A look at the four hottest Launchpad platforms

- 核心观点:ICO结构性回归,机制更成熟。

- 关键要素:

- 基础设施升级,合规可配置。

- 分配机制优化,小额分散化。

- 流动性自动注入,稳定价格。

- 市场影响:提升投资透明度与市场秩序。

- 时效性标注:中期影响

This article comes from: Stacy Muur, founder of Green Dots

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth )

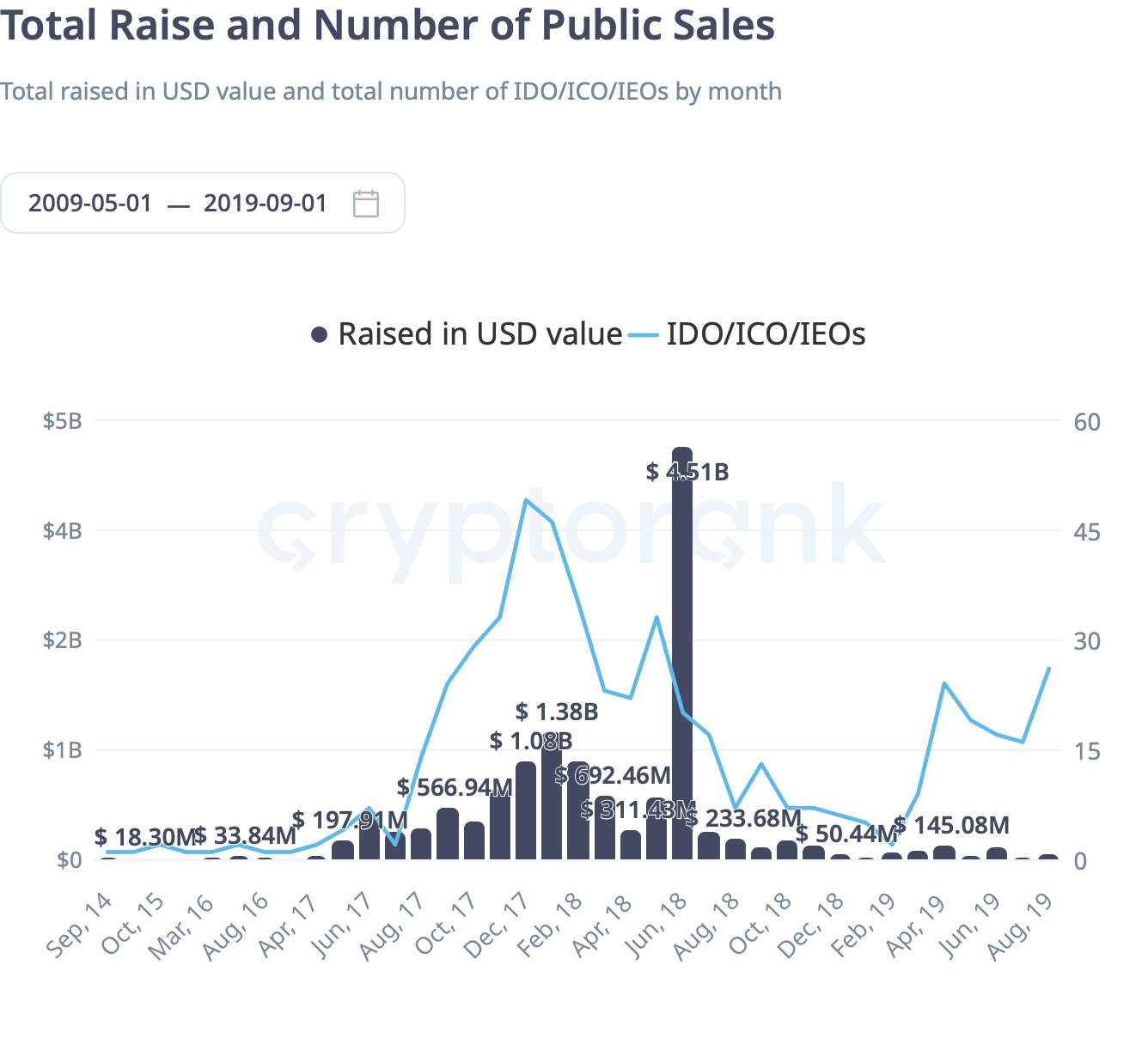

IC0 is making its first real comeback since the crazy wave of 2017 - but this time, the way it operates is completely different from the "Gas War" of that year.

This is not a nostalgia tour, but a structural market reshaping, driven by new infrastructure, more sophisticated allocation design and a clearer compliance framework.

In 2017, anyone who could write an Ethereum contract and a white paper could raise millions of dollars in minutes. There were no standardized compliance processes, no structured distribution models, and no subsequent liquidity framework.

Most investors rushed in blindly, only to see their tokens plummet after listing. Regulators quickly stepped in, and ICOs faded over the next few years, replaced by venture capital funding rounds, SAFT agreements, exchange initial coin offerings (IEOs), and the later-popular retroactive airdrops.

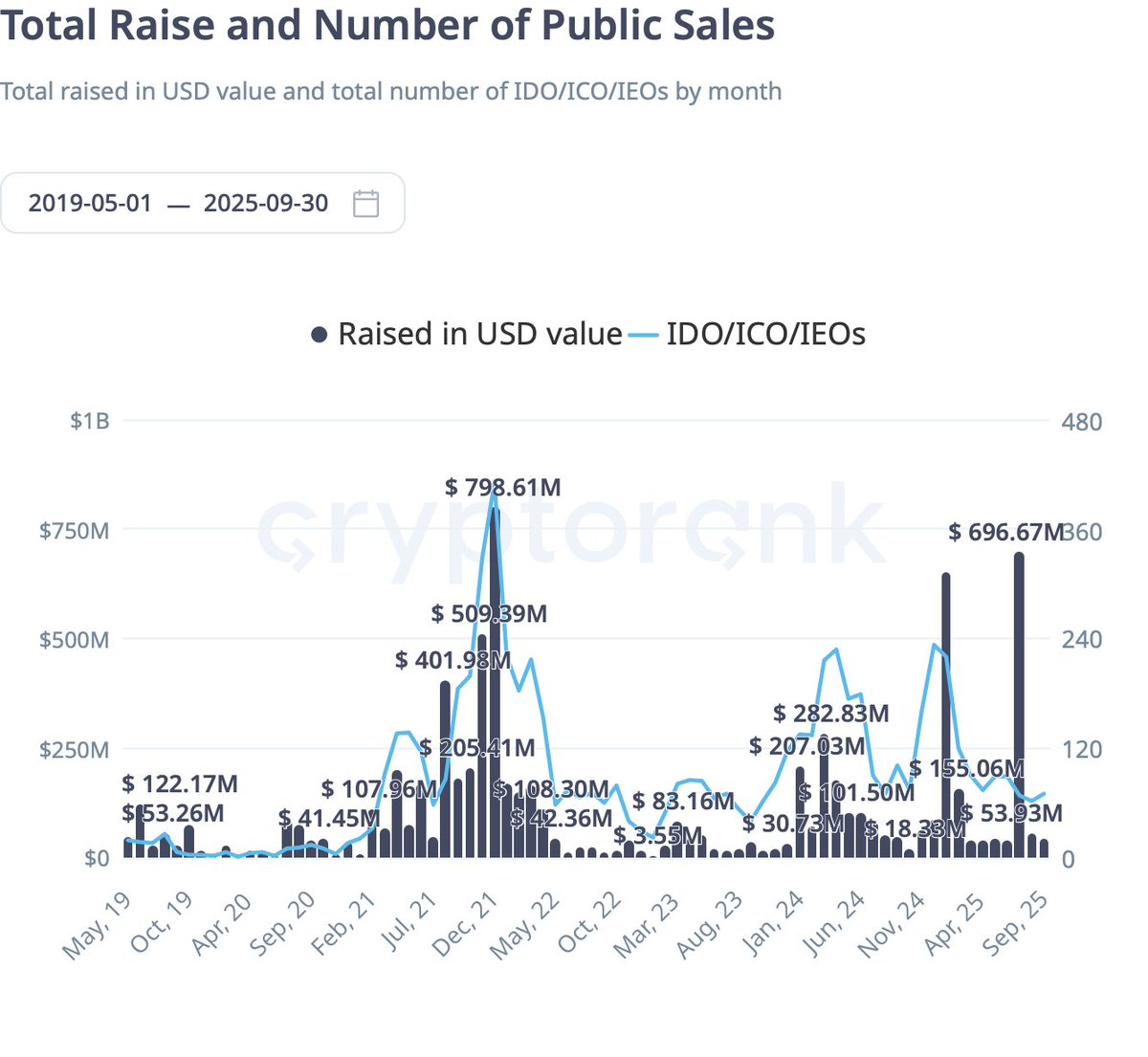

And by 2025, the pendulum has swung back again.

The change this time isn’t that projects are launching at lower valuations—in fact, many projects are now launching at even higher fully diluted valuations than before. The real difference lies in the restructuring of access .

Today's Launchpads no longer rely on speed or gas wars. Instead, participants are screened based on KYC verification, reputation points, or social influence. Micro-tickets replace whale-sized quotas, allowing more users to share in the allocation.

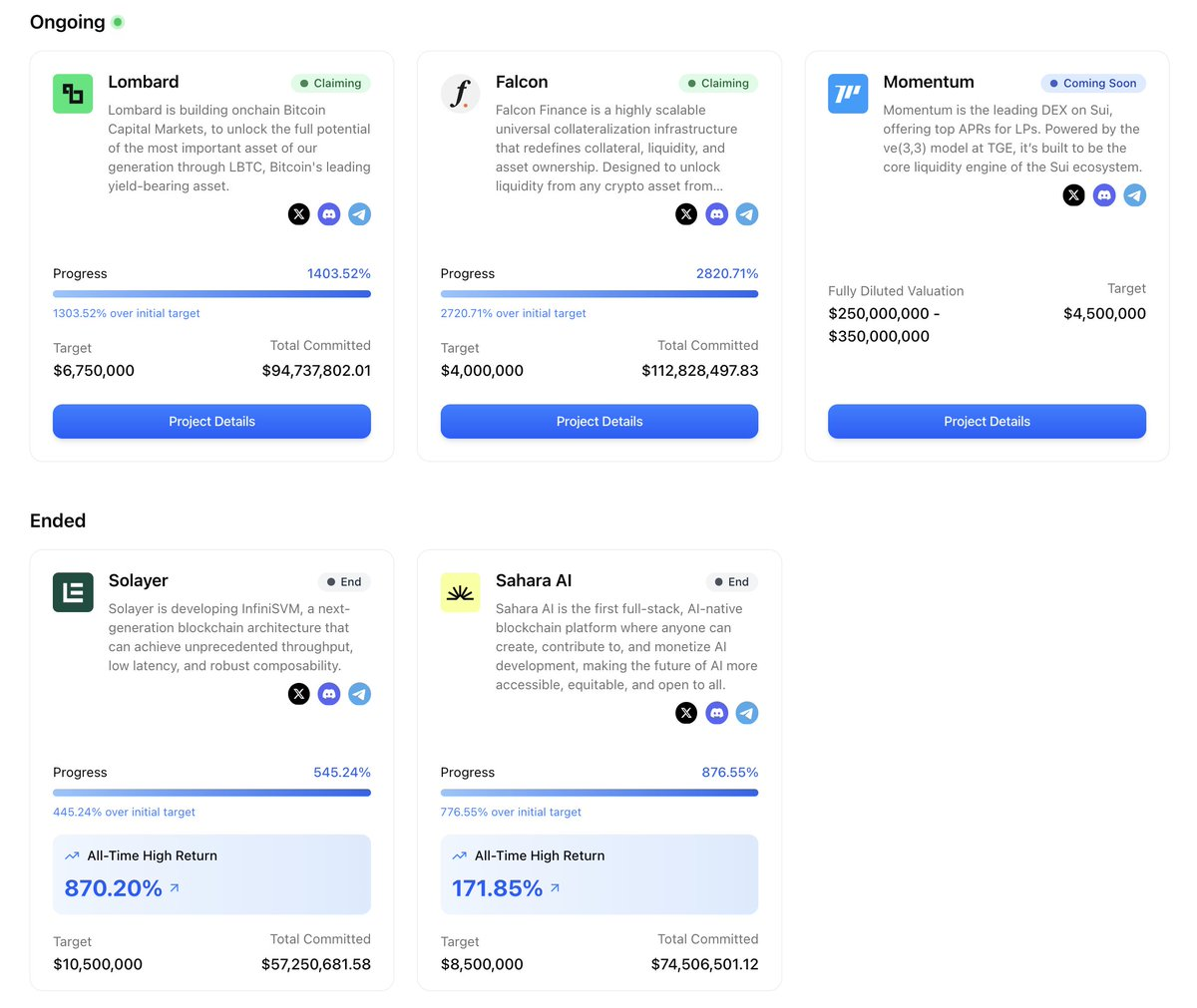

For example, on the Buildpad platform, I applied for $5,000 in Falcon Finance's public sale, but was ultimately allocated only $270—the rest was returned due to oversubscription. A similar situation occurred with Sahara AI, where I applied for $5,000 and was ultimately allocated only $600.

This oversubscription mechanism does not lower prices. Instead, it can maintain high valuations and expand the distribution range by reducing individual quotas.

Regulation is finally catching up . For example, Europe's MiCA regulations provide a clear path for compliant retail investor participation. Major launchpads are making features like KYC, geographic restrictions, and eligibility checks configurable, allowing developers to enable them with just a few clicks.

At the liquidity level, some platforms go a step further - they write post-sale liquidity policies directly into smart contracts, automatically inject liquidity into the liquidity pool (LP) after the sale is completed, or use "buy low and sell high" prices to stabilize early transactions.

By 2025, ICOs accounted for approximately 20% of all token sales, a significant rebound from their negligible share two years prior. Crucially, this resurgence wasn’t driven by a single platform, but rather by a whole generation of new issuance systems, each addressing a different pain point:

- Echo's Sonar supports cross-chain self-hosted sales, and compliance functions can be flexibly turned on and off.

- Legion has partnered with Kraken to integrate a reputation-based distribution mechanism into the exchange system.

- MetaDAO embeds treasury control and liquidity ranges directly into the issuance process.

- Buidlpad focuses on a community-first distribution model with KYC onboarding and has introduced a structured refund mechanism.

Together, these platforms have transformed IC0 from a chaotic fundraising method to an intentionally designed market structure - here, issuance access, sales pricing, liquidity maintenance, etc. are no longer improvisations after the fact, but are carefully planned at the mechanism level.

Each platform is trying to solve different pain points left over from the previous ICO wave. Today, together, they form a more structured, transparent, and attractive environment for investment.

The popular Echo: self-hosted and compliant modes can be switched

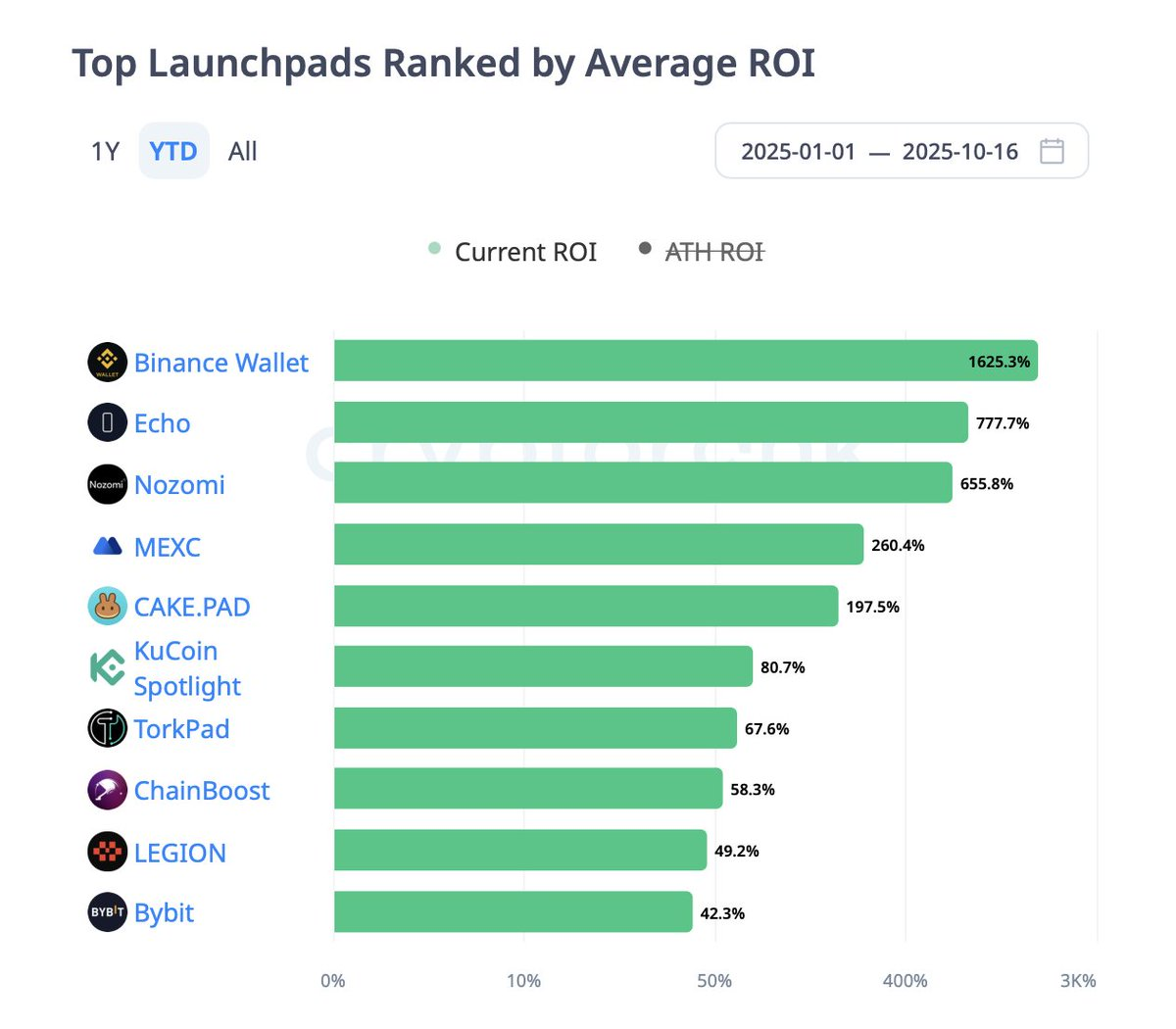

Echo, founded by Cobie, has become one of the most explosive token launch infrastructures in 2025 with its self-hosted public offering tool Sonar.

Unlike centralized launchpads or exchange-based IEOs, Echo provides infrastructure, not a "marketplace." Project teams can choose their own offering model (fixed price, auction, treasury/credit model), customize rules like KYC, investor authentication, and geofencing through Echo Passport, and distribute their own sales links—all while simultaneously offering tokens on multiple chains, including Solana, Base, Hyperliquid, and Cardano.

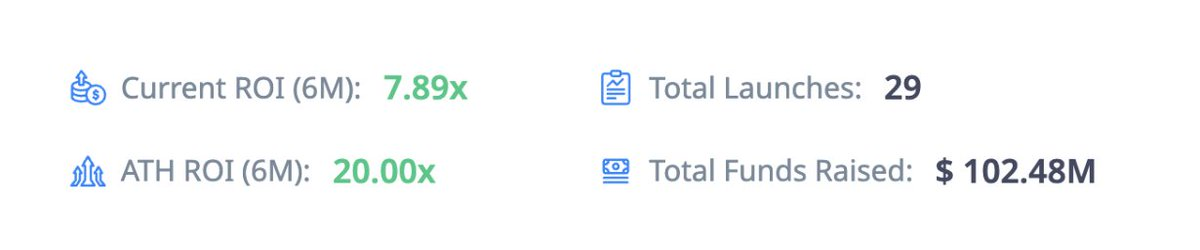

The core data of the platform are shown as follows.

Echo's most iconic success story is Plasma. In July, the project sold 10% of its token supply at $0.05 using a time-weighted vault model, attracting over $50 million in subscriptions. After its launch, Plasma achieved a peak return on investment (ROI) of 33.78x, making it one of the strongest performing ICOs of the year.

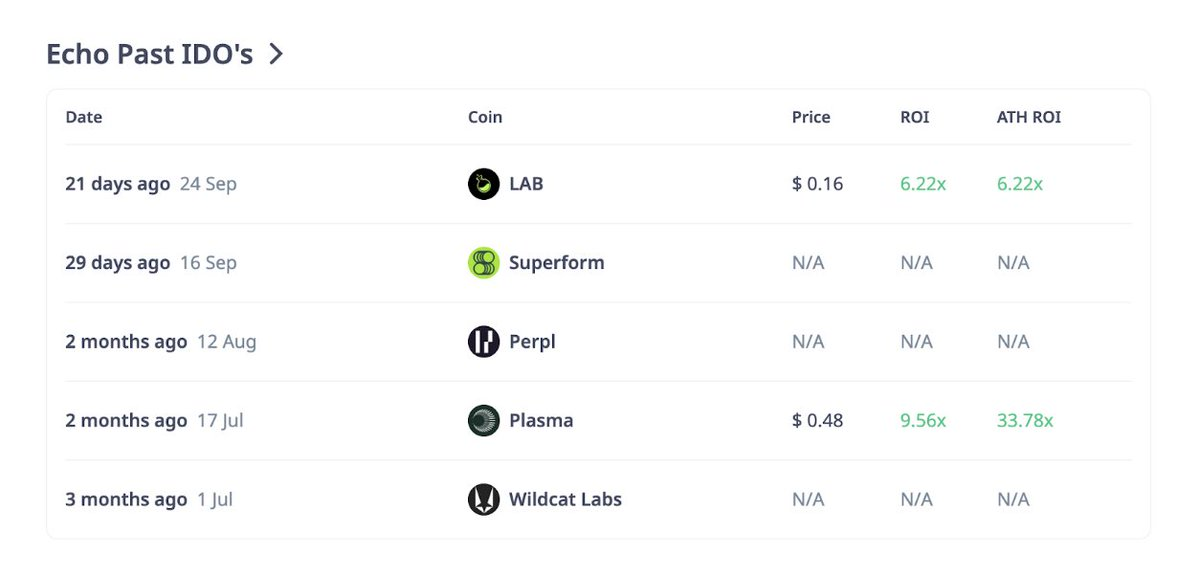

Following closely behind is LAB, which achieved a 6.22x ROI upon launch. Below is a snapshot of Echo's recent releases:

These results demonstrate both the enormous potential of the Echo platform and the diversity of results. While Plasma and LAB have achieved impressive returns, other projects, such as Superform or Perpl, have yet to launch or publish performance data.

Echo itself does not enforce any post-sale liquidity framework - such as LP seeding, market maker participation requirements, or unlocking schedules, which are defined by the issuer rather than standardized by the platform.

For investors, while Echo's flexibility makes it the launch infrastructure with the highest ROI in this cycle, it also means that investors need to conduct their own due diligence and should focus on the following points before participating:

- Compliance toggles: including KYC and investor verification requirements;

- Sales format: whether it is a vault model, auction model or fixed price model;

- The issuer's liquidity plan: Because Echo does not provide a unified liquidity standard.

Legion & Kraken: Fusion of Reputation and Regulation

If the Echo represents founder-led flexibility, the Legion goes in the exact opposite direction.

A structured, reputation-gated public fundraising channel.

In September of this year, Kraken Launch, exclusively powered by Legion's infrastructure, officially launched. This marked the first time a token sale was conducted directly within the Kraken account system, aligning with MiCA regulations and prioritizing users based on their reputation scores.

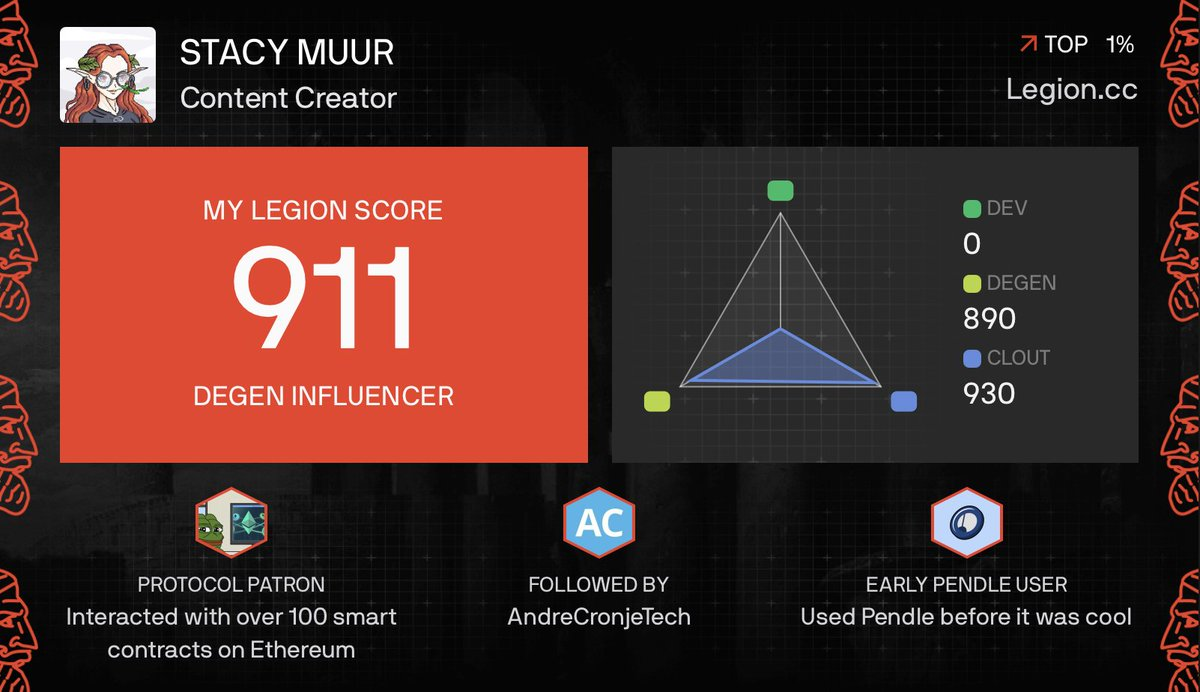

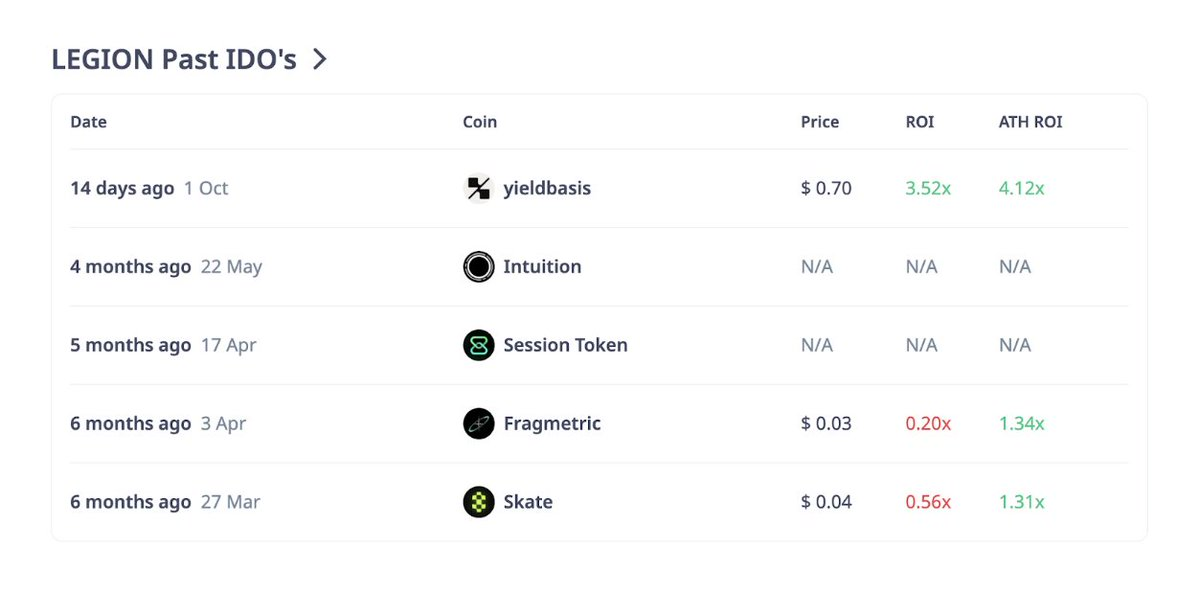

The core data of the platform are shown as follows.

The core of Legion is its reputation scoring system with a score of 0-1000, which comprehensively evaluates multi-dimensional data such as user on-chain activities, technical contributions (such as GitHub), social media participation and endorsements from others.

Projects can reserve 20%-40% of their token allocation for users with high reputation scores, and then open the remaining portion to a first-come, first-served basis or a lottery. This completely subverts the traditional ICO distribution model - no longer rewarding users who use the program to achieve the fastest clicks, but instead rewarding true builders, contributors, and influential community members.

Below is an overview of Legion's recent sales data.

The integration with Kraken provides Legion with an additional layer of assurance: exchange-level KYC/AML audits and initial liquidity. Think of it as a "crypto IPO" with a community allocation mechanism. Early examples like YieldBasis and Bitcoin Hyper experienced significant oversubscription during the Merit Phase, with low-scoring users being directed into a limited public round.

Of course, this system isn't perfect. Some early users have pointed out that Legion Scores may overweight social media influence, leading to superusers on X outperforming real builders. Furthermore, the transparency of the weighting system needs to be improved. However, compared to the previous lottery-based system, it is a significant upgrade.

For investors, the most important factor is undoubtedly the Legion Score. To secure allocations from top projects, build your on-chain footprint and contribution profile as early as possible. Also, be sure to pay attention to each project's Merit/Public allocation ratio and mechanism during its offering, as different projects often adjust this formula based on their strategies.

MetaDAO: Replacing Marketing with Mechanisms

MetaDAO is attempting something no other ICO platform has done before: encoding post-sale market policies directly into the protocol layer.

MetaDAO operates as follows: If the MetaDAO sale is successful, all USDC raised will be deposited into a market-governed treasury, to which token minting rights will be transferred. 20% of this USDC, plus 5 million tokens, will be injected into the Solana DEX liquidity pool as initial liquidity. This treasury is pre-programmed to automatically buy tokens below the initial coin offering (ICO) price and sell them above it, thus creating a soft price range around the anchor price from day one.

This sounds simple, but it fundamentally changes the dynamics of early trading. In a conventional ICO, a lack of liquidity or insider selling can cause secondary market prices to collapse. However, with MetaDAO's price band mechanism, early price movements tend to fluctuate within a well-defined range, with shallower wicks and limited blow-offs. This is a mechanism, not a promise—if market demand is insufficient, the treasury's reserves will eventually be depleted. However, it effectively shapes trading behavior and market expectations during those crucial early days.

A prime example is Solana's privacy protocol, Umbra. Umbra's public offering attracted over 10,000 participants, and its sales attracted over 10,000 participants, with subscriptions exceeding $150 million. The sales page displayed transparent, large-scale subscription data in real time, ensuring a completely transparent distribution process. This real-time, transparent, on-chain, and mechanism-driven distribution experience offers a glimpse into a more structured ICO future.

For all investors participating in the MetaDAO offering, please note:

- Note the IC0 price and understand the corresponding price range.

- When you buy at a price slightly higher than IC0, your counterparty may be the seller's order in the fund pool;

- When you buy at a price slightly lower than IC0, it may be automatically taken away by the buyer mechanism of the fund library.

In short, MetaDAO rewards rational participants who understand the mechanism, rather than speculators chasing hype.

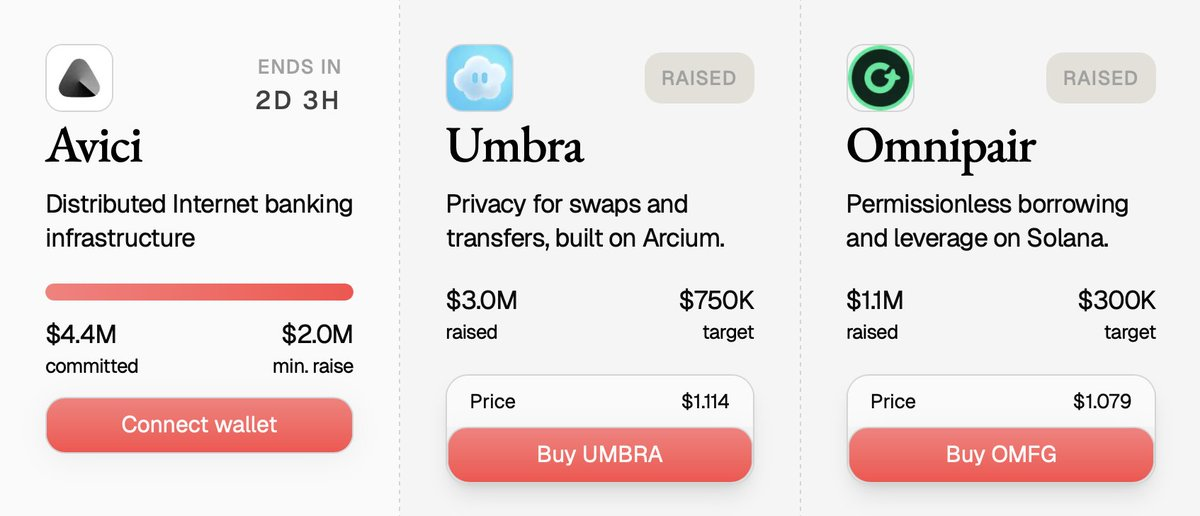

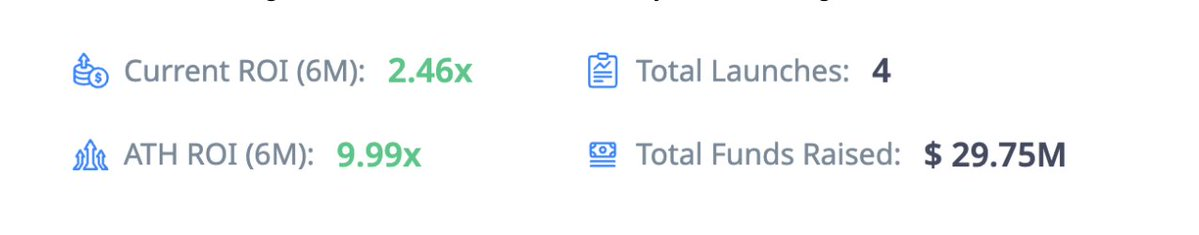

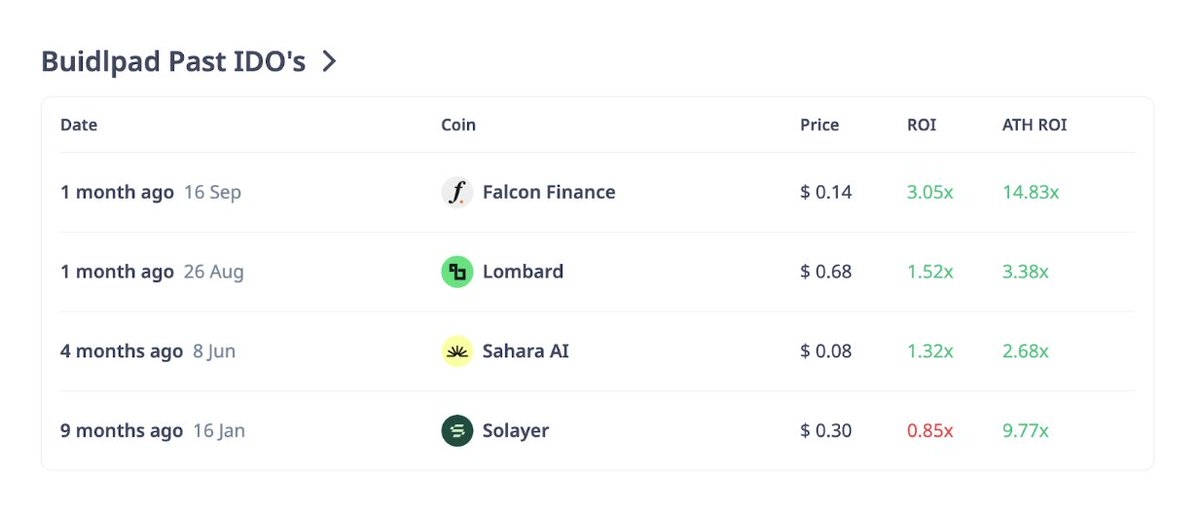

Buidlpad: A KYC threshold compliance channel for large-scale retail investors

Buidlpad is focused on one simple yet impactful thing: providing compliant retail investors with a clear, secure, and transparent way to participate in community rounds of token sales.

Founded in 2024, Buidlpad operates through a two-stage process: first, users complete KYC and subscription registration; then, they invest within the funding window. In the event of oversubscription, the excess amount will be automatically refunded. Some offerings utilize a "tiered FDV" model to regulate market demand: early rounds have lower FDVs (valuations), while later rounds gradually increase FDVs.

A milestone for Buildpad was the Falcon Finance (FF) IPO in September of this year. The IPO, with a target of $4 million, ultimately received $112.8 million, representing an oversubscription of 28 times. KYC verification took place from September 16th to 19th, with a funding window from the 22nd to 23rd, and refunds completed by the 26th. The entire process was smooth, transparent, and driven entirely by retail investors.

Buildingpad's core advantage lies in its simplicity. It avoids complex scoring mechanisms or dynamic treasury models, instead focusing on providing a structured participation channel for the community that has passed compliance audits. It's important to note that liquidity remains entirely dependent on the issuer's planning, and fragmented multi-chain fundraising can occasionally lead to dispersed post-sale trading volume.

For investors, you need to pay attention to:

- Pay close attention to the timeframe: KYC/subscription windows are hard thresholds; missing them means you lose your allotment eligibility.

- Read the tier structure carefully: earlier tiers often offer significantly better valuation starting points.

Cross-platform model and risks

Looking across these platforms, several common patterns emerge.

Oversubscription has become the norm, but the hype isn't always sustainable. Falcon achieved a 28x oversubscription, Plasma garnered nine-figure funding, and Umbra saw strong subscription demand—while these figures are impressive, without sustained use cases, high FDVs often see prices fall after the hype fades.

Mechanism design shapes volatility. MetaDAO's buy and sell ranges effectively curb market volatility, but also limit price increases near the sell range. Echo and Buildpad rely entirely on issuer self-regulation, while Legion relies on exchange listings to provide deep liquidity.

The reputation system restructures the allocation rules. On Legion, building a reputation score in advance may determine whether you can obtain a substantial quota or just struggle in the limited public sale pool.

The compliance funnel has become a feature, not a bug. KYC windows, compliance qualification switching, and reputation scoring mechanisms screen out qualified participants. This makes the sales process more orderly, but also exacerbates class divisions.

Despite these phenomena, risks remain: rating systems can be manipulated, treasury management can be mismanaged, whales can still dominate the market through multiple wallets, and regulatory enforcement often lags behind marketing hype. These mechanisms are not a panacea; they simply change the playing field.

Smart Investor Strategies for 2025

To navigate this new wave of ICOs, you need to develop systematic thinking.

- Before blindly chasing a rally, clarify the mechanism: fixed price or auction? Reputation-based or first-come, first-served? Will a fund protect the market or leave it entirely to the market?

- Mark eligibility windows: KYC/subscription deadlines, compliance requirements, and regional restrictions — missing the deadline will result in a complete loss of quota.

- Understand liquidity design: Is it MetaDAO's built-in LP price band mechanism? Or Kraken's exchange-level listing? Or perhaps the issuer's customized liquidity strategy on Echo Sonar? Remember, liquidity often determines early price action.

- Targeted layout: Master the price range on MetaDAO; build reputation in advance on Legion; target early tiers on Buildpad;

- Maintain a rational position: Oversubscription does not mean a strong secondary market - it should be viewed as a structured investment opportunity rather than a guaranteed profit-making trade.

Author's opinion

The ICO resurgence in 2025 isn’t driven by nostalgia, but rather by the combined effects of new infrastructure, new rules, and a more self-regulated market.

Platforms like Echo, Legion, MetaDAO, and Buildlpad have each addressed different flaws in the 2017 model: some focused on compliance frameworks, others on improved distribution mechanisms, and others on liquidity innovation. Together, they are driving the process of public token sales from speculative stampedes to “structured capital formation.”

For investors, advantage no longer depends solely on "early entry" but also on a deeper understanding of the operating mechanisms. Because in 2025, ICOs are not dying out—they are maturing.