Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

The crypto market generally rebounded after experiencing slight fluctuations caused by macroeconomic data last week, showing a short-term rebound trend.

OKX market data shows that as of press time, BTC rebounded above $114,000 and is currently trading at $113,931.7, a slight increase of 0.09% over the past 24 hours. ETH has rebounded above $4,100, reaching an intraday high of $4,246 and is currently trading at $4,190, a slight increase of 0.6% over the past 24 hours. Regarding other assets, SOL has stabilized at $200, reaching a high of $214 before falling back to $209.73, a slight decrease of 0.18% over the past 24 hours. BNB has returned to the $1,000 mark and is currently trading at $1,023.7, a 24-hour increase of 1.24%.

According to SoSoValue data, as of September 30th, the crypto market saw mixed gains and losses across sectors. The CeFi sector rose 2.33%, led by Aster (ASTER) with an 8.50% gain; the Layer 1 sector rose 0.91%, with Avalanche (AVAX) up 1.56%; the PayFi sector rose 0.90%, with Dash (DASH) up 5.18%; and the Layer 2 sector rose 0.12%, with Mantle (MNT) up 6.72%. Furthermore, the Meme sector fell 0.89%, with BUILDon (B) bucking the trend and rising 13.82%. The DeFi sector fell 0.97%, with Lido DAO (LDO) holding up well, rising 5.83%. The AI sector fell 2.96%, but KAITO rose 21.31%.

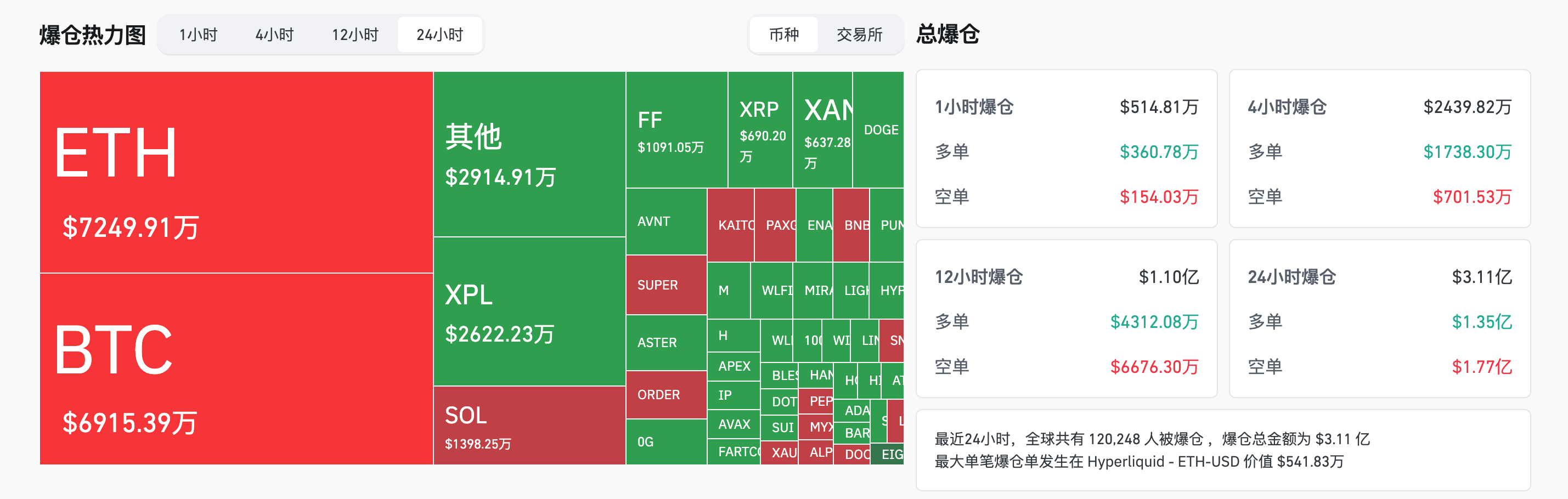

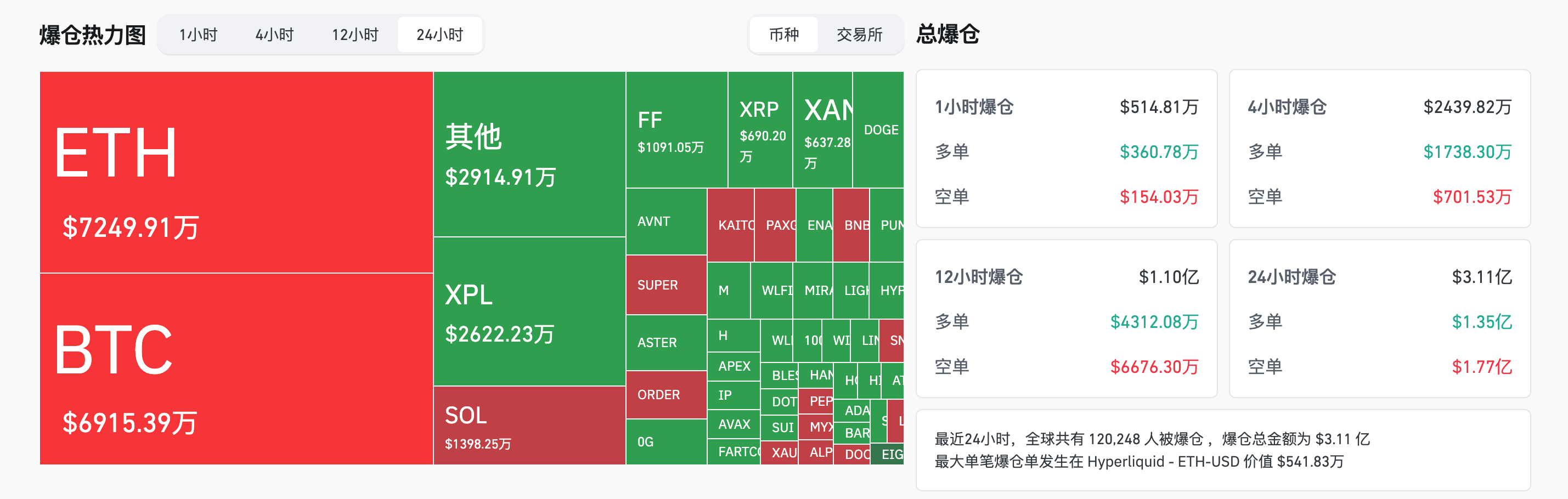

In the derivatives market, according to Coinglass , over 120,000 individuals experienced margin calls in the past 24 hours, totaling $311 million in liquidations across the network, including $135 million in long positions and $177 million in short positions. Ethereum (ETH) was the hardest hit, with $72.49 million in liquidations; BTC and XPL followed closely behind, with $69.15 million and $26.22 million in liquidations, respectively.

The "Fear and Greed Index" on Alternative.me rose to 50 (neutral), a significant increase from the previous reading of 37 (fear), and compared to both 43 last week and 48 last month, indicating a positive sentiment. As market sentiment improves and the market rebounds, the debate over whether the bull market is still here is also heating up. Odaily Planet Daily will review analysts' views and supporting evidence on the market outlook.

What will be the future trend of BTC?

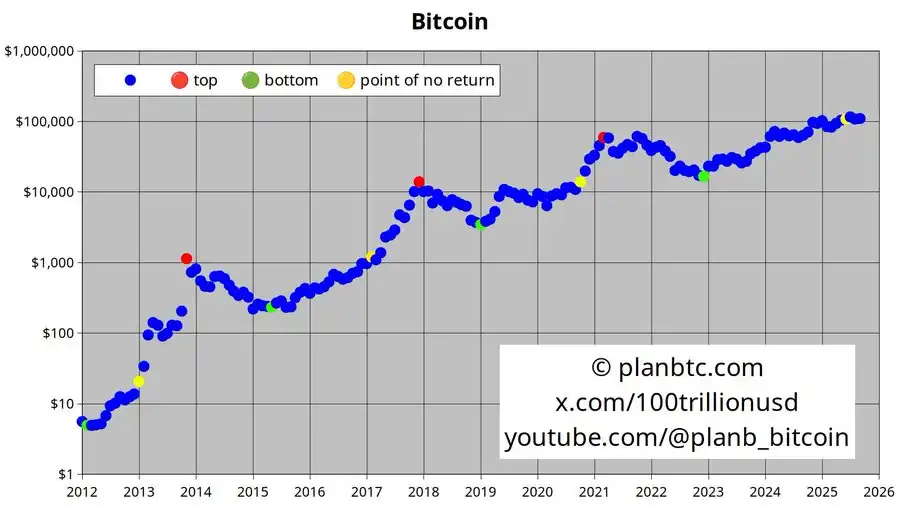

Plan B: The bull-bear dividing point has been experienced in June 2025, and a long-term stable upward trend may be ushered in.

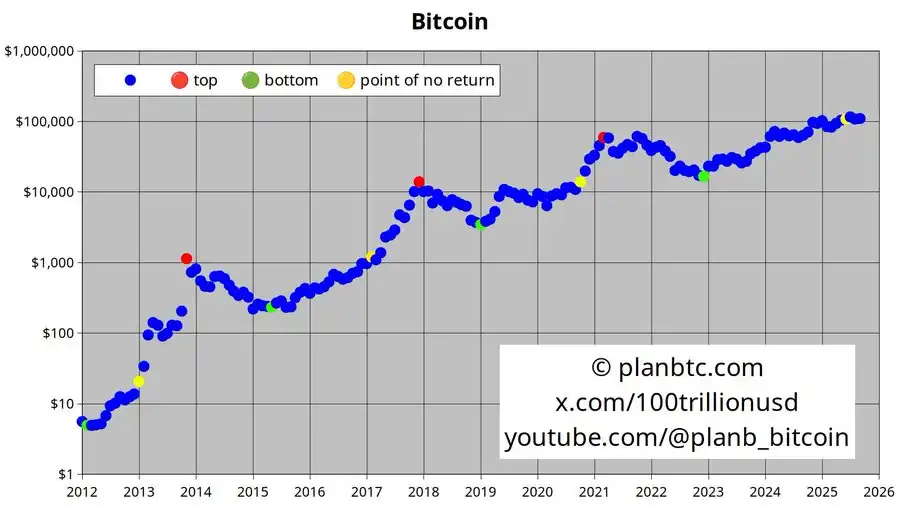

Well-known analyst PlanB tweeted on X: "As you know, I believe the BTC bull market is not over yet and will continue. This will likely be a long-term, stable uptrend without FOMO or crashes. We have already experienced the bull-bear dividing point in June 2025 (yellow dot in the chart), similar to October 2020, February 2017, and January 2013."

XWIN Researcher Japan: The BTC bull market is not over yet, and the recent correction is more like a "digestion period"

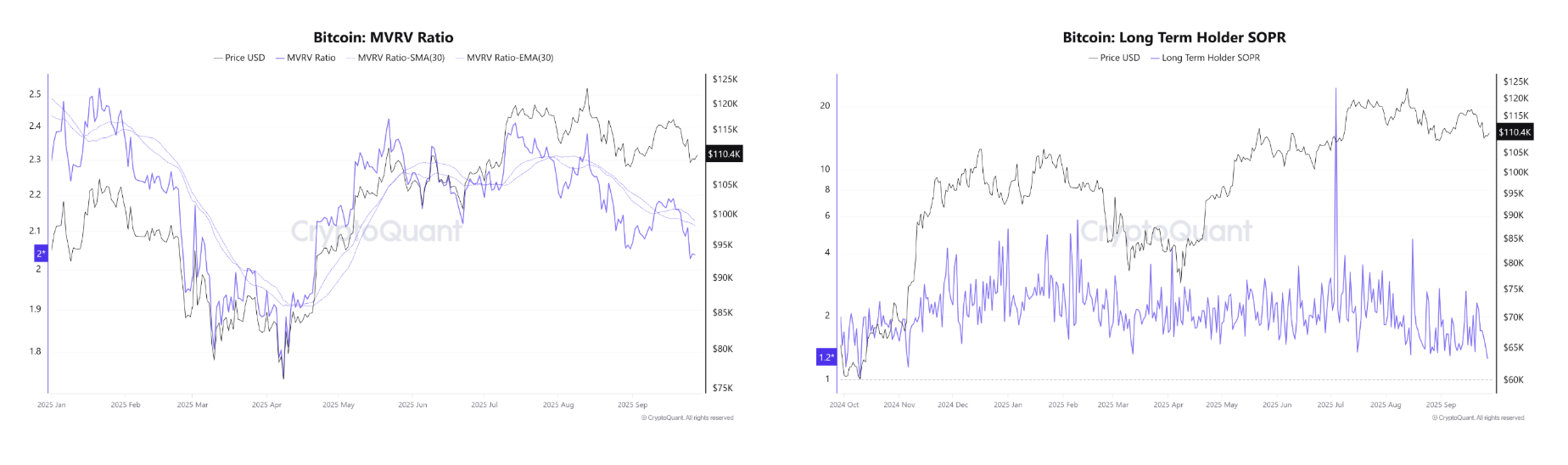

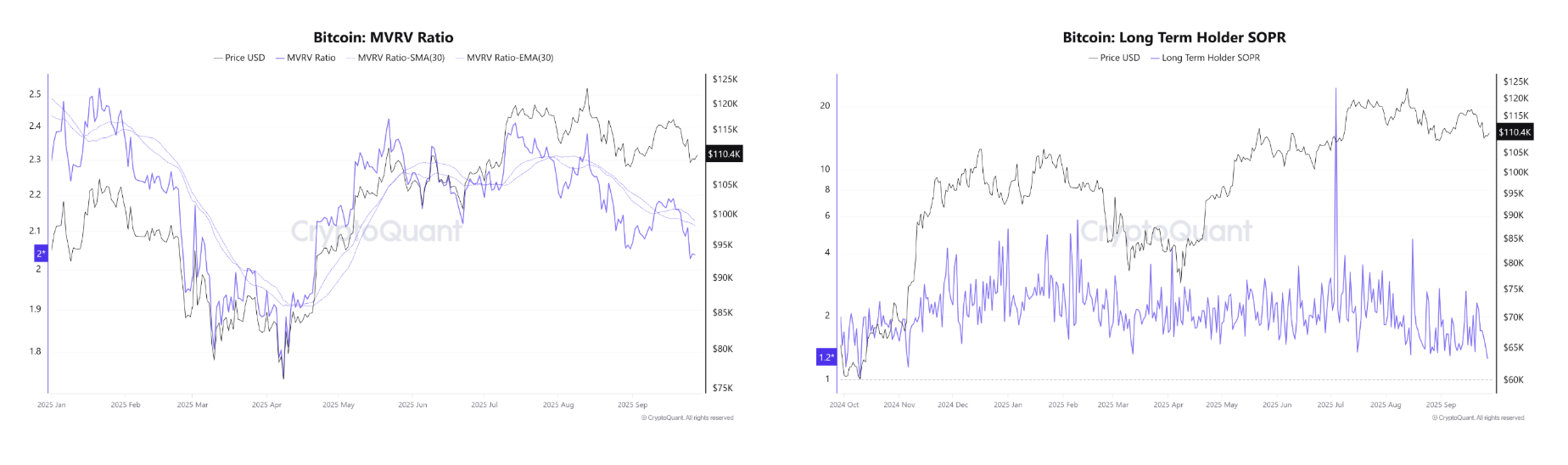

In an analysis published on Cryptoquant, a researcher at cryptocurrency investment firm XWIN Japan noted that while recent volatility has unnerved traders, on-chain data continues to suggest that BTC's bull run is not over. BTC's recent pullback does not appear to be the end of the rally, but rather a period of market "digestion." While the market has cooled from its overheated state, investors are still enjoying healthy gains. Furthermore, BTC's market value to realized value (MVRV) ratio has fallen to 2, potentially signaling a period of expansion after market consolidation, indicating that the current cycle has yet to reach its end.

Bitunix analyst: The start of a rate cut cycle may trigger an asset bubble, and the risk of a congressional shutdown will increase market volatility

A Bitunix analyst wrote: "The Federal Reserve recently resumed interest rate cuts to bolster weak employment, while also warning against overvalued stock markets. The US faces the risk of a government shutdown on October 1st, and Trump will meet with congressional leaders. While the prospect of a rate cut is bullish for risky assets, asset bubbles and political risks amplify short-term volatility, providing both funding support and downside uncertainty for the crypto market."

The mid-term interest rate cuts confirm that improved liquidity supports risky assets. In the short term, concerns about asset bubbles and the risk of a shutdown will exacerbate vulnerabilities, making the market prone to sharp declines and rebounds. In the crypto market, BTC faces resistance at $116,000; $108,000 is a key liquidity support level, with $104,000 as a secondary bottom. Currently, the price has fallen from $112,000-$113,000 to approximately $110,000, with short-term range-bound fluctuations prevalent. A breakout requires significant capital inflows to confirm.

Strategic recommendations:

While dovish policy is bullish in the medium term, Powell's warnings about bubbles and the risk of a government shutdown mean short-term caution remains. Sentiment is oscillating between the positive impact of rate cuts and the risks of political and overvalued valuations. Traders should prioritize liquidity and data. BTC has short-term support between $108,000 and $106,000, with secondary support at $104,000. Resistance lies between $118,000 and $116,000, with a confirmed breakout leading to a move up to $120,000. Risk management recommends reducing leverage and entering and exiting the market in phases.

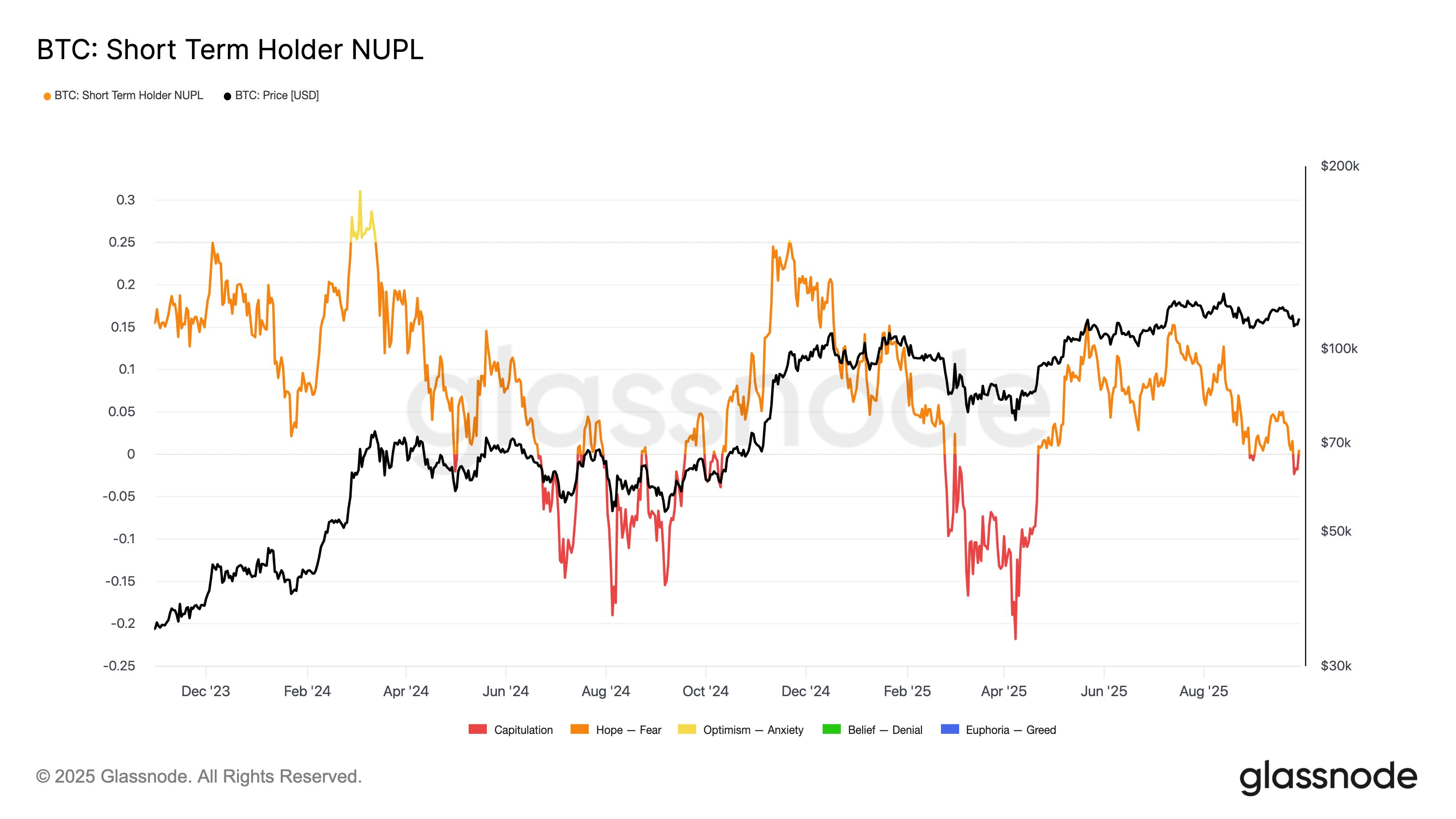

Glassnode: BTC short-term holders are suffering losses and the market may enter a reset phase.

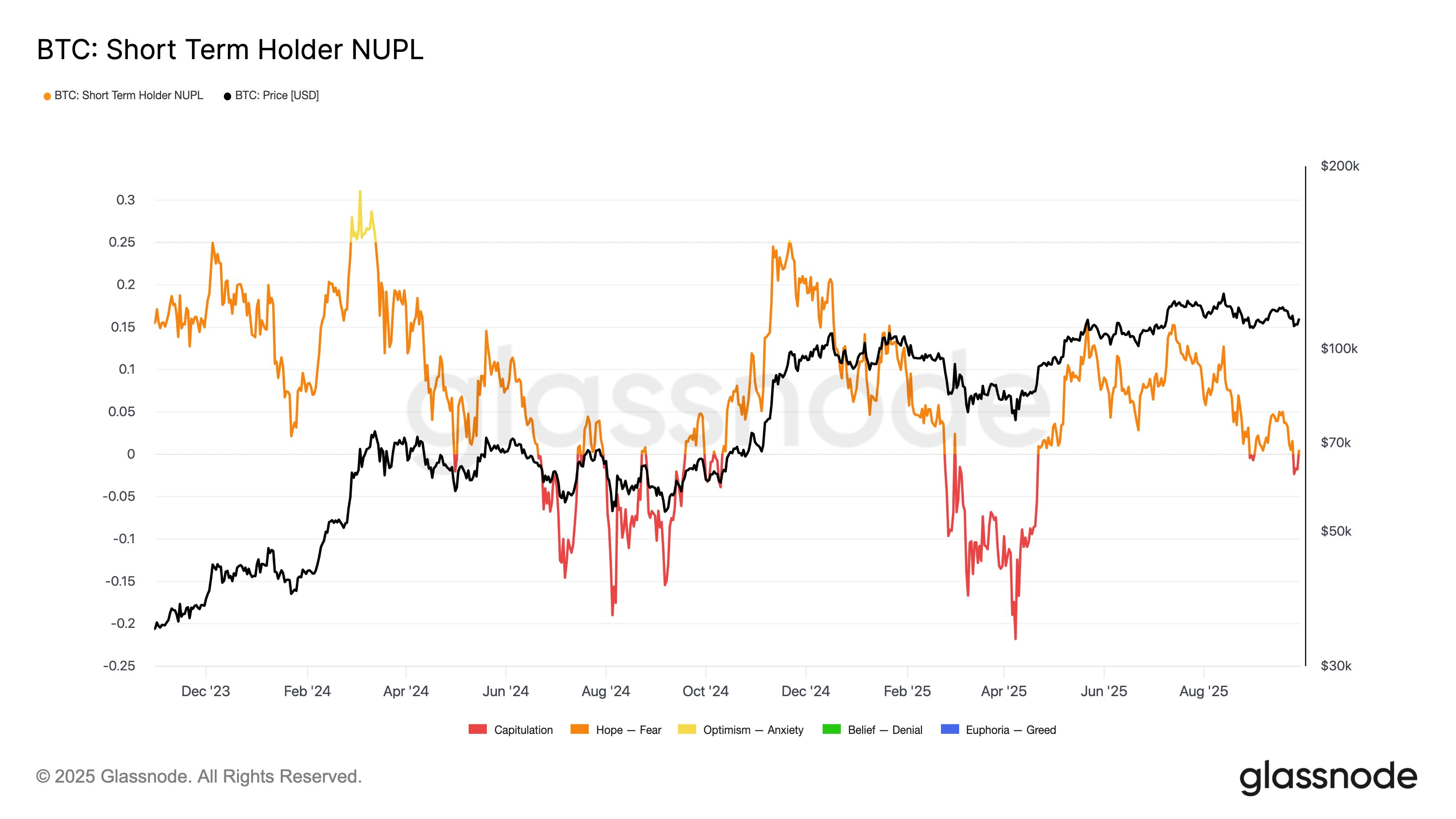

Glassnode published data on X showing that the NUPL (unrealized net profit and loss ratio) indicator for short-term Bitcoin holders has entered a loss-making range, indicating that recent investors are under pressure. Historically, capitulation by short-term holders often signals a market reset, often laying the foundation for a new round of asset accumulation.

Murphy: BTC enters the pricing channel between the yellow and green lines

On-chain data analyst Murphy stated that BTC is currently finding support at the green line of the MVRV extreme pricing range (approximately $108,000). BTC is experiencing a trend decline and has entered the next-level pricing channel, with prices trading between the yellow and green lines.

Murphy believes there are two possible outcomes:

- It continues to fluctuate within the channel, with the lower support level being the green line (currently around $108,000), and the upper resistance levels being $113,000 and $117,000.

- If the resistance level cannot be broken, the price may fall back into the range between the green and blue lines.

Among them, $113,000 is the average cost line for short-term investors with a term of less than 3 months. If the rebound fails to reach this position, the probability of the second situation will increase.

Conclusion

The recovery of sentiment is only the first step. What really determines the market direction is the repair of the on-chain structure and the clarity of policy implementation.

After this rebound, the divergence between bulls and bears has intensified. Whether BTC can break through $116,000 remains to be seen. The Fed's rate cut narrative and political factors may become catalysts for the next phase of market strength or a reversal. In the face of uncertainty, stability may be more important than passion. Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web 3 )

The crypto market generally rebounded after experiencing slight fluctuations caused by macroeconomic data last week, showing a short-term rebound trend.

OKX market data shows that as of press time, BTC rebounded above $114,000 and is currently trading at $113,931.7, a slight increase of 0.09% over the past 24 hours. ETH has rebounded above $4,100, reaching an intraday high of $4,246 and is currently trading at $4,190, a slight increase of 0.6% over the past 24 hours. Regarding other assets, SOL has stabilized at $200, reaching a high of $214 before falling back to $209.73, a slight decrease of 0.18% over the past 24 hours. BNB has returned to the $1,000 mark and is currently trading at $1,023.7, a 24-hour increase of 1.24%.

According to SoSoValue data, as of September 30th, the crypto market saw mixed gains and losses across sectors. The CeFi sector rose 2.33%, led by Aster (ASTER) with an 8.50% gain; the Layer 1 sector rose 0.91%, with Avalanche (AVAX) up 1.56%; the PayFi sector rose 0.90%, with Dash (DASH) up 5.18%; and the Layer 2 sector rose 0.12%, with Mantle (MNT) up 6.72%. Furthermore, the Meme sector fell 0.89%, with BUILDon (B) bucking the trend and rising 13.82%. The DeFi sector fell 0.97%, with Lido DAO (LDO) holding up well, rising 5.83%. The AI sector fell 2.96%, but KAITO rose 21.31%.

In the derivatives market, according to Coinglass , over 120,000 individuals experienced margin calls in the past 24 hours, totaling $311 million in liquidations across the network, including $135 million in long positions and $177 million in short positions. Ethereum (ETH) was the hardest hit, with $72.49 million in liquidations; BTC and XPL followed closely behind, with $69.15 million and $26.22 million in liquidations, respectively.

The "Fear and Greed Index" on Alternative.me rose to 50 (neutral), a significant increase from the previous reading of 37 (fear), and compared to both 43 last week and 48 last month, indicating a positive sentiment. As market sentiment improves and the market rebounds, the debate over whether the bull market is still here is also heating up. Odaily Planet Daily will review analysts' views and supporting evidence on the market outlook.

What will be the future trend of BTC?

Plan B: The bull-bear dividing point has been experienced in June 2025, and a long-term stable upward trend may be ushered in.

Well-known analyst PlanB tweeted on X: "As you know, I believe the BTC bull market is not over yet and will continue. This will likely be a long-term, stable uptrend without FOMO or crashes. We have already experienced the bull-bear dividing point in June 2025 (yellow dot in the chart), similar to October 2020, February 2017, and January 2013."

XWIN Researcher Japan: The BTC bull market is not over yet, and the recent correction is more like a "digestion period"

In an analysis published on Cryptoquant, a researcher at cryptocurrency investment firm XWIN Japan noted that while recent volatility has unnerved traders, on-chain data continues to suggest that BTC's bull run is not over. BTC's recent pullback does not appear to be the end of the rally, but rather a period of market "digestion." While the market has cooled from its overheated state, investors are still enjoying healthy gains. Furthermore, BTC's market value to realized value (MVRV) ratio has fallen to 2, potentially signaling a period of expansion after market consolidation, indicating that the current cycle has yet to reach its end.

Bitunix analyst: The start of a rate cut cycle may trigger an asset bubble, and the risk of a congressional shutdown will increase market volatility

A Bitunix analyst wrote: "The Federal Reserve recently resumed interest rate cuts to bolster weak employment, while also warning against overvalued stock markets. The US faces the risk of a government shutdown on October 1st, and Trump will meet with congressional leaders. While the prospect of a rate cut is bullish for risky assets, asset bubbles and political risks amplify short-term volatility, providing both funding support and downside uncertainty for the crypto market."

The mid-term interest rate cuts confirm that improved liquidity supports risky assets. In the short term, concerns about asset bubbles and the risk of a shutdown will exacerbate vulnerabilities, making the market prone to sharp declines and rebounds. In the crypto market, BTC faces resistance at $116,000; $108,000 is a key liquidity support level, with $104,000 as a secondary bottom. Currently, the price has fallen from $112,000-$113,000 to approximately $110,000, with short-term range-bound fluctuations prevalent. A breakout requires significant capital inflows to confirm.

Strategic recommendations:

While dovish policy is bullish in the medium term, Powell's warnings about bubbles and the risk of a government shutdown mean short-term caution remains. Sentiment is oscillating between the positive impact of rate cuts and the risks of political and overvalued valuations. Traders should prioritize liquidity and data. BTC has short-term support between $108,000 and $106,000, with secondary support at $104,000. Resistance lies between $118,000 and $116,000, with a confirmed breakout leading to a move up to $120,000. Risk management recommends reducing leverage and entering and exiting the market in phases.

Glassnode: BTC short-term holders are suffering losses and the market may enter a reset phase.

Glassnode published data on X showing that the NUPL (unrealized net profit and loss ratio) indicator for short-term Bitcoin holders has entered a loss-making range, indicating that recent investors are under pressure. Historically, capitulation by short-term holders often signals a market reset, often laying the foundation for a new round of asset accumulation.

Murphy: BTC enters the pricing channel between the yellow and green lines

On-chain data analyst Murphy stated that BTC is currently finding support at the green line of the MVRV extreme pricing range (approximately $108,000). BTC is experiencing a trend decline and has entered the next-level pricing channel, with prices trading between the yellow and green lines.

Murphy believes there are two possible outcomes:

- It continues to fluctuate within the channel, with the lower support level being the green line (currently around $108,000), and the upper resistance levels being $113,000 and $117,000.

- If the resistance level cannot be broken, the price may fall back into the range between the green and blue lines.

Among them, $113,000 is the average cost line for short-term investors with a term of less than 3 months. If the rebound fails to reach this position, the probability of the second situation will increase.

Conclusion

The recovery of sentiment is only the first step. What really determines the market direction is the repair of the on-chain structure and the clarity of policy implementation.

After this rebound, the divergence between bulls and bears has intensified. Whether BTC can break through $116,000 remains to be seen. The Fed's rate cut narrative and political factors may become catalysts for the next phase of market strength or a turning point. In the face of uncertainty, stability may be more important than passion.

- 核心观点:加密市场短期反弹,分析师对后市存分歧。

- 关键要素:

- BTC反弹突破11.4万美元,市场情绪回暖。

- 分析师PlanB认为牛市将持续稳定上升。

- 短期持有者亏损,市场或进入重置阶段。

- 市场影响:多空博弈加剧,短期波动风险上升。

- 时效性标注:短期影响