Original author: Deep Tide TechFlow

On October 30, Nvidia's market capitalization surpassed $5 trillion, exceeding the annual GDP of developed countries such as Japan and Germany.

From its initial public offering price of $12 in 1999, Nvidia has generated over 8,000 times its initial investment in 26 years, after accounting for the post-split valuation.

What makes Nvidia most enviable is that it is "not limited by cycles." As the underlying infrastructure, it continues to "collect taxes," and no matter what you do, you can't do without it.

As the creator of GPUs, NVIDIA seized the opportunity of the "PC wave" and entered millions of households along with the explosion of the gaming market.

Then, as the gaming business faltered, the crypto bull market arrived, and Nvidia graphics cards were widely used for mining cryptocurrencies such as Ethereum, making a fortune in silence.

Subsequently, with the rise of the intelligent vehicle industry, its automotive chip business also developed rapidly.

Finally, ChatGPT emerged out of nowhere, and Nvidia transformed itself into an AI arms dealer...

Looking back at Nvidia's growth history, it has also teetered on the brink of failure and bankruptcy time and time again. Huang (Jen-Hsun Huang) once shouted: "My will to live is greater than the will of almost everyone to kill me ."

Nvidia, the creator of GPUs

The invention of the graphics card (GPU) can be traced back to the 1990s.

At the time, some people in Silicon Valley proposed an idea: to reduce the workload of the central processing unit (CPU) by using specialized chips such as sound cards for handling sound and network cards for handling networking. Similarly, it would be logical to create a dedicated chip for computer image output, namely a graphics card. For example, Sony's PlayStation game console, released in late 1994, used a graphics card to process images.

However, at the time, there were many technological paths available for graphics cards. Nvidia's breakthrough lay in achieving 3D graphics acceleration through parallel computing, particularly for applications in gaming. Parallel computing involves breaking down a complex task into multiple smaller tasks and processing them simultaneously to improve computational efficiency .

In 1999, Nvidia launched a graphics card called GeForce. This graphics card was designed specifically for gaming, emphasizing "parallel computing," which significantly improved 3D graphics processing capabilities, thereby providing a smoother and more realistic gaming experience.

The success of GeForce enabled Nvidia to rise rapidly and become a leader in the graphics card industry.

At the time, Nvidia wasn't the only company researching graphics processing units, but it successfully associated itself deeply with the label of "inventor of the GPU."

Nvidia's then-head of marketing, Dan Vivoli, promoted the company's chips using the concept of "graphics processing unit" (GPU). He believed that by repeatedly emphasizing that Nvidia was the inventor of the GPU, it could become an industry leader.

And indeed, that's how it turned out. Nvidia became synonymous with GPUs, and by marketing GPUs, Nvidia carved out a new path for itself.

Nvidia, the big winner of the crypto bull market

Nvidia's market capitalization rose from $14 billion in 2016 to a high of $175 billion in 2018. This more than tenfold increase in two years may be inseparable from the cryptocurrency mining boom .

In 2017, the cryptocurrency market experienced a bull run, attracting a large number of miners to compete for GPUs. GPUs became money-printing machines, and global graphics card sales increased dramatically, with prices soaring.

Taking the NVIDIA GTX 1060 graphics card used by miners as an example, the purchase price before May 2017 was about 1,650 yuan per card, but it rose to about 2,900 yuan after June 2017.

Nvidia became a big winner behind the cryptocurrency bull market, reaping huge profits.

Benefiting from the cryptocurrency mining boom, Nvidia's revenue for fiscal year 2018 reached a new high of $9.7 billion. Jensen Huang stated, "Our GPUs support the world's largest distributed supercomputing, which is why they are so popular in the cryptocurrency space." In addition, Nvidia launched the GTX 1060 3GB, specifically designed for mining, as well as the P106 and P104 professional mining cards.

In 2020, after two years of bear market, the crypto market took off again, with Bitcoin rising more than 2 times and Ethereum rising 4 times. Nvidia once again became a beneficiary of the "crypto boom" .

Nvidia responded quickly and actively participated in the mining market, launching the CMP series of professional mining cards. These cards removed graphics processing functions and had lower core peak voltage and frequency to improve mining performance and efficiency.

At the end of 2020, NVIDIA released the RTX 30 series graphics cards. The entry-level RTX 3060 graphics card was priced at 2,499 yuan, and the RTX 3090 graphics card was priced at 11,999 yuan. However, with the rise of cryptocurrencies, the price of the RTX 3060 reached as high as 5,499 yuan, and the RTX 3090 soared to 20,000 yuan.

After the release of its Q1 2021 financial report, Nvidia CFO Colette Kress revealed that Nvidia's crypto chip sales reached $155 million, with graphics cards used for "mining" accounting for a quarter of total sales in the first quarter.

In 2021, Nvidia's annual revenue reached a record $26.91 billion, a 61% increase over the previous fiscal year, and its market capitalization once exceeded $800 billion. However, this success was short-lived. In September 2022, the Ethereum execution layer and proof-of-stake consensus layer were merged, and the Ethereum blockchain network mechanism changed from PoW (Proof-of-Work) to PoS (Proof-of-Stake), gradually bringing the era of GPU mining to an end.

This has also affected Nvidia's development to some extent. In the third quarter of 2022, Nvidia's revenue and net profit both declined. Quarterly revenue was only $5.931 billion, a year-on-year decrease of 17%, and net profit was only $680 million, a year-on-year decrease of as much as 72%. On November 23, 2022, Nvidia's stock price was $165 per share, nearly half of its highest point last year.

At the time, both overseas media outlets such as Financial Failure and domestic technology media were pessimistic about Nvidia .

Just when things seemed hopeless, the winds of AI and big data models began to blow, and Nvidia was once again in the spotlight.

Nvidia, the AI arms dealer

In March 2016, AlphaGo defeated Lee Sedol, which was a shock to many and sparked a heated discussion about AI.

A month later, at the GTC China conference, Jensen Huang officially announced that Nvidia would no longer be a semiconductor company, but an artificial intelligence computing company .

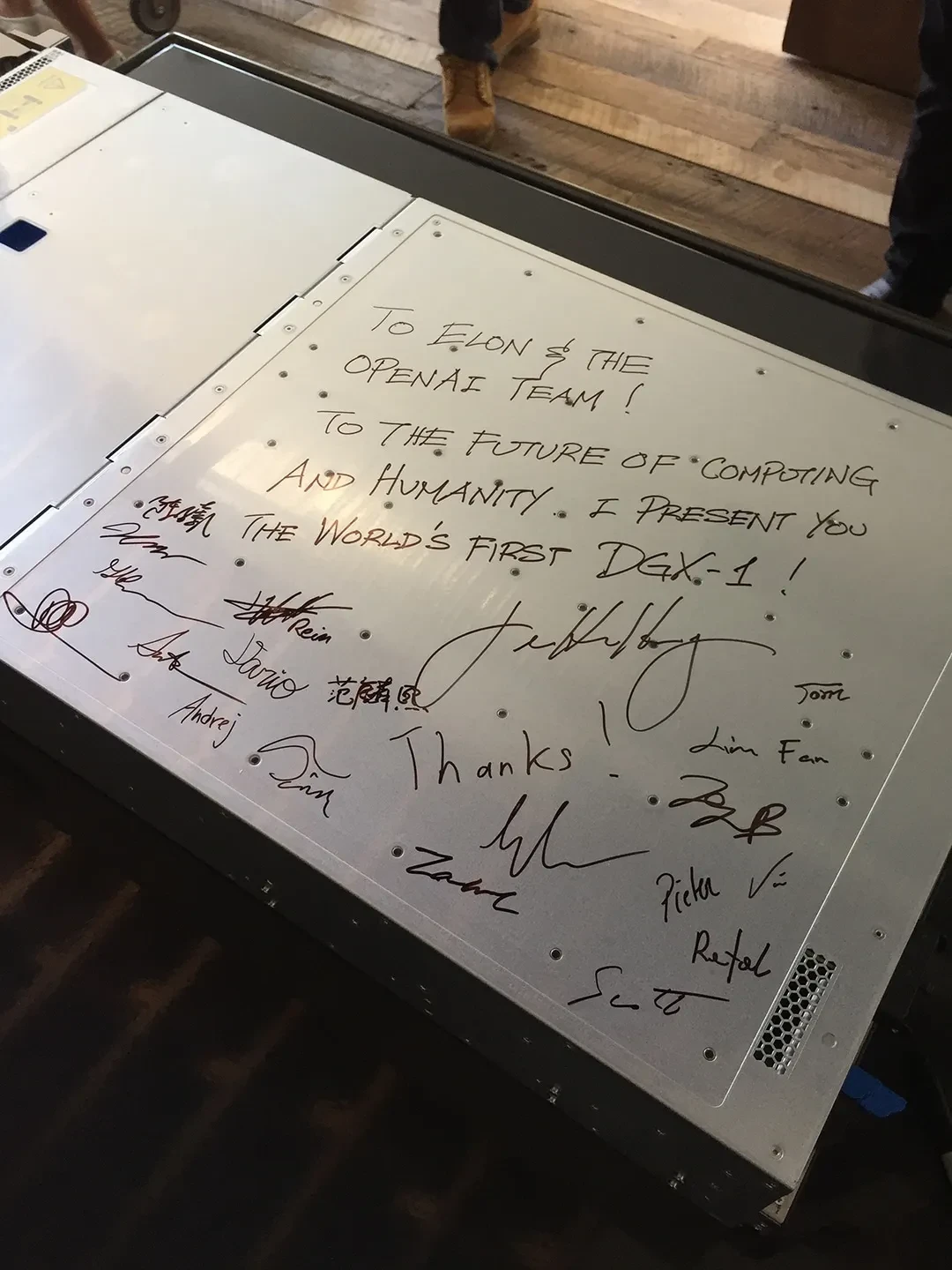

In August 2016, a historic moment occurred when NVIDIA donated its first AI supercomputer, DGX-1, to the newly established OpenAI. Jensen Huang personally delivered the computer to OpenAI's office , and then-chairman Elon Musk opened the package with a box cutter.

Jensen Huang left behind the words: "For the future of computing and humanity, I am donating the world's first DGX-1."

Subsequently, OpenAI trained the globally popular ChatGPT using NVIDIA's supercomputers, and NVIDIA's subsequent updated hardware product, DGX H100, was snapped up by the market and in short supply.

Rome wasn't built in a day, and Nvidia's dominance in the AI industry began with earlier accumulation.

David Kirk, Nvidia’s former chief scientist, has long dreamed of generalizing the 3D graphics rendering capabilities of GPUs, not just for the gaming industry.

Under the leadership of David Kirk and Jensen Huang, NVIDIA launched the revolutionary GPU unified computing platform CUDA in 2007, unleashing massive computing power.

At the time, CUDA failed to impress investors. Instead, due to the huge investment required to build a "supercomputing" system that was ahead of its time, Nvidia's profits were significantly reduced, drawing boos from Wall Street.

Ben Gilbert, host of the popular Silicon Valley podcast "Acquired," commented: " They weren't targeting a big market at the time, but an obscure corner of academic and scientific computing, yet they spent billions of dollars on it ."

External voices did not affect Jensen Huang. His more than ten years of dedication to CUDA has brought Nvidia to its current position.

Jensen Huang considers computing power to be the core. Whether it's AI, autonomous driving, the metaverse, robotics, or cryptocurrency, Nvidia is using its massive computing power to find new opportunities.

Computing power, Nvidia's eternal weapon.

Three failures

In 2023, Jensen Huang delivered a commencement address at National Taiwan University, where he shared three stories of failure to impart the secrets of NVIDIA's success to the university students.

The first failure brought them to the brink of bankruptcy.

In 1994, Nvidia’s first customer was the Japanese game company SEGA, for which they designed graphics cards for their game consoles.

However, the following year, Microsoft released Direct3D, the graphics interface for the Windows platform. This change greatly alarmed Nvidia because it conflicted with their design.

Ultimately, Nvidia chose to terminate its contract with SEGA and instead develop GPUs for the Windows platform. This was a risky decision, as SEGA was their only customer, which they had abandoned. Nvidia's funding only lasted for six months, and if they couldn't launch new products within that time, they risked bankruptcy.

Fortunately, just one month before bankruptcy and with funds running out, Nvidia designed and succeeded with the Riva 128 chip. By the end of 1997, Riva 128 shipments exceeded one million units, allowing Nvidia to survive.

The second failure, by forgoing short-term profits, paved the way for future greatness.

In 2007, NVIDIA launched the CUDA GPU Accelerated Computing initiative, with the vision of making CUDA a programming model that could enhance a wide range of applications, from scientific computing and physics simulations to image processing.

Creating a new computing model is extremely difficult. The CPU computing model has been the industry standard for 60 years since the introduction of IBM System 360.

CUDA requires developers to rewrite applications to demonstrate the benefits of GPUs; but to develop such programs, there must first be a large user base and a huge demand to drive developers to do so.

To solve the "chicken or the egg" problem, Nvidia leveraged its already large user base of GForce gaming graphics cards to build its customer base. However, the additional costs of CUDA were very high, causing Nvidia's profits to decline significantly over the years, and its market capitalization fluctuated around $1 billion.

Nvidia's lackluster performance over the years has led shareholders to be skeptical of CUDA. Shareholders would prefer the company to focus on improving profitability, but Nvidia has persevered, believing the time for accelerated computing is coming.

Jensen Huang founded a conference called GTC and tirelessly promoted CUDA globally. Eventually, his efforts paid off, and applications emerged, including CT reconstruction, molecular dynamics, particle physics, fluid dynamics, and image processing.

Until 2012, AI researchers discovered the potential of CUDA. Renowned AI expert Alex Krizhevsky trained AlexNet on a GForce GTX 580, triggering a major explosion in artificial intelligence.

After its third failure, Nvidia withdrew from the mobile chip market.

Do you remember Lei Jun and Huang Renxun appearing on the same stage?

In 2013, at Lei Jun's invitation, Huang Renxun attended the launch event for the Xiaomi Mi 3.

When Huang Renxun, who went to the United States at a young age, was asked by Lei Jun to speak Chinese, he didn't speak fluently, but he still confidently shouted in Chinese: " Nvidia's GPUs are the best in the world ."

At the time, the Xiaomi Mi 3 flagship version was equipped with a mobile version of the Tegra 4 processor launched by NVIDIA, which was also the swan song of the series.

At that time, the mobile phone market was booming, and Nvidia also entered the mobile chip market. Although the entire mobile phone market was very large, Nvidia could have fought for market share, but they made a difficult decision: to give up this market.

Jensen Huang stated that Nvidia's mission is to build computers that ordinary computers cannot, and they should dedicate themselves to realizing this vision and make unique contributions. Nvidia's strategic retreat has paid off.

Life advice: Experience hardship, lower your expectations.

In 2024, Jensen Huang returned to his alma mater, Stanford University, and gave a speech at the business school, sharing some of his life experiences.

When the host asked Jensen Huang if he had any advice for Stanford students about success, he replied, " I hope you all have the opportunity to experience a lot of pain and hardship ."

He mentioned that one of his greatest strengths is that "my expectations are very low."

Jensen Huang stated that most Stanford graduates have high expectations of themselves, and they absolutely deserve to have high expectations because they come from one of the best universities on Earth and are surrounded by equally incredible peers, so it is only natural for them to have high expectations.

" People who have very high expectations of themselves often have low resilience, " Huang said. " Unfortunately, resilience is crucial for success ."

Huang Renxun emphasized, " Success does not come from intelligence, but from character, and character is shaped through hardship. "

- 核心观点:英伟达通过持续技术创新穿越周期。

- 关键要素:

- GPU并行计算技术奠定基础。

- 加密挖矿潮带来巨额收益。

- CUDA平台提前布局AI算力。

- 市场影响:确立AI算力基础设施核心地位。

- 时效性标注:长期影响