The US-China talks have concluded, the Federal Reserve has cut interest rates again, but Bitcoin has fallen below $110,000: Where has market confidence gone?

- 核心观点:加密市场高波动震荡,机构与鲸鱼分歧加剧。

- 关键要素:

- BTC跌破11万,主流币24小时普跌。

- SOL现货ETF上市,资产净值4.32亿美元。

- 巨鲸空单占优,24小时爆仓8.13亿美元。

- 市场影响:短期波动风险上升,资金向高流动性资产集中。

- 时效性标注:短期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

The US-China talks concluded successfully on October 30, but the performance of the cryptocurrency market was less than ideal.

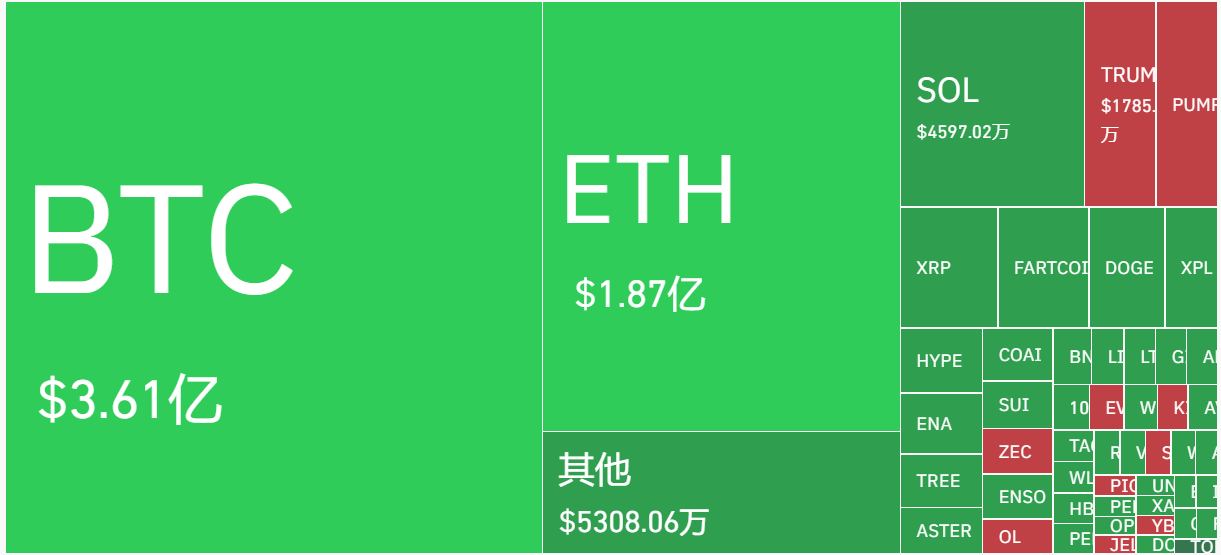

BTC price briefly dipped below $108,000, currently trading at $111,424, a 24-hour drop of 1.68%; ETH is currently trading at $3,941, a 24-hour drop of 1.9%; SOL is currently trading at $195.9 and BNB at $1,117, both of which have rebounded and recovered their losses.

From a trend perspective, SOL and BNB are still fluctuating within a relatively strong range. Meanwhile, Grayscale's Solara Trust ETF officially listed on the NYSE on October 29th , becoming the second Solara spot ETF listed in the US after Bitwise. According to SoSoValue data, the Solara spot ETF has a total net asset value of $432 million, a Solara net asset ratio (market capitalization as a percentage of total Solara market capitalization) of 0.40%, and a historical cumulative net inflow of $117 million.

In the derivatives market, total liquidations amounted to $813 million in the past 24 hours, including $613 million in long positions and $200 million in short positions. The largest single liquidation occurred in Bybit - BTCUSD, valued at $11 million. Recent market conditions have been characterized by high volatility and range-bound trading, a phenomenon referred to in the community as a "monkey market," which has caused significant losses to capital.

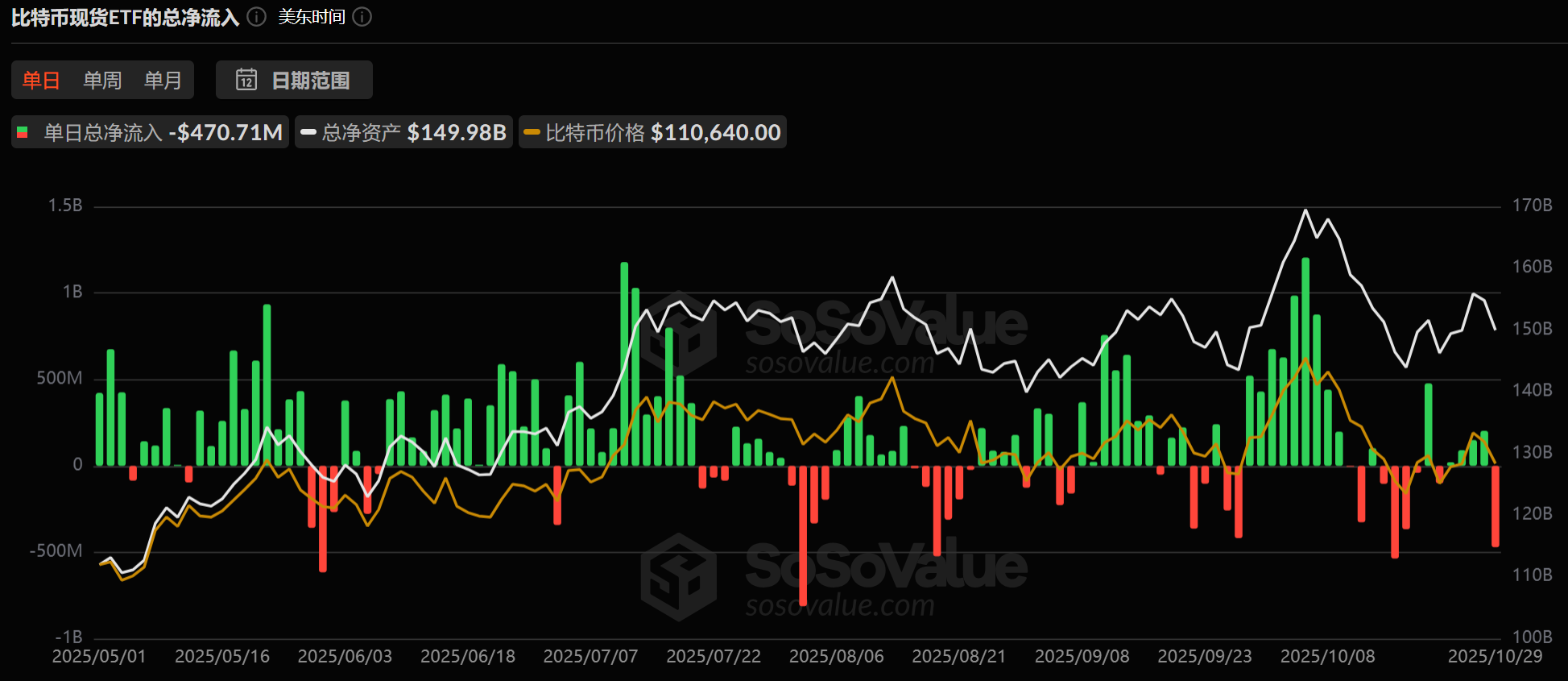

Regarding fund inflows, the BTC spot ETF ended its four-day streak of net inflows, experiencing a significant net outflow yesterday, reaching $470 million; the ETH spot ETF has been relatively weak recently, and although it also experienced a net outflow yesterday, the magnitude was relatively limited.

On a macro level, both major events have been settled today.

First, the Federal Reserve cut interest rates by 25 basis points as expected. The Fed lowered the benchmark interest rate to 3.75%-4.00%, marking its second consecutive rate cut at its meeting. Simultaneously, it announced the end of balance sheet reduction on December 1st, with all principal payments on agency debt and MBS being reinvested in short-term Treasury securities to maintain ample reserves and avoid a liquidity crisis.

Secondly, the talks between China and the US progressed smoothly. According to CCTV, during their meeting in Busan, the Chinese side emphasized that "China's development and revitalization are not contradictory to President Trump's goal of 'making America great again.' China and the US can absolutely achieve mutual success and common prosperity. China and the US should be partners and friends; this is a lesson from history and a necessity of reality. We are willing to continue working with President Trump to lay a solid foundation for China-US relations and create a favorable environment for the development of both our countries."

From this point onward, the market's focus shifted to whether there would be another interest rate cut in December . Federal Reserve Chairman Jerome Powell stated at a press conference that the government shutdown would temporarily drag down economic activity, and that data from before the shutdown indicated the economy was likely moving towards a more stable trajectory. A December rate cut was "not a certainty." This perfectly aligns with expectations given Powell's current stance—he is unlikely to make any promises in advance, especially given that the government shutdown had lasted for a month and severely impacted economic data releases.

However, according to market sources, after nearly a month of government shutdown, the situation seems to be finally starting to change. Senate Majority Leader John Thune and his Senate allies, House Speaker Mike Johnson and other House Republican leaders appear increasingly confident that more and more centrist Democrats are prepared to compromise on a temporary funding bill to mitigate the impact of the shutdown , possibly as early as next week .

Inflation Insights analyst Omair Sharif believes that if official economic data from October and November is still lacking at the December meeting, the Federal Reserve may choose to "pause" due to the data vacuum, potentially delaying the plan for a third consecutive rate cut. This is highly consistent with the internal divisions reflected in the September dot plot —the debate among officials regarding the pace of policy is intensifying.

Nomura Securities had previously predicted that the Federal Reserve would cut interest rates by another 25 basis points in December. Currently, the federal funds futures market's expectation of another rate cut before the end of the year has decreased from 91% to approximately 72%.

On-chain battle: Whales "vote with their feet"

With the Federal Reserve cutting interest rates by 25 basis points as expected and the uncertainty surrounding Powell's indication of a December rate cut, whales on Hyperliquid are also "voting with their feet."

HyperInsight monitoring data shows:

- Starting at midnight today, two addresses of "Abraxas Capital" (0x5b5 and 0xb83) simultaneously increased their short positions in BTC, SOL, and ETH. The total notional value of their positions increased from $690 million yesterday afternoon to $738 million.

- The new address "0x218" with a "100% win rate" has been continuously adding to its ETH short positions since yesterday, and its floating return rate has now reached 60%, with an average holding price of $4,128 and a notional value of approximately $28 million.

- "Calm Opening King" (0x926) has turned from loss to profit overall, with a floating return rate of 40% on BTC short positions, an average holding price of $112,200, and a total notional value of $78.6 million.

- The whale (0x5D2), which once held the largest short position in BTC (4 times), has now turned its $136 million short position into a profit, with an average holding price of $114,000. It has not yet taken any action this morning as the market has recovered.

The bulls were equally determined:

- The "100% win rate" insider whale (0xc2a) opened a long position in BTC at midnight yesterday during the market downturn and added to it against the trend, with an average entry price of $111,000. Its current notional value is $113 million. Furthermore, it opened another long position in ETH at 4 AM today and continued to add to it, with an average entry price of $3,889. Its current notional value is $5,274. The total notional value of this address's holdings reaches $277 million.

- A whale (0x082), suspected of being involved in HYPE's listing scandal, continuously increased its holdings of XPL and Hyperliquid ecosystem meme coin PURR during the market downturn at 0:00 today. The total notional value of the whale's holdings reached $59.48 million.

Overall, the position structure of on-chain whales remains bearish, with short-selling funds having a slight advantage.

Market Voice

Despite the high volatility, Bitcoin believer Michael Saylor made an optimistic prediction in an interview with CNBC, forecasting that Bitcoin's price would reach $150,000 by the end of the year and $1 million within the next 4 to 8 years.

Matrixport believes that Bitcoin's dominance has now rebounded to 59.5%, showing a gradual upward trend . The latest "mini altcoin season" has cooled down temporarily, with market preferences returning to Bitcoin. The increased dominance of BTC in this round of market activity may be related to increased institutional participation and the concentration of funds in highly liquid assets with clearer compliance.

In its latest report, 10x Research stated that Bitcoin is currently in a critical price range, and the market's next move will largely depend on institutional inflows, particularly the movement of funds in Bitcoin ETFs . The report points out that Bitcoin's sideways movement over the past five months is not due to market weakness, but rather a large-scale reallocation of holdings: early-cycle "OG" investors continued to sell, while newly entering institutional funds steadily absorbed the selling pressure. This "transfer phase" has kept the price fluctuating within a range, rather than stagnating.

Regarding price, 10x Research considers $110,000 a "lifeline": if Bitcoin holds steady in the $110,000–$112,000 range, the upward trend can continue; if it falls below $110,000, risk management should be prioritized, as the market may experience a rapid correction, and the target range may drop to around $85,000.