Synthetix V3 returns to the mainnet, sparking a wave of price wars with the Perp DEX market.

- 核心观点:SNX暴涨源于市场对其战略转型的价值重估。

- 关键要素:

- V3将回归以太坊主网并推出Perp DEX。

- 巨鲸持仓翻倍,CEX储备降至月内最低。

- 24小时交易量飙升超500%,买方占比80%。

- 市场影响:推动DeFi老牌项目价值重估预期。

- 时效性标注:中期影响

On October 13, after the crypto market avalanche, Synthetix started a strong recovery. The token SNX broke through the key price of $2 in a short period of time, reaching a high of $2.53, setting a new high for the year. The 24-hour increase once exceeded 100%.

The recent surge in SNX is the result of the market's reassessment of the future value capture capabilities of Synthetix, a legacy DeFi infrastructure, after its fundamental reconstruction. The core driving force is mainly due to Synthetix's upcoming decentralized perpetual contract exchange (Perp DEX) to be launched on the Ethereum mainnet in the fourth quarter of 2025. Whether it can regain vitality in the trillion-dollar derivatives market remains to be seen.

CEX reserves continue to flow out, and whales double their holdings

The surge in SNX prices was accompanied by strong on-chain trading activity, demonstrating overwhelming buying power within the market and a shift in the structure of capital inflows.

Within 24 hours of the SNX price surge, its trading volume surged by over 500%, demonstrating that market interest and liquidity inflows have reached recent highs. Coinbase's trading insights data show that buyers account for nearly 80% of the market, indicating extremely strong market sentiment, with bullish pressure far outweighing short-term selling pressure.

Nansen data shows that SNX reserves on CEX exchanges have fallen to a one-month low of just 73.41 million, a 16% decrease from September. This decline in CEX reserves has limited immediate liquidity, further amplifying upward price fluctuations amidst buoyant market sentiment.

In addition, from October 1st to 13th, the holdings of whale wallets holding more than 1 million SNX doubled. Their large-scale and organized accumulation behavior shows that the incremental funds are not dominated by retail investors chasing high prices, but institutional capital or professional traders are actively allocating chips and laying out in advance the explosion of protocol revenue brought by the launch of V 3.

L2's woes prompt Synthetix V3 to return to Ethereum mainnet

The trigger for the SNX price fluctuations is the major strategic and architectural adjustments of Synthetix V 3. Its core initiatives include migrating back from L2 to the Ethereum mainnet in Q4 2025 and building a new high-performance trading infrastructure.

Against the backdrop of fragmented L2 ecosystems and polarized development, V3's decision to return to the mainnet is both a helpless move and a bet on a potential revival opportunity.

In April 2024, Synthetix V3 launched on Base, officially initiating the deployment of the Layer 2 network. However, after more than a year of observation, Synthetix decided to abandon the Layer 2 solution due to practical challenges such as liquidity fragmentation caused by multi-chain deployment, low capital efficiency of the protocol, and reduced trading depth. Infrastructure instability caused frequent downtime, leading to frequent downtime. Furthermore, multi-chain deployment also carries a higher risk of cross-chain asset bridging.

Synthetix V3's migration to the L1 mainnet will integrate fragmented liquidity. While possessing Ethereum's massive liquidity, this transformation can also integrate the highest level of native security and trust. Mainnet assets can be used directly without cross-chain, thereby reducing bridging risk and re-hypothecation risk. It can also be seamlessly combined with mainnet leading DeFi protocols such as Aave to further improve liquidity and capital efficiency.

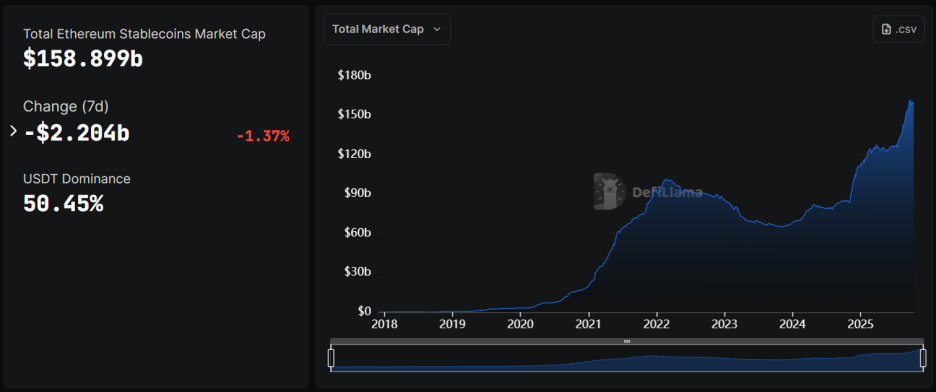

Currently, the market capitalization of stablecoins on Ethereum is nearly $160 billion, representing the deepest liquidity pool in the crypto market. However, this vast pool of capital remains largely untapped in derivatives trading, lying dormant. Synthetix V3 aims to directly tap into this massive liquidity.

Synthetix voted to terminate its Level 2 deployment in the second half of 2024. Since early 2025, it has been gradually deprecating the Level 2 network, culminating in its complete shutdown in September, transitioning entirely to Ethereum. Synthetix announced that Perp DEX will launch on mainnet in Q4. To coincide with the launch of V3, a trading competition with a $1 million USD incentive will be held to further stimulate community participation and trading enthusiasm.

Before officially deprecating L2 deployment, Synthetix acquired Kwenta through a governance proposal and converted all KWENTA tokens into SNX at a 1:17 ratio. Kwenta was previously the primary Perp trading frontend for the Synthetix ecosystem, with cumulative trading volume exceeding $120 billion. It was the primary driver of Synthetix Perp trading growth, contributing over 95% of the incremental trading volume. This acquisition marks a further deep integration of Kwenta with Synthetix, and the transition of its users and trading to the new mainnet product.

New V3 Product Update: CLOB and Multi-Collateral Support

To achieve efficient transactions on the L1 mainnet, Synthetix V3 adopts a hybrid model of a centralized limit order book (CLOB) combined with on-chain settlement. Order matching runs on a high-performance off-chain system, while clearing and settlement are performed on the Ethereum mainnet.

Synthetix V 3's hybrid architecture is designed to address the problems inherent in the DeFi AMM model, such as high slippage, low capital efficiency, and impermanent loss. It ensures that users can enjoy a low-latency trading experience close to that of a centralized exchange (CEX) while retaining the transparency brought by decentralized settlement.

In addition, to ensure transaction fairness, V3 also deploys an anti-MEV (Miner Extractable Value) mechanism. By adopting technologies such as account data privacy and progressive configurable liquidation, it prevents liquidation positions from being front-run by MEV arbitrageurs, thereby improving the system's risk resistance and user trust.

It is worth mentioning that perpetual contract transactions on the mainnet can achieve atomic composability, which means that traders can interact with derivatives positions with other L1 DeFi protocols to implement on-chain arbitrage or hedging strategies. This is also a core advantage that independent App Chain or L2 can hardly provide.

Synthetix V3's architectural upgrade also includes support for multi-collateral. The protocol will now accept highly liquid assets as collateral, including sUSDe, cbBTC, and wstETH. The introduction of multi-collateral significantly broadens liquidity sources, lowers barriers to entry for traders, and strengthens the protocol's capital resilience.

Currently, Synthetix's main products are mainly divided into three categories:

1) Perp DEX (launched at mainnet launch): The hybrid CLOB architecture offers CEX-like transaction speed and volume, with composability, support for multiple collateral margins, and no cross-chain bridging required;

2) Synthetix Liquidity Providers (SLPs, launched at mainnet launch): They passively make markets through sUSD deposits, profiting from spreads, fees, and liquidation fees. The stability of the protocol will increase as TVL increases.

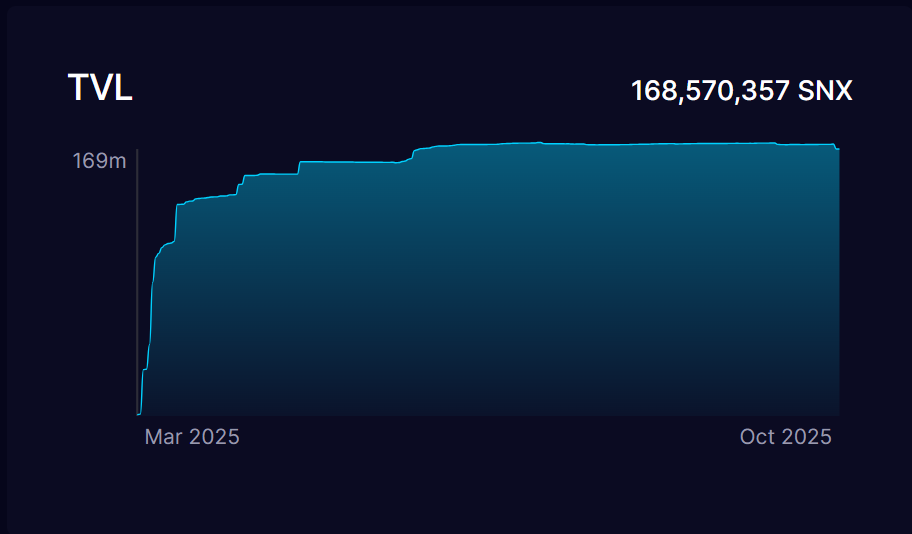

3) Synthetix Staking (420 Pool): Staking SNX or sUSD can earn yield. As of now, the circulating supply of SNX exceeds 343 million, of which approximately 169 million tokens are staked, with a staking ratio of 49.27%. The V3 mainnet launch may further enhance the deflationary effect.

Growth challenges and the issue of stablecoin depegging remain to be resolved

Although Synthetix's prospects have turned around, the frequent decoupling risks of sUSD, the core stablecoin in its ecosystem, have undermined users' trust in the protocol's products.

The community has discussed two potential solutions to the sUSD depegging issue. First, suspend the SNX buyback and burn program and shift to burning sUSD debt to reduce sUSD supply and help it return to its peg. The token economics model will need to be updated after V3 is successfully launched on the Ethereum mainnet and sUSD performance stabilizes.

In December 2024, the official announced that the plan would be implemented, but the effect was not ideal. sUSD still deviated significantly twice in April and July this year, and set a record for the maximum derivation of below US$0.75.

The second option is to introduce a native interest rate for sUSD after the V3 migration is completed. This has not yet been implemented and the effect remains to be seen, but the long-term success of the protocol will depend not only on a high-performance trading system, but also on the reliability of its management of ecological assets.

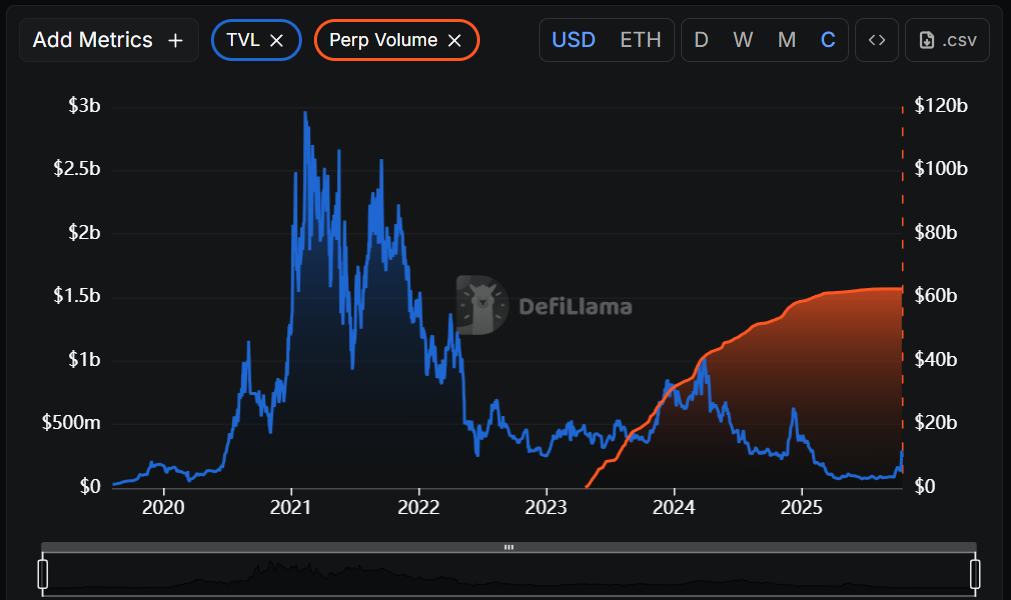

As of now, DeFiLlama data shows that Synthetix's TVL is approximately $243 million, all of which is concentrated on the Ethereum mainnet. The protocol's cumulative Perp trading volume is $62.72 billion, with an average daily trading volume of approximately $42 million.

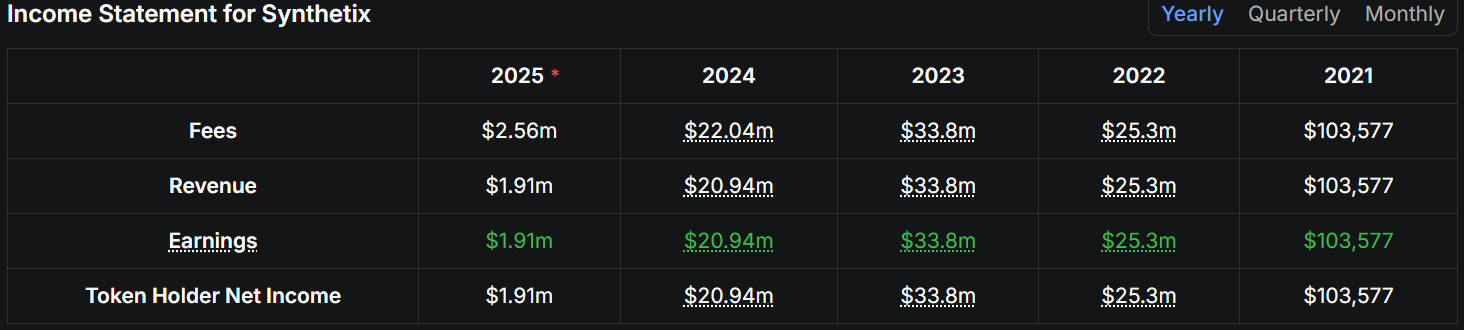

In addition, Synthetix's income statement data shows that the protocol's revenue peaked in 2023, but since its focus shifted to the L2 deployment strategy, its revenue has shrunk significantly by about 38%, even lower than in 2022. The significant reduction in revenue may be one of the important motivations for Synthetix to return to the Ethereum mainnet.

It is particularly noteworthy that since Synthetix V 3 has not yet been launched on the Ethereum mainnet, its annualized fee income and perpetual contract trading volume are zero, which indicates that the price explosion of SNX is mainly based on the market's expectations of future valuations.

As a long-established DeFi project, the market anticipates this breakthrough as a premature reassessment of Synthetix's strategy to transition from L2 experimentation to L1 core infrastructure. Once V3 successfully launches and effectively captures perpetual contract transaction fees, SNX's current valuation may be undervalued.

For investors, validating actual perpetual swap trading volume and fee revenue following the V3 mainnet launch will be key indicators for assessing SNX's growth potential and valuation. Furthermore, the protocol's ability to deliver low-latency, high-performance trading, and the performance of its stablecoin, sUSD, will be crucial factors influencing its long-term competitiveness and user acquisition.