Crypto Market Macro Research Report: TACO Trading and Macro Analysis and Market Outlook After the 1011 Crash

- 核心观点:加密市场系统性风险加剧,需警惕杠杆与抵押品失效。

- 关键要素:

- 特朗普关税政策引发宏观冲击。

- 过度杠杆与统一账户模式放大风险。

- USDe等核心抵押品脱锚触发崩盘。

- 市场影响:加速去杠杆,赛道再定价,监管趋严。

- 时效性标注:中期影响。

1. Background and Analysis of the Incident

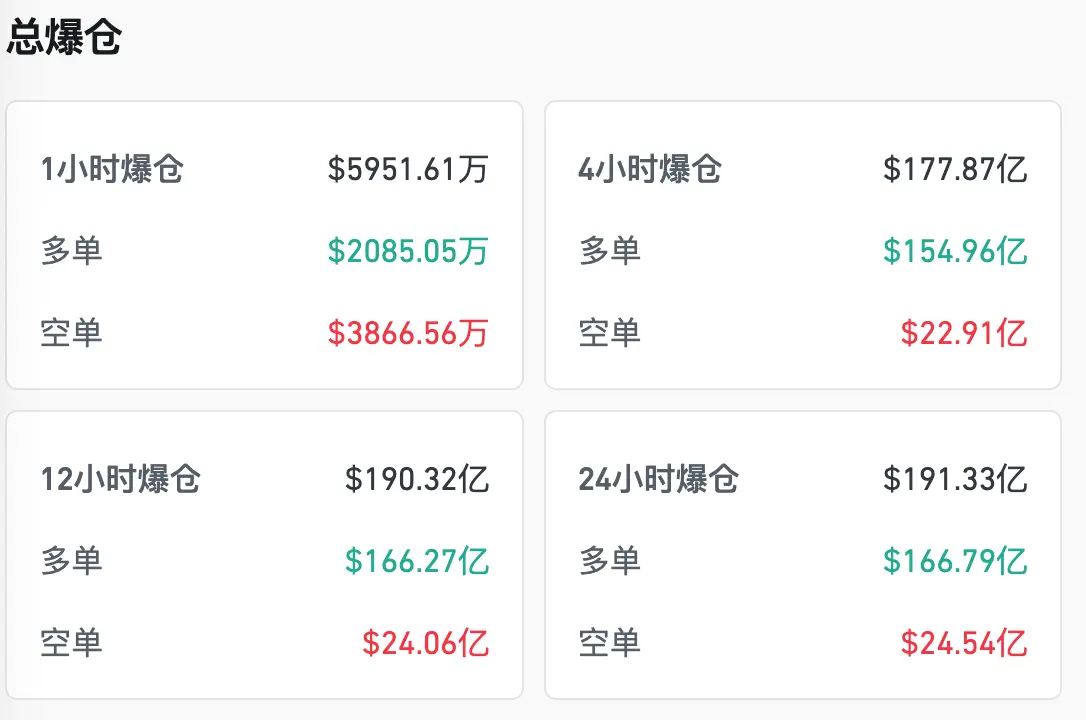

The market shock of October 11, 2025, has earned the industry the nickname "1011." This extreme market movement, which saw over $19 billion in liquidated positions and saw Bitcoin plummet by $15,000 in a single day, was not an isolated incident. Rather, it was the result of a confluence of macroeconomic political factors, structural market vulnerabilities, and localized triggering mechanisms. Its complexity and destructive power are reminiscent of the Lehman Brothers crisis during the 2008 global financial crisis. Below, we examine the underlying logic of this crisis from the perspectives of the macroeconomic background, market vulnerabilities, triggering mechanisms, transmission chains, and clearing mechanisms. Global Macro: Trump's Tariff Policy and the Sino-US Trade Conflict. In the second half of 2025, the global economy was already under high pressure. After several rounds of interest rate hikes and deficit expansion, the US fiscal sustainability was under scrutiny. The US dollar index remained elevated, tightening global liquidity. Against this backdrop, late on the evening of October 10 (EST), Trump abruptly announced a 100% tariff on all Chinese imports, far exceeding market expectations and escalating the Sino-US trade conflict from "structural friction" to "full-scale economic confrontation." This policy instantly shattered the market's illusions about a "detente" between China and the United States. Asia-Pacific stock markets were the first to come under pressure, with US stock futures plummeting in pre-market trading. More importantly, the pricing logic of global risk assets was completely disrupted. For crypto assets, which are highly dependent on US dollar liquidity and risk appetite, this was undoubtedly a systemic shock. It can be said that the macroeconomic level provided the external shock of a "black swan," the initial trigger for the October 11th incident. Furthermore, there are market vulnerabilities: factors such as tight liquidity, excessive leverage, and overly emotional sentiment. However, whether any external shock can escalate into a crisis depends on the inherent vulnerabilities of the market.

The crypto market in 2025 is at a delicate stage. First, liquidity is tight. The Fed's balance sheet reduction and high interest rates have led to a shortage of US dollar funds. Stablecoin issuance has slowed, arbitrage channels between on- and off-exchange markets are congested, and the depth of on-chain liquidity pools has significantly decreased. Second, there is excessive leverage. With BTC breaking through $100,000 and ETH returning to a trillion-dollar market cap, market sentiment is extremely euphoric. Perpetual swap open interest has reached new highs, and overall leverage has surpassed the peak of the 2021 bull market. Furthermore, sentiment is overdrawn. The surge in the meme sector and the resulting capital frenzy have driven a surge in both retail and institutional investors, driven by a single-minded expectation of a sustained bull market. A reversal of this trend could be devastating. Consequently, the market has long been a "house of cards built on high leverage," vulnerable to collapse at the slightest spark. Trigger mechanism: the depegging of USDe, wBETH, and BNSOL. What truly triggered the crisis was the simultaneous depegging of three key assets: USDe (a new over-collateralized stablecoin) briefly fell below $0.93 due to a partial liquidation of reserve assets, triggering a chain reaction of panic. wBETH (a liquid derivative collateralized by Ethereum) saw its discount widen to 7% due to insufficient liquidity and liquidation pressure. BNSOL, after depegging due to cross-chain bridge fund withdrawals, saw its discount reach nearly 10%. All three assets were heavily used as collateral and trading pairs in the market. When their prices rapidly deviated from fair value, the liquidation engine misjudged the risk, and the collateral value plummeted, further amplifying the chain reaction of margin calls. In other words, the failure of these "core liquidity assets" became the trigger for the market's self-destruction. The chain of market collapse: from depegging to margin calls. The transmission logic of the incident can be summarized as follows: depegging impacts collateral → insufficient margin triggers liquidation → CEX/DEX exchanges rush to liquidate and sell → price collapse → more collateral depegging, creating a positive feedback loop. Especially under the "unified account margin model," where users share a shared asset pool, the plummeting price of collateral like USDe and wBETH directly drags down the health of the entire account, leading to large-scale, non-linear liquidations. This flaw became the most critical structural risk point in the 1011 incident. CEX and DEX liquidation mechanisms differ. Centralized exchanges (CEXs) often use automatic position deleveraging (ADL) and forced liquidation mechanisms. Once margin is insufficient, the system forces liquidations. This often exacerbates "stampedes" during periods of high volatility. Binance and OKX, due to their high user concentration, have extremely large liquidation volumes. Decentralized exchanges (DEXs) often use smart contract clearing, which provides on-chain transparency. However, due to limited on-chain settlement speeds, price slippage, and gas congestion limit liquidation efficiency, resulting in some positions being unable to be immediately liquidated, further distorting prices. In the 1011 incident, the overlapping liquidation mechanisms of CEXs and DEXs created a "double stampede." Collateral risk: A fatal flaw of the cross-margin model. The "cross-margin with shared collateral" model, popular in the crypto market in recent years, was originally intended to improve capital efficiency by allowing different assets to share margin. However, in extreme cases, this model can amplify risks: USDe and wBETH depreciation leads to shrinking account equity; deteriorating margin ratios trigger a chain of forced liquidations; and forced liquidation selling pressure further drives down collateral prices. This positive feedback loop can cause small-scale collateral decoupling, rapidly escalating into systemic liquidations.

The October 11th incident wasn't a single black swan event, but rather the result of a complex combination of macroeconomic shocks, leverage vulnerabilities, collateral failures, and liquidation flaws. Trump's tariff policy was the trigger, while excessive market leverage and the unified account model were the detonators. The depegging of USDe, wBETH, and BNSOL was the direct trigger, and the CEX/DEX liquidation mechanism served as an amplifier that accelerated the collapse. This crisis reveals a harsh reality: the crypto market has evolved from an "independent pool of risky assets" into a complex system deeply coupled to global macroeconomics and geopolitics. Within this landscape, any external shock could trigger a chain reaction through leverage and collateral structures, ultimately leading to a "Lehman Brothers"-style liquidity collapse.

II. Historical Comparison and Analysis

On March 12, 2020, amid the spread of the COVID-19 pandemic and plummeting oil prices, global capital markets experienced a historic panic, entering a "crypto-Lehman moment" of the COVID-19 liquidity crisis. Circuit breakers were triggered in the US stock market, and US dollar liquidity was extremely tight. Safe-haven demand led to a sell-off of all high-risk assets. Bitcoin plummeted from approximately $8,000 to under $4,000 in a single day, a drop of over 50%, sparking widespread descriptions of the "crypto-Lehman moment." The March 12th Incident was essentially a macro liquidity shock transmitted to the crypto market: a dollar shortage led investors to sell all non-core assets, and stablecoin exchange became increasingly difficult. At the time, market infrastructure was weak, the DeFi sector was still small, and liquidations were primarily concentrated on centralized exchanges like BitMEX. Leveraged funds were forced to liquidate, and on-chain collateral assets were also subject to a run. However, the overall market was still in its early stages, and while the crisis was severe, it was largely the result of a single external macro shock amplified by leveraged liquidations. Entering 2021, Bitcoin broke through $60,000, and market sentiment was fervent. In May, the Chinese government issued a series of policies to regulate the mining industry and crack down on trading. Coupled with the US SEC's compliance review of trading platforms, the crypto market faced significant regulatory pressure. Amidst excessive leverage and overoptimism, over $500 billion in market capitalization evaporated in a single day, with Bitcoin's price plummeting to around $30,000. The 519 (September 19th) event was characterized by a combination of policy and internal market vulnerabilities. On the one hand, China, a major mining and trading nation, exerted regulatory oversight, directly weakening the BTC network's computing power and market confidence. On the other hand, high open interest in perpetual swaps led to rapid liquidation. Compared to the March 12th event, the trigger for the 519 event was more likely to be a combination of policy and structural risks, demonstrating that the crypto market, as it moves towards mainstream adoption, can no longer avoid regulatory and policy variables. The "1011 Bloodbath" on October 11, 2025, marked a complex systemic moment of macroeconomic volatility, leverage, and collateral decoupling. Over $19 billion in liquidations occurred in a single day, and Bitcoin plummeted from $117,000 to $101,800. Compared to March 12 and May 19, the complexity and systemic characteristics of October 11 are even more prominent. First, at the macro level: Trump's blanket imposition of 100% tariffs on China directly escalated geopolitical friction into economic confrontation, triggering a high US dollar and pressure on risky assets across the board. The impact was similar to March 12, but the backdrop was no longer the black swan of the pandemic, but rather the predictable conflicts arising from political and economic dynamics. Second, market fragility: Leverage ratios reached historic highs again, BTC and ETH hovered at high levels, and the meme craze fostered excessive optimism, while liquidity was significantly insufficient due to the Fed's balance sheet reduction and the slowdown in the expansion of stablecoins. This environment is similar to the one of May 19—a combination of optimism and structural fragility, but on a more profound level. Third, the trigger mechanism: The simultaneous depegging of three core collateral assets, USDe, wBETH, and BNSOL, was the unique "internal trigger" of October 11. These assets serve as collateral and the foundation of trading pairs. If their prices deviate from fair value, the entire margin system will collapse. This is a situation that did not occur in 312 and 519, indicating that collateral risk has become a new systemic weakness.

The similarities between the three crises all reflect the crypto market's inherent logic of "high leverage, fragile liquidity, and liquidation." External shocks served as triggers (the March 12 pandemic, the May 19 regulatory crackdown, and the October 11 tariffs), with internal leverage and insufficient liquidity acting as amplifiers. Each crisis saw sharp daily fluctuations exceeding 40%, accompanied by massive margin calls and a severe blow to market confidence. The differences lie in the fact that the March 12 crisis was a single macroeconomic shock, resulting in a small market and limited on-chain impact; the May 19 crisis involved a combination of regulation and leverage, demonstrating the direct impact of policy variables on the market; and the October 11 crisis involved a combination of macroeconomic factors, leverage, and collateral decoupling, with the crisis spreading from the outside to core assets, reflecting the evolving complexity of the system. In other words, the crisis chain continues to lengthen: from a single macroeconomic shock to a cumulative policy impact to the self-collapse of core assets within the system. Three historic crashes reveal the evolution of crypto market risk: from marginal assets to systemic coupling. While March 12, 2020, was primarily an external shock, October 11, 2025, is highly tied to global macroeconomic and geopolitical factors, rendering the crypto market no longer a "standalone risk pool." From single leverage to a collateral chain: Early crises stemmed primarily from excessive contract leverage, but now they've evolved into issues with the stability of the collateral assets themselves. The unpegging of USDe, wBETH, and BNSOL are typical examples. From external amplification to internal self-destruction: March 12 relied primarily on macro sell-offs, while May 19 combined regulation and leverage. October 11 demonstrates that the market has developed an internal self-destructive chain. Gaps in infrastructure and institutional constraints: The unified account margin model amplifies risks in extreme market conditions. The combined effects of CEX/DEX liquidations and accelerated stampedes indicate that current market institutional design remains focused on efficiency, while risk mitigation mechanisms are severely inadequate. The three crises of March 12, May 19, and October 11 witnessed the crypto market's evolution from a "fringe asset" to a "systemically coupled" entity in just five years. March 12 revealed the lethality of macro liquidity shocks, May 19 exposed the double-edged sword of policy and leverage, and October 11 marked the first demonstration of collateral failure and the full-scale outbreak of structural risks. In the future, the systemic risks of the crypto market will become even more complex. On the one hand, its heavy reliance on US dollar liquidity and geopolitical dynamics has made it a "highly sensitive node" in the global financial system. On the other hand, its high internal leverage, cross-asset collateralization, and unified margin model make it prone to accelerated collapse during crises. For regulators, the crypto market is no longer a "shadow asset pool" but a potential source of systemic risk. For investors, each crash marks a milestone in the evolution of risk perception. The significance of the October 11 incident is that the Lehman Brothers moment in the crypto market is no longer just a metaphor; it could become a reality.

3. Track Impact Analysis: Crypto Market Repricing After the 1011 Incident

Meme Market: From Frenzy to Decline, Post-FOMO Disillusionment. The meme sector was arguably the most promising sector in the first half of 2025. The legacy of Dogecoin and Shiba Inu, coupled with the popularity of emerging Chinese memes, made meme a hub for young users and retail investors. Driven by FOMO, daily trading volume for individual coins exceeded billions of dollars, becoming the primary source of trading volume on both centralized and decentralized exchanges (CEXs). However, after the October 11th incident, the structural weaknesses of meme coins were exposed: Liquidity concentration: Over-reliance on leading exchanges and a single liquidity pool led to significant price slippage in times of market panic. Lack of underlying value: Meme coin valuations relied heavily on social narratives and short-term traffic, making them vulnerable to systemic liquidity runs. The funding effect was fleeting: retail investors retreated and institutions cashed out, resulting in a short-term "disillusionment." It can be said that the meme sector's closed loop of "traffic-price-funding" could no longer be sustained under macroeconomic shocks. Unlike traditional assets, memes' fragility stems from a lack of verifiable cash flows or collateralization, making them one of the sectors that suffered the most losses during the crash. Memes are not only speculative assets but also a form of "social expression" for a younger generation of investors. Their explosive growth reflects group psychology, identity, and internet subculture. However, in today's highly centralized financial world, memes have shorter lifespans and are more susceptible to capital backlash. After the 10/11 incident, the short-term narrative of memes has essentially collapsed, and the future may see a return to a niche existence of "long-tail cultural coins" and "branded memes."

The DAT track: Digital Asset Treasury repricing. Three representative cases include MicroStrategy (MSTR), which continues to increase its Bitcoin holdings through bond issuance, embodying the "single-currency treasury model"; Forward, which focuses on Solana Treasury asset management and emphasizes ecosystem integration; and Helius, which shifts from a healthcare narrative to the "Solana Treasury Platform," generating cash flow through staking income and ecosystem collaboration. The core of the DAT model is holding crypto assets as "quasi-reserve" and generating cash flow through staking, re-staking, and DeFi strategies. In a bull market, this model can generate a NAV premium, similar to a "crypto closed-end fund." After the October 11th incident, the market's pricing logic for DAT companies rapidly contracted: asset depreciation and the plummeting prices of BTC/ETH and other currencies directly depressed the DAT's net asset value (NAV). The direct impacts include: 1. Disappearance of premiums: The market's previous premium for mNAV (Market Cap/NAV) stemmed from expectations of expansion and cash flow, but this premium quickly reverted after the crisis, with some small DATs even trading at a discount. 2. Liquidity divergence: Large companies like MSTR have financing capabilities and brand premiums, while small DATs lack liquidity, leading to significant stock price fluctuations. 3. Large vs. Small Companies: Liquidity differences. Large companies (like MSTR) can still expand their coffers through secondary market issuance and bond financing, demonstrating strong risk resilience. Small companies (like Forward and Helius) rely on token issuance and re-staking income for funding, lacking financing tools. In the event of a systemic shock, both cash flow and confidence are eroded. The sustainability of the model and the substitution effect of ETFs. DATs face long-term competitive pressure from ETFs and traditional asset management tools. As BTC and ETH spot ETFs mature, investors can gain exposure to crypto assets through low-fee, compliant channels, compressing the premium offered by DATs. Its future value lies more in: whether it can build excess returns through DeFi/re-staking; whether it can establish ecological synergy (such as binding to a public chain); whether it can transform into a "crypto asset management company."

Perp DEX track: Reshaping the contract market landscape. The Hyperliquid ETH-USDT liquidation incident, which saw large-scale liquidations on the 1011th Hyperliquid ETH-USDT contract, caused a short-term lack of liquidity and led to price decoupling. This incident revealed the liquidity fragility of on-chain contract markets during extreme market conditions: market makers withdrew funds, causing a sharp drop in depth; the liquidation mechanism relies on oracles and on-chain prices, and its responsiveness is constrained by block confirmations; when users' margin is insufficient, forced liquidations are inefficient, resulting in additional losses. The automatic liquidation mechanism and funding rates reached historic lows. Decentralized contract platforms often use automatic liquidation (ADL) to prevent margin calls, but in extreme market conditions, ADL can force ordinary users to reduce their positions, leading to secondary market volatility. Furthermore, funding rates fell to multi-year lows after the 1011 incident, indicating a severe suppression of leverage demand and a decline in market activity. On-chain vs. centralized: Differences in resilience: Centralized exchanges (CEXs): Offer greater liquidity and high matching efficiency, but the risk lies in user concentration. If a systemic stampede occurs, the scale can be enormous. Decentralized exchanges (DEXs): Offer high transparency, but are limited by block throughput and gas fees in extreme market conditions, making them less resilient. This incident demonstrates that Perp DEX has yet to resolve the conflict between efficiency and security, and its performance underperformed CEXs in extreme market conditions, becoming a market weakness. The future reshapes the contract market landscape. Looking ahead, the following trends are likely to emerge: CEXs will continue to dominate: Leveraging their liquidity and speed advantages, CEXs will remain the primary battlefield; DEXs will seek innovation: Improving resilience through off-chain matching, on-chain settlement, and cross-chain margining; The rise of hybrid models: Some new platforms may adopt a hybrid CEX-DEX structure, balancing efficiency and transparency; Increasing regulatory pressure: Following the October 11th incident, the clearing chain in the contract market has drawn scrutiny, potentially leading to stricter leverage restrictions.

The repricing logic of the three major sectors: Meme sector: From frenzy to decline, the future may return to niche culture and branding, and it will be difficult to recreate a market-wide liquidity center. DAT sector: The premium logic has been compressed, large companies have strong risk tolerance, and small companies are more vulnerable. ETFs will become a long-term alternative competitor. Perp DEX sector: Extreme market conditions have exposed liquidity and efficiency deficiencies. Future technological innovation and institutional reforms are needed to remain difficult to compete with CEX. The October 11th incident was not only a market reckoning, but also the starting point for sector repricing. Meme has lost its bubble support, DAT has entered a period of rational valuation, and Perp DEX faces the challenge of reshaping. It is foreseeable that the next round of expansion in the crypto market will inevitably take place within a more complex institutional and regulatory framework, and October 11th will be a key milestone in this turning point.

IV. Investment Prospects and Risk Warnings

The October 11th incident once again revealed the collective behavior of the crypto market: during upward market trends, leverage usage tends to rise exponentially, with both institutional and retail investors gravitating toward maximizing capital efficiency in the hope of achieving short-term excess returns. However, when external shocks occur, excessive leverage concentration leaves the market vulnerable. Data shows that in the week leading up to October 11th, open interest (OI) in BTC and ETH perpetual contracts was nearing historical highs, and funding rates reached extreme levels. As prices plummeted, margin calls accumulated to $19 billion within hours, creating a classic "herd stampede": once market expectations reversed, investors rushed to liquidate their positions and fled, exacerbating the price collapse. The "TACO" (Trump Anticipated China Outcome Trade), which sparked heated market discussion during this incident, was essentially a pre-pricing and speculation based on Trump's policy signals. The market generally believes that Trump is adept at creating price fluctuations through extreme rhetoric and policy changes, thereby indirectly manipulating market expectations. Some funds even established short positions before the news was released, creating an asymmetric market dynamic: on one side were highly leveraged retail investors and investors chasing the market's gains, while on the other side were smart money engaged in "anticipation trading." This arbitrage based on political signals exacerbated market sentiment and irrational volatility.

Investor Stratification: Old-Era "Hope Strategies" vs. New-Era "Narrative Arbitrage." The October 11th incident highlighted the divergent investor structures: Old-Era investors still relied on the "hope strategy"—holding long-term, believing prices would rise due to macro liquidity or the halving cycle—lacking awareness of structural market risks. New-Era investors, on the other hand, are more adept at "narrative arbitrage," exploiting policy news, macro signals, or on-chain capital flow dynamics to rapidly switch positions and pursue short-term risk-return ratios. This stratification results in a lack of neutral support in extreme market conditions: either overly optimistic long-termists passively bear losses, or high-frequency arbitrage funds dominate short-term fluctuations, exacerbating the overall market's volatility. The October 11th incident further demonstrates that the crypto market is highly financialized and cannot exist independently of the macro environment. The Federal Reserve's interest rate decisions, the state of US dollar liquidity, and the geopolitical friction between China and the United States all shape the pricing logic of crypto assets in real time. From a regulatory perspective, countries around the world have begun to address three major concerns: Insufficient transparency: Limited disclosure of collateralized assets in stablecoins and derivatives can easily lead to a crisis of trust; User protection gaps: Opaque leverage and liquidation mechanisms expose retail investors to asymmetric risk; Financial stability risks: The cascading impact of the crypto market has already had spillover effects on the US stock market and even the commodities market. It is foreseeable that future regulation will focus on improving transparency, protecting user rights, and establishing a stable framework for integration with traditional finance. In the short term, the market will enter a phase of deleveraging. Funding rates have fallen into negative territory, indicating a significant decline in long-term momentum. After the leverage reduction, BTC and ETH may gradually stabilize at key support levels, and market volatility will remain high but converge. High-risk assets such as meme coins have limited room for recovery, while collateralized derivatives and stablecoins with stable cash flows may serve as a safe haven during the recovery. The pace of market recovery depends on two factors: the speed at which leverage is absorbed on the exchange and whether there is marginal improvement in the macroeconomic environment. Federal Reserve liquidity is highly correlated with the crypto market. Over the past two years, the correlation between Federal Reserve liquidity and crypto market prices has significantly increased. When US dollar liquidity tightens, stablecoin issuance slows, the depth of on-chain funding pools decreases, and this directly weakens market carrying capacity. Conversely, when liquidity eases or expectations of peaking interest rates grow, the crypto market tends to rebound first. Therefore, the market outlook for the coming months will largely depend on the Fed's policy direction before the end of the year. If the rate hike cycle truly ends, the market may see a phased recovery; however, if the US dollar remains strong, risk assets will remain under pressure.

Regulatory trends: transparency, user protection, and financial stability frameworks. Regulatory priorities in various countries will include: transparency of stablecoin reserves: requiring disclosure of asset composition to avoid "shadow banking"; regulation of leverage and clearing mechanisms: setting reasonable leverage limits and increasing risk control buffers; and systemic risk firewalls: establishing cross-market risk monitoring to prevent crypto risks from spilling over into the banking system. For investors, regulation may bring short-term uncertainty, but in the long term, it will help reduce systemic risk and boost institutional confidence. Risks and opportunities in the coming months: Risks: Continued escalation of Sino-US trade frictions, further impacting risky assets; Another partial decoupling of stablecoins or derivatives, triggering market panic; If the Federal Reserve maintains a hawkish stance, deteriorating funding conditions will drag down crypto valuations. Opportunities: High-quality collateralized derivatives (such as LSTs and rehypothecation agreements) may benefit from safe-haven demand; The regulatory compliance process for stablecoins will bring long-term incremental institutional and compliant funding; High-quality public blockchains and DeFi blue chips offer medium- to long-term investment value after valuation corrections. The October 11th bloodbath served as a collective wake-up call for the crypto market, reminding investors that crypto assets are deeply embedded in global financial logic. Overleverage and herd mentality will amplify risks in extreme market conditions. In the coming months, the market's recovery path will depend on the progress of deleveraging and macroeconomic policy shifts. Regulatory trends will also gradually become clearer within the framework of transparency and financial stability. For investors, risk management and narrative recognition will be key to navigating periods of high volatility.

V. Conclusion

Following the incident, the investment logic of the crypto market is undergoing a profound repricing. For investors in different sectors, this crisis is not only a loss but also a mirror, reflecting the strengths and weaknesses of each model. First, investors in the meme sector need to understand that memes are essentially "narrative-driven, short-term liquidity assets." During a bull market, social effects and fear of displacement (FOMO) can amplify price increases, but under systemic shocks, their weaknesses, such as a lack of cash flow and underlying value, are easily exposed. Second, investors in the DAT sector need to be wary of the shrinking premium logic. Large treasury models like MicroStrategy, thanks to their financing capabilities and brand advantages, remain resilient to risks. However, small and medium-sized DATs, due to their over-reliance on token issuance and re-staking income, are often the first to experience discounts during liquidity shocks. Third, investors in Perp DEXs need to acknowledge the shortcomings of on-chain liquidity in extreme market conditions. Finally, from a global perspective, liquidity fragmentation will be the norm in the future. Against the backdrop of high US dollar interest rates, stricter regulations, and a complex cross-chain ecosystem, market capital will become more dispersed and volatility will increase. Investors need to build a "resilient portfolio": on the one hand, they should adapt to volatility by controlling leverage and diversifying their positions, and on the other hand, they should lock in assets with advantages such as cash flow, institutional resilience, and ecosystem integration. 1011 tells us that the evolutionary logic of crypto investment is shifting from "pure speculation" to "adaptive survival": investors who can adjust their strategies and identify structural value will have greater survival potential, while speculators who blindly chase bubbles and leverage are destined to be eliminated in the next systemic shock.