Taking over from x402? It’s time to pay attention to ERC-8004

- 核心观点:ERC-8004与x402互补构建AI经济。

- 关键要素:

- x402生态交易量暴涨137倍。

- ERC-8004为AI提供身份声誉系统。

- 以太坊基金会等巨头联合推动。

- 市场影响:催生AI代理经济新投资机会。

- 时效性标注:中期影响

Original author: David, TechFlow

The x402 is clearly a hit.

CoinmarketCap data shows that the trading volume of various projects in the x402 ecosystem has skyrocketed 137 times, and the first ecosystem token PING has surged from zero to a market value of US$30 million in just a few days.

Various KOLs have published intensive analysis articles, covering everything from technical principles to project reviews.

Two weeks ago, when we analyzed x402 earlier and mentioned the potential of projects such as PayAI, there was not much response from the market.

In an era where the lifecycles of various narratives and tokens are rapidly shortening, researching new narratives in advance makes it easier to lock in opportunities in related assets.

(Related reading: With both Google and Visa making investments, what investment opportunities lie ahead in the undervalued x402 protocol? )

Now, every time you refresh Twitter, a new "x402 ecological project" pops up; if you start researching x402 now, frankly speaking, it may be a little late.

It’s not that the protocol itself has no prospects, but that the most obvious Alpha opportunities have been fully explored.

But while everyone is staring at x402, careful people will find that another protocol has recently appeared frequently in discussions in the English encryption circle:

ERC-8004 .

What’s even more interesting is that Davide Crapis, one of the proposers of ERC-8004 and head of the Ethereum Foundation’s DAI team, revealed a detail in an interview with Decrypt in September:

“ERC-8004 will support multiple payment methods, but having the x402 extension will help with the developer experience.”

Wait, multiple payment methods? Isn't x402 a payment protocol? Why does ERC-8004 also involve payments? Are they competing or complementary?

When the Ethereum Foundation announced the final version of ERC-8004 in early October, signatories included MetaMask’s Marco De Rossi, Google’s Jordan Ellis, and Coinbase’s Erik Reppel, the creator of x402.

The same person is promoting two protocols at the same time. What is the logic behind this?

If the explosion of x402 has made everyone see the huge market for AI Agent payments, then ERC-8004 may represent the other half of the puzzle in this market that has not yet been fully recognized.

While everyone is chasing the payment track, perhaps the real opportunity lies outside of payment.

ERC-8004: The prerequisite for payment is to register the identity of AI

To understand ERC-8004, we must first return to a fundamental issue of the AI Agent economy.

Imagine a scenario where AIs collaborate together:

Your personal AI assistant needs to complete a complex task and prepare a market analysis report for your upcoming product launch.

This task is beyond its capabilities, so it needs to hire other professional AIs: one is responsible for data crawling, one is responsible for competitor analysis, and one is responsible for chart production.

Now with x402, payment is no problem; USDC transfers can be completed with just a few lines of code; but before making a payment, your AI assistant faces a series of tricky identity questions:

Which of these self-proclaimed "professional data analysis AI" agents are genuine and which are scams? What's the quality of their past work? How many customers have given them positive reviews, and how many complaints have they received?

It's a bit like doing business in a world without Taobao, Dianping, or business registration. Every transaction is a blind box, and every collaboration is a gamble.

Therefore, if we have to explain it in one sentence, ERC-8004 is the "Industrial and Commercial Bureau + Credit Reporting System + Qualification Certification Center" of AI Agent in the on-chain world.

It allows each AI agent to have an ID card, credit record and ability certification, all of which are recorded on the blockchain. Anyone can query it and no one can tamper with it.

On August 13 this year, Davide Crapis of the Ethereum Foundation, Marco De Rossi of MetaMask, and Jordan Ellis, an independent AI developer, jointly submitted the EIP-8004 proposal .

Interestingly, this Jordan Ellis was later confirmed to have close ties with Google's Agent-to-Agent team.

Simply put, ERC 8004 adds a trust layer to Google's A2A. In the words of the Ethereum Foundation, this is to establish a "trusted neutral track" for AI agents.

Leaving aside the difficult code details, we can take a rough look at how the 8004 does it.

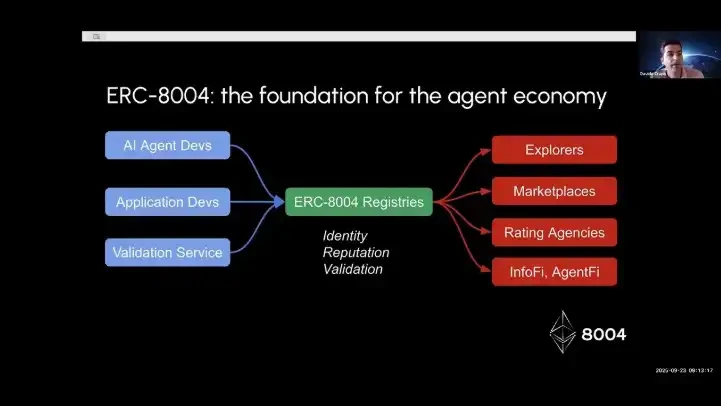

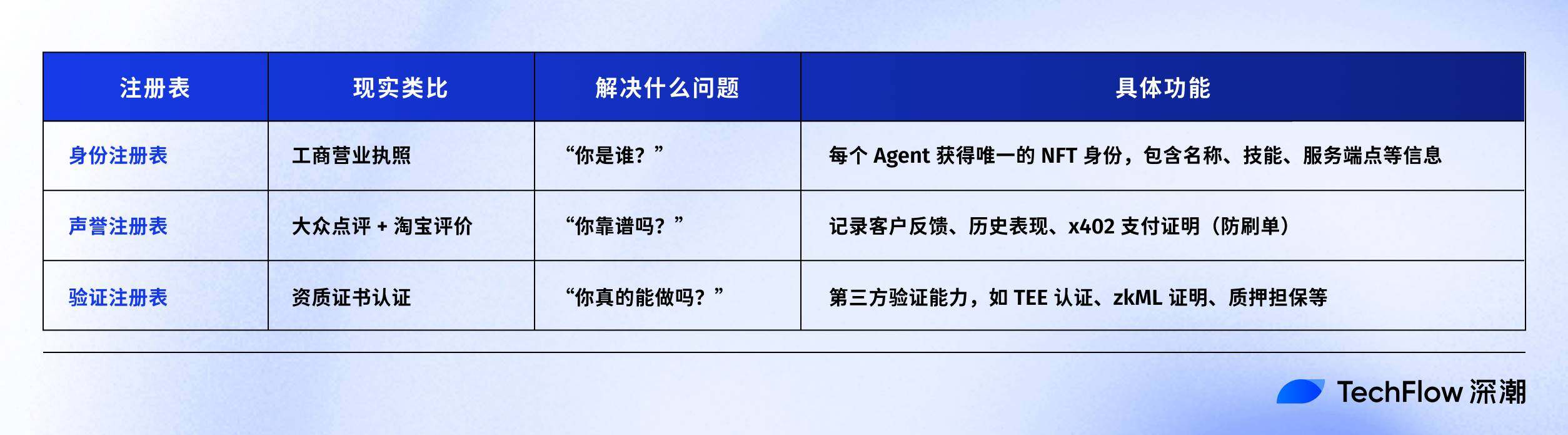

The design of ERC-8004 is extremely streamlined, consisting of only three on-chain registries:

- Each AI agent in the Identity Registry receives an ERC-721 token as its identity. Yes, you read that correctly: the AI agent is NFT-ified. This means the agent's identity can be viewed, transferred, and even traded in any wallet that supports NFTs.

This NFT points to a standardized "Agent Card" that describes the Agent's name, skills, endpoints, and metadata. Because it follows open standards, any browser or market can index it, enabling cross-platform permissionless discovery.

- The Reputation Registry is the Dianping of the AI agent world. Customers and other agents can submit structured feedback, tagged by skill or task. More importantly, it can attach x402 proof of payment. Only customers who have actually paid can leave reviews, preventing fraudulent transactions.

All reputation signals are public goods, which means anyone can build their own reputation scoring system based on this data.

- For high-value tasks, reviews alone are not enough. The Validation Registry allows agents to request third-party validation—be it a TEE (Trusted Execution Environment) oracle, staked inference, or zkML validation.

This is the authentication of the agent world. An agent claiming to be able to perform financial analysis can use cryptography to prove that it actually ran a specific model and produced specific results.

If this gets a bit technical, let's look at a specific example.

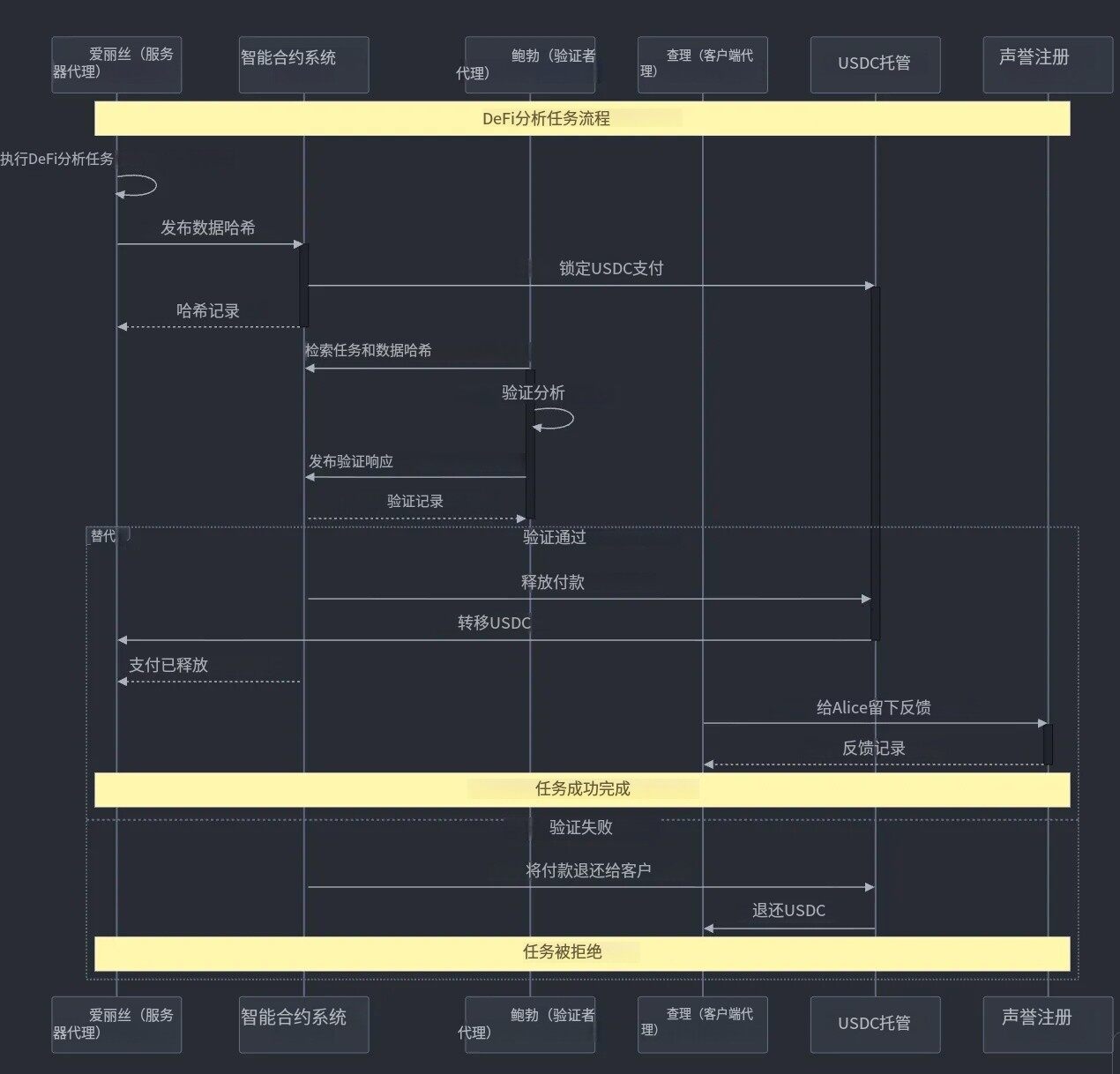

Suppose an exchange’s AI Agent needs a weekly DeFi market analysis report, but it does not have this capability itself.

- Search service : The client Agent finds the analyst Agent Alice through the identity registry and views the service description on her NFT identity card

- Check reputation : Alice has 156 positive reviews, 89% completion rate, and real reviews with x402 payment proof.

- Secured payment : Pay 100 USDC to the smart contract through x402, not directly to Alice

- Third-party verification : After Alice completes the report, the verifier Bob checks the quality and signs the verification registry.

- Automatic settlement : When the contract sees that the verification is passed, it automatically releases funds to Alice and the customer leaves a review

(Source: Researcher Yehia Tarek's personal column )

The entire process required no human intervention, and the three AI agents independently completed a business transaction based on the ERC-8004 trust system.

Wait, does this have anything to do with x402?

To explain the relationship between x402 and ERC-8004 in one sentence:

x402 solves the payment problem of AI Agent, and ERC-8004 solves the trust problem. Both are indispensable for a truly autonomous AI economy.

Specifically, x402 is a standard for micropayments between agents or users, eliminating payment friction; allowing one agent to automatically pay another agent for completing a task.

ERC-8004 is the identity and reputation layer for agents. It introduces on-chain verification, making every task and score traceable.

A more understandable analogy is:

- x402 = ERC20

- ERC 8004 = Etherscan

The former allows you to pay for API access directly based on the number of calls, which is more like a payment standard; the latter is more like an on-chain AI agent registry, where each agent has an associated wallet that can be checked and verified.

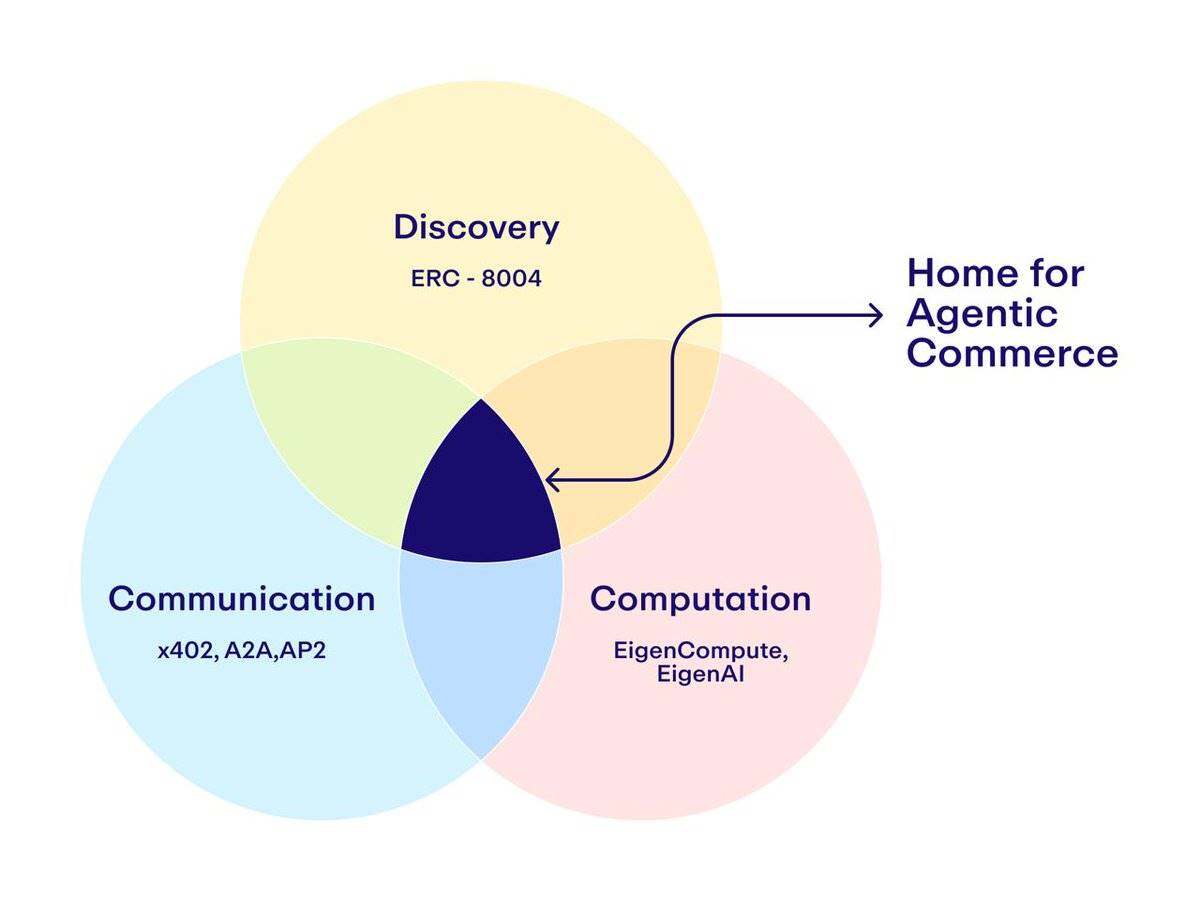

In fact, all of this is contained in a "crypto x AI" narrative, in a large crypto AI economy:

- Crypto AI Economy = Discovery of AI Agents + Communication Between AI Agents + Verifiable Computation

(Image source: Twitter user @soubhik_deb )

How do we discover AI agents? This is essentially about enabling AI agents to find each other. This is what ERC-8004 does, by creating a registry on Ethereum that records the identities of AI agents.

How can AI agents communicate with each other? x402 is an open standard for agents to make on-chain payments; there is also Google's A2A protocol.

How to verify all this? Every AI agent must make verifiable inferences, inferences, and actions, which may be recorded in places that emphasize data availability.

This post by Twitter user @soubhik_deb is worth reading. It explains the above logic very clearly, and you can also discover more Alpha project opportunities based on this logic.

At this point, we have fully understood the relationship between x402 and ERC-8004. It is more appropriate to describe their relationship as complementary and jointly building the overall picture of the AI economy.

If you want a clearer and more explicit comparison, here is a flow chart:

Beneficiary projects under the ERC-8004 narrative

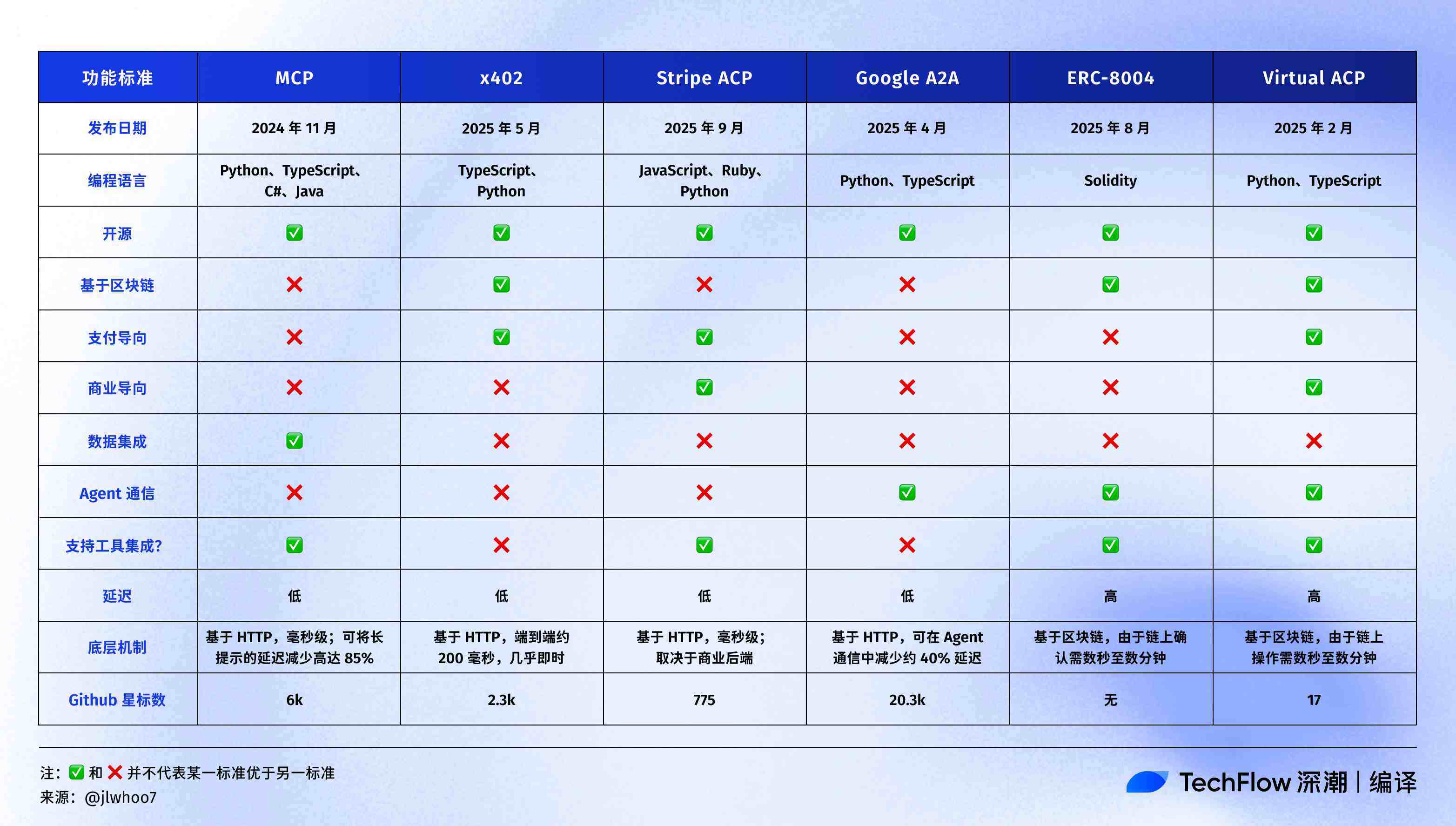

If you don’t want to read the version that’s too long, you can directly refer to the picture below.

When the x402 boomed, payment tokens like PING were the first to see gains. However, the opportunities offered by ERC-8004 are more widespread. From infrastructure to applications, each layer has its own logic. Understanding this logic is more important than chasing individual projects.

- The first is the infrastructure layer , such as Taiko and EigenLayer.

Taiko, L2 execution layer

Why is one L2 being the most actively supported? The narrative here is that the agent economy requires a cheap and fast chain. The mainnet is too expensive, with each identity or reputation update costing several dollars in gas fees, making it unaffordable for agents. Taiko offers a solution, deploying the 8004 registry on L2 to reduce costs. The contract was deployed on October 24th and is likely to become the main battlefield for agent activity.

EigenLayer, security layer

The biggest challenge facing 8004 is what to do if validators act maliciously. EigenLayer's answer is staking penalties. Validators stake ETH, and if they provide false validation, their assets are confiscated. EigenLayer is integrating 8004 into over 200 AVSs, each of which will potentially become a dedicated agent validation service.

The logic of the infrastructure is simple: the more agents, the more transactions, the more revenue. This is the business of selling shovels.

- The second is the middleware layer, such as SANTA and Unibase.

SANTA, payment bridge

Its positioning lies between two narratives: the connector between x402 and 8004. When an agent finds another agent through 8004 and then wants to pay through x402, SANTA handles the process. More importantly, it supports cross-chain transactions. For example, in an ideal scenario, if a Solana agent wants to hire an Ethereum agent, SANTA can play a role.

Unibase, the memory layer

Agents not only need identities, but also memory. Unibase provides persistent storage for each agent, linked through the 8004 identity system. This means agents can "remember" previous interactions, accumulate experience, and even share knowledge. On October 26th, x402+8004 integration was implemented on the BNB chain, taking a leading position.

The value of middleware lies in its irreplaceability. You can replace L2, but certain connection functions are unique.

- Finally, there is the application layer , such as the old friend Virtuals Protocol.

Virtuals is an AI Agent token issuance platform that allows users to create, invest, and trade AI Agent tokens through a bonding curve mechanism.

There are currently more than 1,000 Agent projects on the platform, with a daily trading volume exceeding US$20 million.

For Virtuals, 8004 solves a practical problem: how to enable different agents to identify and interact with each other. A recent official announcement revealed that the ACP protocol update will fully support the 8004 standard. This means that every agent issued on Virtuals will automatically gain on-chain identity and reputation systems.

As for which application can be launched, perhaps we can combine it with the Launchpad gameplay to further observe its updates in rule design and incentives.

Overall, x402 solves the payment problem, while ERC-8004 solves the trust problem. x402 took five months from release to take off, and 8004 may be even faster.

For a more accurate timeline, keep an eye out for the Trustless Agents Day presentation at Devconnect on November 21st. The first wave of 8004-based applications will likely be showcased at the conference. If a killer app emerges, it could trigger the initial wave of hype.

By the end of this year, I predict that the x402 ecosystem will enter a period of integration and will likely announce support for 8004. The integration of the two protocols will produce a 1+1>2 effect.

If you are a conservative player, you may want to focus on large-cap infrastructure projects that benefit from 8004; if you are more aggressive, you need to pay close attention to the small-cap projects in the above table and the emergence of new projects.

After all, the crypto market hasn’t been dominated by a technology-driven narrative for a long time. Whether x402 and ERC-8004 are a flash in the pan or have far-reaching impacts will be tested by the market.