BitMart Insights: November Crypto Market Review and Hot Topic Analysis

- 核心观点:宏观数据缺失与市场情绪低迷致加密市场震荡下行。

- 关键要素:

- BTC现货ETF月净流出高达358亿美元。

- 市场总市值由3.88万亿跌至最低2.98万亿美元。

- 稳定币总流通量减少23.4亿美元。

- 市场影响:资金流出压力增大,市场信心修复依赖关键阻力突破。

- 时效性标注:短期影响。

TL, DR

- In November 2025, the US government shutdown will lead to a lack of key economic data. Coupled with weak employment, sluggish consumption, and unclear policy direction, market expectations will fluctuate repeatedly, and economic growth and inflation signals will diverge. Although external risks have eased somewhat, the overall recovery will remain moderate and will be increasingly dependent on policy transparency, data recovery, and market confidence.

- In November, the average daily trading volume in the crypto market was approximately $180.8 billion, characterized by short-term activity, frequent inflows and outflows of funds, but a lack of sustained trends. During the same period, the total market capitalization fell from approximately $3.88 trillion to a low of $2.98 trillion. Several brief rebounds failed to reverse the overall downward trend. Newly listed popular tokens such as Monad, Pieverse, and Allora saw active trading, but meme projects exhibited low activity.

- In November, BTC spot ETFs saw a significant net outflow of $35.8 billion, while ETH spot ETFs saw a net inflow of $8.34 billion. Meanwhile, the overall circulating supply of stablecoins decreased by $2.34 billion, indicating that the cryptocurrency market experienced significant fluctuations in capital flows due to price declines and low market sentiment.

- Last week, BTC fell by about 8%, but the pullback attracted bargain hunters and is currently attempting to return above $88,000. Whether it can break through the 20-day EMA ($94,620) in the short term will determine the dominant direction of the market. ETH and SOL are also fluctuating around key moving averages. ETH faces resistance in the $3,148–$3,350 range, while SOL is testing bullish strength in the $126–$145 range. If both break through their respective key moving averages, market sentiment may shift to bullish; otherwise, bears will remain in control, and the risk of a downward correction remains.

- In terms of this month's highlights, Coinbase launched its token public offering feature for the first time, Monad experienced significant volatility, and Uniswap proposed the "UNIFication" initiative, planning to enhance UNI's protocol value and long-term competitiveness through deflationary mechanisms and governance restructuring. Looking ahead to next month, Circle is accelerating its Arc ecosystem development and exploring native token issuance, while Dogecoin and XRP ETFs received approval for listing, marking the official launch of the altcoin ETF market, and suggesting that more token products may be launched more rapidly in the future.

1. Macro perspective

In November 2025, the US government shutdown led to a lack of key economic data, causing market assessments of the fundamentals to reverse multiple times and resulting in significant divergence in economic expectations. Although the financial reports of AI and high-tech companies were still relatively good, weak employment, waning consumption, and unclear policy direction made the overall economic performance quite complex.

Policy direction

In November, the Federal Reserve emphasized patience amid a lack of data to avoid further shocks to the fragile economic environment. The statistical disruptions caused by the government shutdown created an information gap in policymaking and led to fluctuating market expectations regarding the future path of interest rates. On the one hand, weak employment prompted some market participants to bet on earlier rate cuts; on the other hand, sticky inflation and fiscal risks reinforced the argument for maintaining interest rates for a longer period. This constant shift in policy expectations between easing and caution became the main source of volatility in the financial markets in November.

US stock market trend

US stocks experienced a significant correction in November under pressure from fluctuating policy expectations. Uncertainty surrounding the timing of interest rate cuts, data gaps caused by the government shutdown, and weakening employment and consumption all weighed on market risk appetite. Towards the end of the month, the three major stock indices saw a brief rebound, driven by renewed expectations of rate cuts and a decline in long-term US Treasury yields. The future direction of US stocks depends on whether core data confirms an economic slowdown and declining inflation, prompting the Federal Reserve to continue cutting interest rates in December. If policy is clear and liquidity improves, the market is expected to regain upward momentum; otherwise, the technology and growth sectors may still face further valuation correction pressures.

Inflation remains above target

The government shutdown, coupled with the lack of some inflation data, has increased short-term instability in market predictions of price trends. While the latest data shows a slight easing of price pressures, prices in sectors such as services and housing remain relatively strong, indicating that structural inflation has not completely dissipated. The Federal Reserve reiterated that in the context of discontinuous data, judgments cannot be based on a single signal, and the inflation path still needs to be verified by a complete sample of data over several months.

The job market weakened further.

The interruption in November's employment market statistics somewhat obscured the true situation, further increasing the difficulty of judgment. The delayed release of the September non-farm payroll report from the Bureau of Labor Statistics showed a significantly larger-than-expected increase of 119,000 jobs, but the unemployment rate rose to a four-year high of 4.4%, and the data for the previous two months were revised significantly downwards. The October and November reports will be released together on December 16th, meaning the September report will be the last employment report the Federal Reserve will see before its December 10th meeting, making the December decision even more challenging.

Political, fiscal, and external risks remain.

While the government shutdown has ended and fiscal spending and statistical work are gradually resuming, the accumulated contract delays and budgetary pressures still require time to dissipate. Meanwhile, the external environment saw a significant easing in November: the resumption and reaching of a phase-one agreement between the US and China helped reduce tensions in the technology and trade sectors; the Russia-Ukraine conflict also showed signs of nearing a ceasefire, significantly reducing geopolitical spillover risks. This shift towards improved external uncertainty creates conditions for the stability of global supply chains and the recovery of business expectations.

Outlook

As the government resumes normal operations, missing data will be gradually supplemented in the coming weeks. The future recovery path depends on whether inflation can continue to decline with the support of complete data, whether employment can stabilize with policy support, and whether easing policies can regain a clear direction after repeated fluctuations in expectations. Overall, the US is in an easing cycle, with a moderate economic recovery but increased volatility, and the recovery process is increasingly reliant on policy transparency and market confidence.

2. Overview of the Crypto Market

Currency data analysis

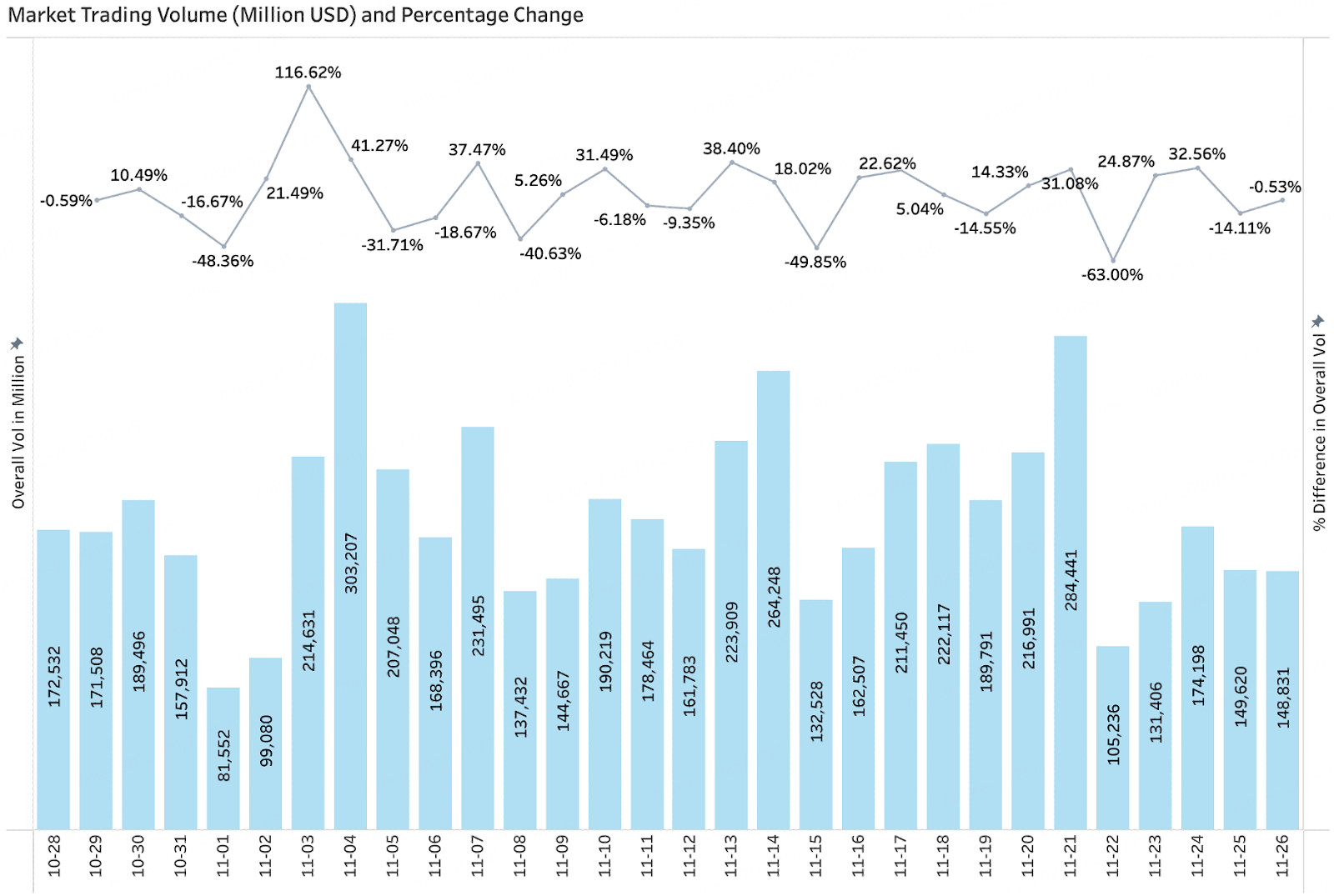

Trading volume & daily growth rate

According to CoinGecko data, as of November 26, the overall trading volume in the crypto market fluctuated significantly, with an average daily trading volume of approximately $180.8 billion. Overall, after a brief pullback at the beginning of November, trading volume rebounded rapidly with increased volume. In mid-November, trading volume remained high and oscillated with frequent fund inflows and outflows. Although there were some localized highs in volume in the latter part of the month, these failed to generate sustained momentum, and trading volume subsequently declined significantly. This suggests that funds are more inclined towards short-term speculation rather than trend-following strategies.

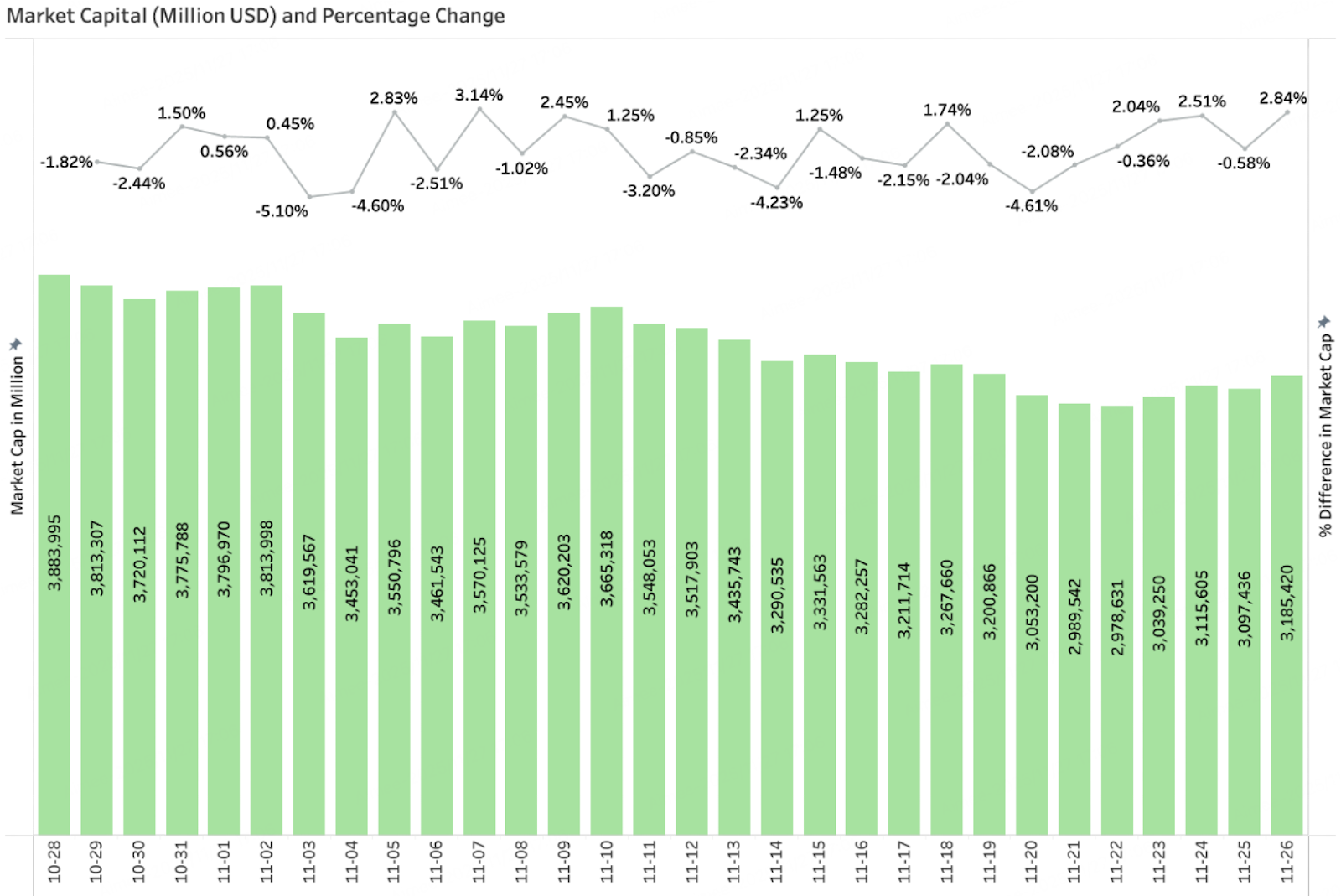

Total market capitalization & daily growth

According to CoinGecko data, as of November 26, the overall market capitalization of the crypto market showed a volatile downward trend. At the beginning of the month, the market capitalization was approximately $3.8 trillion. Subsequently, through several small rebounds and pullbacks, the center of gravity continued to shift downwards, with new lows being repeatedly set (from $3.88 trillion to a low of $2.98 trillion). Although there were several brief rebounds of 2%–3%, none of them reversed the overall downward trend. Overall, the market capitalization performance in November was weak, exhibiting characteristics of a structural correction, and market panic was spreading.

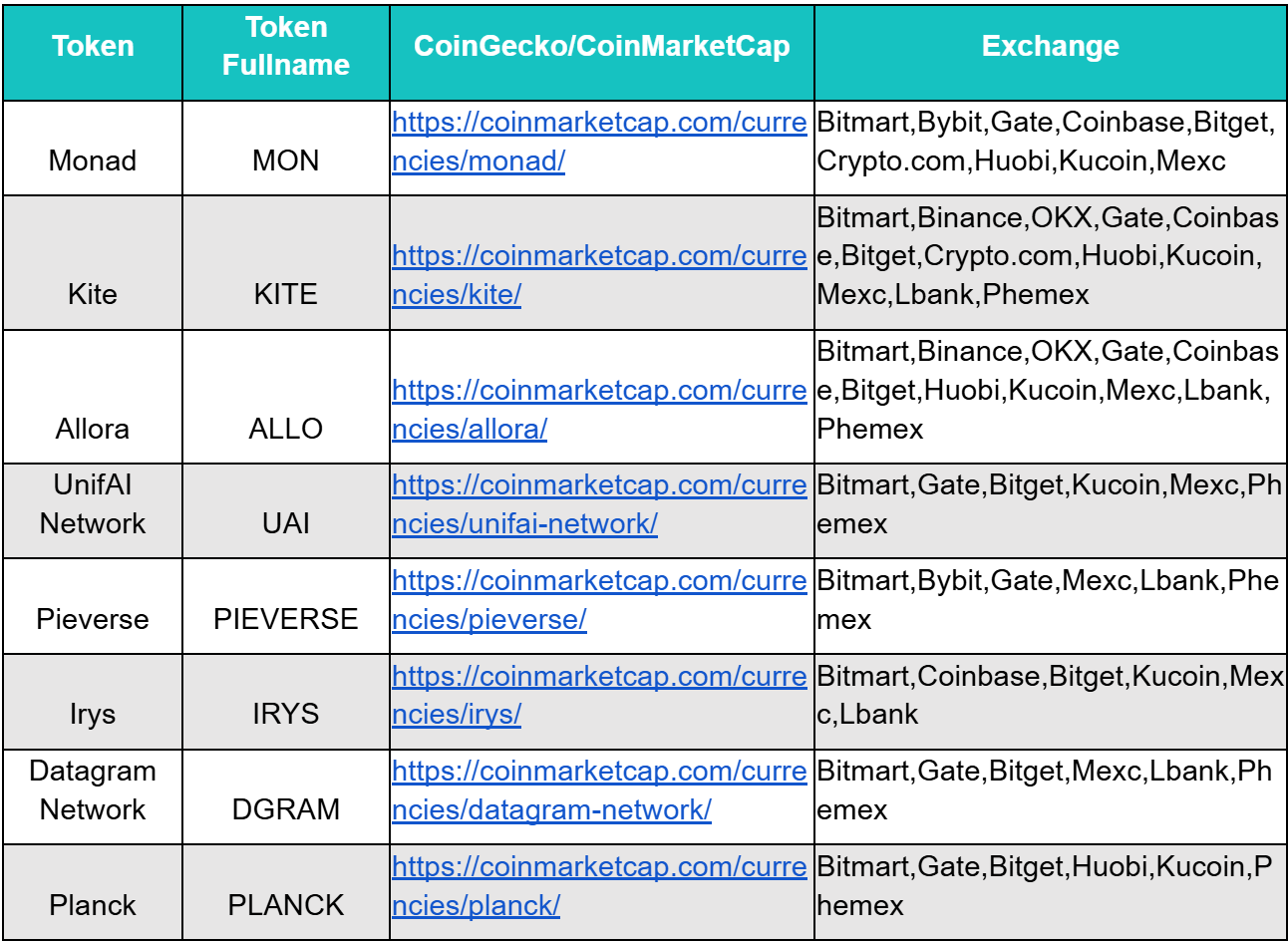

Popular new tokens listed in November

Popular tokens newly launched in November were still dominated by VC-backed projects, with relatively low meme activity. Among them, Monad, Pieverse, and Allora performed well, with relatively active trading volume after listing.

3. On-chain data analysis

Analysis of BTC and ETH ETF inflows and outflows

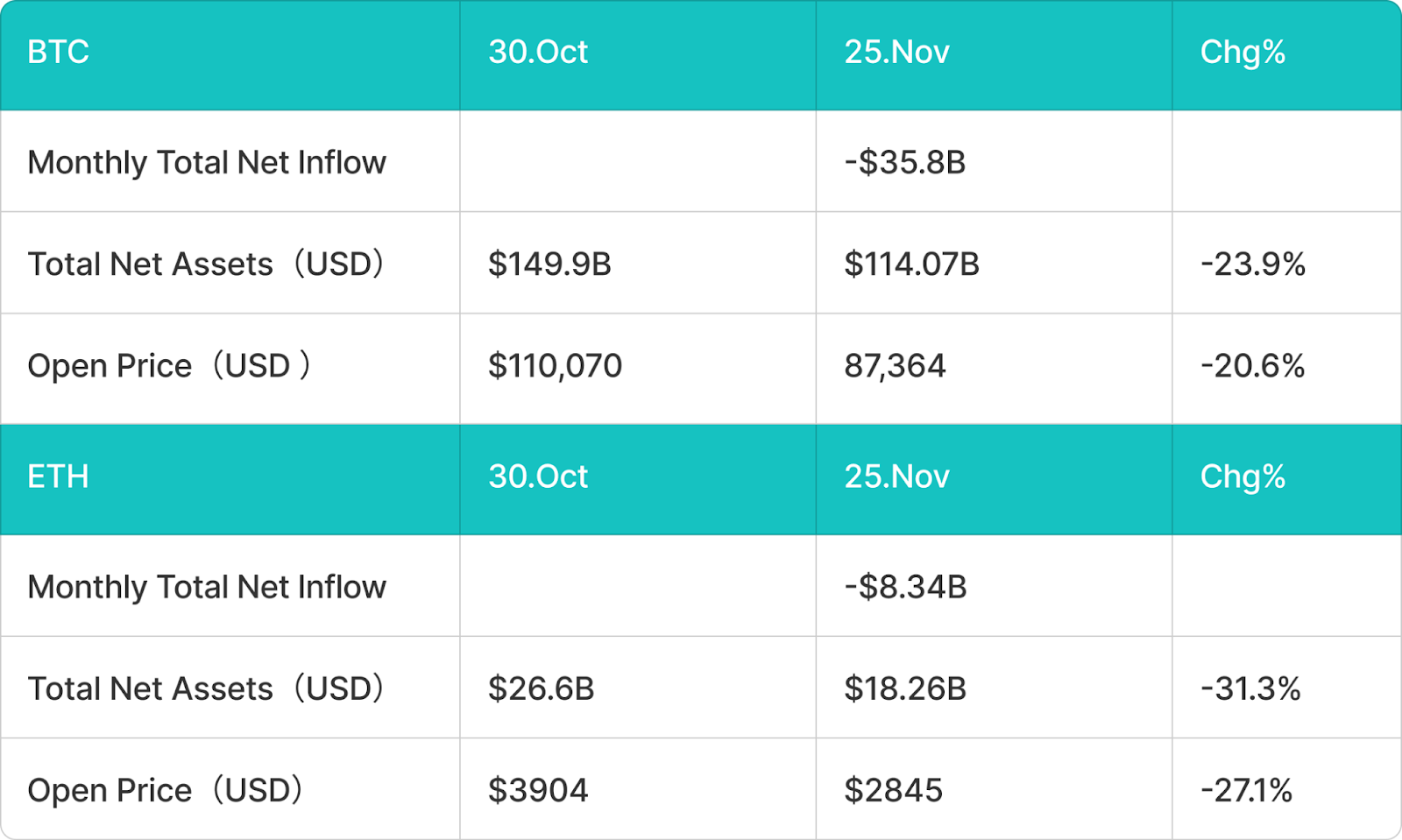

In November, BTC spot ETFs saw a net outflow of $35.8 billion.

This month saw a significant outflow from BTC spot ETFs, with a net outflow of $35.8 billion, a 23.9% decrease compared to the previous month. This trend was mainly driven by the decline in BTC prices, which fell by 20.6% during the month. This not only triggered redemption pressure but also caused a corresponding reduction in the total asset value of the ETFs. Since the black swan event on October 11, the overall rebound in crypto assets has been weak, with insufficient price recovery for BTC and other tokens. The continued low market sentiment has further exacerbated the outflow effect.

In November, the ETH spot ETF saw a net inflow of $8.34 billion.

This month saw a significant outflow from ETH spot ETFs, with a net outflow of $8.34 billion, a 31.3% decrease compared to the previous month. The decline in BTC prices led to a sharp drop in the overall crypto market, and the continued market downturn exacerbated the outflow of funds from ETH ETFs.

Stablecoin Inflow and Outflow Analysis

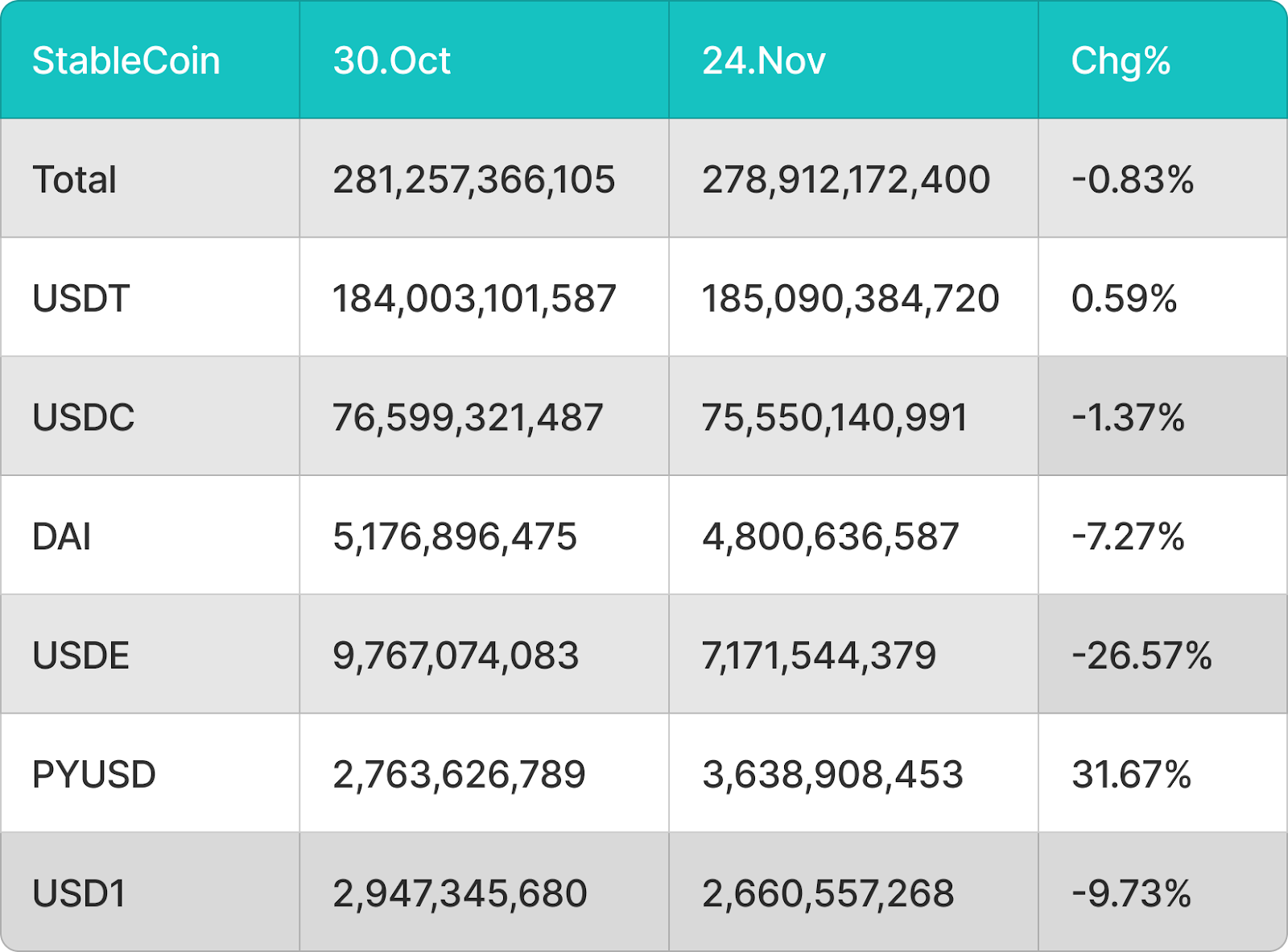

The total circulating supply of stablecoins decreased by $2.34 billion in November.

Affected by the sharp decline in the crypto market, the inflow of new funds from outside the market has slowed significantly, and the overall circulating supply of stablecoins has declined for the first time since 2025. Except for USDT and PYUSD, which maintained a slight net inflow, other major stablecoins all recorded significant outflows. USDE, in particular, was impacted by the black swan event on October 11th and the de-pegging of several algorithmic stablecoins, leading to a sharp drop in market confidence and a monthly circulating supply decrease of approximately 26.5%. Furthermore, leading stablecoins such as USDC and DAI also experienced varying degrees of reduction due to the depressed market sentiment.

4. Price Analysis of Major Currencies

BTC Price Change Analysis

BTC fell about 8% last week, affected by weakening overall market sentiment, but the pullback successfully attracted bargain hunters. As the new week begins, bulls are attempting to push the price back above $88,000, indicating a recovery in confidence after last week's volatility.

BTC is currently rebounding from its sharp drop to a low of $80,600, but the upward path remains challenging. The 20-day exponential moving average (EMA, $94,620) remains a key resistance level and could determine the short-term trend. If the price encounters strong resistance at this moving average, it would mean that bearish sentiment remains dominant, and sellers are still inclined to exit positions during rebounds. In this scenario, a downward correction could accelerate, targeting the historically significant support level of $73,777, where buyers may attempt to regain control.

For bulls to gain substantial momentum, BTC must effectively break through and hold above the 20-day EMA to demonstrate that recent selling pressure has significantly weakened. Once the price stabilizes above this level, market sentiment could clearly shift towards the bulls, giving BTC/USDT a chance to move further towards the next important psychological level: $100,000.

ETH Price Change Analysis

ETH is attempting to recover from its recent decline, but faces significant supply pressure between the 20-day EMA ($3,148) and $3,350. This area has acted as resistance multiple times in the past, and buyers need stronger momentum to break through effectively. If ETH fails to break through this upper resistance zone, bears could quickly regain the upper hand. A break below $2,623 would strongly confirm the start of a new downtrend and could push ETH further down to $2,400, or even as low as $2,111.

Conversely, a strong breakout above $3,350 for ETH would indicate a resurgence in buying momentum and a willingness to buy at higher price levels. In this scenario, ETH/USDT could potentially challenge the 50-day simple moving average (SMA, $3,659). A close above the 50-day SMA would further validate the reversal in market sentiment, suggesting that bulls are preparing for a larger rally.

SOL Price Change Analysis

SOL is attempting to stabilize at the $126 support level, but the current rebound is weak, indicating insufficient buying interest. This cautious stance suggests that bulls remain hesitant amid the recent market downturn. If SOL fails to build momentum and retreats from its current level or the 20-day EMA ($145), it will indicate that bears still control the higher levels. A break below $126 could trigger a further accelerated decline, targeting $110, and potentially even falling to $95—a historically significant support level.

However, if buyers successfully push SOL up and hold above the 20-day EMA, it could be seen as an early bullish signal. If the closing price can stabilize above this key moving average, SOL could rebound further to the 50-day SMA ($174), where the bulls will face their next major test.

5. Hot Topics This Month

Coinbase's public sale feature launched for the first time; Monad's performance fell short of expectations.

This month, Coinbase announced the launch of its token public offering feature, with Monad as the first project. Starting November 17th, the platform offered 7.5 billion MON tokens to the public at a price of $0.025, representing 7.5% of the total token supply and valuing the project at approximately $2.5 billion. Prior to its launch, MON's highest trading price on Binance's OTC market reached approximately $0.051, corresponding to a market capitalization of nearly $5.1 billion, reflecting relatively optimistic market sentiment.

However, after its official launch on November 24th, MON's price plummeted, falling to a low of approximately $0.0204, briefly dipping below the public offering price and triggering short-term panic selling. The selling pressure was subsequently absorbed, and the price rebounded rapidly, briefly reaching $0.048. As of November 28th, Coinbase's first public offering project still recorded a peak return of approximately 92%, exhibiting a clear volatile price structure.

Uniswap releases "UNInformation" proposal: reshaping protocol value and transforming governance architecture.

This month, Uniswap founder Hayden Adams and Uniswap Labs officially submitted the "UNIndication" proposal, the core of which is to activate the protocol fee switch and introduce a deflationary mechanism, transforming UNI from a governance token into an asset that can actually capture the value of the protocol. The proposal first suggests burning 100 million UNI tokens as retroactive compensation, followed by the activation of a long-term deflationary mechanism: a portion of LP transaction fees from the v2 and v3 pools will be injected into TokenJar, with the contract burning UNI to achieve value return; simultaneously, a protocol fee discount auction will be introduced, with the proceeds also used to burn UNI.

At the governance level, the proposal suggests reorganizing Uniswap's governance structure into a Wyoming-based DUNA entity, "DUNI," to strengthen legal liability protection. Labs will also integrate its ecosystem and product teams and eliminate interface, wallet, and API fees, focusing entirely on protocol growth. The market reacted positively, with UNI rising significantly after the announcement. However, the activation of the fee switch may lead to a decrease in LP returns, triggering some liquidity migration. In the long term, however, Uniswap is attempting to leverage its brand and technological advantages (especially v4) to drive its expansion from a single DEX to a platform-level ecosystem. Overall, "UNInception" marks a comprehensive upgrade of Uniswap's economic model and organizational structure. If all goes well, it will reshape UNI's value logic and enhance the protocol's long-term competitiveness.

6. Outlook for next month

Circle accelerates its Arc ecosystem expansion, with the exploration of native token issuance becoming a strategic turning point.

This month, stablecoin issuer Circle released its Q3 financial and business progress report, focusing on the ecosystem expansion and potential token plans of its new public chain, Arc. Arc launched its public testnet at the end of October, and currently has over 100 participating institutions. In its report, Circle explicitly stated for the first time that it is exploring issuing a native token on the Arc network. This move signifies the company's transformation from a single stablecoin issuer to a blockchain infrastructure builder, and its attempt to improve Arc's ecosystem through token incentives to solidify its competitive advantage in stablecoin payments, foreign exchange, and capital markets.

In terms of financial performance, Circle's revenue in the third quarter increased by 66% year-on-year to approximately $740 million, and net profit surged by 202% year-on-year. USDC's market capitalization surpassed $73 billion, firmly maintaining its position as the world's second-largest stablecoin. With increasingly stringent global regulations, the growing compliance advantages of MiCA, and the continued rise of the stablecoin narrative, Circle views its Arc deployment as a key strategy to counter the expansion of the Tether blockchain ecosystem. If the native token is successfully launched, it will become a core lever driving Arc network adoption and community participation, and may form a new growth engine in the DeFi, RWA, and cross-border payment sectors.

Doge and XRP ETFs approved, marking the official start of the altcoin ETF season.

On November 26th, Dogecoin and XRP spot ETFs were officially launched, marking the entry of altcoin assets into the ETF era. Data shows that the DOGE spot ETF saw a net inflow of $365,000 on its first day, while the XRP spot ETF saw a net inflow of a staggering $21.81 million. This not only signifies that mainstream altcoins have officially entered the compliant financial channel, but also foreshadows a period of rapid expansion in altcoin ETF issuance, with more token products potentially accelerating their regulatory compliance process.

Meanwhile, Bitwise is advancing its Avalanche spot ETF process, submitting an update to the SEC application. The ETF, ticker symbol BAVA, has a management fee of 0.34% and plans to use 70% of its AVAX holdings for staking, potentially making it one of the first crypto ETFs in the US market with a yield-generating mechanism. In comparison, VanEck's Avalanche ETF has a fee of 0.40%, and Grayscale's product has a fee as high as 0.50%. As ETF competition enters a phase of comparing fees and yield structures, crypto assets are rapidly integrating into traditional financial valuation systems and evolving from single-asset exposures into "yield-generating" investment vehicles.