Deciphering Monad's 18-page sales document: How does the 0.16% market-making stake support a $2.5 billion FDV?

- 核心观点:Monad披露文件体现透明运营态度。

- 关键要素:

- 公开销售7.5%代币,单价0.025美元。

- 采用自下而上分配机制防垄断。

- 披露1.6亿枚代币做市贷款安排。

- 市场影响:提升行业透明度标准,影响投资者决策。

- 时效性标注:短期影响

Original author: KarenZ, Foresight News

With the countdown to the Monad (MON) token's public sale on Coinbase underway, its 18-page disclosure document has become the focus of the market.

This document, provided by MF Services (BVI), Ltd., a subsidiary of the Monad Foundation, provides a comprehensive overview of Monad, from its project structure and financing to token allocation, sales rules, transparent market maker information, and security risk warnings. It offers investors the crucial information necessary for informed decision-making and reflects the project team's commitment to transparent operations.

In addition to key figures such as "$2.5 billion FDV", "$0.025 per token", and "7.5% public sale ratio" that have been widely cited by the media, this document also systematically discloses a large number of details that cannot be ignored, including legal pricing, token release schedule, market-making arrangements, and risk warnings.

Of particular note is the document's extensive and systematic listing of multi-dimensional risks related to the token sale, the Monad Foundation, the MON token, the Monad project, and its underlying technology. Users interested in investing in the MONAD token are advised to thoroughly study this document to make informed investment decisions.

Legal Framework

- The Monad Foundation is offering the product publicly on Coinbase through its subsidiary MF Services (BVI) Ltd.

- MF Services (BVI) Ltd., a wholly owned subsidiary of the Monad Foundation registered in the British Virgin Islands, is the seller in this token sale.

- The Monad Foundation is the sole director of MF Services (BVI).

Details of the core development entity and the $262 million financing.

- Monad's core contributors are the Monad Foundation and Category Labs, Inc. (formerly Monad Labs, Inc.).

- The Monad Foundation is a Cayman Islands-based foundation company dedicated to supporting the development, decentralization, security, and application promotion of the Monad network through a range of services including community engagement, business development, developer and user education, and marketing. Category Labs, headquartered in New York, provides core development services for Monad clients.

- Monad's three co-founders are James Hunsaker (CEO of Category Labs), Keone Hon, and Eunice Giarta. The latter two are co-GMs of the Monad Foundation.

- The Monad Foundation is overseen by a board of directors consisting of Petrus Basson, Keone Hon, and Marc Piano.

- Funding timeline:

- Pre-Seed: Raised $19.6 million between June and December 2022;

- Seed round: $22.6 million raised in January-March 2024;

- Series A: Raised $220.5 million between March and August 2024;

- In 2024, the Monad Foundation received a $90 million donation from Category Labs to cover operating expenses from 2024 to 2026. This donation is part of the $262 million raised by Monad Labs in various funding rounds.

Key information in the sales terms

- Token sale period: 22:00 on November 17, 2025 to 10:00 on November 23, 2025.

- Token sale ratio: up to 7.5 billion MON (7.5% of the initial total supply).

- Selling price: $0.025 per MON. If all are sold, $187.5 million will be raised.

- The minimum investment is $100 and the maximum is $100,000 (Coinbase One members may enjoy a higher limit according to the platform's terms and conditions).

- FDV: $2.5 billion

- The document discloses a "bottom-up" oversubscription allocation mechanism to ensure broad allocation and prevent large investors from monopolizing the market. If oversubscription occurs, a bottom-up allocation mechanism will be used to maximize distribution among participants while limiting the asset concentration of large buyers.

- Example: In a sale of 1000 tokens: three users (small/medium/high amount) apply for 100/500/1000 tokens respectively. In the first round of allocation, each user receives 100 tokens (the remaining 700 tokens are fully allocated to the low-amount user). In the second round of allocation, the remaining 700 tokens are divided equally between the medium/high-amount user, with each receiving 350 tokens. Final allocation: Small user receives 100 tokens, medium user receives 450 tokens, and high-amount user receives 450 tokens.

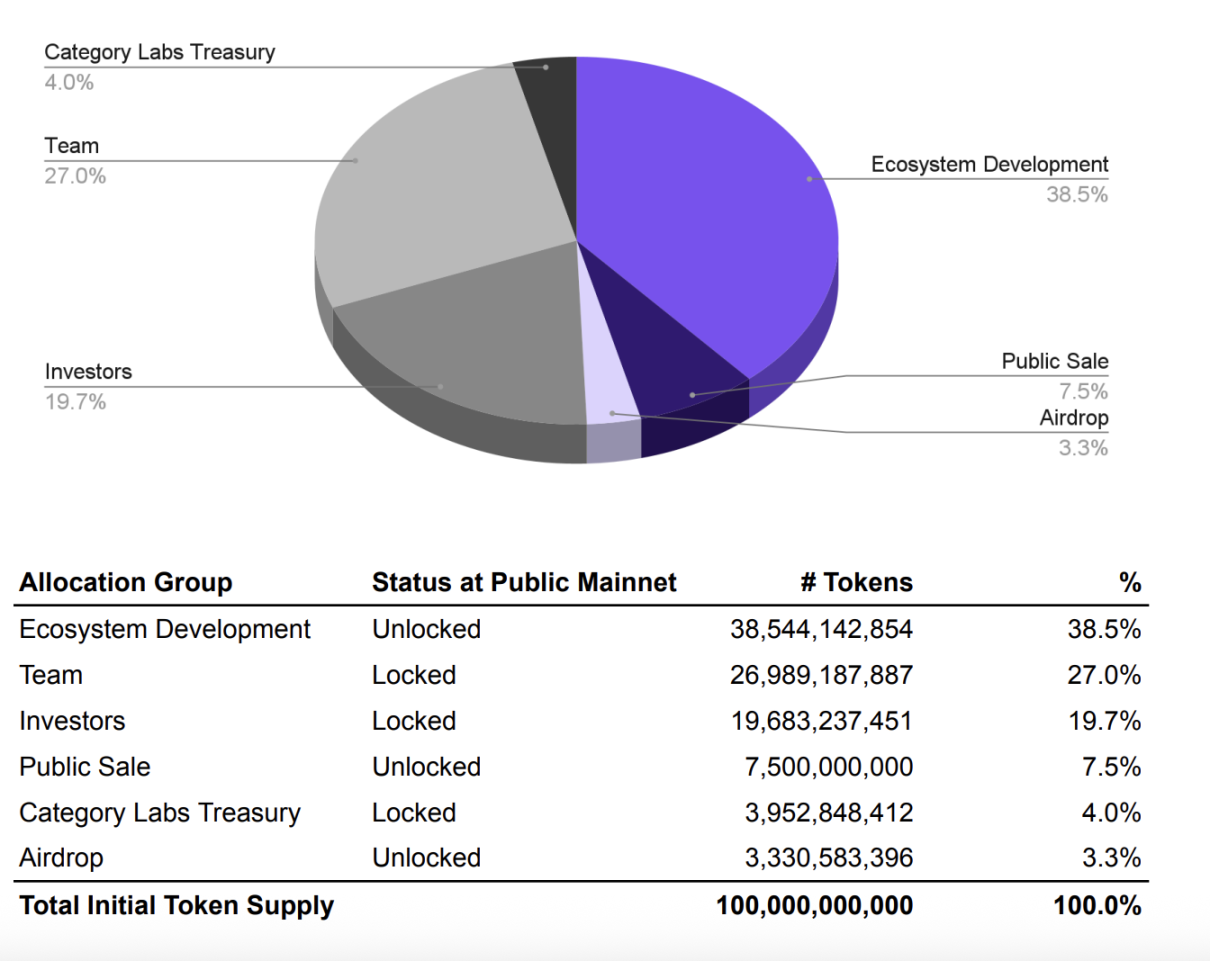

Token allocation and release status

The MON token economic model is shown in the following diagram:

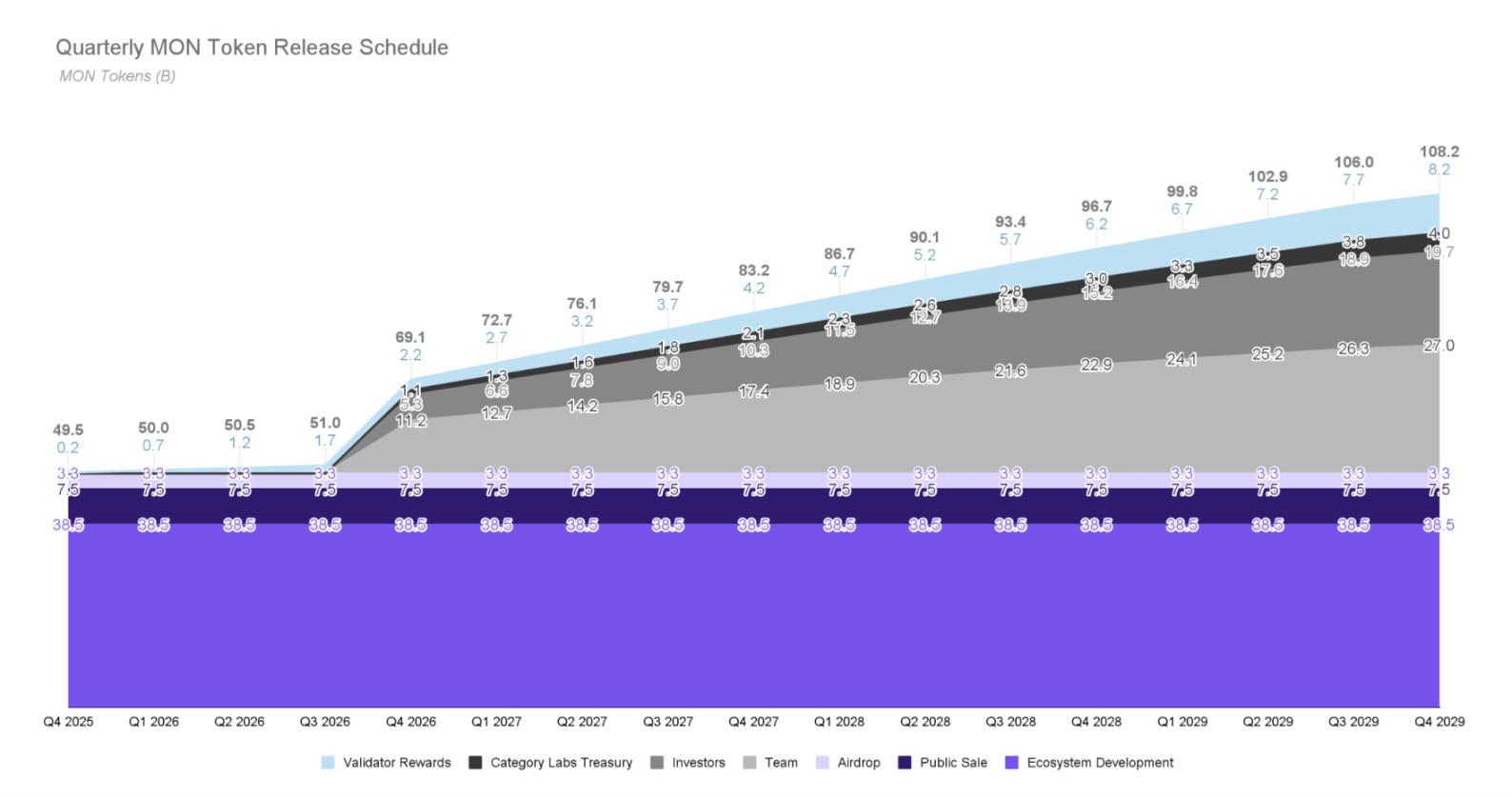

The following chart illustrates the expected token release:

Overall, on the first day of the Monad mainnet public launch, approximately 49.4 billion MON tokens (49.4%) were unlocked. Of these, approximately 10.8 billion MON tokens (10.8% of the initial total supply) were expected to enter public circulation through public sales and airdrops, while approximately 38.5 billion MON tokens (38.5%) were allocated to ecosystem development. Although these tokens were unlocked, they would be managed by the Monad Foundation, which would provide grants or incentives at a strategic level over the next few years and delegate them according to the Foundation's validator delegation program.

All tokens held by investors, team members, and the Category Labs treasury were locked on the first day of the Monad mainnet launch and are subject to a defined unlocking and release schedule. These tokens will be locked for at least one year. All tokens locked in the initial supply are expected to be fully unlocked by the fourth anniversary of the Monad mainnet launch (Q4 2029). Locked tokens cannot be staked.

It is worth mentioning that the document shows that in the future, after the network is launched, the Monad Foundation may continue to airdrop funds to incentivize the exploration and use of applications and protocols within the Monad network and ecosystem.

Future supply: 2% annual inflation + fee deflation

- Inflation: 25 new MON are generated per block as a reward for validators/stakers, with an annualized inflation of approximately 2 billion MON (2% of the initial total supply), designed to incentivize network participants and ensure network security.

- Deflation: All base fees are burned. This mechanism offsets some inflationary pressures by reducing the amount of currency in circulation.

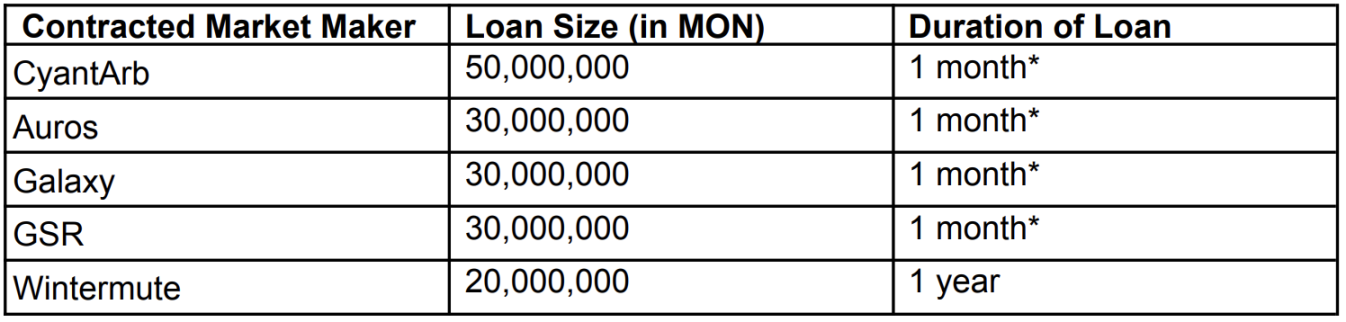

Monad market making and liquidity arrangements

To ensure good liquidity and transparency after the token is listed, MF Services (BVI) Ltd. has disclosed in detail its market maker cooperation and liquidity support plan.

MF Services (BVI) Ltd. has entered into lending agreements with five market makers: CyantArb, Auros, Galaxy, GSR, and Wintermute, lending a total of 160 million MON tokens. The loans from CyantArb, Auros, Galaxy, and GSR have a term of one month (renewable monthly); the loan from Wintermute has a term of one year. The project has also engaged Coinwatch, a third-party monitoring agency, to monitor the use of the lent tokens, ensuring that the funds are used to improve market liquidity and not for illegal activities.

In addition, MF Services (BVI) may deploy up to 0.2% of the initial MON token supply as initial liquidity for the DEX pool.

What is your opinion on Monad's market-making arrangements?

Open and transparent

In the Web3 space, the transparency and rationality of market-making arrangements have always been core issues of market concern. Traditional projects often face investor trust crises due to a lack of transparency in market-making information. However, Monad's disclosure of market-making details during the Coinbase ICO, with transparency at its core, breaks industry norms.

In addition, monitoring by Coinwatch will ensure to the greatest extent possible that the tokens used for lending are genuinely used for market making, demonstrating the project's emphasis on compliant operations.

Prudence in structural design

The loans from the four market makers are for a one-month term with monthly renewals, while only Wintermute offers a one-year commitment. This structure reflects Monad's cautious approach.

- Flexibility: Short-term contracts allow projects to adjust their market-making arrangements flexibly according to market conditions. If a market maker performs poorly, the contract may not be renewed at the end of the month.

- Risk hedging: Windemute's 1-year commitment provides a stable long-term foundation for market liquidity.

This combination shows that the project wants to ensure initial liquidity without becoming overly reliant on a single market maker or committing to excessively long terms.

Restraint in the size of market-making loans

Compared to the total supply of 100 billion tokens, the market-making loans of 160 million tokens represent only 0.16%. This percentage is very small, and the reasons may include:

- Avoid excessive market intervention

- Control token dilution

- Market-based considerations: Maintaining price stability by relying on genuine trading demand rather than excessive market making.

In addition, the foundation will allocate a maximum of 0.2% (200 million tokens) for initial DEX liquidity, further demonstrating this prudence.

Potential risk points

However, we can see from Monad's 18-page sales document that the project team has struck a very conservative, even slightly cautious, balance between "initial price discovery" and "long-term decentralization".

Based on the current pre-market price of $0.0517, these market-making loans are worth only $8.27 million. Compared to the 2-3% "market-making quota" often offered by many projects, this may not be enough to support liquidity in the face of significant selling pressure.

Furthermore, the foundation will allocate a maximum of 0.2% (200 million tokens) for initial DEX liquidity, specifying "possibly" rather than "mandatory." This amount can only guarantee against a sudden, massive sell-off at the opening, and cannot support sustained liquidity. The official announcement also highlighted the risks associated with DEX and CEX liquidity, effectively absolving the foundation of liability in advance.

For investors, this means that if the MON token does not have sufficient natural trading depth and organic buying support after its opening, its price may experience high volatility. Therefore, when investing, in addition to focusing on the project's fundamentals and long-term vision, it is wise to be vigilant about the initial market liquidity and price discovery mechanisms.