The DeFi lending market reached a significant turning point at the end of 2024. After rapid growth in 2021-2022 and a period of adjustment in 2023, the entire industry is shifting from a TVL (Total Value Limit) race to infrastructure optimization and meeting real demand. The Permissionless feature launched by the Gearbox protocol represents the core direction of this shift—allowing any institution, project, or professional curator to create customized lending marketplaces. Gearbox, which began operating in 2021, initially adopted a fully DAO governance model, requiring community consensus for all market creation and risk parameter decisions. This model established trust and protocol resilience, but with the explosive growth of on-chain asset types, institutions considering on-chain deployment, and the realization of multi-chain ecosystems, relying solely on DAO governance could no longer meet market demands. Permissionless is the response to this problem, realizing an architectural shift from "creating marketplaces for users" to "users creating their own marketplaces."

Credit Account: An Efficiency Revolution Brought About by Contract-Level Operations

Traditional DeFi lending protocols operate on a relatively simple model: users deposit collateral, lend out target assets, and then trade on a DEX. The protocol is only responsible for ledger management and does not directly participate in the user's asset operations. This design requires the DEX to have sufficient liquidity to support liquidation, thus risk parameters such as LTV and liquidation thresholds are set very conservatively, limiting capital efficiency. Gearbox's Credit Account changes this logic. This is a smart contract wallet where all user operations are completed within the wallet, and the protocol can interact directly with other DeFi protocols at the contract level. When a user needs to leverage ETH for collateral, the protocol does not need to trade through a DEX but directly calls the contracts of Lido or other staking protocols. This design not only simplifies the operational process but also fundamentally improves capital efficiency and comprehensively optimizes risk management.

Take Lido's DVstETH as an example. This distributed validator staking token uses a vault-based minting and redemption mechanism and is not traded on DEXs. Traditional lending protocols are helpless with this type of asset because they cannot provide lending services without liquidity on DEXs. However, Gearbox directly connects to DVstETH's vault contract, allowing users to achieve zero-slippage leverage, with LTV parameters far exceeding those of traditional protocols. This market has been operating stably for several months, allowing users to easily execute operations of millions of dollars without worrying about slippage losses. This ability to directly connect to asset issuer contracts allows Gearbox to support new assets that are not suitable for trading on DEXs, which is particularly important in the current context of RWA's rapid development.

As real-world assets are increasingly being put on-chain, more and more asset issuers are choosing more efficient methods. Vault systems like Mellow and non-tokenized yield mechanisms like Convex share a common characteristic: they don't require DEX liquidity because they weren't designed for trading. Traditional lending protocols can only wait for these assets to build sufficient liquidity on DEXs, a wait that can take months or even longer. Gearbox, however, can provide lending support from the moment an asset is issued, as it doesn't rely on DEX liquidity and only needs to interact at the contract level. This capability gives Gearbox a significant first-mover advantage in supporting innovative assets and makes it more attractive to projects as their lending infrastructure.

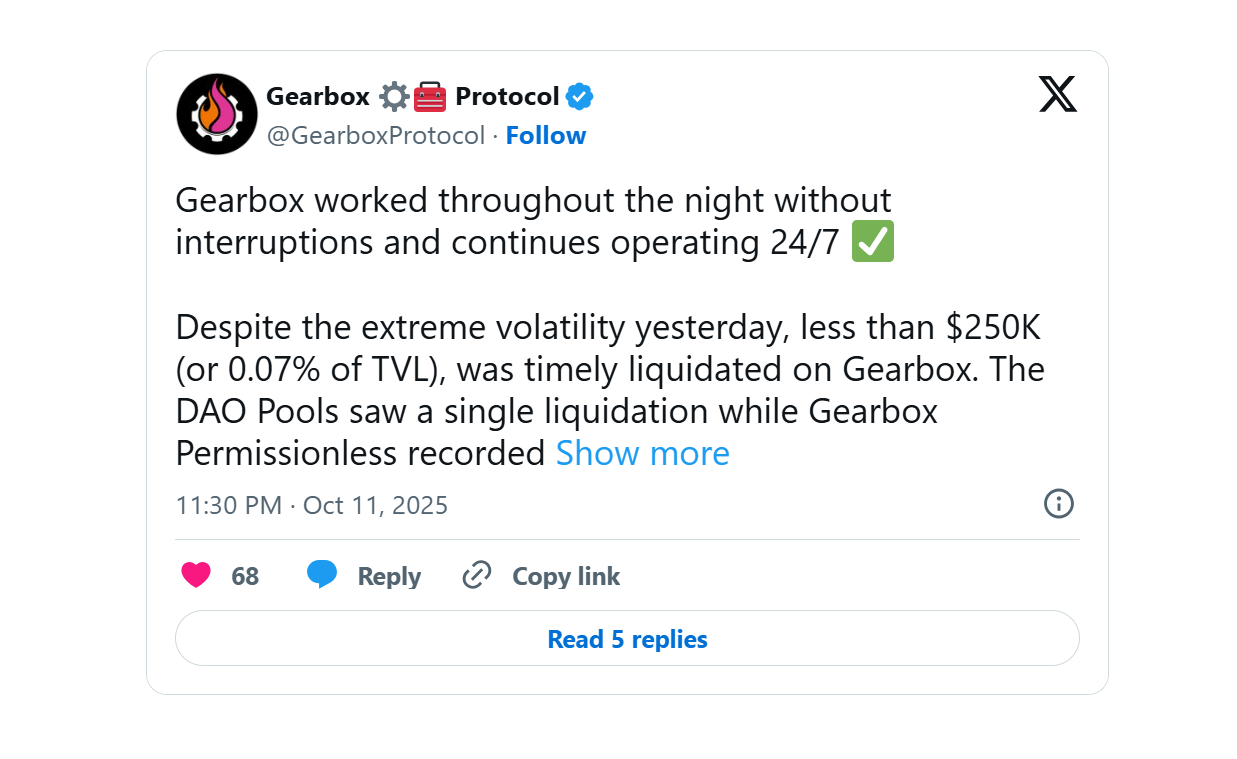

Contract-level operations also bring more refined risk management. When liquidation doesn't need to be completed through a DEX, the protocol can set more aggressive risk parameters, higher LTV for improved capital efficiency, and lower liquidation thresholds for enhanced user position security. Liquidation processes can be completed within days, instead of the weeks that might be required in traditional models. This efficiency improvement not only reduces users' exposure time but also allows the protocol to respond more flexibly to market volatility. The Permissionless feature, based on a Credit Account architecture, fully opens this capability to market participants. Any capable institution, project team, or curator can use the Gearbox technology stack to create their own lending marketplace; this open design brings three core innovations.

First is the liquidity-sharing mechanism. Multiple markets can draw funds from the same liquidity pool, but each maintains independent risk parameters. This solves the long-standing liquidity fragmentation problem in DeFi. In a multi-chain and multi-market environment, shared liquidity is far more efficient than each market maintaining its own independent liquidity pool. Liquidity providers don't need to decide which specific market to invest in; they only need to select the underlying asset pool, and then these funds can be used by multiple markets. Simultaneously, because each market's risk parameters are independent, curators can set appropriate LTV, liquidation thresholds, and other parameters based on the characteristics of the assets they support. This risk isolation mechanism ensures that problems in one market will not affect other markets or the shared liquidity pool.

Secondly, there's the innovation in interest rate models. Traditional DeFi lending only considers capital utilization: higher interest rates for more users and lower rates for fewer users. This model is simple but crude, completely ignoring the risk differences between different assets. In Permissionless, curators can add a risk premium to the utilization rate, based on their professional judgment of asset risk. This allows on-chain lending to truly reflect asset risk pricing for the first time, rather than just a simple supply and demand relationship. For institutions, this is a key breakthrough. The risk assessment frameworks and pricing models they've spent decades building in traditional financial markets can now be directly applied to on-chain lending. Institutions don't need to completely abandon their expertise to adapt to DeFi's simplified models; instead, they can bring these mature methodologies on-chain, significantly lowering the barrier to entry for institutions participating in DeFi.

Thirdly, there's the rapid deployment capability. Gearbox has developed the Bytecode Repository system, essentially an on-chain code repository where all audited contract code is stored. When deployment on a new EVM chain is needed, it can be directly called from the repository, with the auditing firm responsible for signature verification to ensure consistency between the deployed code and the audited code. This allows Gearbox to quickly cover new chains without needing to re-audit each deployment because the exact same code is used. Combined with price data support from the Redstone oracle, Gearbox can provide full lending functionality on the first day of a new chain's launch. In today's multi-chain environment, this rapid response capability is crucial. Assets and users are being dispersed across different chains; a protocol that fails to establish a presence early on a new chain will miss the golden opportunity to acquire users and achieve TVL (Total Value Added).

From a broader perspective of DeFi development trends, asset issuance methods are undergoing profound evolution. The early logic of DeFi was to tokenize assets and then trade them on DEXs, but practice has shown that this model is not always optimal. Many assets do not require frequent trading, and forcing market making on DEXs only increases costs and complexity. Now, more and more projects are adopting vault models, asset packaging, or completely non-tokenized methods; this trend is particularly evident in the RWA (Retail Asset Management) field. Lending protocols must proactively adapt to these new asset forms. If they cling to the traditional premise of "must have DEX liquidity," they will become increasingly passive in supporting new assets. Gearbox's contract layer operation approach is designed to prepare for this trend, allowing the protocol to flexibly connect to various asset issuance methods, rather than being limited to DEX trading models.

Institutional participation is an inevitable trend in DeFi development. For DeFi to become a crucial component of financial infrastructure, it must be able to accommodate institutional-level funds and participants. The key issue isn't whether or not to have institutions, but how to allow them to participate without disrupting the existing decentralized ecosystem. Permissionless's solution provides institutions with sufficient control and flexibility to operate the market according to their own risk management frameworks and compliance requirements, while maintaining the openness and transparency of the underlying protocol. Curators can set risk parameters and interest rate models entirely autonomously, but all these settings and subsequent operations are publicly recorded on-chain, viewable and verifiable by any user. This design strikes a balance between institutional needs and the spirit of decentralization, avoiding both complete "code is law" and the black-box operation of traditional finance.

The multi-chain landscape has moved from debate to reality. A few years ago, the market was still discussing "which chain will ultimately prevail," but that question is no longer relevant. Different chains serve different user groups and application scenarios, naturally distributing liquidity and users across multiple chains. For protocols, one of the core competitive advantages is the ability to quickly cover emerging blockchain networks. This is not just a matter of technical implementation, but also tests the team's organizational and resource allocation capabilities. Gearbox's Bytecode Repository system has standardized multi-chain deployment, instead of having to go through the entire development, testing, and auditing cycle every time. This standardization allows Gearbox to respond quickly when new chains launch, seizing early market opportunities and establishing a first-mover advantage.

As the overall growth of the DeFi market plateaus, the focus of competition shifts from new market growth to the battle for existing users. At this stage, even a difference in yield per basis point can become a decisive factor in a user's choice of protocol. Zero slippage, higher LTV ratios, and faster liquidation speeds may seem like technical details, but for users, they represent tangible differences in returns. If a user loses 1% of their annual returns on protocol A due to slippage, but avoids this loss on protocol B, the difference will become significant over time. Gearbox has clear technological advantages in capital efficiency and user experience, but whether it can maintain its leading position in fierce competition ultimately depends on the team's execution and market strategy.

Permissionless represents a significant shift in the design philosophy of DeFi protocols—from standardized, one-size-fits-all products to modular and customizable platforms. This trend is not limited to lending; similar evolutions can be seen across various sectors, including DEXs, derivatives trading, and asset management. The fundamental driving force is that DeFi is moving from the early stage of "proving the concept is feasible" to the mature stage of "optimizing operational efficiency." Early DeFi protocols primarily aimed to prove that decentralized finance was technically feasible and economically sustainable, so their designs often prioritized simplicity and universality. Now that these fundamental questions have been answered, the focus of competition has shifted to efficiency and adaptability—who can provide better capital utilization efficiency, who can adapt to more diverse asset types and user needs, and who can respond more quickly to market changes and seize new opportunities.

The success or failure of Gearbox Permissionless will not only affect the development of the protocol itself, but will also have a profound impact on the evolution of the entire DeFi lending landscape. If Permissionless can prove that direct contract-level operation and customizable market models are feasible and superior, more protocols will follow this direction, driving the entire industry towards greater efficiency. If it encounters insurmountable difficulties in practice, the market may re-examine whether this technological approach is truly viable. But regardless of the outcome, this is an innovative attempt worth close attention. The DeFi ecosystem needs innovations that truly solve real-world problems, not just concepts piled up for the sake of differentiation. Permissionless is at least seriously addressing several real industry pain points: how to effectively support new assets that do not rely on DEX liquidity, how to improve capital efficiency while maintaining decentralization, how to enable institutions to participate in DeFi in a way that suits their own needs, and how to rapidly expand coverage in a multi-chain environment. The solutions to these problems and their practical effects will greatly influence the development trajectory and market landscape of DeFi in the coming years.

- 核心观点:DeFi借贷转向基础设施优化与定制化。

- 关键要素:

- Gearbox推出无许可定制借贷市场。

- 信用账户提升资本效率与风险管理。

- 支持非DEX资产与多链快速部署。

- 市场影响:推动DeFi向高效与机构化发展。

- 时效性标注:中期影响