JustLend DAO uses ecological benefits as its engine to launch a nearly $60 million JST repurchase and destruction plan

- 核心观点:JST通缩机制正式启动,价值将提升。

- 关键要素:

- JustLend DAO首批销毁占总供应量5.6%。

- 平台累计收益6000万美元用于回购销毁。

- 资金来自JustLend DAO和USDD生态收益。

- 市场影响:增强JST稀缺性,推动价格上涨。

- 时效性标注:中期影响

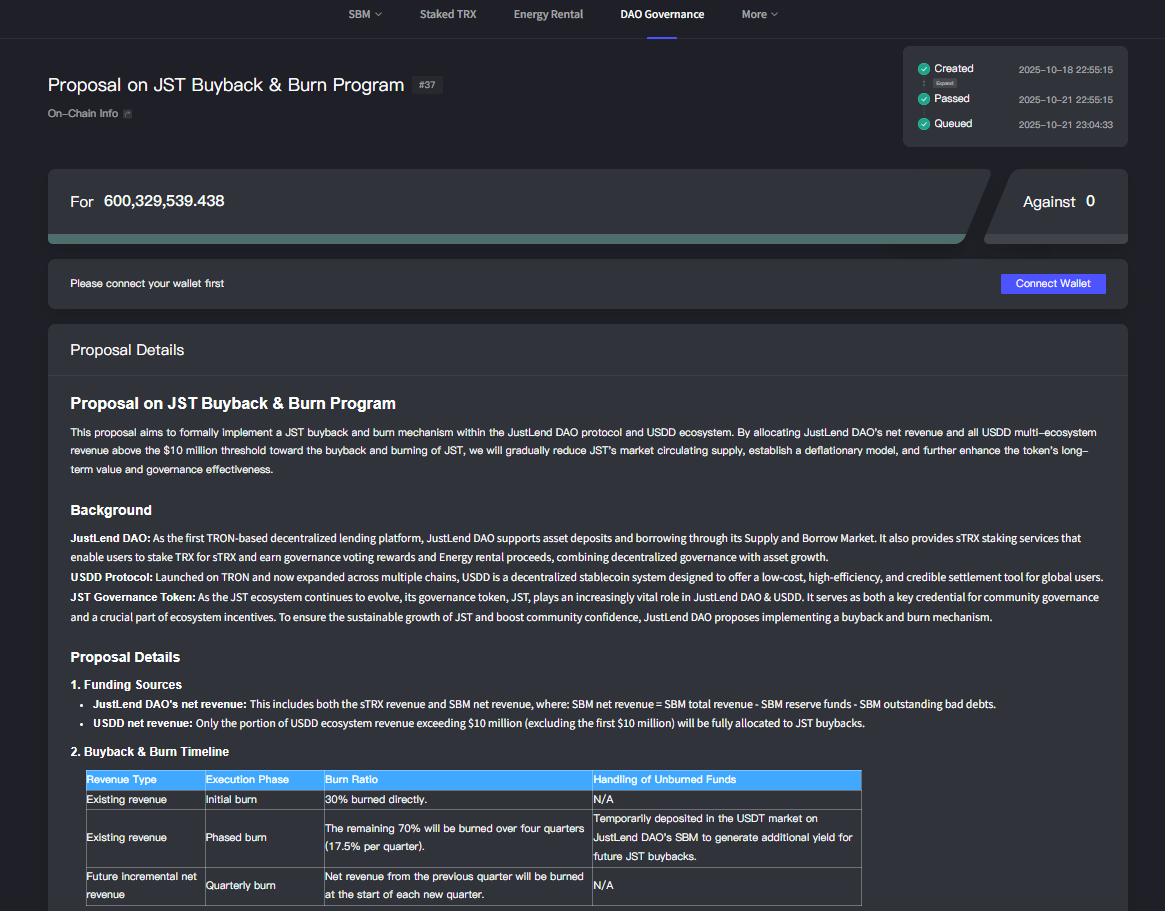

On the evening of October 21st (SGT), the JustLend DAO community of TRON’s core lending protocol completed a vote on the “JST buyback and destruction” proposal, which was ultimately passed with a high vote of approval, marking the official implementation of JST’s deflationary mechanism.

With the implementation of the proposal, JST's deflationary momentum will be deeply integrated with two core ecosystem components within the JUST ecosystem: JustLend DAO and USDD. JustLend DAO, a top-four lending protocol globally, provides stable returns to continuously fund JST burns. USDD, the second-largest stablecoin in the TRON ecosystem, generates incremental returns that will further enrich the buyback pool. The combined returns of these two will generate deflationary momentum for JST, ultimately creating a positive cycle of "ecosystem benefits – token deflation – value growth," helping JST unleash its long-term value potential and usher in a new wave of value growth.

It is worth noting that the JustLend DAO platform currently has accumulated revenue of approximately US$60 million. This money will be invested in the JST repurchase and destruction plan in batches: the first batch will destroy 30% of the existing revenue, and the remaining 70% will be gradually released over four quarters to ensure a stable and sustained deflationary effect.

From a data perspective, the current market value of JST is only about US$300 million. The number of tokens corresponding to the first batch of proceeds destroyed by JustLend DAO alone accounts for more than 5.6% of the total supply of JST. The total cumulative revenue of the platform is close to US$60 million. According to the current market price of JST, the total number of tokens that can be destroyed will account for about 20% of the total supply.

JST deflation process officially begins: JustLend DAO invests approximately $60 million in proceeds into buyback and destruction, with cumulative destruction exceeding 20% of total supply

The successful implementation of the JST buyback and burn plan will officially usher in an era of deflation. The implementation of this plan is expected to open a new round of value growth for JST, releasing long-term value.

On the evening of October 21st (SGT), the JustLend DAO community's proposal for a "JST buyback and burn" program was officially approved with a high vote of approval. This marks the transition of JST's deflationary mechanism from planning to implementation. The JustLend DAO and USDD ecosystems will officially establish a targeted JST buyback and burn mechanism. This mechanism will propel JST into a deflationary era, laying the foundation for a new round of value appreciation and the unleashing of long-term growth potential.

"Sustainable funds + strong destruction" are the two highlights of this JST repurchase and destruction plan. The source of JST repurchase funds is clear and sustainable, which can provide a continuous driving force for the repurchase and destruction plan. The funds mainly come from two parts: one is the current and future net income of JustLend DAO (including sTRX income and SBM net income), achieving dual coverage of "existing income + future incremental income", providing solid financial guarantee for repurchase and destruction; the other is the incremental income after the USDD multi-chain ecosystem profits exceed US$10 million. When the USDD multi-chain ecosystem profits cross this important threshold, the incremental income will inject new vitality into the deflation process of JST.

"Sustainable funds + strong destruction" are the two highlights of this JST repurchase and destruction plan. The source of JST repurchase funds is clear and sustainable, which can provide a continuous driving force for the repurchase and destruction plan. The funds mainly come from two parts: one is the current and future net income of JustLend DAO (including sTRX income and SBM net income), achieving dual coverage of "existing income + future incremental income", providing solid financial guarantee for repurchase and destruction; the other is the incremental income after the USDD multi-chain ecosystem profits exceed US$10 million. When the USDD multi-chain ecosystem profits cross this important threshold, the incremental income will inject new vitality into the deflation process of JST.

Since the JustLend DAO community announced its JST buyback and burn proposal on October 11th, it has garnered significant community attention, primarily due to its direct connection to JST's token economics and price expectations. Now, with the JST buyback and burn underway, the value of JST will be deeply tied to two core components of the JUST ecosystem: JustLend DAO (one of the top four lending protocols globally) and USDD (the second-largest stablecoin in the TRON ecosystem). These two core components act as the wings of JST's value, and their continued returns will directly translate into JST's deflationary fuel.

The introduction of this buyback and burn mechanism not only optimizes JST's economic structure but also enhances its weight and value anchoring as a governance token, becoming a key variable driving price increases. By regularly buying back and burning circulating JST from the market, the circulating supply is gradually reduced, creating a healthy deflationary effect and further enhancing its scarcity, thereby strengthening its value foundation and driving the JST ecosystem onto a sustainable development track.

In terms of the burn rate, JustLend DAO currently has approximately $60 million in accumulated earnings, which will be repurchased and burned in a phased, sustained manner. The first burn will consist of 30% of JustLend DAO's current earnings. The remaining 70% will be gradually released over four quarters, with a quarterly burn rate of 17.5%, ensuring a stable and long-term deflationary effect. After each buyback and burn, JustLend DAO will publish an announcement on its official website, providing comprehensive transaction details, including the transaction hash, date, buyback amount, and tokens burned.

The total supply of JST is 9.9 billion, and full circulation has been achieved since the second quarter of 2023. This means that the implementation of the JST buyback and burn plan will directly and continuously reduce its circulating supply, providing a solid foundation for a deflationary effect. Furthermore, JST currently has a market capitalization of approximately US$300 million, with over 440,000 holding addresses. It is listed on dozens of major global exchanges, including Binance, HTX, OKX, UPbit, Bithumb, and Kraken.

Based on JST's current market capitalization of $300 million, and based on the current revenue from the JustLend DAO platform alone and the current JST market price, the number of tokens eligible for destruction would represent approximately 20% of the total JST supply, with the first batch of destruction accounting for over 5.6%. This demonstrates the magnitude of JST's buyback and destruction, far exceeding the efforts of its peers.

Particularly noteworthy is JustLend DAO, a long-established DeFi protocol deeply embedded in the TRON ecosystem. Since its launch in 2020, it has not only continuously iterated and upgraded its products, but has also consistently maintained a zero-risk operational record, a remarkable achievement in the industry. Even amidst the overall sluggish performance of the DeFi market, JustLend DAO, leveraging its robust profitability and financial accumulation, has been able to repurchase and burn nearly $60 million in JST. This initiative not only demonstrates its strong financial resources and execution capabilities, but also further reinforces the sustainability of its business model and the solid foundation of its ecosystem value.

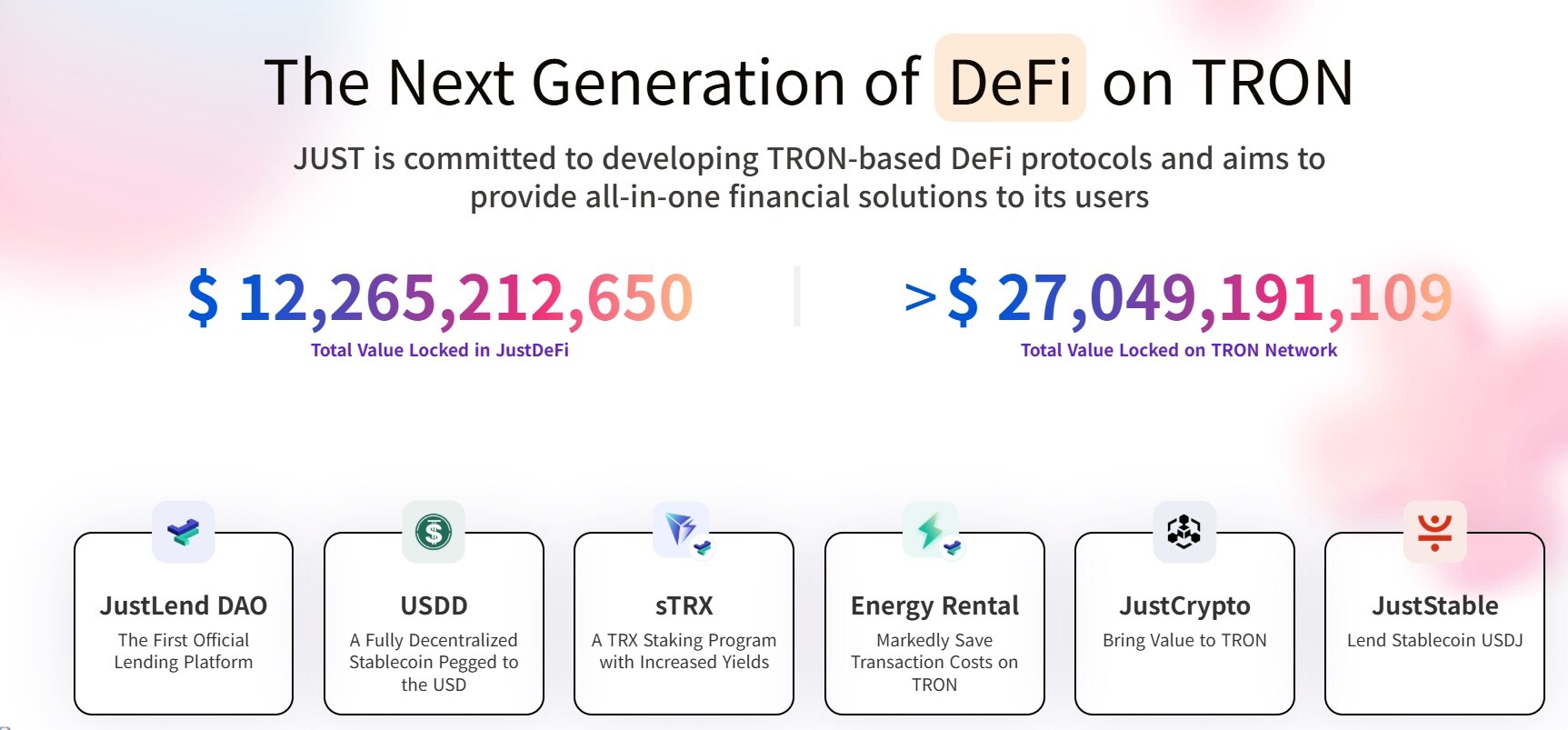

JST is backed by the JUST ecosystem and accounts for 46% of TRON's total TVL.

JST is not only the core governance token of JustLend DAO, but also the native governance token of the JUST ecosystem. It is backed by the JUST ecosystem, the core DeFi system in the TRON ecosystem. It is deeply bound to the development of the entire ecosystem and enjoys all-round empowerment and solid support from the underlying ecosystem.

JUST is a one-stop DeFi solution within the TRON ecosystem, focusing on building a DeFi protocol based on the TRON network. Since its launch in 2020, JUST has consistently prioritized the creation of an integrated DeFi ecosystem, launching a variety of products and services, including stablecoins, staking, and cross-chain services, striving to provide users with a low-barrier, all-scenario, one-stop DeFi experience.

As the core DeFi system of the TRON ecosystem, JUST boasts robust ecosystem strength, particularly in asset accumulation. Official data from October 19th showed that the total value locked (TVL) of the TRON network reached $27 billion, of which the JUST ecosystem accounted for approximately $12.2 billion, representing 46% of the total TRON network. This means that nearly half of all TRON-chain crypto assets are deposited within the JUST ecosystem, fully demonstrating its irreplaceable position as the cornerstone of TRON's DeFi ecosystem. This demonstrates that JUST is not only the DeFi system with the highest TVL in the TRON ecosystem, but also a key driver of its overall development.

At present, JUST has built a complete DeFi product matrix, covering the core product lending agreement JustLendDAO, decentralized stablecoin USDD, TRX staking product sTRX, energy rental Energy Rental, cross-chain product JustCrypto and stablecoin system JustStable and other on-chain financial tools, which can achieve one-stop coverage of users' full needs from "asset appreciation" to "flexible configuration".

Among them, the lending agreement JustLend DAO is the core product of the JUST ecosystem and is also the DeFi application with the highest TVL in the TRON ecosystem. Its TVL has long been among the top four in the global lending track.

The USDD stablecoin is a decentralized, over-collateralized stablecoin jointly launched by JUST DAO and TRON DAO. Following its version 2.0 upgrade in January of this year, USDD's circulation has grown from zero to over $500 million, making it the second-largest stablecoin in the TRON ecosystem after USDT. Currently, USDD has a circulating supply of $476 million and a TVL exceeding $525 million.

JST is the native governance token of the JUST ecosystem, with a total circulation of 9.9 billion tokens, which will be fully circulated in the second quarter of 2023. JST holders are empowered to participate in the governance and key decision-making of the JUST ecosystem, such as voting on new proposals, system upgrades, and other important matters.

Through its core product, JustLend DAO's lending infrastructure, USDD's stablecoin support, and ecosystem services like sTRX staking and energy leasing, JUST has established a complete on-chain financial closed loop encompassing "storage, lending, staking, cross-chain operations, and energy leasing." For users, JUST offers a one-stop access to the TRON ecosystem's asset storage, lending, staking, and other services without switching between platforms, making it the preferred one-stop entry point for users to participate in the TRON ecosystem's DeFi ecosystem.

Currently, JST's buyback and burn plan is tied to two core pillars of the JUST ecosystem: JustLend DAO (one of the top four lending protocols globally) and USDD (the second-largest stablecoin in the TRON ecosystem). This means the entire JUST ecosystem will provide stable and strong support for JST from multiple perspectives, including revenue generation, application expansion, and resource collaboration.

Profit engine JustLend DAO: The platform has accumulated approximately $60 million in revenue, and its TVL has long been ranked among the top four in the lending industry.

As the core funding source for the JST buyback and burn program, JustLend DAO possesses stable and substantial profitability, having previously accumulated approximately $60 million in revenue, demonstrating its strength. DeFiLlama data shows that JustLend DAO generated nearly $2 million in fee revenue in Q3. This robust profitability is not only a key factor supporting the burn program but also holds the potential for significant long-term returns to JST.

As a core pillar of the JUST ecosystem, JustLend DAO has evolved since its launch in 2020 from its initial lending services into a comprehensive DeFi hub integrating multiple functions, including lending, staking, energy services, and a smart wallet. Its total value locked (TVL) has consistently ranked among the top four in the global lending market, making it an irreplaceable financial core of the TRON ecosystem.

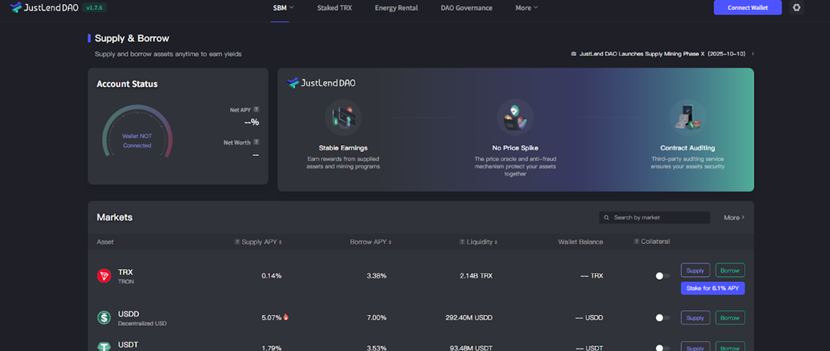

Lending is a core business. JustLend DAO leverages smart contracts to automate the entire lending process. The system uses algorithms to monitor asset supply and demand in real time and dynamically adjusts deposit and lending rates to ensure an efficient and balanced capital market. Currently, users can flexibly allocate assets within JustLend DAO: depositing idle crypto assets to earn stable interest, or lending other currencies by pledging assets, achieving leverage and flexible investment, meeting diverse needs from "steady value-added" to "efficient allocation."

JustLend DAO continues to innovate its product features. In April 2023, JustLend DAO simultaneously launched two new features: TRX staking (sTRX) and energy rental, further expanding its service offerings.

sTRX is a liquidity staking product within the TRON ecosystem, allowing users to stake TRX and obtain sTRX, a liquidity staking certificate. As of October 22nd, approximately 9 billion TRX had been staked on the platform, with over 9,970 participating addresses. With a current annualized return of 6.05%, sTRX is the preferred TRX staking platform within the TRON ecosystem.

● Energy Rental is based on the TRON network’s unique “bandwidth + energy” gas mechanism. Traditional ways of obtaining energy require staking or burning TRX, which has issues such as high prices and complicated processes. JustLend DAO’s energy rental service allows users to “rent and use as needed, and return on demand” without the need to stake TRX long-term. The cost can be reduced by about 70% compared to directly burning TRX, significantly lowering the on-chain operation threshold for small and medium-sized users.

To further optimize the user experience for on-chain transactions, JustLend DAO has launched the innovative GasFree Smart Wallet feature, which allows on-chain transfer fees to be deducted directly from the tokens being transferred, completely breaking the current limitation of holding network-native tokens (such as TRX) to pay for gas fees. Currently, with GasFree, users can pay gas fees directly with stablecoins such as USDT. Combined with JustLend DAO's simultaneous 90% fee subsidy policy, each USDT transfer now costs only approximately 1 USDT, further enhancing the convenience and cost-effectiveness of on-chain transactions.

Currently, the JustLend DAO platform has integrated multiple core DeFi modules, including the lending market (SBM), liquid sTRX (Staked TRX), energy leasing (Energy Rental), and the smart wallet (GasFree), becoming a veritable "one-stop DeFi service portal" within the TRON ecosystem. Going forward, the platform will continue to integrate more ecosystem protocols, streamlining operational processes and deepening functional integration within a single application to drive the overall growth of the TRON network's DeFi ecosystem.

As outlined in JUST's " JUST Ecosystem Overview and Planning " released last March, JUST has built a comprehensive service system encompassing "lending + staking + energy leasing" around its core lending protocol, JustLend DAO. Users can now complete diverse on-chain operations, including "interest-earning deposits and loans + staking for mining + energy leasing transactions," all within the single JustLend DAO protocol, eliminating the inefficiency of traditional DeFi's "multi-platform switching" model.

The "hub" value of JustLend DAO lies not only in its integrated product functionality but also in its ability to connect global resources and institutional capital. At the end of June of this year, TRON, a US-listed company, staked 365 million TRX through JustLend DAO, marking the platform as a crucial gateway for traditional capital to enter the TRON blockchain and poised to attract even more institutional capital in the future. In July of the same year, JustLend DAO was fully integrated with Binance Wallet, allowing users to seamlessly access the platform through the Binance ecosystem and complete operations such as lending and staking. Leveraging Binance's global reach, JustLend DAO further expands its user base and enhances the overall ecosystem's influence.

According to DeFiLlama data, as of October 22nd, JustLend DAO's total value locked (TVL) exceeded $4.5 billion, consistently ranking among the top four lending platforms globally. It's worth noting that JustLend DAO's impressive performance is achieved solely on the TRON chain, yet it rivals leading cross-chain lending protocols like Aave and SparkLend, which operate on multiple chains.

This achievement not only demonstrates JustLend DAO's strong product competitiveness and operational efficiency, but also highlights the high activity and user engagement within the TRON ecosystem. Evolving from a "single lending tool" to a "universal DeFi hub," JustLend DAO has become a key cornerstone of the TRON ecosystem's financial system, and its value will continue to grow as the ecosystem continues to expand.

JustLend DAO will not only provide solid financial support for JST's current repurchase and destruction, but also means that as the ecosystem expands in the future, it will continue to provide momentum for JST's deflation and value enhancement, becoming the "profit ballast" for JST's long-term development.

The value of JST tokens is deeply linked to ecological benefits, and is expected to usher in a new round of growth cycle.

As the JST buyback and burn plan progresses, the value of the JST token is now deeply tied to the ongoing revenue from JustLend DAO and USDD, two core components of the JUST ecosystem. As we move toward a deflationary mechanism, the long-term value of JST will gradually emerge, fueled by the comprehensive development of the JUST ecosystem.

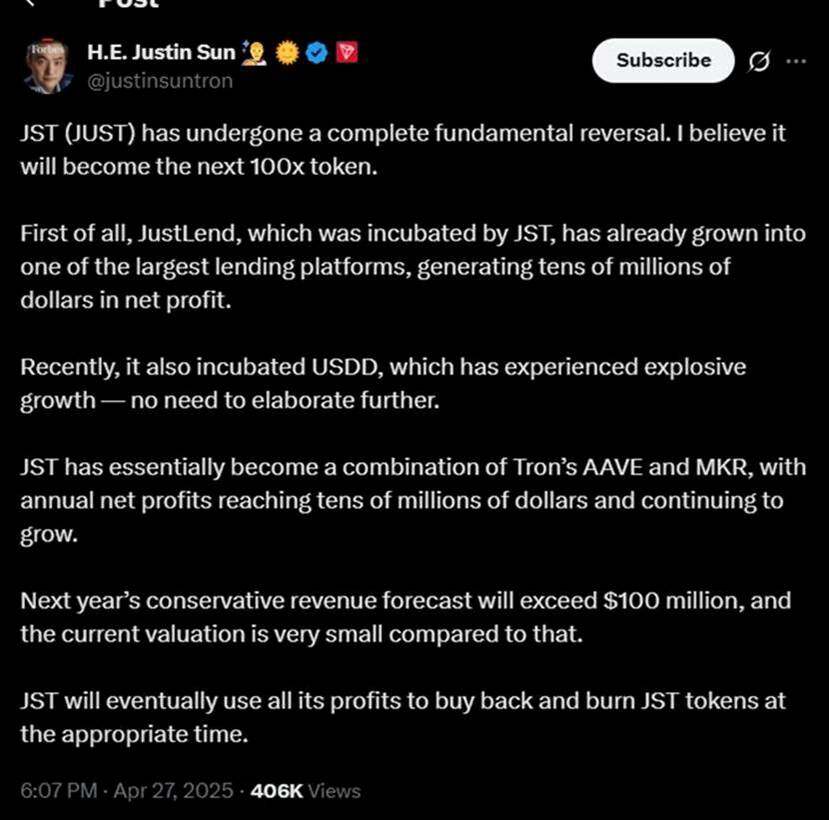

As early as April of this year, TRON founder Justin Sun stated on social media platform X that JST had achieved a fundamental turnaround and was poised to become the next "100x coin." He further emphasized that JustLend, a subsidiary of JUST, has become one of the industry's leading lending protocols, generating tens of millions of dollars in annual net profits, while its ecosystem stablecoin, USDD, has also seen strong growth. JST has essentially become a combination of AAVE and MKR within the TRON ecosystem, with annual profits steadily climbing. Revenue is projected to exceed $100 million next year.

Now, with the implementation of the buyback and burn plan, JST's long-term growth potential is gradually being realized. Its core driving force stems from the deep synergy between ecosystem benefits and the deflationary mechanism: JustLend DAO's current net income and its future incremental net income from USDD will be directly used to buy back and burn JST. This means that JST's deflationary model is not just empty talk, but is built on real ecosystem profits, forming a deep connection between ecosystem benefits and token value. The revenue performance of JustLend DAO and USDD will directly translate into an endogenous driving force for JST's value growth.

JustLend DAO, the two core products supporting this mechanism, currently boasts approximately $7.7 billion in TVL. It integrates multiple features, including lending, energy leasing, and sTRX staking, and is experiencing a simultaneous increase in both user base and profitability. USDD, the second-largest stablecoin in the TRON ecosystem, has nearly $500 million in circulation and is expanding its application scenarios. As the revenue of these two protocols continues to grow, more funds will be injected into the JST buyback pool.

At the same time, the overall support of the JUST ecosystem provides solid support for JST's value. This not only feeds into JST's value foundation through the continuous income from JustLend DAO and USDD, which are core rentals, but also broadens JST's application by leveraging the ecosystem's rich DeFi landscape. Ultimately, this will help JST further consolidate its value anchor in the crypto space, expand its development potential, and achieve comprehensive improvements in value from both the token economy and the ecosystem.