The whale bayonet fight behind the biggest liquidation day in crypto history: Air Force drunk, took the knife and left the table

- 核心观点:巨鲸精准做空致市场爆仓超191亿美元。

- 关键要素:

- 巨鲸提前布局空单盈利超2亿美元。

- BTC跌至101500美元,全网爆仓161万人。

- 巨鲸或与Trend Research存在关联。

- 市场影响:加剧市场波动,暴露内幕交易风险。

- 时效性标注:短期影响

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

When I woke up, I believed that I was not the only one who suspected that I was dazzled.

Coinglass data shows that over the past 24 hours, the total amount of liquidations across the entire network reached $19.133 billion, with 1,618,240 individuals liquidated . OKX market data shows that BTC plummeted to $101,500; ETH plummeted to $3,373; and SOL plummeted to around $144. For more details on the dire situation in spot prices, see " A Shocking Night of Liquidations: A Record-High $19.1 Billion in Single Days, a Wild Flow of Wealth ."

Although the prices of major cryptocurrencies have recovered to varying degrees, this remains a bonanza for the short-term investors . The biggest winners of this extreme market are undoubtedly a suspected insider trader, a BTC OG, and a crypto whale who opened a nine-digit short position. In this article, Odaily Planet Daily will briefly analyze the insider whale's operations and possible identities.

Crypto whales opened a 10-digit short position, raking in $200 million in one day

Perhaps no one expected that BTC would experience such a huge correction after reaching a new high, except for some insiders and some crypto whales with a keen eye.

Bitcoin OG whale opens a massive short position 3 days in advance, here's a look at its trading history

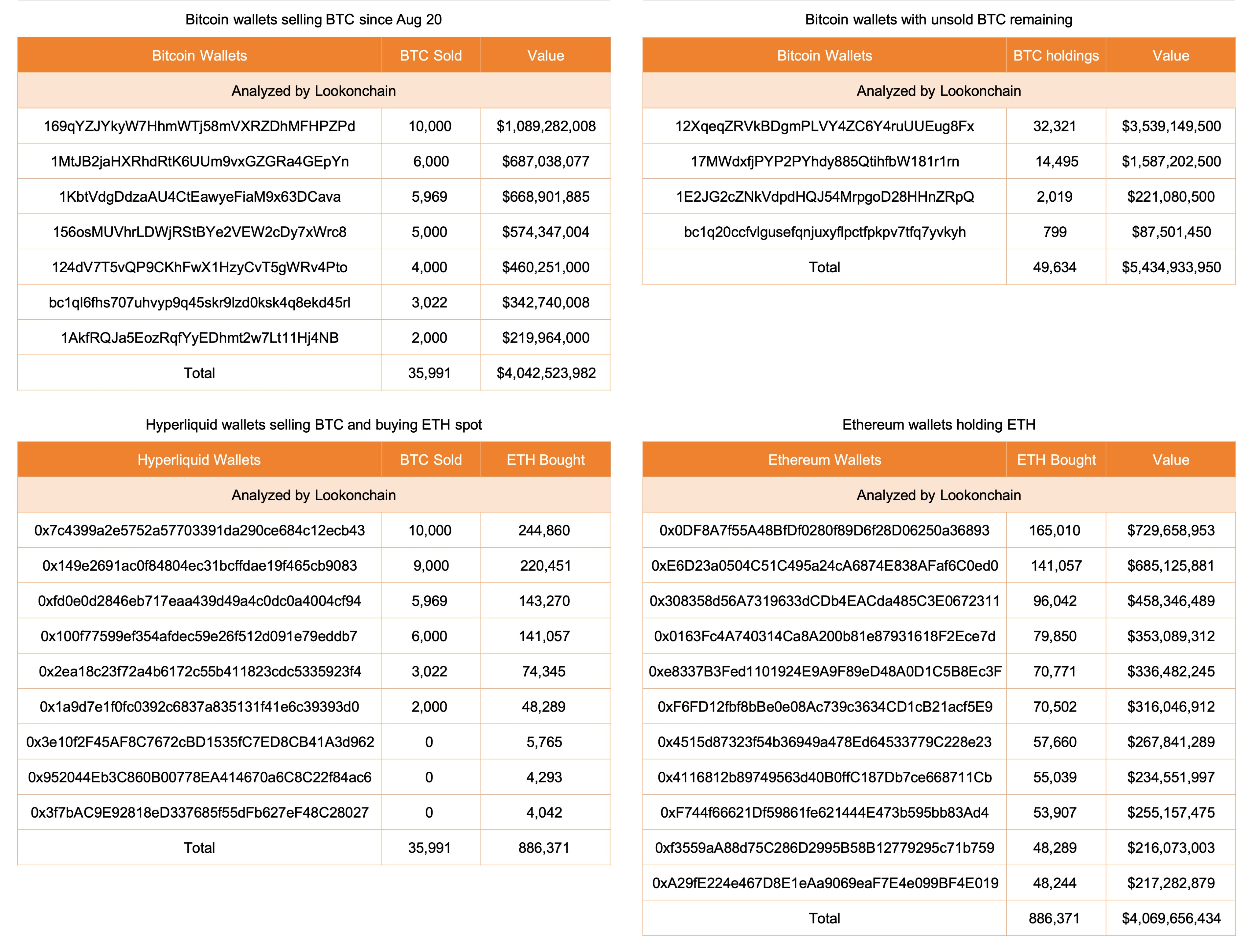

The earliest trading operation of a BTC OG whale with a floating profit of over US$70 million can be traced back to August 20: According to LookonChain monitoring , since August 20, the trader/institution has sold nearly 36,000 BTC and bought more than 886,000 ETH on Hyperliquid. At that time, the ETH/BTC exchange rate was 0.0406; in its other four wallets, it still holds more than 49,000 BTC, worth US$5.43 billion.

On October 8, the whale sold another 3,000 BTC worth $363 million. Currently, two of the three related addresses have been liquidated; one address holds

Address List:

bc1pxeg2c8yy5gklex2z8qvmxlwgvf7kzhx07a68xek52kfl0s9dc20qjydsuu (cleared);

0x757f88e931ef4d57c23b306c5a6792fc0d16edb2 (Hyperliquid address, liquidated);

0x4f9A37Bc2A4a2861682c0e9BE1F9417Df03CC27C (holding $426 million USDC).

On October 10, the whale started its own " insider short selling show " -

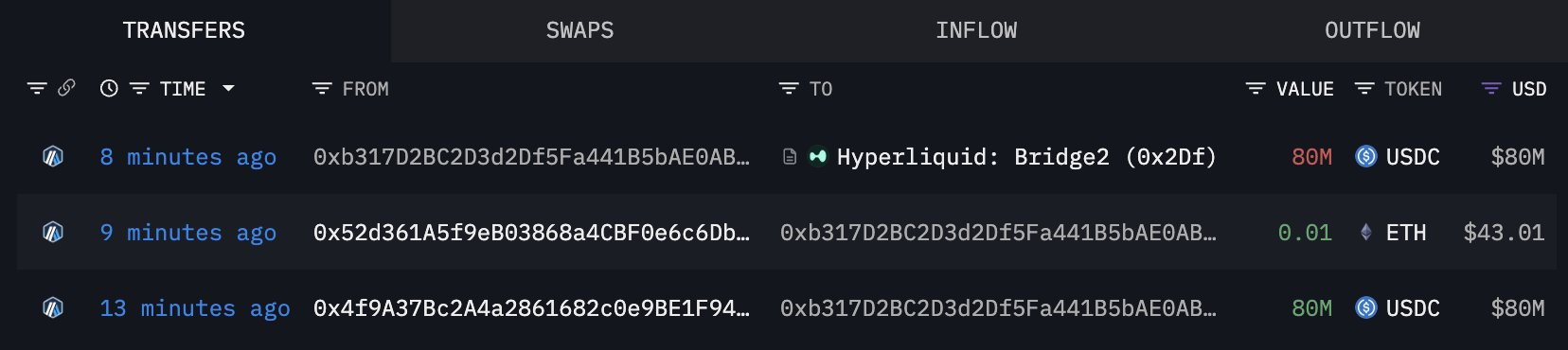

It first deposited $80 million into Hyperliquid and opened a 6x short position of 3,477 BTC; in addition, it deposited $50 million in USDC into Binance. Address: 0xb317D2BC2D3d2Df5Fa441B5bAE0AB9d8b07283ae;

Subsequently, it increased its short position again, increasing its BTC short position to 3,600.

Yesterday afternoon, it targeted ETH for short selling, depositing $30 million with Hyperliquid to open a 12x short position of 76,242 ETH. The on-chain address can be found here; the position has now been liquidated.

On the evening of the 10th, the whale 's short position continued to increase , and at one point it increased to about US$1.1 billion, of which the BTC short position was worth US$752 million; the ETH short position was worth US$353 million.

As Trump launched another tariff war last night and the market fell, the whale's short position turned from loss to profit, with a profit of over $27 million at one point.

The latest news today is that Hypurrsan data shows that the whales who had previously shorted BTC and ETH withdrew $60 million in USDC back to Arbitrum, making a profit of $72.33 million in the past 24 hours.

Hyperliquid once again emerged as a winner in this extreme market, with HLP's single-day profit exceeding $40 million.

In addition,according to on-chain analyst @mlmabc, the whale made a daily profit of approximately US$190 million to US$200 million on Hyperliquid; on the other hand, in the extreme market conditions,Hyperliquid also took a share of the pie : HLP's daily profit was as high as US$40 million; the annual interest rate soared to 190%; and the overall capital return reached 10-12%.

The hidden identity of the insider whale: Could it be related to Trend Research?

As for the identity behind this giant whale, there is no conclusion yet.

However, according to Lookonchain analysis, Bitcoin OG, which has been making a high-profile Ethereum swap, may be connected to Trend Research, a subsidiary of Yi Lihua. Evidence suggests that wallet 0x52d3 previously sent 0.1 ETH as gas fees to this Bitcoin OG address and subsequently deposited 1.31 million USDC into Trend Research's Binance deposit address.

Odaily Planet Daily will also continue to follow market trends and more news about the crypto whale/institution.