Reflect's Early Bird Deposits Open; Perena Launches Season 1 Points Program (October 29th)

- 核心观点:稳定币理财提供多种低风险收益机会。

- 关键要素:

- Reflect USDC+ 池APY达7.6%。

- Perena Season1提供13.33% APY。

- Stable预存款热度高但难参与。

- 市场影响:推动稳定币理财需求增长。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover low-risk, high-return strategies currently available in the market, primarily based on stablecoins (and their derivative tokens) (Odaily note: code risk can never be eliminated), to help users who wish to gradually increase their capital through USDT-based investment to find more ideal interest-bearing opportunities.

Previous records

New opportunities

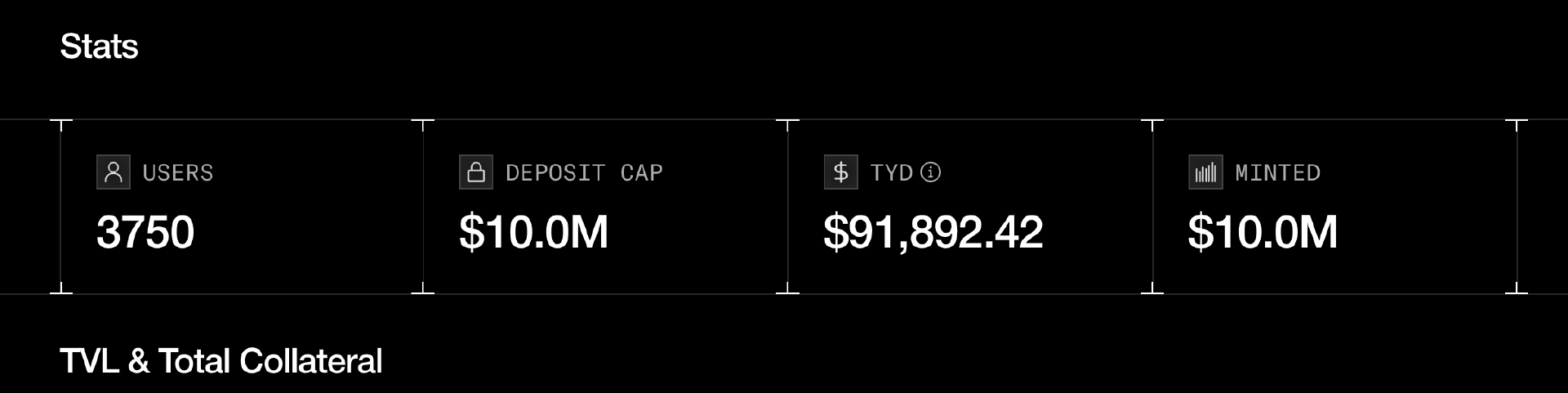

Reflect Early bird deposits are open (fully booked).

The stablecoin project Reflect ( link ) opened its first USDC+ pool for deposits early this morning, with a limit of $10 million. While writing this, I noticed there was still some capacity available, but after finishing, I realized it was already full—a slightly embarrassing situation…

In early September, Reflect announced the completion of a $3.75 million seed funding round, led by CSX Accelerator under a16z crypto, with participation from Solana Ventures, Equilibrium, BigBrain Holdings, and Colosseum.

Currently, the APY for depositing USDC as USDC+ on Reflect is around 7.6%, but early depositors are clearly more focused on the potential airdrop rewards associated with the points , especially in the current relatively less competitive environment.

It's worth noting that Reflect requires an invitation code for deposits, and since each code can only be used once, this is the main reason why many users haven't been able to deposit. Interested users can try the codes below (first come, first served) to open an account in advance and prepare for the next opening.

- UOJDPE5V

- 0DKDADE3

- KLDWH42M

- 7BXFINIP

Perena Season 1 Launch

Perena ( portal ) is an old mine that has been launched many times. The project was founded by Anna Yuan, the former head of stablecoins at the Solana Foundation. At the end of last year, it completed a Pre-Seed round of financing of approximately US$3 million, led by Borderless Capital, and participated by Binance Labs, Primitive Ventures, ANAGRAM, Maelstrom, Breed VC, Temporal, ABCDE Labs, SevenX Ventures, Pivot Global, Miton, Graph Ventures and other institutions.

On October 23, Perena officially announced the launch of its Season 1 points program. In short, you accumulate points by minting USD* using stablecoins on the Perena platform and holding them, earning approximately 13.33% APY. You can also explore further earning possibilities by using RateX, Exponent to form LPs, or buying YT.

It's worth noting that users who participated in Perena Season 0 and the Pre-Season phase did not retain their points; instead, they were all converted into badges. Furthermore, the official statement mentioned that Season 1 would have a greater weight in airdrops, which has sparked considerable controversy within the community—users need to assess the protocol's credibility themselves before deciding whether to participate.

Two small alarm clocks: Stable and Neutral

In addition, there are two other popular deposit programs that require you to pay close attention to official announcements.

One is the hot stablecoin public chain project Stable. The potential returns are not low at present, but due to market hype and team structure issues, it is difficult to deposit funds (see " Stable's first round of $825 million pre-deposits were sold out in seconds, will $700 million be released first before tweeting? "). You can turn on notifications and wait and see.

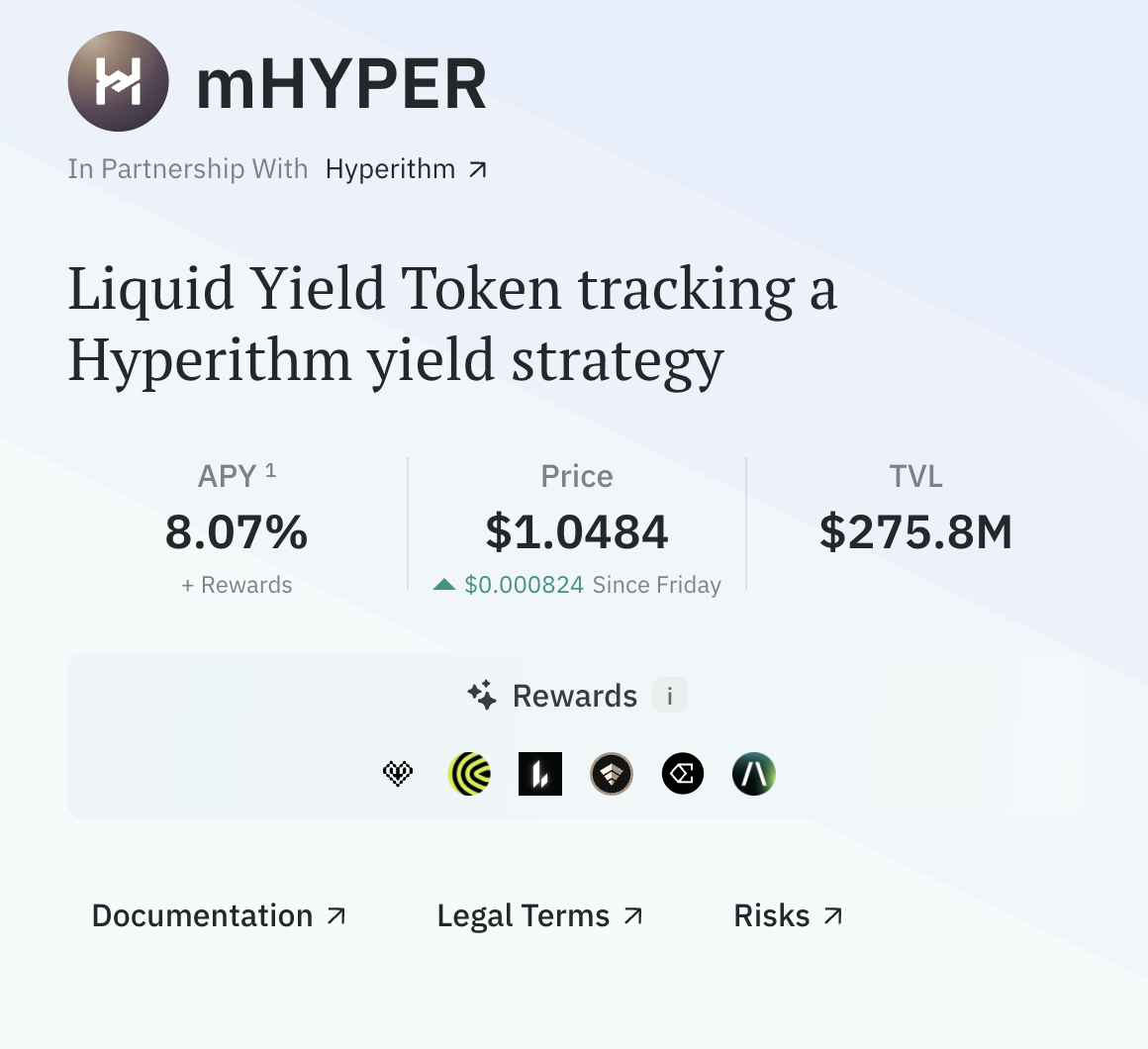

If you absolutely cannot deposit funds into Stable, you can consider participating indirectly through Midas' mHYPER ( link ) treasury . mHYPER indirectly contributed $25 million to Stable's pre-deposit pool by lending it to Hyperithm; funds deposited into this pool can share in the returns. Currently, the mHYPER treasury's APY is 8.07%, and it also offers exposure to points from popular protocols such as Cap, Lighter, USDai, Ethena, and Almanak.

Another one is Neutrl, a term hedging arbitrage protocol that previously raised $5 million and focuses on over-the-counter altcoins. The project previously opened two batches of quotas ($50 million and $25 million), which were basically filled within an hour. Neutrl is definitely easier to deposit than Stable, so it is worth paying attention to and participating in.