Polymarket's $9 Billion Valuation War: A Hidden Gold Mine for Arbitrageurs

- 核心观点:Polymarket套利机会丰富但竞争加剧。

- 关键要素:

- 扫尾盘策略利用时间换确定性收益。

- 多选项市场存在合计小于100%套利机会。

- 做市商可获得三重收益叠加。

- 市场影响:推动预测市场套利策略专业化发展。

- 时效性标注:中期影响

After receiving $2 billion in investment, Polymarket was valued at $9 billion, which is one of the highest financing amounts obtained by a project in the Crypto field in recent years.

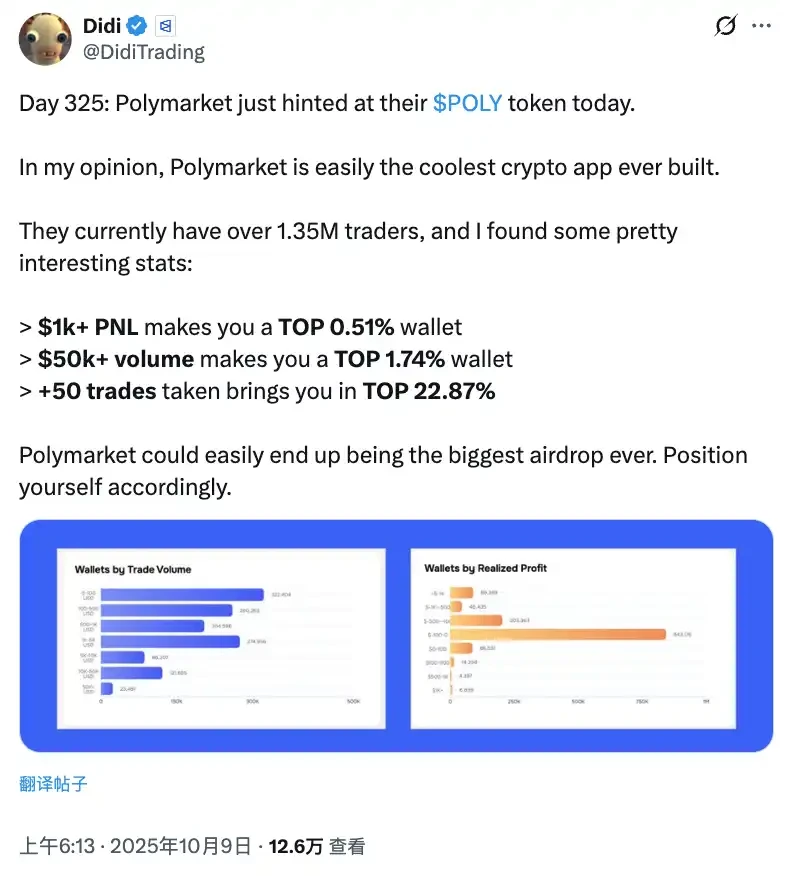

As rumors of IPO+IDO+airdrop intensify, let's first look at a set of interesting data: If your PNL exceeds $1,000, you will be among the top 0.51% of wallets; if your transaction volume exceeds $50,000, you will be among the top 1.74% of large users; if you complete more than 50 transactions, you will surpass 77% of users.

This data also means that in the fertile land of Polymarket, there are actually not many people who have continued to cultivate and reap the fruits over the past few years.

With ICE's strategic investment, Polymarket's liquidity, user base, and market depth are all growing rapidly. More capital inflow means more trading opportunities; more retail investor participation means more market imbalances; and more market types mean more arbitrage opportunities.

For those who know how to truly make money on Polymarket, this is a golden age. While most people view Polymarket as a casino, the smart money sees it as an arbitrage tool. In this lengthy article, BlockBeats interviewed three veteran Polymarket players and broke down their money-making strategies.

Sweeping the tail end of the market has become a new financial management tool

“About 90% of large orders worth over $10,000 on Polymarket are executed at prices above 0.95,” veteran player fish said straight to the point.

In the prediction market Polymarket, this kind of gameplay called "sweeping the tail" is very popular.

The gameplay is simple: when the outcome of an event is basically settled and the market price soars to above 0.95 or even close to 0.99, you buy at this price, and then patiently wait for the event to be officially settled, and eat up the last few points of deterministic profit.

The core logic of sweeping the tail market can be summed up in four words: time for certainty.

When an event has already occurred, such as an election with a clear outcome or a sporting event concluded but the market hasn't officially settled, the price often remains in a range close to 1 but below 1. Entering the market at this point, theoretically, allows you to secure those last few points of profit as long as you wait for the settlement.

"Many retail investors can't wait for settlement," Fish explained to BlockBeats. "They're eager to cash out and place their next trade, so they sell directly at 0.997 to 0.999. This leaves room for arbitrage for larger investors. While the profit is only 0.1% per trade, with sufficient capital and high frequency, it can add up to a substantial profit."

But just like all investments are risky, end-of-day trading is not a risk-free "brainless financial management" strategy.

"The biggest enemy of this strategy," Fish said, changing the subject, "is not market volatility, but black swan events and manipulation by large investors."

Black swan risk is a risk that end-of-day traders must constantly be vigilant about. What is a black swan? It refers to seemingly settled events that suddenly and unexpectedly take a turn. For example, a game may seem over, but the referee later declares it void; a political event may seem settled, but a scandal suddenly overturns the outcome. If these low-probability events occur, those chips you bought at 0.99 will instantly become worthless.

"So-called black swan events that can potentially reverse the market are generally manipulated by large investors," Fish continued. "Their typical strategy is this: For example, when the price approaches 0.99, they suddenly use large orders to drive the price down to 0.9, creating panic. They then use comment sections and social media to spread rumors of a potential reversal, amplifying retail investors' panic. After retail investors panic sell, they then buy back their holdings at lower prices. After the event is officially settled, these large investors not only profit from the price difference of 0.9 to 1.00, but also pocket the profits that retail investors would have earned."

This is the complete closed loop of manipulation by big investors.

Another veteran player, Luke ( @DeFiGuyLuke ), added an interesting detail about this closed loop: "Polymarket's comment section is very readable. I think this phenomenon is quite unique and rarely seen in other products."

People will write a lot of evidence to prove their point of view, and many people also know that you can align with the others. Therefore, it is very easy to manipulate public opinion on Polymarket.

This also became the inspiration for Luke's current business venture: "When I used Polymarket, I noticed an interesting phenomenon: when you look at the content on Twitter, no one wants to read it, right? It's all nonsense and not real. Most people don't talk much. But the comments section of Polymarket is very interesting. Even though they may be betting only a few dozen or a hundred dollars, not much money, they will talk at length."

"You'll find this kind of content incredibly interesting. So, I immediately thought, the Polymarket comments section is incredibly readable." Based on this observation, Luke started a business called Buzzing: it allows anyone to create a market on any topic. After placing a bet, everyone can leave a comment, which then forms a feed, distributing the market through content.

Then again, since there is a black swan risk of manipulation in the tail-end market, does that mean we can’t play it?

"Not really. The key lies in risk control and position management. For example, I only hold a maximum of 1/10 of my position in any market," Fish added. "Don't put all your money on a single market, even if it looks like a 99.9% chance of winning. Prioritize markets that are about to settle (within a few hours) and have a price above 0.997. This way, the window for black swan events is shorter."

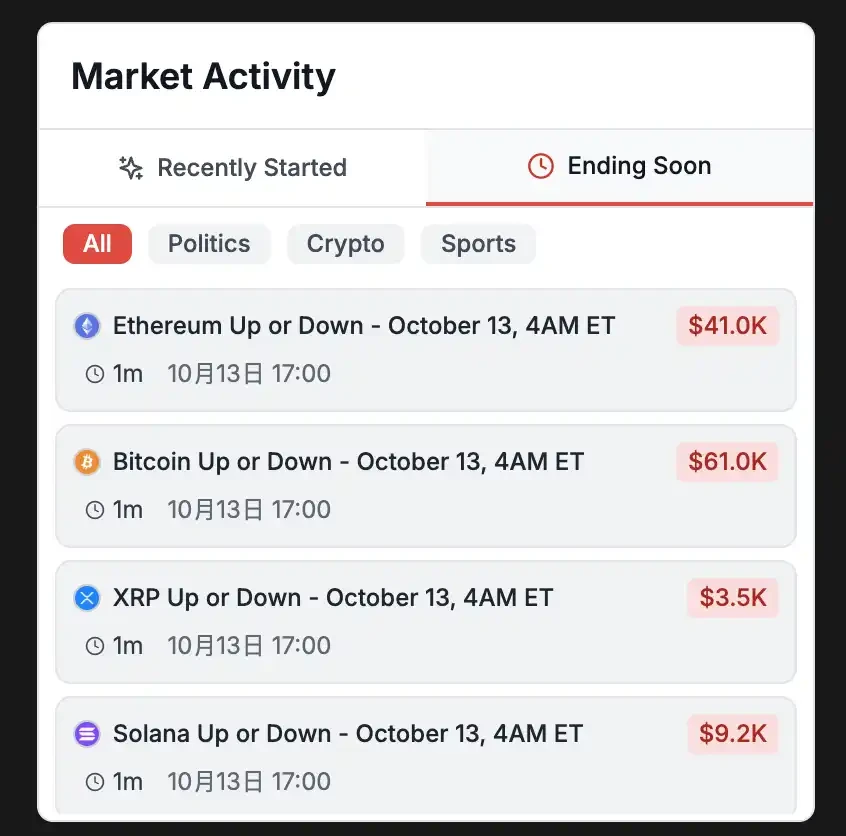

Markets that are about to end as shown on polymarketanalytics

Arbitrage opportunities totaling less than 100%

There is an address on Polymarket that turned $10,000 into $100,000 in half a year and participated in more than 10,000 markets.

It does not rely on betting on size or insider information, but on an arbitrage strategy that looks simple but requires technical skills to execute - capturing opportunities with a total of "less than 100%" in the multi-option market.

The core logic of this strategy is breathtakingly elegant: in a multi-option market with only one winner ("Only One Winner"), if the combined price of all options is less than $1, then if you buy one share of all options, you will inevitably receive $1 upon settlement. The difference between the cost and the benefit is your risk-free profit.

This might sound a bit confusing. Let's use a concrete example to illustrate. Imagine a market where the question is "Will the Federal Reserve cut interest rates in July?" and there are four buy and sell options:

Rate cut of 50 basis points or more: price $0.001 (0.1%);

A rate cut of 25 basis points or more: price $0.008 (0.8%);

Unchanged: Price $0.985 (98.5%)

25 basis point rate hike or more: Price: $0.001 (0.1%)

Add up these four prices: 0.001 + 0.008 + 0.985 + 0.001 = $0.995. What does this mean? You paid $0.995 for one option of each. At settlement, one option will win, and you will receive $1. Your profit is $0.005, a 0.5% yield.

"Don't underestimate this 0.5%. If you invest $10,000, you can earn $50. If you do dozens of transactions a day, the returns in a year will be amazing. Moreover, this is risk-free arbitrage. As long as the market settles normally, you will definitely make a profit," said Fish.

Why does this arbitrage opportunity arise?

In a multi-option market, the order book for each option is independent of each other. This leads to an interesting phenomenon:

Most of the time, the sum of the probabilities of all options is greater than or equal to 1 (this is normal; market makers profit from the bid-ask spread). However, when retail investors trade a single option, it only affects the price of that one option, while the prices of other options do not adjust synchronously. This creates a temporary market imbalance—the sum of the probabilities of all options is less than 1.

This window of time may be only a few seconds, or even shorter, but for arbitrageurs who run monitoring scripts, this is a golden opportunity.

"Our bot monitors the order books of all multi-option markets 24/7," Fish explained. "If it detects a probability sum of less than 1, it immediately places an order to buy all the options, locking in profits. Once the bot system is established, it can monitor thousands of markets simultaneously."

“This strategy is somewhat similar to atomic arbitrage around MEV (miner extractable value) in cryptocurrency,” Fish continued. “Both exploit temporary market imbalances, using speed and technology to complete arbitrage before others, and then allowing the market to rebalance.”

Unfortunately, this strategy seems to be monopolized by a few bots, making it difficult for ordinary people to make significant profits. What was theoretically a risk-free arbitrage opportunity for everyone has, in practice, become a battle between a handful of specialized bots.

“The competition will become increasingly fierce,” Fish said. “It will depend on whose server is closer to the Polygon node, whose code execution is more efficient, who can monitor price changes faster, and who can submit transactions and confirm them on the chain faster.”

Essentially, this is also a market maker

At this point, many people may have discovered that the arbitrage strategies mentioned earlier are essentially acting as market makers.

A market maker's job is simply to deposit USDC into a specific market pool, effectively placing both a buy and sell order for "Yes" and "No," providing a counterparty to all buyers and sellers. Deposited USDC is converted into corresponding contract shares based on the current "Yes/No" ratio. For example, at a 50:50 price, a 100 USDC deposit would be split into 50 "Yes" contracts and 50 "No" contracts. As the market fluctuates, your "Yes/No" inventory ratio may deviate from the optimal 50:50 ratio. A good market maker will continuously rebalance their positions through active trading or adjustments to capital, thereby locking in arbitrage opportunities.

So, from this perspective, these arbitrage bots are actually acting as market makers—they continuously rebalance the market through arbitrage, making prices more reasonable and liquidity better. This is beneficial to the entire Polymarket ecosystem. Therefore, Polymarket not only does not charge transaction fees, but also provides incentives to makers (order makers).

“From this perspective, Polymarket is actually very friendly to market makers,” said Fish.

"According to the data, market makers on Polymarket must have earned at least $20 million over the past year." This was the figure Luke revealed to BlockBeats two months ago. "We haven't compiled the data yet, but it's definitely more than that after a few months."

"Specifically speaking, regarding the revenue model, based on market experience, a relatively stable expectation is 0.2% of the trading volume," Luke continued.

Assume you provide liquidity in a market with a monthly trading volume of $1 million (including buy and sell orders you receive), then your expected profit is approximately: $1 million × 0.2% = $2,000

This rate of return may not seem high, but the key is that it is a relatively stable return, unlike the huge ups and downs of speculative trading; and if the scale is expanded to increase the return, then 10 markets will be 20,000, and 100 markets will be 200,000. If the platform's LP rewards and annualized holdings are added, the actual return will be higher. "But the main income still comes from the market making spread and the rewards given by Polymarket, these two parts."

Interestingly, compared to other arbitrage strategies that have been swept to the extreme by bots, in Luke's opinion, the competition in the market making field is not very fierce yet.

"The competition in token trading is definitely fierce right now, and it involves hardware and other things. But the market competition in Polymarket is not very fierce. So the current competition is still focused on strategy, not speed."

This means that for players with sufficient technical skills and capital, market making may represent an undervalued opportunity. With Polymarket reaching a $9 billion valuation and continued liquidity growth, the profit potential for market makers will only grow. It may not be too late to enter the market now.

2028 Election Arbitrage

During the conversation with BlockBeats, both Luke and Tim mentioned the potential opportunities for market making arbitrage, especially in the 2028 US election market where Polymarket launched a 4% financial management return.

Three years before the 2028 election, Polymarket has already begun its layout. In order to seize the market and attract early liquidity, the platform offers an annualized return of 4%.

“Many people may think that at first glance, 4% annualized return is very low in the cryptocurrency world, and the APY on platforms like AAVE will be much higher.”

"But I actually think Polymarket is doing this because they're competing with Kalshi," Luke explained. "Kalshi has long offered US Treasury yields on account balances, which is actually very common in traditional financial products. For example, with Interactive Brokers, even if you don't actively buy bonds or stocks, you can still enjoy a yield. These are all very common features of traditional financial products."

"Kalshi is a Web 2 product, so it's easy to implement," Luke continued. "But Polymarket hasn't done this because its funds are all in the protocol, which makes it more difficult to implement. So, in terms of this financial management function, Polymarket was previously a little behind Kalshi."

This shortcoming is even more pronounced in a long-term market like 2028. "Think about it: if you put money in now, it'll take three years for it to be settled. Your money sits idle for those three years, which is a bit frustrating, right? So, to close the gap with their competitors, they introduced this annualized bonus, essentially subsidizing themselves," Luke said.

“However, I think the market maker’s goal is definitely not this 4% annualized return. This annualized return is mainly for ordinary users.” Through this subsidy, users’ transaction costs have been reduced to a certain extent. This is also a very good thing for those who have been increasing the trading volume and number of transactions on Polymarket for a long time. After all, studios are still very sensitive to the calculation of costs and benefits.

Tim has also conducted in-depth research in this area. “If you carefully study the details of this mechanism, you will find that for market makers, there is a much greater arbitrage opportunity than 4%.”

"Polymarket's rewards are a detail many people don't notice. Each option offers an additional $300 in daily LP rewards," Tim continued, explaining that in addition to the 4% annualized return on holdings, Polymarket also offers additional rewards to market makers. If you provide liquidity in this market—that is, place both buy and sell orders to help maintain market depth—you can share in this $300 daily LP reward pool.

Tim did some simple math. Assuming there are 10 popular options in the "Who will be president in 2028?" market, and each option pays $300 in LP rewards per day, the total LP reward pool is $3,000 per day. If you hold 10% of the liquidity, you'll receive $300 per day, or $109,500 per year.

“This is just the LP reward. If you add in the bid-ask spread profit from market making, and the 4% annualized compound interest on holding positions, the triple return can easily exceed 10%, or even 20%.”

“If you ask me, is it worth investing in the 2028 election? My answer is: if you have the skills, the capital, and the patience, this is a severely undervalued opportunity. But to be honest, this strategy is not suitable for everyone.”

Tim said: "It is suitable for those conservative players who have a certain amount of capital (at least tens of thousands of dollars); for technical players who have programming skills and can build automated market making systems; for long-term investors who are not looking for quick wealth and are willing to invest time in exchange for stable returns; and for players who have a certain understanding of US politics and can judge market trends.

However, it's not suitable for players with very small capital (a few thousand dollars); it's not suitable for speculators who are looking for quick riches and can't wait four years; it's not suitable for novices who have no understanding of US politics and can't judge the rationality of the market; nor is it suitable for players who need liquidity and may need money at any time."

News Trading on Polymarket

While digging into Polymarket's market data, Luke and his team discovered a phenomenon that overturned common sense.

“Everyone used to say that Polymarket users were smart and prescient, right? They predicted the outcome through trading before it even happened,” Luke said. “But it’s actually quite the opposite.”

"Most users on Polymarket are actually just dumb money, pretty newbies," Luke said with a laugh. "Most of the time, everyone misjudged the event. Then, after the outcome and news, many people jumped in and took arbitrage opportunities, driving the price to their expected level, pushing it towards a yes or no. But before the news breaks, many people often misjudged the event."

"From a data perspective," Luke continued, "the entire Polymarket market actually lags behind real events in terms of user bets and price feedback. Often, the real event has already occurred, but everyone's bets are wrong, and then a huge reversal occurs."

Luke gave a vivid example: "Take the papal election, for example. The first person elected was an American. Before the Vatican announced the result, the American candidate's chances of winning were only a few thousandths, extremely low. But once the Vatican announced it, boom, the price skyrocketed."

“So you can see that users often make mistakes in these markets,” Luke concluded. “If you have the corresponding news source and can get ahead of the curve, it seems profitable. I think it’s still feasible.”

But the threshold for this path is still not low.

"I think this requires quite high development requirements," Luke admitted. "You need to access news sources in a timely manner, a bit like doing something like MEV. You need to crawl news deterministically, add several layers, and then do natural language understanding and trade quickly. But there is definitely opportunity here."

In the $9 billion valuation battlefield of Polymarket, we have seen a variety of money-making strategies, but no matter what the strategy is, it seems that many low-key players who make money on Polymarket are more treating it as an arbitrage machine than a casino.

From our interviews, it's clear that Polymarket's arbitrage ecosystem is rapidly maturing, leaving less room for newcomers. However, this doesn't mean that ordinary players have no chance.

Let’s go back to the data at the beginning of the article: if the PNL exceeds $1,000, you will be in the top 0.51%, if the transaction volume exceeds $50,000, you will be in the top 1.74%, and if you complete 50 transactions, you will be in the top 77% of users.

Therefore, even if you start trading frequently from now on, on the day of the airdrop, Polymarket, as the cryptocurrency project with the largest amount of financing in recent years, may still give ordinary players a big surprise.