Farcaster Launches USDC Deposit Promotion; Neutrl Pre-Deposits Open Tomorrow Night (October 14th)

- 核心观点:介绍多个稳定币低风险收益机会。

- 关键要素:

- Farcaster提供10% USDC存款奖励。

- Strata上线主网推出分级稳定币。

- Neutrl开放预存款支持USDT。

- 市场影响:为稳定币持有者提供多元收益渠道。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

Author|Azuma ( @azuma_eth )

This column aims to cover the current low-risk return strategies based on stablecoins (and their derivative tokens) in the market (Odaily Note: code risks can never be ruled out), to help users who hope to gradually expand their capital scale through U-based financial management to find more ideal interest-earning opportunities.

Previous records

New opportunities

Farcaster Deposit Event

On October 14th, Farcaster, the decentralized social media protocol that once featured a highly popular airdrop, announced that it would launch a USDC deposit campaign on the Base chain, offering up to 10% in additional rewards. The key points of the campaign are as follows:

1. The deposit currency must be USDC on the Base chain.

2. Rewards will be distributed weekly (1% per week for 10 consecutive weeks).

3. USDC transferred or exchanged during the week will not be counted towards rewards.

4. When rewards are calculated, the USDC balance must be higher than the current balance.

5. The maximum USDC reward for each account is $500.

Although the source of the rewards is unclear, considering Farcaster's solid financing background and good historical reputation, the risk factor is not too bad. In addition, with the potential airdrop expectations, you can participate at your discretion.

Strata launches on mainnet

The Ethena ecosystem risk grading protocol Strata, which was previously recommended during the pre-deposit stage, has been launched on the mainnet today, and the Season 1 points activity has been launched simultaneously.

The key point of the mainnet launch is that Strata has launched two derivative stablecoins with different risk and return levels around Ethena's USDe: Senior USDe (srUSDe, lower risk + lower return) and Junior USDe (jrUSDe, higher return + higher return).

Users who have participated in Strata's Season 0 pre-deposit can cast the then-current certificate token pUSDe into srUSDe or jrUSDe, and migrate the pUSDe LP (which would have expired tomorrow) to the new srUSDe LP or jrUSDe LP pool on Pendle.

Currently, srUSDe offers an annualized return of 4.64% (plus 30x Strata points and 30x Ethena points), and jrUSDe offers an annualized return of 8.38% (plus 10x Strata points and 5x Ethena points). For higher point efficiency, we recommend choosing Pendle srUSDe LP, which currently offers an annualized return of 7.96% with 60x Strata points and 40x Ethena points.

Strata Portal: https://app.strata.money

Neutrl pre-deposit will be available soon

Tomorrow at 7:00 PM Beijing time, Neutrl, a term-hedging and arbitrage protocol focused on altcoins, will open for pre-deposits. Deposits will be made on the Ethereum mainnet and will be bridged to Plasma. The deposit limit is $50 million USD, and USDT is supported. Deposits are locked for two and a half months, and participants can earn both base returns and points.

Simply put, Neutrl is an aggressive version of Ethena (risks and returns will be magnified), which will make profits by buying altcoins at a discount in the over-the-counter market and shorting equal contracts to hedge.

In April this year, Neutrl announced the completion of a $5 million seed round of financing, led by digital asset private market STIX and venture capital firm Accomplice, with participation from a number of cryptocurrency angel investors such as Amber Group, SCB Limited, Figment Capital and Nascent, including Ethena founder Guy Young and Joshua Lim, a derivatives trader at Arbelos Markets (recently acquired by FalconX).

This is also the earliest opportunity to participate in Neutrl at present, and individuals will tend to deposit money.

Hylo catch-up homework

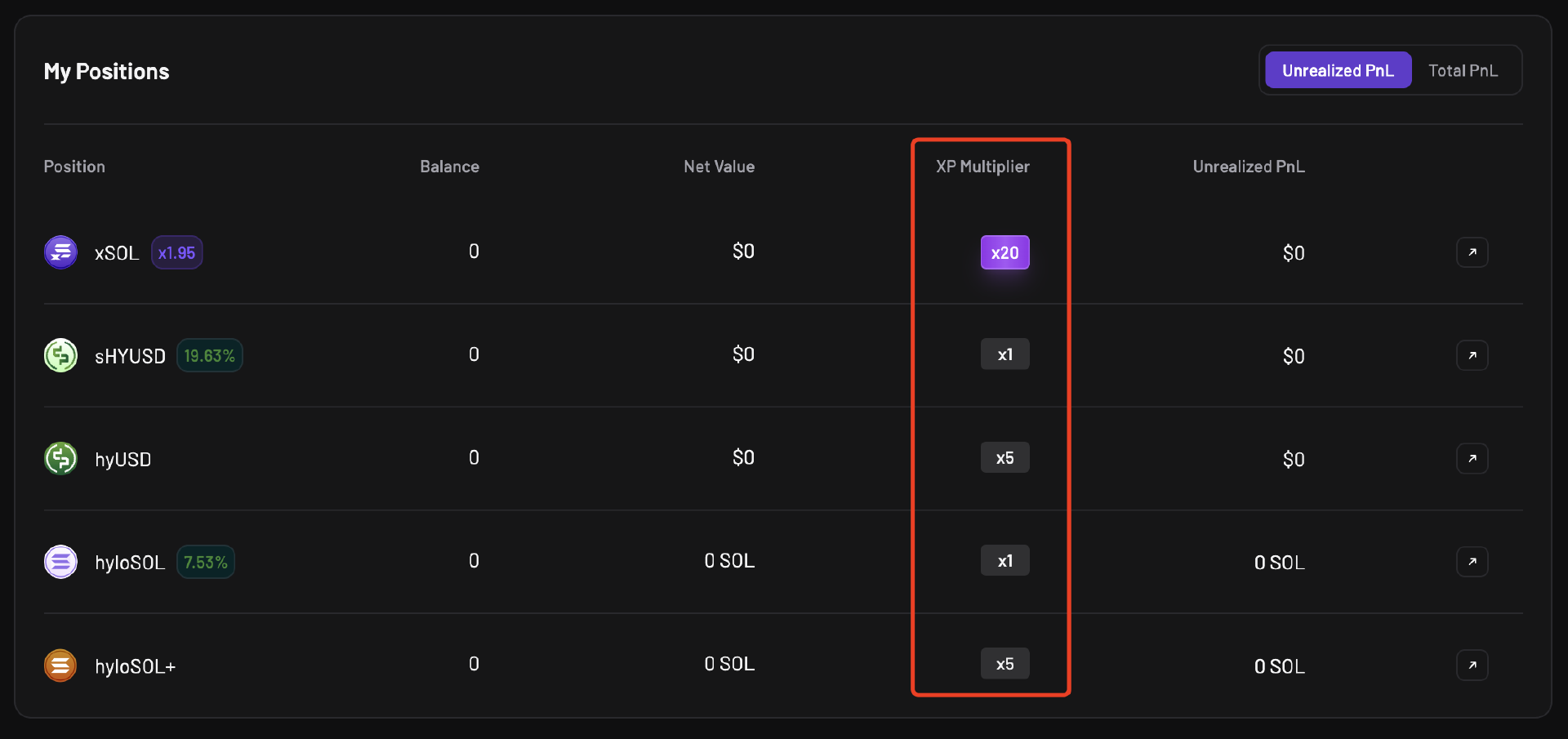

Hylo, the comprehensive DeFi protocol within the Solana ecosystem, has recently seen significant growth in TVL. Hylo currently offers the leveraged SOL derivative token xSOL, the liquidity staking token hyloSOL, and the hyUSD stablecoin and its staking token sHYUSD.

If you only focus on stablecoins, hyUSD itself does not generate interest, and static holding can obtain 5 times the points efficiency; sHYUSD's annualized rate is currently reported at 19.66%, but static holding only has 1 times the points efficiency.

A more efficient alternative is to become an LP for hyUSD and its collateralized token, sHYUSD, on Rate-X and Exponent. For example, currently, LPs for hyUSD on RateX can earn an annualized return of 19.32%, while also earning double the Hylo Points and quintuple the RateX Points.

Users considering participating in Hylo can fill in the invitation code NBJ99E, which will receive a 5% points bonus.

Hylo Portal: https://hylo.so

RateX Portal: https://app.rate-x.io