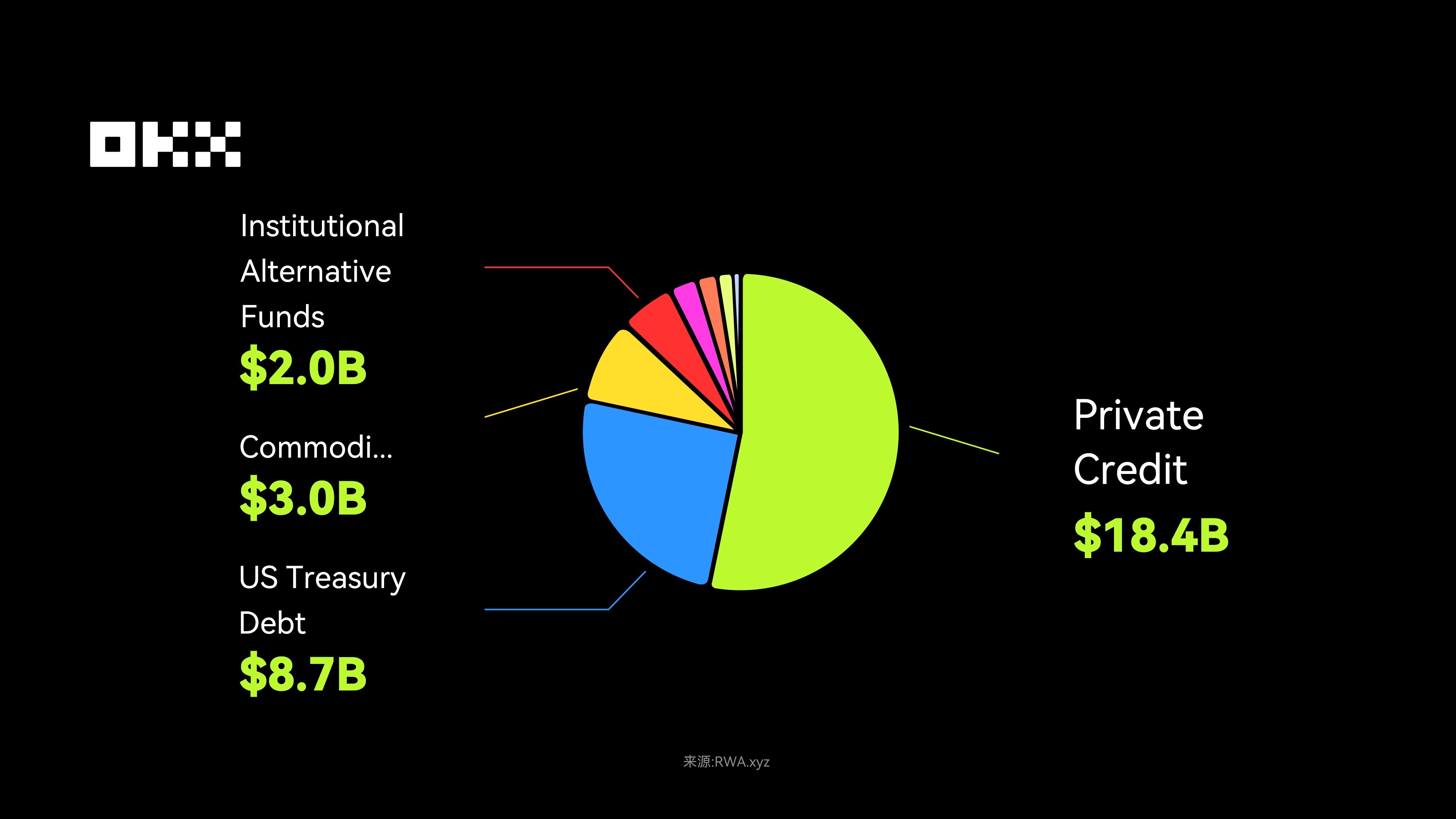

The on-chain RWA asset structure reveals market preferences: private lending and US Treasury bonds are core assets, with the former accounting for half due to their high yields, and the latter serving as an "entry-level" product for institutional capital; commodities and institutional alternative funds account for approximately $3 billion and $2 billion, respectively. Non-US government bonds ($1 billion), public equities ($690 million), and private equities ($580 million) constitute the long-tail assets, possessing greater growth potential. In the long term, the potential for asset tokenization far exceeds its current size. BCG predicts that by 2030, the global asset tokenization business opportunity could expand to $16.1 trillion, approximately 10% of global GDP.

It's important to note that not all assets are suitable for tokenization. Real growth often comes from assets with modest returns but stable cash flow, such as short-term government bonds, HELOCs, and consumer credit. These assets are predictable and have ample cash flow, making them ideal for on-chain packaging. Conversely, assets with extremely poor liquidity (such as some real estate assets) will likely still face liquidity challenges even after tokenization.

A common but misleading understanding is that "tokenization creates liquidity." The reality is that tokenization cannot generate liquidity; it only exposes and amplifies the inherent liquidity characteristics of an asset. For highly liquid assets (such as US Treasury bonds and blue-chip stocks), tokenization can optimize and expand liquidity, making it available 24/7, global, and programmable—a nice bonus. For low-liquidity assets (such as individual real estate units and specific private equity investments), tokenization only changes the form of ownership registration and cannot solve the fundamental problems: information asymmetry, valuation difficulties, complex legal transfers, and insufficient market depth. On-chain real estate NFTs, without buyers, still have zero liquidity.

The core logic is that liquidity comes from a strong market-making network, a clear price discovery mechanism, and market confidence, not from the token standard itself. Blockchain addresses settlement and custody efficiency, not asset attractiveness. The lesson for the market is that successful RWA projects (such as tokenized US Treasury bonds) do not create new assets, but rather provide a better channel for cash cow assets that are in high demand but have low trading efficiency. Furthermore, the current slow-growing RWA sector (such as real estate) suffers not from technological issues, but from the non-standard and low-frequency trading characteristics of the assets themselves. The primary value of tokenization lies in transparency and process automation; only secondarily can it potentially improve liquidity.

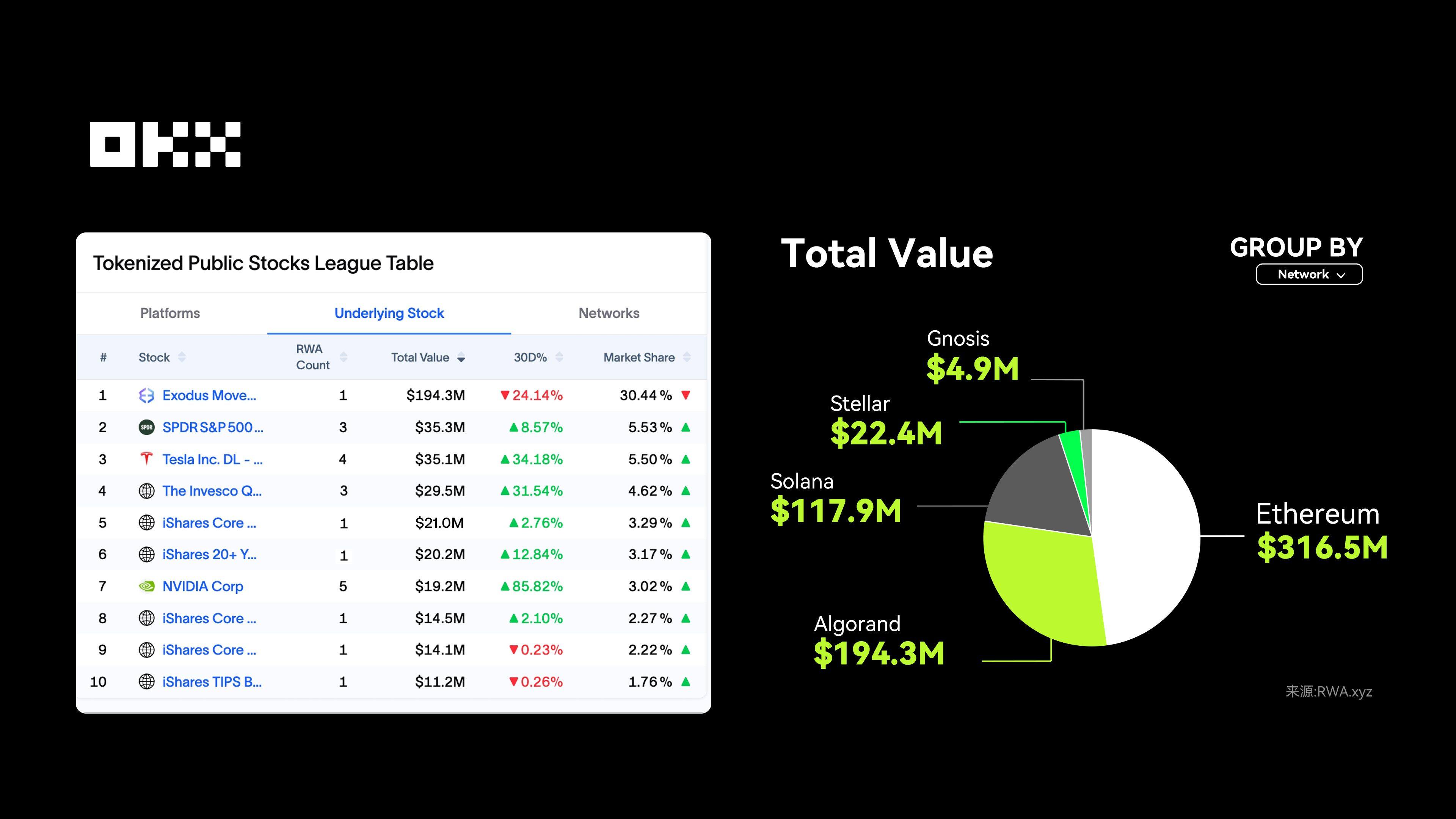

RWA assets vary significantly across different public blockchains. Aside from private, permissioned blockchains like Canton developed by Digital Asset, RWA assets are primarily concentrated on the Ethereum network. Additionally, networks such as Polygon, Solana, and Arbitrum also have deployments of varying sizes.

From the perspective of income-generating assets or investment potential, the core focus remains on categories such as private lending, US Treasury bonds, and commodities. Although these are smaller in scale, they are the true "income-driven" RWAs. Therefore, understanding the RWA market requires distinguishing between the different perspectives of total market capitalization dominance and income-generating asset dominance.

(a) Private lending: Core assets of high-yield RWA

Private lending, amounting to $1.6 trillion in traditional finance, is currently the largest asset class among non-stablecoins like RWA. It utilizes blockchain smart contracts to encapsulate privately traded debt instruments such as corporate loans, invoice financing, and mortgage lending into tradable tokens.

The growth of private lending stems from high yields and relative stability, offering DeFi users 5%-15% annualized returns with volatility independent of the crypto market. Tokenization fragments illiquid assets, attracting global crypto capital, improving liquidity, and empowering traditional lenders. Furthermore, it doesn't redefine credit, but rather provides a more efficient receipt mechanism. Once these assets are on-chain, they can be inserted into lending markets, used as collateral, or packaged into asset-backed securities, just like other crypto assets.

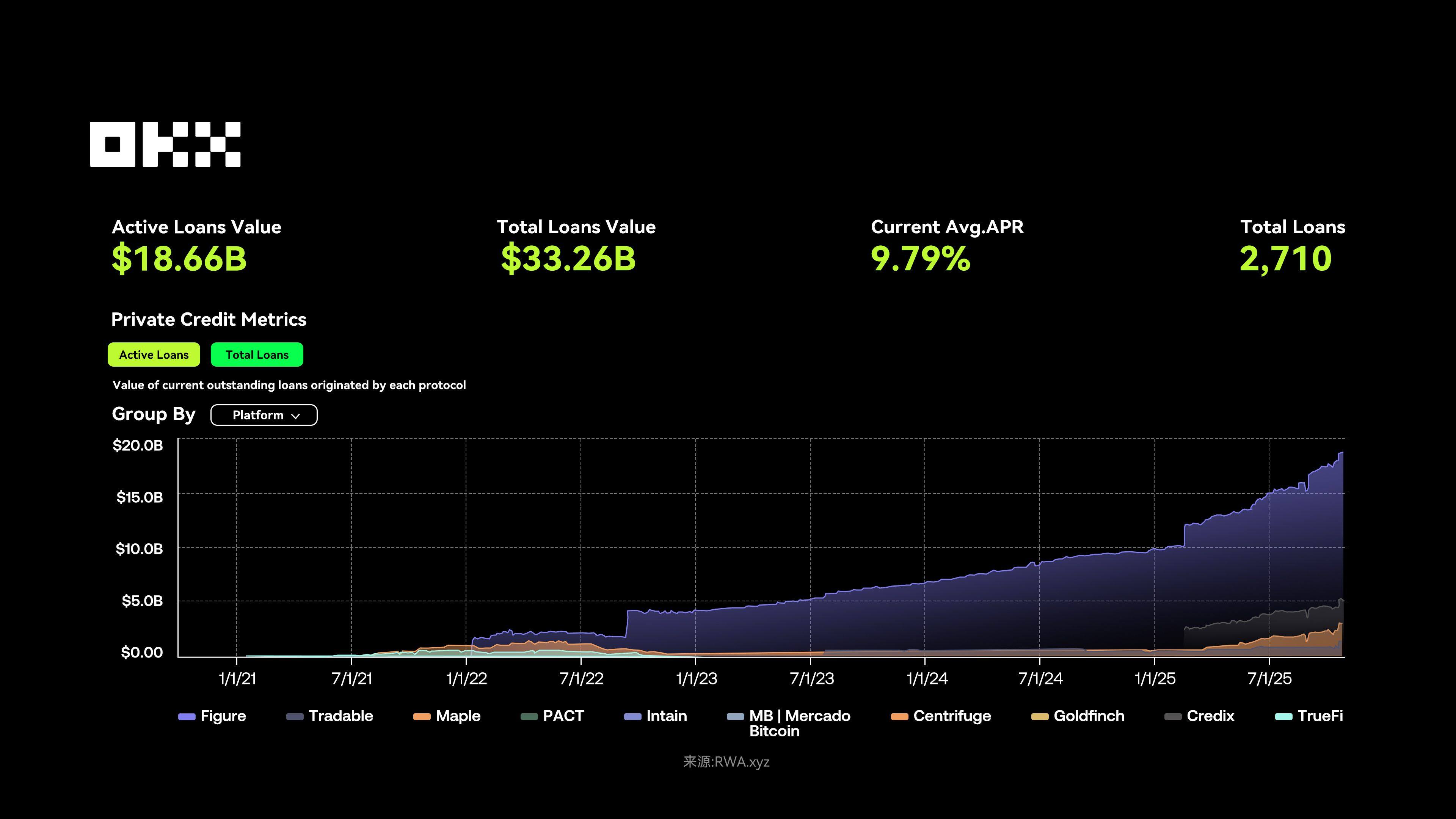

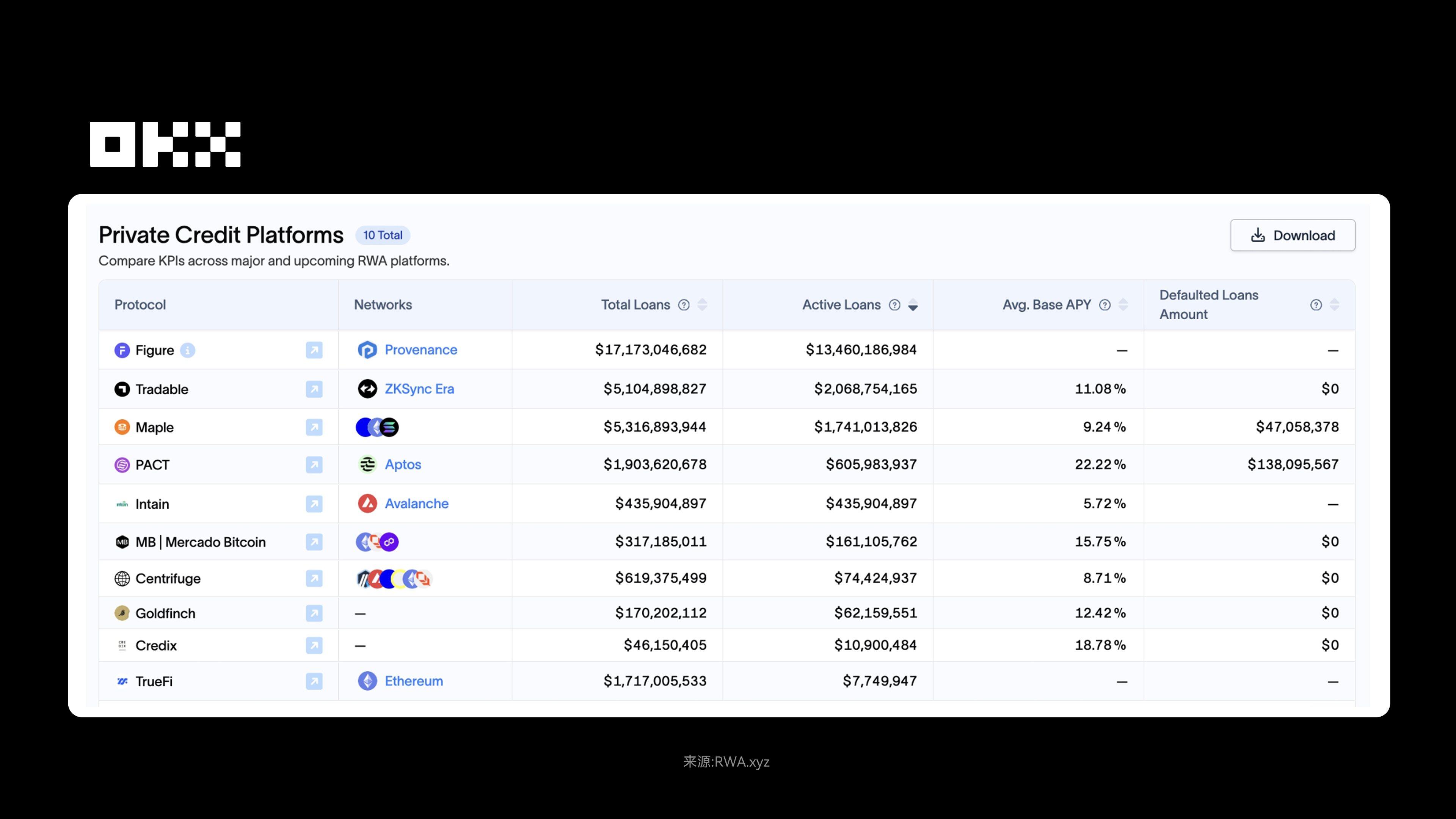

As of November 7, 2025, the active private lending volume in the RWA sector was approximately $18.66 billion, with an average annualized interest rate of 9.79% and a total of 2,710 loans. The Figure platform holds approximately 92% of the market share, with a total loan volume of $17.2 billion; Centrifuge, through its multi-chain architecture and interoperability with DeFi protocols, has seen its TVL grow from $350 million to over $1.3 billion, with a historical annualized return of 8%-15%.

The on-chain boom in private lending replicates the traditional credit cycle: starting with high-quality loans and then expanding to low-quality collateral. The collapse of some yield-generating stablecoins may be a signal of entering the "junk bond" phase—these products essentially lend user funds to opaque on-chain/off-chain hedge funds, bearing enormous counterparty risk behind high returns. The Stream Finance incident shows that the real threat to the modular lending market is a liquidity freeze: even if the protocol's repayment capacity is normal, a run triggered by the collapse of inferior assets can drain the entire shared liquidity layer, causing temporary paralysis for users. This is not only a technical risk but also a collapse of reputation and trust.

Figure follows a highly compliant US-based approach. It addresses the pain points of traditional lending, such as numerous intermediaries, slow approval processes, and poor asset liquidity. The platform uses its self-developed Provenance blockchain to tokenize the entire Helium Equity Loan (HELOC) process, enabling rapid on-chain liquidation and custody of assets. In other words, the borrower experience is incredibly fast—pre-approval in 5 minutes and funds arriving in 5 days. This highly efficient model not only meets borrowers' needs but also attracts institutional investors. With over $16 billion in cumulative home equity loans and over 50% active market share, Figure virtually dominates the HELOC market and successfully listed on Nasdaq in September 2025.

Centrifuge takes a completely different approach, focusing on DeFi infrastructure and emphasizing multi-chain interoperability. It solves the problem of traditional illiquid assets (such as corporate invoices and accounts receivable) being difficult to put on-chain. Its core product, Tinlake, can split assets into tokens of different risk levels (Senior/Junior), while providing DeFi users with an annualized return of approximately 8%–15%. Centrifuge's biggest advantage lies in its deep integration with the DeFi ecosystem—for example, Aave and MakerDAO can directly use its assets as collateral. Through this method, the platform's TVL (total value locked on-chain) has exceeded $1 billion, providing SMEs and asset providers with an efficient, on-chain financing channel.

(ii) U.S. Treasury Bonds: RWA, the "entry-level" for institutional capital

As of the end of October 2025, the total size of US national debt exceeded $38 trillion. The tokenization of US Treasury bonds actually originated from the DeFi bear market of 2020-2022, when market returns were generally low, and users began looking for more stable assets with better returns. US Treasury bonds perfectly met this demand: government-backed, virtually risk-free, with annualized returns of 4%-5%, significantly higher than bank deposits (1%-2%) and some DeFi lending products. However, the problems were also obvious—insufficient liquidity (buying and selling must be done through brokers or securities accounts), high barriers to entry (KYC required), and geographical restrictions (it's difficult for non-US users to invest directly). In 2023, the Federal Reserve's interest rate hikes pushed Treasury yields to peak above 5%, and coupled with the explosion of the stablecoin market, the demand for Treasury bond tokenization rapidly increased.

Early examples include Ondo Finance's OUGG (2023) and Franklin Templeton's FOBXX. In 2024, BlackRock officially joined the fray, driving the market size from $85 million in 2020 to $4-5 billion in Q1 2025 through its BUIDL fund, with the overall market exceeding $8 billion. In terms of yield, BlackRock's BUIDL offers an annualized return of 4%-5%, while Ondo's USDY even exceeds 5%, and it can also be used as collateral in DeFi scenarios for "sustainable yield farming," further amplifying returns.

Technically, the tokenization of government bonds relies on ERC-20/ERC-721 to achieve on-chain ownership transfer; BUIDL and USDY are essentially programmable wrappers for extremely conservative debt instruments. They do not redefine government bonds, but rather provide an on-chain interface. Once these assets are on-chain, they can be used as DeFi collateral, participate in yield farming, and even circulate across chains. This Wrap as a Service model is key to RWA's transition from pilot to large-scale deployment. Regulatoryly, approvals from the EU's MiCA and the US SEC accelerate its implementation.

In terms of stability, US Treasury bonds have virtually zero defaults (AAA rating), offering protection against both inflation and market volatility. On-chain tokenization also enhances transparency and security through smart contracts and auditing. Even better, its liquidity and accessibility are significantly improved—24-hour trading, minimum participation of $1, and global user access; it can even be used as collateral to borrow USDC in DeFi. As institutions continue to join, KYC support is being improved, and product diversification (both short-term and long-term Treasury bonds are available) is strengthening the compliance and universality of tokenized Treasury bonds.

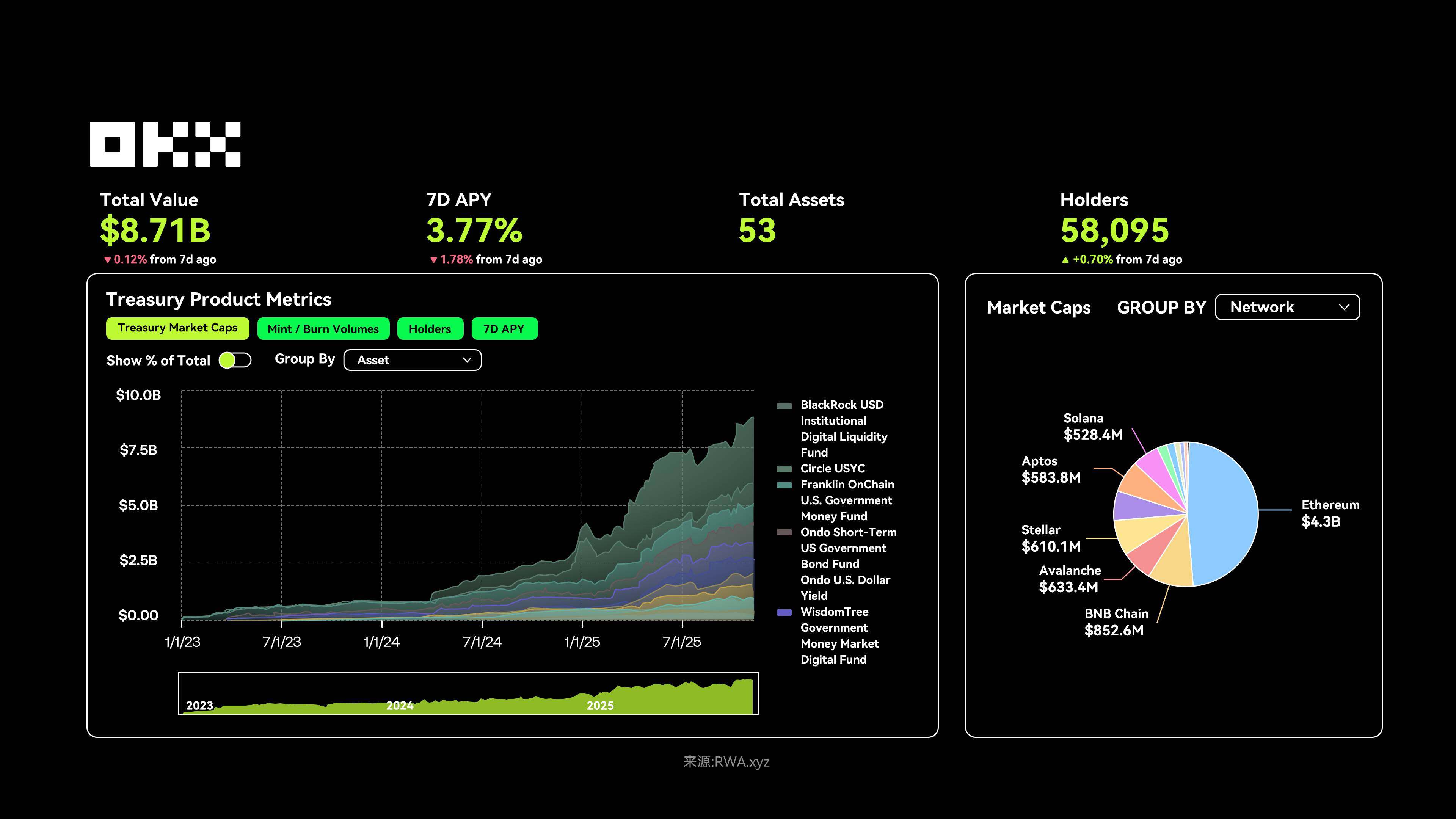

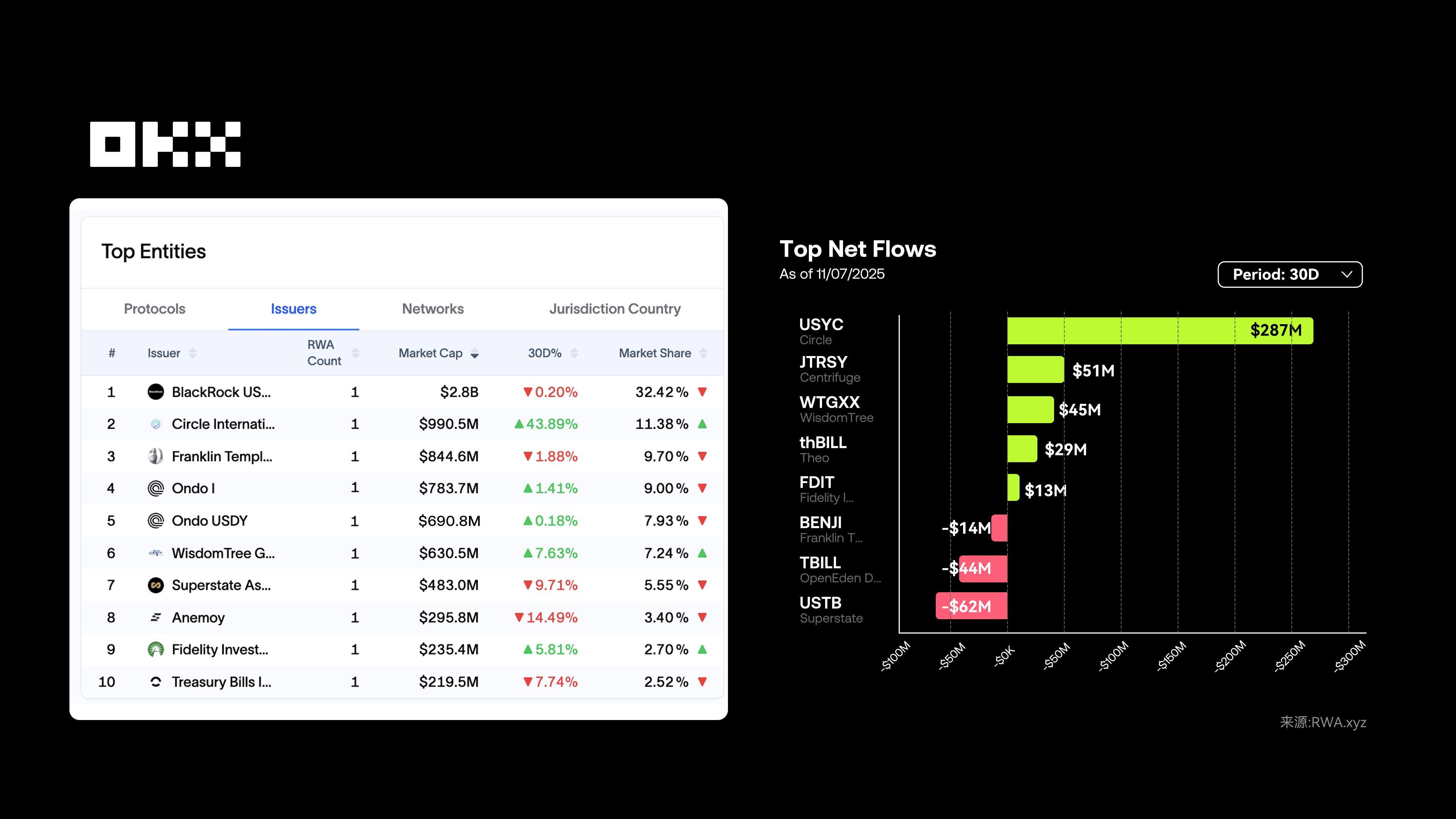

As of November 7, 2025, the total value locked in the tokenized US Treasury market was approximately US$8.7 billion, with over 58,000 holders. The 7-day average annualized yield (APY) was 3.77%, slightly lower than the previous period, reflecting changes in the interest rate environment. In terms of on-chain distribution, Ethereum accounted for over US$4.3 billion, and a multi-chain trend was evident, with VanEck's VBILL fund expanding into multiple ecosystems.

The tokenization market for US Treasury bonds (RWA) is currently dominated by institutions such as BlackRock BUIDL, Circle USYC, and Ondo Finance. With interest rates expected to return to normal levels in 2025, coupled with clearer regulations for stablecoins, this sector is rapidly gaining momentum. The core objective is straightforward: to bring US Treasury bonds to the blockchain, allowing users to obtain stable and readily available returns. Simultaneously, these products strictly differentiate between accredited US investors and global non-US investors, with entry thresholds ranging from retail (e.g., USDY/USYC) to high-net-worth individuals (e.g., OUSG/BUIDL). Users can rationally diversify their investments based on factors such as geographical location, risk tolerance, returns, and fees.

BlackRock's BUIDL is a pioneer in the tokenization of institutional-grade US Treasury bonds. It solves the problems of high barriers to entry and poor liquidity inherent in traditional investment. Leveraging BlackRock's brand endorsement and Securitize's compliance pathway, BUIDL has a market capitalization of approximately $2.8 billion, representing about one-third of the market. The entry barrier is very high (at least $5 million), targeting only qualified US institutions. Returns are based on the SOFR rate (simply put, the average overnight lending rate secured by US Treasury bonds) minus management fees, yielding approximately 3.85% annualized. Furthermore, its transparent on-chain audit makes it the highest compliance benchmark for the integration of traditional finance and Web3.

Circle USYC primarily serves non-US users and qualified institutions, addressing their inconvenience in purchasing US Treasury bonds. Currently, it has approximately $990 million in assets under management. Deeply integrated with USDC and regulated by Bermuda, it offers a 7-day annualized yield (APY) of approximately 3.53%, with returns automatically updated daily via net asset value (NAV), eliminating the need for manual withdrawals. The fund does not charge management fees, only a 10% performance fee, which is considered moderately high. USYC supports T+0 real-time redemption, multi-chain circulation, and has a reasonable entry threshold (US$100,000 and KYC/AML verification). Through partnerships with traditional financial institutions such as DBS Bank, it is accelerating its global expansion.

Ondo Finance adopts a mass-market approach, covering different user groups through its two products, OUSG and USDY, addressing the high KYC threshold and insufficient liquidity issues associated with US Treasury investment. OUSG (approximately $783 million) targets qualified US institutions investing in short-term Treasury ETFs, requiring strict verification (net assets ≥ $5 million, minimum investment of 100,000 USDC). USDY (approximately $690 million, with over 16,000 holders) targets global non-US investors, requiring no strict verification; simply depositing USDC earns returns, greatly simplifying participation for retail investors. Its advantages include low management fees (0.15%), multi-chain compatibility (Ethereum, Solana), and DeFi collateralization, turning US Treasury yields (approximately 3.7% APY) into readily available cash. Strategically, Ondo is building a full-stack RWA infrastructure through acquisitions like Strangelove, providing asset issuance, secondary markets, custody, and compliance tools, preparing for institutional-grade RWA solutions.

The success of tokenized government bonds lies not in disrupting government bonds themselves, but in their role as a compliant, low-risk "Trojan horse," bringing institutional capital and trust onto the blockchain. BUIDL and USDY are essentially programmable wrappers for conservative debt instruments, making traditional financial products portable, composable, and always online. This is the true PMF (product-market fit) of RWA's first phase: serving machines rather than humans, providing a risk-free yield curve for on-chain finance, and paving the way for more complex RWA financial engineering. In the next phase, whoever can build a killer application for on-chain money market funds based on this will capture enormous value.

(III) Commodities: Gold tokenization leads growth

Commodities in the RWA field refer to the tokenization of traditional commodities such as oil, gold, silver, and agricultural products through blockchain, giving them digital ownership and enabling them to be traded on the chain.

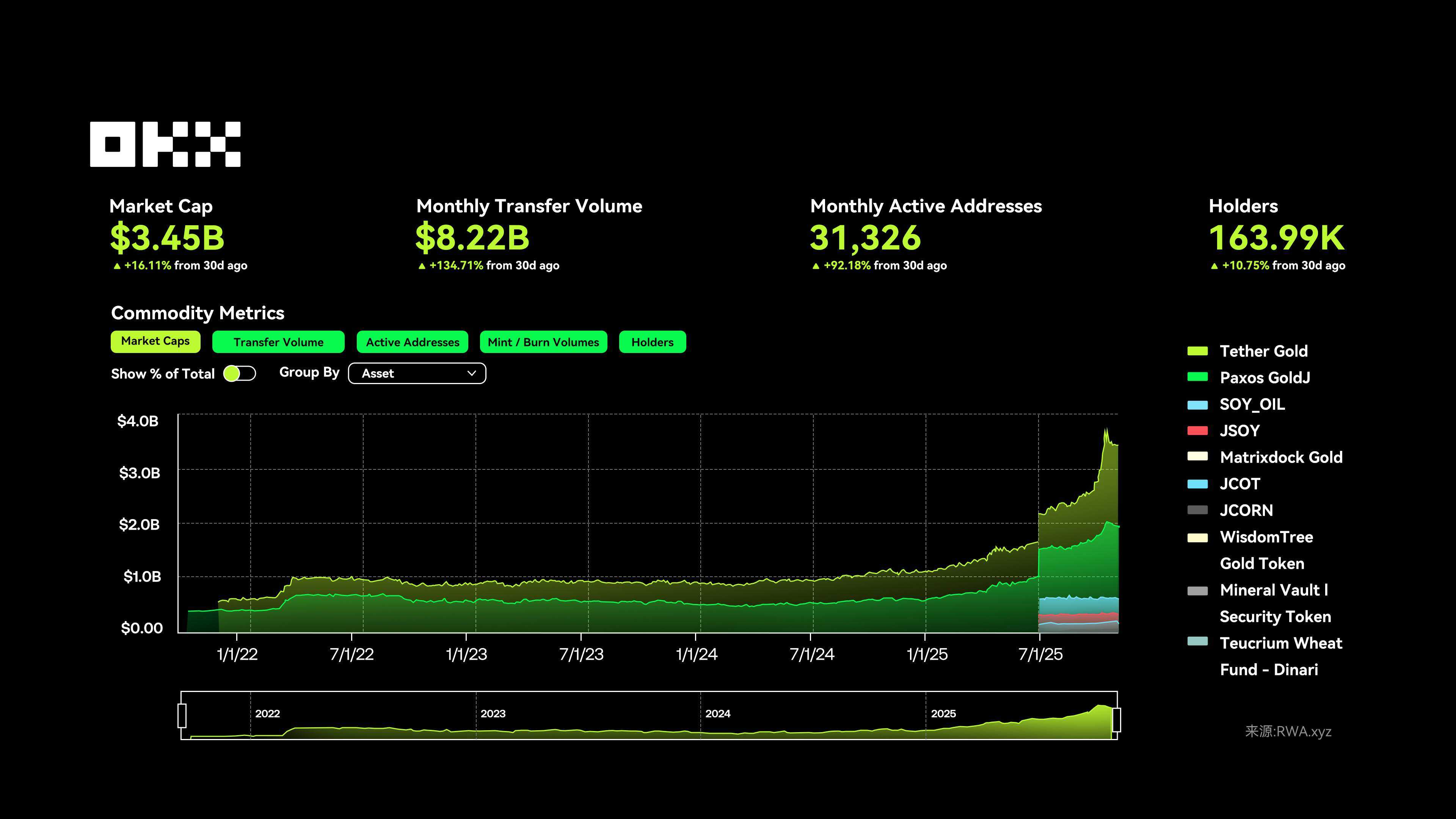

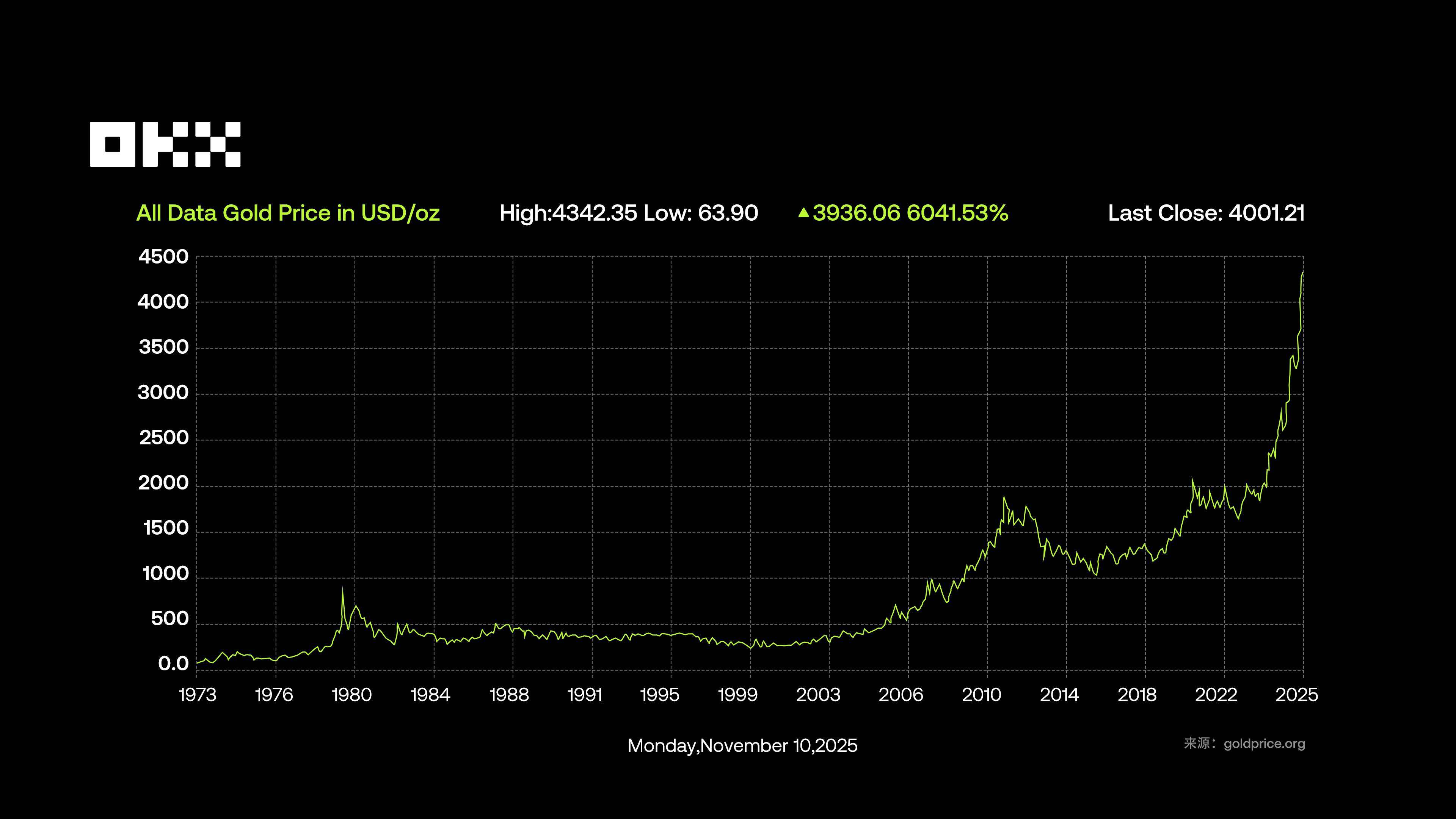

As of November 10th, commodity tokens in the RWA (Real Estate Assets and Services) space are showing significant growth, with the total market capitalization increasing from less than $10 to approximately $3.5 billion, monthly trading volume reaching $8.22 billion, monthly active addresses at 31,326, and the number of holders at 164,000. Gold tokens, in particular, have performed exceptionally well, while tokenized assets of commodities such as oil and soybeans have recently experienced accelerated price increases, with overall market activity and size expanding rapidly.

As of November 10, 2025, the spot gold price had risen to approximately $4,075 per ounce, a cumulative increase of 55.3% year-to-date, reaching a record high. The price increase was primarily driven by geopolitical tensions, inflation expectations, and continued gold purchases by central banks—in the first three quarters of 2025, global central banks made net purchases of over 600 tons of gold. In terms of market size, the global total gold stock is approximately 216,000-282,000 tons (including minerals, central bank reserves, and jewelry), with a total value of approximately $27 trillion at current prices. Global annual demand is estimated at 4,500-5,000 tons, reaching 1,249 tons in the second quarter of 2025 (worth approximately $132 billion, a year-on-year increase of 45%), and is projected to exceed 5,000 tons for the entire year.

The asset structure in the RWA commodities sector is relatively concentrated, with gold-based tokens becoming the preferred choice for users to invest in RWA commodities due to their traditional safe-haven attributes and mature on-chain issuance mechanisms. This growth reflects both the increased market demand for on-chain commodity assets and gold's pioneering breakthrough as a "digitally native" physical asset in the RWA field. Gold-based tokens such as Tether Gold and Paxos Gold are core assets in the RWA commodities sector, with their market capitalization far exceeding that of other commodities (such as oil and agricultural product tokens). In particular, after July 2025, the market capitalization of gold-based RWA tokens experienced explosive growth, becoming the main driving force for the expansion of the entire sector.

The tokenized gold market is currently dominated by products such as Tether Gold (XAUt) and Paxos Gold (PAXG). Although both are pegged 1:1 to physical gold, they differ significantly in their strategic focus and user services. The former is suitable for users seeking convenient trading and profit opportunities, while the latter is more suitable for holders who prioritize security and prefer long-term allocation.

Tether Gold (XAUt) is the largest tokenized gold coin issued by Tether, with each token representing one ounce of physical gold stored in professional vaults. As of November 2025, its market capitalization was approximately $2.1 billion, accounting for 56.8% of the market, making it the undisputed leader. XAUt can be traded on exchanges such as OKX, supports small-scale holdings, and allows users to exchange it for physical gold by paying a fee of 0.1%–0.5%. Some DeFi protocols also support staking or earning yield. Technically, it runs on multi-chain networks such as Ethereum, Solana, and Algorand. According to data released by Tether, its gold reserves exceed 7.7 tons. However, due to centralized custody and Tether's past transparency controversies, users should still be aware of custody and audit risks.

Paxos Gold (PAXG) prioritizes compliance and targets institutional and stable users. Issued by the Paxos Trust Company, regulated by the New York Department of Financial Services, each token represents one ounce of physical gold in London vaults. Its advantages lie in compliance and traceability; users can check the corresponding gold bar serial number and storage information on-chain. As of November 2025, its market capitalization was approximately $1.12 billion, representing 30.3% of the market, with over 41,000 holding addresses. PAXG supports purchases starting from 0.01 ounces and can be traded on OKX or the Paxos website. Redemption options include physical gold bars, unallocated gold, or fiat currency. Settlement is completed as quickly as the same day, with a total cost of 19–40 bps, no custody fees, audited by KPMG, and monthly reserve reports, making it one of the most transparent companies in the industry.

(iv) Listed stocks: Technology stocks and ETF tokenization are the mainstream.

In the RWA (Retail Asset Management) space, stocks refer to crypto assets that tokenize traditional publicly traded company shares using blockchain technology. Each token represents a portion of ownership of the company's stock, and holders are entitled to benefits such as dividends and voting rights. Through tokenization, stocks can be traded 24/7 on the blockchain, achieving high liquidity and cross-border settlement while maintaining compliance and transparency.

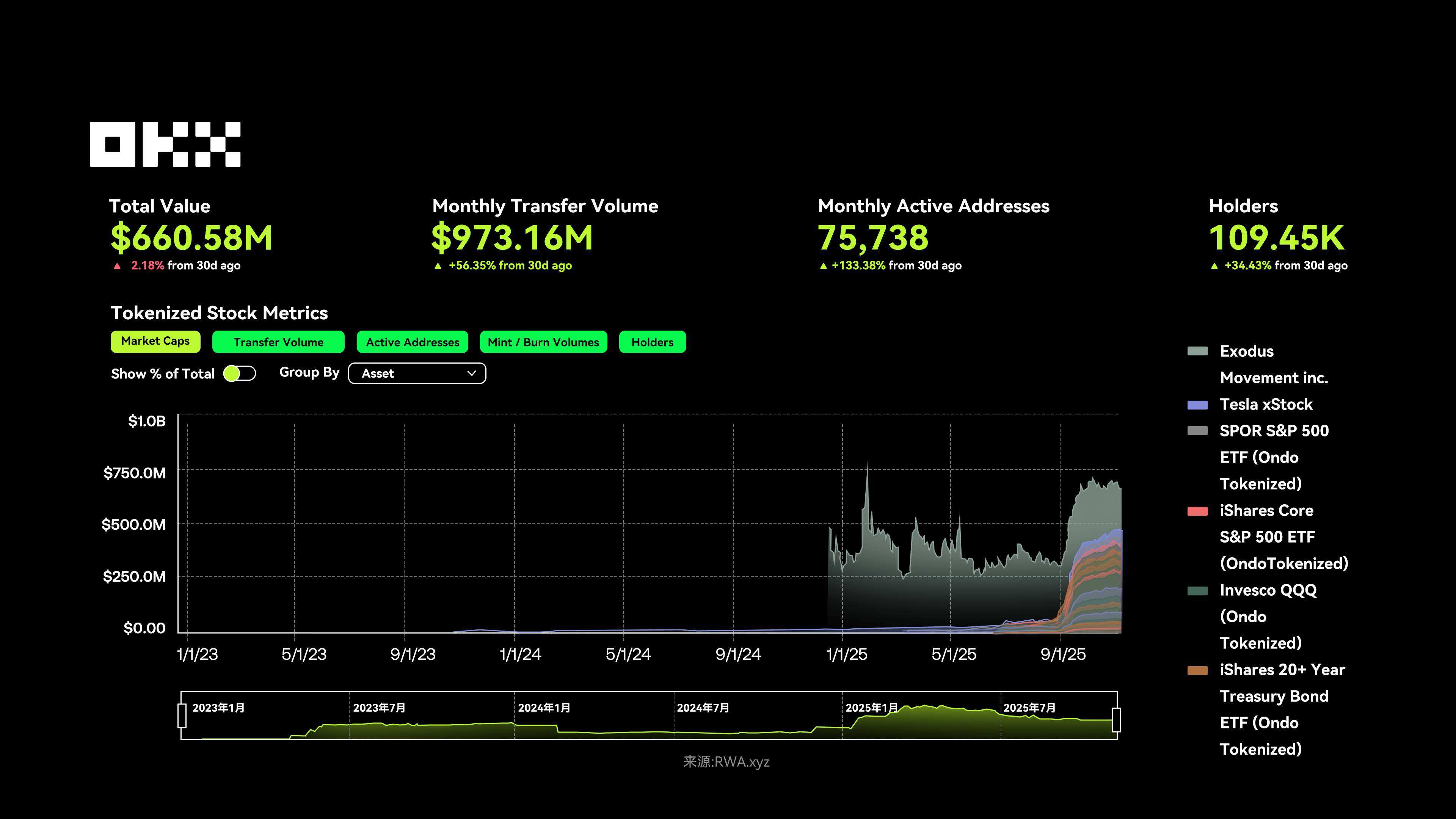

As of November 10, 2025, the total value locked in listed stocks was approximately US$661 million, with a monthly trading volume of US$973 million (up 56.35% month-over-month), 75,738 active addresses (up 133.38% month-over-month), and the total number of holders exceeded 109,000 (up 34.43% month-over-month). Overall, user participation and trading activity are continuing to recover, and the market is entering a new growth cycle.

Tokenized stocks are facing a triple challenge: structural, liquidity, and regulatory issues. The mainstream model relies on SPVs (Special Purpose Vehicles), which has been criticized for denying users full shareholder rights, but proponents argue it's a necessary step from zero to one. The most critical weakness is liquidity: market makers are unwilling to naked positions on weekends, resulting in large spreads and low market depth. A black swan event like a tweet from Musk in the early morning can instantly crash on-chain prices, only to see spot prices recover on Monday, leaving retail investors perpetually exploited. DeFi lending liquidations at these prices could also trigger a chain reaction of liquidations. The real opportunity may not lie in becoming the next Robinhood, but in the "water sellers" who provide the infrastructure for it.

From an asset structure perspective, the core of tokenized stocks currently lies in technology stocks and ETF products, with the market highly concentrated in a few leading projects. For example, Exodus Movement Inc. (EXOD) holds the top spot with a total value of $194 million. On October 20, 2025, Exodus announced the expansion of its common stock tokens to Solana (previously primarily running on the Algorand chain) through Superstate's issuance platform, becoming a representative case of "native on-chain stocks" and demonstrating that compliant equity tokenization is moving from concept to reality.

The popularity of tech giants has also extended to the blockchain. Tesla xStock (TSLAx), issued by Backed Finance on Solana, has a total value of approximately $29.44 million and over 17,000 holders, demonstrating the continued appeal of tech stocks in the crypto market. Furthermore, the combined market capitalization of two tokenized ETFs, SPDR S&P 500 ETF (SPYon) and iShares Core S&P 500 ETF (IVVon), issued by Ondo Finance, exceeds $45 million, further reinforcing the strategic importance of ETF tokenization in providing broad market exposure.

From the issuance perspective, the growth of this sector is almost entirely dominated by a few platforms. They generally use 1:1 physical asset backing and achieve asset mapping and profit distribution through on-chain infrastructure. Ondo Finance ($ONDO) ranks first with a market share of approximately 47.8% ($316 million), focusing on ETF tokenization (SPYon, IVVon, QQQon, etc.), and operates based on its self-developed Ondo Chain and Nexus framework, which is currently the core driving force of tokenized ETFs.

While Securitize currently only issues one asset, EXOD, it holds nearly 30% of the market share with a total value of $194 million. As an SEC-regulated compliance platform, Securitize focuses on institutional-grade equity tokenization and has processed over $10 billion in assets by 2025. Additionally, Backed Finance (BackedFi) holds approximately 18.6% of the market share ($123 million), focusing on tech stock tokenization (TSLAx, NVDAx, etc.), ensuring accurate price synchronization through Chainlink oracles, and actively developing the Solana multi-chain ecosystem. WisdomTree, representing traditional financial giants, has its WisdomTree 500 Digital Fund (SPXUX) holding approximately 3.4% of the market share, focusing on ETF digital fund issuance and leveraging its traditional finance (TradFi) experience to accelerate compliance implementation.

Overall, the top four platforms collectively control over 90% of the market share. With major exchanges such as Robinhood and Kraken gradually opening up tokenized stock trading by mid-2025, coupled with the maturation of cross-chain clearing and regulatory mutual recognition mechanisms, tokenized stocks are gradually moving from a niche experiment to a mainstream asset class.

However, centralized custody and fragmented regulation remain potential risks that require continued attention in this sector.

While tokenized public stocks offer convenience, they don't solve the fundamental pain points, as the experience offered by traditional brokerages is already good enough. The next wave of growth is more likely to stem from a core contradiction: providing an efficiency premium for traditionally inefficient assets.

The main battleground for growth will shift from the transparent and efficient public market (listed stocks, government bonds) to the private market (private lending, private equity). The real pain points in these markets lie in the difficulty of exiting investments, unclear valuations, and slow settlements—for example, selling a private equity fund unit can take months and relies on email and manual matching. Tokenization, through on-chain clearing and fragmented ownership, can shorten these months to minutes, releasing liquidity for non-standard assets. True PMF (product-to-market fit) lies in the tokenization of private lending and pre-IPO equity (such as SpaceX), which not only lowers the investment threshold but also solves industry-level problems of capital lock-up and price discovery.

(v) Real Estate: Fragmented ownership lowers the investment threshold

RWA's real estate sector refers to tokenizing traditional real estate assets via blockchain, enabling ownership or income shares to be traded and managed on-chain. Market growth is primarily driven by fragmented ownership, allowing global users to invest in high-value properties with a minimum investment of as low as $50 (such as Lofty AI) and enjoy the efficiency of rental income and instant settlement.

While private lending and US Treasury bonds account for the vast majority of tokenization, real estate tokenization is still in a phase of rapid growth and possesses significant long-term potential. However, the structural challenges of real estate tokenization will not automatically disappear simply by "going on-chain": pricing lacks transparent benchmarks, title transfers are complex, and cash flow costs remain high. Even with real estate tokens or NFTs, ownership still relies on off-chain contracts and registration systems, which is why RWA primarily focuses on standardized assets such as government bonds while real estate remains in the pilot stage.

Players in the real estate sector are highly focused on solving the two major pain points of compliance and liquidity, mainly through equity tokenization and transaction settlement platforms, such as:

RealT is a pioneer in fractionalized home ownership models, managing over $500 million in assets as of November 2025. Its core model is based on equity tokens, with each token corresponding to an LLC equity stake in an underlying US residential property. Token holders can enjoy rental income and potential property appreciation. The entry barrier is low, typically requiring only a few hundred dollars to purchase, and returns are automatically distributed to a compatible wallet, making it convenient for retail investors to directly participate in the US real estate market.

Propy focuses on the real estate transaction process and has already processed over $1 billion in transactions. Its model is based on NFT-Backed Deeds, which maps NFTs to property deeds to automate sales and title transfers. Users can complete the buying, selling, payment, and compliance verification of tokenized properties within the app, significantly improving transaction efficiency and resolving the complex legal and escrow processes inherent in traditional transactions.

Lofty is a rapidly growing new player with a TVL growth rate of 200%. Its model is an AI-driven, fractionalized rental property system that tokenizes rental real estate assets. The investment threshold is extremely low, starting from $50 to purchase tokens. All investment management (such as rental income and exit mechanisms) is handled in real-time through the app, making it easy for retail investors to participate in the real estate market.

(vi) Stablecoins: Dominating the market

With the inclusion of stablecoins, a re-evaluation of the RWA market from an asset class market capitalization perspective reveals that stablecoins undoubtedly hold more than ten times the combined market capitalization of all other RWA categories, ranking first. This signifies that stablecoins form the liquidity foundation and base of the entire on-chain RWA ecosystem. The future growth potential and innovation story of the RWA sector primarily lie in how to leverage this infrastructure tool to bring trillions of dollars worth of non-monetary real-world assets (such as bonds, credit, and stocks) onto the blockchain.

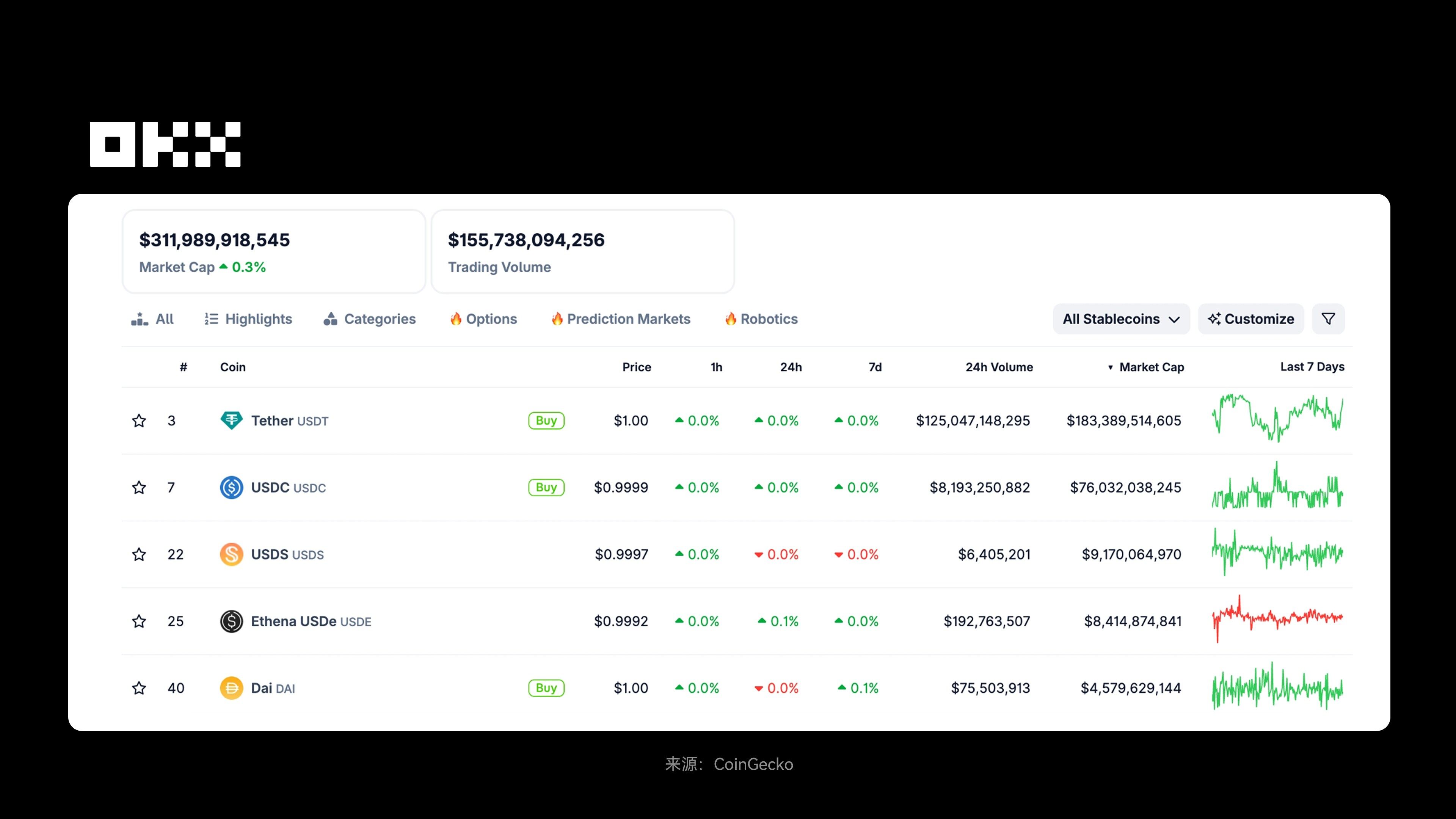

Stablecoins are cryptocurrencies whose value is pegged to fiat currencies, commodities, or other financial assets, aiming to maintain on-chain price stability. According to CoinGecko data, as of November 11th, the total market capitalization of stablecoins was $311.99 billion. In terms of issuing networks, Ethereum leads in market capitalization, followed by TRON, with networks such as Solana and Arbitrum also holding a certain share, reflecting the diverse distribution of stablecoins across multiple blockchain ecosystems.

The stablecoin market is highly concentrated, with USDT and USDC accounting for over 80% of the market capitalization. These stablecoins are primarily backed by fiat currency, cash, and US Treasury reserves, exhibiting a high degree of centralization and mainly used in traditional scenarios such as cross-border payments, transaction settlements, and corporate payroll. In contrast, smaller stablecoins like DAI, USDe, and sDAI employ yield-based or over-collateralized models, are partially decentralized, rely on on-chain monitoring and smart contracts, and serve DeFi, on-chain lending, and asset tokenization. These stablecoins carry higher risk and volatility. Overall, centralized fiat-backed stablecoins offer lower risk and greater transparency, while innovative stablecoins emphasize on-chain financial functions and automated returns.

The centralization of stablecoins stems from the inherent need for fiat currency backing: issuance and management must rely on regulated financial institutions. While decentralization is technically feasible, it is difficult to design and costly, thus most transactions occur at the Level 2 layer. Users are willing to pay a premium for decentralization at the core settlement layer, but for lower costs and faster processing speeds, they prefer centralized systems at the upper layers.

Issuers have an incentive to keep activity on networks they control (such as Circle's Arc, Tether's Stable and Plasma), while crypto and fintech players want transactions to take place on networks they control (such as Base and Robinhood Chain). This competition will determine the future landscape of the stablecoin ecosystem.

The table below provides an overview of major stablecoins worldwide (as of November 11, 2025).

As the most mature and strategically core liquidity infrastructure in RWA, stablecoins serve several purposes. First, leading centralized stablecoins (such as USDT and USDC) introduce the stable value and low-risk returns of off-chain assets onto the blockchain by allocating highly liquid RWA assets such as US Treasury bonds, thus reconstructing the trust foundation of 1:1 fiat currency peg. Second, yield-generating stablecoins (such as USDe and USDM) utilize derivatives or tokenized government bonds to convert off-chain asset returns into native on-chain returns, enabling stablecoins to not only serve as payment tools but also provide low-volatility investment returns. Finally, as a unified pricing and clearing and settlement tool, stablecoins enable cross-scenario interoperability in various RWA projects, improving asset liquidity and capital efficiency, and becoming the core value bridge of the on-chain RWA ecosystem.

It is worth noting that stablecoins and tokenized government bonds are complementing each other. The former is on-chain cash used for payments, while the latter is on-chain savings used for returns and collateral, together constructing a two-tiered monetary structure for on-chain finance.

III. Why will RWA become a key narrative in 2025?

In 2025, the RWA narrative will reach its climax, but ultimately it may not be dominated by crypto companies. Platforms like Robinhood will aggregate traffic through a unified window (equities, crypto, and future private lending) and earn distribution fees; while traditional financial giants (such as BlackRock and Fidelity) who control trillions of dollars in assets will control the top of the value chain. They will have the ability to launch their own L2 or private blockchains to create a closed loop of assets, tokenized services, trading, and settlement.

RWA's long-term story is not about crypto disrupting traditional finance, but about bringing traditional finance onto the blockchain. Crypto companies may take a backseat to the role of infrastructure providers, with their opportunity lying in serving long-tail assets that traditional giants cannot efficiently cover, or in establishing an irreplaceable competitive advantage in key areas such as cross-chain settlement, privacy computing, and dynamic risk pricing. Its core value lies in activating the liquidity of illiquid assets and providing investment opportunities for approximately 1.7 billion unbanked people worldwide, achieving true financial inclusion.

Despite its promising prospects, RWAs face multiple challenges: regulatory fragmentation increases cross-border issuance costs and compliance pressures, and the SEC may classify some RWAs as securities; legal complexity, oracle vulnerabilities, and centralized custody introduce counterparty risks; market volatility and privacy compliance issues slow adoption. During credit expansion cycles, underwriting standards may loosen, and collateral quality may quietly deteriorate, sowing the seeds for the next recession. DeFi protocols must have a thorough understanding of the credit risk of their underlying assets when introducing RWAs as collateral.

Therefore, strategically, a hybrid model integrating CeFi and DeFi is needed to maintain momentum. Users should ideally choose a diversified portfolio and operate through audited platforms; issuers should embed ERC-3643 compliance standards from the outset; and regulatory bodies need a unified framework to avoid fragmentation. Overall, RWA is not a bubble, but a crucial cornerstone of crypto finance, expected to support approximately 30% of global financial assets by 2030.

Disclaimer:

This article is for informational purposes only. The views expressed are solely those of the author and do not represent the position of OKX. This article is not intended to provide (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risk and may result in significant volatility. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. For your specific circumstances, please consult your legal/tax/investment professional. You are solely responsible for understanding and complying with applicable local laws and regulations.