Messari Researcher: Using Perp DEX to Invest in US Stocks: The Next New Blue Ocean

- 核心观点:股票永续合约潜力大但短期难突破。

- 关键要素:

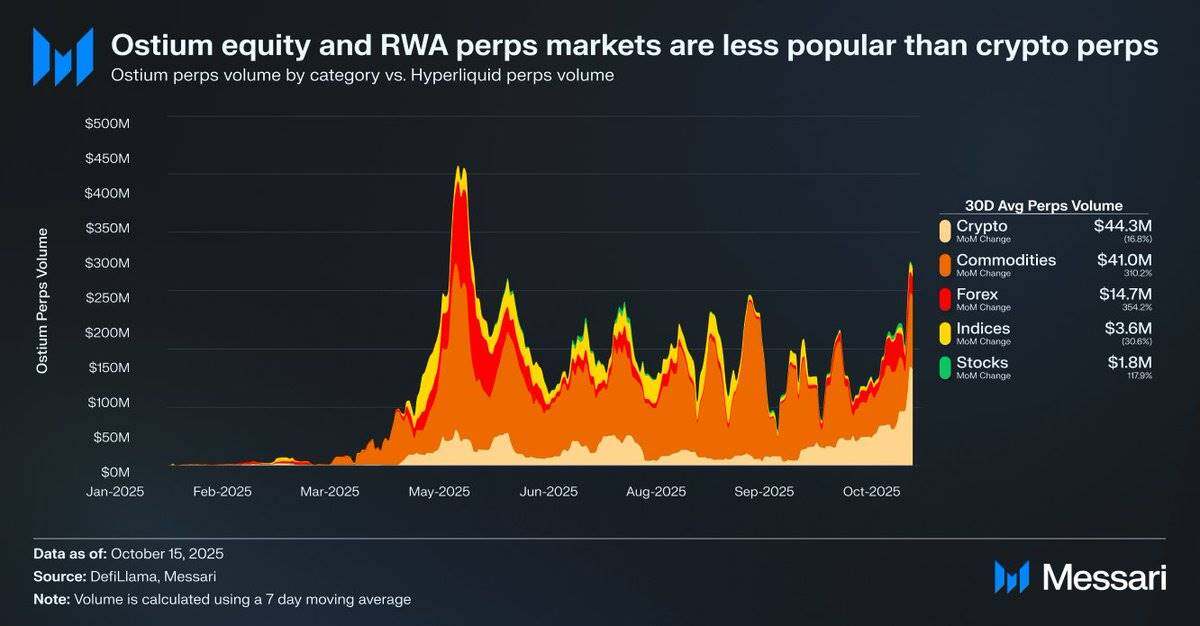

- Ostium股票合约日均交易量仅180万美元。

- 链上交易者对股票兴趣低,受众错位。

- Hyperliquid升级提供基础设施支持。

- 市场影响:可能分流现有交易量而非带来新增。

- 时效性标注:中期影响。

Original author: Sam

Original translation: TechFlow

Key insights:

- Equity perpetual contracts remain a high-potential but unproven area with limited appeal in the on-chain market, primarily due to audience misalignment, weak demand, and more popular alternatives such as 0DTE options.

- For example, the average daily trading volume of stock perpetual contracts on the Ostium platform is only US$1.8 million , while the trading volume of cryptocurrency perpetual contracts is as high as US$44.3 million, indicating weak market demand.

- This may suggest that market demand has yet to be fully unleashed due to infrastructure and regulatory constraints . Hyperliquid's recent HIP-3 upgrade provides the best opportunity for perpetual stock contracts, but adoption is expected to be gradual.

Source: Messari (@0xCryptoSam)

Perpetual stock swaps are considered the next big thing in the on-chain market, but current data suggests that breakthroughs are unlikely in the near term. Ostium, a decentralized exchange specializing in perpetual swaps for real-world assets (RWAs), sees only $1.8 million in average daily trading volume for stock swaps, compared to $44.3 million for cryptocurrency swaps, reflecting weak demand.

This adoption gap stems primarily from a misaligned audience. On-chain traders have little interest in stocks, while traders on off-chain platforms like Robinhood can easily trade stocks and options but are unable to trade perpetual contracts. International investors, who lack direct access to the US stock market, may be a potential target group. However, these investors may prefer to directly hold stocks to gain shareholder value while avoiding funding fees and liquidation risks.

Compared to tokens, stocks present fewer interoperability challenges, while tokens benefit from the convenience of synthetic wrappers. For the average investor, nearly every stock in the global market is abstracted away through individual tickers in a search bar. Therefore, while perpetual swaps add permissionless and censorship-resistant properties to stocks, the average stock investor is either unaware of them or uninterested in them.

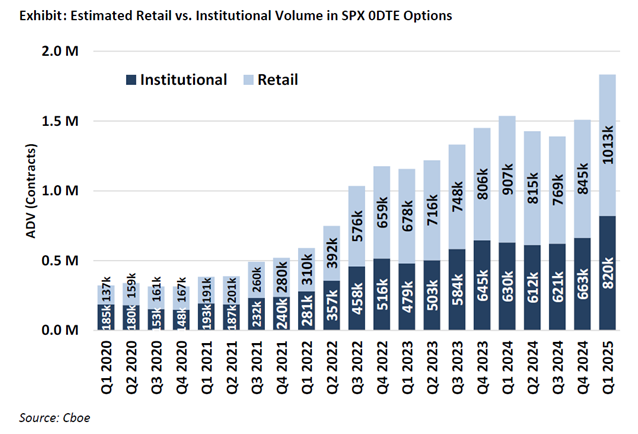

https://www.fow.com/insights/analysis-cboe-points-to-retail-flow-as-zero-day-options-grow

The most likely users of perpetual stock swaps are retail options traders (who drive 50%-60% of ODTE trading on the Robinhood platform). However, traditional exchanges that rely on banking services will only adopt perpetual stock swaps once legal clarity emerges. The U.S. Commodity Futures Trading Commission (CFTC) has approved perpetual swaps for BTC and ETH, but both have been deemed non-securities. While perpetual swaps are more intuitive than options, their adoption may be slower than expected, as the path to retail adoption is closely tied to legal clarity.

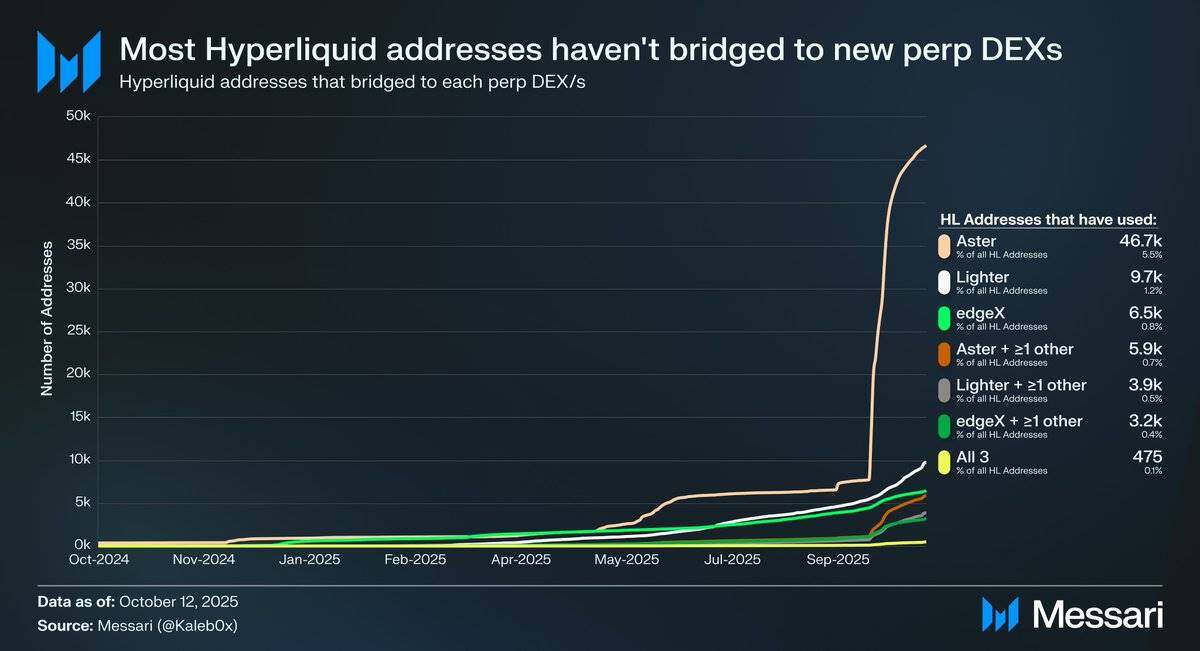

Source: @Kaleb0x

Let's explore the potential future of stock perpetual swaps in the context of Hyperliquid's HIP-3 upgrade. HIP-3 introduces a permissionless perpetual swap market. Data shows that less than 10% of Hyperliquid addresses are bridged to Aster, Lighter, and edgeX, and even fewer users have chosen multiple perpetual swap decentralized exchanges (DEXs) . This suggests that Hyperliquid's capital is sticky and high-quality. Based on this data, we can predict the future of stock perpetual swaps from two perspectives:

- Hyperliquid users are loyal to the platform and are more likely to choose Hyperliquid over other perpetual contract DEXs regardless of asset list or features.

- Hyperliquid users are satisfied with the current offerings in the perpetual contract market.

I think both perspectives have merit. Given that Hyperliquid users haven't moved funds en masse in response to incentives, they may be loyal to the platform. However, since the majority of trading volume and open interest on Hyperliquid is concentrated in mainstream assets, similar to other perpetual swap DEXs, it's difficult to determine whether Hyperliquid users value market diversity or whether stock perpetual swaps are attractive to average users (and, more importantly, the large traders who hold 70% of Hyperliquid's open interest).

Additionally, these traders may have accounts on both traditional exchanges and brokerage platforms, further limiting the potential market size for stock perpetual contracts on Hyperliquid.

It’s important to note that stock perpetual contracts may not bring new open interest or trading volume to Hyperliquid, but may divert existing trading flow.

While Ostium (with $22 billion in annual perpetual swap volume) and equity token wrappers like xStocks, with $279 million in spot volume, haven't yet experienced explosive growth, this may reflect infrastructure limitations rather than a lack of latent demand . This pattern resembles the early growth trajectory of perpetual swaps. GMX demonstrated the demand for an on-chain perpetual swap market, but the infrastructure at the time couldn't support sustained trading volume. Hyperliquid addressed this bottleneck, unlocking latent demand. By the same logic, equity perpetual swaps may find their first scalable product-market fit on Hyperliquid, once HIP-3 provides the necessary performance and liquidity. While current data doesn't confirm this outcome, the precedent is worth noting.

Compared to 0DTE options, the long-term potential of perpetual stock swaps remains clear. Projects like Trade[XYZ] can exploit regulatory arbitrage and build an early user base before traditional exchanges enter the market. However, the real challenge lies in attracting off-chain retail traders, which has always been difficult for crypto applications.