CZ calls for orders in the Perp DEX era, these tools will help you seize the opportunity

- 核心观点:PerpDex工具成为交易者必备辅助。

- 关键要素:

- Coinglass提供用户类型热力图分析。

- HyperBot实时推送大户仓位变化。

- Pear Protocol支持多生态合约聚合。

- 市场影响:提升交易效率,推动PerpDex生态发展。

- 时效性标注:中期影响。

As the founder of Binance, CZ actually declared the arrival of the PerpDex era without further ado. There are many PerpDex products, but they present challenges such as funding rate discrepancies, cross-platform exchange rate deviations, and opaque position information. To participate in the market more efficiently, auxiliary tools have become essential for many players. BlockBeats has compiled several practical PerpDex tools.

On-chain wallet analysis

Whether it is on-chain or centralized trading platforms, the whereabouts of smart money has always been a concern. They often bring higher trading momentum than KOL fans because tracking them is usually a spontaneous behavior, especially when tools for on-chain transaction address analysis were born. Whether it was the memecoin craze or the prediction market, such auxiliary projects were the first to appear, and PerpDex was no exception.

Coinglass

Players who often participate in secondary market transactions will definitely be familiar with this website. As one of the oldest data websites, its data covers most usage scenarios such as FundingRate of various tokens on the trading platform, institutional ETFs, options, etc.

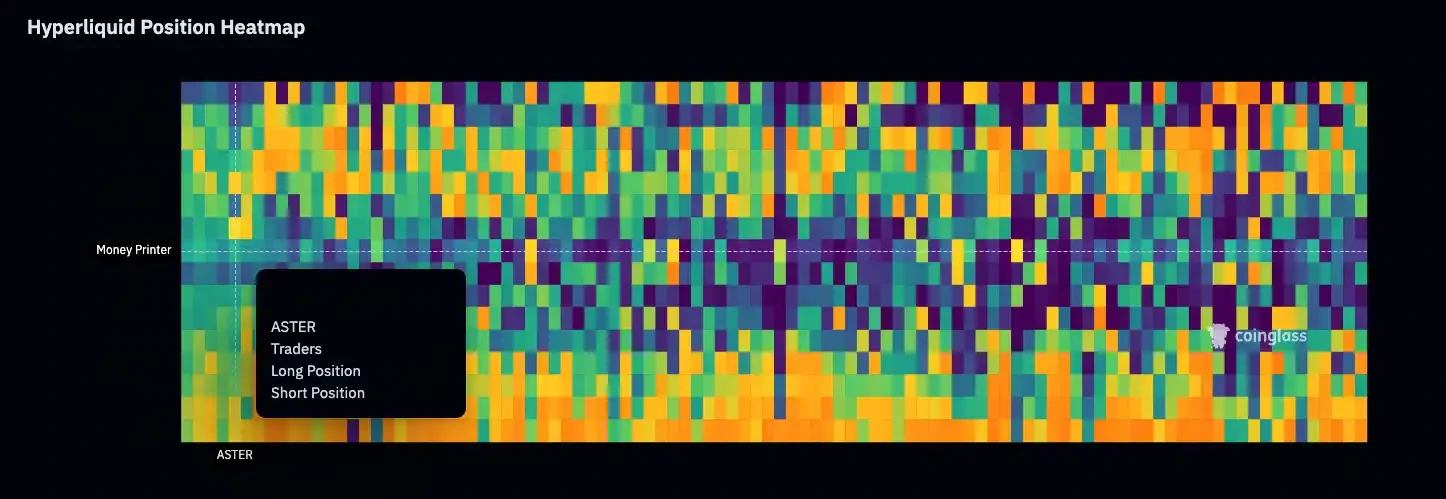

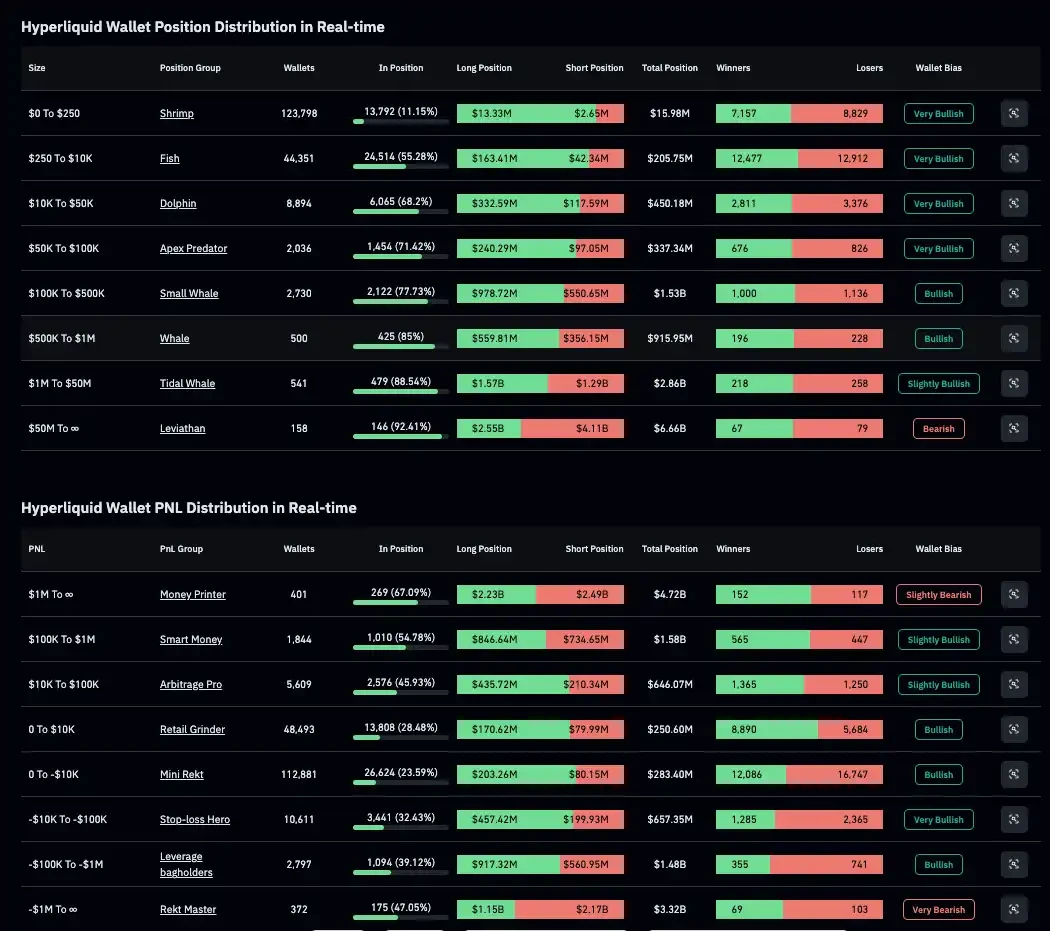

For PerpDex, the only publicly available data currently available is wallet analysis related to Hyperliquid. However, the presentation of this data is quite interesting. Coinglass categorizes users into 16 user types (similar to the 16 MBTI types) based on their position size and profit and loss patterns. This user heat map clearly shows how these 16 user types view a particular mainstream token (bullish or bearish).

As shown in the figure, the current attitude of "MoneyPrinter" who has earned more than $1 million towards the Aster coin

The second is information about the overall ratio of long and short positions and wins and losses for these 16 user types. Generally speaking, this can reflect the current attitude of players in each position towards the market. For example, the proportion of Shrimp positions opened by people like me with positions between $0 and $250 or Fish positions between $250 and $10,000 is not high. On the contrary, players with positions exceeding $10,000 are almost all increasing their positions.

HyperBot

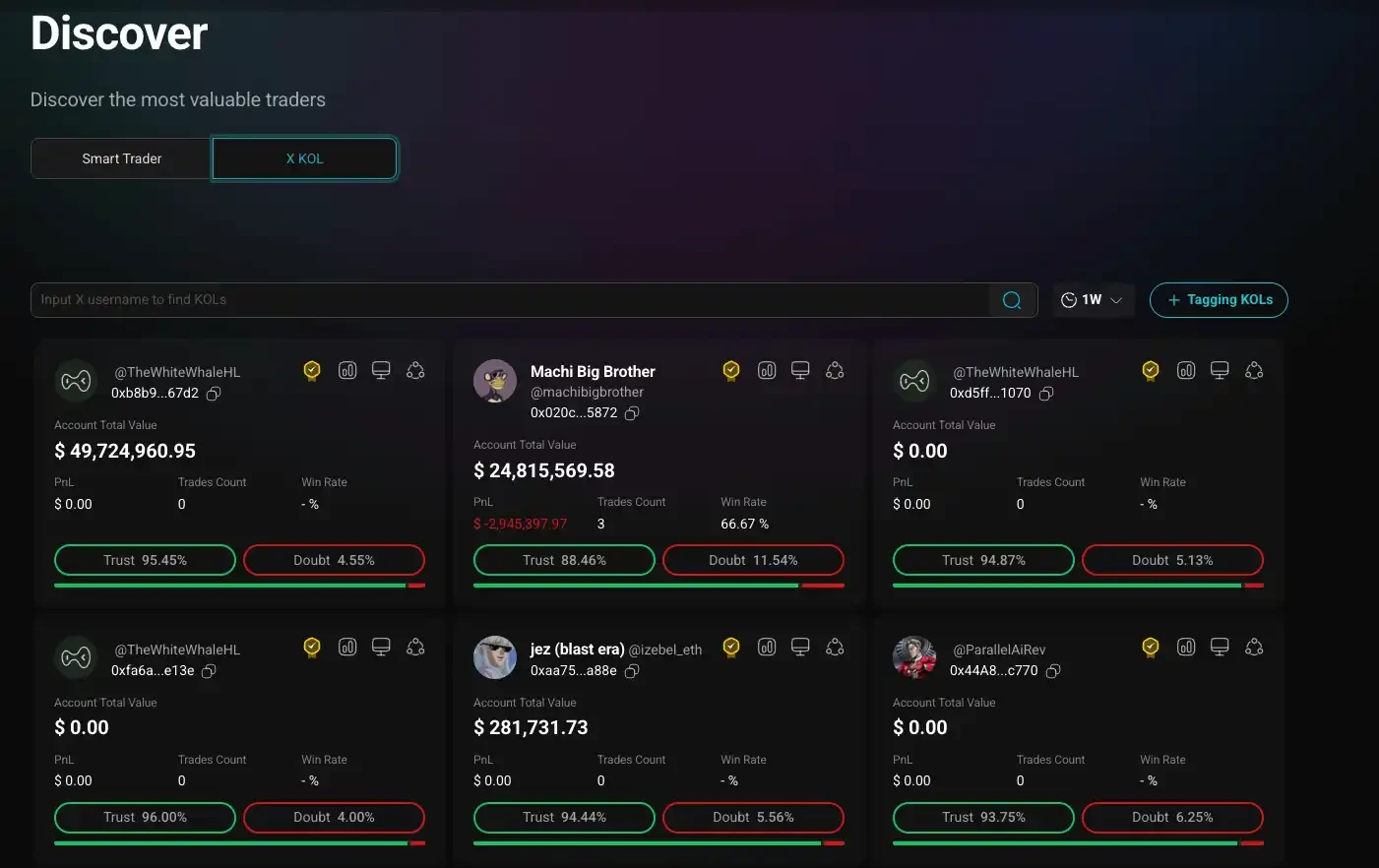

When it comes to smart wallet tracking, Hyperbot has become a hot topic recently. Originally a tool within the Hyperliquid ecosystem, it was later expanded to the Aster platform. More importantly, it provides real-time notifications of major investor position changes and fund flows, allowing even ordinary users to capture the movements of smart money.

HyperBot provides a smart money exploration page, similar to the experience meme players have on GMGN or Axiom.

Hyperbot's token, BOT, has been listed on Binance Alpha. Due to the recent popularity of Aster and the launch of its second airdrop, the price of Hyperbot's $BOT token has also shown promising growth, reaching a market capitalization of $15 million and a FDV of $1.4. For users who monitor fund activity, Hyperbot has become a comprehensive tool.

Further reading: " To give $700 million airdrop, how to brush Aster S 2 best "

arbitrage

As more and more perpdex platforms emerge, the price and interest rate differences between platforms will create a certain degree of arbitrage space. At the moment when PerpDex is popular, the corresponding data platforms have also begun to consider it within the scope of data collection.

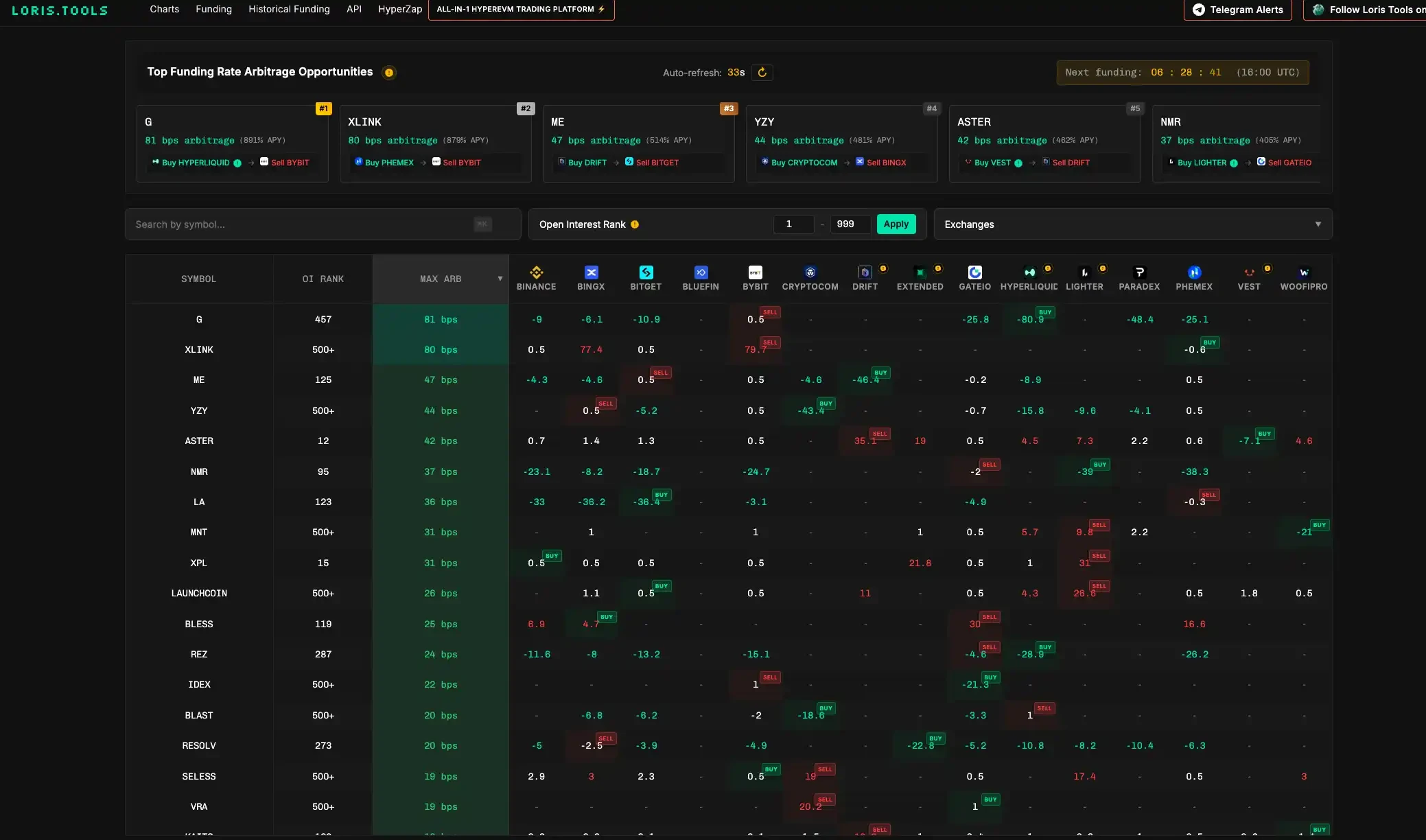

Loris Tools

Loris Tools is a funding rate arbitrage dashboard and market data platform developed by Loris , the founder of HyperZap. Its data is relatively clear, including the most desirable OI, the basis points with the greatest arbitrage potential, and which platforms to trade on. It automatically updates every 60 seconds and features a rolling bar showing the best "arbitrage opportunities."

In addition to tracking on the dashboard, users can also set reminders for TG BOT. However, settlement times vary across different platforms, so users need to be familiar with the settlement mechanisms of these platforms to effectively use them.

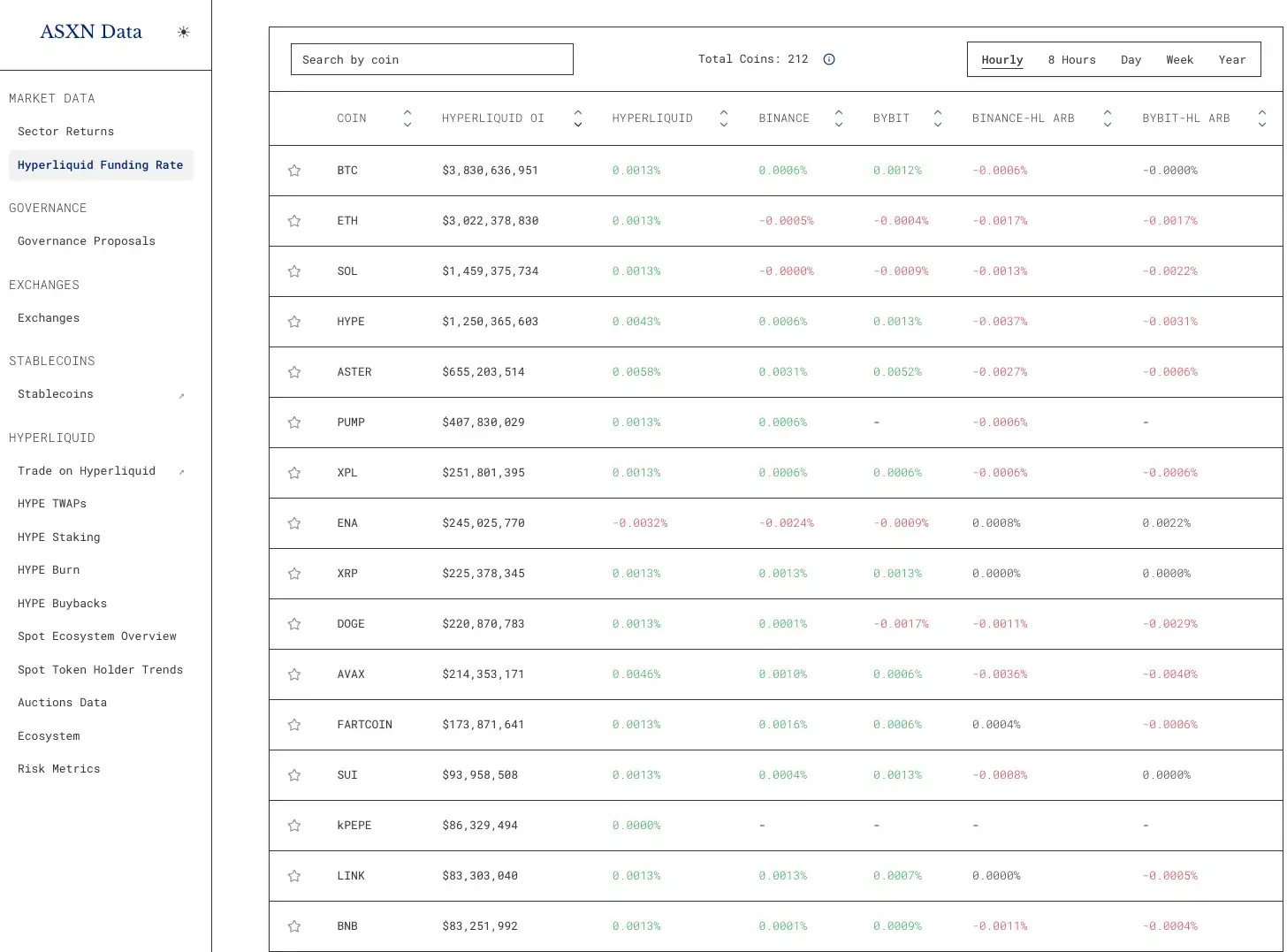

ASXN

While ASXN isn't as comprehensive as Loris in funding rate data, its capabilities extend far beyond that. ASXN DATA, a dashboard created by crypto researcher ASXN , provides a nearly complete set of Hyperliquid data dashboards.

Users can view the overall status of recent transactions in the Ecosystem Overview interface and gain in-depth insights into a token's liquidity risk in the Risk Metrics section. Furthermore, the TWAPs page provides a comprehensive overview of the validator distribution and status. These tools consolidate previously fragmented on-chain information into actionable dashboards, providing powerful support for traders with in-depth insights. Unfortunately, the PerpDex dashboard currently only contains data from the Hyperliquid ecosystem.

Data Dashboard

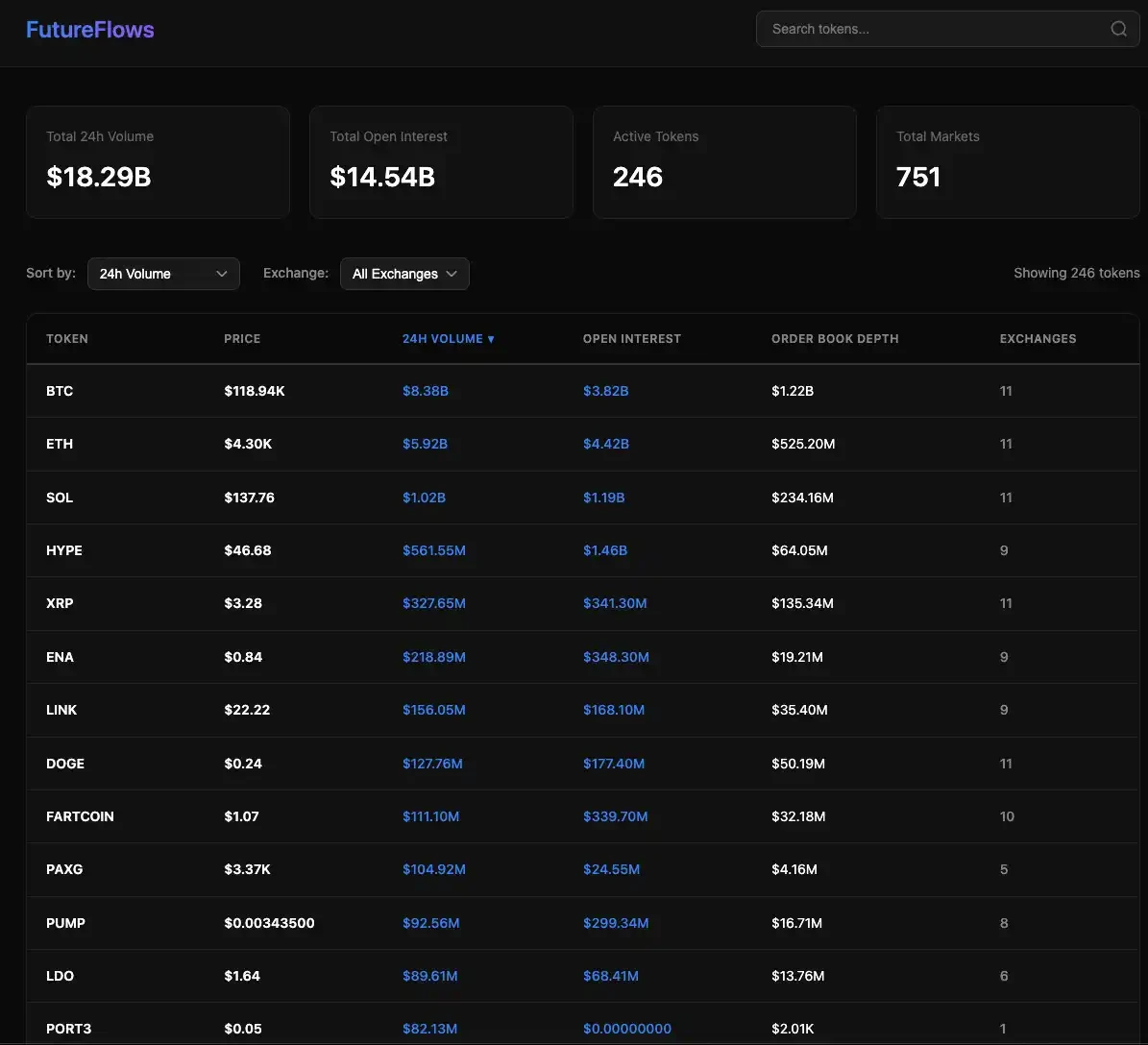

FutureFlows

Unlike Coinglass’s token trading volume heat map, Future Flows provides more holistic data. It includes most of the PerpDex data on the market, and from this dashboard, we can talk about the overall on-chain trading situation of most tokens.

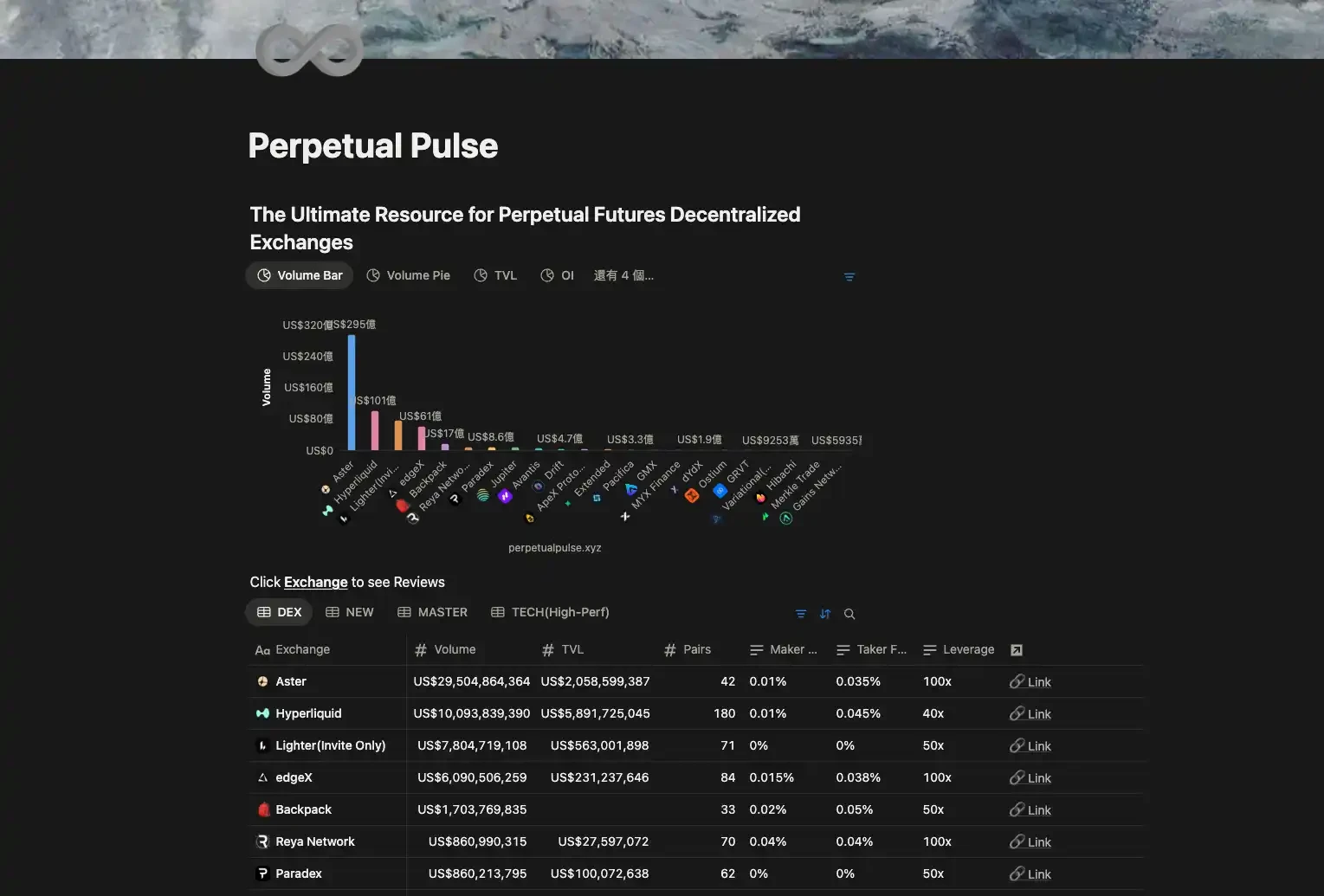

Perpetual Pulse

Perpetual Pulse, a PerpDex data dashboard developed by Lighter team member hansolar , provides similar overall market data monitoring capabilities. It tracks multi-chain contract trading volume, TVL, and OI, and provides real-time market updates.

Traders can use this platform to view information such as trading volume trends, capital flows, and other information of different projects to assist in judging market sentiment and hot sectors.

Trading Tools

Pear Protocol

Pear Protocol is a contract trading aggregation tool that supports the SYMM (Symmetric Network) and Hyperliquid ecosystems. It has accumulated nearly $1 billion in trading volume.

The Pear platform allows users to simultaneously access the contract markets of both networks, eliminating the hassle of manually switching wallets and exchanges. It's ideal for active derivatives traders. Its key advantage is the ability to simultaneously open long and short trading pairs for hedging, and the availability of Pair Markets, which provides real-time updates on trading pairs suitable for hedging.

As shown in the figure, BNB/FTT in the Hyperliquid environment can open 3x leverage, while in the SYMM environment, trading pairs such as BTC/ETH can be opened with a maximum leverage of 54x.

Currently, Pear Protocol's platform token $Pear is issued on Arbitrum, with a current market value of US$4.2 million and an FDV of US$15 million.

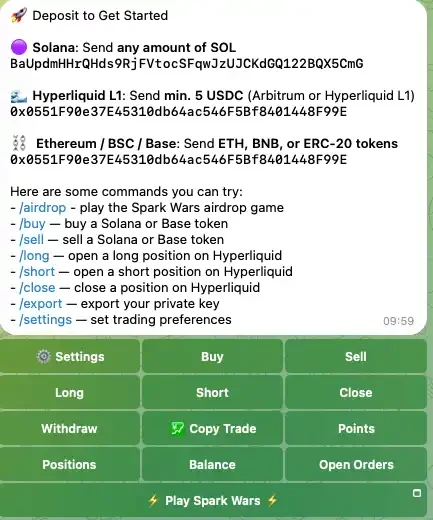

Spark

Spark is a TG trading terminal dedicated to multi-chain transactions. Some time ago, it began to support multiple PerpDex contract opening, closing, copy trading smart wallets and other operations. The one-stop interface greatly simplifies the steps of switching between different PerpDex.

The tool currently covers several mainstream on-chain PerpDex, including Hyperliquid and Aster, and also provides real-time quotes for deep order books, funding rates, and more. Although TGBOT's advantages are less pronounced now that many platforms have adopted mobile terminals, it still facilitates multi-platform transactions.

PerpDex’s live streaming platform?

At a recent KBW SideEvent (Perp-Dex Day), traders livestreamed their trades on the four major PerpDex platforms, a phenomenon that went viral and was widely circulated, with the message being that "Koreans have already treated trading like a livestream game."

In terms of publicity, the organizers of this event , par_D & Magon, are undoubtedly quite successful, and it also indirectly shows that this trading status seems to have been accepted by most Crypto players. When the live broadcast track was hot before, in addition to various abstract anchors, the most popular thing was live broadcast trading. This also allowed many players who "beat dogs" late at night to inadvertently find some golden dogs.

FLIPgo

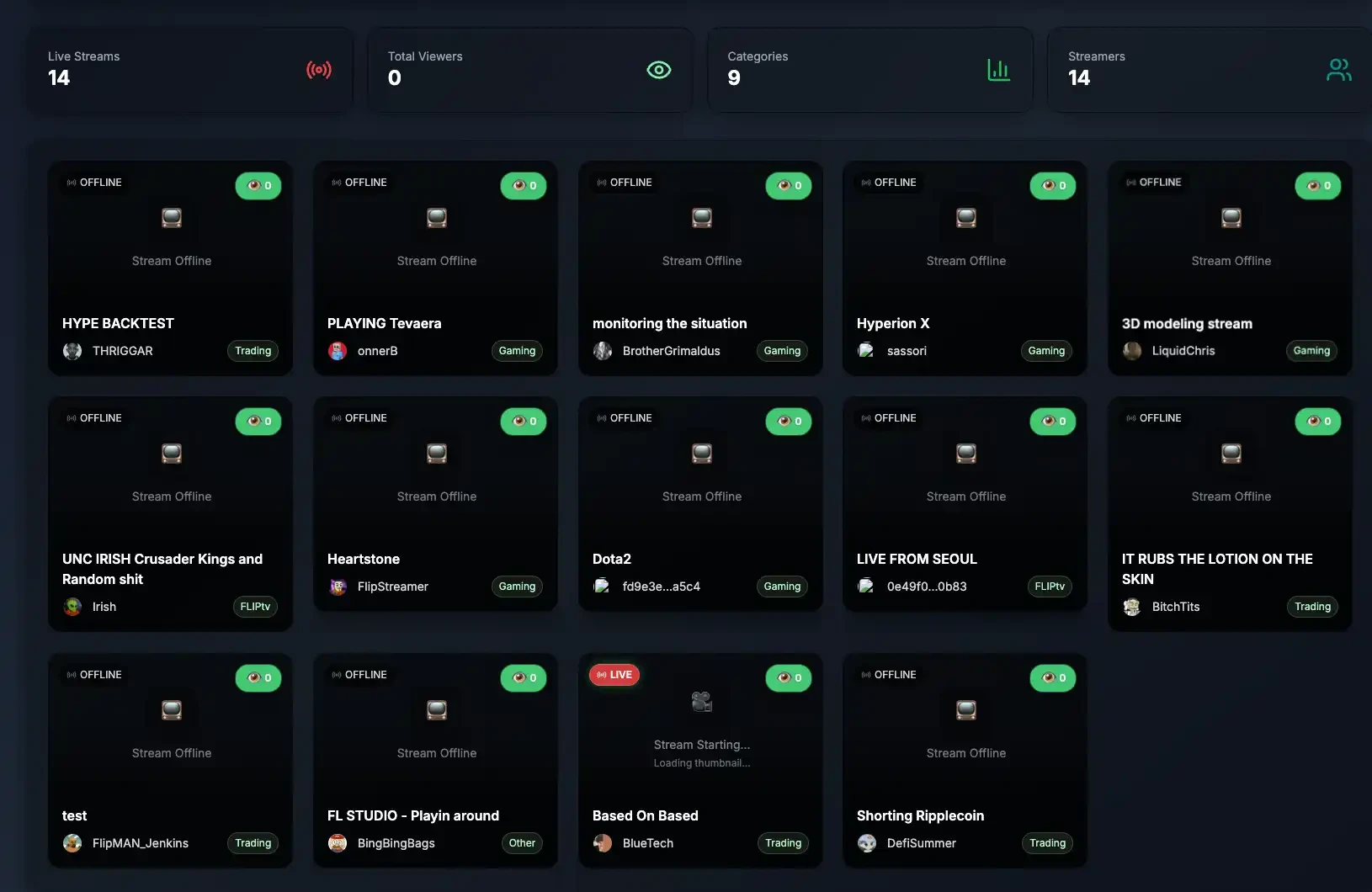

In addition to Solana, Base, and BSC, Hyperliquid actually has a live streaming platform. Although FLIPgo has not yet fully formed in terms of the number of live broadcasts and product UI, if it can do well in the vertical track of PerpDex, it seems that its potential as an "e-sports platform" is also quite large.

And "naturally" FLIPgo also has its own live broadcast token $FLIP, which is now issued on HyperEVM and the token market value is currently quoted at 1.5 million US dollars.