x402 In-Depth Research Report: The Restructuring of the Internet Payment Paradigm and Investment Implications

- 核心观点:x402协议激活HTTP 402,构建互联网原生支付层。

- 关键要素:

- HTTP原生兼容,一行代码集成。

- 区块链与稳定币实现秒级结算。

- 专为AI代理微支付设计。

- 市场影响:推动微支付普及,重构互联网商业模式。

- 时效性标注:长期影响

I. Project Background and Overview

Since the rise of the internet in the 1990s, the HTTP protocol has been the cornerstone of information transmission. It defines how browsers and servers communicate and has shaped internet usage habits. However, in the HTTP/1.1 standard, there is a long-neglected status code—402 "Payment Required." This should have been the gateway to native internet payments, but it has never been widely activated in the past three decades. The reason behind this is not that the demand did not exist, but rather that there was a lack of technology and ecosystem conditions in the early stages: while solutions such as credit cards and PayPal promoted the popularization of electronic payments, they all relied on additional account systems, complex integration processes, and high cost structures, making it difficult to truly integrate into the semantics of HTTP. The result of this deficiency is that the internet business model has moved towards a path dominated by "free + advertising." Users are accustomed to "zero direct payment," while businesses rely on advertising monetization or subscription models to maintain operations. Although this model has played an indispensable role in driving the rapid growth of the internet, its negative effects have also become increasingly apparent: user privacy has been excessively collected and exploited, the income structure of content creators is unreasonable, and advertising oligopolies have monopolized traffic entry points. It can be said that the lack of a native payment layer on the internet directly shaped the business ecosystem of the Web2 era.

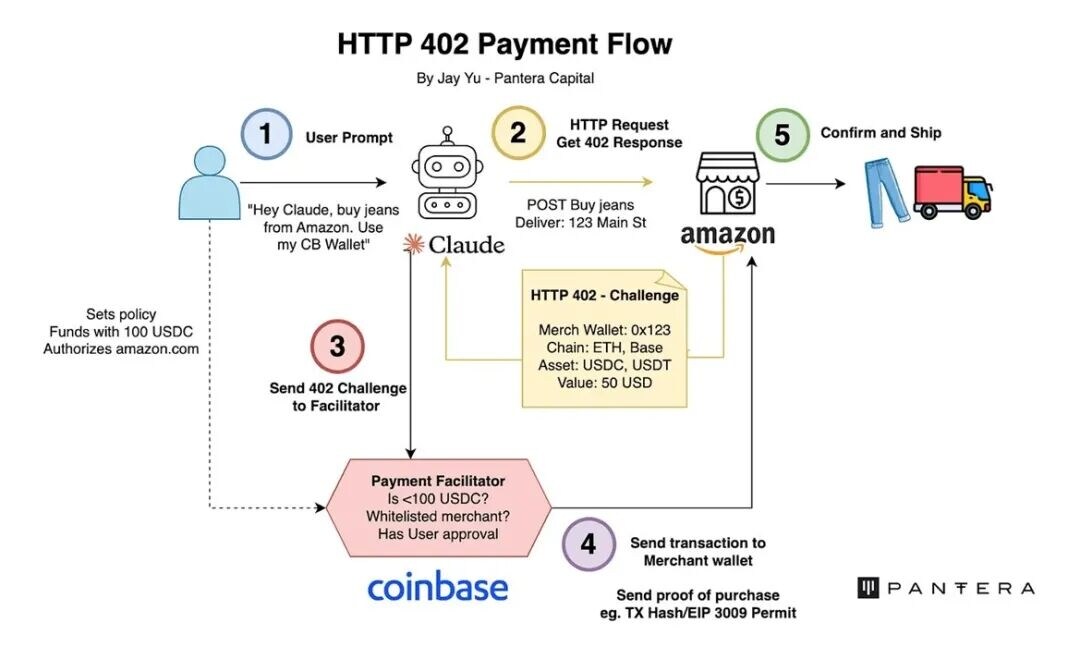

In September 2025, Coinbase and Cloudflare jointly proposed the x402 protocol, aiming to truly activate the 402 status code and create a native payment layer for the internet. Its concept is not simply "making HTTP chargeable," but rather leveraging Web3 technologies such as blockchain, stablecoins, and smart contracts to solve the core obstacle of early payments' difficulty in embedding into the internet. Coinbase provides the infrastructure for encrypted payments and a stablecoin ecosystem, while Cloudflare utilizes its global CDN and edge computing capabilities to embed the protocol into the existing network stack, requiring almost no large-scale modification to the internet architecture. The core value of the x402 protocol can be summarized in three points: Payment as Settlement: Using blockchain and stablecoins, transactions are confirmed within seconds, eliminating the need for intermediary clearing. HTTP Native: Designed based on standard status codes, it is compatible with existing internet protocols and naturally embedded in the web environment. Extremely Simple Integration: Only "one line of code" is needed to enable payment functionality on websites or APIs, significantly lowering the integration threshold. Essentially, x402 is not a replacement for payment systems like Visa and PayPal, but rather fills the long-standing gap in the internet protocol layer's "value transfer module." Just as SMTP is to email and DNS is to domain name resolution, x402 aims to become the "payment protocol standard" of the information world. To understand the necessity of x402, we need to return to the fundamental limitations of current payment systems: High transaction fees: Credit cards and third-party payment institutions typically charge 2-3% fees, which can even exceed the transaction amount itself in micro-payment scenarios. Settlement delays: Fund transfers generally require T+1 or even longer cycles, putting significant pressure on merchants' cash flow. Cross-border barriers: The fragmentation of exchange rates, compliance, and regulatory systems makes cross-border small-amount payments almost impossible. Insufficient programmability: Traditional payment systems are not designed for automation and struggle to support condition-triggered or machine-to-machine payments without human intervention. These pain points were tolerable in the Web2 era because the main business models relied on advertising and subscriptions. However, in the AI economy era, micro-payments and automated payments will become core demands, which traditional systems can no longer meet.

The launch of x402 is closely related to the rise of AI agents. AI agents, capable of autonomously completing tasks, invoking services, and making payment decisions, are gradually becoming important economic players on the internet. Gartner predicts that by 2030, machine clients will influence over $30 trillion in global transactions. Research from the World Economic Forum also indicates that the AI agent market will grow from $7.84 billion in 2025 to $50.3 billion in 2030, a compound annual growth rate of 45%. The operational logic of AI agents dictates that payment systems must meet the following conditions: High frequency, small amounts: Each API call and data read may only involve transactions in the range of $0.001–$0.01. Full automation: The payment process requires no human intervention and must be fully programmable. 24/7 operation: Uninterrupted machine transactions require extremely high system stability. Cross-border universality: AI agents are not geographically limited, requiring a globally unified value settlement layer. Traditional payment networks are almost completely ineffective in these aspects, and x402 is designed precisely to meet these new demands. It can be said that the AI economy is the true historical mission of the 402 protocol. Over the past few years, the maturity of several key technologies has collectively created the conditions for the implementation of x402: Stablecoins: USDC, USDT, and others provide a stable value anchor for micropayments, eliminating concerns about cryptocurrency volatility. Layer 2 scaling: Networks like Base and Polygon have significantly reduced gas fees, making payments at the $0.001 level possible. Account abstraction and smart contract wallets: These bring the blockchain payment experience close to Web2 levels, supporting access control, multi-signature, and transaction limits. Widespread edge computing: Vendors like Cloudflare can accelerate verification and payment confirmation globally, reducing latency. The combination of these conditions has finally brought the "402, dormant for 30 years," into its optimal window for activation. Under the x402 system, payment and HTTP requests form a standardized closed loop: Client accesses resource → Server returns a 402 status code, along with the payment amount, receiving address, and currency requirements. Client wallet automatically generates a payment transaction and submits it to the blockchain. Payment confirmation → Client re-requests the resource with proof of payment. Server verifies payment → Returns the original content. This "payment-as-access" experience makes micropayments as natural as browsing the web, with users experiencing virtually no complexity. The greatest strategic significance of the x402 protocol lies in the fact that it is not a closed solution from any single company, but an open standard. Coinbase and Cloudflare chose to open-source it and promoted the establishment of a foundation for governance, avoiding control by a single company. This means: Any service provider can integrate it without barriers; the protocol layer is independent of specific business models and does not directly compete with ecosystem applications; and it complements, rather than replaces, giants like Visa, Google, and Anthropic. This positioning enhances the acceptability of x402, making it more like internet infrastructure than a proprietary product of a single company.

Looking back at the development of the internet over the past thirty years, payment has always been a missing link. The 402 status code is like an "unfinished puzzle piece," abandoned due to technological limitations and locked-in business paths. Now, with the rise of blockchain, stablecoins, and AI agents, this puzzle piece finally has a chance to be filled. The launch of the x402 protocol is not just a technological upgrade, but may well be a profound reconstruction of the internet business paradigm:

From advertising-driven to value-driven; from account system to protocol-native; from person-to-person payment to machine-to-machine payment. All of this is precisely the core message revealed in the "Project Background and Overview" section: x402 is not simply a payment tool, but a piece of the puzzle in the history of the internet that has been delayed for thirty years, finally having the opportunity to be realized in 2025.

II. Ecological Development and Market Outlook

The x402 protocol is not merely the release of a technical specification, but a recombination of a multi-party ecosystem. Following its release, both Coinbase and Cloudflare emphasized that x402 is not a proprietary protocol of a single company, but rather an "internet-native payment layer standard." This openness positioned it from the outset as the core of an ecosystem, rather than an isolated product. Ecosystem building around x402 is primarily focused on infrastructure, platform applications, partner integration, developer communities, and market education, exhibiting a bottom-up network effect growth model. In other words, the market prospects and ecosystem expansion of x402 are not a single breakthrough, but rather the combined force of multiple links.

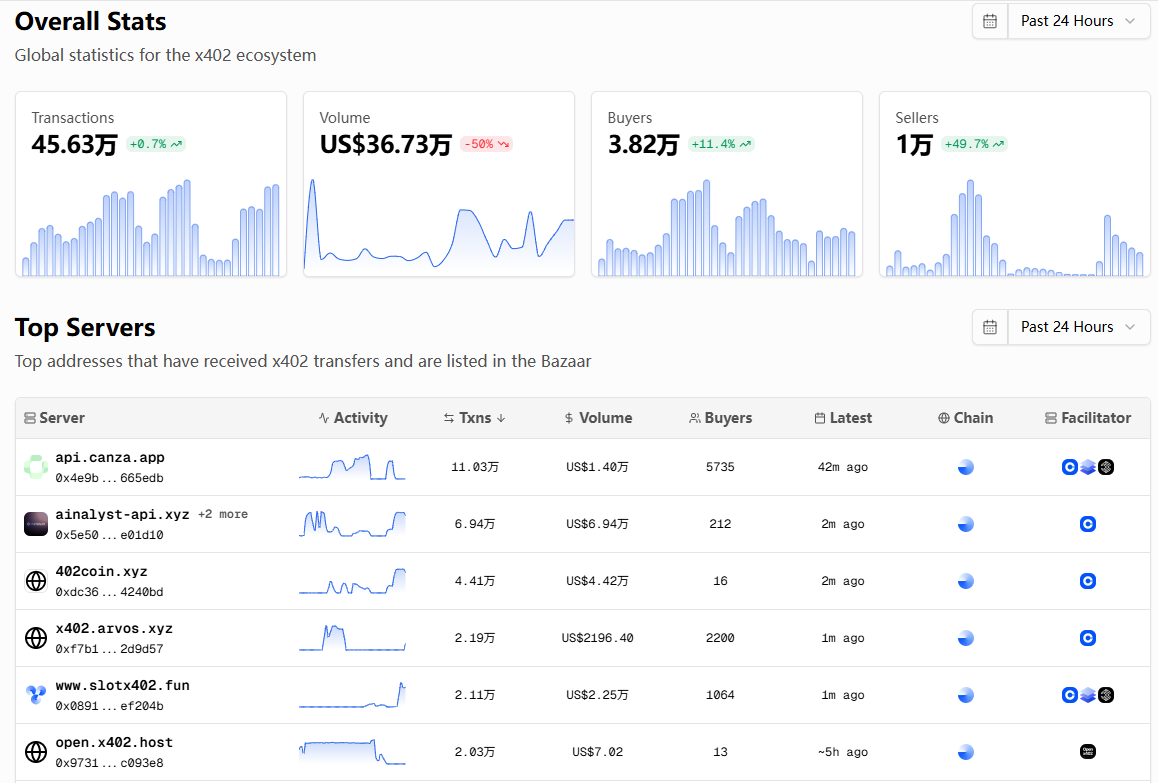

At the infrastructure level, the x402 protocol has chosen the simplest entry point: deep compatibility with HTTP via the 402 status code, allowing developers to enable payment functionality for websites or APIs with just "one line of code." This minimalist integration logic not only lowers the barrier to entry for small and medium-sized developers but also prevents large platforms from incurring huge migration costs during the exploration phase. The middleware, client libraries, and multi-chain adapters provided by Coinbase and Cloudflare further reduce development and maintenance costs. In particular, the existence of multi-chain adapters allows service providers to choose the optimal blockchain execution environment based on their specific scenarios. For example, they can use Polygon for low-cost, high-concurrency requirements, the Ethereum mainnet for high-security scenarios, or achieve deep integration with the exchange system on Coinbase's own Base chain. This flexibility greatly enhances the protocol's universality, thereby increasing its likelihood of becoming a de facto standard. At the platform level, Coinbase's x402 Bazaar is the earliest application scenario with a nascent ecosystem. This marketplace platform for AI agents and developers allows service providers to list their APIs, data sources, or functional modules, which users or AI agents can then call upon as needed and make instant payments via the x402 protocol. Its value lies in solving the long-standing billing and integration challenges in the API economy. Previously, API monetization often required complex registration, subscription, and monthly billing processes. However, in the x402 Bazaar environment, payment is instantaneous, and settlement is immediate; the micro-payment feature makes pay-per-use a reality. For AI agents, this means they can autonomously and flexibly access various services on the market without relying on manual human authorization or credit card binding. This market mechanism aligns perfectly with the autonomy of AI agents, presenting a highly promising growth point for Coinbase and Cloudflare. If x402 Bazaar can accumulate sufficient supply and demand, it could very well evolve into the "App Store of the AI agent economy."

Cloudflare's involvement brings another layer of explosive growth to the protocol. As one of the world's largest CDN and cybersecurity service providers, Cloudflare controls over 20% of internet traffic entry points, and its Workers edge computing platform has become a tool for millions of developers to deploy lightweight services. Embedding x402 payment functionality into Cloudflare Workers means that countless small and medium-sized websites, APIs, and services can quickly integrate payment functionality with zero modification costs. This "frictionless deployment" allows the protocol to rapidly spread to the long-tail developer community, and long-tail applications are precisely the most vibrant scenario for the micropayment model. Whether it's unlocking articles on independent blogs or making a single call to a niche tool, payment capabilities can be obtained with the support of Cloudflare's distribution capabilities. This strategy contrasts sharply with traditional payment gateways, which typically target medium and large enterprises and require complex integration, while x402 takes the opposite approach, breaking through from the long tail and developer communities first, and then gradually feeding back into the mainstream commercial system. More importantly, x402 does not limit itself to the native crypto ecosystem, but actively achieves interoperability with traditional payment systems. The addition of Visa provides a key bridge for the entire ecosystem. By interoperating with Visa's TAP protocol, x402 achieves compatibility between stablecoin payments and traditional credit card networks. This bridging design is strategically significant, avoiding direct competition with traditional payment networks while providing users and businesses with a dual-track option: in familiar scenarios, they can still use credit cards for payments, while in new scenarios such as machine-to-machine and cross-border micropayments, they can complete transactions with stablecoins through the x402 protocol. This gradual transition reduces the difficulty of market education, allowing traditional businesses and consumers to accept the new protocol with less psychological and technical costs. In other words, Visa's involvement makes x402 not just a Web3 experiment, but a pathway into the mainstream financial system.

The participation of tech giants like Google, AWS, and Anthropic in the partner matrix is equally noteworthy. Google's AP2 (Agent Payments Protocol) was originally designed as a unified payment framework for AI agents, supporting various traditional payment methods. Its integration with x402 adds the dimensions of stablecoins and on-chain payments. In Google's demonstration, users only need to issue a prompt, and the AI agent, supported by AP2 and x402 extensions, can complete a series of actions, including research, inventory confirmation, payment, and settlement. This experience showcases a typical "end-to-end automated transaction" process in the AI agent era, with x402 serving as the underlying payment layer. Anthropic's involvement demonstrates the urgent need for such payment standards among AI companies. AI assistants like Claude will need to interact with numerous third-party services in the future, and automated payments are an indispensable part. Without standards like x402, AI assistants will find it difficult to operate fully autonomously in a commercial context. Ecosystem building not only relies on the promotion of large enterprises, but the role of the open-source community is equally crucial. The x402 protocol chose the open-source path from the beginning, adopting the Apache-2.0 license and releasing its code on GitHub. In just a few months, the protocol has garnered over 1,600 stars, with developers contributing SDKs in multiple languages, visual configuration tools, and sample applications. These community tools have further lowered the barrier to entry for ordinary developers, driving the self-expansion of the ecosystem. Engineers from Coinbase and Cloudflare actively participate in community discussions, responding to feedback and regularly releasing improved versions. This open model is highly similar to the IETF standards development process in the early days of the internet, indicating that x402 may be on the path to true standardization.

From a market size perspective, x402 sits at the intersection of two high-growth markets: global digital payments and the AI agent economy. The global digital payments market exceeded $10 trillion by 2025, while the AI agent market is projected to reach $50 billion by 2030, with a CAGR exceeding 40%. This means x402 not only has the potential to penetrate the existing massive payments market but also to play an infrastructure role in the emerging machine economy. API economics and digital content micropayments are the most direct application scenarios. The global API management market is projected to reach $6.18 billion by 2027, while paid content is experiencing a new wave of growth due to limitations in advertising models. Traditional subscription models somewhat restrict user experience, as users may only want to pay for a single article, a single piece of music, or a single tool call. The x402 protocol's micropayment capabilities make this "deconstruction of subscriptions" possible, thereby driving more diversified business models. In terms of the competitive landscape, the x402 protocol is not without rivals. Micropayment solutions within the Bitcoin ecosystem, such as Lightning Network, already exist, and some decentralized applications also offer token-driven payment mechanisms. However, their limitation lies in their failure to integrate with the internet protocol layer, creating natural barriers to integration with HTTP, browsers, and APIs. While traditional payment networks are robust, they lack advantages in micropayments, low cross-border fees, and automation. x402, with its HTTP-native, simplified access, and cross-chain compatibility, has established a differentiated positioning. It does not directly compete with any single payment system, but rather provides a common "interface" for all parties through protocol standardization. This positioning makes it easier to gain support from multiple parties, thereby forming a broad alliance ecosystem.

In summary, the x402 protocol's ecosystem development has already demonstrated early vitality: from Coinbase Bazaar to Cloudflare Workers, and the collaboration between Visa TAP and Google AP2; from the active open-source community to the improvement of developer tools; from micro-payment scenarios in long-tail applications to the autonomous transaction needs of AI agents—all of this collectively outlines a vast potential market space. While the market outlook remains uncertain, particularly regarding regulatory and large-scale adoption challenges, the overall direction is quite clear: x402 is becoming a key interface for the integration of the AI economy and internet payments. If the first part emphasized the historical background and technological inevitability of the x402 protocol's emergence, then this section on ecosystem development and market outlook reveals the potential chain reactions and reshaping of the business landscape it may trigger. The future of the protocol depends not only on technological maturity but also on whether the ecosystem can form a positive feedback loop. Once the network effect is established, its diffusion speed will far exceed the path of traditional payment innovation.

III. Investment Potential and Risks

While the x402 protocol has demonstrated sufficient promise and practical application logic at the technological and ecosystem levels, the most crucial perspective for investors remains assessing its potential value and risks. This involves not only its network effect potential as a protocol standard, but also the commercial value unleashed by applications, platforms, and services built around the protocol, and, more importantly, the challenges it may face in the coming years across multiple dimensions, including technology, regulation, and market acceptance. In other words, investors need to establish reasonable expectations between macro narratives and micro indicators to grasp the strategic opportunities inherent in the x402 protocol.

First, from a potential perspective, the greatest value of x402 lies in its "protocol-layer network effect." Throughout internet history, every successful underlying protocol has become long-term infrastructure, possessing investment value that transcends economic cycles. For example, TCP/IP laid the foundation for the entire internet's communication framework, SSL/TLS became the de facto standard for secure communication, and SMTP propelled the widespread adoption of email. Once established, they are extremely difficult to replace and can bring long-term benefits to the industries built upon them. If the x402 protocol can become the standard for "payment as HTTP," its value lies not in the profitability of a single application, but in the reinvention of the entire internet business model. Once widely adopted, the x402 protocol could provide payment capabilities for millions of websites, billions of devices, and countless AI agents, continuously strengthening the network effect and ultimately forming a path dependency on the de facto standard. Once this standard dividend emerges, its value is difficult to measure using traditional valuation methods because it involves a fundamental restructuring of the entire industrial ecosystem. Second, from an ecosystem investment perspective, multiple levels of business opportunities may arise around the x402 protocol. The most fundamental layer consists of protocol-related infrastructure services, such as payment gateways, authentication services, multi-chain adapters, and exchange rate services. These belong to the "protocol tool layer," similar to products like routers, firewalls, and load balancers that emerged around TCP/IP. This layer is typically the first to see commercialization because it provides the necessary support for protocol operation, which users and developers cannot bypass. Above this layer are platform applications, such as Coinbase's x402 Bazaar and Cloudflare's Workers integration, which may become the first scenarios to achieve large-scale revenue. Further up are new business models derived from the protocol, such as AI agents calling third-party services on demand, content creators directly benefiting through micropayments, and machine payments between IoT devices. Once these models are validated by the market, they may generate long-term, stable cash flow. Investors should focus on these different layers of ecosystem opportunities when evaluating their investments, betting on both the steady growth of the underlying infrastructure and capturing the high-elasticity returns of the application layer.

However, all potential must be weighed against risk. The primary risk facing the x402 protocol is its technical scalability. In theory, Layer 2 blockchains and state channels can achieve low-cost, high-concurrency transactions, but in practice, when AI agents emerge on a large scale, payment systems may need to handle hundreds of thousands or even millions of microtransactions per second. This pressure may exceed the capacity of existing public chains and Layer 2 blockchains, leading to transaction congestion, increased fees, and a degraded user experience. If the scalability issue cannot be resolved, x402's micropayment advantage will be weakened, and it may even be surpassed by alternatives. Therefore, investors need to continuously monitor the protocol's performance in real-world environments, including key metrics such as average confirmation time, failure rate, fee curve, and multi-chain load distribution. The second risk dimension is regulatory uncertainty. While stablecoins have gradually been accepted by the mainstream financial system, their compliance status varies greatly across different countries. In the United States, stablecoins are under intense scrutiny from Congress and regulatory agencies, involving multiple requirements such as Anti-Money Laundering (AML), Know Your Customer (KYC), and payment licensing. In Europe, while frameworks like MiCA offer some compliance pathways, operational details are still evolving. In emerging markets, stablecoin payments may even be seen as a threat to monetary sovereignty and subject to restrictions. The x402 protocol's "accountless, direct payment" model, while offering an excellent user experience, may conflict with the identity verification and AML requirements emphasized by regulators. Once regulations tighten in major markets, the protocol's adoption rate could be severely impacted. Therefore, regulatory uncertainty is a core external risk affecting its commercialization process. Market acceptance uncertainty is equally significant. While the demand for micropayments and AI-assisted payments is logically clear, user and business habits often exhibit path dependence. Most internet users are accustomed to subscription and advertising-subsidized models; whether they are willing to switch to "pay-per-use" still requires market education.

Furthermore, security risks are a crucial factor to consider. As a payment protocol, vulnerabilities in x402 could lead to large-scale financial losses or a systemic crisis of trust. Although the protocol incorporates mechanisms such as anti-tampering, anti-replay attack, and minimal information leakage, it still faces challenges such as hacker attacks, smart contract vulnerabilities, and wallet security issues. Historical experience shows that any protocol involving fund flows must undergo long-term security verification and iteration to gradually gain market trust. Investors should pay attention to whether the protocol has experienced any major security incidents in actual operation, as well as the foundation and development team's investment and performance in security audits and emergency response. In terms of competition, while the x402 protocol possesses unique advantages such as HTTP native support and cross-chain compatibility, it is not without alternative threats. Lightning Network, micropayment solutions on Rollup, and the proprietary payment systems of large internet companies (such as Apple Pay and Google Pay) may provide alternative solutions in certain scenarios. It is particularly noteworthy that if traditional payment networks rapidly iterate, launch low-fee, programmable micropayment tools, and quickly popularize them through their existing large user base, x402's differentiated advantages may be partially weakened. Therefore, investors need to dynamically observe competitors' actions and assess the sustainability of x402's differentiation. Despite the numerous risks, the investment value of the x402 protocol lies in the "paradigm shift dividend" it represents. Just as cloud computing, despite facing security and compliance concerns in its early stages, ultimately became the inevitable choice for IT infrastructure, the demand for an internet-native payment layer is almost irreversible. If x402 can establish a standard first and gain multi-party endorsements through open source and foundation models, its long-term value will not lie in short-term profits, but in its strategic position as the "underlying standard of the digital economy." For venture capital firms, this means that early investments in related ecosystem companies may yield excess returns; for traditional financial institutions, participating in standard setting and ecosystem building can ensure a proactive position in the AI agent economy; for industrial capital, building application scenarios around x402 may bring entirely new growth curves.

Investors should pay attention to several core indicators to judge the progress of the protocol in practice: First, adoption rate, including GitHub developer activity, SDK downloads, Cloudflare Workers integrations, and the number of websites and APIs connected; second, transaction indicators, including daily transaction volume, average order value, confirmation time, and failure rate; third, ecosystem indicators, including active supply and demand on Bazaar, and integration with mainstream AI platforms and content platforms; and fourth, compliance indicators, including the legal status of stablecoins, KYC/AML compliance schemes in various jurisdictions, and communication between the foundation and regulatory agencies. These indicators together constitute key signals of whether the protocol can cross the "early experimentation-mainstream adoption" gap. Overall, the investment potential of the x402 protocol lies in its potential to become the de facto standard for internet payments, empowering the AI agent economy and micropayment models, and driving the restructuring of internet business models. However, at the same time, it also faces multiple risks, including technology, regulation, market acceptance, and competition. For investors, the key is to correctly understand the relationship between its long-term logic and short-term fluctuations, recognizing both the potential standardization benefits and being prepared to cope with the challenges brought by uncertainty. Only those investors who can participate early, continuously track the market, and flexibly adjust their strategies can truly capture the maximum value from this potential payment revolution.

IV. Conclusion

The x402 protocol is not only a technological innovation but also a structural reshaping of the internet payment system. By reactivating the HTTP 402 status code, which had been dormant for thirty years, it embeds payments into the internet's foundational protocol layer, thus opening up a path for value transfer beyond information transmission. Leveraging blockchain, stablecoins, and Layer 2 scaling solutions, x402 achieves the characteristics of "payment as settlement," "extremely simple access," and "chain independence," providing much-needed underlying capabilities for AI agent economies and micropayment scenarios. The joint efforts of Coinbase and Cloudflare, along with the participation of giants like Visa, Google, and Anthropic, have endowed this protocol with cross-industry integration and standardization potential from its inception, while the positive response from the open-source community has injected vitality into long-tail innovation. However, risks cannot be ignored. Technical scalability still needs to be verified in real-world environments, regulatory uncertainty may slow global adoption, user and business payment habits need time to change, and competitors may emerge as substitutes in certain scenarios. In other words, for x402 to truly become mainstream, it still needs to go through three stages: "feasibility verification - large-scale adoption - de facto standardization". This process will be influenced by technological iteration, policy evolution, and market education.

From an investment perspective, the value of the x402 protocol lies not in its short-term revenue curve, but in the paradigm shift it may trigger: internet business models are poised to move from "advertising subsidies and subscription lock-in" to "micro-payments and instant value exchange," AI-assisted autonomous payments will drive the rise of the machine economy, and the global payment system may usher in a new unified interface. For businesses, early piloting and integration means gaining a head start in the future ecosystem; for investors, the multi-layered opportunities surrounding the protocol itself and its ecosystem deserve close attention. Therefore, it can be said that the x402 protocol is a key node in the development of the internet. It is both a product of technological maturity, demand catalysis, and ecosystem synergy, and the starting point of a leapfrog transformation. In the coming years, whether it can truly become the standard of the "internet-native payment layer" will determine whether it is a fleeting innovative experiment or the infrastructure for a new round of global business restructuring. Regardless of the final outcome, x402 has already illuminated a long-missing piece of the puzzle in the long history of the internet, opening up new possibilities for the future of value transfer.