The Undercurrents Amid the Stablecoin Crisis: How to Safeguard Risk Boundaries Behind Decentralized Innovation?

- 核心观点:稳定币机制存在脆弱性风险。

- 关键要素:

- Delta中性等复杂机制掩盖真实风险。

- 近期xUSD等多起脱锚事件频发。

- 缺乏透明度与有效监管框架。

- 市场影响:引发对DeFi系统性风险的担忧。

- 时效性标注:中期影响

The stablecoin market has been turbulent for the past month.

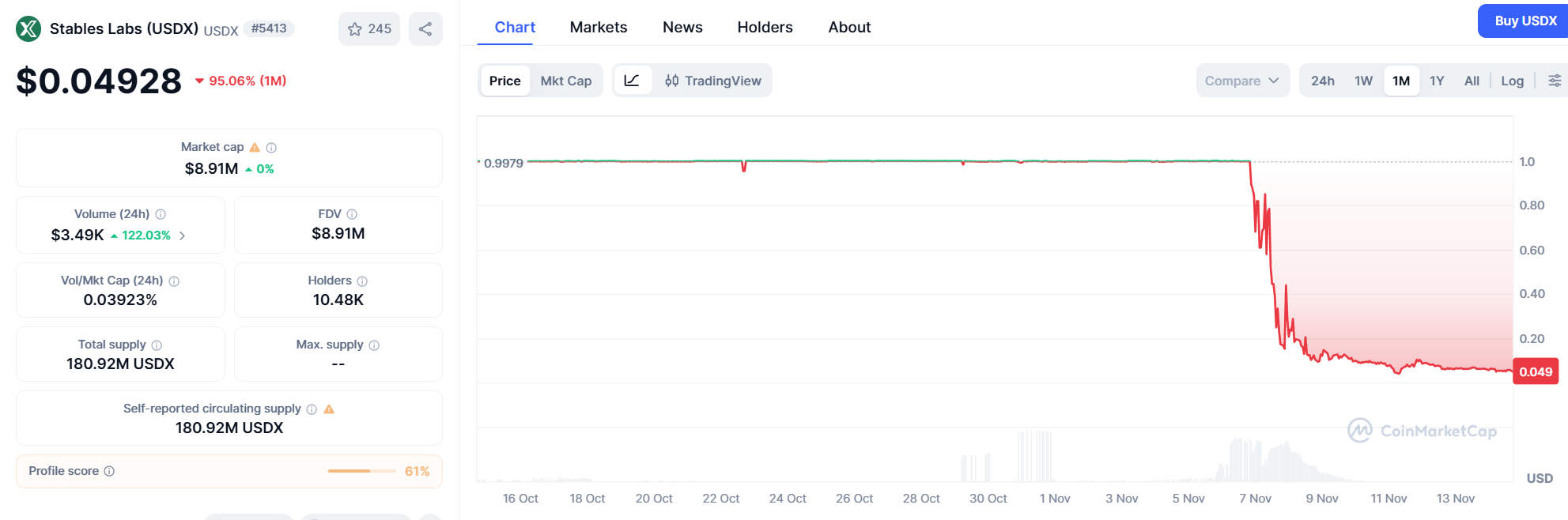

From xUSD to USDX, then to deUSD, and then to the bad debt propagation of protocols such as Euler, Stream, Compound, and Aave, the stablecoin world and even the entire on-chain protocol are undergoing a systemic stress test.

The core issue behind this is the potential risks exposed in the stablecoin mechanism, which to some extent confirms the essence that "stablecoins are not inherently stable, but rather maintain a fragile balance under different mechanisms. " This article will also explore this wave of "de-anchoring" and the important warnings it provides from multiple perspectives of the Web3 ecosystem and TradeFi.

I. Stablecoins Fail: Continuous Growth, Continuous Risk Exposure

As one of the "holy grails" sought by the crypto world, stablecoins have always been the most promising sector in the crypto market.

Especially after the DeFi Summer in 2020, the surge in native DeFi scenarios has provided a large amount of real demand (collateralization, strategies, lending, yield pools), making stablecoins a key infrastructure for on-chain balance sheet expansion. The mechanisms have also become more diversified, from the initial overcollateralized type (DAI), to the algorithmic stablecoin (UST) which has experienced ups and downs, and now to the Delta-neutral mechanism (USDe, XUSD) which is increasingly biased towards complex structured financial products.

After years of expansion, CoinGecko data shows that as of November 14, the total circulating supply of stablecoins on the network has exceeded $300 billion. USDT ranks first with $183.9 billion and USDC ranks second with $75.7 billion. The combined volume of the two is close to $260 billion, still holding an absolute advantage.

Source: CoinGecko

To be frank, with a market capitalization exceeding $300 billion and still growing rapidly, stablecoins, coupled with the massive demand for collateral and their impact on traditional financial and payment systems, inevitably face regulatory scrutiny. Especially as stablecoins gradually penetrate various scenarios such as global payments, DeFi, and safe-haven assets, they are no longer a concept that can be defined by a single narrative.

It can be a primary tool for cross-border transfers, a core component of on-chain revenue, an on-chain financial management tool that provides returns, or a collateral asset in DeFi protocols.

From a broader perspective, it has even begun to assume the roles of "digital deposit" and "on-chain settlement unit," which means that its use cases vary from person to person and arise from need. Moreover, each mechanism is trying to find a difficult balance between decentralization, capital utilization efficiency, and credit endorsement, and the risk profiles of different stablecoins are also vastly different .

In other words, "stablecoins" have essentially become systemic financial intermediaries on the blockchain. Once they are breached, the impact will be far wider than imagined. This is why events such as xUSD, USDX, and deUSD have attracted widespread attention in the past month.

Against this backdrop, understanding stablecoin mechanisms, sources of risk, and regulatory perspectives is no longer just an industry issue, but a public topic that all stakeholders should promote.

II. From Computational Stability to Delta Neutrality: The Myth of Decentralized Stablecoins

It can be said that, based on the current situation, centralized stablecoins such as USDT/USDC are still within the scope of regulatory oversight, while the development speed and complexity of various "mechanism innovation" decentralized stablecoins have actually far exceeded the effective coverage of the current regulatory framework.

For example , most recent cases of stablecoins de-pegging are concentrated on highly structured financial designs such as synthetic collateral and Delta neutrality. After all, while pursuing capital efficiency and innovative returns, these products also bear more flexible non-linear risks.

When discussing the de-pegging of innovative decentralized stablecoins and the potential secondary disaster risks they may bring, Terra/UST is undoubtedly an unavoidable topic. If UST, with its 20% annualized return, was once the most dangerous high-yield trap in the Web3 world, then the protagonist of this wave of events is the more complex "structured stablecoin".

The most representative examples are xUSD and USDX. Their core mechanism is often a combination of "Delta-neutral strategy + liquidity pool + derivatives hedging", which at first glance sounds like a rational, professional, and highly financially engineered mechanism.

However, the reality is that regardless of whether it's algorithmic stability, synthetic stability, or Delta neutral stability, the core risk points to the same thing: complex mechanisms can mask real risks. Of course, objectively speaking, the first half of USDe's stablecoin generation/stabilization mechanism is significantly different from Terra's approach and does not belong to the "ladder to the clouds" approach. On the contrary, because it is reaping profits from all traders who went long in the bull market and paid for their funds, the high yield is supported, which is also the biggest difference between it and Terra.

What's truly noteworthy is the latter part of Ethena's trajectory. When faced with the challenge of de-pegging, it could genuinely follow a negative spiral similar to LUNA/USDe, potentially leading to a run on the platform and accelerated collapse—funding rates would continue to be negative and widen, discussions about Fud would begin, USDe yields would plummet due to the de-pegging discount, and ultimately, market capitalization would crash (due to user redemptions).

For example, if the value drops from $10 billion to $5 billion, Ethena would have to close out its short positions and redeem the collateral (such as ETH or BTC). If any problems arise during the redemption process (such as liquidity issues caused by extreme market conditions or large market fluctuations), the peg of USDe will be further affected.

Source: CoinMarketCap

This is precisely one of the core factors exposed by the recent USDX risk events. Although the 10/11 incident itself was a CEX issue and the on-chain price was not directly affected, if the positions of Delta-neutral stablecoins like USDX are mainly held on large CEXs, they may be indirectly affected.

- Transmission of losses to underlying assets: If the underlying assets on the CEX side suffer losses for any reason (including pricing issues, security incidents, or clearing system failures), it will theoretically affect the value of the short positions used by the stablecoin issuer for hedging or the ability to liquidate the collateral.

- Liquidation chain: This can also cause the issuer to experience delays or setbacks in the liquidation process of the CEX when redeeming stablecoins, ultimately causing the stablecoins to become de-pegged on the chain;

Objectively speaking, whether it's USDe or USDX, these so-called stablecoin products with "Delta neutrality" as their core are essentially more like structured financial products. They require a more detailed regulatory framework and transparent disclosure requirements, as well as more flexible risk reserves.

To put it bluntly, no matter how the underlying mechanism changes, all stablecoins should start from the same point regarding fundamental requirements such as transparency, underlying asset support, and custody mechanisms. So-called "mechanism innovation" should not be used as an excuse to evade regulation and risk disclosure.

III. Prudent Considerations Behind the Evolution of Stablecoins

Looking at the bigger picture, the stablecoin sector has always been a highly profitable and massive market. Its profit model and potential size pose a direct challenge to traditional finance (TradFi), which is the core motivation for regulatory intervention.

According to Tether's Q2 2025 attestation report, Tether's total holdings of U.S. Treasury securities exceeded $127 billion (an increase of approximately $8 billion from the first quarter), with total net profit of approximately $4.9 billion in the second quarter and a total net profit of $5.7 billion for the first half of the year.

It's worth noting that Tether only has about 100 employees, yet its profit margins and operational efficiency are astonishingly high, almost an order of magnitude lower than that of crypto trading platforms and traditional Web2 financial giants! (Further reading: " USDe Soars? Deconstructing the 'Satoshi Dollar' Practice Behind its $14 Billion Size ")

This unchecked financial power and super-monopoly profits will inevitably trigger deep vigilance from regulators regarding the transmission of systemic risks and financial sovereignty. Moreover, at the level of ordinary users, stablecoins are also becoming a mass wealth management tool that is siphoning off the incremental users of traditional financial institutions.

Whether you're familiar with Web3 or not, you've probably seen similar promotions recently, such as "USDC offers 12% annualized flexible deposit yield." This isn't just a gimmick; although it's just a short-term activity by Circle to subsidize interest, it reflects how the logic of making money on the blockchain is permeating a wider range of financial management scenarios.

Objectively speaking, this is an emerging "Web2 & Web3" trend. However, the great simplification of user experience does not mean a great reduction in risk.

Conversely, when ordinary users purchase DeFi structured products—which lack the protection of the Deposit Insurance Ordinance, have complex underlying mechanisms, and may face liquidation and depletion at any time—through the user interface of a bank's app, the misalignment of risks reaches its peak.

There's nothing new under the sun.

Whether it's LUNA/UST, USDe, xUSD, or USDX, the development of stablecoins has long since shifted from "technological innovation" to "financial structural challenges." In the pursuit of efficiency and decentralization, they have continuously exposed the fragility of their mechanisms.

In essence, stablecoins are not inherently safe; their safety is determined by their mechanisms, collateral, transparency, and governance.

The de-pegging of xUSD to USDX is just the latest reminder that, under the lure of huge profits and the cover of complex mechanisms, users need to remain vigilant at all times: any digital financial instrument that promises "high returns and zero risk" deserves to be examined with the utmost caution and skepticism regarding its underlying structure and risk boundaries.

Stablecoins can only achieve a truly sustainable future when innovation is combined with responsible transparency and an increasingly stringent global regulatory framework.