In 2025, why did digital gold Bitcoin lose to real gold?

- 核心观点:2025年黄金表现超越比特币。

- 关键要素:

- 黄金年内涨幅超50%,比特币仅15%。

- 全球央行持续增持黄金,需求占比达20%。

- 比特币与科技股相关性高,偏离黄金走势。

- 市场影响:促使投资者重新评估避险资产配置。

- 时效性标注:中期影响

Original author: Liam, TechFlow

Remember the end of 2024, when everyone was writing asset forecasts for 2025.

Stock investors are keeping an eye on the S&P and the A-share market, while people in the crypto circle are betting on Bitcoin.

But if someone told you at that time that the best-performing asset in 2025 would not be Bitcoin or stocks, but the "antique" gold that is disliked by Generation Z, you would definitely think that person was joking.

But reality is so magical.

Over the past five years, Bitcoin has outperformed gold by nearly 10 times, with a surge exceeding 1,000%, repeatedly topping the annual top asset list. However, by 2025, the story has completely reversed: while gold has risen by over 50% since January, Bitcoin has only risen by 15%.

The aunties who bought gold early laughed, and the elite traders in the crypto industry fell silent.

What's even more bizarre is that gold and Bitcoin seem to have entered a parallel world: when gold rises, Bitcoin falls; when Bitcoin falls, gold rises.

On October 21st, gold suffered a heavy blow, falling 5% in a single day. Bitcoin, like a shot of chicken blood, reversed its downward trend and began to rise...

Why is Bitcoin, known as digital gold, decoupled from physical gold?

Buying gold in troubled times

Who will be the most enthusiastic gold buyers in 2025? Not retail investors, not institutions, but central banks around the world .

The data doesn't lie: In 2024, global central banks' net gold purchases reached 1,045 tons, exceeding 1,000 tons for three consecutive years.

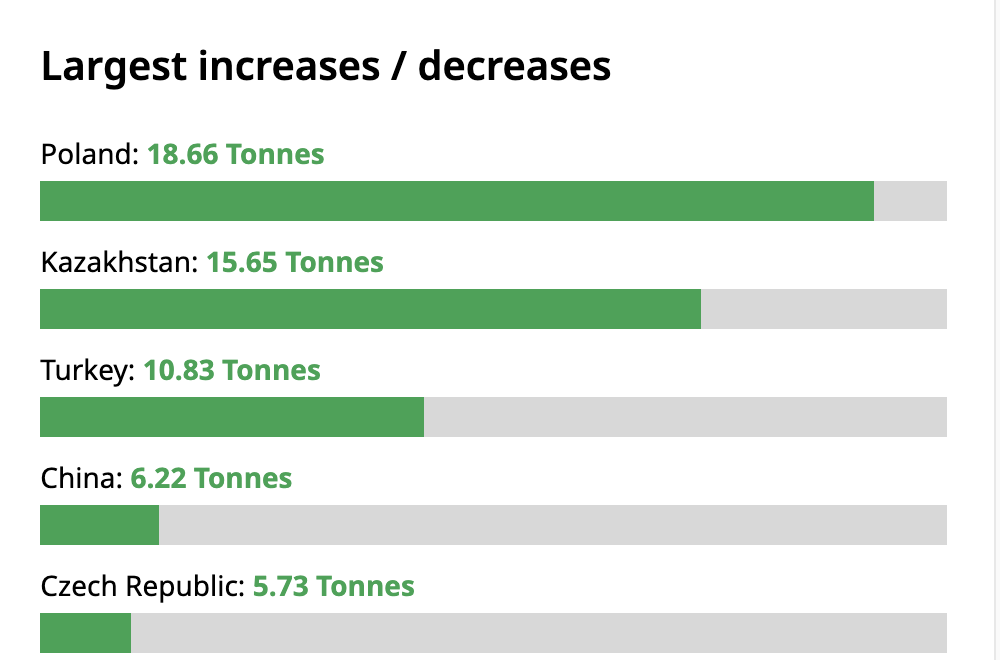

According to the World Gold Council's Q2 2025 data, Poland increased its holdings by 18.66 tons, followed closely by Kazakhstan with an increase of 15.65 tons. The People's Bank of China took a steady approach, increasing its holdings by 6.22 tons.

Why are developing countries increasing their gold holdings?

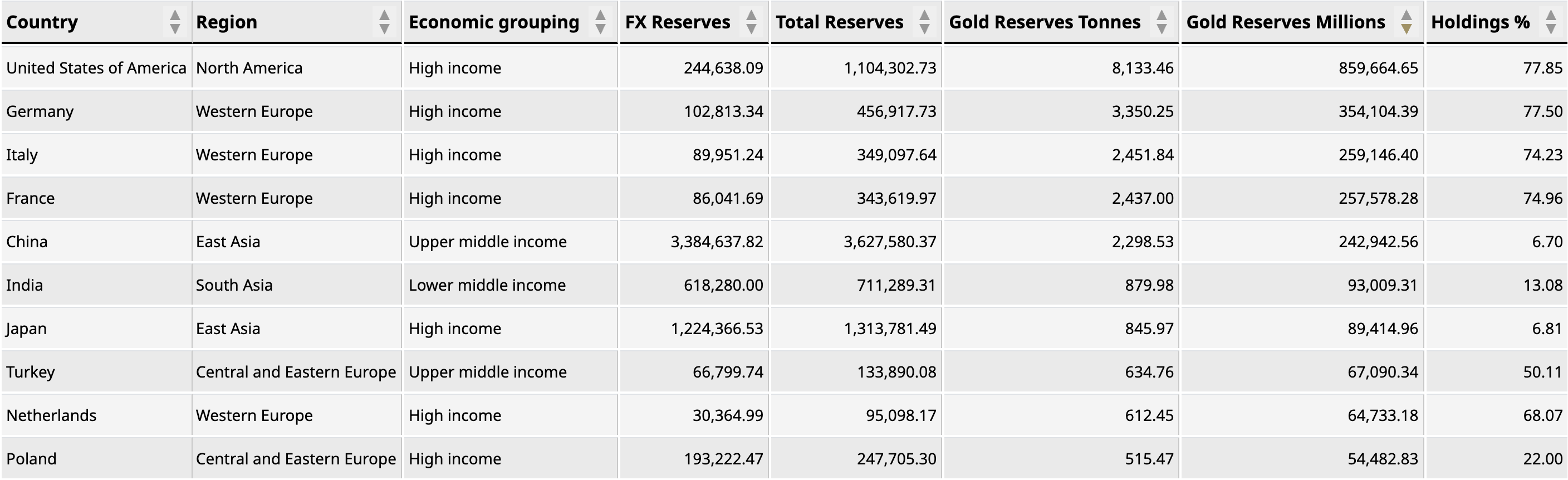

Looking at the proportion of gold reserves held by central banks of various countries, developed countries and developing countries are completely two different worlds:

77.85% of the United States' asset reserves are gold, with holdings of 8,133 tons, far ahead of second-place Germany at 3,350 tons, followed by Italy and France, which hold 2,452 tons and 2,437 tons of gold respectively.

The gold reserves of the People's Bank of China only account for 6.7% of the total asset reserves, but the absolute amount has reached 2,299 tons and is continuing to increase.

This contrast is stark: emerging market countries still have ample room to increase their gold holdings. Economies like China hold less than 7% of their reserves in gold, while developed countries in Europe and the United States generally hold over 70%. This is like a catch-up lesson: the greater the gap, the stronger the motivation to catch up.

What is exaggerated is that the proportion of central bank gold purchases in total demand has soared from less than 10% in the 2000s to 20%, becoming an important support for gold prices.

Why are central banks suddenly so obsessed with gold? The answer is simple: the world is in chaos and the US dollar is no longer trustworthy.

The Russia-Ukraine conflict, the situation in the Middle East, the Sino-US trade frictions...the global village has become as chaotic as the Warring States Period.

The US dollar has long been a core foreign exchange reserve for central banks around the world, serving as a safe haven. However, the US is now struggling to cope with its own problems, with $36 trillion in debt, a ratio of 124% to GDP. The Trump administration is volatile, making enemies externally and facing internal divisions.

Especially after the outbreak of the Russia-Ukraine conflict, when the United States could freeze other countries' foreign exchange reserves at will, countries realized that only the gold kept in their own safes is their true wealth.

Although gold does not generate interest, at least it will not suddenly "disappear" due to the policies of a certain country.

Gold is a risk hedge for both individuals and countries. The more chaotic the world is, the more sought after gold is. However, when news came that "the Russia-Ukraine war may be ending", the sharp drop in gold prices was understandable.

Digital gold or digital Tesla?

The most embarrassing asset in 2025 may be Bitcoin. Its long-term narrative is "digital gold", but it has become "digital Tesla".

Data from Standard Chartered Bank shows that Bitcoin's correlation with the Nasdaq is now as high as 0.5, having even reached 0.8 at the beginning of the year. And its correlation with gold? A measly 0.2, having even been zero at the beginning of the year.

Translated into human language, it means: Bitcoin is now tied to technology stocks. It rises when the Nasdaq rises, and it falls when the Nasdaq falls .

Everything has cause and effect.

Under the Trump administration, the US's attitude towards Bitcoin has changed from "illegal cult" to "welcome to join." The approval of the Bitcoin spot ETF in 2024 marked the official incorporation of Bitcoin into the US dollar system.

This is a good thing, proving the legitimacy of Bitcoin. But the problem is that when you become part of the system, it is difficult to fight against it .

The initial charm of Bitcoin lies in its rebellious spirit, its independence from any government and its non-control by any central bank.

But what about now? Wall Street giants like BlackRock have become the market's largest buyers, and Bitcoin's rise and fall are completely dependent on the Federal Reserve and Trump's mood. So much so that cryptocurrency traders now have to stay up late to listen to Powell and Trump's speeches, turning themselves into dollar macro analysts.

In terms of consensus, Bitcoin is still in the stage of understanding "what the hell is this" in many parts of the world, while gold is already something that "even my grandmother's grandmother likes."

The number of Chinese aunties who own gold bracelets and gold necklaces may be greater than the number of Bitcoin HODLers in the world .

Compared to gold, the young Bitcoin still has a long way to go in its evangelism.

Gold in the left hand, Bitcoin in the right hand

Many people like to choose between gold and Bitcoin, but smart investors know that this is a fill-in-the-blank question.

While central banks around the world are frantically buying gold, sending its price soaring, this trend cannot continue indefinitely. When the price of gold reaches a certain level, problems with the storage, transportation, and delivery of physical gold will arise, and this is when Bitcoin's advantages become apparent.

Imagine a specific scenario where a war breaks out in a country and the rich find that gold is too heavy and too conspicuous to transfer wealth quickly. At this time, Bitcoin in a hardware wallet becomes the best option. Such an incident has already happened to Russia.

Simply put, gold is a "bulky store of value" and Bitcoin is a "light store of value."

If the price of gold reaches a very high level, funds need to look for alternatives with similar properties but cheaper prices. In this case, Bitcoin has the opportunity to gradually break away from the gravity of the US dollar and Trump, obtain capital overflow from gold, and move closer to "digital gold" again.

In summary, the relationship between Bitcoin and gold should not be understood as one replacing the other, but rather as one of inheritance and evolution.

Gold is the wealth memory of human civilization, and Bitcoin is the wealth imagination of the digital age.

70-year-old Aunt Li buys gold jewelry, 25-year-old programmer Li Xiaoming hoards Bitcoin, everyone has a bright future.