JustLend DAO's Leap Forward to 2025: Steady Growth in TVL and Revenue, JST Deflation and Accelerated Globalization

- 核心观点:JustLend DAO实现跨越式发展。

- 关键要素:

- TVL环比增长46.1%至50亿美元。

- 启动5900万美元JST回购销毁计划。

- 产品矩阵覆盖借贷、质押及能量租赁。

- 市场影响:增强DeFi生态信心与通缩价值。

- 时效性标注:中期影响。

Amidst the overall volatility of the DeFi market, JustLend DAO, the core DeFi protocol of the TRON ecosystem, achieved leapfrog development in the first three quarters of 2025. It not only made comprehensive breakthroughs in terms of total value locked (TVL) growth, product feature expansion and innovation, and global influence, but also continued to release value through the recently launched large-scale JST buyback and burn mechanism, demonstrating strong ecosystem vitality and development potential.

According to Messari's Q3 revenue report for Tron, JustLend DAO's total value locked (TVL) increased by 46.1% quarter-over-quarter, jumping from $3.4 billion to $5 billion, maintaining its position among the top four in the lending industry and firmly establishing itself as a leading player in the global DeFi sector.

What has attracted even more market attention is that JustLend DAO's recently launched large-scale JST buyback and burn mechanism, worth approximately $59 million, has been implemented. The first round of burning involved approximately 560 million JST tokens, accounting for 5.66% of the total supply, and there is still over $41 million in funds to be invested in subsequent burning.

Amidst the current weak and volatile crypto market, JST's substantial buyback initiative fully demonstrates JustLend DAO's strength and ecosystem confidence, directly impacting market sentiment. According to CoinGeck data on November 11th, JST has seen a more than 20% increase in the past 30 days, climbing from $0.030 to $0.037, indicating a growing consensus on its deflationary value.

JustLend DAO continues to upgrade its product capabilities: building upon lending as its foundation, it expands into diversified services such as collateralization and energy leasing.

As a core DeFi platform within the TRON ecosystem, JustLend DAO was launched by JUST, a company specializing in DeFi system solutions for the TRON ecosystem. Since its launch in 2020, it has been deeply involved in the DeFi lending field for five years. Leveraging its continuously upgraded product capabilities, it has constantly expanded its service boundaries, evolving from a single lending service into a comprehensive DeFi platform integrating lending, staking, energy services, and smart wallets, becoming an indispensable financial infrastructure within the TRON ecosystem.

In terms of product functionality, JustLend DAO has completed the deep integration of multiple core DeFi modules, covering lending markets (SBM), liquidity staking (Staked TRX), energy rental, and smart wallets (GasFree), etc. It is a one-stop DeFi service portal for the TRON ecosystem, providing users with a comprehensive financial service experience.

SBM Lending Market: As the core business of JustLend DAO, the SBM lending market is a highly efficient and balanced asset allocation center. On the one hand, users can deposit idle crypto assets to earn stable interest and achieve steady asset appreciation; on the other hand, they can also borrow other cryptocurrencies by pledging existing assets, engaging in leveraged operations or diversified investments, unlocking more use cases for their assets.

In terms of asset coverage, the SBM lending market offers an extremely rich selection. It not only includes major global cryptocurrencies such as ETH, BTC, and USDT, but also comprehensively encompasses TRON ecosystem native assets such as TRX, USDD, JST, NFTs, SUN, sTRX, and BTT, covering dozens of crypto assets and creating a diverse and comprehensive investment pool for users. Furthermore, SBM continues to introduce emerging assets: in August of this year, the SBM market added the supply and lending services for the compliant stablecoin USD1.

Liquidity Staking (sTRX) is the preferred TRX liquidity staking entry point in the TRON ecosystem, allowing users to stake TRX to obtain liquidity staking tokens (sTRX). Holding sTRX not only allows users to earn basic staking yields on the TRON network, but also enables flexible participation in various on-chain DeFi activities to generate additional yields, ensuring that TRX continuously creates extra value during the staking period.

In sTRX yield applications, JustLend DAO works in synergy with DeFi applications within the TRON ecosystem to further expand yield horizons. For example, in April of this year, the stablecoin USDD launched the sTRX Vault minting feature, allowing users to directly mint USDD using sTRX as collateral, easily activating their assets.

Energy Rental is a unique and innovative service within the TRON ecosystem. Relying on a dual-resource gas fee mechanism of "bandwidth + energy", it can help users directly save about 70% of transaction gas costs, optimizing the new experience of on-chain operation costs on TRON.

Compared to traditional methods that require long-term staking of TRX or direct burning of TRX to obtain energy, JustLend DAO allows users to lease energy on demand and per transaction, without the need for long-term staking. This significantly reduces the on-chain operation threshold and cost for small and medium-sized users, allowing ordinary users to easily enjoy low-cost on-chain interaction.

To continuously optimize user experience, JustLend DAO has iterated its energy leasing parameters multiple times this year, releasing benefits: On September 19, the energy leasing prepayment (deposit) was reduced from 40 TRX to 20 TRX, further lowering the entry barrier; On August 29, the TRON network reduced the basic energy unit price from 0.00021 TRX to 0.0001 TRX (a direct reduction of 60% in smart contract operation costs), and JustLend DAO responded immediately on September 1 by reducing the basic energy leasing tax rate from 15% to 8%, allowing users to simultaneously enjoy the double benefits of "lower basic unit price + lower leasing tax rate"; On July 13, the annualized yield on leasing (APY) was adjusted, comprehensively reducing the total cost of energy leasing.

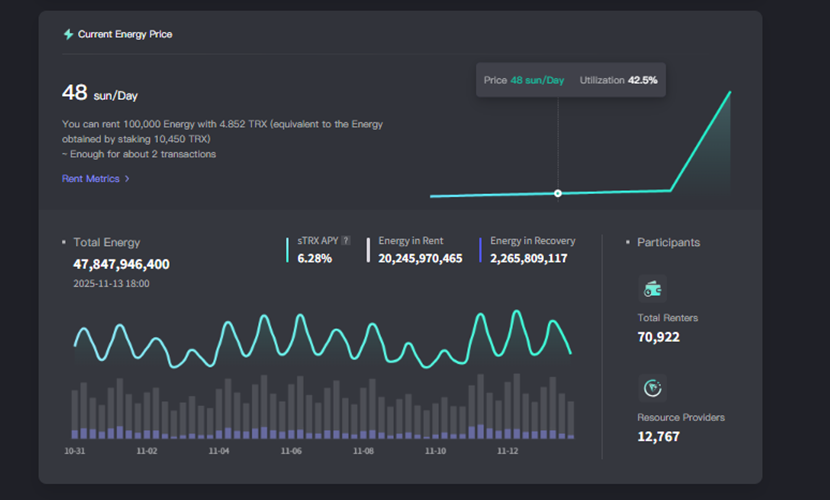

As of November 13, the daily price for JustLend DAO energy rental is 48 SUN. You can rent 100,000 units of energy for only 4.8 TRX (equivalent to the energy obtained by staking 10,450 TRX), which is enough to cover two contract transactions. The cumulative number of participating users has exceeded 70,000, making it one of the core services with high frequency and high demand in the ecosystem.

In summary, JustLend DAO's core product matrix consists of lending, liquidity staking, and energy leasing. These three modules work together in a deep and efficient manner to build a closed-loop ecosystem, providing users with a full-chain service from asset lending, storage, staking to low-threshold on-chain operations, truly achieving one-stop on-chain asset management.

Beyond its core products, JustLend DAO prioritizes user experience, innovatively launching the GasFree smart wallet. This wallet allows users to directly deduct transaction fees from their transferred tokens, completely breaking the industry restriction that "you must hold the native token to trade." Since its launch in March of this year, JustLend DAO has also simultaneously launched a 90% transaction fee subsidy program, meaning users only need to pay approximately 1 USDT in fees each time they transfer USDT using GasFree (regardless of the amount).

In terms of ecosystem development and token incentives, JustLend DAO is further empowered by the community-led incentive organization Grants DAO. With diversified support at its core, Grants DAO provides resource support and specific incentives to projects and builders contributing to the development of JustLend DAO and the JUST ecosystem, while also building a strong defense for ecosystem security through meticulous market risk management. To date, Grants DAO has allocated approximately $189 million through various dimensions including user incentives, ecosystem buybacks and token burning, market stability maintenance, and developer support.

From core product collaboration to experience optimization tools and ecosystem incentive systems, JustLend DAO has formed a complete ecosystem that supports each other and develops synergistically through a comprehensive layout across three dimensions: product innovation, user experience, and ecosystem building.

TVL remains among the top four global lenders, with cumulative net revenue of nearly $62 million. JustLend DAO has solidified its growth foundation through diversified revenue models.

While continuously expanding the boundaries of product functionality, JustLend DAO's core operational data has also shown steady growth—its total value locked (TVL) has consistently ranked among the top four in the entire lending industry, and the platform's cumulative net revenue is approaching $62 million.

Messari and CoinDesk's recent TRON Q3 reports both highlighted that JustLend DAO achieved significant growth in its TVL in Q3, rising sharply by 46.1% quarter-over-quarter, from $3.4 billion to $5 billion, further solidifying its position as one of the top four global lending platforms.

Both liquidity and lending demand have seen steady increases in JustLend DAO's core metrics. As of November 12, the platform's total TVL had risen to approximately $6.9 billion, and the number of ecosystem users was approaching 480,000. The SBM lending market performed particularly well, with assets under management reaching $4.4 billion (including $4.28 billion in supply assets and $140 million in lending assets), clearly demonstrating the depth and activity of the lending ecosystem.

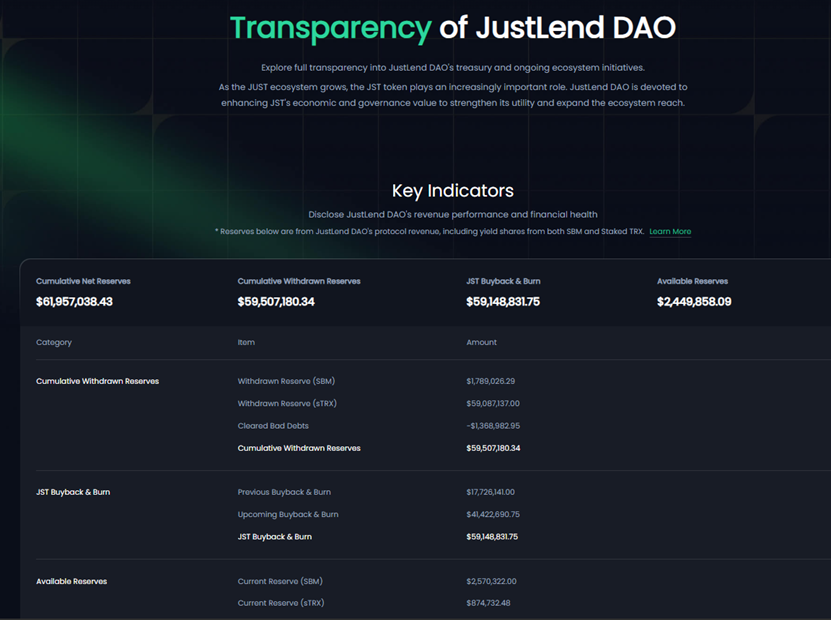

Regarding platform revenue, financial transparency has been upgraded. On November 1st, JustLend DAO officially launched the "Financial Transparency Operational Metrics" on its official website, fully disclosing core financial dimensions, including cumulative net revenue (mainly covering SBM lending market and Staked TRX revenue), withdrawn net revenue, remaining net revenue, and the JST buyback and burn process.

According to disclosed financial data, JustLend DAO platform has accumulated net revenue of nearly $62 million, of which $59.5 million has been withdrawn and approximately $2.44 million remains. The overall financial situation is stable and controllable.

In JustLend DAO's revenue structure, sTRX is undoubtedly the core pillar of revenue. Of the $59.5 million in revenue withdrawn, $59.08 million was net revenue withdrawn from sTRX, and approximately $1.79 million was net revenue withdrawn from the SBM lending market.

With the steady increase in sTRX staking, the resulting income is also expected to increase significantly. Official data shows that the amount of TRX staked behind sTRX exceeds 9 billion, with nearly 13,000 addresses participating in the staking. The current annualized yield is 7.26%, while in June of this year, only about 4,200 addresses participated in the staking, demonstrating the rapid growth trend.

The SBM lending market also performed exceptionally well, with its captured fees continuing to grow steadily. According to DeFiLlama data, as of November 12, 2025, the platform had accumulated approximately $5.68 million in captured fees (this figure only includes interest paid by borrowers), representing an increase of over $1.5 million compared to $4.06 million for the entire year of 2024. This growth directly confirms the continued expansion of the JustLend DAO lending market.

In addition to the two core business highlights mentioned above, JustLend DAO also offers high-frequency, essential energy leasing services. In the future, this business is expected to be incorporated into the revenue statistics system, becoming a new growth engine for the platform's revenue and continuously injecting momentum into overall revenue growth.

By diversifying its business across "liquidity pledging + lending + energy leasing," JustLend DAO has successfully built a diversified revenue model. This model effectively mitigates the risks associated with relying on a single business, enhances the robustness of its overall financial structure and its potential for sustained growth, and demonstrates strong competitiveness and dynamism in the face of fierce market competition.

The $59 million JST buyback and burn program has been completed, and ecosystem benefits continue to drive JST's deflationary value growth.

As the governance token of JustLend DAO and the entire JUST ecosystem, JST has always been a focal point of attention in the crypto market. Since 2025, JST has made continuous breakthroughs in ecosystem expansion and value enhancement. Recently, a JST buyback and burn program with a scale of approximately $59 million has been fully launched, laying a solid foundation for its long-term deflationary value.

On October 21, JustLend DAO, in conjunction with the USDD multi-chain ecosystem, launched the JST long-term buyback and burn plan, with the first round of large-scale burning completed simultaneously, marking JST's official entry into a new stage of value growth.

Specifically, data shows that JustLend DAO has extracted approximately $59 million USDT from its existing earnings for this round of buybacks and burns. The first round has already executed 30% (approximately $17.72 million), burning approximately 560 million JST, representing 5.66% of its total supply. The remaining 70% (approximately $41.42 million) has been deposited into the SBM USDT lending market and will be burned gradually over four quarters. Currently, users can track the burn progress and the amount of funds to be burned in real time through the Grants DAO or Transparency pages on the JustLend DAO website.

The buyback and burn of JST marks the beginning of JustLend DAO's long-term deflationary model, built upon the real revenue generated by its ecosystem. This model is based on JustLend DAO's approximately $59 million in existing revenue, and will continue to be injected with the platform's net revenue, as well as over $10 million in incremental revenue from the USDD multi-chain ecosystem. This "existing capital as the foundation, incremental capital for continued growth" design deeply binds JST's value to the development of JustLend DAO and the USDD ecosystem, forming a virtuous cycle of "a more prosperous ecosystem → higher profitability → stronger deflation," thus establishing a clear and sustainable long-term deflationary path for JST.

As the burning plan is implemented, JST's long-term value logic is becoming increasingly clear. The first round of burning, involving approximately 560 million JST, has already reduced the total supply by about 5.66%. With the continued implementation of subsequent quarterly buybacks, based solely on the extracted JustLend DAO reserves, JST's cumulative deflationary ratio may exceed 18% (based on JST's current market price), making JST one of the tokens with the largest number of tokens burned in the current DeFi market.

With a fixed total supply of JST (9.9 billion), the destruction of each JST means a reduction in circulating supply. This continued deflation of circulating supply will significantly enhance its scarcity, thus providing strong support for the JST price and driving its value into a long-term upward trend.

With genuine ecosystem benefits at its core, coupled with compliance progress and high liquidity advantages, JST's long-term value logic is constantly being strengthened, and its growth potential is becoming increasingly clear.

Globalization is accelerating across the board: offline activities have reached dozens of countries around the world, and the ecological influence continues to expand.

This year, JustLend DAO has continued to increase its global expansion efforts, using multiple channels such as exchanges, mainstream financial institutions, and high-frequency offline events to comprehensively expand its circulation boundaries, funding channels, and brand influence.

In terms of deepening cooperation with exchanges, JST's global circulation layout has yielded significant results, with a flurry of listings on multiple top-tier trading platforms in the first half of the year, resulting in simultaneous improvements in compliance recognition and market liquidity. In April, Kraken, a globally compliant crypto exchange, first launched the JST/USD and JST/EUR spot trading pairs, not only opening up access to the European and American markets and significantly increasing the asset's global exposure and liquidity, but also marking a crucial step forward for the TRON ecosystem in its compliance process. Subsequently, Binance, a leading global exchange, launched the JST/USDT perpetual contract, providing investors with diverse trading strategy options. Several other platforms, including Lbank, followed suit, further enriching the global trading matrix.

As of November 12, JST has been successfully listed on dozens of mainstream centralized exchanges such as Binance, Upbit, and Kraken, establishing a solid position in the global crypto market.

In connecting with mainstream financial resources, JustLend DAO has successfully built a bridge between traditional funds and ecosystem traffic: At the end of June, Tron, a US-listed company of TRON, completed the staking of 365 million TRX through JustLend DAO, marking the platform as an important channel for traditional funds to enter the TRON chain, and is expected to attract more institutional funds in the future; In July, JustLend DAO completed full integration with Binance Wallet, allowing Binance users to seamlessly perform lending and staking operations, further expanding its user base and ecosystem influence with the help of Binance's global traffic.

Furthermore, this year JustLend DAO has partnered with core projects in the TRON Eco ecosystem, such as SunPump, AINFT, and Bittorent, and frequently appeared at top global blockchain industry summits, participating in nearly ten high-profile international events across more than ten countries and regions in Asia, Europe, and the Middle East. From the Hong Kong Web3 Summit, Japan WebX 2025, and Dubai TOKEN 2049 in the first half of the year, to the Singapore TOKEN 2049, Thailand Blockchain Week, Korea Blockchain Week, Vietnam GM Vietnam 2025, and Istanbul Blockchain Week in the second half of the year, JustLend DAO and its ecosystem partners have comprehensively showcased their collaborative development and technological accumulation through a unified brand matrix.

At each summit, JustLend DAO, in collaboration with core projects of TRON Eco, not only set up professional booths to showcase the latest ecosystem achievements and data, but also enhanced brand recognition and community cohesion through customized themed merchandise and other means. Through multi-faceted brand exposure and technology demonstrations across multiple regions, JustLend not only comprehensively presented the integrated strength of its ecosystem's synergistic development, but also propelled cutting-edge Web3 technologies and innovative concepts onto a broader global stage, further accelerating the globalization of blockchain technology and continuously strengthening TRON Eco's influence in the global industry.

Currently, JustLend DAO's business footprint covers dozens of countries and regions around the world, demonstrating strong global development momentum and ecosystem synergy capabilities, and has become a core force driving the globalization process of the TRON ecosystem.

From continuous product feature iteration and user experience optimization to the leapfrog growth of TVL and the steady increase in global influence, JustLend DAO is firmly established among the world's top DeFi applications with its comprehensive strength, further consolidating TRON's ecological position as a core hub of decentralized finance.