How on-chain TCGs can leverage the next $2 billion market: Landscape Overview and Valuation Outlook

- 核心观点:宝可梦卡牌主导TCG市场,链上化趋势显著。

- 关键要素:

- 宝可梦卡牌全球发行超529亿张。

- 链上TCG交易量两月内增长四倍。

- 链上平台手续费低至2%,优势明显。

- 市场影响:推动收藏品资产数字化与金融化。

- 时效性标注:中期影响

Since the release of Magic: The Gathering in the early 1990s, trading card games (TCGs) have undergone over three decades of development, gradually evolving into a global industry encompassing entertainment, collectibles, and investment. Currently, tens of billions of cards are in circulation, and the global player and collector base continues to expand.

Source: zionmarketresearch , pokebeach , Gate Ventures

Among all TCG brands, Pokémon TCG undoubtedly occupies a dominant position. As of 2023, more than 52.9 billion Pokémon cards have been produced worldwide, covering 14 languages and nearly 90 countries and regions, far surpassing other competitors and ranking first in the industry in terms of audience coverage and revenue scale. Its success is not only due to the strong IP appeal of Pokémon games, animations, and movies, but also due to its design that combines playability and collectible value. (1)

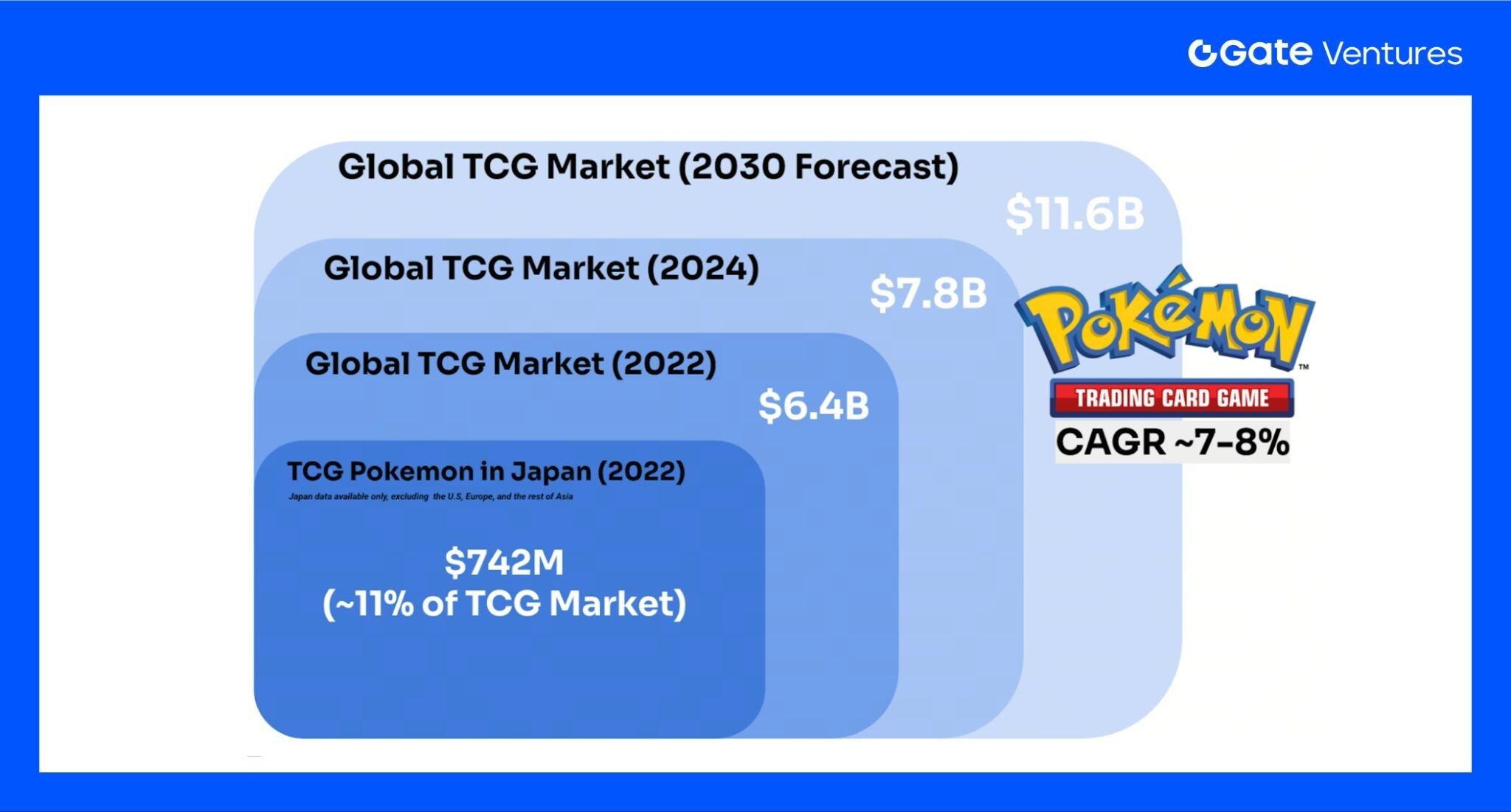

According to public data, Pokémon TCG holds a prominent position in the global TCG market. In 2022 alone, its revenue in Japan accounted for 11% of the global TCG market. Looking ahead, according to forecasts, the global TCG market is expected to grow to US$11.6 billion by 2030, with a compound annual growth rate of approximately 8%. This growth is not only due to the rise of collectible culture, but also benefits from the continued expansion of digital channels and secondary markets. (2)

Source: pokebeach , Gate Ventures

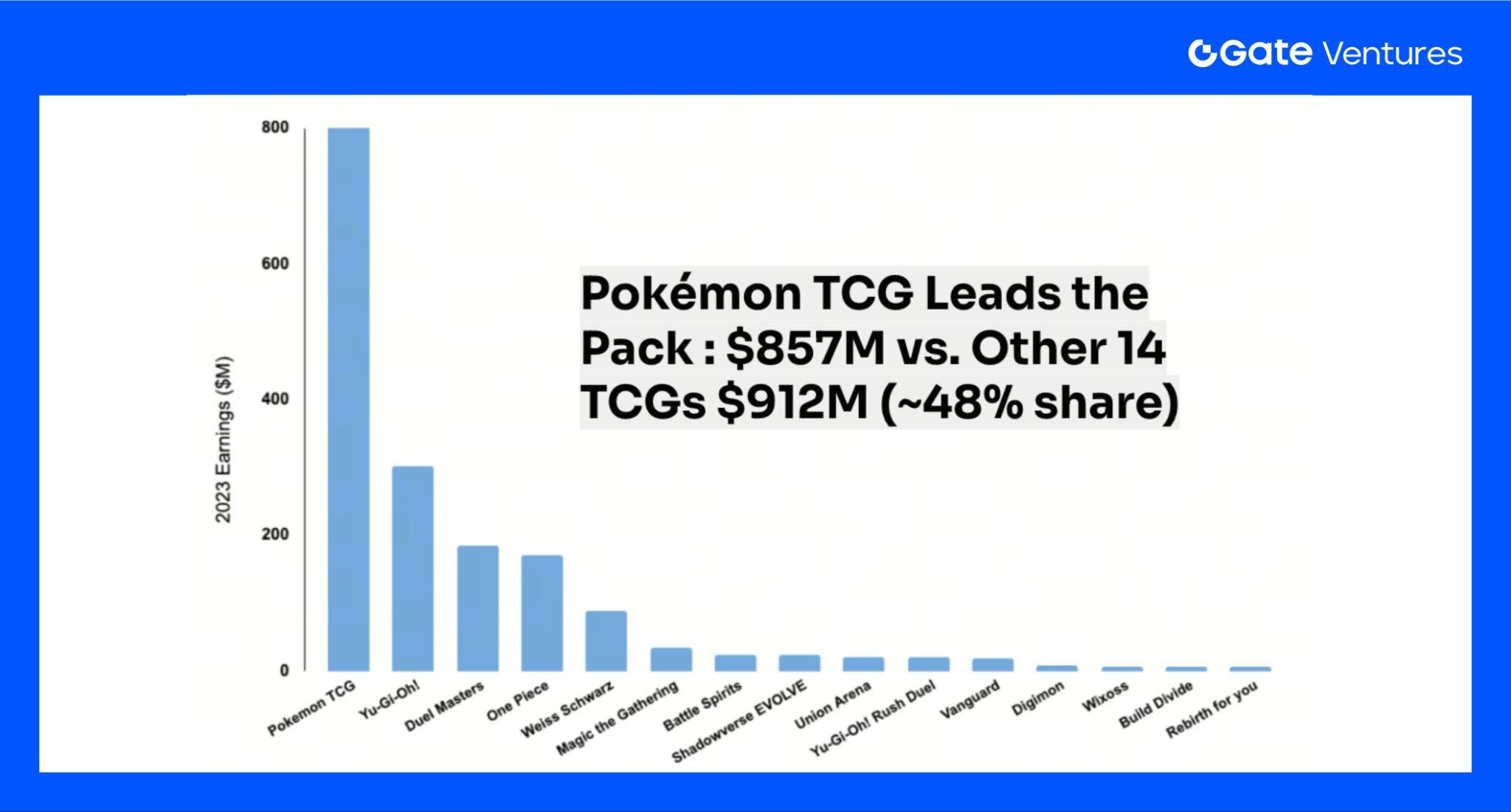

From a geographical perspective, North America and Europe are the most mature markets, with stable player groups and a well-developed competition system. Japan, as the birthplace of Pokémon, has long maintained strong demand. In 2023, the revenue of Pokémon TCG in Japan will be equivalent to the total of the other 14 TCGs, with a market share of nearly 50%. At the same time, the Southeast Asian and Latin American markets are expanding rapidly, showing significant growth potential. (2)

Source: Wall Street Journal

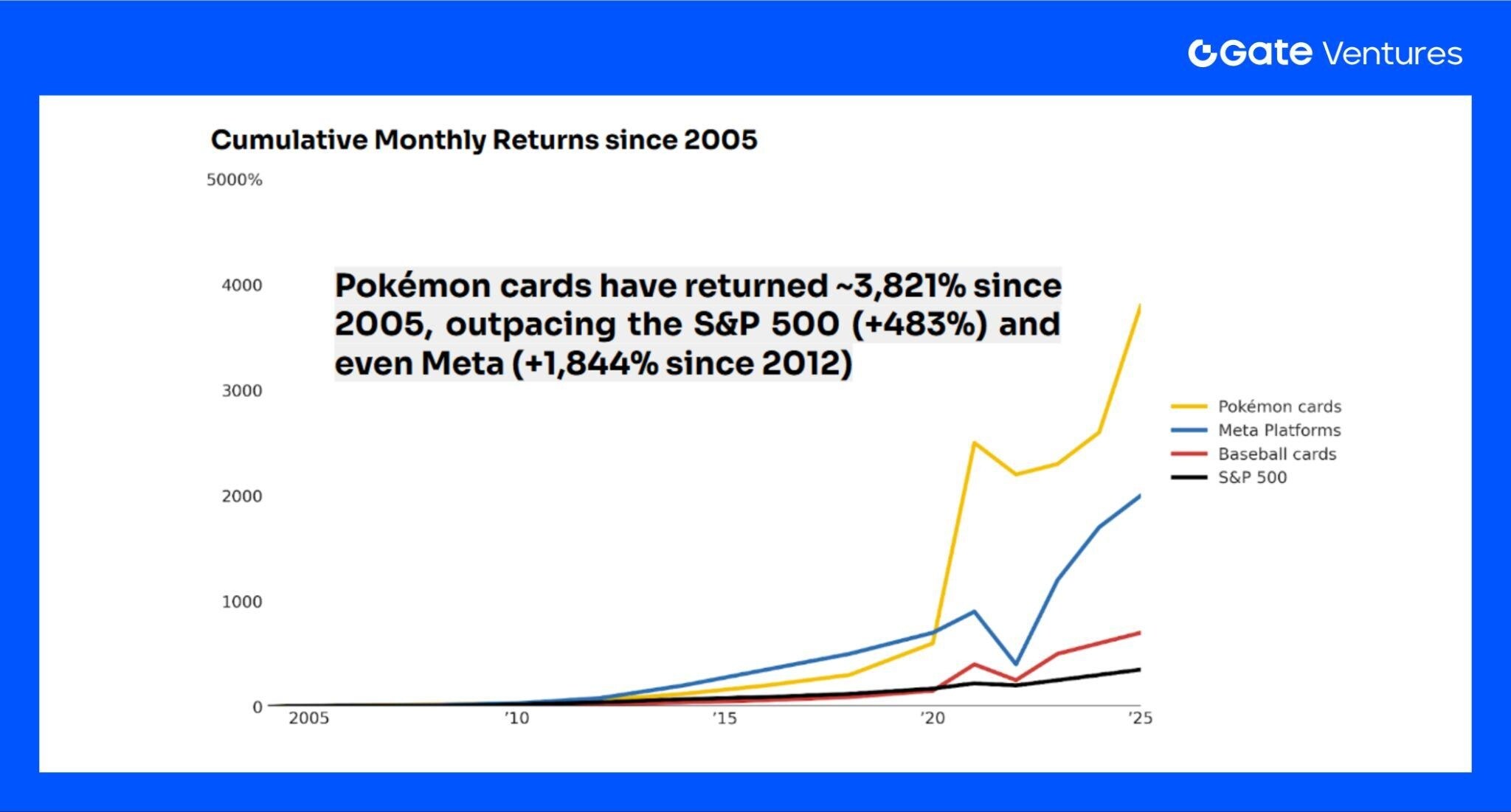

With the development of online trading platforms, the spread of social media, and the growth of a cross-cultural fan base, Pokémon cards are gradually evolving from a purely consumer entertainment product into a global asset with both collectible and investment properties, further consolidating their core position in the TCG ecosystem. While the investment value of Pokémon cards has long been underestimated, data shows that their returns over the past 20 years have even exceeded those of the S&P 500 and MetaTrader, fully demonstrating their unique investment attributes.

Pokémon TCG World

Before understanding the market for the on-chain Pokémon TCG, we must first understand the operating model of its industry.

Source: Gate Ventures

Send the card to the safe depository (or have the rating agency deliver it directly to the safe depository); complete the link registration, take photos to create files, and verify the certificate; maintain constant temperature and humidity, and store it in a safe depository .

We provide certification/grading services on behalf of the depository: PSA/CGC/BGS grading. After grading, the certificate will be returned to the depository and the certificate number and image information will be updated.

Sell on the market connected to the vault: / List at the auction house; set a fixed price or reserve price; the system directly calls the image and certificate data in the vault.

Buyer pays → Platform funds are escrowed → Vault account transfer (ownership is transferred to the buyer). Transaction and settlement:

Delivery method (choose one):

Intra-Vault Transfer (Vault-to-Vault Transfer): The buyer requests shipment; the vault arranges insured transportation at the buyer's expense. Vault-to-Vault Transfer: The buyer maintains custody, and ownership is transferred within the vault. The custodian updates ownership on its ledger.

The assets can be resold within the vault, auctioned, or fractionalized (subject to compliance); the vault statement and link records can serve as traceable proof of origin.

The synergy between Pokémon TCG and Web 3

The Pokémon TCG has already established a mature ecosystem and business model, and has laid a complete infrastructure for its on-chain version. The next step is to consider: In what ways will the synergy between the Pokémon TCG and Web 3 manifest?

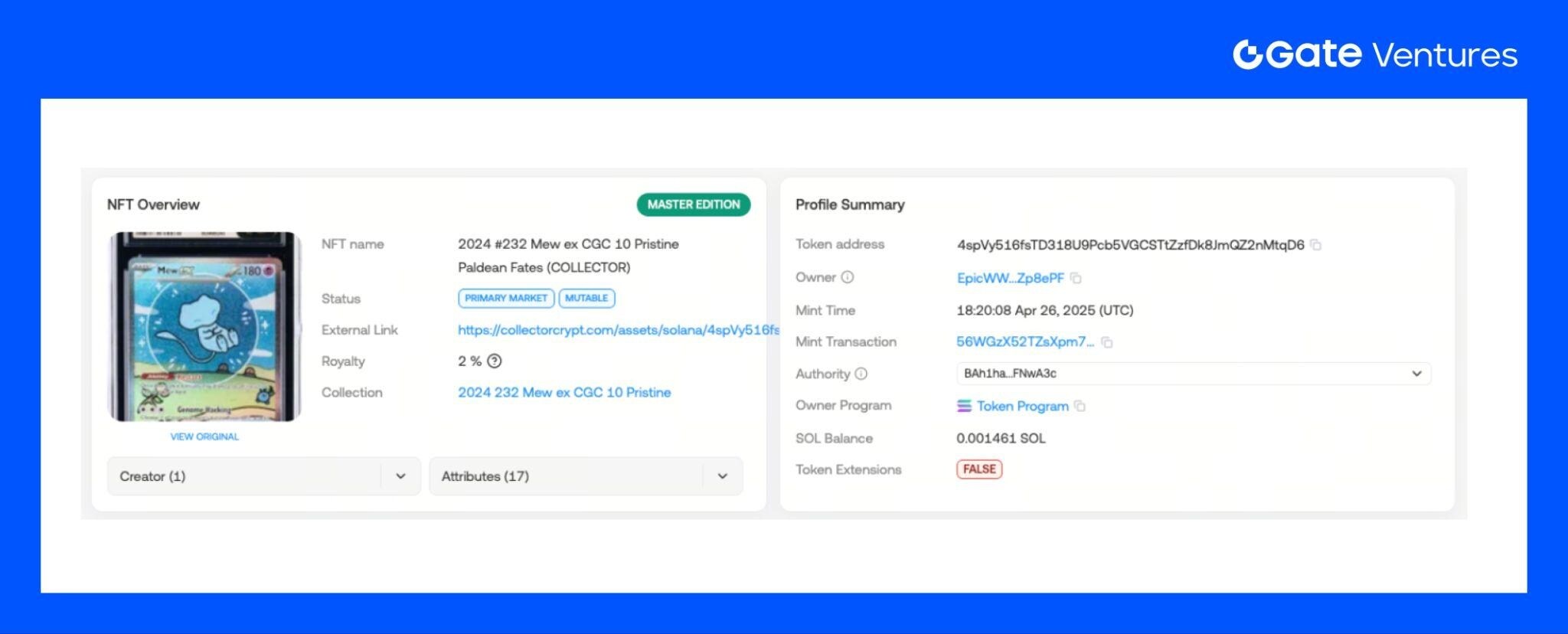

Source: SolScan

After each card is minted as a true rarity and trusted NFT, a permanent record of its rarity and authenticity is recorded on the blockchain, ensuring on-chain confirmation of ownership and global free circulation. As a digital proof of ownership, the NFT corresponds to a unique token address and comes with a minting timestamp and a complete transaction history, ensuring the authenticity and traceability of the card.

NFTs enable free cross-platform trading and liquidity . Once cards are NFTed, they become blockchain assets, freely tradeable across various markets, significantly increasing liquidity. With the development of on-chain TCGs, platforms like Collector_Crypt and Courtyard.io now offer 24/7 trading support. Compared to traditional physical cards, which can only be traded through specific channels or privately, NFT cards enable 24/7 global circulation, significantly reducing transaction barriers and friction costs.

Traditional TCG trading platforms (such as eBay) charge fees of over 13%, which places high costs on sellers. On the other hand, the on-chain platform Courtyard charges approximately 6%, and Collector_Crypt only around 2% (detailed comparison below). These significant fee advantages are gradually attracting more users to on-chain transactions.

Source: DexScreener

Its investment potential cannot be ignored, but for investors unfamiliar with the Pokémon ecosystem, the barrier to entry is often high. The Beta Effect of the Pokémon TCG: The core value of Web 3 lies in the rapid realization of value. Any asset or information with a premium can be tokenized, gradually forming the on-chain Beta of the Pokémon TCG. Numerous projects have already benefited from the Pokémon premium, such as $CARD, which has seen a tenfold increase in price, and the Phygital project $PKMN, which is preparing to launch an airdrop, providing investors with new alternative investment targets.

On-chain TCG Market Overview

Source: Gate Ventures

The core functions of the on-chain TCG platform are mainly divided into two categories:

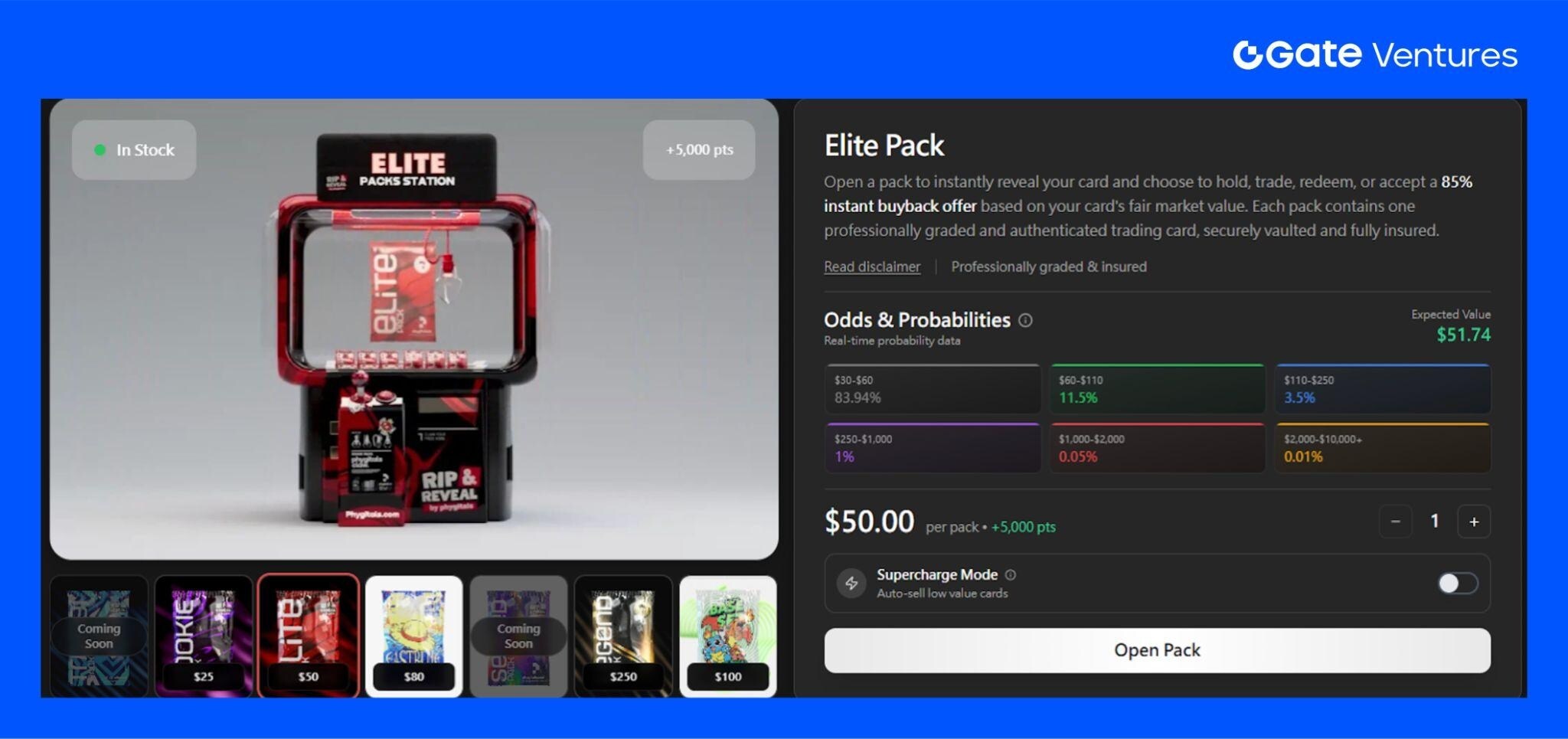

1. Gacha: Users randomly obtain digital cards through on-chain blind boxes or card packs, enhancing gamification and entertainment. For example, Courtyard's blind box mechanic allows players to experience the thrill of opening a pack while ensuring that all cards correspond to real assets and are stored in a professional vault.

2. Secondary Market: Users can freely trade cards on the on-chain platform or sell them back to the platform. Some platforms even offer a guaranteed buyback mechanism. For example, Courtyard allows users to sell unsatisfactory cards back to the platform at 85%–90% of the original price, ensuring basic liquidity and reducing user participation risk.

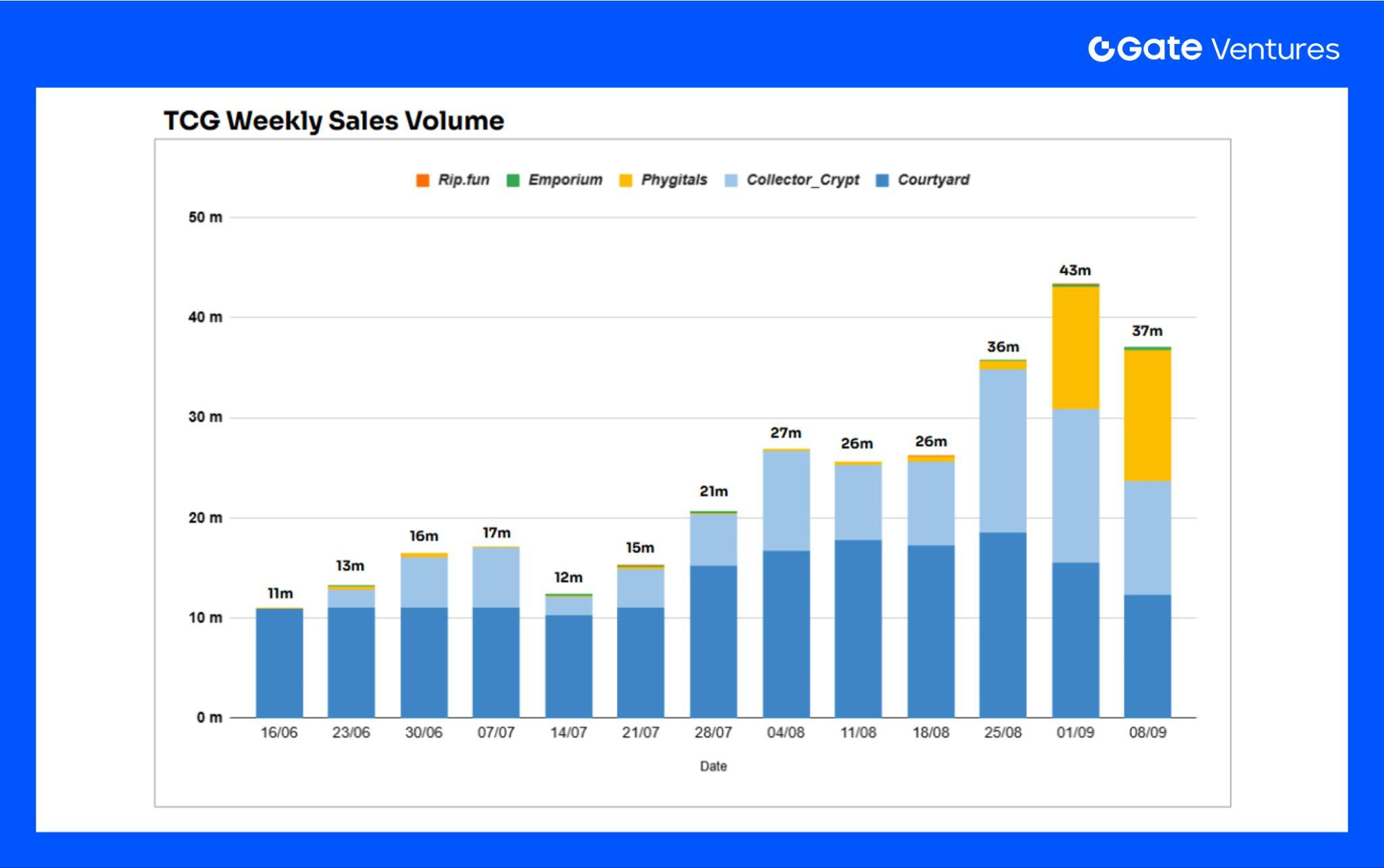

Source: Dune Analytics

Data from the past two months shows a sustained upward trend in TCG market transaction volume, growing nearly fourfold from approximately 10 million in mid-June to approximately 40 million in September. Courtyard.io initially held almost the entire market share, but with the entry of new platforms like Collector_crypt and Phygitals, and the anticipated influx of users fueled by various airdrops, these platforms are gradually expanding their share.

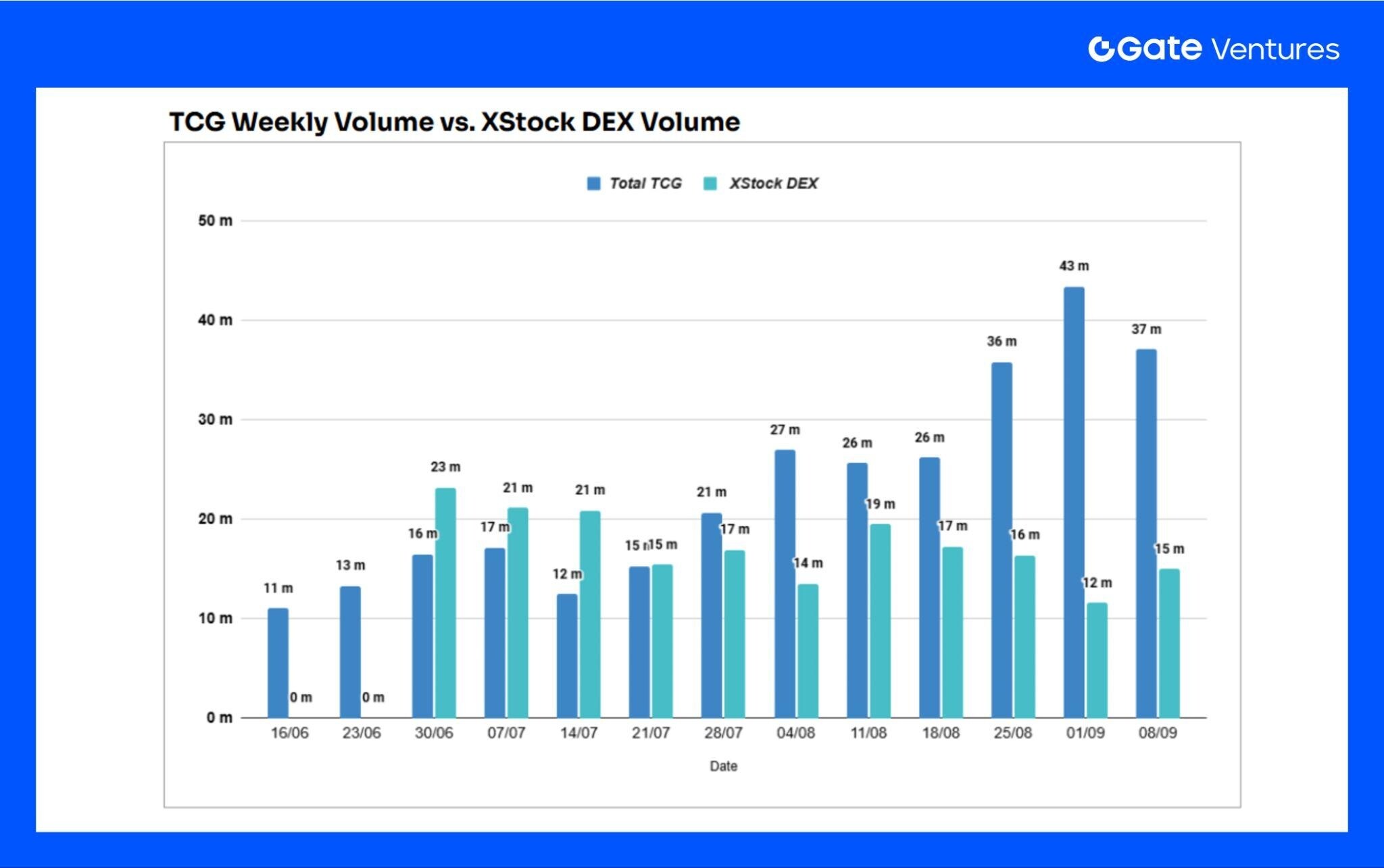

Source: Dune Analytics

So, what is the current level of trading volume in the on-chain TCG market? xStock, a fellow on-chain RWA, saw trading volume comparable to TCG from mid-June to early July. However, starting in early August, TCG's trading volume climbed significantly, surpassing xStock by September, reaching over three times its size. When considering "which assets are best suited for on-chain transfer," on-chain TCG demonstrates a stronger appeal than on-chain stocks, further demonstrating its strong compatibility with blockchain.

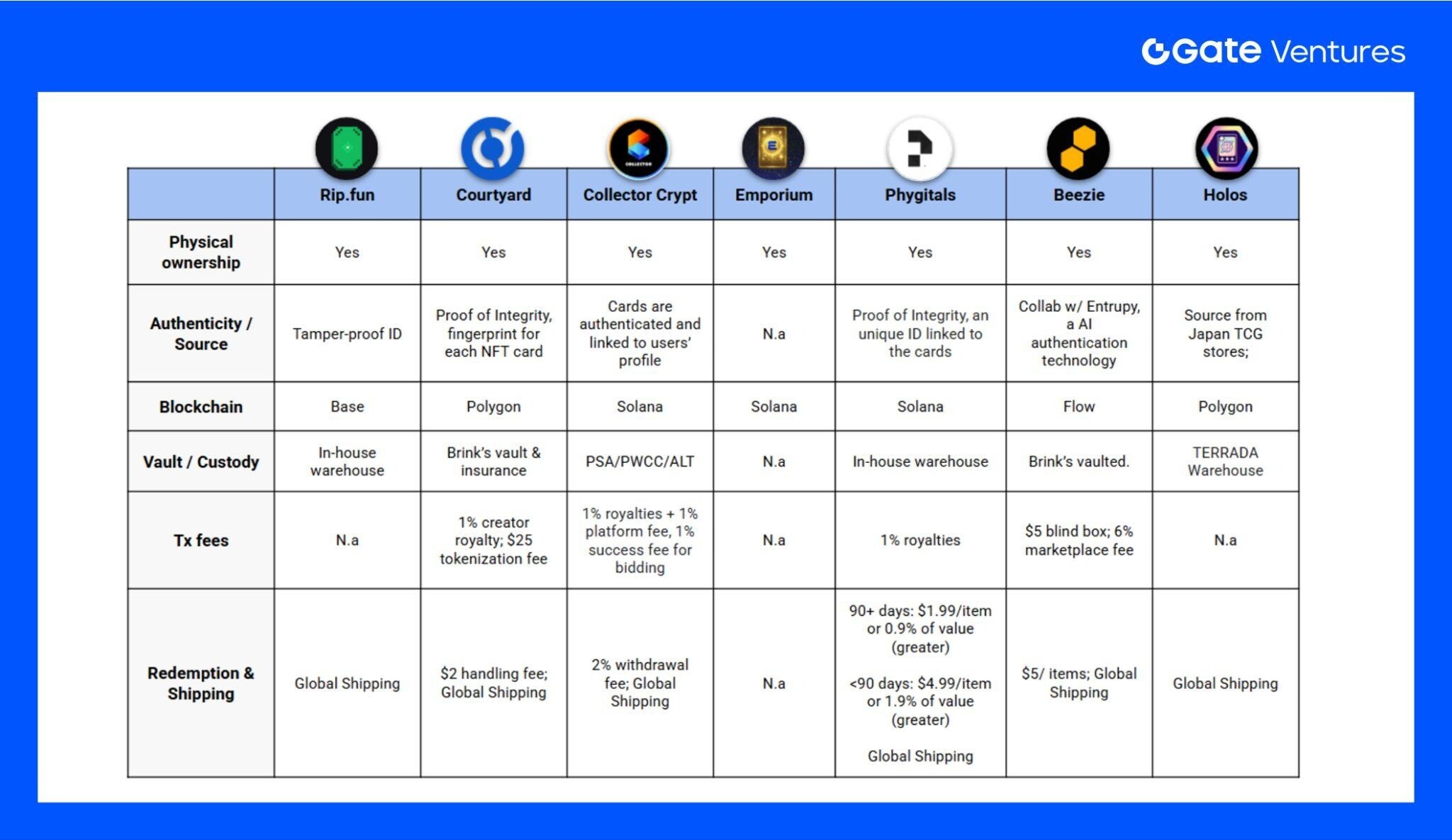

Source: Documentations from each platform

Key Points of This Section – Overview of the On-Chain TCG Platform

1. NFT cards issued by various platforms basically correspond to physical ownership and are equipped with different authenticity verification mechanisms.

2. Deployed on chains such as Base, Solana, Polygon, and Flow, they all offer low fees and fast transactions, making them more advantageous than traditional platforms.

3. Transaction fees are generally lower than traditional platforms such as eBay, and it also supports royalty sharing, which benefits creators and holders.

4. We support global delivery. However, some regions are subject to customs duties, and some platforms may charge additional withdrawal or storage fees.

Case Study - Collector_Crypt

Collector is currently the leading platform in the TCG collectible asset market. Its core business is the sale and circulation of card assets based on Solana. The overall mechanism is:

Source: Collector_Crypt

The physical card is stored in the warehouse → minted into a redeemable NFT → users can open an "electronic package" or trade it on the secondary market at any time.

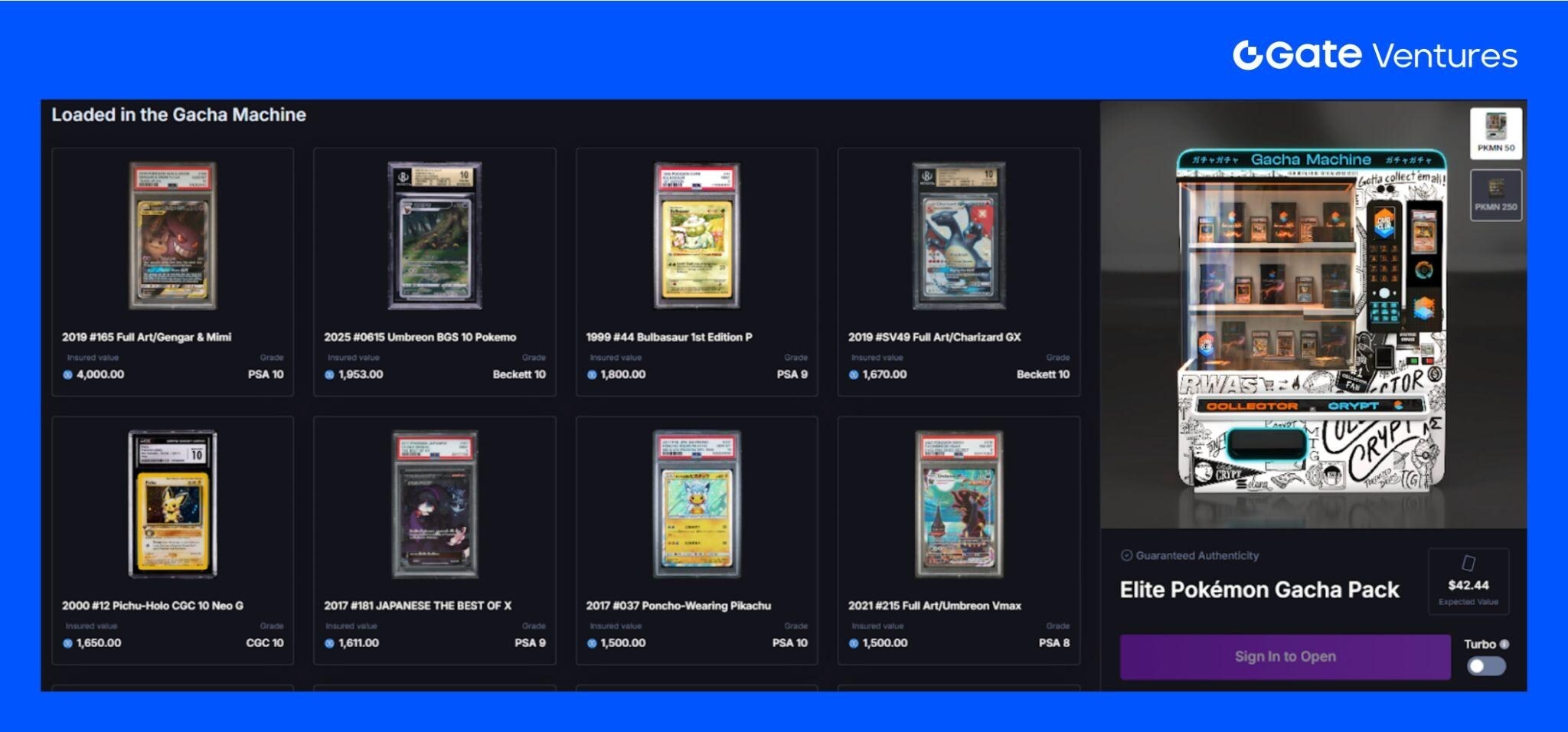

The platform introduced the GACHA Gacha card mechanic, which not only provides a highly realistic pack opening experience but also becomes a major source of revenue for Collector_crypt. As can be seen on the official website, the prices are 50 USDC and 250 USDC, respectively.

Source: Collector_Crypt

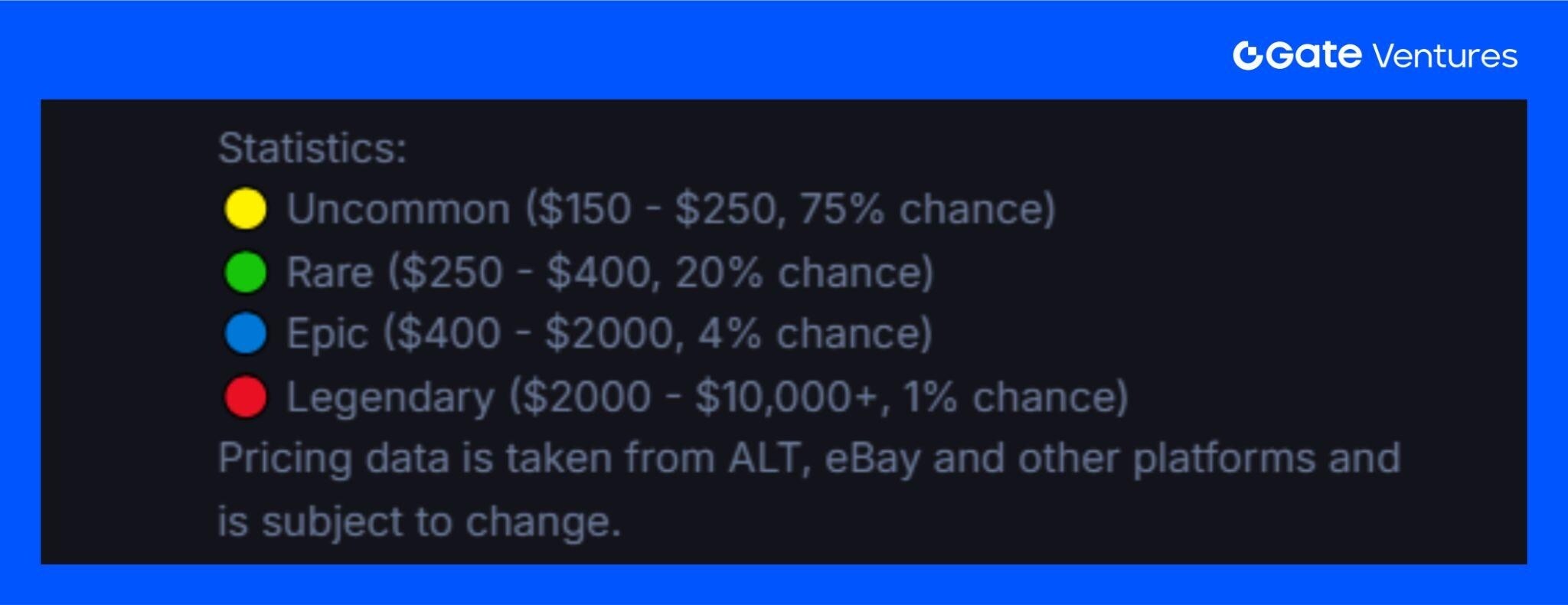

According to official probability distribution and market pricing calculations, Collector's Gacha model exhibits positive expected value. The expected value of a single card draw is approximately $258.89, exceeding the cost of $250. This means that participants experience positive long-term returns on average. Most users draw cards close to their cost, minimizing the risk of losses. Meanwhile, in rare cases, there are explosive upsides (Epic and Legendary cards can yield returns several times or even dozens of times higher). Combined with instant settlement and a buyback mechanism, Collector effectively transforms the entertaining card draw experience into a positive EV investment.

Platform revenue

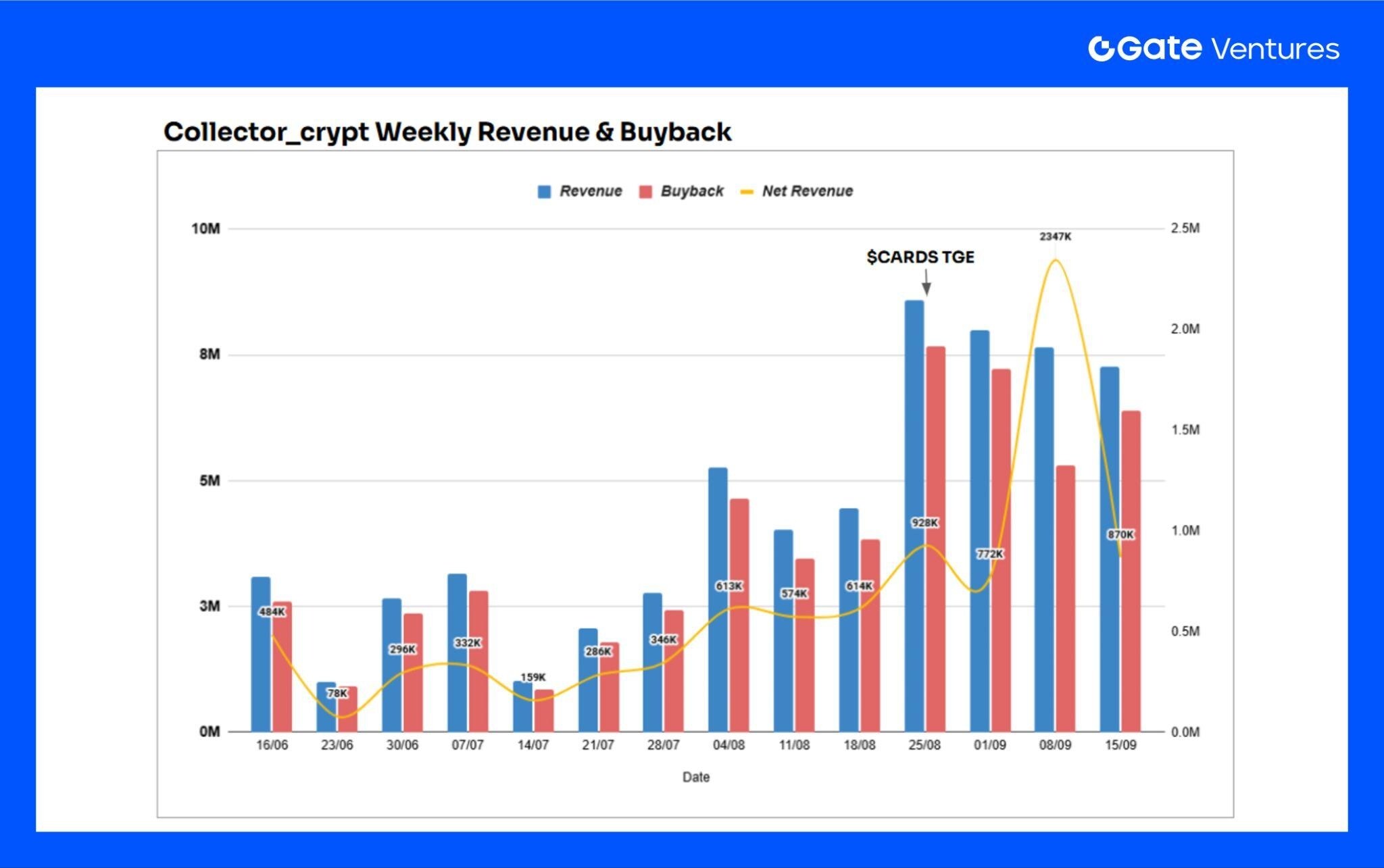

Source: Dune Analytics

The platform's primary revenue comes from a 2% Gacha and secondary market fee, as well as a 2% withdrawal fee. The primary cost is the 85%–90% card buyback. Driven by the anticipated $CARDS token airdrop, the platform performed strongly in August, with revenue nearly doubling compared to July and peaking after the token's TGE. A single week saw a peak net profit of $2.3 million, with over 120,000 Gacha packs opened, demonstrating a remarkably strong overall growth trajectory.

As of now, the platform has issued nearly 1.5 million Gachas, and the overall transaction volume has exceeded US$180 million.

Token Economy

Source: Collector_Crypt

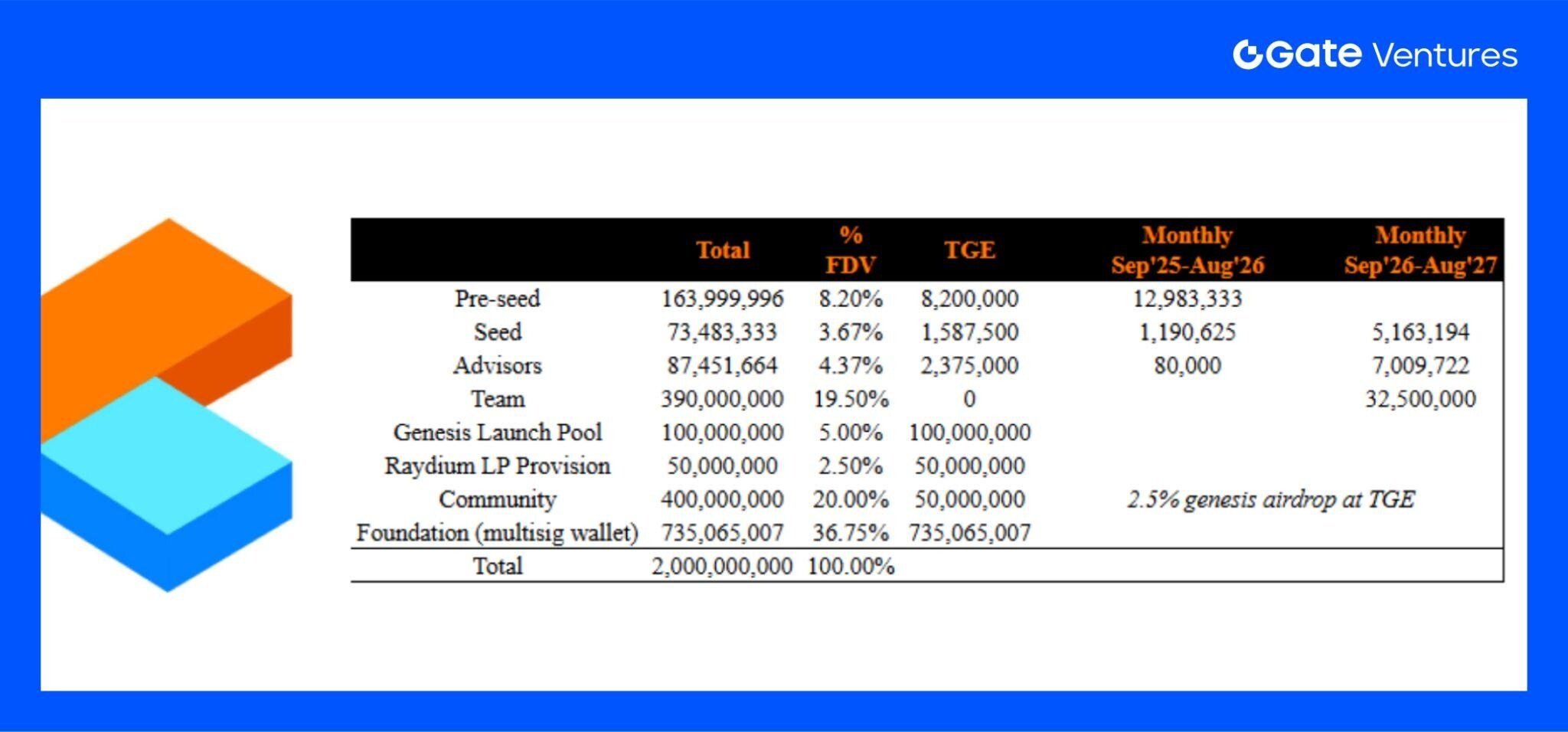

Of the $CARDS token distribution, approximately 16% went to early investors, 5% was released in the initial Launchpool, and the team and foundation together hold over half. The remainder is used for liquidity and market expansion.

During the early launchpool phase, after deducting issuance and liquidity fees, 100% of the raised funds will be used to purchase Pokémon cards, which will serve as the platform's base inventory. Officials have also stated that they will announce more detailed token usage in the weeks following the TGE. Currently, $CARDS lacks clear functional design, such as payment, staking, or fee discounts.

However, considering Collector already has strong cash flow, if it uses part of its future profits to repurchase $CARDS or continue to purchase rare Pokémon cards to maintain the platform's appeal, it may become an important price catalyst.

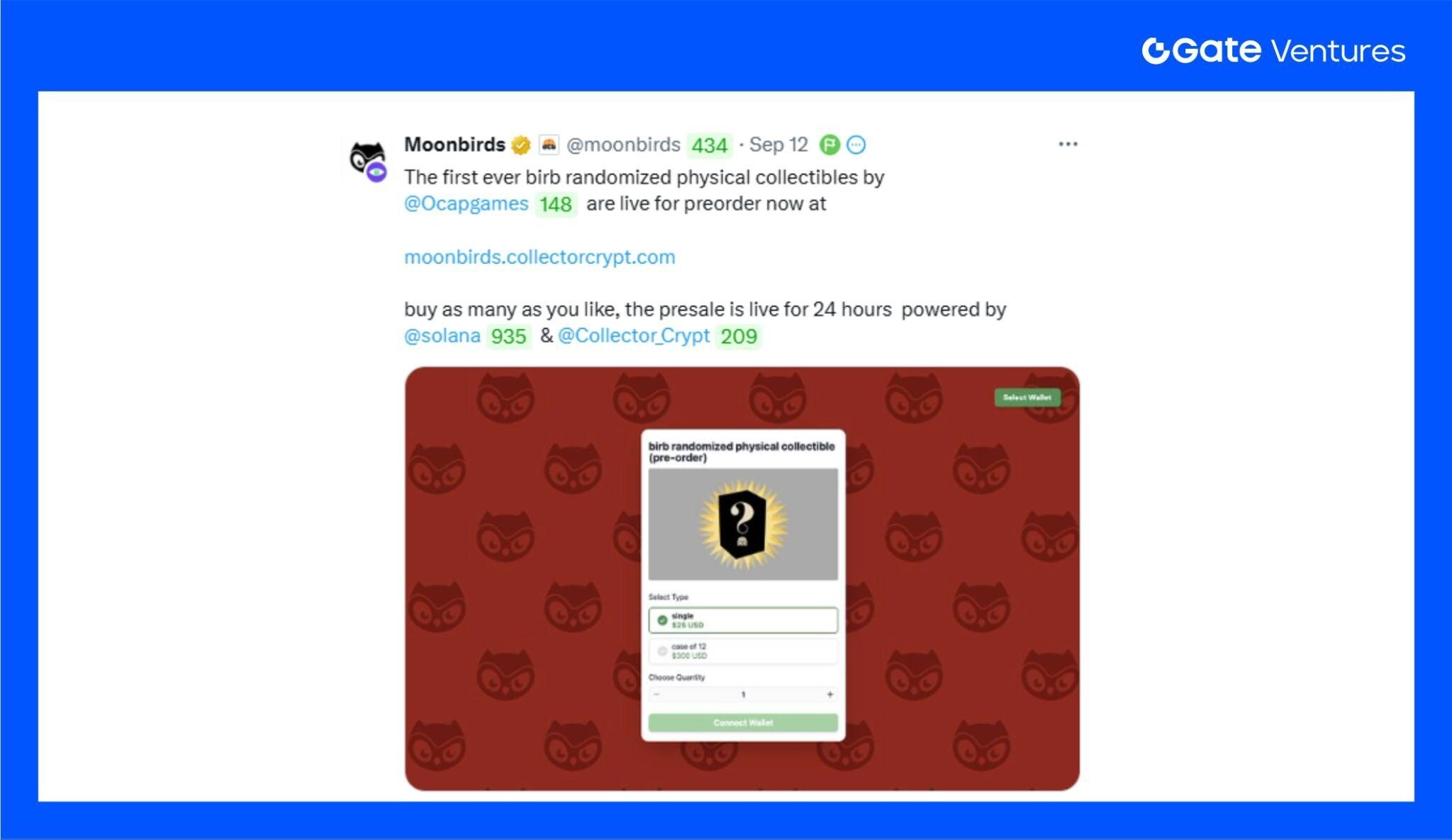

Source: X @Moonbirds

Currently, Collector primarily focuses on Pokémon cards, but as a popular on-chain TCG platform, its future potential is enormous. Almost any type of TCG, including sports cards and other anime and movie IPs, can be sold on-chain, just like Pokémon. The platform will also soon collaborate with Moonbirds, a well-known Web 3 NFT project, to launch physical collectibles and issue corresponding on-chain certificates on Collector.

This "off-chain physical object + on-chain certificate" model, with the natural advantages of blockchain in transaction efficiency and authenticity verification, is very likely to become a new trend in the collectibles market, and will further promote the development and expansion of Collector.

Case Study - Phygitals

Phygitals, similar to the Collector model, features card packs that unlock cards of varying values. Users can choose to hold onto their cards, trade them on the secondary market, or sell them back to the platform at approximately 15% off the market price. Card packs are priced at $25, $50, $80, $250, and $500, each corresponding to varying rarity and potential value. In addition to Pokémon cards, the platform also features other popular IPs like One Piece, expanding the collection and audience base.

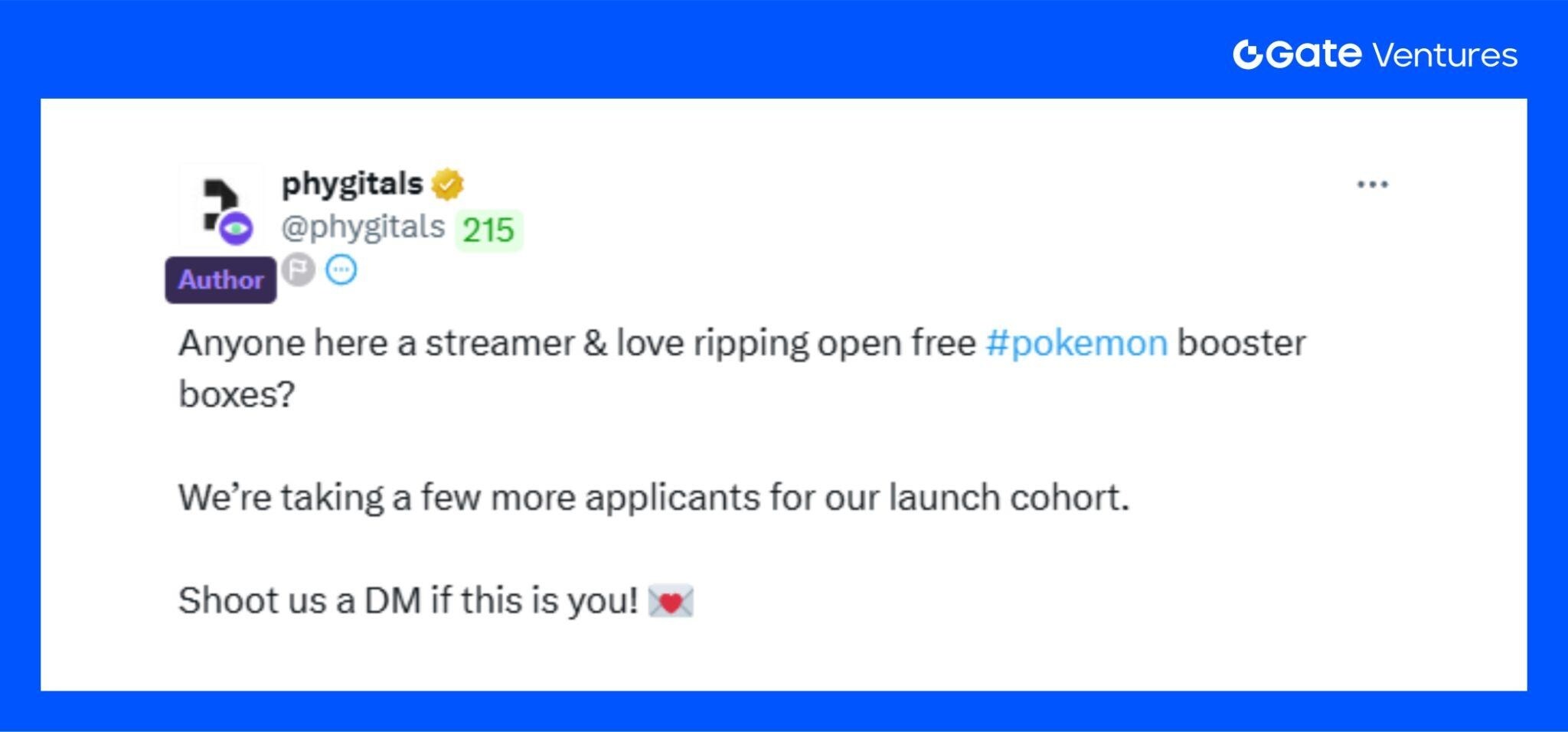

Source: X @phygitals

A major future highlight for Phygitals is the upcoming live-streaming of pack unpacking sessions. Drawing on the success of pump.fun's live-streamed token issuance, the platform hopes to create a trend similar to youth subculture through this "live-streaming + asset issuance" model. This highly interactive and entertaining gameplay is gradually becoming a new narrative direction, and is expected to drive higher user engagement and buzz for the platform.

Additionally, Phygitals will soon offer free hosting and withdrawal services (excluding shipping). The platform will be fully integrated with a single hosting partner, further enhancing its pricing compared to other platforms.

Platform revenue

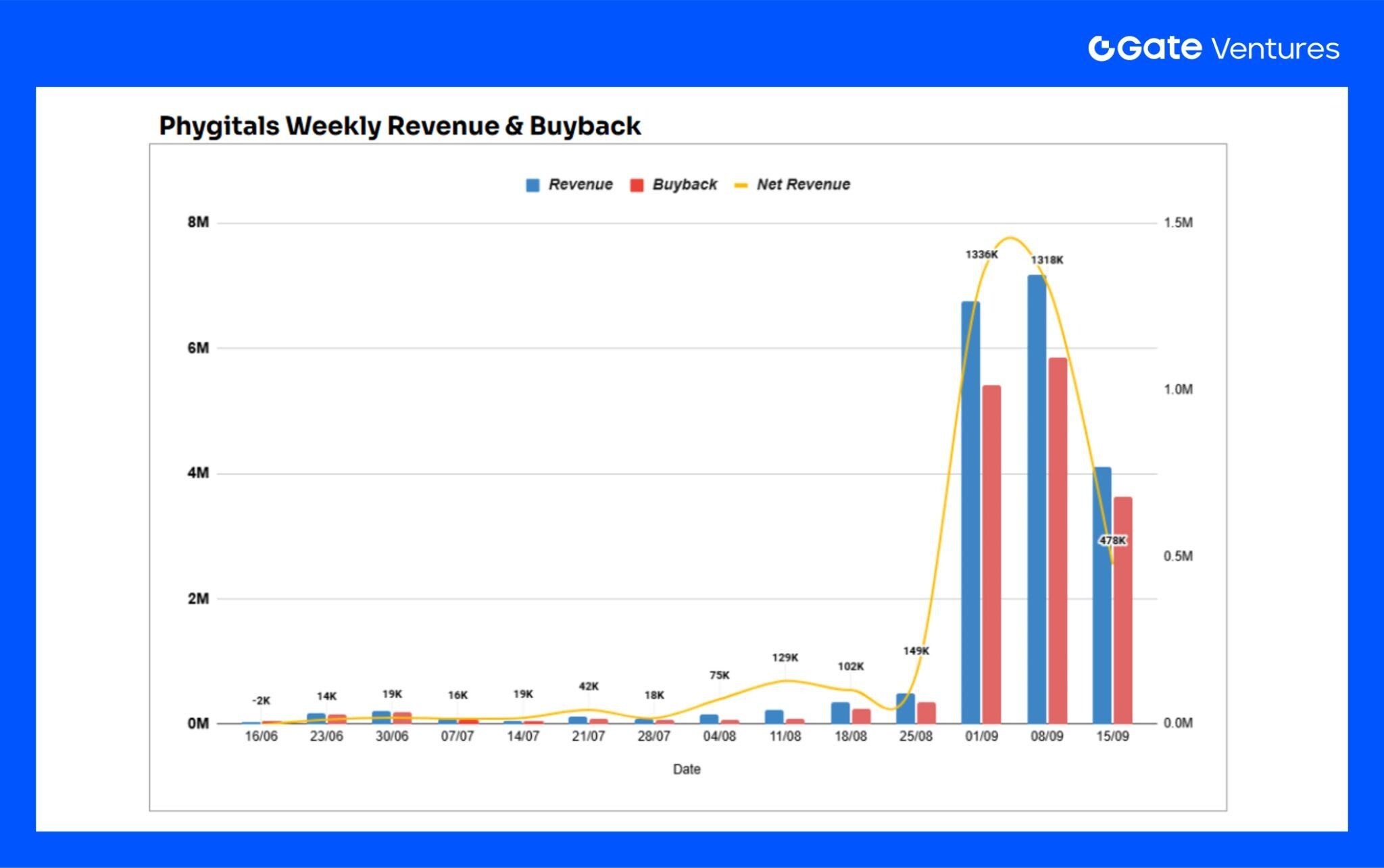

Source: Dune Analytics

Before the TCG concept exploded in popularity, Phygitals' trading volume remained mediocre. It wasn't until the initial wave of $CARDS fueled the market that investors began to seek out the "second-best performers," and the premium gradually trickled down to the next batch of TCG platform tokens with anticipated airdrops.

Source: X @phygitals

Phygitals has officially announced a token auction on Hyperliquid, with the ticker symbol $PKMN, hinting at its issuance within the Hyperliquid ecosystem. Following the announcement, a surge of players flocked to the platform to open packs, pushing its weekly net revenue to over $1.3 million, with approximately 170,000 packs opened.

Source: X @phygitals

The project also collaborated with HypurrFi, a lending protocol within the HL ecosystem, on X, hinting at the future launch of DeFi services such as lending and perpetual contracts around Pokémon cards. This not only highlights the value of Pokémon cards as on-chain RWAs, but also demonstrates their potential for integration with the DeFi world.

Track size prediction

Source: Dune Analytics, zionmarketresearch

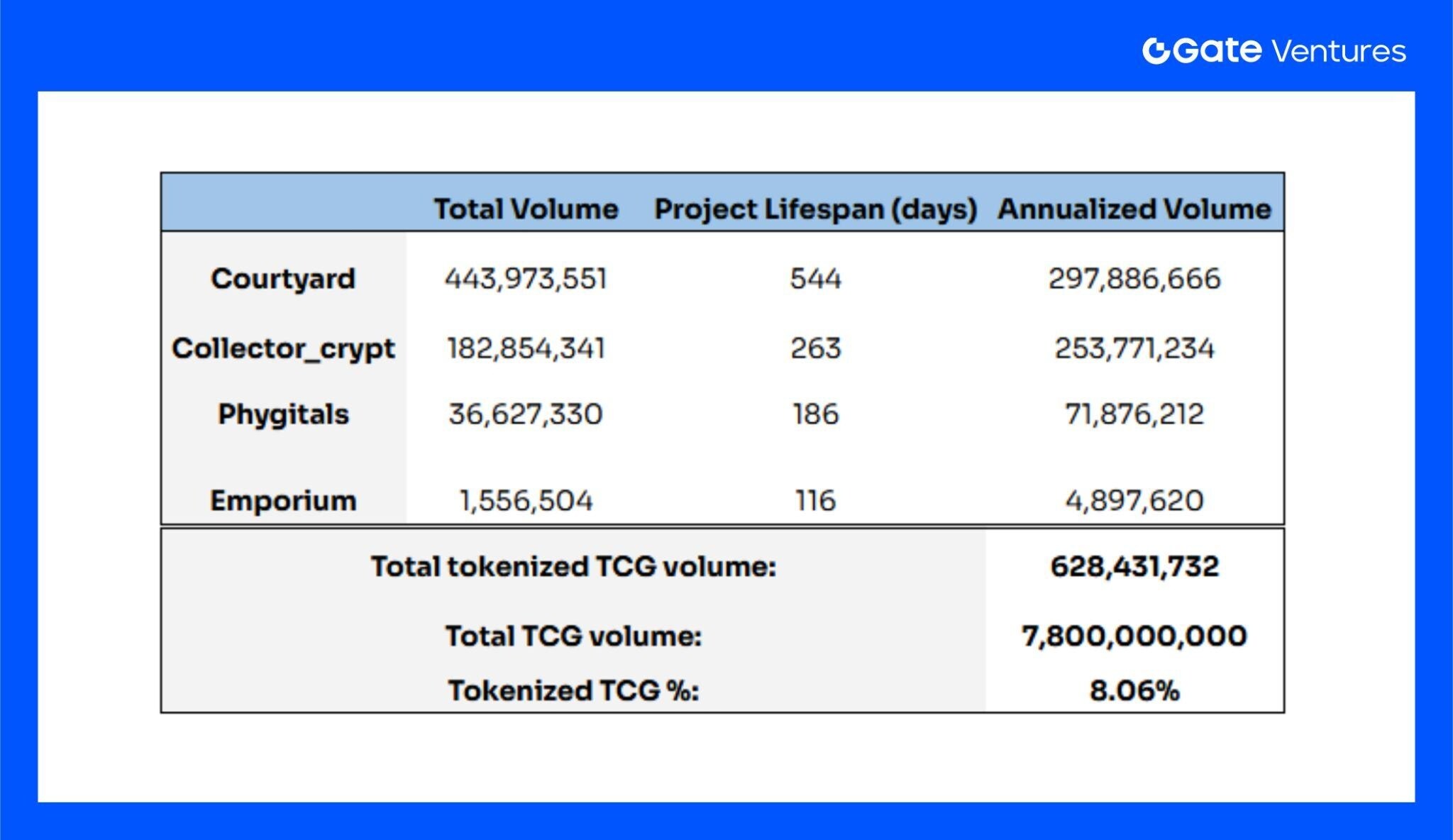

Data shows that the current transaction volume of the on-chain TCG market is approximately $630 million, accounting for approximately 8% of the global TCG market. This share is expected to continue to increase as the market gradually recognizes the advantages of putting game cards on the blockchain and its natural fit with blockchain in terms of circulation efficiency and transaction properties.

Source: Gate Ventures

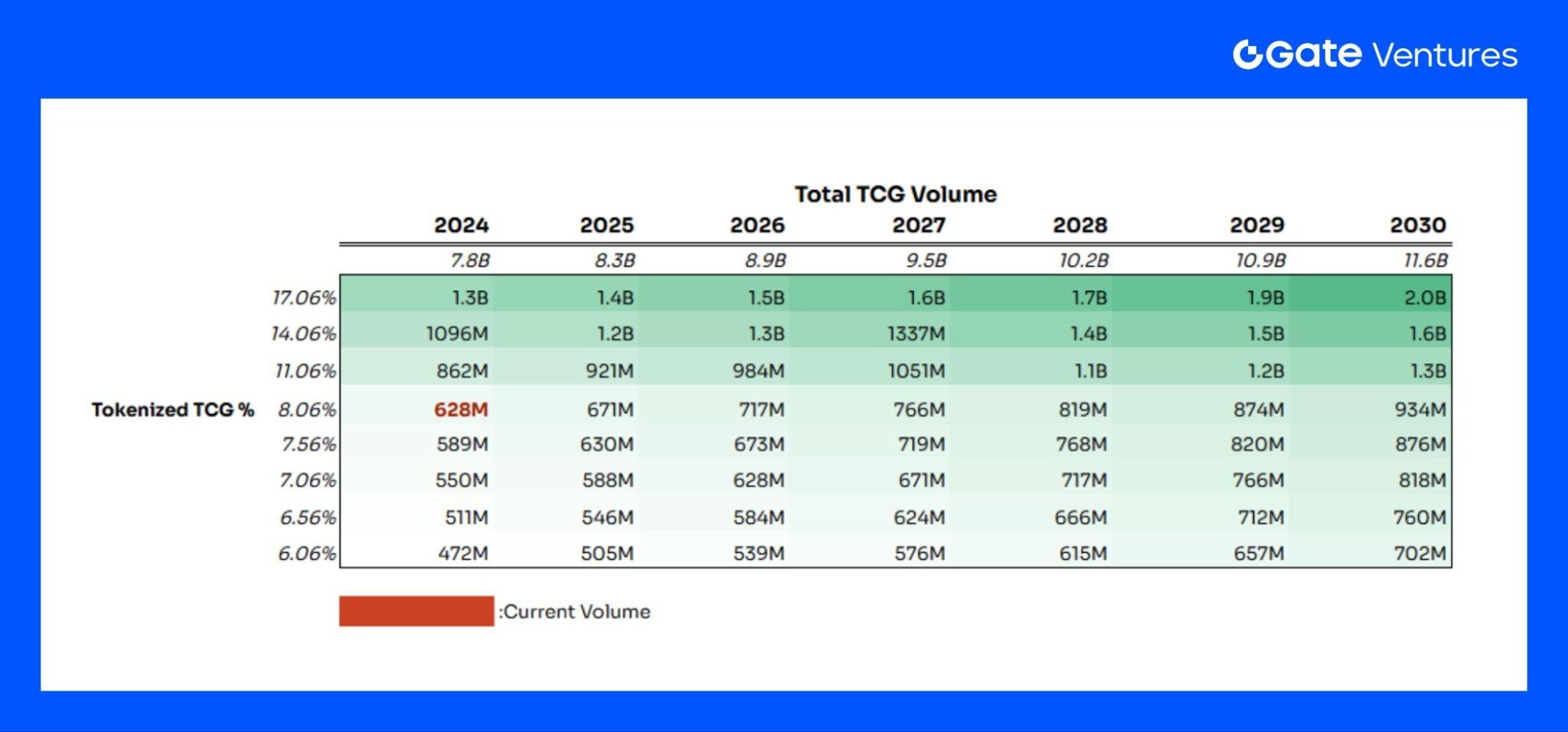

To this end, we conducted a sensitivity analysis: Based on research firm forecasts, the global TCG market's transaction volume growth is expected to reach $11.6 billion by 2030. Regarding the market share of tokenized TCGs, based on our optimistic outlook for the sector, we assumed a range of 3% increase and 0.5% decrease.

The analysis results show that in the most optimistic scenario, if the global TCG market and the tokenized TCG market expand simultaneously, the market share of tokenized TCG is expected to increase to approximately 17% by 2030, corresponding to a transaction volume of US$2 billion, an increase of approximately 300% compared to the current level.

catalyst

1. Powerful IP empowerment

Pokémon is the world's most profitable entertainment IP, with cumulative revenue of nearly $100 billion, covering the entire industry chain including games, animation, cards, movies, and peripherals. In addition, its card sector has long formed a global collection ecosystem, with a large group of players, collectors, and investors. Users have a high degree of emotional and value recognition for scarce cards. This strong IP reduces the "education cost". Users do not come for blockchain, but enter the market because of familiar brands and emotional recognition. (3)

Furthermore, Pokémon cards have long enjoyed significant trading volume and transparent pricing on platforms like eBay, TCGPlayer, and Heritage Auction. This mature price anchoring mechanism, combined with on-chain tokenization, allows NFT/tokenized cards to directly inherit the value consensus of the real market. The foundation of user trust stems not from Web 3 technology but from established offline markets.

Pokémon is just an entry point case, proving the feasibility of transforming traditional collectibles into on-chain assets. This can be rapidly expanded to include:

-Sports cards (the new generation after NBA Top Shot)

-Other anime/manga IPs (such as One Piece, Naruto Card Game, etc.)

- Movie/game derivative IP (Star Wars, Marvel, Nintendo)

The trading and collection culture in these markets is equally active, and their user base has a high degree of overlap with Web 3.

Also crucial are its cultural penetration and network effects. Strong IPs inherently possess cross-cultural reach, enabling them to transcend the niche of purely crypto users and enter the mainstream player and collector circles. The IP's inherent secondary reach (social media buzz, celebrity collections, and news coverage) can further drive sustained user growth and capital investment. Therefore, IP is the most crucial lever for the rapid expansion of the on-chain TCG market.

2. New narrative and compatibility after assets are on-chain

On-chain NFTs correspond one-to-one to physical cards, and information is transparent and verifiable, solving the common problems of authenticity and trust gaps in the traditional market. Users can not only confirm the source of the cards but also track the complete transaction and custody records.

Furthermore, in terms of liquidity and immediacy, mainstream platforms offer guaranteed buybacks of 85%–90% and instant settlement, allowing users to quickly cash out. In contrast, traditional platforms like eBay not only require settlement cycles of 7–14 days, but also suffer from transactional opacity and difficulty in dispute resolution. On-chain mechanisms significantly improve transaction efficiency.

On-chain TCGs also offer cost and pricing advantages. Traditional platforms like eBay often charge transaction fees exceeding 14%, while on-chain platforms like Collector_Crypt and Courtyard offer lower transaction costs and a clearer structure. Furthermore, with each resale, the original card owner still earns revenue through an on-chain royalty mechanism. This means:

-Users pay less transaction fees.

-Original holders can share the transaction value in the long term.

As users gradually become aware of this price advantage and value return mechanism, the habits of ordinary TCG traders will most likely gradually migrate from traditional platforms to the chain.

3. New financial gameplay

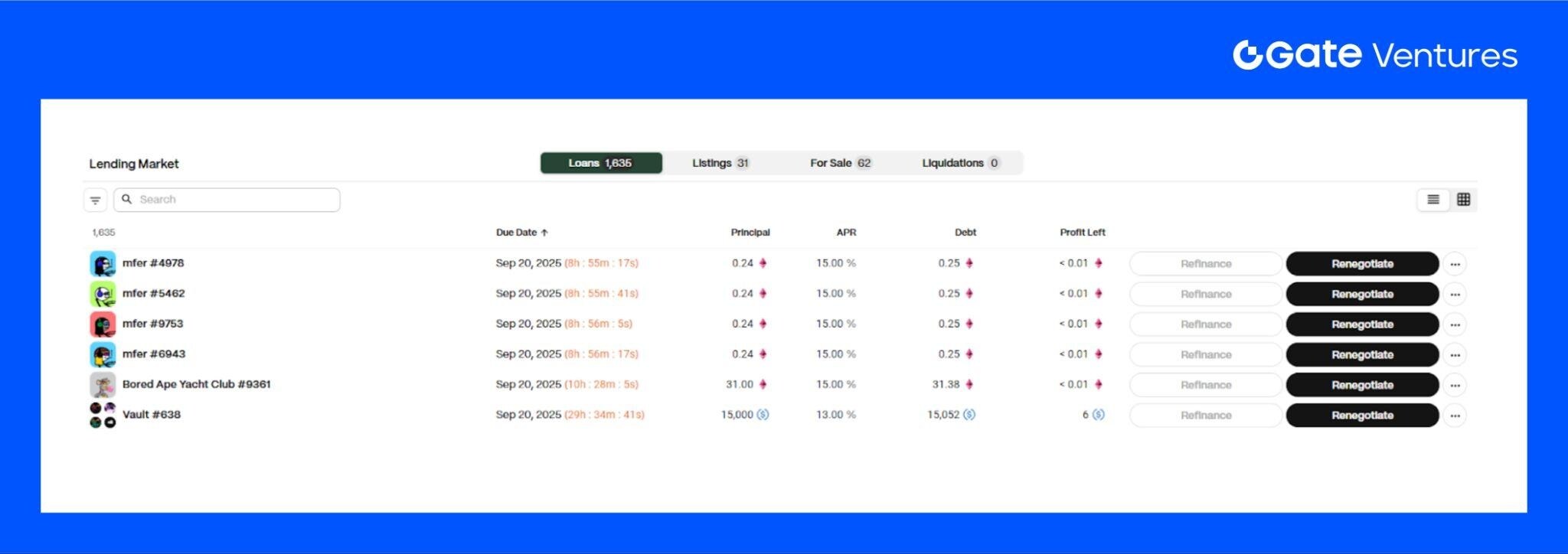

Building on the foundation of high-value cards, developers are exploring the use of NFTs as collateral, enabling the development of DeFi services such as lending, perpetual contracts, and staking, gradually forming the so-called "Collectibles-Fi." This not only introduces a new financial narrative to the collectibles market, but also transforms cards, once limited to collection and trading, into RWAs with the attributes of financial assets.

Furthermore, the advantage of Web 3 lies in its efficient value transfer mechanism. Issuing tokens related to card trading can further expand investment opportunities, making TCG-related tokens the beta asset of this sector and providing investors with a new path to participation beyond physical cards and NFTs.

Source: GONDI

The integration of TCG and DeFi is not a new concept. NFT lending platforms have already emerged in the early days of Web 3. For example, Blur Lending boasted a TVL exceeding $100 million at its peak, while Gondi also reached approximately $60 million. At the time, blue-chip NFTs like CryptoPunks and BAYC did support a sizable lending market. However, their fatal flaw lay in the unstable value of the underlying assets. A significant drop in NFT prices could quickly collapse the entire lending market.

TCG also has systemic risks, but compared with pure NFT, physical assets such as Pokémon cards have a deeper foundation:

-With nearly 30 years of history and ecology, the market price formation mechanism is relatively mature.

- Long-term cultural influence and emotional value, which users often grow with and have a stronger sense of identification with their assets.

Therefore, the stability of TCG's underlying assets and cultural stickiness may provide more solid support for DeFi integration than blue-chip NFTs. We also expect the TCG market to develop into the ecosystem of the former NFTfi track and continue like this.

risk

Special attention should be paid to the sustainability of card supply. For example, in the Pokémon TCG, some card packs have been experiencing a period of intense speculation in the secondary market due to chronic shortages. For on-chain TCG platforms, ensuring a consistent and stable supply will be a long-term challenge. For example, Collector_Crypt's Legendary Gacha series is already showing signs of supply shortages. Delayed replenishment will significantly weaken user engagement and spending habits, so this issue warrants continued attention.

Conclusion and Outlook

The rise of on-chain TCGs has proven the logic that putting collectibles on-chain equals tradability and financialization. Pokémon Go is the beginning of this trend, but it's not the end.

In terms of market size, the volume of sports card trading is almost twice that of Pokémon, and it comes with a global fan economy and investment attributes; at the same time, other classic IPs such as One Piece and Yu-Gi-Oh! also have large collector groups and mature secondary markets.

As these IPs gradually enter the Web 3 world, the market potential of Exotic RWA will be further expanded, forming a diverse ecosystem covering sports, animation, and entertainment culture. It will not only push the on-chain collectibles market beyond its existing boundaries, but also potentially become a new engine connecting the fan economy and decentralized finance.

Reference:

2. https://www.zionmarketresearch.com/report/trading-card-game-market

4. https://dune.com/zkayape/pokemontcgsol