EIGEN unlocking wave: market value diluted by 10% per month, smart money withdraws early

- 核心观点:EIGEN面临长期解锁抛压。

- 关键要素:

- 68%顶级交易者提前清仓退出。

- 每月4700万美元代币解锁冲击市场。

- 仅23%代币流通,77%待解锁。

- 市场影响:持续解锁将压制币价上行。

- 时效性标注:中期影响

Original author: Cryptor

Original translation: TechFlow

On October 10th, the entire crypto market plummeted on the tariff news, with $EIGEN plummeting 53% that day, from $1.82 to $0.86. At first glance, this appeared to be another victim of a flash crash, but the truth was far more than that.

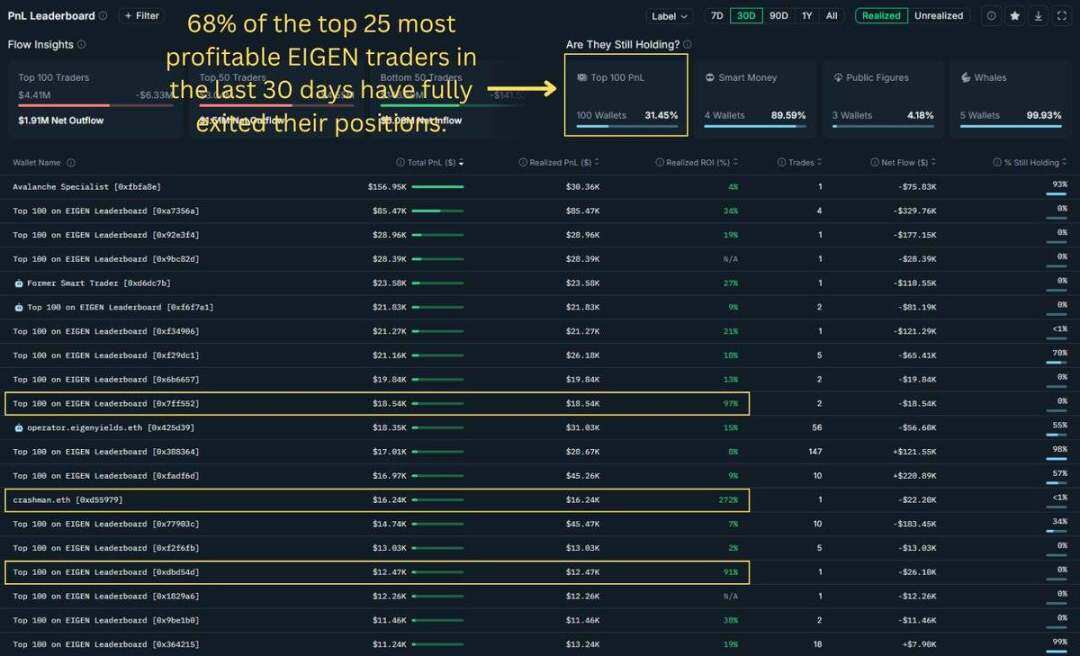

68% of $EIGEN’s most profitable traders have exited the market over the past 30 days. They weren’t panic selling in response to the October 10th tariff plunge, but rather positioning themselves to avoid the upcoming 24-month supply shock, the first unlock of which occurred on October 1st.

I specifically looked at on-chain data because my timeline was filled with overly optimistic headlines and these narratives were not consistent with the price action.

In fact, EigenCloud has strong momentum: a partnership with Google has been reached, the total value locked (TVL) has increased from $12 billion in August to $17.5 billion, Coinbase AgentKit integration has been launched, and EigenDA V 2 and multi-chain expansion are also under active development.

But the problem is that starting from November 1st, approximately $47 million worth of $EIGEN tokens will be unlocked and released into the market every month for the next two years. In other words, this is equivalent to 13% of the current market value entering circulation every 30 days.

The most profitable traders had already grasped this and exited the market early. A review of data from the past 30 days shows some smart money buying into the dips following the flash crash, primarily driven by a single whale investor, who, according to data from @nansen_ai, has since gone silent. Meanwhile, approximately $12.2 million in funds flowed into exchanges last week.

The market crash on October 10th was just noise and interference. The real signal is in the timing: who got out before October 1st, who bought during the flash crash, and who is staying silent now.

Exit mode: September-October 2025

The first thing that stands out is that 68% of the top 25 most profitable traders on $EIGEN have completely liquidated their positions over the past 30 days. They are not just taking partial profits, but exiting completely.

The top-performing trader, "crashman.eth," achieved a 272% return on investment (ROI) and no longer holds any tokens. The second-place trader exited after achieving a 97% return, and the third-place trader also exited after achieving a 91% return. This pattern repeats itself across the leaderboard.

Only 8 of the top 25 traders still hold $EIGEN, and their average holdings are only 30%. Even those who are still holding have cut their peak holdings by 70%.

This data is more significant than investment returns. High returns coupled with low holdings suggest that early confidence is gradually turning to caution. These exits began in mid-September, weeks before the October 10 flash crash, when prices were still above $2.

These traders apparently saw the unlocking plan and exited early.

Token Flow

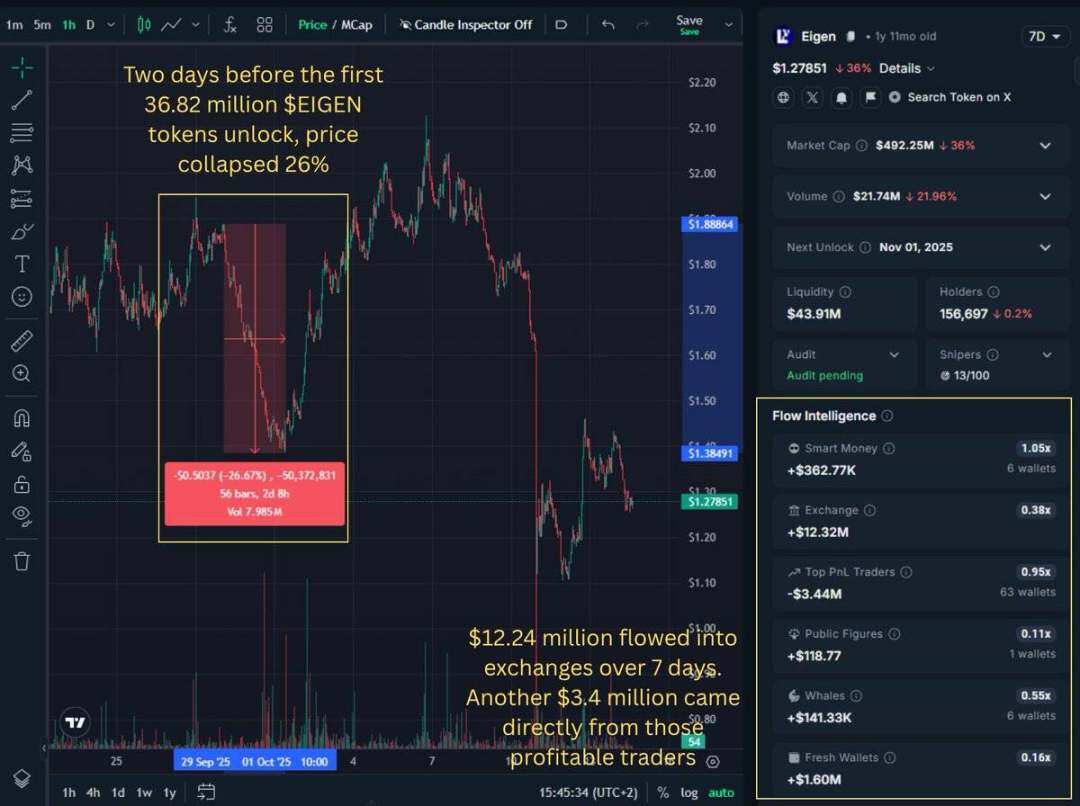

The timeline coincides with the first unlock event on October 1st, when $EIGEN became available for trading after months of restrictions. Just two days before the first 36.82 million $EIGEN were unlocked, the price plummeted 26%.

Top traders took action before this event, selling tokens onto exchanges. While this may appear to be accumulation, it's actually a systematic distribution. At least based on on-chain data, I believe this is a reasonable interpretation.

Fund flow data for the past seven days shows that approximately $12.32 million worth of $EIGEN has flowed into exchanges, including $3.44 million from these top profitable traders.

Contradiction: A smart money whale buys the dip

Smart money holdings increased by 68% last month, from 1.4 million to 2.36 million. However, the turning point is that more than half of this increase came from a single wallet, which now holds 1.23 million $EIGEN.

The whale continued to buy in September, sold near the low unlocked on October 1, then re-buyed at higher prices and increased his position again after the market flash crash on October 10.

While this staggered buying pattern is somewhat odd, more importantly, it's not a widespread smart money consensus. The remaining smart money holdings, spread across dozens of wallets, total approximately 1.2 million $EIGEN, which is unconvincing to me. Smart money holds only 0.13% of the total supply.

Furthermore, there has been no activity from smart money and no other significant inflows over the past 24 hours. Even the whale has remained silent.

Meanwhile, the price of $EIGEN continued to decline as more top PnL wallets took profits and moved their tokens to exchanges. This trend can be seen in the right column of the screenshot above.

There are two ways to interpret this silence:

- Bullish view: Confidence. Choose to hold, ride out the volatility, and wait for fundamentals to catch up.

- Bearish view: Uncertainty. Even at lower prices, there is not enough confidence to continue adding to positions.

We will find out on November 1st.

The $47 million monthly problem

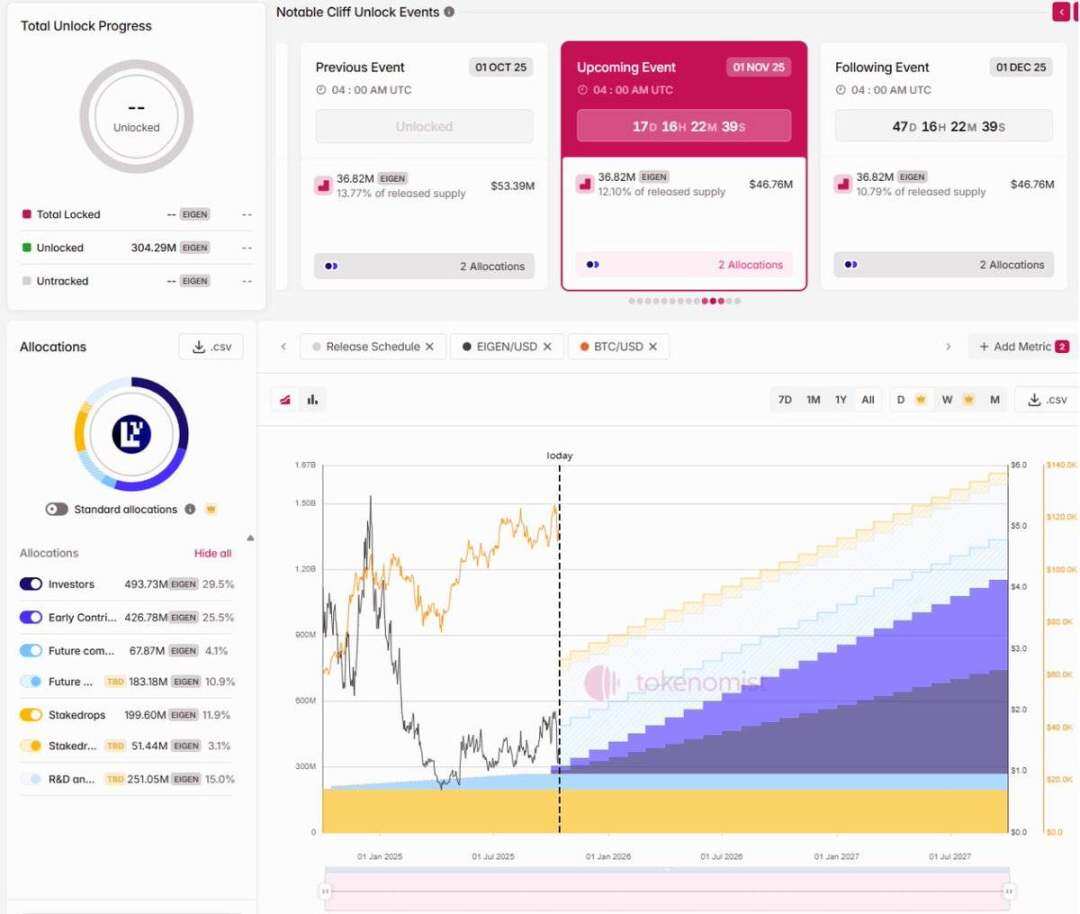

Because on November 1st, the next challenge is coming: More Unlocks.

The unlocking plan is public information, it’s not a secret, but few seem to be paying attention to what it actually means, or putting it into a meaningful context.

The unlock on October 1, 2024, removed the transfer restrictions and started a one-year lock-up cliff period.

On October 1, 2025, the first batch of 36.82 million $EIGEN will be unlocked. Starting from November 1, 2025, 36.82 million $EIGEN will be unlocked every month for approximately 23 months until September 2027.

At current prices, $47 million worth of tokens enter circulation every 30 days. At the current market capitalization ($490 million at the time of writing), these monthly unlocks equate to a dilution rate of approximately 10%. This is a significant pressure.

Only 23% of tokens are currently in circulation, and the fully diluted valuation (FDV) to market capitalization ratio is 4.5x, meaning 77% of tokens are still locked.

The top ten holding addresses control 50% of the token supply. Most of this is held in protocol wallets, exchange reserves, and venture capital allocations, all of which are subject to the same vesting schedule.

This means that there will be sustained selling pressure over the next two years rather than a one-time event.

Those who exited in September did so not because of any particular price action, but rather to prepare for a supply shock on a known date.

Protocols and Tokens: Why Both Are Possible

Ironically, EigenCloud as a protocol actually performs quite well.

Total value locked (TVL) reached $17.5 billion (up from approximately $12 billion in August). A partnership with Google Cloud was established for AI-powered payment verification. Coinbase AgentKit integration supported verifiable blockchain agents. Slashing went live in April. EigenDA V2 launched in July. Multi-chain scaling is also underway.

Development is real, adoption is growing, and the logic of the infrastructure is being realized.

But strong fundamentals don’t eliminate poor token economics. These are two separate issues. Just because a token belongs to a project doesn’t mean the two will grow in tandem.

$EIGEN's growth story is colliding head-on with a heavy, multi-year unlocking cycle that has yet to fully kick in. This is why I always separate product analysis from token analysis, as they are rarely in sync, especially during the vesting period.

The token’s success requires the protocol to generate enough real demand to absorb $47 million in new supply each month.

Even for a project like EigenCloud that has real traction and scale, this is a high bar to cross.

November 1: The real stress test

I don’t know who will win in this battle: the growth of the protocol or the pressure on supply.

But what I do know is that the data tells us something. Once again, my timeline is filled with (only) bullish news for $EIGEN. Does this sound familiar to us? Those of you who follow me will know which cases I'm referring to.

For $EIGEN, profitable traders exited weeks before the first unlock, with the most successful exiting while the price was still above $2. A single smart money whale bought heavily during the dip but then went completely silent. Exchange inflows continued to rise until the next unlock window.

The tariff-driven market crash on October 10th grabbed everyone’s attention, but the real story was the wallet layout surrounding the 24-month unlocking plan, which officially accelerated on November 1st.

The enlightenment of pattern recognition:

When the Still Holding % of top performers drops below 30%, when exchange inflows surge relative to market cap, and when a major cyclical unlock is approaching, this is generally not your entry signal.

November 1st is the next monthly test of this supply cycle. We will see whether the whales’ confidence is rewarded or the early sellers are correct.

Focus on these metrics:

- Changes in smart money positions and whether more wallets are increasing their holdings.

- Whether other groups (such as the top 100 holders, top profitable accounts, whales, and funds) are increasing their holdings.

- Exchange traffic velocity (will the $12 million weekly inflow accelerate?)

- Number of active wallets (are there new participants entering, or is it just rotation among existing holders?)

This framework applies to any token with an unlocking plan. The methodology here is more important than a single transaction.

On-chain data provides you with the same information that institutions and funds have. The difference is whether you know where to look before the market discovers it.

If you did that? You’ve already surpassed 99% of all crypto Twitter users.