RWA Weekly Report | US SEC's Proposed Blockchain Stock Trading Faces Strong Opposition from Traditional Financial Institutions; Stablecoin Market Cap Exceeds $300 Billion (October 1-10)

- 核心观点:RWA市场呈现放量上行与结构扩容。

- 关键要素:

- 链上总价值达336.7亿美元,创历史新高。

- 美国国债与商品类资产涨幅显著,超9%。

- 公开股权首次出现,资产结构多元化。

- 市场影响:推动资产代币化,加速传统金融融合。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3)

RWA Sector Market Performance

As of October 10, 2025, the total value of RWA on-chain reached $33.67 billion, an increase of $2.4 billion, or 7.67%, from $31.27 billion on September 30. This marked another significant increase after a period of double-digit growth, and the scale of on-chain assets continued to reach a new record high. The total number of asset holders increased from 407,788 to 422,820, with 15,032 new holders, or 3.69%, marking the largest single-week net increase in nearly a month. The number of asset issuers increased from 221 to 224, with 3 new issuers, maintaining a moderate upward trend. In the stablecoin market, the total market capitalization increased from $289.06 billion to $318.36 billion, an increase of $29.3 billion, or 10.13%. The number of stablecoin holders increased from 193.52 million to 195.38 million, an increase of approximately 1.87 million, or 0.97%.

In terms of asset structure, private credit remains the dominant force in the RWA market, currently valued at $17.5 billion, up $200 million, or 1.16%, from $17.3 billion last week. While its share has declined slightly, it still exceeds 50%. US Treasuries rebounded further, rising $700 million, or 9.09%, from $7.7 billion to $8.4 billion. This strong rebound, seen for two consecutive weeks, may reflect a return of risk appetite and a strengthening inflection point in interest rate expectations. Commodity assets saw the strongest performance, increasing from $2.1 billion to $2.5 billion, a $400 million increase, or 19.05%. This growth reflects a rapidly growing interest in inflation hedging and commodity allocations. Institutional alternative funds continued to grow, increasing from $2.3 billion to $2.6 billion, a 13.04% increase, continuing last week's momentum and reflecting the increasing diversification of institutional allocations. The newly added public equity (Public Equity) has reached a scale of US$1.3 billion, which is the first time it has been explicitly marked, reflecting that the on-chain asset structure has gradually expanded from "debt-credit" to "equity-equity"; other sub-categories such as non-US government debt, active management strategies, stocks, corporate bonds, etc. are relatively small in size, but the overall structure is richer, and the market depth and breadth are growing simultaneously.

What are the trends (compared to last week )?

Overall, the RWA market in this cycle exhibits the dual characteristics of "increasing volume and structural expansion." On the one hand, the total market capitalization has surged significantly, coupled with a simultaneous surge of nearly $30 billion in stablecoins, indicating significant new liquidity. On the other hand, user activity and the number of asset issuers have grown simultaneously, demonstrating the continued vitality of the platform ecosystem. In terms of asset structure, US Treasuries and commodity assets have been the primary drivers of this upward trend. While credit's share has declined slightly, it still holds the largest absolute weight, indicating a market rebalancing and reallocation amidst rising risk appetite. The market is transitioning from a "credit-dominated, high-safety margin" model to a diversified portfolio of "debt, commodities, and alternative assets." The emergence of public equity products, in particular, may indicate that on-chain RWAs are increasingly capable of integrating the logic of the secondary capital market, evolving towards more complex structured finance.

Combined with this analysis, key areas of focus include: first, the ability of stablecoin supply fluctuations to sustainably support RWA assets; second, whether commodity assets can establish long-term allocation value after a short-term surge; and third, whether issuers of public equity and actively managed assets are experiencing expansion milestones. Overall, the RWA market has entered a new plateau, surpassing 30 billion in scale and entering a critical phase of "accelerated stratification and institutional investment."

Review of key events

U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins stated at an event in Manhattan that the agency remains committed to establishing an "innovation exemption" for companies operating in the United States based on digital assets and other innovative technologies as soon as possible, perhaps by the end of this quarter. While the current government shutdown has hampered the SEC's ability to advance rulemaking, developing this exemption remains a top priority for the agency, scheduled for the end of this year or the first quarter of 2026. He stated that the agency intends to initiate rulemaking by the end of 2025 or the first quarter of 2026 and is confident of achieving this goal. He added that formal rulemaking in the cryptocurrency sector would allow it to break free from the previous regulatory model. During a Q&A session, he stated that the exemption he is promoting is one of the areas he hopes to finalize quickly, as a way to welcome innovators to the United States. He also noted that the government shutdown has hindered work and has halted rulemaking. He also praised Congress's efforts to pass cryptocurrency legislation, mentioning the GENIUS Act but stating that the SEC did not play a major role in it.

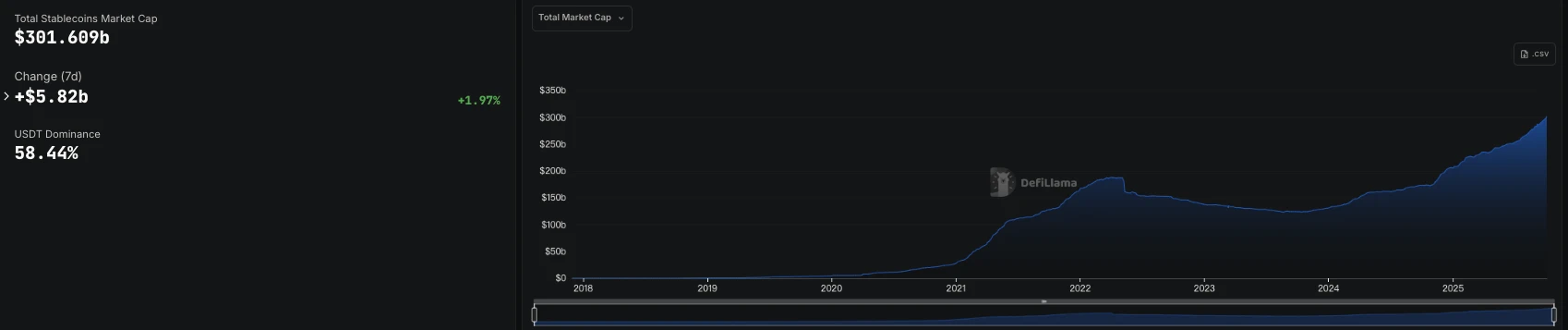

The total market value of stablecoins exceeded US$300 billion, setting a new high

According to DeFiLlama data, the total market value of stablecoins exceeded US$300 billion, setting a new high.

Goldman Sachs, Barclays and other major global banks plan to jointly launch a stablecoin project

According to market news: Major global banks plan to jointly launch a stablecoin project. Alliance members include Santander, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, MUFG, TD Bank and UBS.

The U.S. Securities and Exchange Commission is developing a plan to enable stocks to be traded on blockchain technology, similar to cryptocurrencies. This initiative, a key component of the Trump administration's pro-cryptocurrency regulatory agenda, could allow investors to purchase tokens representing shares of companies like Tesla and Nvidia on cryptocurrency exchanges. SEC staff are currently discussing the proposal with industry representatives. Companies including Coinbase (COIN.O) and Robinhood (HOOD.O) are actively pushing for expedited regulatory approval to conduct stock trading on blockchain platforms. However, the plan has faced strong opposition from traditional financial institutions, which have established profit models within the existing market structure.

Coinbase and Mastercard plan to acquire stablecoin startup BVNK for approximately $2 billion

Cointelegraph, citing Fortune magazine, reported that Coinbase and Mastercard are in talks to acquire stablecoin startup BVNK for approximately $2 billion, with Coinbase reportedly in a leading position in the negotiations.

Ondo Finance announced in a post on the X platform that it has completed the acquisition of Oasis Pro, which includes its digital asset broker-dealer, alternative trading system (ATS), and transfer agent (TA) licenses registered with the U.S. Securities and Exchange Commission (SEC).

The acquisition enables Ondo Finance to develop a regulated market for tokenized securities, providing it with infrastructure such as a tokenized real-world asset (RWA) engine, a digital asset transfer agent, a primary issuance market, and a secondary trading system.

At the Token 2049 event in Singapore, Robinhood CEO Vlad Tenev told Bloomberg in an interview, "Asset tokenization is like a train of time; it's inevitable and will eventually engulf the entire financial system. But the reality is, many people talk about RWAs, but few take action. Compared to stablecoins, the number of people holding RWA assets is still small. Since our stock token launch in France this summer, we've launched stock (equity) tokenized products for approximately 200 companies, and the number is constantly expanding."

Hot Project Dynamics

Plume Network (PLUME)

One sentence introduction:

Plume Network is a modular, Layer 1 blockchain platform focused on tokenizing real-world assets (RWAs). It aims to transform traditional assets (such as real estate, art, and equity) into digital assets through blockchain technology, lowering investment barriers and increasing asset liquidity. Plume provides a customizable framework that supports developers in building RWA-based decentralized applications (dApps) and integrates DeFi with traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Recent Updates:

On October 6th, Plume Network received approval from the U.S. Securities and Exchange Commission to become a registered transfer agent . As a registered transfer agent, Plume will now manage digital securities and shareholder records directly on-chain, supporting interoperability with the Depository Trust & Clearing Corporation (DTCC) settlement network. Furthermore, it will facilitate a range of use cases, including on-chain IPOs, small-cap financings, and registered funds. Following the news of Plume Network's SEC approval as a registered transfer agent , PLUME's price surpassed 0.13 USDT, a 35% increase over the past 24 hours.

On October 8th, Plume announced the acquisition of Dinero, an institutional-grade staking protocol on Ethereum . This acquisition will integrate ETH, SOL, and BTC staking functionality into the Plume ecosystem, enabling institutions and DeFi users to earn returns and manage tokenized assets on the same platform.

MyStonks (STONKS)

One sentence introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing and trading Reliable Warrants (RWAs) such as US stocks on-chain. Through a partnership with Fidelity, the platform offers 1:1 physical custody and token issuance. Users can mint stock tokens like AAPL.M and MSFT.M using stablecoins like USDC, USDT, and USD 1, and trade them 24/7 on the Base blockchain. All trading, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is committed to bridging the gap between TradFi and DeFi, providing users with highly liquid, low-barrier-to-entry on-chain investment in US stocks, and building the "NASDAQ of the crypto world."

Previous news:

On September 16th, the MyStonks platform officially launched Hong Kong stock futures trading . Users can trade directly with USDT/USDC using their wallet, with up to 20x leverage. This launch includes a number of high-quality Hong Kong stocks, including Guotai Junan International (1788.HK), BYD Co., Ltd. (1211.HK), Xiaomi Group (1810.HK), Mixue Group (2097.HK), Meituan (3690.HK), Tencent Holdings (700.HK), Pop Mart (9992.HK), JD.com (9618.HK), and SMIC (981.HK). These stocks cover a variety of sectors, including technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

On September 25th, the MyStonks platform announced a brand upgrade , officially changing its domain name to msx.com, marking its entry into a new era of global fintech. The announcement stated that this upgrade not only simplifies access and facilitates user connectivity, but also demonstrates the company's transformation from a meme-based platform to a professional international financial brand, demonstrating its commitment to digital financial innovation and global expansion. The msx.com team stated that it will continue to prioritize users, drive technological innovation, and enhance the security and efficiency of digital financial services.

Related links

Sort out the latest insights and market data for the RWA sector.

Crazy RWAs going to Hong Kong: Financing or "Momentum Integration"?

According to an incomplete review by a reporter from the First Financial Daily, from 2024 to the present, 13 institutions or companies have successfully carried out RWA, including Longxin Group, Xunying Group, Hua Xia Fund, and Pacific Insurance. The underlying assets include funds, bonds, physical gold, real estate mortgage loans, agricultural products, etc., and technical partners include Ant Digital Technology, OSL, and HashKey.