S&P gives Strategy a B- rating. Why is the leading DAT considered junk by institutions?

- 核心观点:标普首次评级MicroStrategy为B-垃圾级。

- 关键要素:

- 业务过度集中于比特币持仓。

- 存在美元流动性不足风险。

- 风险调整后资本为负值。

- 市场影响:推动机构投资门槛,引发会计标准争议。

- 时效性标注:中期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

On October 27, Eastern Time, S&P Global rated Bitcoin Treasury Strategy (formerly Microstrategy, stock code MSTR) for the first time.

Embarrassingly, as the absolute leader in the DAT field, Strategy only received an issuer credit rating of B- - in other words, in the eyes of S&P, Strategy is a "junk" with an extremely high risk of default.

S&P and its rating system

S&P, Moody's and Fitch are known as the world's three major rating agencies and are currently recognized as one of the most authoritative credit rating agencies in the international financial market.

According to S&P, its credit ratings primarily reflect its forward-looking opinion on the creditworthiness of the issuer and its debt, typically focusing on analyzing the issuer's ability and willingness to fulfill its financial commitments. Creditworthiness encompasses a variety of factors, including the likelihood of default, potential external support, repayment priorities, and recovery rates.

S&P usually has ten main grades for long-term credit ratings, from high to low: AAA, AA, A, BBB, BB, B, CCC, CC, C, D. Except for AAA and CC and below, each grade can also be fine-tuned using the "+" or "-" symbol to indicate different high and low levels under the same grade.

It is generally believed that the two sub-grades of BBB- and BB+ are regarded as a dividing line. BBB- and above belong to "Investment Grade", while BB+ and below belong to "Speculative Grade", or more bluntly, "Junk Bond".

Obviously, the B- that Strategy got is still some distance away from BB+...

Why does S&P not approve the Strategy?

In its rating article for Strategy, S&P detailed the reasons for giving it a B- rating.

In S&P's view, Strategy has problems such as excessive business concentration, a large proportion of Bitcoin holdings, insufficient US dollar liquidity, and extremely weak risk-adjusted capital. Although the company has strong financing capabilities in the capital market and prudently manages its capital structure, it is not enough to offset the above negative impacts. After comprehensive consideration, it gave a judgment of B-.

S&P highlighted that Strategy's Bitcoin strategy creates a natural currency mismatch—it holds a significant amount of Bitcoin (a long position) while its debt and dividend obligations are denominated in US dollars (a short position). Strategy faces debt maturities, interest payments, and preferred stock dividends in US dollars, yet its primary asset is Bitcoin. While Strategy maintains a certain amount of US dollar holdings on its balance sheet, this is primarily used to support operating expenses for its software business, with any remaining cash invested in Bitcoin.

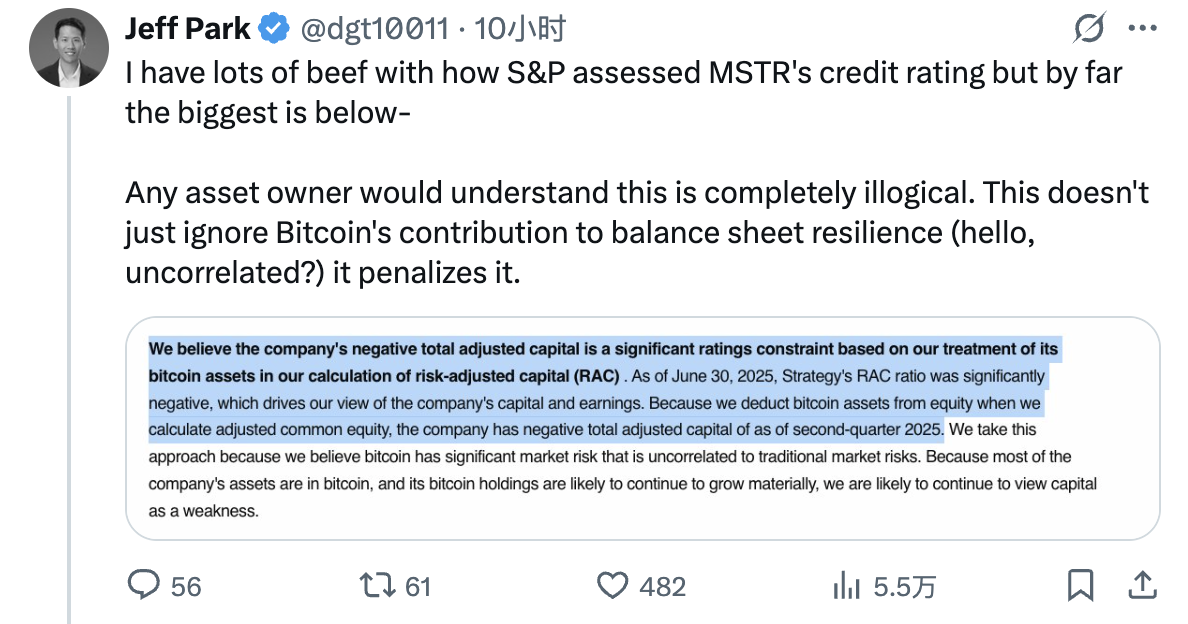

Furthermore, S&P's treatment of Bitcoin assets in its risk-adjusted capital (RAC) calculation resulted in Strategy's negative RAC, a key factor contributing to its negative assessment of its capital and profitability. S&P explained that it deducted Bitcoin assets from equity when calculating adjusted common equity because it believes Bitcoin carries significant market risk uncorrelated with traditional market risks. Given that the majority of Strategy's assets are in Bitcoin and that its holdings are expected to continue to grow, it believes capital issues will remain a major weakness for the company.

S&P also noted that Strategy's operating cash flow was negative $37 million in the first six months of 2025. The company's primary source of profit is the appreciation in the value of its Bitcoin holdings, which generate no cash flow, while its software business is roughly flat in terms of earnings and operating cash flow. S&P believes this situation is unlikely to change in the foreseeable future.

At the end of the rating, S&P also added the possibility of adjusting the rating of Strategy.

Over the next 12 months, the rating could be downgraded if:

- Strategy's ability to raise capital from the capital markets is hampered (whether due to a significant decline in Bitcoin's valuation or for other reasons);

- We believe the company faces increased risk in managing the maturities of its out-of-the-money convertible bonds.

An upgrade of the rating is unlikely in the next 12 months. In the long term, an upgrade of the rating is possible in the following circumstances:

- Strategy Company significantly improved US dollar liquidity;

- Reduce the use of convertible bonds;

- Even when the Bitcoin market is under pressure, it can still maintain strong capital market financing capabilities.

Strategy and market response

Regarding the obviously negative rating result given by S&P, Strategy is quite optimistic.

Strategy founder Michael Saylor generously forwarded the relevant news on his personal X account and celebrated that "Strategy became the first digital asset treasury company to be rated by a mainstream credit rating agency."

However, some financial institutions that are deeply involved in the cryptocurrency field are not satisfied with S&P's rating.

Matthew Sigel, head of digital asset research at VanEck, said that although Strategy's business model is indeed vulnerable to shocks (currency price fluctuations), the company's current debt repayment ability is not a problem .

Bitwise consultant Jeff Park's opinion is more direct. He believes that S&P's RAC calculation method for Strategy is unreasonable . Strategy's core business is to hoard coins for appreciation, and there is no reason to deduct Bitcoin assets from equity.

In short, even though cryptocurrencies have begun to gradually integrate into the traditional financial world, there are still many frictions surrounding issues such as accounting methods and rating processing, and these contradictions will take longer to collide and resolve.

What is worth celebrating now is that Digital Asset Treasury has opened the door to mainstream rating agencies, as obtaining a rating is usually a necessary step for many pension funds and other institutional investors to enter the investment market. Although Strategy is currently rated "junk", there is still a potential possibility of an upward adjustment, which may be an opportunity to attract more new funds to enter the market.