xBitMart launches BMRUSD, ushering in the era of yield-pegged stablecoins.

- 核心观点:BitMart推出首款收益型稳定币BMRUSD。

- 关键要素:

- 与USDT1:1挂钩,年化收益6%-8%。

- 底层为受监管美国国债等RWA资产。

- 支持即时赎回,无缝集成交易所生态。

- 市场影响:推动稳定币从支付工具向收益资产转型。

- 时效性标注:中期影响

November 17, 2025 – Crypto asset trading platform BitMart announced the launch of BMRUSD , a yield-generating USD stablecoin backed by DigiFT . DigiFT is an MAS-regulated digital asset platform focused on serving institutionalized tokenized real-world assets (RWAs). This launch reflects a structural shift occurring in the stablecoin space – the category is moving from simple value-pegged stability to sustainable yields backed by real-world economic assets.

Stablecoins enter the third stage of development

The development of stablecoins can be divided into different stages:

- First generation: Achieve price stability by pegging to fiat currency.

- Second generation: Expanding to more uses such as payments, transactions, and liquidity.

- The third stage (emerging): achieving stable, verifiable returns while maintaining liquidity and risk transparency.

BMRUSD is a product designed for this new phase.

It maintains a 1:1 peg to USDT while automatically accruing daily returns from tokenized US Treasury bonds and regulated money market funds. BitMart also offers additional yield incentives, projecting an annualized return of 6% to 8%, depending on market dynamics and BitMart's promotional revenue support.

BMRUSD's unique advantages

Unlike other yield-generating stablecoins such as USDY, USDM, or STBT, BMRUSD is deeply integrated with the BitMart exchange ecosystem, enabling instant creation and redemption, zero lock-up, and seamless use for trading, staking, and yield strategies.

BMRUSD was launched in partnership with BitMart and DigiFT, the latter being RWA's tokenization partner, which holds a license from the Monetary Authority of Singapore (MAS). It combines regulated real-world asset backing, exchange-grade liquidity, and on-chain transparency to provide users with a compliant and composable yield solution that seamlessly integrates into daily trading and portfolio management.

Stablecoins that combine functionality and asset value

Users can buy or redeem BMRUSD at BitMart at any time and enjoy instant settlement with no lock-up period.

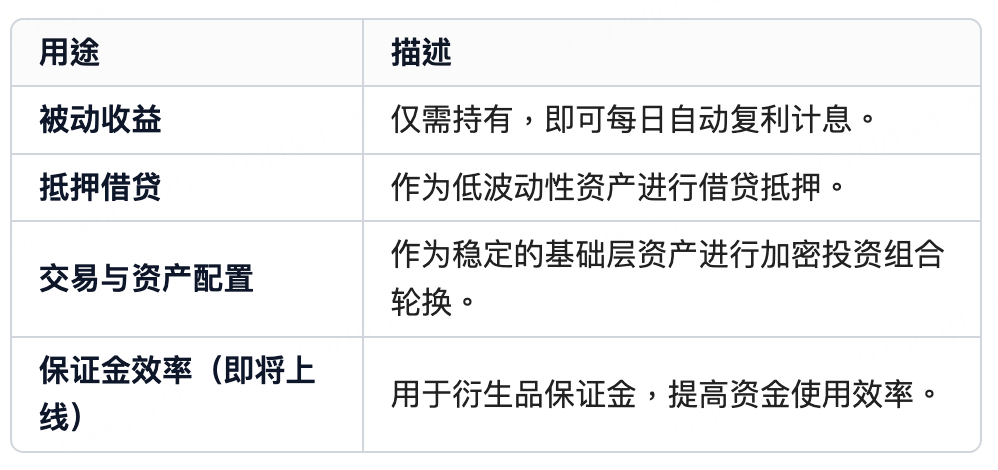

Besides holding it, BMRUSD can be used for the following purposes:

This makes BMRUSD suitable not only as a store of value but also as a yield-generating collateral asset for both stable holdings and active allocation.

Regulated, on-chain verifiable real-world assets

Its underlying asset portfolio consists of diversified RWAs obtained through DigiFT, issued by global financial institutions, including:

- UBS uMINT

- China Merchants Bank International (CMBMINT)

- Fundbridge (ULTRA) is managed by Wellington Management.

All underlying RWA tokens are issued on public blockchains such as Ethereum, and the yield calculation and redemption processes are fully auditable. DigiFT operates under license from the Monetary Authority of Singapore (MAS), ensuring compliance and transparency for the underlying asset issuers and fund managers. BMRUSD holders do not directly hold the underlying real-world assets.

“Stablecoins are transforming from passive capital containers into profitable assets,” said the head of BitMart’s financial business. “BMRUSD targets markets that seek transparency, sustainability, and composability. The partnership with DigiFT not only ensures regulatory compliance but also enables open verification on a public blockchain.”

The Market Significance of BMRUSD

During periods of heightened market uncertainty, users often shift funds into stablecoins to hedge against volatility. However, traditional stablecoins do not generate returns during the holding period.

BitMart's BMRUSD fills this gap, allowing users to achieve continuous compound interest returns while maintaining stability.

This will bring:

- More efficient fund management

- Stable liquidity provision

- Constructing a long-term portfolio using reliable foundational assets

How to get started with BMRUSD

- Purchase BMRUSD with USDT at a 1:1 exchange rate.

- Enjoy daily automatic compound interest.

- Use BMRUSD for asset allocation, collateralization, or yield strategies.

- Redeemable at any time for USDT, with instant settlement (daily individual redemption limit: 50,000 BMRUSD).

For more information, please visit: https://www.bitmart.com/bmusd

About BitMart

BitMart is a leading global digital asset trading platform with over 12 million users worldwide. A top performer on CoinGecko for many years, BitMart offers over 1,700 trading pairs with competitive fees. BitMart is committed to continuous innovation and financial inclusion, striving to provide a seamless trading experience for users worldwide. To learn more about BitMart, visit our website , follow us on Twitter , or join our Telegram account for updates, news, and promotions. Download the BitMart App to trade anytime, anywhere.

About DigiFT

DigiFT is a next-generation platform focused on tokenizing Real-World Assets (RWAs). Regulated by the Monetary Authority of Singapore (MAS) and the Securities and Futures Commission of Hong Kong (SFC), DigiFT provides end-to-end digital asset services tailored for institutional RWAs, encompassing tokenization, issuance, distribution, trading, and instant liquidity provision. As a trusted on-chain tokenization and distribution partner for leading global asset management companies, DigiFT collaborates with institutions such as Invesco, UBS Asset Management, DBS Bank, CMB International, and Wellington Management. For more information, please visit [website address missing]. http://www.digift.io.

Risk warning:

The information above is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no representations or warranties, express or implied, regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

Using BitMart's services and participating in BMRUSD is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past performance, hypothetical results, or simulated data are not indicative of future results. The value of cryptocurrencies may rise or fall, and buying, selling, holding, or trading cryptocurrencies may involve significant risks. Before trading or holding cryptocurrencies, you should carefully assess whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice. BitMart does not guarantee any specific rate of return for BMRUSD, and all returns are subject to change without notice.