BitMart Weekly Market Report (October 27 - November 2)

- 核心观点:加密市场震荡回调,资金流向分化。

- 关键要素:

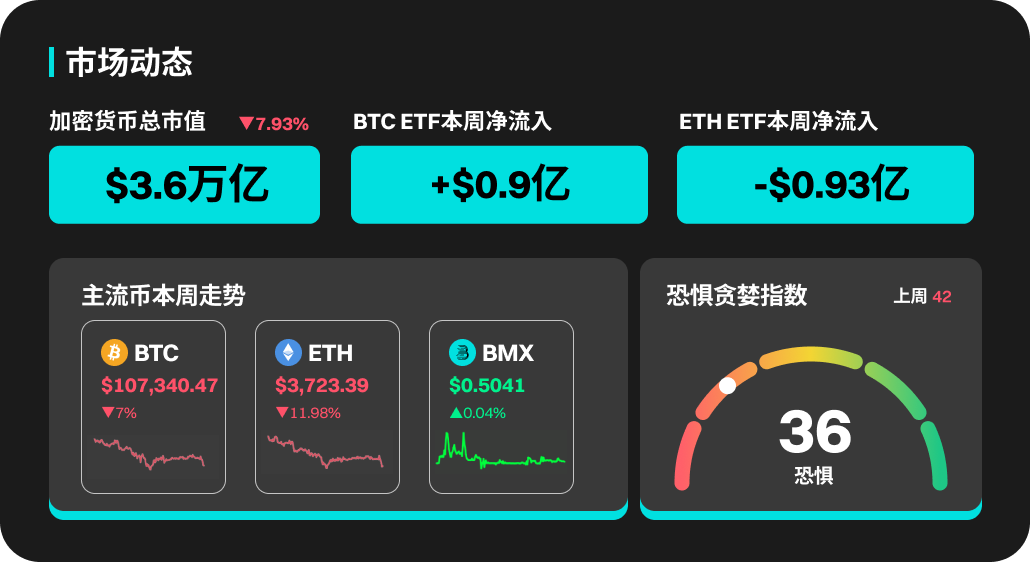

- 总市值下降7.93%,BTC、ETH震荡回落。

- BTC ETF净流入,ETH ETF净流出,资金分化。

- Tokenized Gold板块涨17.3%,成避险热点。

- 市场影响:短期波动加剧,资金寻求避险资产。

- 时效性标注:短期影响

According to BitMart's market report on November 3, the total market capitalization of cryptocurrencies was 3.6 trillion last week, a decrease of 7.93% from the previous week.

Crypto Market Updates This Week

Last week, the crypto market experienced a volatile session characterized by a surge, pullback, and weak recovery: BTC twice attempted to break through $116k but failed, retreating to a low of $106.3k before fluctuating between $109k and $111k. Multiple positive expectations (interest rate cuts, trade talks) failed to translate into sustained upward movement, with prices fluctuating more in line with stock market and risk appetite. ETH underperformed BTC, repeatedly falling below $4,000, dipping between $3,681 and $3,709 during the week, before recovering at the weekend but failing to hold above $4k.

Funding flows diverged: BTC ETF saw a net inflow of approximately $0.90 billion last week, while ETH ETF experienced a net outflow of approximately $0.93 billion. On the derivatives side, CME ETH futures trading and open interest continued to strengthen (average monthly trading volume has exceeded BTC since April 2025), coupled with institutional buying (such as BitMine's weekly increase of 27,316 ETH), resulting in a slight divergence between spot and derivatives signals. Key levels to watch: BTC $116k resistance, $110k/$106k support; ETH $4,000 psychological level and $3,680 support. In terms of trading strategy, control leverage before and after events, and use volume breakouts/breakouts as trading triggers.

Popular cryptocurrencies this week

Among popular cryptocurrencies, DASH, ZK, ICP, TAO, and ZEC all performed well. PAYAI's price rose 74.7% this week. ZK's price rose 52.9%. ICP's price rose 15.3%, with a 24-hour trading volume of 424.33M. TAO and ZEC rose 12.5% and 8.9% respectively this week.

US Market Overview and Hot News

This week has seen a volatile week for risk assets, including Bitcoin. Wednesday began what should have been a positive day for cryptocurrencies and other risk markets: the Federal Reserve delivered on market expectations, cutting interest rates by 25 basis points and announcing the end of quantitative easing (QT). However, market optimism was short-lived. Fed Chairman Jerome Powell's subsequent hawkish stance at his press conference—suggesting a December rate cut was not a certainty—completely reversed market sentiment, triggering widespread "safe-haven" selling. On Thursday, news of some positive progress from the US-China summit, however, was hampered by a lack of details, further exacerbating market volatility. While the end of QT signaled technical easing, the market's focus remained on Powell's tightening signals. Consequently, the dollar and US Treasury yields surged, directly pressuring non-yielding and illiquid assets like Bitcoin. Traditional stock markets also experienced significant volatility; although the S&P 500 closed higher, its extreme internal divergence—primarily supported by Nvidia—exposed the fragility of market confidence. The mixed earnings reports from tech giants failed to significantly boost market risk appetite.

At 22:45 on November 3, the United States released the final reading of the S&P Global Manufacturing PMI for October;

Hong Kong Fintech Week 2025 will kick off in Hong Kong on November 3.

At 21:15 on November 5th, the US October ADP employment figures were released.

Williams, a permanent voting member of the FOMC and president of the Federal Reserve Bank of New York, will speak at the European Central Bank's monetary market conference at 4 p.m. on November 7.

The U.S. Securities and Exchange Commission (SEC) has postponed its decision on the Grayscale DOT spot ETF; the decision date is now November 8.

The US government shutdown may see a turnaround early this week.

Unlocking popular sections and projects

Tokenized Gold sector

The Tokenized Gold sector performed exceptionally well this week, with an overall increase of 17.3%, becoming one of the defensive hot spots attracting capital. As US Treasury yields declined and expectations of interest rate cuts strengthened, the safe-haven and collateral attributes of "on-chain gold" were reassessed, leading to a strong rebound in several gold tokens, with PAXG and XAUt leading the gains. Improved liquidity coupled with updated project narratives (on-chain settlement, collateralized lending, and improved efficiency of cross-market arbitrage) enabled this sector to significantly outperform the broader market over the past week. Overall, the strength of Tokenized Gold reflects the market's renewed focus on the gold + on-chain liquidity track; against the backdrop of crypto capital inflows and application-layer innovation, gold tokens are gradually evolving from "traditional asset mapping" to foundational assets for DeFi collateral and payments, with continued growth in investor and developer interest.

Memecoin (MEME) will unlock approximately 3.45 billion tokens at 3:30 PM Beijing time on November 3rd, representing 5.98% of the current circulating supply, with a value of approximately $5.4 million.

The Jupiter community has released a proposal regarding whether to burn JUP tokens held in the Litterbox Trust. Voting will end on November 4th. The proposal includes whether to burn the 120 million JUP tokens currently accumulated in the Jupiter Litterbox Trust.

Ethena (ENA) will unlock approximately 172 million tokens at 3 PM Beijing time on November 5th, representing 2.52% of the current circulating supply, worth approximately $67.1 million.

Risk warning:

Using BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are inherently highly speculative and involve a significant risk of loss. Past, assumed, or simulated performance is not indicative of future results.

The value of cryptocurrencies may rise or fall, and there may be significant risks involved in buying, selling, holding, or trading cryptocurrencies. You should carefully consider whether trading or holding cryptocurrencies is right for you, based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.