PayAI surpasses PING, changing the value anchor of the x402 ecosystem

- 核心观点:x402生态价值转向实用基础设施。

- 关键要素:

- PayAI市值4天涨10倍破5000万。

- PayAI处理x402生态14%成交额。

- PING回调显Memecoin价值缺陷。

- 市场影响:推动行业从炒作向价值投资转型。

- 时效性标注:中期影响

Original author: KarenZ, Foresight News

In the ever-changing competition in the cryptocurrency market, a remarkable reversal has just occurred in the x402 ecosystem.

PING, considered the x402 protocol's "star token" last week, has seen its market capitalization surpassed by the x402 protocol's payment infrastructure. According to the latest data, PayAI's market capitalization surpassed $50 million this morning, a more than tenfold increase in four days. Meanwhile, PING has experienced a correction after its initial surge, currently sitting at $34 million.

This is not just a competition between two projects, but a critical moment for the entire x402 ecosystem and even the decentralized payment infrastructure field to transform from hype to practicality.

PING's highlights and difficulties

PING, the first token issued on Base through the x402 protocol, had its "highlight moment" last week. In just two days from October 23 to 24, its value increased by more than 20 times, and its market value once reached over 80 million US dollars.

This exponential growth has attracted a large number of industry investors and has also made the x402 protocol itself gain unprecedented market attention, successfully opening up a traffic entrance for this emerging track.

However, hype without value is ultimately unsustainable. Essentially, PING is a pure memecoin, devoid of practical utility and real-world use cases. Some in the community have even compared it to an "inscription" asset—its price rise is driven more by market speculation than by long-term growth driven by value creation.

PayAI's Breakthrough: x402 Infrastructure's "Hands-on"

In stark contrast to the speculative nature of PING, PayAI, as the x402 protocol facilitator, has broken through with its clear infrastructure positioning and practical value, becoming a core target for the shift in ecological value.

What is an x402 Facilitator? x402 Facilitators are service providers that support x402 payment processing on Solana and EVM networks. They provide unified endpoint access and enable verification and settlement of payments on-chain using HTTP resources under the x402 protocol.

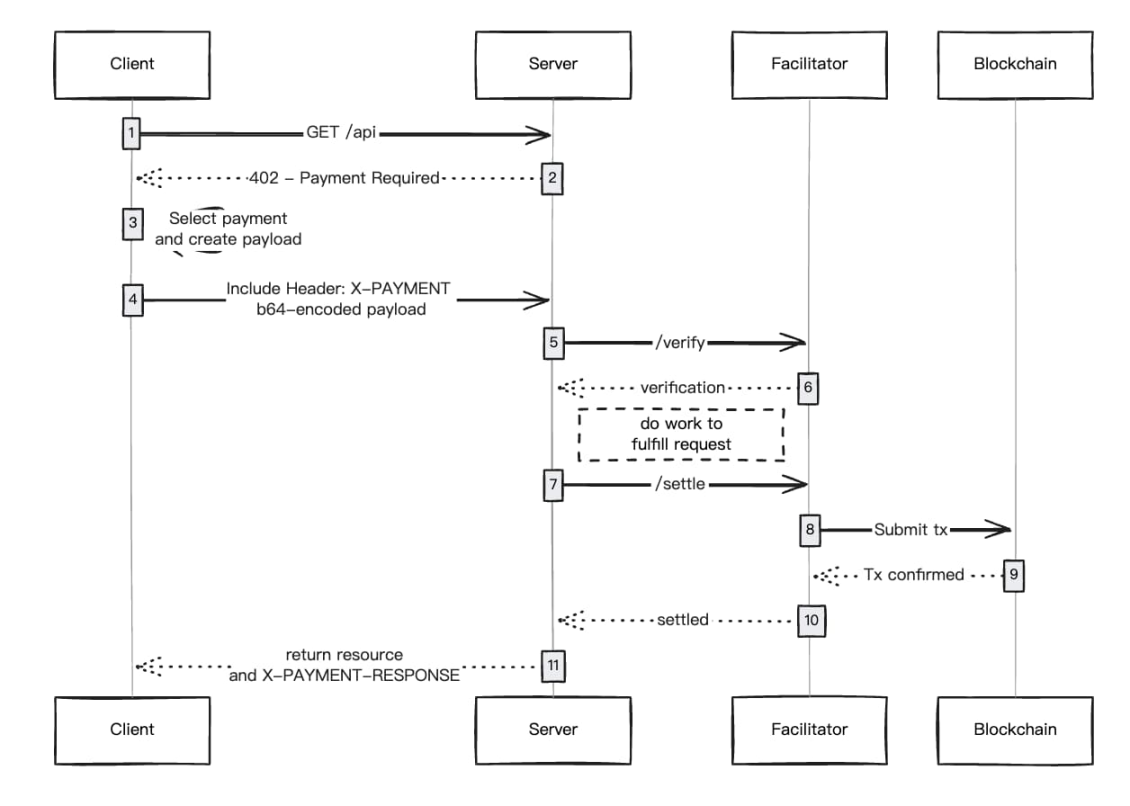

These Facilitators form the core infrastructure layer of the x402 payment ecosystem, responsible for verifying and settling on-chain payments for HTTP resources using the x402 protocol:

- Supports different blockchain networks (such as Solana, Base, etc.).

- Facilitators are responsible for covering network fees and handling validation/settlement.

- No API key required. Plug and play.

- Designed for both human and agent use cases, from pay-per-use APIs to AI agents, payments are settled within a second of blockchain confirmation.

From the perspective of the x402 payment process logic, the client calls the protected resource and constructs the payment payload; the resource server publishes the payment request, verifies/settles the payment, and satisfies the request; the facilitator server verifies the payment payload and performs settlement through the standard endpoint; finally, the blockchain network executes and confirms the payment.

Eroding Coinbase's market share, becoming the second largest facilitator in the x402 ecosystem

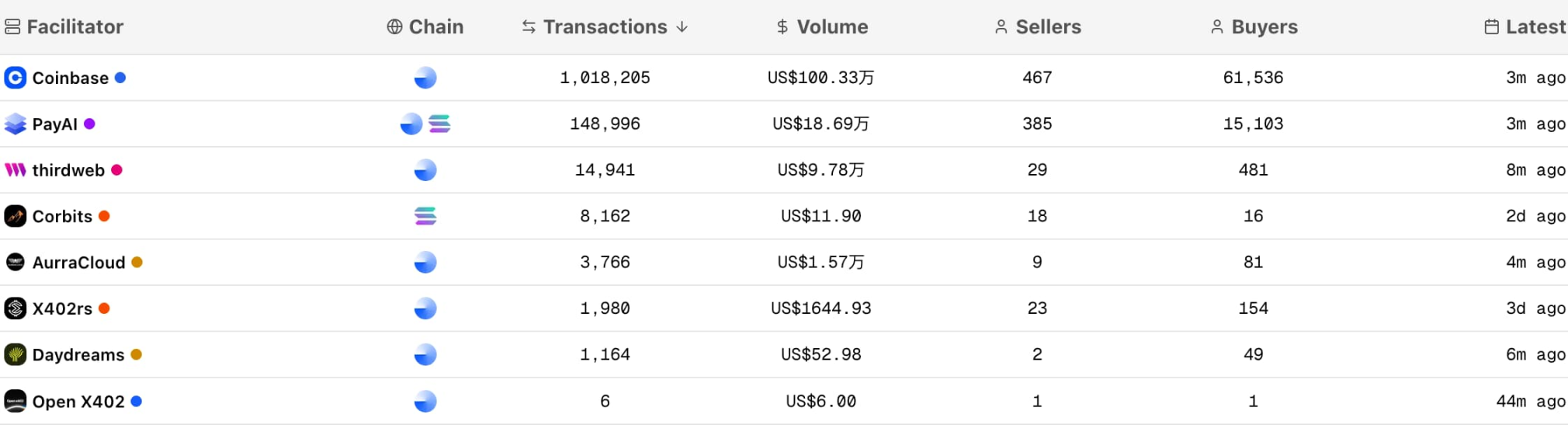

This role makes facilitators the most valuable participants in the x402 ecosystem. Among these x402 facilitators, PayAI is gradually eroding Coinbase's dominant position. According to x402scan data, PayAI currently handles over 14% of x402 transaction volume, making it the largest facilitator after Coinbase. In contrast, Coinbase's market share has declined from its early dominance to approximately 77%.

Chart source: x402scan

From the perspective of ecosystem participants, the number of PayAI sellers has reached more than 82% of Coinbase, and the gap continues to narrow.

In the x402 ecosystem, sellers are the service providers that provide APIs or content monetization. The x402 protocol provides them with a "frictionless small transaction monetization" solution - without the need for mandatory subscriptions or advertising, they can obtain revenue directly from customers through programmatic payments.

The scale of sellers directly determines the market potential of the x402 ecosystem: more high-quality sellers means buyers have more choices, which will attract more traffic and form a positive cycle of "increase in sellers → influx of buyers → prosperous ecosystem". PayAI's rapid penetration on the seller side is laying a solid foundation for its ecological status.

PayAI Token Economics and Utility

In terms of PayAI token economics, the total token supply is 1 billion, and all tokens will be fully circulated at launch.

The PayAI team will purchase 20% of the token supply at launch and transfer it to the project treasury. These funds will be used for operations, marketing, and future token releases, such as community rewards and partnerships. Specifically, half of the treasury tokens will provide liquidity to generate fees, and the other half will vest linearly over 1 year.

So what is the utility of PAYAI tokens? According to official documentation, the intended uses of PAYAI include:

- Reduce or waive platform fees when enforcing service contracts between AI agents.

- Improve visibility of your buyer or seller agent listings.

- Participate in future platform governance (e.g. voting on feature proposals, proxy ratings).

- Covering arbitration costs in dispute resolution (coming soon).

Deep Thinking

The rise and fall of PING and PayAI's momentum actually reflects an important issue: the x402 ecosystem is moving from concept to reality, and from hype to practicality.

The first issued token, PING, received a "dividend premium," a common market sentiment. However, as the market cooled, investors began to question: What exactly am I investing in? If PING is simply an inscription-like minting game, then its value foundation is weak.

In contrast, PayAI, as the payment infrastructure of x402 Facilitator, has anchored the two core values of "transaction flow" and "ecological needs", and has demonstrated the fundamental value of the project with actual market share and application scenarios, naturally gaining continued recognition from capital.

Throughout this process, we've witnessed further maturity in the x402 space—market participants are beginning to determine a project's status based on actual transaction volume and fundamental value, rather than blind speculation. This is undoubtedly a positive sign for the entire x402 ecosystem and the open payment ecosystem.