In-depth analysis: Current status and data comparison of the four major Perp DEXs

- 核心观点:Hyperliquid凭持仓量主导Perp DEX市场。

- 关键要素:

- Hyperliquid持仓量占比63%,远超对手。

- 交易量/持仓量比1.57,反映真实需求。

- Aster交易量存疑,Lighter依赖空投激励。

- 市场影响:推动行业关注真实资本沉淀指标。

- 时效性标注:中期影响

Original author: Stacy Muur , DeFi

Original translation by CryptoLeo ( @LeoAndCrypto )

The battle for Perp DEX status continues, with four major Perp DEXs now holding leading positions: Hyperliquid, Aster, Lighter, and EdgeX. Crypto analyst Stacy Muur analyzes the current state, advantages, and future of these four on-chain contract applications based on trading volume, open interest, trading activity, and background information. Odaily Planet Daily has translated the article below:

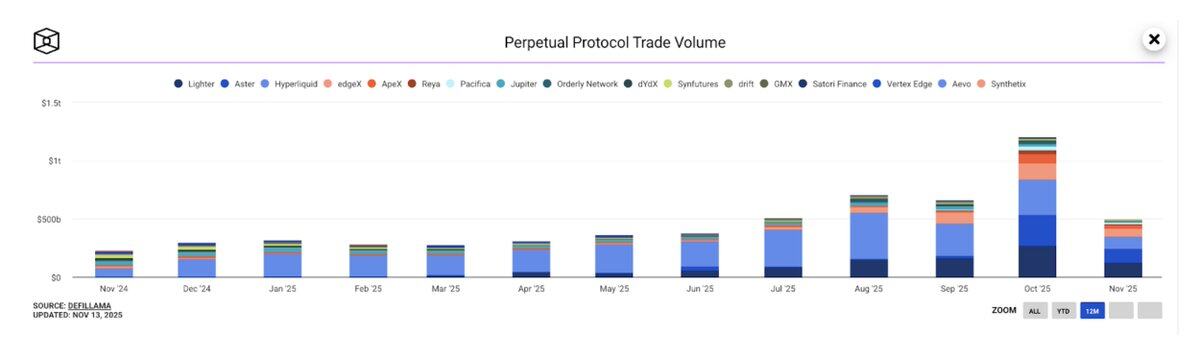

In 2025, the Perp DEX market experienced significant growth. In October 2025, Perp DEX's monthly trading volume surpassed $1.2 trillion for the first time, attracting the attention of retail investors, institutional investors, and venture capitalists.

For most of the past year, Hyperliquid held a dominant position, accounting for 71% of all on-chain perpetual contract trading volume in May. Fast forward to November, with the entry of the new challenger Perp DEX, its market share has plummeted to just 20%, with the remaining three giants being:

Lighter: 27.7%

Aster: 19.3%

EdgeX: 14.6%

In the rapidly evolving ecosystem of Perp DEX, four dominant projects are vying for control of the Perp DEX ecosystem:

Hyperliquid: A veteran of on-chain contracts;

Aster – A platform with massive trading volume;

Lighter – a zero-fee, native ZK disruptor;

edgeX – a dark horse backed by institutional investors.

This in-depth investigation distinguishes between hype and reality, analyzing the technology, metrics, controversies, and long-term viability of each platform.

Part 1: Hyperliquid – The Undisputed King

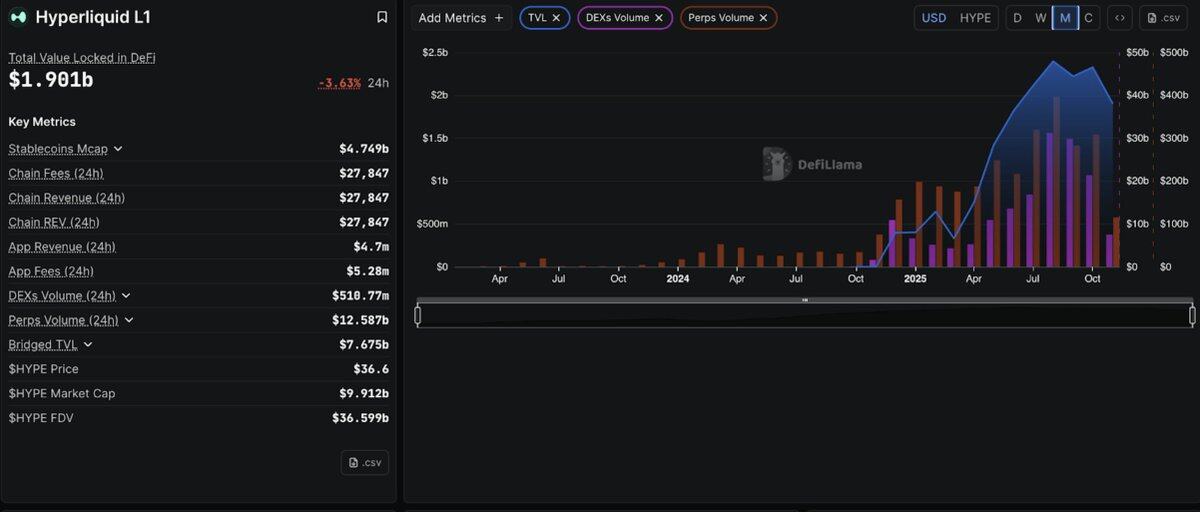

Hyperliquid has become a leading on-chain contract exchange in the industry, with a market share exceeding 71% at its peak. Although its competitors have temporarily seized the spotlight with their rapidly growing trading volume, Hyperliquid remains a mainstay of the Perp DEX ecosystem.

Technical foundation

Hyperliquid's dominance stems from a revolutionary architectural decision: building a customized Layer 1 blockchain specifically designed for derivatives trading. The platform's HyperBFT consensus mechanism enables sub-second order finality and a performance of 200,000 transactions per second, comparable to or even surpassing centralized exchanges.

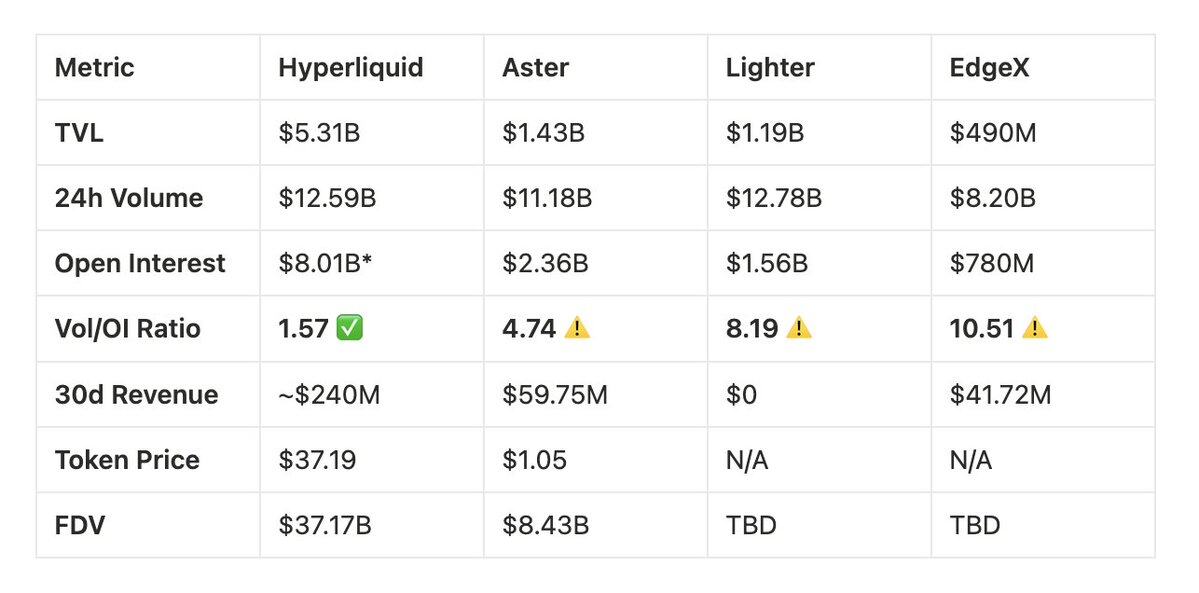

Actual verification of open positions

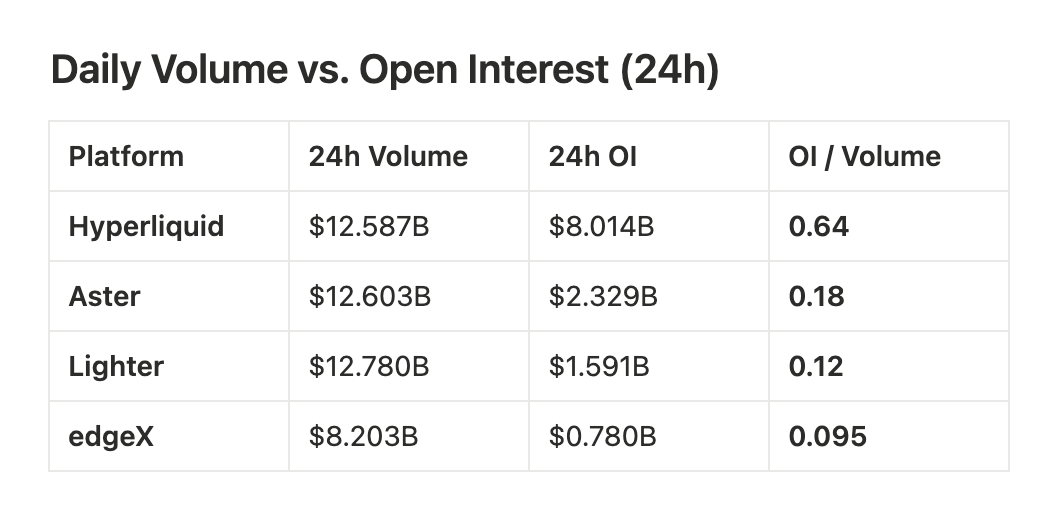

While competitors often publish high 24-hour trading volume figures, the true indicator of real capital deployment is open interest (OI), which is the total value of outstanding perpetual contracts. Trading volume reflects activity, while open interest reflects users' willingness to hold positions on the platform.

According to data from 21Shares, during September 2025:

Aster accounted for about 70% of the total;

Hyperliquid has temporarily dropped to around 10%.

However, this dominance is only reflected in trading volume, which is the most easily distorted indicator through incentives, rebates, market maker changes, or shakeouts.

Latest 24-hour open interest data:

Hyperliquid: $8.014 billion;

Aster: $2.329 billion;

Lighter: $1.591 billion;

edgeX: $780.41 million.

Total OI (top four): $12.714 billion, Hyperliquid's share: approximately 63%

This means that Hyperliquid holds nearly two-thirds of the open interest on major Perp DEXs, exceeding the combined total of Aster, Lighter, and edgeX.

Market share of open interest (24-hour benchmark)

Hyperliquid: 63.0%

Aster: 18.3%

Lighter: 12.5%

edgeX: 6.1%

This metric reflects whether traders are holding funds overnight, rather than simply earning incentives or trading frequently.

Hyperliquid: A high OI/volume ratio (around 0.64) indicates that a large portion of the trading volume translates into active, sustained positions;

Aster & Lighter: Lower ratios (around 0.18 and around 0.12) indicate high transaction turnover but relatively little remaining capital, which is typically characteristic of incentive-driven activity rather than a sign of sustainable liquidity.

Overall Overview:

-24-hour trading volume reflects short-term trading activity;

- Contract positions (24 hours) show funds that are still at risk;

-OI/Trading Volume (24 hours) shows the ratio of real trading volume to incentive-driven trading volume.

Based on all OI-based metrics, Hyperliquid leads in terms of architecture:

-Highest open interest;

- The maximum share of the contract margin;

-Optimal OI/Trading Volume Ratio;

-OI is more than the other three platforms combined.

Trading volume rankings fluctuate, but open interest truly represents market leaders.

10.11 stress test

During the liquidation event on October 11, 2025, $19 billion in positions were liquidated, and Hyperliquid maintained perfect uptime while handling the surge in trading volume.

Institutional accreditation

21Shares has submitted its Hyperliquid (HYPE) product to the US SEC and has listed a regulated HYPE ETP on the Swiss Stock Exchange. These developments have been reported by CoinMarketCap and other market tracking agencies, indicating increasing institutional investor participation in HYPE. The HyperEVM ecosystem is also expanding, although publicly available data cannot verify the exact figures of "over 180 projects" or "$4.1 billion TVL".

According to current filings, exchange listings, and ecosystem growth reported by CoinMarketCap and similar tracking agencies, Hyperliquid is demonstrating strong momentum and increasing institutional recognition, solidifying its position as a leading DeFi derivatives platform.

Part 2: Aster – A New Star of Explosive Growth

Aster, launched in early 2025, is a multi-chain perpetual contract exchange with a clear goal: to provide users of the BNB chain, Arbitrum, Ethereum, and Solana with high-speed, high-leverage derivatives trading without requiring them to bridge assets. The project didn't start from scratch; it began with the merger of Asterus and APX Finance in late 2024, combining APX's working perp engine with Asterus's liquidity technology.

Explosive growth

ASTER launched on September 17, 2025, with an initial price of $0.08. Within a week, it surged to $2.42, a gain of 2800%. Daily trading volume peaked at over $70 billion, dominating the Perp DEX market at the time.

YZi Labs invested in Aster, and CZ tweeted about it, driving up the token's price. In the first 30 days, Aster's trading volume exceeded $320 billion, at one point accounting for more than 50% of the DEX market share.

DefiLlama removed from shelves

On October 5, 2025, DefiLlama discovered that trading volume on the Aster platform almost perfectly matched that on Binance (showing a 1:1 correlation), and removed the existing core data from Aster. Real exchange rates fluctuate naturally, and a perfect positive correlation with Binance trading volume suggests the data is questionable.

data:

The trading volume model is completely consistent with Binance (XRP, ETH, all trading pairs);

Only 6 wallets controlled 96% of the ASTER tokens;

The volume/online activity ratio reaches 58 or higher (normal value = below 3).

Subsequently, the price of ASTER plummeted from $2.42 to around $1.05 currently.

Aster's defense

Aster CEO Leonard claimed that the connection was merely "airdrop hunters" hedging on Binance. A few weeks later, Aster relisted on the platform, but DefiLlama warned that "Aster platform data cannot be verified."

Actual functions provided

Aster boasts truly unique features: 1001x leverage, hidden orders, multi-chain support (BNB, ETH, Solana), and yield-bearing collateral. Aster is building the Aster Chain with zero-knowledge proofs to protect privacy.

evaluate

Aster gained immense value through CZ hype and manufactured trading volume, but failed to build any real infrastructure. It may survive thanks to Binance's backing, but its reputation has been damaged.

For traders: High risk, this is betting on CZ's narrative rather than actual growth.

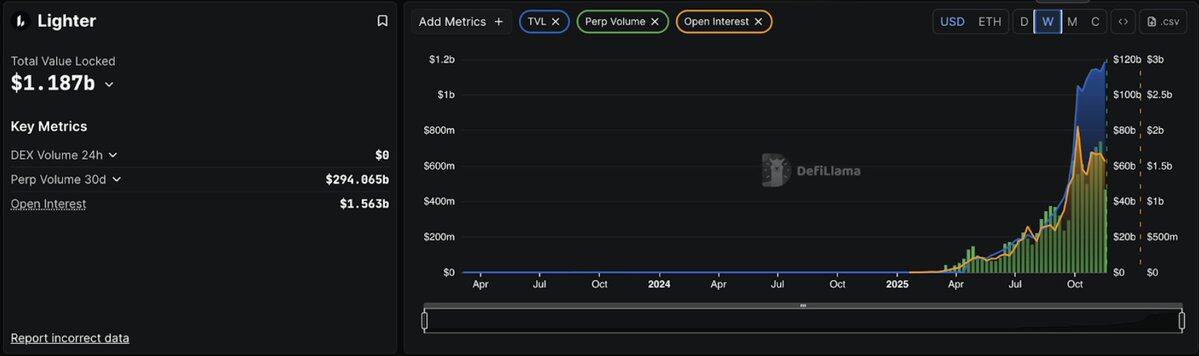

Part 3: Lighter – A Promising Technology, Questionable Indicators

Founded by former Citadel engineers and backed by Peter Thiel, a16z, and Lightspeed (which raised $68 million at a $1.5 billion valuation), Lighter uses zero-knowledge proofs to cryptographically verify every transaction.

As an Ethereum L2 blockchain, Lighter inherits Ethereum's security through an "escape hatch" (which can be understood as a safety valve)—if the platform malfunctions, users can recover their funds through smart contracts, a security guarantee that other L1 application chains do not have.

Launched on October 2, 2025, TVL reached $1.1 billion within weeks, with a daily transaction volume of $7-8 billion and more than 56,000 users.

Zero cost = aggressive playstyle

Lighter charges 0% for both placing and completing orders, which makes all fee-sensitive traders think that other competing platforms are outdated.

The strategy is simple: seize market share through an unsustainable economic model, cultivate loyalty, and then generate profits.

10.11 Stress Test

Ten days after its mainnet launch, the cryptocurrency market experienced its largest liquidation event, with $19 billion being liquidated.

Advantages: The system successfully handled a chaotic situation for 5 hours, and LLP provided liquidity when competitors withdrew.

Problem: The database crashed after 5 hours, causing the platform to be offline for 4 hours.

Negative factors: LLP incurred losses, while Hyperliquid's HLP and EdgeX's eLP were profitable.

Founder Vlad Novakovski: The database upgrade was scheduled for Sunday, but Friday's volatility destroyed the old system first.

Trading volume issues

These figures demonstrate score-boosting behavior:

24-hour trading volume: $12.78 billion

Open interest: $1.591 billion

Transaction volume/OI ratio: 8.03

A score below 3 indicates good health, a score above 5 indicates suspicion, and 8.03 is an extreme case.

Background information:

Hyperliquid: 1.57 (Standard Natural)

EdgeX: 2.7 (Medium)

Aster: 5.4 (High)

Lighter: 8.03 (for airdrop farming)

Traders can generate $8 in profit for every $1 of trading volume they deploy—by quickly building positions to earn credits, rather than holding actual positions.

30-day data shows: transaction volume of $294 billion, OI of $47 billion, a ratio of 6.25, which is still very high.

airdrop issue

Lighter's points program is quite attractive, with points converting into LITER tokens at TGE (Q4 2025/Q1 2026). The price range on the over-the-counter market is $5-$100+, and given the potential airdrop value of tens of thousands of dollars, such a large trading volume is not surprising.

Key question: What will happen after TGE? Will users stay or leave, causing a sharp drop in trading volume?

evaluate

Advantages:

Cutting-edge technology (ZK verified);

Zero cost, a real competitive advantage;

Ethereum secure inheritance;

A top-notch team and support.

Focus points:

A trading volume of 8.03/OI indicates heavy profiteering.

LLP incurred losses during stress testing;

The 4-hour service interruption has raised questions.

The retention rate after the airdrop cannot be verified.

The key difference between this and Aster is that the high rate reflects aggressive but temporary incentives rather than systemic fraud.

In summary, Lighter possesses world-class technology, but its data is not good. Can it convert farmers into real users? Technically, it is possible, but historical experience suggests it is not very realistic.

For farmers: the period before TGE is a good opportunity.

For investors: After TGE, wait 2-3 months to observe whether the trading volume can be sustained.

Probability analysis: There is a 40% chance of it becoming one of the top three platforms, and a 60% chance of it becoming another technically strong platform for profiteering.

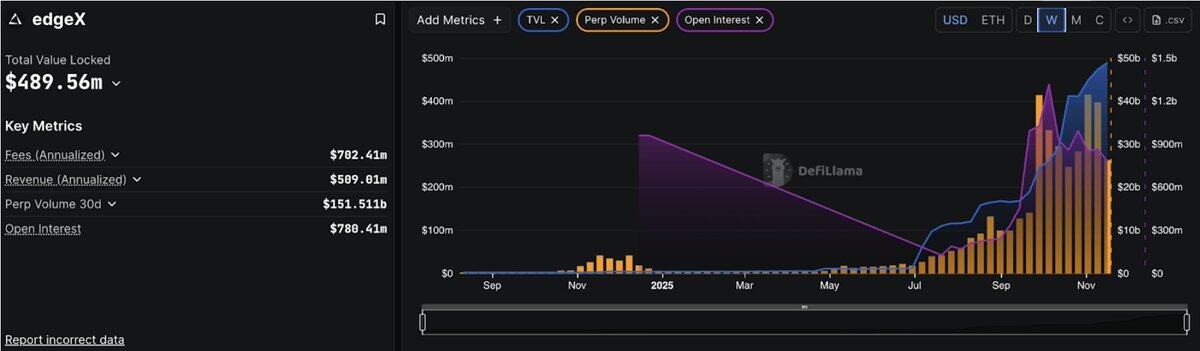

Part 4: EdgeX – Service Providers and Professionals

Amber Group's Institutional Advantages

EdgeX operates on a completely different model, originating from Amber Group's incubator (which manages $5 billion in assets) and bringing together professionals from Morgan Stanley, Barclays, Goldman Sachs, and Bybit. Its team is not cryptocurrency novices; rather, it comprises professionals from TradeFi bringing institutional expertise to DeFi.

Amber's market-making DNA is directly reflected in EdgeX: deep liquidity, low spreads, and execution quality comparable to centralized exchanges. Launched in September 2024, the platform has only one goal: to achieve centralized exchange-level performance without sacrificing self-custody.

EdgeX is built on StarkEx (StarkWare's ZK engine), processing 200,000 orders per second with a latency of less than 10 milliseconds, comparable to Binance's speed.

The cost is lower than Hyperliquid

EdgeX is superior to Hyperliquid in all aspects of cost:

cost:

EdgeX order completion rate: 0.038% vs Hyperliquid: 0.045%

EdgeX order book open: 0.012% vs Hyperliquid: 0.015%

For traders with a monthly trading volume of $10 million, this could save them $7,000 to $10,000 annually compared to Hyperliquid.

In addition, it offers better liquidity for retail investors (orders under $6 million), and has smaller spreads and lower slippage compared to its competitors.

Actual income, health indicators

Unlike Lighter's free model or Aster's surge in data, EdgeX delivers real and sustainable revenue:

Current indicators:

TVL: $489.7 million

24-hour trading volume: $8.2 billion

Open interest: $780 million

30-day revenue: $41.72 million (147% increase from Q2)

Annual revenue: $509 million (second only to Hyperliquid)

Trading volume/OI ratio: 10.51 (worrying)

10.51 seems terrible. But the context matters: EdgeX launched with an aggressive points program to drive liquidity, and that ratio has been steadily increasing as the platform has matured. More importantly, EdgeX has consistently maintained healthy revenue, proving that its platform has genuine traders, not just those who are airdropping.

10.11 Stress Test

EdgeX performed exceptionally well during the crash on October 11 (when $19 billion was liquidated):

Uninterrupted (Lighter was down for 4 hours)

eLP Vault remains profitable (while Lighter LLP incurs losses).

The annualized return for LPs is 57% (the highest in the industry).

At critical moments, eLP demonstrated excellent risk management capabilities, profiting from extreme volatility, while its competitors struggled to survive.

The unique features of EdgeX

Multi-chain flexibility: Supports Ethereum, Arbitrum, and BNB chains;

Using USDT and USDC as collateral;

Cross-chain deposits and withdrawals (Hyperliquid only supports Arbitrum).

Best mobile experience: Official iOS and Android apps (Hyperliquid does not have this feature). A clean and simple user experience for easy position management;

Focus on the Asian market: Strategically enter the Korean and Asian markets through localized support and the Korea Blockchain Week event. While competing with rivals for the same users, capture underserved regions.

Points program:

60% of the trading volume;

A 20% recommendation rate;

10% TVL/Vault;

10% liquidation/OI.

We explicitly state: "We do not reward score-boosting transactions."

The data also proves this point, showing an increase in the transaction volume/OI ratio, rather than the data from projects focused on exploiting loopholes.

challenge

Market share: Only 5.5% of all DEX open interest. Further growth would require offering highly attractive incentives or establishing significant partnerships.

No killer feature: The Edge X does a good job in many ways, but nothing particularly outstanding. It's a "business-grade" product, performing steadily in all aspects, but without any revolutionary innovation.

Unable to compete on price: Lighter's zero cost makes EdgeX's "lower than Hyperliquid" advantage less convincing.

TGE's timing is later: expected in the fourth quarter of 2025, later than its competitors, missing the opportunity for initial airdrop hype.

evaluate

EdgeX is the choice of professionals, not something for retail investors to speculate on.

Advantages:

- Institutional support (Amber Group Liquidity)

- Actual revenue (annual revenue of US$509 million)

- Best vault yield (APY 57%, still profitable during market crashes)

- Lower cost than Hyperliquid

- Clean indicators (no market manipulation scandals)

- Multi-chain flexibility + Best mobile applications

Focus points:

- Small market share (5.5% of total)

- Trading volume/OI was 10.51 (an improvement but still relatively high).

- No unique differentiating advantages

- Unable to compete with free platforms

EdgeX is suitable for:

- Asian traders seeking localized support;

- Institutional users who are optimistic about Amber Group's liquidity;

- Conservative traders should prioritize proven risk management approaches;

- Mobile-first traders;

- LP investors seeking stable returns.

In summary, EdgeX is poised to capture 10-15% market share in serving the Asian market, institutional investors, and conservative traders. While this won't threaten Hyperliquid's dominance, it's unnecessary for EdgeX to do so, as it's building a sustainable and profitable niche.

Think of it as the "Kraken of DEXs": not the biggest or the most flashy, but robust, professional, and trusted by savvy users who value execution quality over hype.

For farmers: the opportunity is moderate, and the market saturation is lower than that of competitors.

For investors: small positions allow for diversified investments. Risk is lower, but so are returns.

Comparative Analysis: The Perp DEX Debate

Estimate based on existing data

Transaction volume/OI ratio analysis

Industry standard: Health ratio ≤ 3

Hyperliquid: 1.57 indicates a strong natural trading pattern.

Aster: 4.74, a relatively high value, reflecting frequent incentive activities.

Lighter: 8.19, a high ratio indicates that trading is driven by points.

EdgeX: 10.51, the impact of the points program is visible, but it is improving.

Market share: Distribution of open interest

Total Market: Open Interest: Approximately US$13 billion

Hyperliquid: 62% - Market Leader

Aster: 18%, a strong performance

Lighter: 12%, market share continues to grow.

EdgeX: 6%, focusing on specific market segments.

Platform Information

Hyperliquid – Industry Leader

With a 62% market share, all indicators remain stable;

With annualized revenue of $2.9 billion, it has an aggressive share buyback program;

A community ownership model with a good track record;

Strengths: Market dominance, sustainable economic benefits. Grade: A+

Aster – High Growth

BNB ecosystem integration, CZ support;

DefiLlama data issues;

Multi-chain model drives adoption;

Advantages: Ecosystem support, broad coverage of retail investors.

Factors to consider: Transparency of the data to be monitored. Grade: C+

Lighter - Tech Guru

Zero-cost model, advanced ZK verification technology;

Elite support (Thiel, a16z, Lightspeed);

Performance data is limited before TGE (Q1 2026);

Advantages: Technological innovation, Ethereum L2 security.

Factors to consider: Business model sustainability, post-airdrop retention rate. Results: Unknown (awaiting TGE performance).

EdgeX – Institutional Endorsement

Amber Group provides support and professional-level execution capabilities;

Annualized income of $509 million; vault performance is stable.

Asian market strategy, mobile-first approach;

Strengths: Institutional reputation, steady growth. Factors to consider: Small market share, less competitive positioning. Grade: B

Investment considerations

Trading platform selection:

Hyperliquid – the deepest liquidity, proven reliability;

Lighter – Zero transaction fees, benefiting high-frequency traders;

EdgeX – Lower cost than Hyperliquid, excellent mobile experience;

Aster – Multi-chain flexibility, BNB ecosystem integration.

Token investment timeline:

HYPE – currently trading at $37.19;

ASTER - currently trading at $1.05;

LITER – TGE Q1 2026: Evaluation metrics for token launch.

EGX – TGE Q4 2025, preliminary performance assessment.

Industry perspective

Market maturity: The DEX sector exhibits significant differentiation, with Hyperliquid establishing its dominance through sustainable metrics and community cohesion.

Growth strategy: Each platform targets a different user group – Hyperliquid (professionals), Aster (retail/Asia), Lighter (tech enthusiasts), and EdgeX (institutions).

Key metrics focus: The volume/OI ratio and revenue provide clearer performance indicators.

Future Outlook: Lighter and EdgeX's performance after TGE will be crucial in determining their long-term competitive position. Aster's future path depends on its ability to address data transparency issues and maintain ecosystem support.