The last week of October 2025 saw a delicate turning point in the crypto market. Gold briefly broke through $4,300 to reach a new all-time high this month, Nvidia became the first company to surpass a $5 trillion market capitalization, and Bitcoin fluctuated around $107,000. The euphoria of traditional assets and tech stocks contrasted sharply with the relative calm in the crypto market. At this seemingly tranquil moment, a payment protocol called X402 began to spark discussion in the tech community, RWA tokenization received further endorsement from Wall Street institutions, and the AI Agent economy moved from concept to experimental implementation.

For most traders, this fragmented information is difficult to piece together into a clear investment picture. However, for professional crypto trading platforms, this is precisely the best window of opportunity for strategic planning—to complete analysis before market consensus forms and to filter investments before liquidity floods in. Ju.com's actions this week perfectly demonstrate how an exchange can transform macro insights into tradable alpha opportunities for its users: releasing dual research reports on X402 and ERC-8004 this week, hosting an in-depth Twitter Space on October 30th to discuss 2025 market trends , and simultaneously launching the Ju Selected Trading Zone . Behind this series of intensive actions is the gradual unfolding of Ju.com's systematic layout, from "discovering alpha" to "researching alpha" and then to "providing alpha."

Abstract: This week, Ju.com established a comprehensive system from trend identification to project selection through three major initiatives: macro market analysis, in-depth technical reports, and the launch of a curated trading zone. Amid emerging narratives such as the X402 payment protocol, RWA tokenization, and the AI Agent economy, Ju.com demonstrated its expertise in identifying and providing Alpha assets in the early stages of the market.

The market turning point in 2025: Alpha is becoming increasingly scarce.

While traditional financial markets are hitting record highs, the crypto market is facing a delicate dilemma. Although Bitcoin has stabilized above the $100,000 mark, its upward momentum has clearly weakened; the altcoin market is in dire straits, with many projects experiencing significant pullbacks from their peaks. Ju.com provided an in-depth analysis of the reasons behind this divergence in a Twitter Space post on October 30th.

Invited industry guests unanimously pointed out that 2025 will be a year of structural divergence in liquidity. Although the Federal Reserve cut interest rates twice in September and October, the released liquidity mainly flowed into traditional risk assets. Technology stocks benefited from massive investments in AI infrastructure, while gold benefited from geopolitical tensions and central bank purchases aimed at de-dollarization. The crypto market, however, failed to share in this liquidity dividend due to multiple factors, including regulatory uncertainty, institutional investors' wait-and-see attitude, and a lack of innovation in the DeFi ecosystem.

A deeper problem lies in the lack of narrative. The 2021 bull market had the DeFi Summer and the NFT craze, and 2023 had the expectation of a Bitcoin spot ETF and the innovation of Ordinals inscriptions, but the market in 2025 seems to be waiting for the next story that can trigger a large influx of funds. While Meme coins have experienced periods of popularity, most projects have extremely short lifecycles and are unable to bear long-term value. Public chain competition has fallen into a homogenization trap, and new Layer 1 or Layer 2 projects are finding it difficult to tell a differentiated story. In this context, truly innovative early-stage projects have become extremely scarce, which is what Ju.com calls the "Alpha scarcity era".

However, crises often breed opportunities. The guests at the Space event reached several important consensuses during the discussions: First, when the market is in a state of confusion, it is often the eve of a new narrative, and infrastructure innovations that can solve real problems will accumulate momentum during periods of silence; second, Wall Street institutions are shifting their attitude towards the crypto market from observation and tentative exploration to strategic deployment, especially in the areas of RWA tokenization and stablecoin infrastructure; third, the explosive development of AI technology is creating a chemical reaction with blockchain, and the autonomous payment needs of AI agents are giving rise to entirely new protocol-layer opportunities.

X402: An Underestimated Signal of a Payment Revolution

When the X402 protocol began to attract attention in late October, Ju.com immediately organized its technical team to study the protocol and promptly released an in-depth analysis report of more than 4,000 words entitled "X402 and ERC-8004 Narrative Study: Asset Analysis".

The research report begins by pointing out the essence of X402: establishing a standardized protocol for internet payments. Traditional internet payment methods are extremely fragmented; credit cards charge 2-3% transaction fees, subscription systems require users to actively link their accounts, payment firewalls offer a poor user experience, and cross-border small-amount payments are almost impossible. These problems were barely acceptable in the Web2 era, but they have become fatal bottlenecks in the context of the imminent large-scale application of AI agents.

Imagine this scenario: Your AI assistant needs to call a weather API to retrieve real-time data, and this call is worth $0.001. In traditional payment systems, this transaction is impossible to complete; the transaction fees for any payment channel far exceed the transaction amount itself. However, X402, by embedding payment logic into the HTTP 402 status code ("Payment Required"), allows websites, APIs, and AI agents to request payment directly at the protocol layer. The entire process is intermediary-free, requiring only blockchain gas fees, making a $0.001 transaction economically feasible.

Ju.com's research report provides an in-depth analysis of the far-reaching impact of this innovation. First, it makes a pay-as-you-go business model a reality, eliminating the need to subscribe to the entire service and instead charging for each API call, each article read, and each second of video streaming. Second, it provides the payment infrastructure for the AI Agent economy, enabling AI systems to complete transactions autonomously when they need to purchase data, computing resources, and storage space. Finally, it may reshape the monetization model of the internet—creators will no longer rely on advertising and platform revenue sharing but will instead earn revenue directly from consumers' micropayments.

Major tech platforms like Cloudflare and Google have expressed support for X402, with Cloudflare even launching the NET Dollar stablecoin integrating the protocol. This institutional backing distinguishes X402 from purely speculative projects. However, research reports also issue a clear warning: protocol-level innovation does not equate to token-level investment value. The valuations of many X402-related tokens on the market reflect expectations of future mass adoption, not current actual usage. Most of these tokens have experienced rapid price surges followed by quick corrections. Investors should focus on the protocol's adoption data itself: How many websites have integrated X402? What is the actual transaction volume? How active is the developer community?

Ju.com's research on X402 demonstrates the attitude a professional trading platform should have: keenly capturing early signs of innovation while rationally assessing the boundaries between speculation and value. The report's conclusion suggests that the X402 protocol is worth long-term attention, but token investment should adopt a "small position, long-term, adoption-oriented" strategy, using no more than 5-10% of the portfolio and being prepared to hold for 3-5 years, focusing on tracking actual usage data of the protocol rather than short-term price fluctuations.

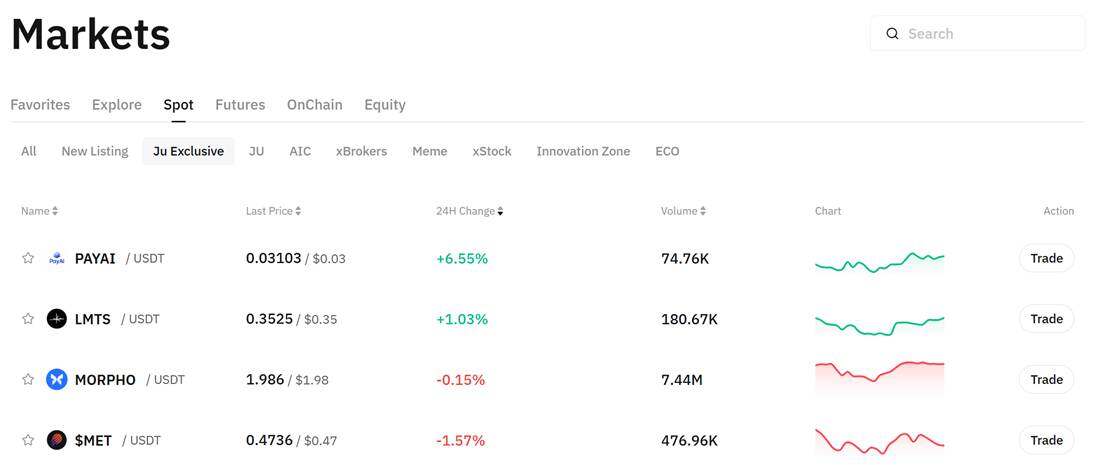

Ju Selected Trading Zone: Your Crypto World's Boutique

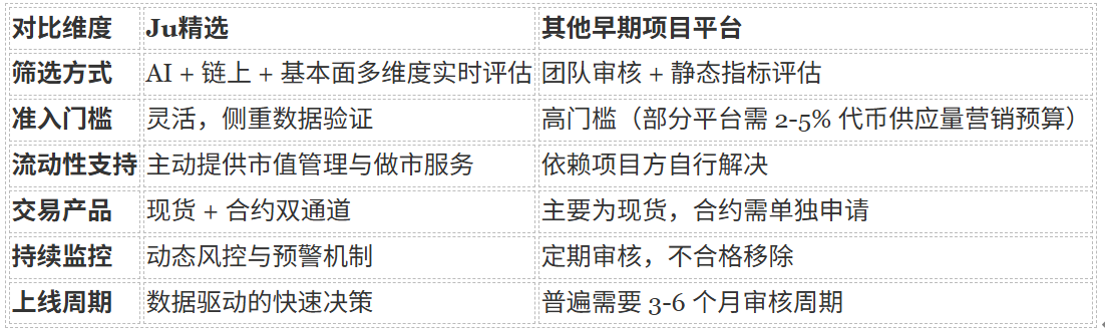

In the exchange industry, listing strategies can be broadly divided into two extremes: one is the "wide net" model, which lists several new projects every day to capture dark horses with high-density coverage; the other is the "strict review" model, which lists only a few projects that have been validated over a long period of time each month to ensure quality but sacrifice timeliness.

Ju.com chose a third path: the curated selection model. Its core philosophy is to find a sound balance between "speed" and "quality": to quickly capture early-stage potential assets while controlling risk through systematic screening.

In its selection process, Ju.com considers multiple factors, including a project's innovativeness, execution capabilities, economic model sustainability, community health, and compliance potential. The platform's evaluation focuses on whether the project truly has the ability to solve real-world problems, demonstrates a commitment to long-term development, and creates genuine value for users while remaining compliant.

For example, some projects focusing on AI, RWA, and the X402 protocol have recently been selected for the featured section because they demonstrate clear application scenarios and structural innovations.

Regarding the team and token model, Ju.com emphasizes transparency and robustness. The project team's professional background, long-term commitment, and token allocation and unlocking schedule are all taken into account in the overall evaluation. At the community level, the platform values genuine interaction and willingness to contribute, rather than simply traffic metrics; a healthy community is the underlying support for the project's long-term development.

Regarding compliance, Ju.com prioritizes safety and sustainability. When selecting projects, the platform focuses on their overall legal structure and risk management awareness to ensure a robust and transparent environment for user participation.

Once this screening mechanism was fully operational, Ju's curated trading zone gradually cultivated a high-quality pool of projects. Each project underwent multi-dimensional evaluation, with overall quality and success rate significantly exceeding the market average. The user trading experience in the curated zone is built upon a professional team's systematic assessment of the risk-reward ratio. Ju.com's core philosophy is clear: while it's impossible to eliminate market risk, it can help users better understand which opportunities are worth pursuing.

RWA tokenization: The strongest endorsement from Wall Street

If we view X402 as an innovative pulse on the technology side, then RWA tokenization is more like the main thread on the funding side. On Ju.com's Twitter Space, guests gave a highly consistent positive assessment of RWA when looking ahead to 2026, for a straightforward reason: this sector has already received substantial investment and pilot projects from traditional finance.

Wall Street and regulators in multiple locations are accelerating their efforts to move assets such as bonds, real estate, and commodities onto the blockchain. Related products are already operational, and the pilot scope continues to expand. RWA's value proposition is clear: improve settlement efficiency, expand global circulation, and combine with DeFi as collateralized assets to unlock more use cases and liquidity.

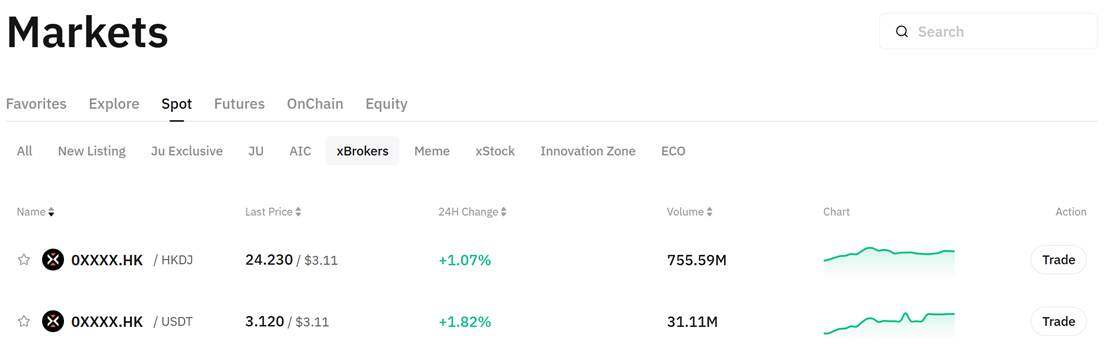

At the implementation level, xBrokers provides a quantifiable example. Its core business segment, the xBrokers trading zone, officially entered trial operation on October 20, 2025, with the first real-share mapping target being "Ju" (0XXXX.HK). This signifies that the RWA ecosystem architecture of "stock trading + staking mining + token incentives" is beginning to be tested by the market.

During its trial operation, "Ju" uses a 1:1 real-share custody + on-chain verification + HKDJ settlement method to bring real Hong Kong stock assets onto the blockchain for circulation. Users can exchange USDT for HKDJ through Ju.com to directly purchase 0XXXX.HK and withdraw the funds to any licensed brokerage after December 1st, enjoying the same rights as real-shares. During the staking phase, the stock itself can also act as a "mining machine" to generate $X in revenue, thus transforming static equity into a sustainable income asset.

From a market performance perspective, "Ju" (0XXXX.HK) has shown a steady upward trend amidst a generally sluggish crypto market. As of October 31, the price was over 24 HKDJ (Hong Kong dollar stablecoin), representing an increase of over 380% compared to the opening price of 5 HKDJ. The daily chart shows a step-by-step upward trend since the trial operation, with trading volume maintaining a moderate increase, verifying the liquidity and market acceptance of on-chain real-money trading.

From a cyclical perspective, Ju.com's focus on RWA is based on its assessment of changes in the funding structure. Easing expectations are no longer the dominant force; existing assets in traditional finance are becoming new entry points for incremental growth in the on-chain market. Even if only a very small percentage of traditional assets complete on-chain circulation, the entire funding structure, yield tiers, and risk management system of the DeFi and crypto markets will be reshaped.

In terms of selection, Ju.com focuses on three things: whether the underlying assets are verifiable and clearly managed, whether the legal structure can protect the rights of holders, and whether the cash flow distribution mechanism is transparent and enforceable. For investors, RWA is more suitable to serve as a stable foundation in the portfolio; Ju.com regards it as the ballast of the crypto portfolio, providing certainty during periods of volatility.

AI Agent Economy: From Payment Instruments to Autonomous Entities

The popularity of X402 stems from the convergence of AI and blockchain. As model capabilities leap forward, agents are evolving from "tools" to "participants capable of independently initiating and settling transactions." As infrastructure such as payment, identity, data, and computing power gradually become integrated, micropayments and on-demand settlement will become default capabilities, and new business models will emerge on top of this.

Let's zoom in a bit: Agents, triggered by market conditions or tasks, invoke data and services, settle fees on a per-transaction basis, and complete asset exchanges and risk control actions on-chain when necessary; humans are mainly responsible for setting targets and managing thresholds. This chain doesn't rely on grand imaginations; the key lies in data utilization: how many connections are there, whether transactions are genuine, and whether retention and reuse are increasing.

Ju.com's research conclusions are relatively restrained: this is a long slope in the early stages of infrastructure development. A better approach is to participate with small positions, a long time horizon, and a focus on adoption, rather than chasing short-term fluctuations. When evaluating relevant projects, Ju.com focuses on three key questions: does it address the real needs of agents? Is the architecture open enough for multiple parties to integrate? Are the token's economics and permissions within the system necessary and self-consistent? Only projects meeting these criteria are eligible for deeper evaluation and trading support.

Macro perspective: Why now?

Ju.com's intensive release of research reports, Space, and curated sections this week is a deliberate timing move. By the end of October 2025, traditional financial assets will have reached new highs, while the crypto market remains sluggish. A new narrative is brewing, yet it has not yet been widely understood by the market. For mature platforms, this seemingly calm phase is often the most valuable time to cultivate their research systems and project selection mechanisms.

From a cyclical perspective, the shakeout of the past two years has brought the industry back to reality. Most of the projects that experienced a brief boom during the 2021 bull market have disappeared, leaving only a few survivors with real users, stable income, or institutional support. Although the market has experienced growing pains, it has also been purified, and innovations with true long-term accumulation capabilities have begun to emerge.

The funding landscape is also quietly shifting. The launch of Bitcoin spot ETFs has brought institutional investment into a compliant phase. Pension funds, asset management companies, and family offices are no longer merely observing but are actively seeking crypto assets for long-term allocation. RWA tokenization thus becomes an ideal connecting point: familiar underlying assets are given on-chain settlement efficiency and liquidity, providing a secure entry channel for traditional funds.

Technological evolution has also reached a critical juncture. The integration of AI and blockchain is moving from slogans to reality. Breakthroughs in large-scale language models have enabled artificial intelligence to understand and execute complex logic, moving beyond being merely passive tools to directly read smart contracts, analyze on-chain data, and automate operations. This is ushering in a new round of restructuring for the infrastructure of payments, identity, and data interaction, and the emergence of the X402 protocol is the harbinger of this technological revolution.

The regulatory environment is maturing simultaneously. The US passed the stablecoin bill, the EU's MiCA was officially implemented, and Singapore and Switzerland are also improving their digital asset licensing systems, creating greater growth potential for the compliant ecosystem. For platforms with a long-term perspective, this means a more robust development path. Ju.com has already positioned itself in this direction, giving it clearer boundaries and standards in selecting and supporting projects.

Multiple factors combined are driving the market into a new accumulation phase. The end of 2025 to the beginning of 2026 may mark the start of the next growth cycle. Platforms that can deepen their research, build a portfolio of high-quality projects, and establish a professional reputation now will be the first to benefit when market sentiment recovers.

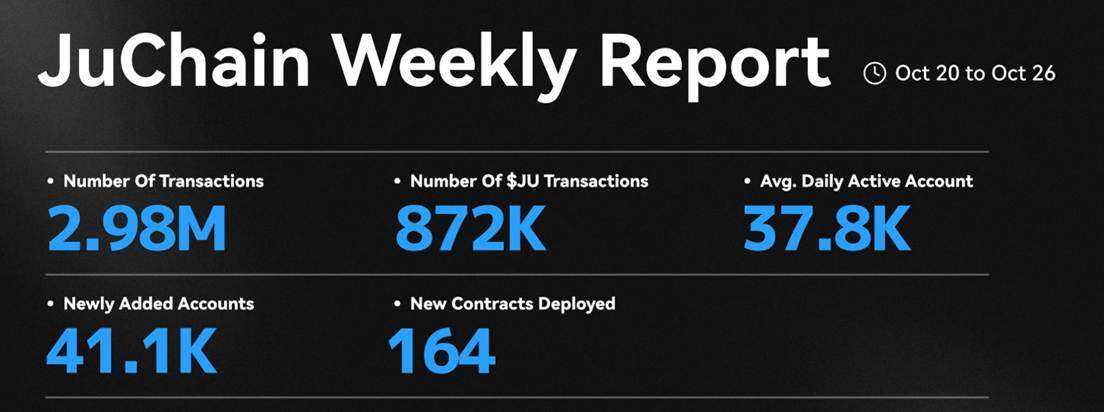

Correspondingly, on-chain data provides a clear echo. From October 20th to 26th, JuChain recorded 2.98 million transactions, 37,800 daily active accounts, 41,100 new accounts, and 164 new contract deployments; $JU's weekly transaction volume reached 872,000 transactions. These figures confirm that a positive cycle is forming on Ju.com, from content output to listing strategies, and from user growth to on-chain activity.

Practical advice for investors: How to leverage the Ju.com ecosystem

For investors, Ju.com's value lies not only in providing a trading platform, but also in building a complete ecosystem from information to decision-making. In a market with extremely fragmented information, the ability to access authentic, timely, and verifiable research often determines the upper limit of investment results.

Space is a window into understanding market rhythm. The analytical frameworks used by the panelists in the discussions are more valuable than any immediate buy recommendations. By observing how they break down macro trends, assess innovative logic, and identify potential risks, investors can build their own thinking models and maintain sound judgment in rapidly changing market conditions.

Research reports are a core asset of the Ju.com ecosystem. These reports are research-driven, focusing on logic, data, and risk, rather than marketing narratives. The "Uncertainty" section, in particular, often includes the team's assessment of the project's true state. When a report states that "protocol innovation does not necessarily equal token value," it reflects real industry experience, not a formal disclaimer. Reading these sections is an important step in developing a mature investment mindset.

The Selected Trading Zone serves as a bridge between research and execution. Each selected project undergoes multi-dimensional evaluation, which does not guarantee a short-term price increase, but rather indicates a relatively clear risk-reward structure. For investors who want to save screening time, this mechanism acts as a pre-screened project pool, helping them focus on higher-quality sectors and make their own judgments.

In position management, rational allocation remains the core of long-term returns. Market volatility is high, and over-concentration often leads to emotional decision-making. Maintaining a core portfolio of stable assets, using a portion for medium-risk projects, and allocating a small percentage to innovative themes is a more balanced approach. Stop-loss and take-profit levels should be set for every trade upon entry; adhering to discipline is more important than predicting direction.

Risk identification and review are the dividing line for professional investors. Frequent team changes, a sharp drop in community activity, or repeated roadmap delays often indicate underlying problems. Timely reduction of positions and post-trade reviews allow judgment to continuously iterate in practice. Every trade should become a learning example, not just an isolated record of profit and loss.

Ju.com provides tools and a framework of understanding, not predetermined outcomes. Market risks cannot be avoided, but rationality and methodology can be accumulated. A transparent, research-driven, and compliant ecosystem enables investors to identify trends earlier, assess risks, and remain clear-headed during market cycle transitions. This is precisely the long-term value Ju.com hopes to deliver: making alpha discovery a learnable and replicable skill.

Looking ahead to 2026: Ju.com's strategic priorities and market opportunities

From this week's discussions on Space and the series of research reports from Ju.com, the market landscape for 2026 is gradually becoming clearer. Several directions have reached a consensus: the accelerated implementation of RWA tokenization, the formation of the AI Agent economy, the rise of yield-generating stablecoins, and the long-term potential of zero-knowledge proof technology.

Stablecoin innovation is giving rise to a new landscape. Traditional stablecoins offer stability but lack returns; the next generation of yield-generating stablecoins, by holding low-risk assets (such as government bonds and money market funds), achieves annualized returns of 3-5%, and is becoming the new underlying infrastructure of DeFi. Ju.com will closely monitor global regulatory developments and, within the bounds of legality and compliance, provide users with stablecoin products that combine yield and security.

Zero-knowledge proofs and other native cryptographic technologies are key directions for blockchain privacy and scalability. ZK can achieve efficient verification while protecting privacy, which has profound implications for transaction privacy, identity authentication, and data security. Ju.com will continue to monitor this development and reserve space for ZK projects with clear application scenarios and feasible technical routes.

At the strategic level, Ju.com's positioning is becoming increasingly clear. The platform adheres to a "boutique buyer" approach, rather than pursuing a large number of listed tokens. Rather than becoming a token supermarket, it aims to create a curated pool of high-quality projects. The core value of Ju's curated trading zone lies in quality and certainty—preferring to list only a small number of projects each month, ensuring that each asset can withstand professional evaluation.

Furthermore, Ju.com chooses to cultivate its core user base rather than pursuing superficial scale. Its target users are traders with research capabilities and a forward-thinking mindset; they are aware of new technologies and understand risk management. Building reputation and trust through consistently serving these users is more valuable in the long run than blindly expanding.

Conclusion: Choice is more important than effort.

As 2025 draws to a close, the market is at a critical juncture. Traditional assets are hitting new highs, while the crypto market is still searching for a new narrative. Institutional funds continue to flow in, but are concentrated in a few sectors, and projects with true long-term value remain scarce.

For investors, the quality of the platform and information sources they choose often determines whether they can weather market shifts. Ju.com doesn't promise guaranteed profits or create illusions; instead, it provides a more reliable system: pathways to information acquisition, a framework for research and analysis, and a risk screening mechanism. This ability to anticipate market changes is the true core competitiveness of a professional platform. It stems from an understanding of market cycles, a sensitivity to technology, and a balance between risk and return. Ju.com cannot guarantee profitability on every trade, but it ensures that users access verified projects, obtain information from the forefront of the industry, and enter the market ahead of popular consensus.

In an era where Alpha is scarce, this foresight and judgment are themselves the greatest Alpha. No one can predict the market's trajectory in 2026, but one thing is certain: true advantages are accumulating right now. Ju.com is redefining what assets truly deserve to be called Alpha through research, careful selection, and practical application.

- 核心观点:Ju.com通过系统化布局捕捉早期Alpha机会。

- 关键要素:

- 发布X402与ERC-8004深度研报。

- 举办Twitter Space探讨市场趋势。

- 上线精选交易区筛选优质项目。

- 市场影响:推动行业从投机转向价值发现。

- 时效性标注:中期影响。