As the core battlefield of global stablecoins, the TRON network carries massive capital flows every day: the USDT circulating on the chain is as high as US$82.7 billion, the daily trading volume of stablecoins has long been stable at around US$30 billion, and the number of on-chain users has exceeded 330 million.

This massive capital and user base has made TRON a "gold mine" in the crypto space, continuously attracting a flood of capital and developers seeking wealth creation opportunities. Developers are eager to freely deploy cross-chain DApps between TRON and other multi-chain ecosystems, leveraging greater capital flows and reaching a wider user base. Users, in turn, hope to freely transfer their crypto assets across multiple chains, allowing them to capture alpha opportunities within the TRON ecosystem.

As of September 18th, the total value locked in crypto assets (TVL) on the TRON blockchain reached approximately $28.4 billion. JustCrypto, a cross-chain protocol under JUST, the ecosystem's one-stop DeFi solution, has performed particularly well, with over $4.5 billion worth of high-quality crypto assets like BTC and ETH locked up. Its TVL ranks among the top three applications in the TRON ecosystem, followed by TRX Staking and JustLend DAO.

In order to lower the threshold for users to interact across chains, TRON has been accelerating its cross-chain layout: in July this year, the Meme coin TRUMP was successfully deployed across chains to the TRON network; on August 26, the multi-chain cross-chain protocol deBridge was fully integrated into the TRON ecosystem; on September 8, the TRON ecosystem's native stablecoin USDD was officially deployed to the Ethereum network and a 12% high-yield reward activity was simultaneously launched; on September 16, TRON announced that it will fully integrate Near's multi-chain transaction protocol NEAR Intents, etc.

On-chain capital "gold mining holy land": What are the Alpha opportunities in the TRON ecosystem?

The TRON ecosystem not only leads in asset size and user base, but also, with its continuously emerging wealth creation opportunities, has become a "gold rush" in the crypto space. Whether it's the endless stream of popular meme projects, the all-encompassing DeFi infrastructure, or the multi-faceted stablecoin ecosystem, TRON offers users a wealth of alpha opportunities.

In terms of on-chain financial infrastructure, TRON has built a comprehensive DeFi application matrix ranging from "asset trading" to "yield enhancement" to fully adapt to the investment and trading needs of different users.

At the asset exchange and trading level, the one-stop trading center Sun.io not only integrates the DEX function SunSwap, supports crypto asset exchange and liquidity mining, but is also equipped with SunCurve (stablecoin low-slippage trading tool) and PSM (stablecoin exchange tool). PSM supports 1:1 zero-fee exchange between USDD and USDT, significantly reducing transaction costs.

In terms of increasing asset returns, the lending center JustLend DAO provides multi-dimensional profit paths:

First, deposit and earn interest: users can directly deposit assets such as TRX, SUN, BTT, ETH, BTC and various stablecoins (USDT, USDD, USD 1) to earn fixed income;

Second, collateralized lending: supporting assets such as TRX or stablecoins as collateral, allowing for flexible lending of other digital assets to improve capital utilization efficiency;

Third, TRX on-chain staking yields and capturing excess returns: Through the sTRX staking product, users can stake TRX to obtain sTRX liquidity staking certificates, which can then be used to participate in DEX market making, lending, or minting stablecoins, achieving compounded returns. Furthermore, users can use sTRX as collateral to mint USDD, and leverage the "sTRX+USDD" combination to increase their combined returns to over 15%, capturing excess returns. In July of this year, the listed company TRON had staked 365 million tokens through JustLend DAO.

In the stablecoin ecosystem, TRON has built a diversified product portfolio encompassing USDT (a mainstream stablecoin), USDD (a native decentralized stablecoin), and USD 1 (a compliant stablecoin). Leveraging its comprehensive DeFi infrastructure, TRON has created a comprehensive ecosystem for stablecoins, encompassing trading, value-added, and cross-border investment. This ecosystem supports stablecoins for various DeFi activities, including trading, storage, and collateralized lending. This provides clear value-added pathways and meets user needs across various dimensions, including security and decentralization. For example, the DEX platform Sun.io offers low-slippage stablecoin exchange and crypto asset purchase services, while JustLend DAO supports stablecoin deposits for interest generation and lending as collateral.

Regarding stablecoin yield appreciation, the TRON ecosystem also offers stUSDT, a decentralized asset management (RWA) product, which provides stablecoin holders with access and channels to invest in traditional financial markets, enabling cross-sector asset appreciation. As of September 17th, stUSDT achieved an annualized yield of 5.11%. Furthermore, USDD is about to launch a new interest-bearing product, sUSDD, a decentralized savings tool designed to help USDD holders earn stable interest, further expanding the earning potential of stablecoins.

In the meme sector, the TRON ecosystem has been producing a steady stream of blockbuster assets, demonstrating a strong wealth-creating effect. SunPump, a meme issuance platform, has been dubbed a "blockbuster incubator," continuously launching new projects and high-potential assets. Previously, major meme projects such as SUNDOG and PePe have successfully entered the Binance Alpha Zone, earning recognition from top global trading platforms and providing small and medium-sized investors with an important window to early access high-quality meme assets.

The wealth narrative surrounding the TRON ecosystem continues. Recently, TRON founder Justin Sun has repeatedly revealed on the X platform that "major initiatives are brewing and will be announced soon." Many community users speculate that TRON is poised for a new round of product iteration and ecosystem expansion, worthy of continued market attention.

How to cross-chain assets to the TRON ecosystem with one click?

As the ecosystem grows and Alpha opportunities increase, "cross-chain asset transfers to the TRON ecosystem" has become a core user demand for value-added. While withdrawing assets to the TRON network through CEX exchanges remains an option, the current explosion of on-chain applications and the concentration of wealth opportunities are driving a greater preference for on-chain capital flows. According to Bridge WTF data from September 17th, daily cross-chain transfers of crypto assets reached $640 million, making cross-chain asset transfers a mainstream method.

Currently, facilities supporting cross-chain to the TRON network are mainly divided into two categories: native cross-chain infrastructure and third-party cross-chain tools .

Native cross-chain infrastructure BTTC: As the ecosystem's native cross-chain infrastructure, BTTC combines the dual capabilities of cross-chain asset transfer and application deployment: it supports users to quickly transfer assets from other public chains to the TRON network, achieving seamless capital flow; it also supports developers to deploy their own applications to the TRON ecosystem with one click, lowering the threshold for multi-chain development.

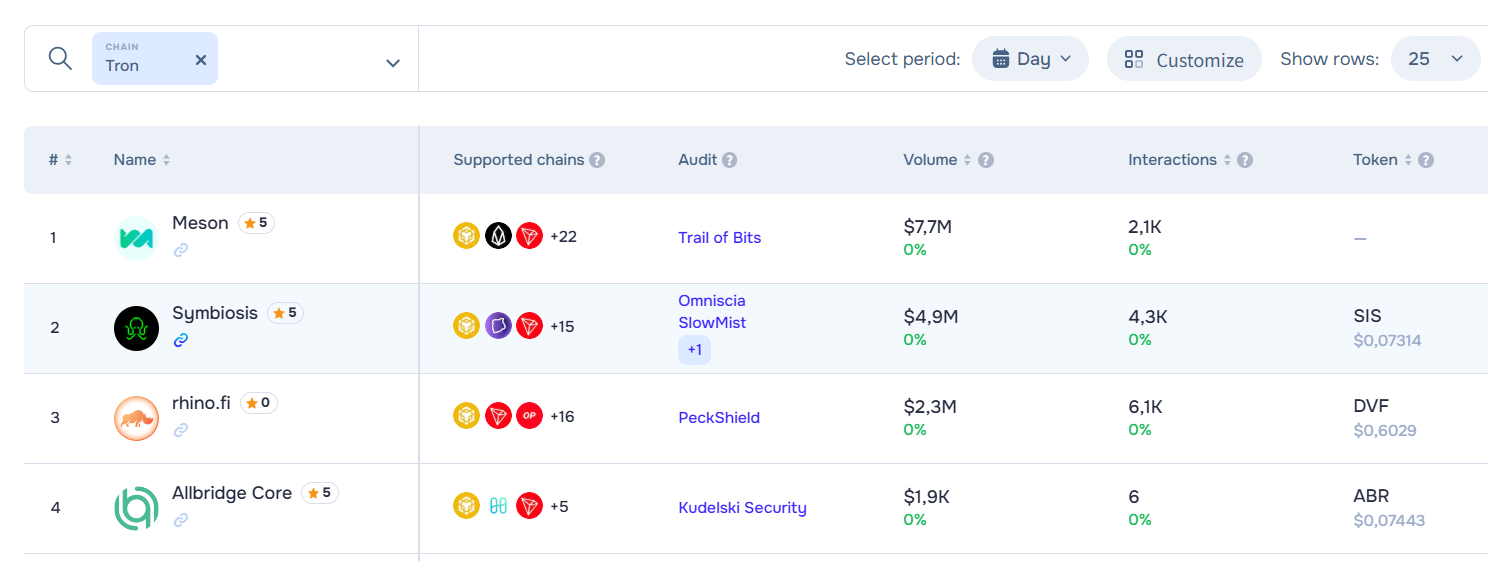

Third-party cross-chain bridge tools: These tools cover a wider range of public chain networks, providing users with more options. According to data from the cross-chain aggregation platform ChainSpot, 17 third-party cross-chain facilities currently support the TRON network, enabling asset interoperability with multiple public chains, including Bitcoin, Ethereum, Solana, BNB Chain, and Layer 2. The top four tools used by users are Meson, Symbiosis, rhino.fi, and Allbridge Core.

In addition, TRON has recently continued to expand cross-chain cooperation and further enrich cross-chain channels: On August 26, the multi-chain cross-chain protocol deBridge was fully integrated into the TRON ecosystem, helping TRON to achieve instant interconnection with 25 mainstream blockchains such as Ethereum and Solana, and build a larger liquidity network; On September 16, TRON and NEAR chain reached a strategic cooperation, and will fully integrate the multi-chain transaction protocol NEAR Intents, bringing cross-chain operations directly into a new stage of "intent-driven" intelligence. Users only need to initiate a simple cross-chain request, and the system will automatically match the optimal path, truly realizing a new "one-click direct access" experience for cross-chain operations.

6 cross-chain tools supporting the TRON network

1. Native cross-chain protocol: BTTC (BitTorrent Chain) is committed to becoming the control center of a multi-chain operating system

BTTC (BitTorrent Chain) is a cross-chain solution jointly launched by the TRON Foundation and BitTorrent in 2021. As an EVM-compatible Layer 2 scaling network using PoS consensus, BTTC is positioned as the "Layer 2 cross-chain scaling protocol for the TRON ecosystem," aiming to address scalability and interoperability issues across blockchain networks. It currently supports asset interoperability between the three major public chains: Ethereum, BNBChain, and TRON.

In June this year, BTTC upgraded to version 2.0, further enhancing network security and token value by reducing the total BTT output and setting the staking yield to 6%.

Among them, BitTorrent is the world's largest decentralized P2P file-sharing network with more than 100 million active users. It was acquired by TRON founder Justin Sun for approximately US$120 million in July 2018. It has now developed into a complete ecosystem covering data transmission protocol (BitTorrent), decentralized storage (BTFS), cross-chain protocol (BTTC) and native token (BTT).

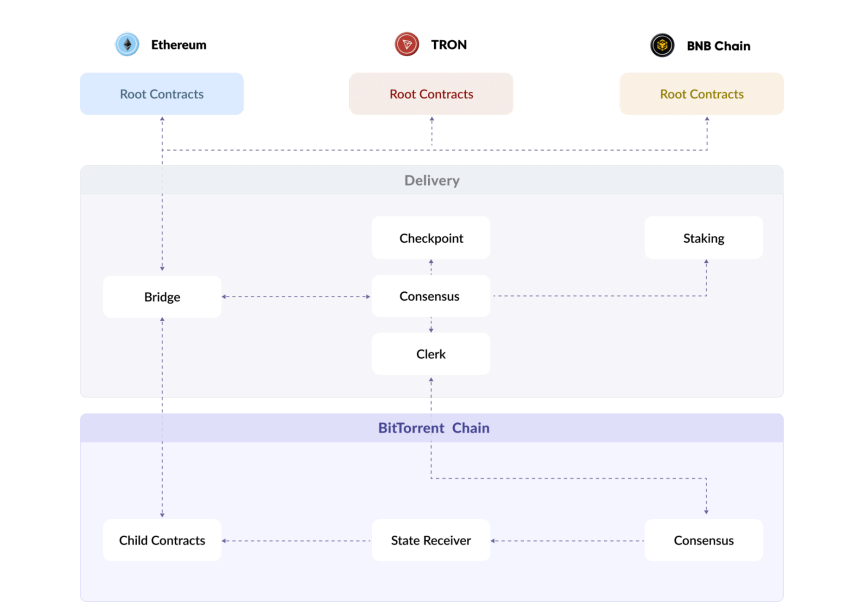

In terms of cross-chain implementation, BTTC adopts a "connection rather than custody" cross-chain model. Through a modular layered design, it breaks down the entire cross-chain process (from request initiation on the source chain to execution on the target chain) into common logic and standards, enabling two-way interoperability of assets and data between multiple chains. Its architecture is divided into three layers:

Root Contracts : A smart contract cluster deployed on TRON, Ethereum, and BNB Chain. It manages cross-chain assets and data, provides a user interface, and is the initiator and receiver of user cross-chain requests.

Delivery (Delivery Relay): A consensus and data relay hub, responsible for relaying state transfers between the source and target chains. As a relay hub, it monitors source chain events (asset lockup, staking, etc.) and generates "checkpoint" snapshots, which are then synchronized to the target chain after a multi-signature consensus of more than 2/3 of the nodes.

BitTorrent Chain (Execution Layer) : DApp application running platform, processing cross-chain messages, verification, receiving snapshots of the Delivery layer, performing operations such as asset release and contract triggering.

For example, taking "cross-chain ETH from Ethereum to TRON", the specific cross-chain process can be broken down as follows: the user locks ETH in the BTTC smart contract on the Ethereum chain, triggering a cross-chain event → the Delivery layer verifies the legitimacy of the event, generates a snapshot and reaches node consensus → the BTTC execution layer mints the corresponding BTTC version of ETH and distributes it to the user's TRON address.

BTTC's goal is not only to enable cross-chain asset transfers but also to achieve the interoperability of underlying information and data across multiple chains. As stated in its latest white paper released in May of this year, "Building a superior cross-chain bridge is the starting point of our transformation. BTTC's ultimate goal is to become the control layer of a multi-chain operating system."

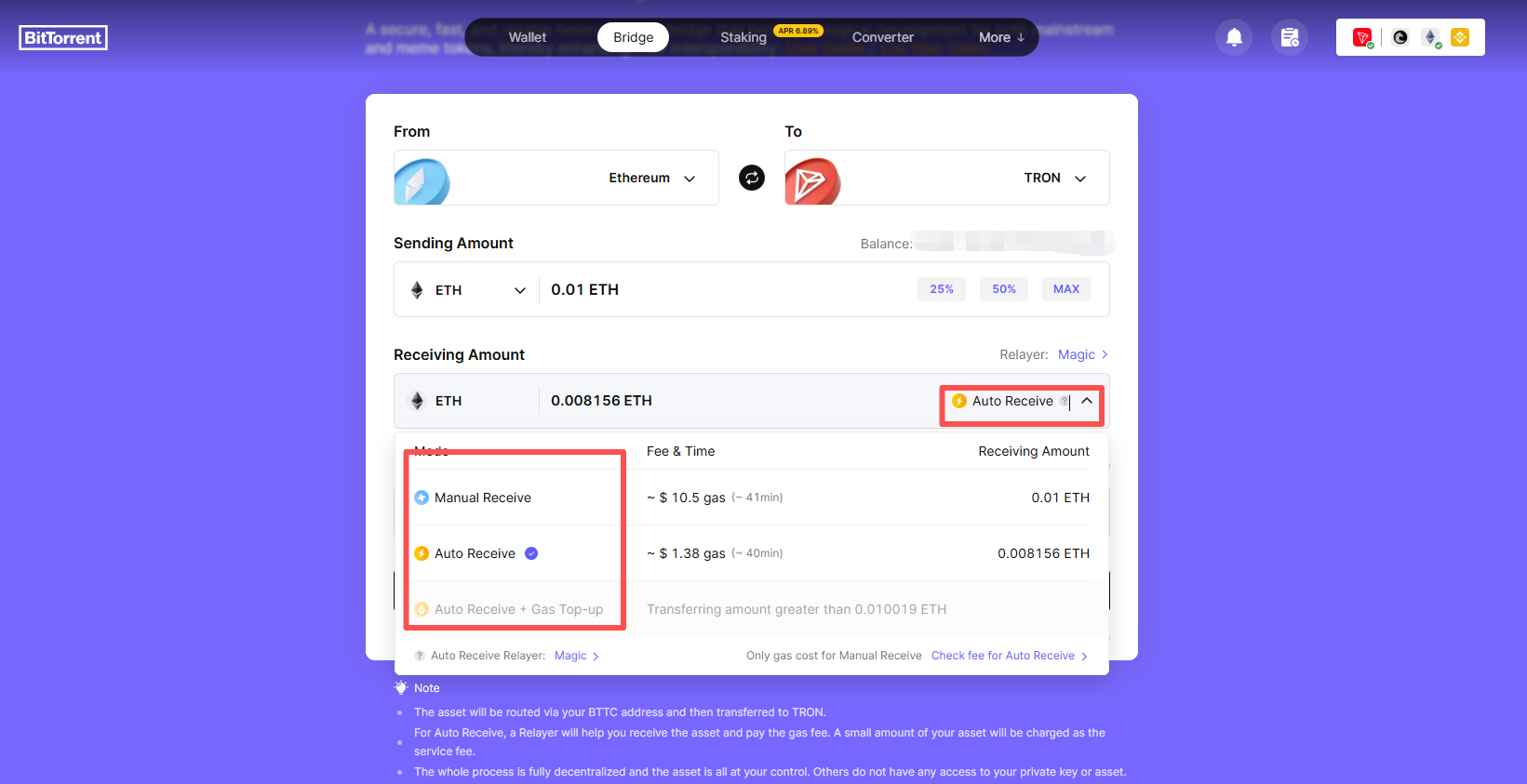

In terms of cross-chain products, BTTC launched BitTorrent Bridge , focusing on the cross-chain flow of assets between EVM chains. It currently supports the interoperability of TRX, BTT, USDD, JST, SUN, WIN, NFT, ETH and other assets between TRON, Ethereum and BNB Chain, and will be expanded to more chains and assets in the future.

To enhance the user experience, BTTC offers an Auto Receive mode , where the Relayer prepays the target chain's gas fees, allowing users to quickly receive cross-chain assets and avoid asset retention due to a lack of gas tokens. It's important to note that in this mode, gas fees are directly deducted from cross-chain assets, and the amount of cross-chain assets received is the amount minus the deducted gas fee.

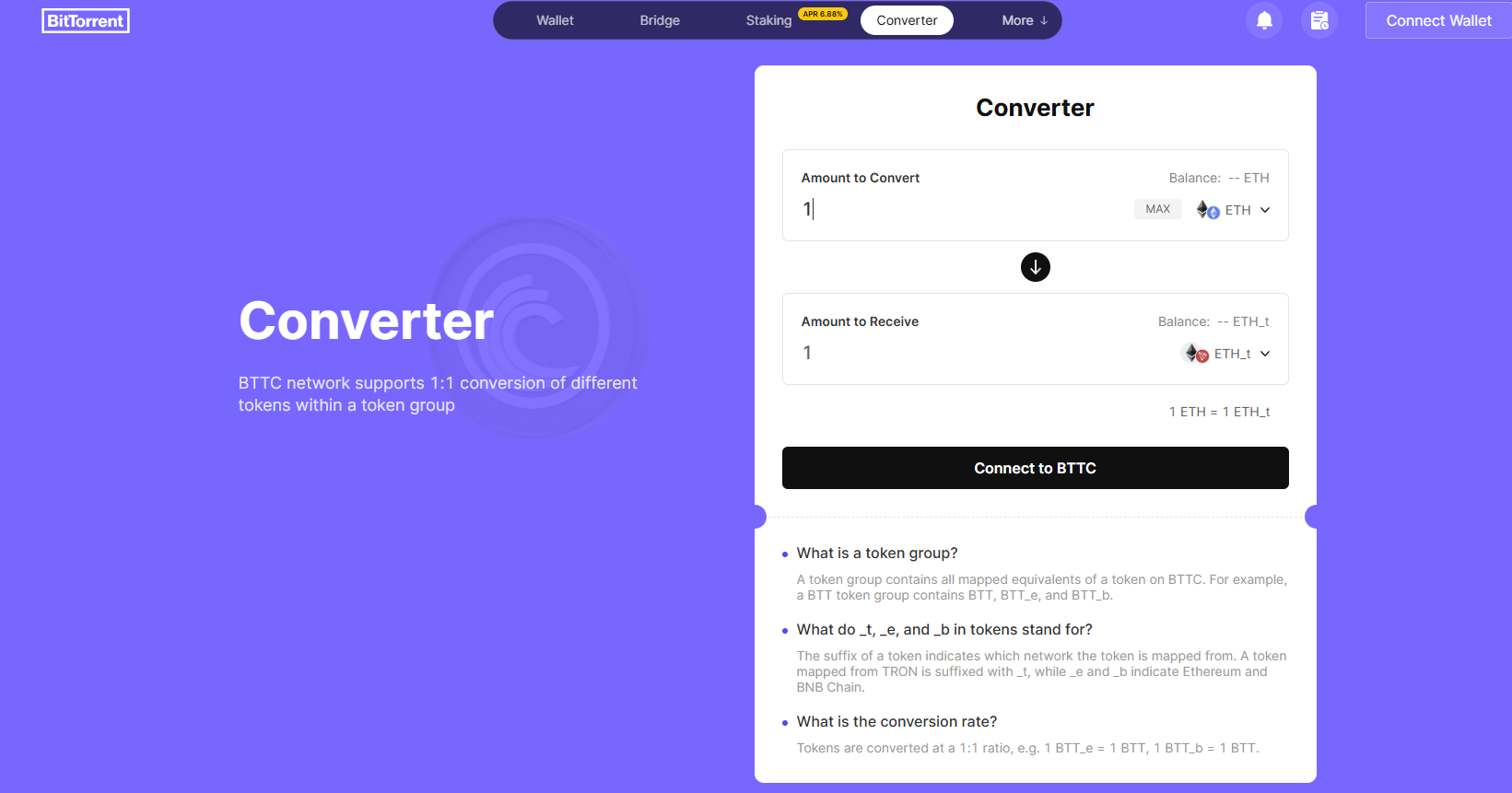

In addition, BTTC has also launched a 1:1 token converter that supports fee-free swaps of similar assets on BNB Chain, Ethereum, and TRON networks. For example, 1 ETH_e (Ethereum) can be exchanged 1:1 for 1 ETH_b (BNB Chain).

As TRON's official Layer 2 cross-chain scaling protocol, BTTC inherits the security of its mainnet and offers fee-free cross-chain transfers using BitTorrent Bridge, with users only paying gas fees. This makes it the preferred cross-chain option for TRON users. Furthermore, BTTC is EVM-compatible and supports the Solidity programming language, enabling one-click cross-chain migration and deployment of existing DApps on the EVM network.

2. Third-party cross-chain tools supporting the TRON ecosystem

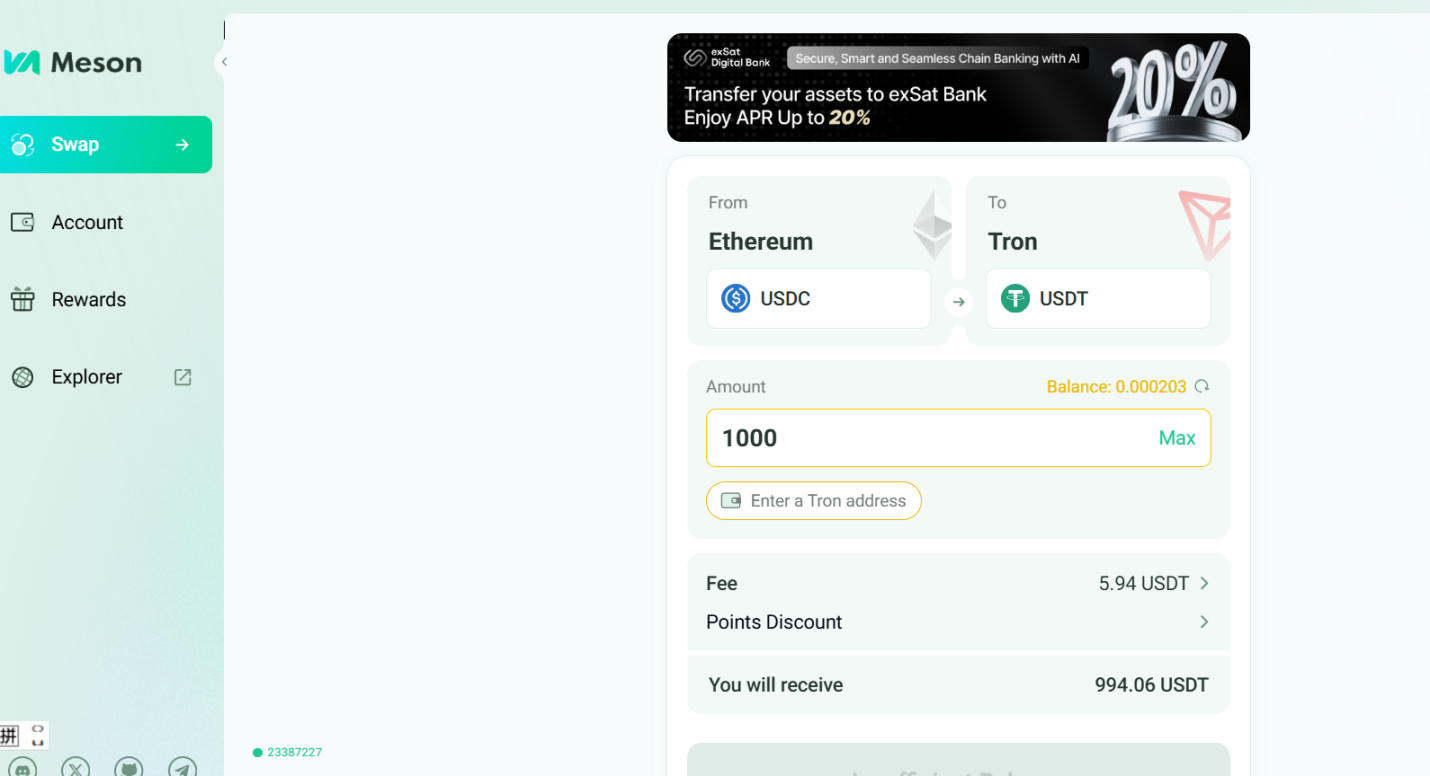

1. Meson: Focusing on stablecoin cross-chain transactions

Meson is a multi-chain stablecoin cross-chain transaction protocol that supports multiple chains. It mainly focuses on supporting cross-chain exchange of native stablecoins between EVM, non-EVM and Layer 2 networks, such as USDT, USDC, USD 1, DAI, etc.

Through the Meson platform, users can currently quickly exchange stablecoins such as USDC, USD 1, USDT on multiple chains such as Ethereum, Arbitrum and other Layer 2, Solana, etc. for TRC 20-USDT on the TRON network.

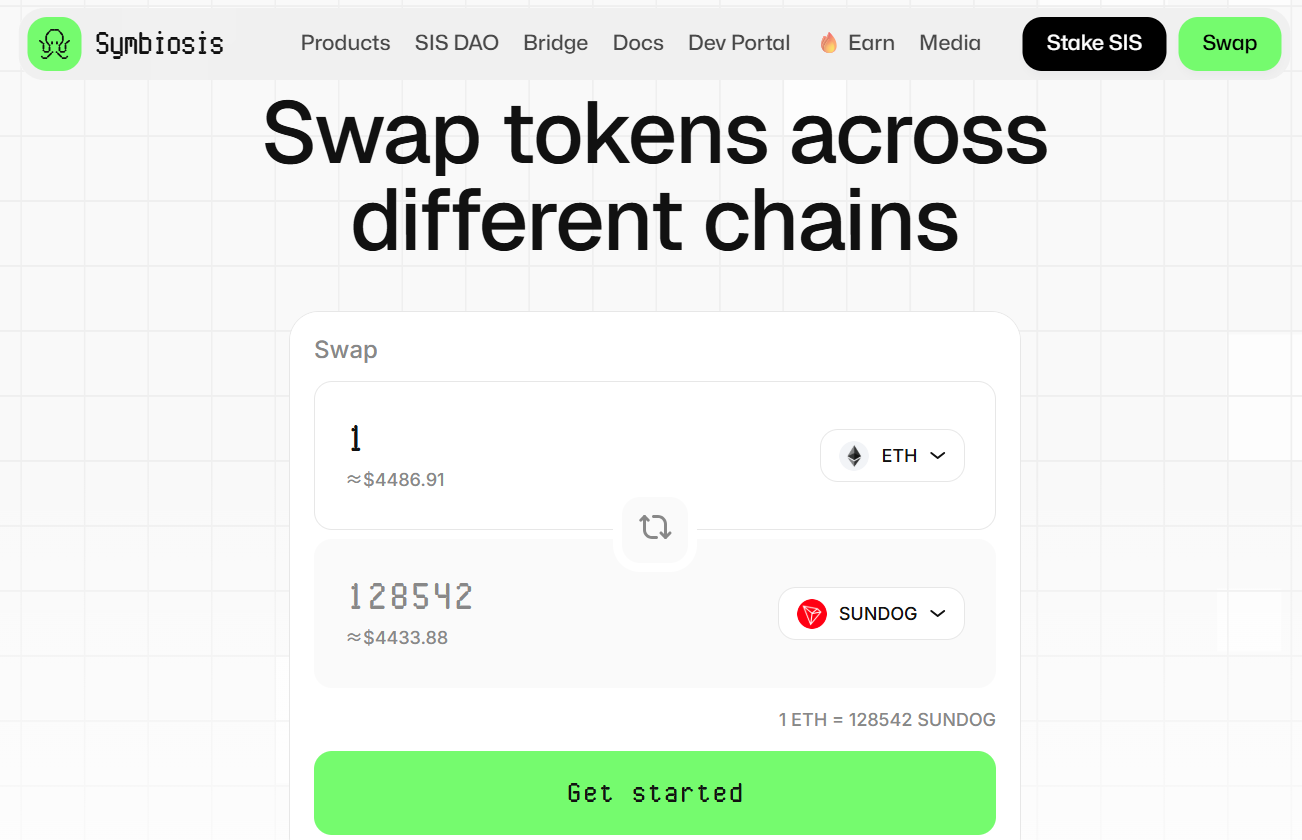

2. Symbiosis: Cross-chain DEX

Symbiosis is an AMM-based decentralized cross-chain exchange (DEX) protocol that supports not only the cross-chain transfer of homogeneous assets but also cross-chain swaps of arbitrary token pairs. Users simply select the source and target chain assets on the Symbiosis interface, and the protocol automatically converts the source chain asset into an intermediate stablecoin, transfers it across chains, and then converts it back to the target asset. For example, users can directly exchange ETH on Ethereum for USDT, TRX, or SUNDOG on the TRON blockchain.

Currently, the Symbiosis platform supports cross-chain exchange of dozens of TRON network assets, including TRX, BTT, SUN, JST, SUNDOG, etc.

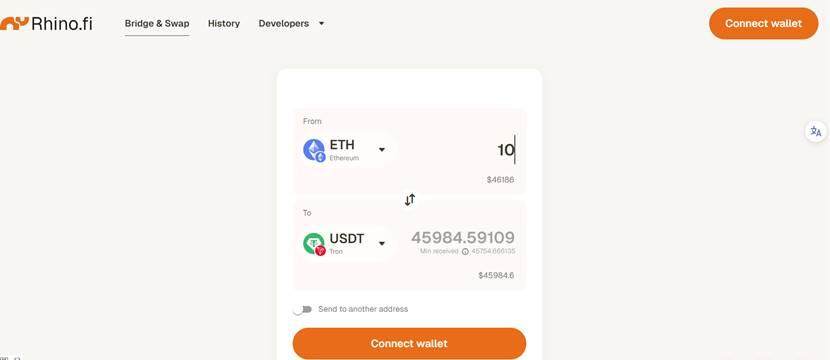

3. Rhino.fi: A cross-chain DeFi facility focused on stablecoin liquidity

Rhino.fi is a cross-chain DeFi infrastructure designed to address the issue of fragmented liquidity in a multi-chain ecosystem. In its latest product roadmap, released in June of this year, Rhino.fi clearly stated its commitment to building a stablecoin liquidity layer. By unifying global stablecoin liquidity, Rhino.fi aims to address liquidity fragmentation and cross-chain interoperability. The company also launched the Bridge+ developer toolkit, providing a complete stablecoin interoperability solution to help developers efficiently handle stablecoin payments, multi-chain integration, and other needs.

To meet users' cross-chain asset needs, Rhino.fi has created the Bridge&Swap feature. This feature combines cross-chain and transactional capabilities, acting as a "cross-chain DEX," allowing users to directly exchange asset B on chain A for target asset D on chain C. For example, ETH on the Ethereum chain can be exchanged for USDT on the TRON chain with a single click, significantly simplifying cross-chain and transaction processes.

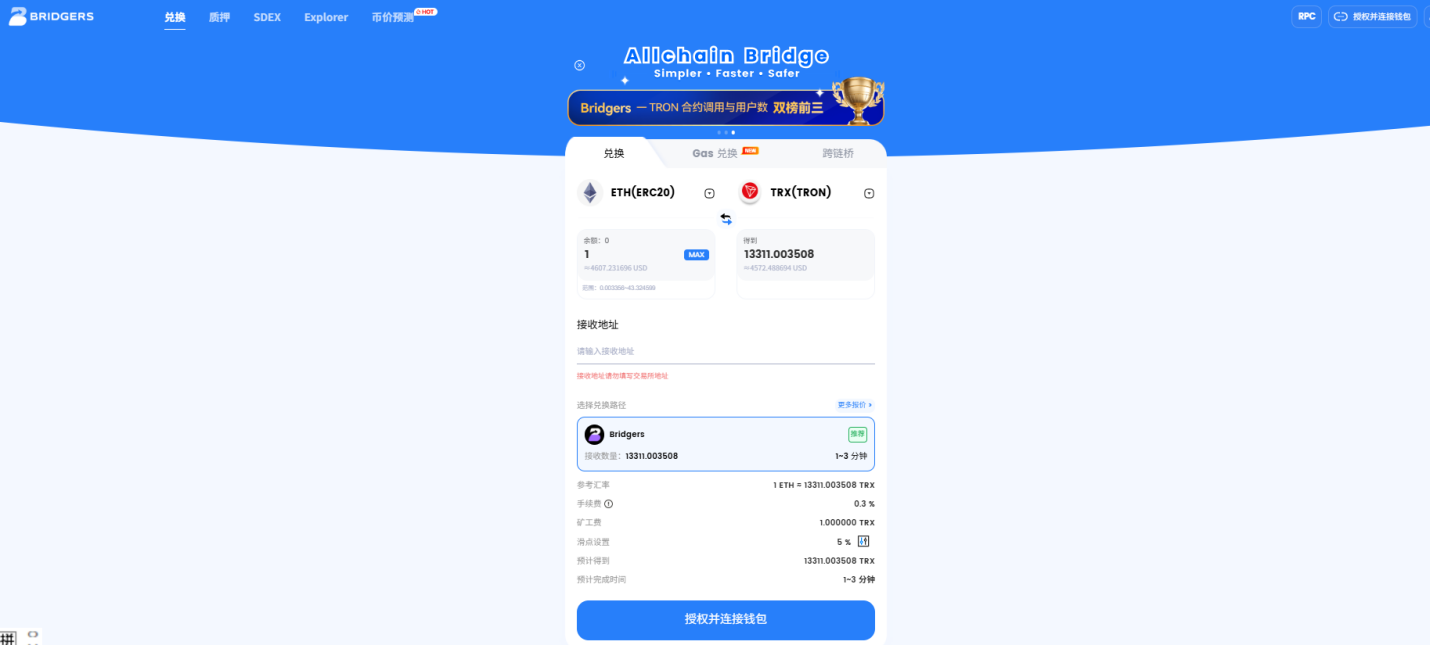

4. Bridgers: Cross-chain liquidity aggregator

Bridgers (also known as AllChain Bridge) is a cross-chain liquidity aggregator that aggregates liquidity from external DEXs and bridges, calculates the optimal execution path for assets across DEXs and bridges, and then uses smart contracts to execute transactions. For example, ETH on the Ethereum chain can be directly exchanged across chains for TRX on the TRON chain.

Bridgers is a cross-chain application that is frequently used by users of the TRON ecosystem. According to the TRONSCAN browser, the number of Bridger contract calls ranks among the top three in the TRON ecosystem.

5. deBridge: Cross-chain interoperability infrastructure

deBridge is a universal cross-chain interoperability infrastructure and messaging protocol that supports the transmission of arbitrary messages, data, and assets between different blockchains. It not only provides services such as a cross-chain liquidity network, but also provides developers with a full set of tools for building various cross-chain applications (deApps).

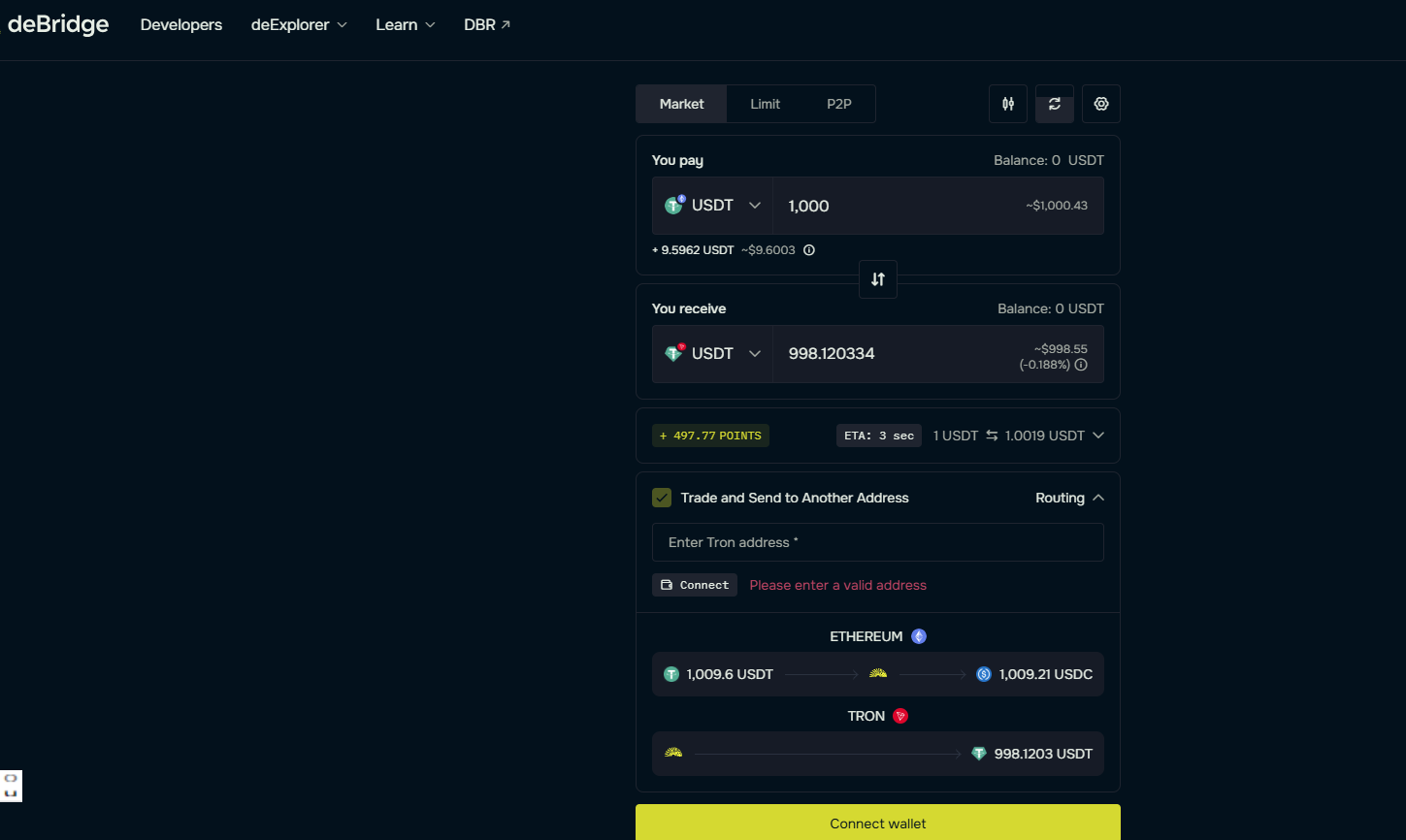

To meet the demand for cross-chain assets, deBridge launched its core product, the cross-chain token bridge dePort, which is mainly used for cross-chain transfer and transaction exchange of assets between different blockchains. That is, it not only supports cross-chain transfer of homogeneous assets, but also supports one-click cross-chain transaction exchange.

On August 26th, deBridge announced its full integration into the TRON ecosystem, enabling users to cross-chain assets from other supported public chains to the TRON ecosystem with a single click. According to deBridge's official data from September 18th, since integrating into the TRON ecosystem, cross-chain flows from Ethereum alone have reached $4.28 million , demonstrating the TRON ecosystem's appeal.

- 核心观点:波场TRON已成稳定币与跨链核心枢纽。

- 关键要素:

- USDT流通量达827亿美元。

- TVL超284亿美元,生态活跃。

- 跨链工具丰富,日跨链规模6.4亿美元。

- 市场影响:增强多链互操作性,吸引资金与开发者。

- 时效性标注:中期影响。