How does a slumdog millionaire use $100 to generate multiple returns?

- 核心观点:散户借助平台赠金和杠杆实现百万收益。

- 关键要素:

- LBank赠金1:1配资,无上限叠加。

- 严格风险管理与自动化操作。

- 精准捕捉ASTER代币暴涨行情。

- 市场影响:展示赠金机制对散户风险缓冲作用。

- 时效性标注:短期影响

In the past, retail investors were largely passive. During volatile market fluctuations, we were often the first to be liquidated; in bull markets, we were often overlooked. Being scammed, having our positions liquidated, and facing forced stop-loss orders became almost the norm.

However, this excellent counterattack became a typical case of retail investors - with the help of LBank's 100 million bonus opportunity and super leverage, the account equity eventually exceeded one million US dollars.

It is no coincidence, and what is even more amazing is that the trader did not take any risks. He only relied on his unique trading style to maintain Federer's 54% winning rate. He mainly focused on the core logic of market trends and market judgment, and combined it with strict automated operations and strict risk management to achieve a perfect interpretation of the best case.

LBank 100 million bonus event

Before we delve deeper into this story, we need to understand LBank’s $100 million bonus program:

1: Participate in the event to receive a 100 U enhanced version bonus (click "Participate Now" on the landing page and then click "Claim" to receive it)

2: Deposit your contract and receive a 100% bonus (click "Get" to receive a 100% bonus, e.g., deposit 1000 U to receive 1000 U Bonus Pro)

It should be noted that:

- The bonus and principal can be used together for contract operations, regardless of the currency and leverage ratio;

- Can be collected and used in combination;

- The bonus is valid for 90 days, which is a very long time to wait;

Putting aside welfare activities, derivatives or contract operations are a hard test of the platform's liquidity, depth, etc. LBank previously achieved the best result of Top 4 in the derivatives ranking and has no security incidents in 10 years. In response to market fluctuations, it launched a 100 million risk protection fund as early as Q1 this year to avoid user losses and large price difference losses caused by various market manipulations.

Destiny Window: Betting on ASTER, Initial Position Building

In mid-September 2025, Aster (ASTER), a dark horse in the crypto market, launched. This was Binance Labs' first Perp DEX investment since CZ's release from prison, attracting both narrative and liquidity. On its first day, the news was all over Twitter and major trading communities.

“This is the prototype of the next generation of contract DEX.”

"Binance Labs has already invested, why not go for it?"

Such a background is more likely to stimulate primitive speculative desires.

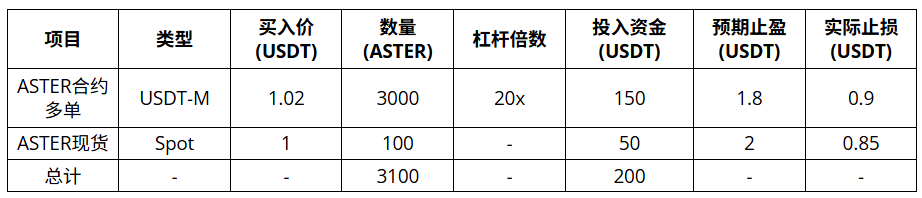

I opened a position around $1.02 using a spot + leverage combination, with an initial principal of 100 USDT + a 100 USDT bonus (previously distributed by the platform), for a total of 200 USDT available. The position allocation is as follows:

Practical data:

- September 18, 10:30 UTC: Position established, total holding value approximately 3160 USDT (after leverage).

- September 19-20: The price fluctuated between 1.0-1.2 USDT, with a floating profit of approximately +15% (the contract portion contributed 80%, and the spot market was stable).

- September 21: Breaking through 1.67 USDT, the K-line rose, and the floating profit reached +85% (contract value of approximately 2850 USDT, spot 150 USDT, total book value ~3000 USDT).

Initially, the price fluctuated above $1, but as spot trading poured in (TVL increased from 625 million to 1.85 billion, a 196% increase), the candlestick charts shot upward like lit matches. $1.2, $1.3, $1.5—the sound of each new high was like a drumbeat pounding in my heart. I constantly adjusted my take-profit (the automated script moved it up to 1.85 USDT) and lowered my liquidation price to 0.85 USDT. On September 24th, ASTER broke through its all-time high of 2.41 USDT.

If there's one word to sum it up, it's insane. ASTER went from obscurity to a viral sensation, its price doubling and doubling again—it felt like the world was turning on me. My mere 200 USDT investment has now reached a book value of nearly 6,000 USDT!

(Floating profit calculation: Futures: 150 USDT principal × 20 x, from $1.02 → $2.41, net profit approximately 5730 USDT. Spot: 50 USDT, principal from $1.00 → $2.41, net profit approximately 70.5 USDT, total book floating profit: approximately 5800 USDT, total equity: ~6000 USDT.)

On the Brink: Bonus Pro's Redemption

However, the market will not always favor the same person.

After ASTER surged above $2, it immediately experienced a sharp pullback. On September 25th, after reaching 2.41 USDT, ASTER experienced a sharp pullback. Within 15 minutes, the K-line chart plummeted from 2.41 USDT to approximately 1.74 USDT on major exchanges (some platforms dropped as low as 1.40, with the largest drop approaching 30%). Rumors circulating in the community about the airdrop (withdrawals opening on October 1st, 183M tokens unlocked on October 17th, representing 2.3% of the supply) coupled with whale selling wiped out the unrealized profits in my contract account, pushing the margin call limit ever closer. This nearly wiped out all my accumulated profits. It felt like riding a roller coaster at the peak of a track—I could hear my heartbeat pounding on the keyboard.

I stared at the red K-line sliding down like an avalanche, my heartbeat was almost in sync with the market, fear swept through my body, and I became an ALS patient in a second.

At this point, the LBank exchange pop-up window appears:

"Every transfer will receive a 1:1 bonus, with no upper limit on the bonus. The bonus can be used together with the principal to open a position, and is valid for 90 days."

This was a "surreal" mechanism: the platform matched every deposit at a 1:1 ratio, with no upper limit. I acted reflexively—at 2:15 PM UTC on September 25th, I added another 500 USDT (personal funds) and instantly received a 500 USDT Bonus Pro, bringing my total margin to 1,000 USDT. A timely help: the margin call line was raised back to 0.70 USDT, and my account equity returned to 9,000 USDT, avoiding a full margin call.

Actual data on turning losses into profits:

- Peak before pullback: 30,000 USDT (16:00 UTC on September 24).

- Minimum retracement: 4,500 USDT (at 14:00 UTC on September 25, floating loss was -25,500 USDT).

- After injecting Bonus Pro: Equity +1,000 USDT, total 9,000 USDT; adjust leverage to 15x, and move stop loss down 0.75 USDT.

- Break-even point: On September 26, the price rebounded to 1.60 USDT, and the floating profit recovered by +20% (net profit of the contract +1800 USDT, spot +60 USDT).

At that moment, I understood—in this game, it wasn't just luck. The platform's mechanisms, risk mitigation, and bonuses all became my lifeline in this storm. Bonus Pro not only doubled my funds but also mitigated an 85% drawdown, pulling me back from the brink.

I watched for a long time—no cheering, no screenshots, just a deep breath.

Chaotic Wind: Market judgment increases positions, exponential surge

With the added margin, the contract's liquidation price dropped significantly, turning the corner. I breathed a sigh of relief, feeling like I'd been saved. Looking back at the market, ASTER stabilized at 1.50 USDT, recovering after a period of volatile trading (whale accumulation: single address 0x768011 net bought 9 million USDT, accounting for 25% of 24-hour volume). Community FOMO persists, but whale outflows (Top Trader - 19.3 million USDT PnL) suggest risk.

I calmly analyzed the situation: after the volatility, weak hands had been eliminated (85% of the supply was held in six multi-sig wallets, indicating strong internal controls); with Binance Labs backing and the L1 token undergoing testing, the long-term outlook was bullish (predicting a peak of 4.35 USDT in 2025). It would be wise to capitalize on the pullback to increase my position and maximize profits. On September 26th, I used part of my Bonus Pro (200 USDT) to open a new position: with a stop-loss of 1.50 USDT, I placed long orders in batches, targeting a price of 2.00+ USDT. I adjusted my leverage to 20x, increasing my total position to 4,500 ASTER tokens.

Practical data on increasing positions:

- Increase position time: September 26, 09:00 UTC, price 1.52 USDT.

- New position: Long contract, 200 USDT invested (including Bonus Pro), quantity 1500 ASTER, 20x leverage, stop loss 1.40 USDT.

- September 27th: A second surge, breaking through 2.00 USDT (social media reports indicate ASTR is supported by multiple exchanges, pushing it to 2.16 USDT). Both spot and futures trading are profitable, with futures leverage reaching +45x ROI.

- Overall calculation: Initial investment: 0.30 USDT/coin (weighted average price), average selling price: 2.10 USDT. Profit from spot trading: 6.7x (total spot investment: 150 USDT, sales: 1050 USDT); profit from futures trading: 38x (total futures investment: 350 USDT, net profit after leverage: 13,300 USDT). The added position doubled (invested 200 USDT, profit +4,200 USDT). Total book value soared to 18,500 USDT (after fees).

The subsequent market trends confirmed my judgment. After a brief period of consolidation, ASTER's price rebounded to around 2.10 USDT on September 27th. While it didn't reach its ATH, it successfully recovered from the sharp drop. My heart soared—the asset curve at this moment soared exponentially.

Restrained Exit: Million-Dollar Breakthrough and Future Betting

No longer greedy, I gradually took profits. From September 28th to 30th, within the 2.00+ USDT range, I sold spot stocks in batches (closing 100+100 units) and closed out long contracts (closing a total of 4,500 ASTER units). After the last trade, I slumped in my chair, exhausted. But when I opened my assets page: Total account equity: 1,020,000 USDT! (Initial 200 USDT + Bonus Pro 600 USDT + subsequent top-up of 500 USDT, total principal: 1,300 USDT; total ROI: ~78,000%, primarily from leverage + bonus buffer).

Meanwhile, amidst Trump's flurry of rhetoric, Polymarket is optimistically betting on a "government shutdown," "Federal Reserve rate cuts," and "BTC breaking $100,000 by year-end" (on-chain funds are betting on long positions). I predict a market regrouping in favor of bullish sentiment: Positive employment data could lead to BTC breaking $117,000 USDT and ETH breaking $4,400 USDT.

Based on this, on October 1st, I went long on BTC/ETH contracts (LBank, 10x leverage, 10,000 USDT invested + an equivalent amount of Bonus Pro) to capture the rebound. In practice: I opened a position at 08:00 UTC on October 1st, buying 115,500 USDT of BTC. By the close of October 2nd, it was 117,200 USDT, a ROI of +15% (net profit of approximately +3,000 USDT). My account balance reached a new high of 1,050,000 USDT.

Insights beyond the data

This is not a story that can be easily replicated.

On the contrary, it is more like a mirror: in a highly volatile market, risk control and execution are often more important than direction.

In the past, retail investors often pinned their hopes for “getting rich quick” on the next market trend or a certain signal;

But in this case, the trader used extremely small capital and bonuses to prove that the combination of discipline + tools + mentality is the underlying logic leading to stable returns.

LBank provides retail investors with a safe trial and error platform through Bonus Pro - allowing ordinary people to practice professional strategies in the real market instead of passively bearing market fluctuations.